Chairman Duncan, Vice Chair Curtis, Ranking Member DeGette, and distinguished members of the subcommittee:

Thank you for the opportunity to testify on the impact of the Biden-Harris administration’s energy policies on the affordability and security of energy and other necessities for American families and businesses. The Cato Institute is a nonpartisan public policy research organization dedicated to the principles of individual liberty, limited government, free markets, and peace. At Cato, I am the Director of Energy and Environmental Policy Studies, and my research focuses on the role of free markets in improving the availability and affordability of energy and natural resources.

Executive Summary

The state of American energy policy is weak. American families face rising utility costs, increased strain on household budgets, and uncertainty about whether new supply can meet rising energy demand. Congress should address these issues by reducing regulations, removing barriers to energy production and delivery, and ensuring American families have access to the nation’s abundant energy resources.

Many of the Biden-Harris administration’s policies aimed at reducing energy costs are ineffective or transient, such as the administration’s use of the Strategic Petroleum Reserve (SPR) to achieve political ends by temporarily reducing the price of gasoline. Other policies—like the multi-trillion-dollar energy subsidies enacted in the so-called Inflation Reduction Act (IRA)—hide large increases in energy costs by shifting them to the tax base.

Claims that the oil and gas industries are thriving under Biden-Harris policies are disingenuous—American oil and gas production is hitting record highs despite the current administration’s policies, not because of them. Indeed, the Biden-Harris administration campaigned on a promise to “end fossil fuels,” and its track record reflects that promise. Without these policies and others that predate the Biden-Harris administration, the supply of energy would be vastly greater in the United States.

Consequently, Americans have seen the cost of energy rise. This is a significant problem because higher energy costs raise the cost of everything. Food, transportation, and other basic goods and services require energy as an input—when energy costs rise, those increased costs show up in every part of the economy.

There is a better way. Policymakers should recognize that embracing the Green New Deal (or watered-down versions of it like the IRA) is economic self-destruction. The way to a prosperous, high-energy future is to embrace free enterprise and cut the red tape that bogs down so many American energy producers. We must remember the definition of energy in physics—the ability to do work—and create a policy environment that unleashes the nation’s energy resources and gives Americans the best opportunity to work, grow, and flourish.

Power in Focus: Affordable Electricity Is the Economy’s Foundation

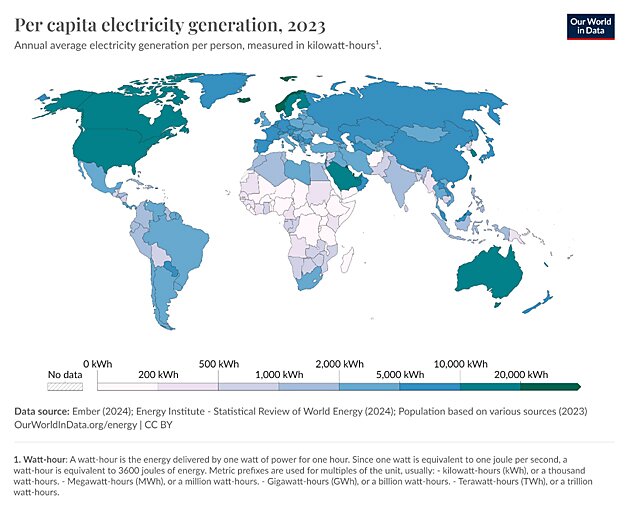

At the turn of the millennium, the National Academies of Engineering ranked the electric grid the greatest engineering achievement of the twentieth century.1 The main criterion for selection was how much an achievement improved people’s quality of life. American businesses need low-cost and reliable energy to compete globally, and American families need access to electricity at low and stable prices to thrive without breaking the budget.

Even in an energy-wealthy country like the United States, many households face energy insecurity.2 A recent Congressional Research Service (CRS) report on electric utility disconnections highlighted the hardships and threats to energy security faced by many American families:

“Researchers estimate that approximately 1% of households are disconnected each year. Broader measures of energy insecurity (e.g., foregoing other necessary expenses like food or medicine) are higher, with approximately 30% of American households experiencing some form of energy insecurity. Black and Hispanic households appear more likely to be disconnected than non-Hispanic White households. For many American families, electric utility disconnections are the most significant threat to energy security.”

