Dear Chairman Heinrich, Vice Chairman Schweikert, and Members of the Committee: Thank you for inviting me to testify today.1

Industrial policy is back in Washington, and supporters claim not only that it can bring about a market-beating manufacturing renaissance for critical industries, but that this renaissance has already begun. In my testimony today, I’ll offer several notes of caution.

First, while domestic investment in manufacturing and related construction has increased substantially, it must be put into context. Both demand for and onshore investment in goods targeted by new U.S. industrial policy were increasing prior to the measures’ enactment, and recent increases in related private spending are still a relatively small share of U.S. economic output. Actual U.S. manufacturing performance, meanwhile, remains subdued.

Second, we must also consider the actual return on these investments. When the government showers preferred companies with trillions of taxpayer dollars and numerous restrictions on foreign trade competition, the policies will inevitably produce something in the real economy. The question is what, exactly, all that government support is getting us. If, for example, the policies generate hundreds of billions of dollars in private manufacturing investment that eventually translates into dozens of vibrant, innovative, and globally competitive American factories and a sterling U.S. economy, then the federal government’s gamble will have paid off. On the other hand, declarations of policy victory today will look foolish in retrospect if government coddling results in a few such successes but as many or more failures—not just a few empty fields or moribund facilities but entire companies and industries that depend on continuous federal protection or support—and myriad unintended or unseen costs in the broader U.S. economy.

Today it is too early to definitively say what new U.S. industrial policy will produce. However, there are already signs that the subsidies and protectionism supposedly fueling a U.S. manufacturing “boom” are encountering problems both domestically and internationally—problems that could undermine the industrial policies’ objectives at great budgetary and economic cost, and ones that the United States has encountered many times before in previous industrial policy experiments.

What Is Industrial Policy?

Examining the effects of the current U.S. industrial policy push requires clarifying what is and isn’t “industrial policy”—especially since advocates routinely claim that a wide range of past industrial or technological successes were caused by U.S. “industrial policies” that cannot meet any plausible definition of the term. Instead, both theory and practice in the United States lead analysts to coalesce around four elements that an industrial policy must reflect:

- It is focused on manufacturing;

- It consists of targeted and specific microeconomic (firm or industry-specific) support (e.g., tax credits, tariffs, or subsidies), as opposed to horizontal, sector-wide, or economy-wide policies (e.g., corporate tax reductions);

- It implements a broader government plan or strategy to achieve market-beating commercial outcomes in targeted industries or companies; and

- It requires that these outcomes are generated within national borders.2

Industrial policy does not seek to make the macroeconomic environment more conducive to industrial development in general. It does not target the overall levels of research, jobs, or even industrial activity in the United States, nor does it even correct perceived or real shortcomings of markets by any means necessary. Instead, industrial policy seeks to dictate the specific composition of commercial industrial activity within the nation to achieve a broader national goal. Thus, for example, industrial policy does not say “we need to lower carbon emissions” (via, for example, a carbon tax or a nondiscriminatory consumer subsidy paired with unilateral free trade in environmental goods); it says, “we need to lower carbon emissions by subsidizing or protecting American solar panel companies and workers.”

