Chairman Negron and members of the committee, my name is Michael F. Cannon. I am the director of health policy studies at the Cato Institute, a non-partisan, non-profit, educational foundation in Washington, D.C.. The mission of the Cato Institute is to promote the principles of individual liberty, limited government, free markets, and peace.

Introduction

The Patient Protection and Affordable Care Act and the Supreme Court's recent ruling in NFIB v. Sebelius give Florida officials considerable power to shape how that law operates in Florida — but only if the state declines to implement the health insurance Exchanges and the Medicaid expansion that law envisions. The moment Florida implements those programs, it cedes even greater control over its health care sector and the state's destiny to the federal government.

The PPACA

The Patient Protection and Affordable Care Act of 2010 depresses economic activity, eliminates jobs, increases health care costs, makes access to care less secure, increases the burden of government, and traps people in poverty. Repealing the PPACA is essential to making health care better, more affordable, and more secure.

In just its first six years, the PPACA will reduce economic output by as much as $750 billion1 and eliminate an estimated 800,000 jobs.2 Some of those job losses will be the result of the law's "employer mandate," which fines employers up to $2,000 per worker if they fail to offer "minimum value" and "affordable" health benefits.3 The rest will result from the disincentives to work the Act creates, such as implicit marginal tax rates that exceed 100 percent for many low-income households.4

The "individual mandate" requires nearly all Americans to purchase a governmentdesigned health plan or pay a penalty. That mandate has already increased the cost of health insurance for millions of Americans,5 has forced many to choose between violating their religious principles and paying a fine,6 and will increase premiums for millions more Americans when it takes full effect in 2014. Neutral observers and even supporters of the law project that in 2014, some consumers and employers will see their health insurance premiums rise by more than 100 percent.7

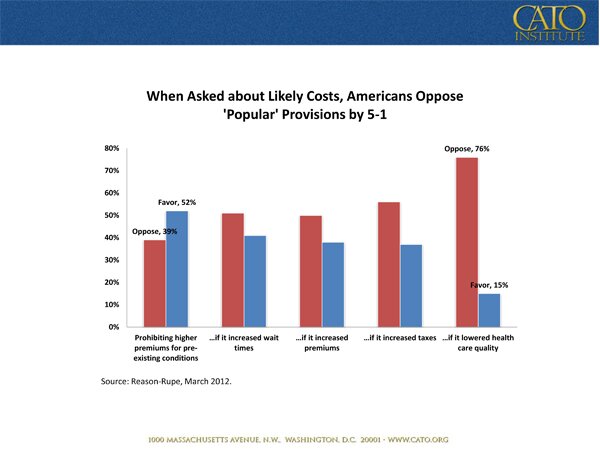

The PPACA's "community rating" price controls will destroy innovations that make health insurance better and more secure.8 They have already caused the markets for child-only health insurance to collapse in 17 states and caused insurers to flee the child-only market in a further 18 states.9 When implemented elsewhere, these price controls have forced health insurance companies to compete to avoid and mistreat the sick.10 Millions of Americans will suffer those consequences if these price controls take full effect in 2014. When informed that these price controls will reduce the quality of care their families receive, consumers overwhelmingly oppose these supposedly popular provisions.11

The law's minimum "medical loss ratio" requirement has already forced at least one health insurance carrier, Principal Financial Group, to exit the market, forcing nearly one million Americans out of their existing coverage.12

The PPACA's Medicaid expansion will crowd out private health insurance and leave many Americans with less secure access to care. A recent study projected "high rates of crowdout for Medicaid expansions aimed at working adults (82%), suggesting that the Medicaid expansion provisions of PPACA will shift workers and their families from private to public insurance without reducing the number of uninsured very much."13 Nationwide, nearly one third of physicians refuse to accept new Medicaid patients.14

The Act will further reduce access to care by reducing incomes. From 2013 through 2022, it imposes $1.2 trillion in new taxes15 and commits taxpayers to pay for an estimated $1.7 trillion in new federal spending.16 Roughly half of that amount consists of subsidies to private health insurance companies that will flow through new government agencies called health insurance "exchanges." The balance comes from a 50 percent increase in the number of nonelderly Medicaid enrollees.17

