1. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017). The other groundbreaking study mentioned in the executive summary is National Research Council, The New Americans: Economic, Demographic, and Fiscal Effects of Immigration (Washington: National Academies Press, 1997).

2. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 349.

3. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 337.

4. Michael A. Clemens, “The Fiscal Effect of Immigration: Reducing Bias in Influential Estimates,” Centre for Research and Analysis of Migration Discussion Paper Series no. 2134, University College London, December 2021.

5. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 367.

6. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 338.

7. For a detailed discussion of the interpretation of marginal cost and average cost estimates, see National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), Chapter 7.

8. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 365.

9. “Annual Survey of School System Finances,” U.S. Census Bureau, last revised July 1, 2022.

10. “American Community Survey,” U.S. Census Bureau, last revised December 2, 2022; and Steven Ruggles et al., Integrated Public Use Microdata Series: Version 11.0 [data set] (Minneapolis: University of Minnesota, 2021).

11. Steven Ruggles et al., Integrated Public Use Microdata Series: Version 11.0 [data set] (Minneapolis: University of Minnesota, 2021).

12. “Population and Housing Unit Estimates,” U.S. Census Bureau, last revised July 22, 2022.

13. “National Income and Product Accounts,” Bureau of Economic Analysis, last modified April 17, 2018; “Historical Tables,” Office of Management and Budget, White House; and “National Health Expenditure Accounts,” Centers for Medicare & Medicaid Services, last modified December 15, 2022.

14. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 485.

15. Data for the limited English proficiency rates come from the ACS as the CPS does not include questions on language proficiency. The ACS’s measure of English proficiency is the variable SPEAKENG, and the language spoken at home is the variable LANGUAGE. Additional details on this estimate can be found in Appendix A.

16. The Medical Expenditure Panel Survey is also used in health care policy, typically for individual-level analysis. However, it excludes institutionalized persons, military personnel, long-term hospital stay expenditures, service revenues (such as private nonpatient care revenue), and some nonprescription personal health care goods. Those omissions make it a poor source for this aggregate analysis.

17. Jared Ortaliza et al., “How Do Health Expenditures Vary across the Population?,” Peterson-KFF Health System Tracker, November 12, 2021.

18. “Effectuated Enrollment: Early 2021 Snapshot and Full Year 2020 Average,” Centers for Medicare & Medicaid Services, June 5, 2021.

19. We used the ACS because the CPS lacks a measure of a mother’s biological children. Thus, using children-per-household data in the CPS may under- or overestimate the number of her biological children, depending on adoption. Further details on the age-specific fertility rates can be found in Appendix A.

20. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 488.

21. Although many individuals pursue higher degrees after age 25, educational completion after that age drops off, and the age 25 assumption allowed us to use more data.

22. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), pp. 448–49.

23. The CBO, from which we obtained data for the budget projections, also publishes detailed demographic projections. However, as these data do not distinguish by age or nativity, they are less applicable than those from the Census Bureau. Also, the March 2021 CBO Long-Term Budget Outlook projects the future budget for the years 2021–2051. We added CBO historical data for the years 2018–2020. So although we started our projection in 2018, this technically gives us 33 years of projected data. But as the 2018–2020 numbers are not projected, we refer to our estimates as 30-year projections from here forward.

24. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), pp. 429. We considered using emigration rates from Jennifer Van Hook and Weiwei Zhang, “Who Stays? Who Goes? Selective Emigration Among the Foreign-Born,” Population Research and Policy Review 30 (2011): 1–24, but this resulted in higher-than-reasonable emigration rates when used in our projections.

25. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 413. The 2017 National Academy of Sciences report settled on a 3 percent discount rate as a relatively conservative estimate. The Social Security trustees used rates of 2.4, 2.9, and 3.4 in their 2014 and 2015 reports. The CBO used a rate of 2.5 in its 2014 long-term forecasts.

26. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 409.

27. U.S. Citizenship and Immigration Services, “Inadmissibility on Public Charge Grounds,” Department of Homeland Security, 83 Fed. Reg. 51114, October 10, 2018; and U.S. Citizenship and Immigration Services, “Inadmissibility on Public Charge Grounds,” Department of Homeland Security, 84 Fed. Reg. 41292–508, October 15, 2019.

28. David Bier, “Public Charge Rule Bans Almost Entirely Self-Sufficient Legal Immigrants,” Cato at Liberty (blog), Cato Institute, August 12, 2019.