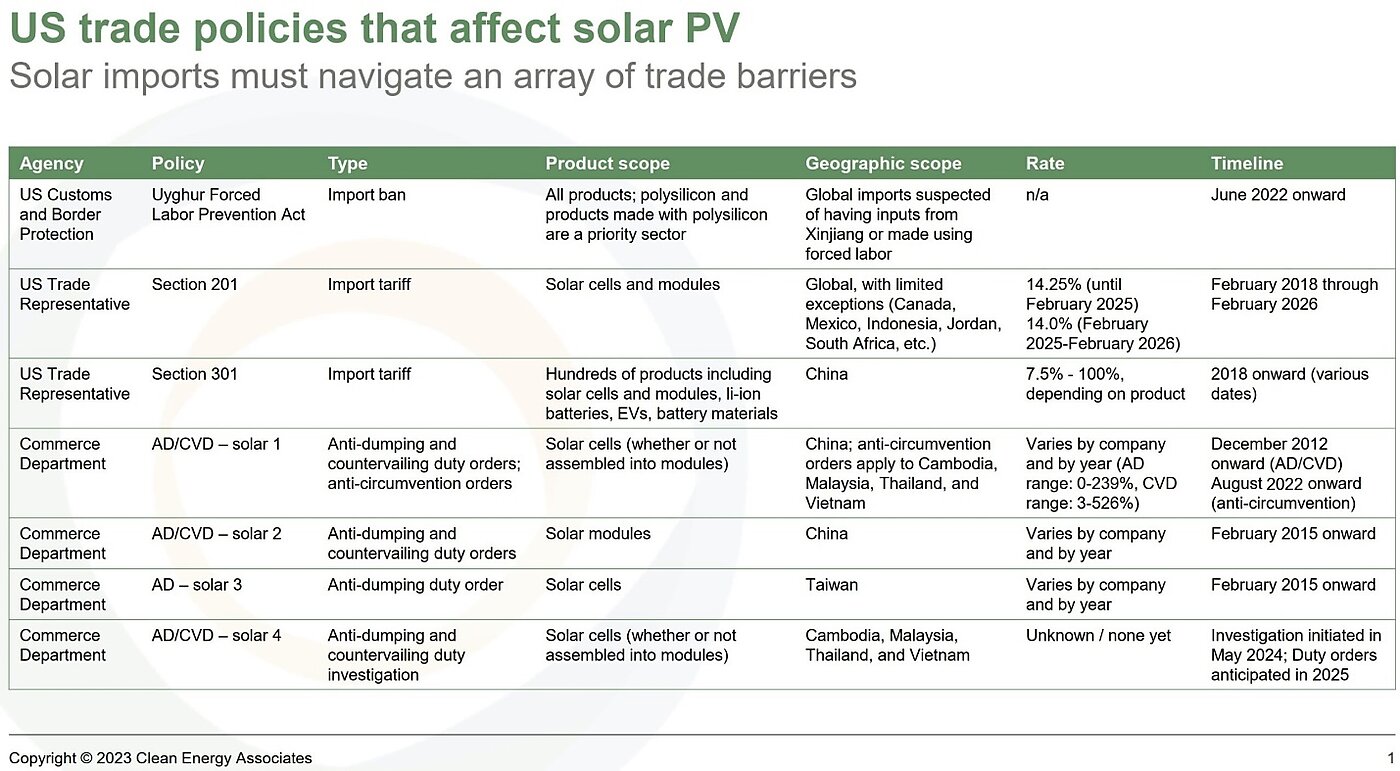

Based on these four criteria, the United States has indeed embarked on a vast new industrial policy experiment through a wide array of measures. This includes potentially trillions of dollars in federal grants, loans, loan guarantees, and tax credits extended to commercial manufacturers and buyers of “green” products and technologies under the Inflation Reduction Act (IRA), as well as tens of billions of dollars more in similar subsidies to semiconductor producers under the CHIPS and Science Act. (Energy analysts at Wood Mackenzie recently found that the cumulative cost of IRA tax credits alone could reach $2.5 to $3 trillion (about $9,200 per person in the United Sates) or more.3 The CHIPS and Science Act includes both $53 billion in direct government spending and an open-ended 25 percent tax credit for equipment that “some [semiconductor] executives estimate has already funneled tens of billions of dollars into the industry,” and that industry lobbyists are already seeking to extend beyond 2026.4) New U.S. industrial policies also include various “Buy American” restrictions in the Infrastructure Investment and Jobs Act and implemented via executive action, as well as recent U.S. restrictions on imported solar panels, semiconductors, electric vehicles, and other “strategic” goods.

In all cases, the measures at issue are intended to achieve market-beating outcomes in furtherance of broader federal environmental, industrial, or national security objectives. They are classic industrial policy.

The four criteria also reveal many past and ongoing U.S. industrial policies, such as the Jones Act, ethanol mandates, 1980s automotive import quotas, Bush- and Trump-era steel tariffs, Department of Energy loans, subsidies for “clean coal”, the U.S. antidumping law, and others. As I and other Cato Institute scholars have written5, these measures have been studied extensively and provide valuable lessons about not only the costs and failures of past industrial policy, but also possible warning signs in today’s industrial policy initiatives.