Policymakers should understand the profound impacts that electricity policy can have on the daily lives of Americans. In living rooms across the country, the availability of low-cost electricity can make the difference between light and darkness, comfort and worry, or prosperity and hardship. Unfortunately, policies put forth by the Biden-Harris administration have undermined the affordability and reliability of electricity.3

Biden-Harris Policies Hurt the Power Grid

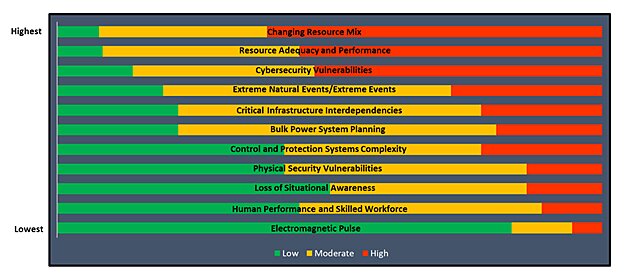

The current administration’s power grid policy can be summed up as follows: Green the grid, electrify everything, and brace for blackouts. Last year, for the first time ever, the North American Electric Reliability Corporation (NERC) identified energy policy as a leading risk factor for electric reliability.4 In NERC’s 2023 ERO Reliability Risk Priorities Report, the energy transition tops the risk rankings.

PJM Interconnection, Inc. (PJM), the largest electricity market in North America by revenue and volume, provided an accurate outline of the concerns facing the electricity industry in its 2023 report titled Energy Transition in PJM: Resource Retirements, Replacements & Risks.5 PJM identified four major trends (the bullets below are quotes):

- The growth rate of electricity demand is likely to continue to increase from electrification coupled with the proliferation of high-demand data centers in the region.

- Thermal generators are retiring at a rapid pace due to government and private sector policies as well as economics.

- Retirements are at risk of outpacing the construction of new resources, due to a combination of industry forces, including siting and supply chain, whose long-term impacts are not fully known.

- PJM’s interconnection queue is composed primarily of intermittent and limited-duration resources. Given the operating characteristics of these resources, we need multiple megawatts of these resources to replace 1 MW of thermal generation.

High prices in the recent PJM capacity auction are further evidence of strain on the PJM system. Capacity prices rose nearly ten-fold between last year and this year, highlighting the increases in new demand, the high cost of early power plant retirements, and the barriers to reliable new supply.6 Consumer advocates have estimated that the higher capacity costs could increase retail rates in Maryland by 24 percent.7

The electricity industry is at an inflection point. The drawbacks of a forced energy transition are becoming clearer—particularly if we look at examples of what not to do, such as Germany’s Energiewende.8 Still, many policymakers fail to recognize the gravity of the situation and the harm it will inflict on the American people if we continue to artificially restrict electricity supply. Below is a brief summary of some of the most damaging electricity policies in the United States.

The Inflation Reduction Act Weakens the Grid with Subsidies

The Inflation Reduction Act (IRA) threatens to undermine the well-functioning of the power grid by flooding it with subsidized, intermittent energy. One inescapable fact of the electricity industry is that dispatchable resources are necessary to match supply with demand and keep the grid energized at all times.9 By providing unlimited amounts of subsidies to intermittent resources like wind and solar energy, the IRA erodes the economics of dispatchable resources.

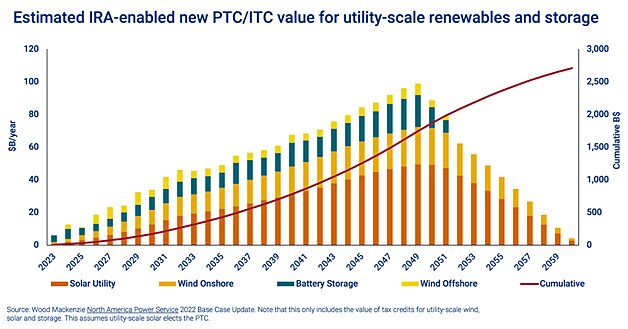

Beyond the 10‐year budget window, the cost of the IRA credits could increase and remain high for years, perhaps indefinitely. That is because the “applicable year” when the production tax credit (PTC) and investment tax credit (ITC) in the IRA will phase down is triggered by a greenhouse gas (GHG) reduction target that is impossible to meet. Specifically, GHG emissions in the electricity sector must fall to 25 percent of their 2022 level for the PTC to begin to phase down.