29. Alison Siskin, “Noncitizen Eligibility for Federal Public Assistance: Policy Overview,” Congressional Research Service Report no. RL33809, updated December 12, 2016.

30. Tara Watson, “Inside the Refrigerator: Immigration Enforcement and Chilling Effects in Medicaid Participation,” American Economic Journal: Economic Policy 6, no. 3 (2014): 313–38; Marcella Alsan and Crystal Yang, “Fear and the Safety Net: Evidence from Secure Communities,” National Bureau of Economic Research Working Paper no. 24731, June 2018; Abigail S. Friedman and Atheendar S. Venkataramani, “Chilling Effects: US Immigration Enforcement and Health Care Seeking among Hispanic Adults,” Health Affairs 40, no. 7 (July 2021): 1056–65; and Jennifer M. Haley et al., “One in Five Adults in Immigrant Families with Children Reported Chilling Effects on Public Benefit Receipt in 2019,” Urban Institute, June 18, 2020.

31. “Everything You Need to Know about the Tax Cuts and Jobs Act,” Tax Foundation.

32. “What Is the National Deficit?,” Fiscal Data, Department of the Treasury; “Historical Tables,” Office of Management and Budget, White House; and Jane G. Gravelle and Donald J. Marples, “The Economic Effects of the 2017 Tax Revision: Preliminary Observations,” Congressional Research Service Report no. R45736, updated June 7, 2019.

33. Jared Walczak, “State Tax Changes That Took Effect on January 1, 2018,” Tax Foundation, January 2, 2018.

34. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 468.

35. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 373.

36. George Psacharopoulos and Harry A. Patrinos, “Returns to Investment in Education: A Decennial Review of the Global Literature,” Education Economics 26, no. 5 (2018): 445–58.

37. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 381.

38. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), pp. 384, 479.

39. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 385.

40. U.S. House of Representatives, To Restrict Certain Federal Assistance Benefits to Individuals Verified to Be Citizens of the United States, H.R. 756, 117th Cong., 1st sess., introduced in House February 3, 2021; and Alex Nowrasteh and Sophie Cole, “Building a Wall around the Welfare State, Instead of the Country,” Cato Institute Policy Analysis no. 732, July 25, 2013.

41. Christian Dustmann and Tommaso Frattini, “The Fiscal Effects of Immigration to the UK,” Economic Journal 124, no. 580 (2014): 593–643.

42. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 387.

43. U.S. Citizenship and Immigration Services, “Inadmissibility on Public Charge Grounds,” Department of Homeland Security, 83 Fed. Reg. 51114, October 10, 2018.

44. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 388 and footnote 13.

45. The 2017 National Academy of Sciences report presents Scenario 1 (see Box 2). Scenario 1 is likely an underestimate and Scenario 5 an overestimate of each generation’s fiscal impact.

46. Organisation for Economic Co-operation and Development (OECD), International Migration Outlook 2021 (Paris: OECD, 2021), p. 124.

47. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 393; and Christian Dustmann and Tommaso Frattini, “The Fiscal Effects of Immigration to the UK,” Economic Journal 124, no. 580 (2014): 593–643.

48. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), pp. 396–97.

49. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), pp. 407–08.

50. “The Accuracy of CBO’s Budget Projections for Fiscal Year 2020,” Congressional Budget Office, December 2020.

51. Andrew Forrester and Alex Nowrasteh, “Immigrant Wages Converge with Those of Native-Born Americans,” Cato Institute Immigration Research and Policy Brief no. 9, October 4, 2018.

52. The birthplace groups are the United States, Central America, Europe, East Asia, Mexico, Southeast Asia, and Other Asian Countries. These categories are consistent with what the National Academies of Sciences used in 2017.

53. Alex Nowrasteh and Sophie Cole, “Building a Wall around the Welfare State, Instead of the Country,” Cato Institute Policy Analysis no. 732, July 25, 2013.

54. Individuals with one native-born parent and one foreign-born parent are sometimes referred to as the 2.5 generation.

55. A few tables and figures in this paper are slightly sensitive to multiple simulations, which occur due to random generational assignment. We ran multiple simulations of Table 6 that are available upon request.

56. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 424.

57. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), pp. 424–25.

58. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 427.

59. For this scoring, 1 is assigned to high school dropouts, and each subsequent level of education is increased by 1, up to a maximum of 5 for persons with more than a college degree. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 427.

60. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 427.