As I’ll discuss in the following sections, those signs are indeed appearing.

Putting the “Boom” in Context

First, however, we must put recent increases in both manufacturing investment and construction spending in proper context. For starters, it is unclear just how much of these gains have been caused by, instead of merely coincident with, new U.S. industrial policies. Prior to the measures’ enactment, the pandemic, geopolitics, and other factors had already increased companies’ interest in diversifying semiconductor sourcing6, and private demand for and investment in green energy was already soaring.7 As I document in Figure 1 below, moreover, a large share of major U.S. semiconductor and EV investment announcements trumpeted by the White House came months or even years before the CHIPS and Science Act and IRA became law:

It is possible that some of these early announcements were made in anticipation of new U.S. subsidies or tariffs, but many if not most probably weren’t. Even as late as July 2022, climate-related incentives in the IRA were considered off the table due to insufficient votes in the Senate8, and the CHIPS and Science Act also faced uncertainty until the very end.9 It is therefore reasonable to conclude that a nontrivial portion of the manufacturing investments that occurred before (or even shortly after) these bills passed Congress were not owed to the policies themselves. Indeed, even the Treasury Department, when heralding U.S. industrial policies’ effect on manufacturing investment last year, admitted that the increase in semiconductor and related electronics construction spending “began in the months before the CHIPS Act passed, as many factors beyond policy contribute to construction spending,” and that construction of several chipmaking facilities began before the law was enacted.10

Regardless, the manufacturing investments at issue, while historically elevated, are still a relatively small share of total private investment and even smaller share of total economic output. Real private fixed investment in manufacturing structures in Q12024, for example, was $147.6 billion (in chained 2017 dollars) and thus accounted for only 3.6 percent and 0.6 percent of total private fixed investment ($4.1 trillion) and Real Gross Domestic Product ($22.7 trillion), respectively, recorded during that same quarter.11 The month-over-month increases in nominal U.S. manufacturing construction spending also have stalled since February—though at still-higher levels than they were before 2022.12 And as the Treasury Department noted last year, total inflation-adjusted construction spending in the United States through April of 2023 was actually below levels seen in 2019 and early 2020.13

Thus, while the manufacturing investments might someday be important for the U.S. manufacturing sector, they are not the current economic gamechangers that they are often made out to be.

In the meantime, the actual U.S. manufacturing sector—i.e., the one producing goods and hiring manufacturing (not construction) workers today—has stagnated, thanks to higher interest rates, continued materials inflation, worker availability, economic uncertainty, tariffs and trade disputes, and other headwinds. Thus, Figure 2 shows that total U.S. manufacturing employment, output, orders, and capacity utilization have been basically flat since the Fall of 2022 (i.e., right after the IRA and CHIPS and Science Act were signed into law).14

Private surveys show similar trends. The latest (April 2024) Institute for Supply Management’s private survey of manufacturing purchasing managers (aka the “Manufacturing PMI”) sat at 49.2 percent—a contraction in economic activity that followed one month of expansion and 16 consecutive months of contraction before that, dating back to September 2022.15 The National Association of Manufacturers latest (Q1 2024) Manufacturers’ Outlook Survey, meanwhile, found that 68.7 percent of respondents felt “either somewhat or very positive about their company’s outlook”—“the sixth straight reading below the historical average of 74.8%.” The NAM report added that “the expiration of federal tax incentives related to R&D, interest deductibility and expensing for capital investments has already caused nearly 40 percent of respondents to pull back on hiring and investing due to increased taxes,” while 72.4 percent cited the costly federal permitting process as also affecting their investment decisions.16 The previous quarter’s report cited pessimism as particularly high among small and medium-sized businesses.17

Industries such as semiconductors and transportation have performed better in recent months. But, so far at least, the United States is witnessing less a “manufacturing boom,” and more the possible formation of a two‐tier industrial economy. In Tier One are large companies in industries preferred by the government and, to a lesser extent, reshoring operations because of pandemic‐related and geopolitical uncertainties. According to various reports, these firms are investing, more optimistic, and, theoretically at least, poised to grow in the future. In Tier Two, however, are many existing American manufacturers, especially smaller ones and ones not targeted for government support, that are weaker and more pessimistic. Their future remains more in doubt.