Finally, the PPACA spends money the federal government simply does not have. The federal treasury is currently running a $1.1 trillion deficit and has accumulated an $11 trillion debt.18 Exchanges would add roughly $700 billion to federal deficits over the next 10 years.19 The Medicaid expansion would add another $931 billion.20

Congress and President Obama have already repealed one of the PPACA's three new entitlement programs: the Community Living Assistance Services and Supports Act, or CLASS Act.21 They have also repealed federal funding for any new Consumer Operated and Oriented Plans,22 which Congress enacted as an alternative to a "public option."23

Why Florida Should Not Create a Health Insurance "Exchange"

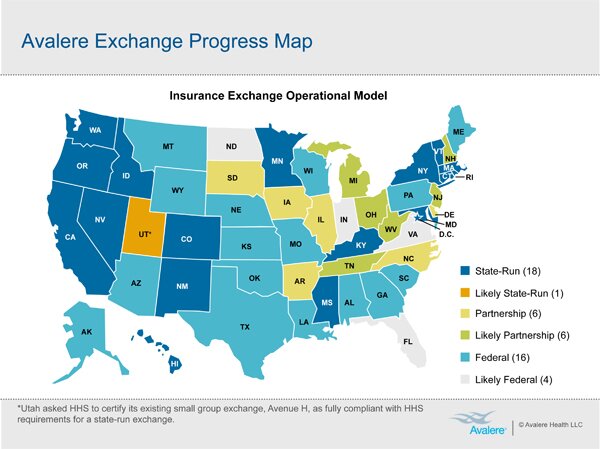

An astounding 32 states have refused to establish their own health insurance Exchange.24 Many states that initially pursued an Exchange did a complete about-face. Oklahoma, Kansas, and Wisconsin each returned to the federal government tens of millions of dollars in Exchangerelated grants.25 After an Exchange bill died in the New Hampshire Senate, a bill to prohibit the state from establishing an Exchange cleared the legislature and was signed by Democratic Gov. John Lynch.26

Many factors are driving state officials to reject Exchanges.

First, the PPACA does not mandate that states create Exchanges.

Second, in many states, creating a PPACA-compliant Exchange would violate state law.

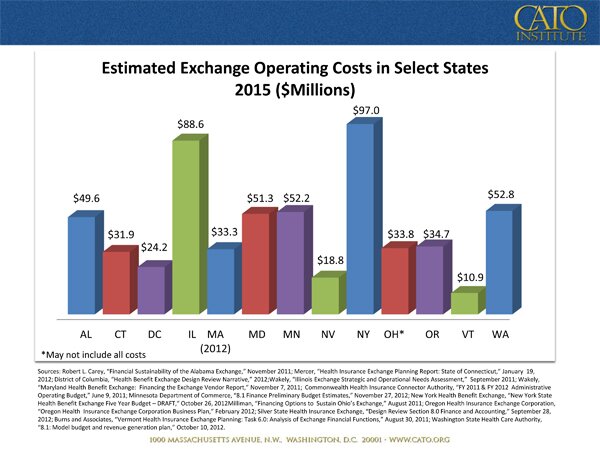

Third, Exchanges could require states to raise taxes. Based on estimates conducted in similar states (see attached), the cost of operating a Florida Exchange is likely to approach $100 million per year or more. Minnesota initially estimated its Exchange would cost $30 to $40 million per year to operate in 2015. The state subsequently increased that projection to $54 million in 2015 and $64 million in 2016. That's a 35-80 percent jump over initial projections and a growth rate of 19 percent per year.27

Fourth, there is no rush. The deadlines for establishing an Exchange are no more real than the "deadlines" for implementing REAL ID.

Fifth, states can always switch to a state-created Exchange if they decide they don't like a federal Exchange.

Sixth, state officials are increasingly coming to see the choice they face is not between a state-controlled Exchange and a federally controlled one, because even state-created Exchanges will be controlled by Washington.

Seventh, it is questionable whether the federal government will be able to create any Exchanges at all. The choice states actually face is therefore between a state-created, federally controlled Exchange and perhaps no Exchange at all.

Eighth, states are leery of committing to an Exchange when the federal government has yet to provide crucial information that states need to make an informed decision.

Ninth, creating an Exchange sets state officials up to take the blame when the PPACA increases insurance premiums and denies care to the sick.