61. Here and elsewhere, we use 2012 dollars to increase comparability to the 2017 National Academy of Sciences report.

62. This issue is addressed in the Cato Model so that all ages can be directly comparable.

63. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 438.

64. The 2021 Long-Term Budget Outlook (Washington: Congressional Budget Office, March 2021).

65. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 438.

66. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 439.

67. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 439.

68. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 444.

69. The CPS data are for the year 2018, and the Congressional Budget Office 30-year projection begins in 2021.

70. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 444.

71. This method is explained in greater detail in the Cato Model Motivation and Methodology section.

72. The Cato Model later in this report incorporates this change and others into every table.

73. “Federal Debt: Total Public Debt (GFDEBTN),” Federal Reserve Economic Data, Federal Reserve Bank of St. Louis, updated December 2, 2022.

74. Michael A. Clemens, “Fiscal Effect of Immigration: Reducing Bias in Influential Estimates,” Centre for Research and Analysis of Migration Discussion Paper Series no. 2134, University College London, December 2021.

75. “Fertility Rate, Total (Births per Woman)—United States,” World Bank Group.

76. Michael A. Clemens, “Fiscal Effect of Immigration: Reducing Bias in Influential Estimates,” Centre for Research and Analysis of Migration Discussion Paper Series no. 2134, University College London, December 2021.

77. U.S. Citizenship and Immigration Services, “Inadmissibility on Public Charge Grounds,” Department of Homeland Security, 83 Fed. Reg. 51114, October 10, 2018; and U.S. Citizenship and Immigration Services, “Inadmissibility on Public Charge Grounds,” Department of Homeland Security, 84 Fed. Reg. 41292, October 15, 2019.

78. Jason Richwine, “The National Academies Did Not Say that Young, Low-Skill Immigrants Are a Fiscal Benefit,” Center for Immigration Studies, May 13, 2020.

79. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), Table 8–12, p. 430.

80. Renee Reichl Luthra and Thomas Soehl, “From Parent to Child? Transmission of Educational Attainment within Immigrant Families: Methodological Considerations,” Demography 52 (2015): 543–67.

81. The regression used to predict education for people younger than 25 in the third-plus generation has a constant term that is higher than that of the high school dropout level itself. That constant term makes it technically impossible for native-born Americans younger than 25 to be assigned a level of educational attainment below high school, which is not realistic. To correct that possibility, we include a random error term with mean zero and a standard deviation of half an education level in the prediction equation so that at least some natives younger than 25 will be coded as high school dropouts. The standard deviation was chosen to be consistent with the pattern of increasing variability in the equations used to predict educational attainment for future generations used in the Updated Model. In those equations, the error term for the attainment of immediate descendants has a standard deviation of 0.6 educational categories; the next generation has a standard deviation of 0.7; and so on. We simply work backward one generation to arrive at a standard deviation of 0.5 for the current generation.

82. The 2018 Long-Term Budget Outlook (Washington: Congressional Budget Office, June 26, 2018).

83. “Personal Consumption Expenditures Price Index,” Bureau of Economic Analysis, December 23, 2022.

84. Noah Johnson, A Comparison of PCE and CPI: Methodological Differences in U.S. Inflation Calculation and Their Implications (Washington: Bureau of Labor Statistics, 2017).

85. Joseph G. Haubrich and Sara E. Millington, “PCE and CPI Inflation: What’s the Difference?,” Federal Reserve Bank of Cleveland, April 17, 2014.

86. Philip Armour, Richard Burkhauser, and Jeff Larrimore, “Using the Pareto Distribution to Improve Estimates of Topcoded Earnings,” National Bureau of Economic Research Working Paper no. 19846, January 2014.

87. Phillip Armour, Richard Burkhauser, and Jeff Larrimore, “Using the Pareto Distribution to Improve Estimates of Topcoded Earnings,” National Bureau of Economic Research Working Paper no. 19846, January 2014.

88. Christian Gunadi, “On the Association between Undocumented Immigration and Crime in the United States,” Oxford Economic Papers 73, no. 1 (September 2019): 200–24.

89. Organisation for Economic Co-operation and Development, International Migration Outlook 2021 (Paris: OECD, 2021), p. 124.

90. Michael A. Clemens, “Fiscal Effect of Immigration: Reducing Bias in Influential Estimates,” Centre for Research and Analysis of Migration Discussion Paper Series no. 2134, University College London, December 2021.