Perhaps a broad, nationwide “boom” materializes in the future, but it is just as likely—if not more so—that we are again seeing what critics of targeted tax credits, subsidies and tariffs have long cautioned regarding these types of policies, i.e., that they do not expand the overall economic pie in the United States or generate sustainable, long-term growth, but instead simply redistribute existing resources (money, materials, manpower, etc.) to favored companies at a net loss to the U.S. economy. This unfortunate outcome is especially a concern today, absent significant tax, regulatory, trade, immigration and other supply‐side reforms that would allow total national output to increase in response to stimulus-fueled demand—reforms that American manufacturers, including in government-preferred industries, are expressly seeking.

Early Warning Signs in the United States

As noted, it is too early to definitively judge new U.S. industrial policies. Measures of national manufacturing investment, even when adjusted for inflation, cannot tell us what those dollars—and U.S. taxpayer subsidies—will generate for targeted industries, in terms of output, jobs, innovation, and other concrete measures of success. Nor can such data tell us the extent to which U.S. industrial policy directly caused the increase in investment (as opposed to merely paying companies to do what they had already planned to do), or how the broader national economy will fare if or when subsidized and protected U.S. facilities come online. Thus far, we mainly have just national investment data and optimistic reports from government officials and the corporate recipients of federal support.

Recent developments in the United States, however, give us at least four reasons to be concerned about whether these investments will pay off.

First, the costs of building, staffing, and starting production within subsidized facilities has increased substantially—thanks in large part to U.S. policy. Part of the cost increase is owed to macroeconomic factors, as well as U.S. government subsidies further boosting demand for a limited supply of construction goods, services, and equipment.18 But it is also the result of new U.S. industrial policies colliding with longstanding supply-side constraints that prevent more resources from becoming available to U.S. builders and manufacturers – constraints often caused or exacerbated by other federal policies. For example:

- Long environmental impact assessments, litigation under the National Environmental Policy Act (NEPA), and other permitting restrictions have delayed or scuttled U.S. wind and solar projects and related domestic manufacturing.19 Semiconductor, EV, and minerals projects have faced similar regulatory constraints.20

- Restrictions on legal immigration are contributing to subsidized firms’ difficulties in finding workers to build and operate new facilities.21 This is a particular problem for high-tech manufacturing, which requires specialized talent in limited supply (here and abroad).22 Thus, for example, Taiwan Semiconductor Manufacturing Company (TSMC) has reportedly sought to bring in more than 1,000 workers from Taiwan to staff its Arizona project.23

- Tariffs, “Buy American” provisions, trade remedies duties, and other U.S. trade restrictions inflate the cost of construction materials and manufacturing inputs. Buy American restrictions in the IRA, for example, force companies to exclusively source products from American producers when cheaper alternatives are available from foreign sources and to undergo lengthy and bureaucratic compliance proceedings.24 Meanwhile, steel prices in the United States remain far higher than elsewhere, thanks to myriad import restrictions.

For these and other policy-related reasons, many subsidized manufacturing projects’ costs have increased substantially25, and even advocates have recently worried that existing supply-side impediments threaten U.S. industrial policies’ implementation and efficacy. As the former director of the White House National Economic Council Brian Deese just wrote in The Atlantic26, he and his colleagues “underestimated just how big a barrier [regulations] would pose to clean-energy adoption” and the IRA itself27—even though many experts had warned of these very problems long before the IRA became law.28

Second, higher costs, changing market conditions, and other issues have already caused many announced U.S. manufacturing projects to be delayed or canceled outright, some after companies had already spent significant sums on initial siting and construction. For example:

- TSMC has delayed production at its first semiconductor facility in Arizona (announced before CHIPS became law) from 2024 to 2025, while delaying its second plant from 2026 to 2028.29 Samsung originally said in 2021 (again, pre-CHIPS) that its Taylor, Texas facility would be mass producing chips in the first half of 2024 but has since punted the deadline to next year.30 In March of this year, Intel pushed the launch date of its Ohio factory from 2025 to 2027 or even 2028.31 Many other promised investments from these and other chip companies have not yet broken ground, and there is no guarantee they ever will. SkyWater Technology, for example, received a glowing 2023 New York Times review of its $1.8 billion investment in Indiana, yet just recently canceled those plans after losing out on CHIPS funds.32 Applied Materials’ $4 billion semiconductor research hub in Silicon Valley has been downgraded for similar reasons.33

- Numerous EVs and battery projects have also experienced delays and cancelations. For example, Vietnamese EV company VinFast has already pushed its factory in North Carolina, which President Biden in 2022 called “the latest example of my economic strategy at work,” from 2024 to at least 2025 but is now considering even further delays, as its already-cleared land sits quiet.34 Ford has announced that it would stall production of a new electric pickup truck at its new factory in Tennessee amid waning U.S. consumer demand for EVs (the company recently reported losses of 100,000 for every EV unit sold).35 Other issues have arisen with Ford in Michigan and the company’s battery ventures with China’s CATL and Korea’s SK, as well as with Rivian in Georgia, Nissan in Mississippi, GM in Michigan, the Apple Car project in California, Tesla in New York and Texas, VW/Scout in South Carolina, Panasonic in Kansas and Oklahoma, an un-sited Honda/GM joint venture.36 Various EV startups, such as Rivian and Lucid motors, are also struggling financially.

- Finally, Bloomberg reported last month that, less than two years after the IRA “unleashed a $16 billion flood of promised investments in solar manufacturing” (and despite numerous tariffs on imported solar modules and cells), “manufacturers have quietly shelved or slowed plans for at least four of those plants”, including Enel SpA in Oklahoma, Mission Solar in Texas, CubicPV in Massachusetts, Heleine in Minnesota.37 As the Financial Times reported in March, more than 115GW of solar manufacturing commitments are at risk because of higher costs and a surge of Southeast Asian imports that “remain far cheaper than US-made counterparts even accounting for tariffs and IRA subsidies.”38

Surely, not every subsidized and protected U.S. manufacturing investment is experiencing such difficulties, but these and other episodes nevertheless remind us that a wide and uncertain chasm lies between investment announcements and construction starts on the one hand and actual, functioning production facilities on the other. They also highlight the risk of industrial policies imposing not only significant budgetary costs, but also numerous unseen costs, including higher consumer prices (where higher costs are passed on39) and the diversion of taxpayer and private resources away from more productive and timely U.S. endeavors.

Third, there are already signs that at least some of the U.S. factories eventually completed might not produce innovative technologies that can compete in a global marketplace without open-ended government support. For example, even with numerous import restrictions and “hugely lucrative” IRA subsidies, BloombergNEF estimates that “US-made solar cells and modules will cost 18.5 cents a watt, compared with 15.6 cents for a product from south-east Asia.”40 Thus, U.S. solar producers recently filed yet another petition for import protection41—the seventh such action since 2012.42

New U.S. semiconductor facilities raise similar competitiveness concerns. TSMC’s first Arizona facility will produce 4‑nanometer chips in relatively small volumes (20,000 wafers per month) when it begins commercial production in mid-2025, but the company is already producing 3‑nanometer chips in Taiwan in much larger volumes (100,000 wafers/month this year43) and intends to begin mass producing 2‑nanometer chips there next year.44 Samsung will also reportedly begin 4‑nanometer production in Texas in 2025, at which time the company will be moving to 2‑nanometer production in Korea.45 Both companies have also reported substantial cost overruns at their U.S. facilities—costs that they may pass on to U.S. customers.46 (TSMC’s U.S. chipmaking operations reportedly cost 50 percent or more than they do in Taiwan.47) The companies’ executives also have repeatedly maintained that they will keep “the most cutting-edge chip fabrication technologies in their home countries.”48 National champion Intel, meanwhile, has suffered setbacks in advanced chip production since at least 201849, and many analysts today question the company’s ability to catch industry leaders like TSMC and Samsung.50

Finally, recent articles on the state of Chinese EV production suggest that U.S. producers’ vehicles are lagging not just in price, but also in quality and innovation.51 President Biden supposedly imposed high tariffs on these vehicles in the hopes that American automakers can catch up.