Tenth, state officials would be assisting in the creation of something akin to a "public option" that could drive the state's domestic carriers out of business.

Eleventh, refusing to create an Exchange blocks federal subsidies for controversial abortifacients.

Twelfth, the PPACA is still unpopular, even after three years.

Finally, rejecting an Exchange blocks major provisions of the PPACA. Those provisions include the tax penalties imposed by the employer and individual mandates and hundreds of billions of dollars in deficit spending. Rejecting an Exchange therefore improves a state's prospects for job creation, and protects the religious freedom and conscience rights of millions of employers and individuals whom the Obama administration would force to purchase items that violate their moral convictions.

Perhaps the most important reason not to establish an Exchange is the last. Under the PPACA, if Florida creates an Exchange, then all employers with 50 or more employees will be subject to a tax of up to $2,000 per worker under the Act's "employer mandate."28 Employers with 50 workers could face a tax of $40,000, while those with 100 workers would face a tax of $140,000. In addition, millions of Florida residents will be subject to the Act's "individual mandate." Families of four earning $24,000 per year who run afoul of this mandate would face a tax of $2,085.

If Florida opts not to establish an Exchange, however, it can exempt all its employers and 1.1 million Floridians from those taxes. Florida would be in a position to lure jobs away from other states where those crushing taxes would apply. My coauthor Jonathan Adler and I explain this feature of the PPACA in a forthcoming article in the law journal Health Matrix.29

Contrary to the statute and congressional intent, the IRS is attempting to tax employers and such individuals even in states that do not establish Exchanges. Oklahoma, which has opted not to establish an Exchange, has filed a complaint in federal court to block the IRS from taxing employers in the state. If Florida were to establish an Exchange and Oklahoma prevailed in court, then Florida will be at a competitive disadvantage with other states with respect to job creation. Even if one supports the creation of an Exchange, therefore, Florida should postpone that decision until Pruitt v. Sebelius and any similar cases are resolved.

Another alternative would be for Florida to protect the rights of its employers and residents by filing a similar suit to block the IRS's illegal taxes. In addition, a strengthened version of the Health Care Freedom Act could effectively block the IRS's illegal taxes, and even prevent the federal government from operating Exchanges.30

Why Florida Should Not Expand Medicaid

You are all too familiar with how little control Florida has over its Medicaid program. If Florida implements the PPACA's Medicaid expansion, it will cede further control over the state's budget and its health care sector to Washington.

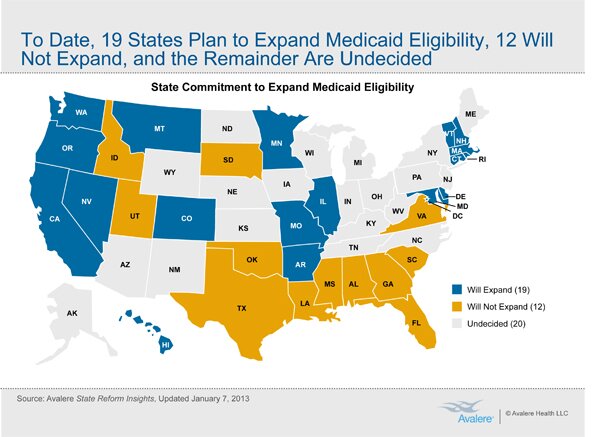

As originally conceived, the PPACA's Medicaid expansion was mandatory. Congress made state implementation of the expansion a condition of receiving federal Medicaid funds. That mandate required states to expand their Medicaid rolls numerous ways, resulting in a 50 percent increase in nonelderly enrollees.31 The penalty for non-compliance was states would lose all federal Medicaid funds, which comprise 12 percent of state revenues.32 Twenty-six states, led by Florida, challenged that mandate as unconstitutional, and won. NFIB v. Sebelius frees states not to implement the law's Medicaid expansion — i.e., all mandatory Medicaid provisions of the law, not just the newly eligible adult population.33

States should exercise that freedom and refuse to expand their Medicaid programs, for several reasons.