91. We also ran the Cato Model with the higher emigration probabilities from Jennifer Van Hook and Weiwei Zhang, “Who Stays? Who Goes? Selective Emigration Among the Foreign-Born,” Population Research and Policy Review 30 (2011): 1–24, but that resulted in unrealistically high emigration probabilities. Surprisingly, this disadvantaged immigrants when calculating their net fiscal impact because they tended to emigrate in the middle of their most productive years, overwhelming the fiscally positive act of emigrating before retirement. The chances of young immigrants leaving the country by retirement were upwards of 70 percent when using those numbers, so we deemed those probabilities too high and stuck with those used by the National Academy of Sciences.

92. Michael A. Clemens, “Fiscal Effect of Immigration: Reducing Bias in Influential Estimates,” Centre for Research and Analysis of Migration Discussion Paper Series no. 2134, University College London, December 2021.

93. National Academies of Sciences, Engineering, and Medicine, The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), p. 488.

94. The 2018 Long-Term Budget Outlook (Washington: Congressional Budget Office, 2021).

95. Jennifer Van Hook and Weiwei Zhang, “Who Stays? Who Goes? Selective Emigration Among the Foreign-Born,” Population Research and Policy Review 30 (2011): 1–24.

96. U.S. Citizenship and Immigration Services, “Inadmissibility on Public Charge Grounds,” Department of Homeland Security, 83 Fed. Reg. 51114, October 10, 2018; and U.S. Citizenship and Immigration Services, “Inadmissibility on Public Charge Grounds,” Department of Homeland Security, 84 Fed. Reg. 41292, October 15, 2019.

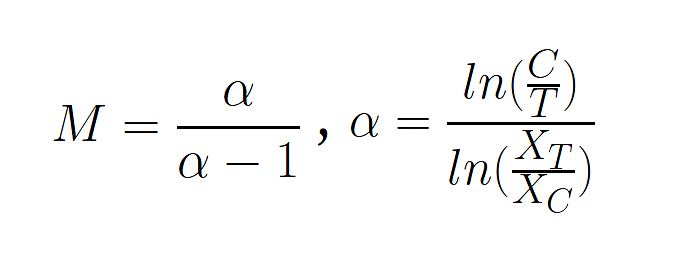

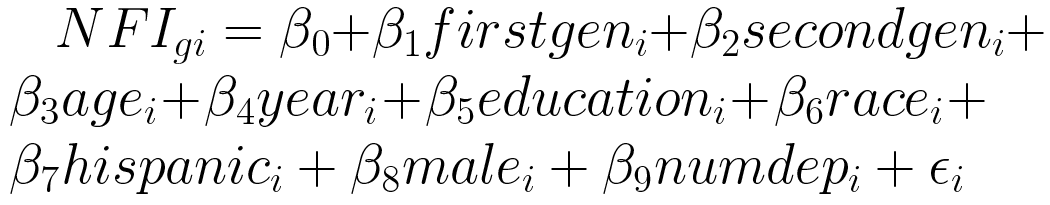

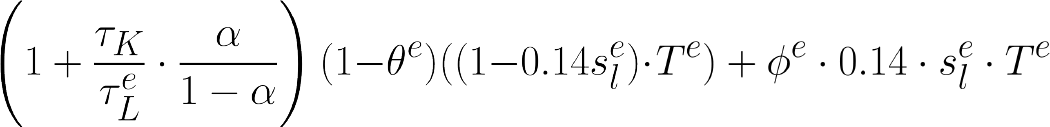

is the ratio of effective capital tax to effective labor tax for education level e (e refers to education level in all superscripts); α is the capital share of income (the complement of which is the labor share of income); θ is immigrants’ average fraction of nontransfer income from financial capital; s is the share of state/local taxes paid by immigrants; ϕ is the fraction of property taxes paid by immigrants that are owners rather than renters; and T is the NPV of total taxes paid.

is the ratio of effective capital tax to effective labor tax for education level e (e refers to education level in all superscripts); α is the capital share of income (the complement of which is the labor share of income); θ is immigrants’ average fraction of nontransfer income from financial capital; s is the share of state/local taxes paid by immigrants; ϕ is the fraction of property taxes paid by immigrants that are owners rather than renters; and T is the NPV of total taxes paid. . However, some capital income is already included in the taxes paid—including taxes on financial capital (θe) and taxes on property—so that must be removed to avoid double counting.

. However, some capital income is already included in the taxes paid—including taxes on financial capital (θe) and taxes on property—so that must be removed to avoid double counting.