As I have documented52, however, there are strong economic and historical reasons to suspect that solar, EV, semiconductor, and other government supported industries will not become efficient, innovative, and globally competitive enterprises in the years ahead. There is also a serious risk that, instead of letting struggling industrial policy projects fail, U.S. policymakers will be tempted to keep them afloat with more subsidies and protectionism, and that American consumers and the broader U.S. economy and environment will suffer as a result.53

Fourth, we have strong reasons to worry that politics will undermine industrial policies’ implementation and efficacy—a common problem for such measures, especially the American political system.54 For example:

- The Biden administration has conditioned receipt of CHIPS and Science Act subsidies on applicants fulfilling certain social conditions—such as providing care for the children of workers; implementing diversity, equity, inclusion, and accessibility (DEIA) initiatives; and paying construction workers local “prevailing wages,” as defined under the Davis-Bacon Act—that will inevitably raise chipmakers’ costs.55 Per Bloomberg, nearly half of the IRA’s factory spending thus far has gone to a handful of swing states56, while a separate analysis recently found that the nine new U.S. “workforce hubs” targeted for place-based subsidies were located in politically important states instead of ones well-suited to receive workforce-growing subsidies (because of labor market slack).57 Given that U.S. industrial policies have generated a lobbying boom in Washington58, other political distortions seem likely.

- Bureaucratic delays and confusion have also materialized. For example, the EV transition requires availability of a vast network of charging stations, yet despite Congress previously agreeing to spend $7.5 billion to deploy thousands of chargers, not a single charger had been installed through this program by the end of 2023, with state governments and the industry blaming “the labyrinth of new contracting and performance requirements they have to navigate to receive federal funds.”59 Meanwhile, the eligibility of EV models for the IRA’s tax credits has changed multiple times as the Treasury Department has modified the relevant rules.60 The Environmental Protection Agency has similarly made multiple changes to tailpipe emissions rules—partly due to swing-state opposition—and thus changed the incentives surrounding EV adoption.61 And various groups have repeatedly blamed confusing and onerous Buy American rules for delaying, if not thwarting, the rollout of other industrial policy initiatives.62

- Political uncertainty and partisanship also threaten industrial policies’ ability to incentivize long-term investments in the United States. Given the differing positions taken on climate by the presumptive candidates for this year’s presidential election, firms cannot know whether at least some of the incentives currently available to them could be rolled back.63 An analysis by Wood Mackenzie reports that a change in administration come November would risk $1 trillion in investments in the U.S. energy sector.64 Similar uncertainty exists with regard to investments in electric vehicle production.65 Finally, politics means partisanship, which might be dictating many Americans’ views on, for example, buying an EV.66 Ford’s Motor Co.’s executive chair recently went so far as to worry that EVs have become as politically polarizing as COVID-19 vaccines.67

In sum, even if we assume that new industrial policies have caused most of the recent increase in U.S. manufacturing investment, many questions remain as to whether this spending will ultimately result in thriving domestic semiconductor, EV and other industries and thus justify the industrial policies’ exorbitant seen and unseen costs.

Many signs, in fact, point to the opposite conclusion.

Bring on the Subsidy Race (and Future Trade Disputes)

Recent U.S. industrial policy also raises concerns internationally. Subsidies here have prodded Japan, South Korea, Taiwan, the European Union, India, and other countries to offer subsidies of their own, while encouraging the Chinese government to double- or triple-down on its recent industrial policy schemes.68 Since the CHIPS Act was passed, for example, governments have offered more than $300 billion in grants, loans, tax credits, and other supports to keep or attract semiconductor investments (see Figure 3). The IRA fomented a similar reaction abroad.69