First, Medicaid is rife with waste and fraud.34

Second, Medicaid increases the cost of private health care and insurance, crowds out private health insurance and long-term care insurance, and discourages enrollees from climbing the economic ladder.35

Third, there is scant reliable evidence that Medicaid improves health outcomes at all, and absolutely no evidence that it is a cost-effective way of doing so.36

Fourth, states still lack guidance from Washington about how the Medicaid expansion will operate. A recent survey of governors' statements on the Medicaid expansion found, "three quarters of [uncommitted] governors said they needed more information on federal requirements, cost and enrollment projections, and policy alternatives."37

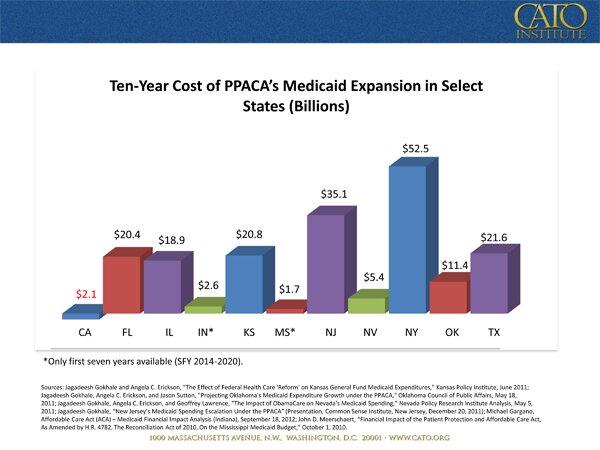

Fifth, even if states were facing deadlines and armed with all the regulatory guidance they need (neither of which is the case), they cannot afford to expand Medicaid. My colleague Jagadeesh Gokhale estimates the expansion will cost the state of Florida roughly $20 billion over its first 10 years.38 The National Conference of State Legislators reported that in 2012, states faced combined budget deficits of $32 billion.39 States' finances have improved only modestly since.

Sixth, historical experience with government health programs shows that enrollment and spending often dramatically exceed projections. Yet such programs are never eliminated or pared back in any significant way.

Seventh, rejecting the Medicaid expansion would reduce federal deficits and would reduce total government spending even more. According to CBO estimates, the handful of states that have refused to expand Medicaid have reduced federal deficits by $84 billion.40 The states that are refusing to expand Medicaid are doing more to reduce federal deficits than Congress and the president.

Finally, it would seem odd for Florida, which was a leader in the multi-state challenge to the PPACA that lead the Supreme Court to strike down the Medicaid mandate as unconstitutionally coercive, to respond to that victory by shrugging and implementing that costly Medicaid expansion anyway. It would more befit Florida's role to join Maine in challenging the Obama administration's arbitrary attempt to limit the Supreme Court's Medicaid ruling in NFIB v. Sebelius to the newly eligible adult population.

Real Health Care Reforms

Americans' access to health care is less secure than it should be precisely because of government interventions like the PPACA. Blocking and repealing this Act are therefore positive steps that will make health care more secure. For example, the CBO reports that repealing the Act would reduce premiums for many consumers by freeing them to purchase more affordable health plans.41 But state and federal officials should not stop there.

After rejecting both an Exchange and the Medicaid expansion, Florida should adopt reforms that make health care better and bring it within the reach of vulnerable Floridians.

First, Florida should enact a "Good Samaritan" law, like those enacted in Tennessee, Illinois, and Connecticut.42 Volunteer groups like Remote Area Medical engage doctors and other clinicians from around the country to treat indigent patients in rural and inner-city areas.

These clinicians are often turned away from providing free medical care to the poor because, while they are licensed to practice medicine in their own states, they are not licensed to practice medicine where Remote Area Medical is holding its clinics.

Remote Area Medical has had to turn away patients or scrap clinics in places California, Florida, and Georgia. "Before Georgia told us to stop," says founder Stan Brock, "we used to go down to southern Georgia and work with the Lions Club there treating patients." After a tornado devastated Joplin, Missouri, Remote Area Medical arrived with a mobile eyeglass lab, yet state officials prohibited the visiting optometrists from giving away free glasses.43

Tennessee, Illinois, and Connecticut have enacted laws that allow out-of-state-licensed clinicians to deliver free charitable care in their states without obtaining a new license. To protect patients, visiting clinicians should be subject to the licensing laws of the state in which they are practicing.