The U.S. Energy Information Administration analyzed electricity sector GHG emissions in the IRA reference case (and in the no‐IRA case) and found neither case to hit the “applicable year” target by 2050. Hence, the IRA subsidies are set to pile up for decades, potentially reaching $3 trillion in just the PTC and ITC.10 The chart below assumes GHG emissions targets will be met around 2050.11

The PTC will undermine the profitability of generators that use hydrocarbon-based fuels and will limit the ability of wholesale electricity markets to send accurate price signals and ensure reliability.12 In 2023, hydrocarbons provided 60 percent of America’s electricity and a higher share of dispatchable energy.13 The longer the IRA subsidies remain in place, the higher the cost to American taxpayers and to grid reliability.

Harmful Impacts of EPA’s Power Plant and Vehicle Regulations

The IRA also enables the Environmental Protection Agency (EPA) to claim carbon dioxide capture and storage (CCS) has been adequately demonstrated when, in fact, it is merely adequately subsidized.14 Thus, the IRA forms the basis of the EPA’s Best System of Emission Reduction (BSER). Even if CCS were feasible, it would be inappropriate to base a permanent rulemaking on a temporary budget reconciliation measure like the IRA.

The EPA’s regulatory regime is laden with legal infirmities, conflicts of interest, and technical and economic problems. The proposed power plant GHG regulation—sometimes referred to as CPP 2.0 because it’s the second attempt at a Clean Power Plan—relies on CCS, which has not been “adequately demonstrated” by any stretch of the imagination.15

In the CPP 2.0 final rule, EPA relied explicitly on the subsidies in the IRA to claim that the BSER technology—CCS designed to capture and store 90 percent of a power plant’s GHG emissions—is “adequately demonstrated.”16 A corollary of EPA’s reliance on IRA subsidies is that, when fiscal realities demand a claw-back of IRA subsidies, the CPP 2.0 will have to be clawed back as well.

The practical impact of CPP 2.0 will be to greatly reduce electricity supply. Given that CCS is not commercially available at any useful scale, the only compliance option for owners of existing coal-fired power plants is to shut down. The same goes for natural gas-fired generators—CPP 2.0 requires CCS for any new gas plant that operates above a 40 percent capacity factor, meaning new gas plants will be forced to operate at arbitrarily low levels.17 The inevitable result of the rule is the shutdown and inefficient operation of a significant amount of reliable generation.

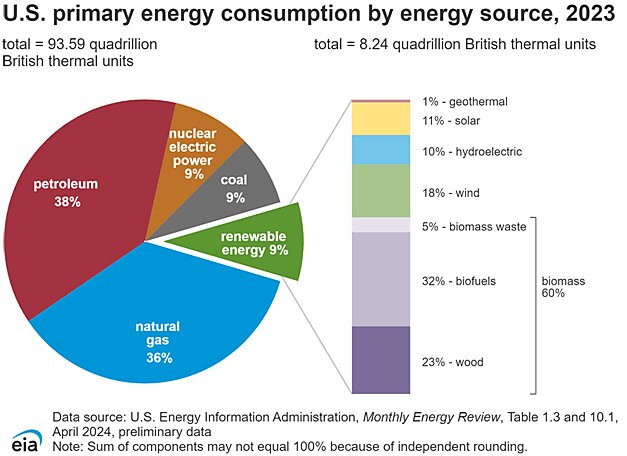

Likewise, the vehicle tailpipe emissions standard—a de facto mandate for electric vehicles—will also greatly increase electricity demand.18 That is because a significant amount of the energy needed for transportation must shift from being supplied by petroleum (gasoline and diesel) to being supplied by the power grid. In other words, the tailpipe rule will further increase demand growth, which is already accelerating.

The substantial amount of energy required for transportation is indicated by the pie chart below. Very little petroleum is used in electricity generation, yet approximately 38 percent of total primary energy came from petroleum last year, mostly for transportation.19

The result of reduced supply and increased demand is straightforward to predict: increased prices, energy shortfalls, and perhaps growing support for energy rationing.20 What that means for a typical electricity consumer is a higher power bill and an increased risk of blackouts.21 According to NERC, we are already in an elevated risk scenario. Hence any EPA policies that force an increase in demand or decrease in supply—including the tailpipe rule and CPP 2.0—will further weaken an already fragile grid.