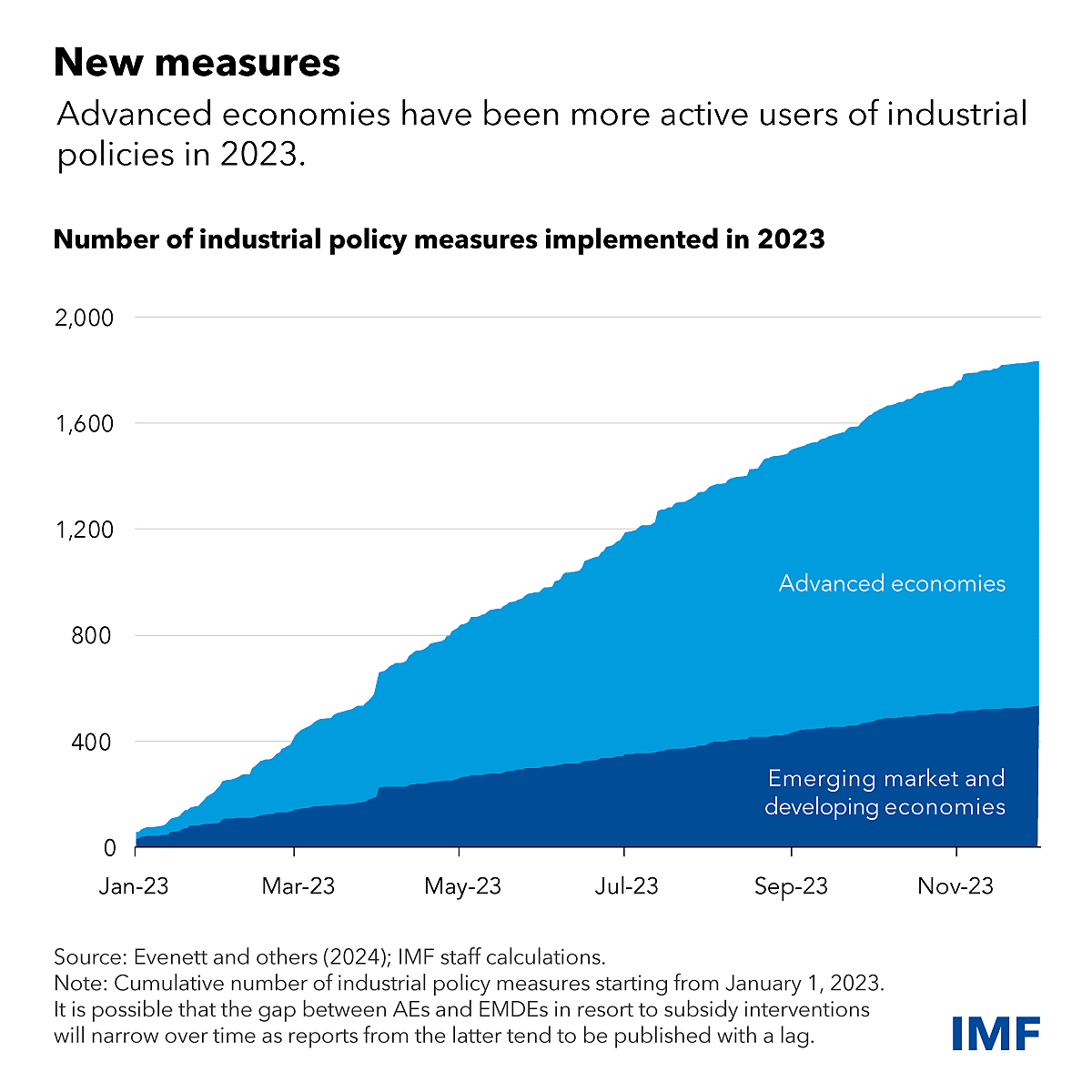

Overall, experts at the International Monetary Fund and the organization Global Trade Alert, which tracks nations’ use of industrial policy and related measures, have found a dramatic global increase in such measures in recent years—more than 2500 last year alone. They further concluded that this wave was “primarily driven by advanced economies” like the United States, with subsidies “the most employed instrument.”70

This recent trend is again unsurprising, as subsidy races are common throughout history.71 In fact, Global Trade Alert previously examined governments’ subsidy awards since 2008 and found that new measures in one economy were typically followed by similar subsidies in another economy just six months later.72