Second, Florida should apply for a waiver to determine whether Medicaid works. Most non-health care experts are surprised to learn how little reliable evidence there is that Medicaid has a positive impact on health, and how there is absolutely no evidence it is a cost-effective way to improve health.44

Rather than expand Medicaid, Florida should apply for a waiver to conduct an experiment like the Oregon Health Insurance Experiment (OHIE).45 The OHIE randomly assigned patients to receive Medicaid or not, with the goal of producing reliable data to measure the impact of Medicaid on existing populations. Unfortunately, Oregon officials arbitrarily halted the experiment. Florida should apply for a waiver from the federal government to conduct a similar study with existing populations. There likely will be objections to randomly assigning Medicaid slots to existing populations, yet the truly unethical position is to preserve or expand Medicaid without knowing whether it even helps the populations it is meant to help.

Third, Florida should let doctors and patients enact their own medical malpractice liability reforms. The cost of medical malpractice liability insurance increases the price of health care services, pricing many low-income patients out of the market. A given reform might reduce the price of medical services, but at the expense of preventing some injured patients from recovering the full cost of their injuries.46 When these complicated tradeoffs exist, the best approach is to let patients choose the tradeoff that works best for them.

Florida should therefore allow patients and providers to adopt their own "med mal" reforms via contract.47 Patients who want caps on non-economic damages, mandatory binding arbitration, medical courts, or a "loser pays" rule could have those measures, and any concomitant reduction in their medical bills. Patients who prefer to have an unlimited right to sue could write that into contracts with their medical providers, and pay whatever markup comes with that added protection.

The obstacle to such contracts is that courts do not enforce them. That unfortunate judicial trend denies access to care for low-income patients by denying them the opportunity to decide for themselves whether accessing medical care now is more important than having an unlimited right to sue in the unlikely event they suffer an injury due to a provider's negligence.

In states that have already enacted caps on noneconomic damages or other med-mal reforms, freedom of contract would allow patients to obtain greater protections than those laws allow. Florida's legislature should direct courts to enforce such contracts.

Conclusion

Thank you for allowing me to address the committee today. I look forward to your comments.

1 Christopher J. Conover, "Congress Should Account for the Excess Burden of Taxation," Cato Institute Policy Analysis No. 669, October 13, 2010, p. 8, https://www.cato.org/pubs/pas/PA669.pdf.

2 Michael F. Cannon, "Yes, ObamaCare Will Eliminate Some 800,000 Jobs," Cato@Liberty, November 2, 2011, https://www.cato.org/yes-obamacare-will-eliminate-some-800000-jobs/.

3 Congressional Budget Office, The Budget and Economic Outlook: An Update, August 2010, p. 49, http://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/117xx/doc11705/…. The employer mandate applies to employers with more than 50 employees. The penalty for failing to provide "essential" and "affordable" health benefits is a fine of $2,000 per full-time employee, minus the first 30 full-time employees.

4 Michael F. Cannon, "Obama's Prescription for Low-Wage Workers, High Implicit Taxes, Higher Premiums," Cato Institute Policy Analysis No. 656, January 13, 2010, https://www.cato.org/pubs/pas/pa656.pdf.

5 Michael F. Cannon, "Should Everyone be Required to Have Health Insurance?" Wall Street Journal, January 23, 2012, https://www.cato.org/publications/commentary/should-everyone-be-require….

6 Michael F. Cannon, "The Illiberality of ObamaCare," Huffington Post, February 14, 2012, http://www.huffingtonpost.com/michael-f-cannon/the-illiberality-of-obam….

7 Jonathan Gruber et al., "The Impact Of The ACA On Wisconsin's Health Insurance Market," July 18, 2011 ("Prior to tax subsidies, 41% of the market will receive a premium increase that is higher than 50%...54% of the members receiving greater than a 50% premium increase are age 29 or under.); Dennis Smith, Wisconsin Secretary of Health Services, Email Correspondence with Author, January 13, 2012 (Citing supplemental findings from Gruber et al.: "Another way to look at the data is to just look at the 1% of single policies that see the highest increases after accounting for the tax subsidy. In this case these 'top' 1% see an average increase of 126%."); Jeremy D. Palmer, Jill S. Herbold, and Paul R. Houchens, "Milliman Client Report: Assist with the First Year of Planning for Design and Implementation of A Federally Mandated American Health Benefits Exchange in the Individual Market," 2011, p. 7, http://www.ohioexchange.ohio.gov/Documents/MillimanReport.pdf ("In the individual market, a healthy young male (with benefit coverage at the market average actuarial value pre and post-ACA) may experience a rate increase of between 90% and 130%.").