Profound Flaws in the Biden-Harris EPA’s Impact Assessments

In the case of both the tailpipe rule and CPP 2.0, the EPA used a deeply flawed black-box model developed by a consulting firm to estimate the impacts of the rules on the retail price of electricity. The draft regulatory impact assessment for the tailpipe rule states that “[r]egional average retail electricity price differences showed small increases or decreases (less than approximately 1 to 2 percent),” meaning that EPA’s price model violates the law of supply. In no case should a rule that forces the rapid electrification of the transportation fleet—which represents a large increase in electricity demand—cause a price reduction.22

Regarding the price impacts of CPP 2.0, EPA finds that vastly reducing the supply of electricity generation would only increase retail electricity prices by 0.2% in 2035 on average.23 This is simply implausible and irreconcilable with recent observations, such as the high prices in PJM’s capacity auction and the multi-billion-dollar support program for dispatchable generation enacted in Texas.24 In other words, the costs are significant, but the EPA’s modeling assumes they don’t exist.

The EPA also dictates the benefits of its own regulations by using its own estimate of the Social Cost of Carbon Dioxide (SC-CO2). One fundamental problem (among others) is that the EPA faces a conflict of interest. The EPA should not be allowed to essentially print its own regulatory currency—the SC-CO2—to be used in justifying its own rules under the required cost-benefit analyses.25

The Anti-Hydrocarbon Agenda Hurts American Families

Politico recently reported that “[i]n the weeks before her CNN interview, Harris’ campaign responded to questions about fracking by pointing to the country’s record energy production under Biden.”26 However, these claims are disingenuous. American oil and gas production is hitting record highs despite the current administration’s policies, not because of them.

President Biden’s promise during the 2020 campaign to “end fossil fuel” is reflected in his administration’s track record.27 For example, the American Energy Alliance has documented more than 250 ways the Biden-Harris administration has hindered American oil and natural gas production since 2021.28 These restrictions have come in numerous forms: canceling pipelines, curtailing energy production on federal lands, and expanding environmental regulations.

The administration’s attempts to stop American oil and gas production have been facilitated by nearly every department and agency. In some cases, the anti-hydrocarbon policies have come from typical agencies like the EPA or Department of Energy (DOE). Recall, for example, the DOE’s arbitrary and capricious decision to pause natural gas exports.29 But in other cases, the agenda has emerged at agencies that have little to do with energy or the environment, such as the Securities and Exchange Commission.30

A White House press release stated, “President Biden and Vice President Harris have mobilized a whole-of-government effort in every sector of the economy” to address climate change and environmental issues.31 This “whole-of-government” approach is an ongoing attempt to stem the use of hydrocarbon fuels like coal, oil, and natural gas, ultimately harming consumers by decreasing supply and increasing costs. However, despite the widespread efforts to slow natural gas production in the United States, the industry has still managed to produce record amounts.32

The administration’s hindrance has resulted in higher prices than necessary for essential commodities. For example, in nominal dollars (not adjusted for inflation), Americans are now paying approximately 56 percent more for gasoline than they were when the Biden-Harris administration started.33 According to the Energy Information Administration, “U.S. inflation-adjusted energy expenditures for the end use of natural gas totaled $179 billion in 2022, a 26% increase from 2021.”34 Likewise, average electricity prices are outpacing inflation.35

The rising cost of energy is a significant problem because higher energy costs raise the cost of everything. Food, transportation, and other basic goods and services require energy as an input—when energy costs rise, the increased costs show up in every part of the economy.36 Mining, farming, manufacturing, and delivery all require energy.

Energy Freedom Is the Path to Prosperity

Economist Frederic Bastiat wrote: “Treat all economic questions from the viewpoint of the consumer, for the interests of the consumer are the interests of the human race.” Rather than engaging in debates about which corporate interest group should receive government favors, policymakers should put American families and businesses first.

Polling shows that most Americans are not willing to pay $1 per month to address climate change.37 Consumers’ focus is clearly on affordability rather than reductions in GHG emissions, and policymakers should take note of this.38and the federal government should not be in the business of making them equal by throwing taxpayer dollars at politically favored technologies.

I see two starkly different paths forward regarding energy policy in the United States. The first, which I endorse, is to embrace American free enterprise and foster an energy industry that competes to best serve the interests of American families. The second, which has taken hold in the Biden-Harris administration, is to force an unwise transition to politically favored energy resources and to limit the production and use of the resources that presently comprise the vast majority of American energy use.

Rather than allowing an energy crisis of their own making to unfold, policymakers should foster reliable, low-cost energy systems that provide a solid foundation upon which to build a strong and growing American economy. Recall that the physics definition of energy is the ability to do work. Policymakers should remove the barriers erected by unwise energy policy and let Americans get to work.

Thank you for the opportunity to provide testimony on the critical issue of the reliability and affordability of energy in the United States.

Thanks to my Research Associate Joshua Loucks for his help with this testimony.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.