Today’s uncoordinated and predictable subsidy race raises several concerns. First, it could offset or even undermine the very domestic investments that the U.S. industrial policy is trying to encourage. Semiconductor subsidies, for example, were largely justified on the grounds that the United States’ share of global chipmaking has declined substantially in recent decades. However, as the Wall Street Journal recently reported, the Boston Consulting Group estimates that the semiconductor “building boom” here will—optimistically assuming everything announced actually gets built—boost the U.S. share of global chip production from 12 percent in 2020 to just to 14 percent in 2032, largely because other governments are also “stepping up” their own spending on these industries.73

Furthermore, rampant government subsidies raise a serious risk of global overcapacity that could collapse prices and put U.S. and foreign producers of subsidized goods in serious financial distress. In fact, there are already signs that the global semiconductor, solar panel, EV, and battery markets are reaching a point of saturation (or worse).74 Should global gluts materialize and persist, domestic manufacturers in the United States and other jurisdictions could request government protection from foreign competition, via “trade remedy” measures (i.e., antidumping or countervailing duties) or other import restrictions. This common move, in turn, could spawn retaliatory actions here and abroad, not only exacerbating economic losses from tit-for-tat protectionism but also raising diplomatic and geopolitical tensions with allies and challengers alike. In the end, almost everyone—consumers, producers, investors, etc.—would be worse off. And in the case of “green” goods, the environment would suffer too. (Solar panel prices in the tariff-protected United States, for example, are today around twice the global spot market price.75)

The risk of U.S. industrial policy encouraging subsidy races and trade conflicts is not merely theoretical. As I have documented repeatedly in several papers and columns76, this very scenario has played out many times throughout U.S. trade policy history—including in automotive goods and semiconductors in the 1980s and 1990s and solar panels today. Similar problems are not guaranteed to unfold in other industries in the future, but we should not be surprised if they do.

Second, subsidy races and trade conflicts can significantly harm developing countries that lack wealthy governments’ resources and typically depend on manufacturing and exports to move up the development ladder. The most common example of such harms is in agriculture, where subsidized and protected products from the United States, Europe, China, and other jurisdictions displace poor local farmers’ products in both domestic and export markets. As the World Bank recently noted in cautioning against the use of trade-distorting subsidies, the same problems exist for manufacturing: Poor countries are less integrated into global supply chains, in part because “subsidized exports of industrial goods, including parts and components, prevent developing countries from entering manufacturing value chains,” and “this may especially be the case as they lack the resources to counter the effects of other countries’ subsidies.” The authors further warn that this displacement “can limit the growth potential that trade offers low- and middle-income countries, as participation in manufacturing value chains is typically associated with higher investment and technological spillovers.”77 Other organizations, such as the IMF and World Trade Organization, have expressed similar concerns about the effects of today’s global subsidy race on the developing world.78

Conclusion

Industrial policy in the United States has long been hampered by economic, political, and practical challenges that limit its effectiveness, and it has repeatedly created unintended problems that harm the U.S. and global economies while fomenting government dysfunction along the way.79 While it is too soon to conclude that our latest round of industrial policy is following a similar path, the initial returns—both here and abroad—raise serious concerns and should, at the very least, caution against declaring victory based on a few positive stories and datapoints.

Plenty of warning signs indicate that history is indeed repeating again.

This does not mean that Congress should sit back and watch things unfold, simply hoping for the best. As I and others have written, including years before the CHIPS and Science Act and IRA became law, there are many market-oriented reforms that Congress should pursue to boost U.S. manufacturing and minimize problems associated with industrial policies. This includes eliminating tariffs and other restrictions on imports of key industrial and construction inputs; using international agreements to help U.S. companies access other markets and to expand our industrial base to include close allies; improving the tax treatment of capital investments; reforming NEPA and other burdensome regulations; increasing legal immigration; injecting competition in K‑12 and higher education; and enacting other market-based reforms. Global overcapacity, moreover, is best addressed through multilateral dispute settlement, instead of self-defeating, tit-for-tat protectionism.80

In short, there is a long list of time-tested policies that Congress and the administration can pursue to boost strategic industries in the United States and address some of the most pressing challenges facing our country today. Tariffs and subsidies, however, are not on that list.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.