8 See Michael F. Cannon, "BCBSNC's Premium Refunds Show the Perils of ObamaCare," Charlotte Observer, October 6, 2010, https://www.cato.org/publications/commentary/bcbsncs-premium-refunds-sh…; and John H. Cochrane, "Health-Status Insurance: How Markets Can Provide Health Security," Cato Institute Policy Analysis No. 633, February 18, 2009, https://www.cato.org/pubs/pas/pa-633.pdf.

9 United States Senate, Committee on Health, Education, Labor and Pensions, Ranking Member Report: Health Care Reform Law's Impact on Child-Only Health Insurance Policies, 112th Congress, August 2, 2011, http://help.senate.gov/imo/media/doc/Child-Only%20Health%20Insurance%20….

10 "Insurer Ends Health Program Rather Than Pay Out Big," Washington Times, October 14, 2009, http://www.washingtontimes.com/news/2009/oct/14/ny-insurance-company-tr…? page=all#pagebreak/; Editorial, "N.Y. Bill Would Protect High-Claims Patients," Washington Times, November 6, 2009, http://www.washingtontimes.com/news/2009/nov/6/ians-law-would-protect-h…, and Between You and Your Doctor: The Bureaucracy of Private Health Insurance, Day 1, Before the House Committee on Oversight and Government Reform, Subcommittee on Domestic Policy, 111th Cong. (September 16, 2009) (Testimony of Michael F. Cannon), https://www.cato.org/publications/congressional-testimony/providing-sec….

11 Reason-Rupe Public Opinion Surveys, "Reason-Rupe: March 2012 Topline Results (March 10-20)," March 26, 2012, http://reason.com/assets/db/13327241811317.pdf.

12 Avery Johnson, "Principal Financial Quits Writing Health-Care Policies," Wall Street Journal, October 1, 2010, http://online.wsj.com/article/SB100014240527487047894045755242811267003….

13 Steven D. Pizer, Austin B. Frakt, and Lisa I. Iezzoni, "The Effect of Health Reform on Public and Private Insurance in the Long Run," March 9, 2011, http://ssrn.com/abstract=1782210. See also Jeffrey R. Brown and Amy Finkelstein, "The Interaction of Public and Private Insurance: Medicaid and the Long-Term Care Insurance Market," American Economic Review 98, No. 3 (2008): 1083–1102; Geena Kim, "Medicaid Crowd-Out of Long-Term Care Insurance with Endogenous Medicaid Enrollment," 12th Annual Joint Conference of the Retirement Research Consortium, 2010.

14 Sandra L. Decker, "In 2011 Nearly One-Third of Physicians Said They Would Not Accept New Medicaid Patients, But Rising Fees May Help," Health Affairs 31, No. 8 (2012), http://content.healthaffairs.org/content/31/8/1673.full.

15 Douglas W. Elmendorf, "Letter to Rep. John Boehner on Repeal of Obamacare Act, as passed by the House of Representatives on July 11, 2012," July 24, 2012, p. 6, http://www.cbo.gov/sites/default/files/cbofiles/attachments/43471-hr607….

16 Congressional Budget Office, Updated Estimates for the Insurance Coverage Provisions of the Affordable Care Act, March 2012, p. 11, http://cbo.gov/sites/default/files/cbofiles/attachments/03-13-Coverage%….

17 Congressional Budget Office, Updated Estimates for the Insurance Coverage Provisions of the Affordable Care Act, March 2012, p. 12, http://cbo.gov/sites/default/files/cbofiles/attachments/03-13-Coverage%….

18 Congressional Budget Office, The Budget and Economic Outlook: Fiscal Years 2012 to 2022, January 2012, p. 10, http://www.cbo.gov/sites/default/files/cbofiles/attachments/01-31-2012_….

19 Congressional Budget Office, Updated Estimates for the Insurance Coverage Provisions of the Affordable Care Act, March 2012, p. 11, http://cbo.gov/sites/default/files/cbofiles/attachments/03-13-Coverage%…. This figure is reflects the net budgetary impact of $808 billion in refundable premium-assistance tax credits (foregone revenues and new outlays) and cost-sharing subsidies (new outlays), and $113 billion of penalties levied against employers (new revenues), which the tax credits and subsidies will trigger.

20 Congressional Budget Office, Updated Estimates for the Insurance Coverage Provisions of the Affordable Care Act, March 2012, p. 11, http://cbo.gov/sites/default/files/cbofiles/attachments/03-13-Coverage%….

21 American Taxpayer Relief Act of 2012, Pub. L. 112-240, Sec. 642, __ Stat. __ (2013).

22 Sarah Kliff, "The Fiscal Cliff Cuts $1.9 Billion from Obamacare. Here's How.", Washington Post, January 2, 2013, http://www.washingtonpost.com/blogs/wonkblog/wp/2013/01/02/the-fiscal-c…. Elise Viebeck, "Health Plan Advocates Slam 'Cliff' Deal Cuts," The Hill, January 3, 2013, http://thehill.com/blogs/healthwatch/health-reform-implementation/27547…. Sarah Kliff, "In 'Fiscal Cliff' Deal, a Blow to ObamaCare," Washington Post, January 15, 2013, http://www.washingtonpost.com/blogs/wonkblog/wp/2013/01/15/co-ops-were-….

23 Michael F. Cannon, "Fannie Med? Why a 'Public Option' Is Hazardous to Your Health," Cato Institute Policy Analysis No. 642, July 27, 2009, https://object.cato.org/sites/cato.org/files/pubs/pdf/pa642.pdf.

24 Kaiser Family Foundation, "State Decisions For Creating Health Insurance Exchanges in 2014," State Health Facts, January 4, 2013, http://statehealthfacts.kff.org/comparemaptable.jsp?ind=962&cat=17 .

25 Kansas returned $31.5 million and Oklahoma returned $54.6 million, see "Kansas Returns Health Insurance Exchange Grant," Reuters, August 9, 2012, http://www.reuters.com/article/2011/08/09/usa-health-exchangesidUSN1E77…. Wisconsin returned $37 million, See "Walker Turning Down $37 Million for Health Care," Associated Press, January 18, 2012, http://www.cbsnews.com/8301-505245_162-57361562/walker-turningdown-$ 37-million-for-health-care/.

26 Matthew Spolar, "Lynch Signs Bill Prohibiting State Health Exchange," Concord Monitor, June 22, 2012, http://www.concordmonitor.com/article/337540/lynch-signs-bill-prohibiti… .

27 Elizabeth Stawicki, "Minnesota Facing Bigger Bill For State's Health Insurance Exchange," Kaiser Health News, November 25, 2012, http://www.kaiserhealthnews.org/stories/2012/november/26/minnesota-heal… .

28 I.R.C. § 4980H(a).

29 Jonathan H. Adler and Michael F. Cannon, "Taxation Without Representation: The Illegal IRS Rule to Expand Tax Credits Under the PPACA," Case Legal Studies Research Paper No. 2012-27, December 14, 2012, pp. 42-44, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2106789; See also Michael F. Cannon and Jonathan H. Adler, "The IRS Has Gone Rogue," National Review Online, September 26, 2012, http://www.nationalreview.com/articles/328523/irs-has-gone-rogue-michae….

30 I am indebted to Joe Coletti for alerting me to this joint-approval provision.

31 Congressional Budget Office, Updated Estimates for the Insurance Coverage Provisions of the Affordable Care Act, March 2012, p. 12, http://cbo.gov/sites/default/files/cbofiles/attachments/03-13-Coverage%….

32 Cindy Mann, Joan C. Alker, and David Barish, "Medicaid and State Budgets: Looking At The Facts," May 2008, http://ccf.georgetown.edu/wp-content/uploads/2012/03/Medicaid_state-bud… ("It is often reported that states spend, on average, almost 22 percent of their state budgets on Medicaid, but this figure can be misleading because it considers federal as well as state funds. On average, federal funds account for 56.2 percent of all Medicaid spending.").

33NFIB v. Sebelius, 567 U.S. __, __ (2012), http://www.supremecourt.gov/opinions/11pdf/11-393c3a2.pdf. Emphasis added. Internal citations omitted.

34 Michael F. Cannon, "Entitlement Bandits," National Review, July 4, 2011, https://www.cato.org/publications/commentary/entitlement-bandits-how-ry….

35 Michael F. Cannon, "Medicaid's Unseen Costs," Cato Institute Policy Analysis No. 548, August 18, 2005, https://www.cato.org/publications/policy-analysis/medicaids-unseen-costs. See also Michael F. Cannon, "Sinking SCHIP: A First Step toward Stopping the Growth of Government Health Programs," Cato Institute Briefing Paper No. 99, September 27, 2007, https://www.cato.org/publications/briefing-paper/sinking-schip-first-st…- growth-government-health-programs-0.

36 Michael F. Cannon, "Oregon's Verdict on Medicaid," National Review Online, July 7, 2011, http://www.nationalreview.com/articles/271252/oregon-s-verdict-medicaid….

37 Benjamin D. Sommers and Arnold M. Epstein, "U.S. Governors and the Medicaid Expansion — No Quick Resolution in Sight," New England Journal of Medicine, January 16, 2013, http://www.nejm.org/doi/full/10.1056/NEJMp1215785.

38 Jagadeesh Gokhale, "Estimating ObamaCare's Effect on State Medicaid Expenditure Growth," Cato Institute White Paper No. 4, January 11, 2011, https://www.cato.org/publications/working-paper/estimating-obamacaresef…. See also Jagadeesh Gokhale and Angela C. Erickson, "The Effect of Federal Health Care 'Reform' on Kansas General Fund Medicaid Expenditures," Kansas Policy Institute, June 2011, http://www.kansaspolicy.org/researchcenters/healthcare/studiesanalysis/…; Jagadeesh Gokhale, Angela C. Erickson, and Geoffrey Larence, "The Impact of ObamaCare on Nevada's Medicaid Spending," Nevada Policy Research Institute Analysis, May 5, 2011, http://npri.org/docLib/20110510_Impact_of_Obamacare_on_Nevadas_Medicaid…; Jagadeesh Gokhale, "New Jersey's Medicaid Spending Escalation Under the PPACA" (Presentation, Common Sense Institute, New Jersey, December 20, 2011).

39 National Council of State Legislatures, "State Budget Update," Spring 2012, http://www.ncsl.org/portals/1/documents/fiscal/sbu_spring2012_freeversi….

40 Congressional Budget Office, Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision, July 2012, p. 2, http://www.cbo.gov/sites/default/files/cbofiles/attachments/43472-07-24….

41 Douglas W. Elmendorf, "Letter to Rep. John Boehner on Repeal of Obamacare Act, as passed by the House of Representatives on July 11, 2012," July 24, 2012, p. 13, http://www.cbo.gov/sites/default/files/cbofiles/attachments/43471-hr607… (Consumers in the individual market would be free to choose health plans that "cover a smaller share of enrollees' costs for health care and a slightly narrower range of benefits.").

42 See CONN. GEN. STAT. § 52-557b; 745 ILL. COMP. STAT. ANN. 49/25; and TENN. CODE ANN. § 63-6-701.

43 "Medical Volunteers Not Free to Cross State Lines," Associated Press, July 21, 2012, http://www.knoxnews.com/news/2012/jul/21/medical-volunteers-not-free-to….

44 Michael F. Cannon, "Oregon's Verdict on Medicaid," National Review Online, July 7, 2011, http://www.nationalreview.com/articles/271252/oregon-s-verdict-medicaid….

45 Amy Finkelstein, et al., "The Oregon Health Insurance Experiment: Evidence from the First Year," Quarterly Journal of Economics 127, No. 3 (2012): 1243-1285.

46 Shirley Svorny, "Could Mandatory Caps on Medical Malpractice Damages Harm Consumers?" Cato Institute Policy Analysis No. 685, October 20, 2011, https://www.cato.org/publications/policy-analysis/could-mandatorycaps-m….

47 Michael F. Cannon, "Reforming Medical Malpractice Liability through Contract," Cato Institute Working Paper, November 12, 2010, https://www.cato.org/publications/working-paper/reforming-medical-malpr…- contract.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.