Mr. Chairman and members of the subcommittee, thank you for inviting me to testify. I will discuss current proposals to increase federal spending and taxation. The Biden administration has proposed a $2.3 trillion American Jobs Plan and a $1.8 trillion American Families Plan. These spending increases would come on top of other large spending increases passed over the past year.

Additional federal spending would be a mistake. If Congress borrows to fund new spending, it would unfairly burden future generations and push the nation closer to a financial and economic crisis. If Congress funds new spending with higher taxes, it would undermine the recovery and reduce long-run growth.

Furthermore, the spending areas targeted by the Jobs Plan and Families Plan—from electric vehicles to childcare—would be more efficiently funded by the states or private sector. Federal intervention in state, local, and private activities usually increases costs, adds regulatory burdens, and reduces beneficial policy flexibility in the states.

The Budget Situation

President Trump and the previous Congress approved $3 trillion in pandemic relief last year, and President Biden and the current Congress approved another $1.9 trillion in March. Even without the proposed Jobs Plan or Families Plan, the federal government will spend about $6.8 trillion in fiscal 2021, up from $4.4 trillion in 2019.1 All the added spending has gone on the national credit card, which currently has an accumulated balance of about $22 trillion, or $172,000 for every household in the nation.2

Rising federal debt is a cost pushed onto Americans in the future in the form of reduced benefits and higher taxes. It is unfair to impose today’s costs on future generations because they will have their own costs and crises to deal with. Growing federal debt may also generate rising inflation and interest rates, precipitate adamaging economic crisis, and undermine long-run prosperity.

The president apparently recognizes that we cannot borrow-and-spend forever, so his Jobs and Families plans would be mainly funded by corporate and individual tax increases. But those tax increases would damage productivity and competitiveness, and thus reduce wages, incomes, and growth over the long run.

The federal government is already far too large for legislators to efficiently control and oversee. The federal budget is about 100 times larger than the average state government budget, and it includes more than 2,300 benefit and subsidy programs.3 Adding more programs would further undermine effective federal management and oversight.

As the economy continues to recover in the months ahead, Congress should shift its focus to reducing federal spending and deficits, reforming existing programs, and allowing the states and private sector tackle the nation’s spending and investment priorities.

Who Should Fund Priorities?

If the benefits of the proposed spending in the Biden administration’s Jobs Plan and Families Plan outweigh the costs, then they should be funded by the states and private sector. Tackling spending and investment priorities in a decentralized manner is more efficient because it involves less bureaucracy and allows more flexibility and diversity. There is no need for new federal subsidies or top-down micromanagement.

The administration proposes to increase funding of state infrastructure such as highways, transit, and water systems, as well as new social programs for childcare, paid family leave, and other activities. But the states are fully capable of funding such activities with their own income, sales, property, gas, and other taxes. Since 2013, 31 states have raised their own gas taxes to fund their transportation systems.4 With regard to paid family leave, eight states have created their own programs in recent years funded by state payroll taxes.5 Other states have decided not to create mandatory paid leave programs. The advantage of federalism is that it allows such policy diversity. In most domestic policy matters, it makes no sense for the federal government to override the democratic choices of the states.6

Supporters of expanded federal programs often suggest that the states lack resources, while the federal government has deep pockets. It is true that the federal government can run large deficits, which gives the illusion of deep pockets.But that is an argument against federal intervention, not for it. It is better to fund spending activities at the state level because the states must generally balance their budgets and be more fiscally prudent.

The administration has proposed spending hundreds of billions of dollars on private infrastructure, including electric vehicles, manufacturing, broadband, and the electric grid. As a political matter, such large corporate subsidies would be rocket fuel for more corporate lobbying in Washington, and they would also be incongruent with Joe Biden’s campaign statements against corporate welfare.

Furthermore, industry subsides are not needed. The Jobs Plan, for example, includes $174 billion in subsidies for electric vehicles and charging stations. But businesses are alreadypouringbillions of dollars into EV research, production, and infrastructure. There are already tens of thousands of EV charging stations across the country in places such as Target and Walmart parking lots. As businesses continue to invest, EV prices will likely come down, performance will improve, more EVs will be bought, and more charging stations will be installed by businesses. There is no need for further government subsidies.

Lastly, federal spending usually comes with top-down regulations that restrict state policy diversity and free choice. As a result, rather than unifying the nation, the administration’s new programs would risk increasing anger and division as the federal government imposed more one-size-fits-all rules in areas such as education, childcare, and automobiles.

Contradictions of Proposed Tax Increases

President Biden has proposed an array of large tax increases, including raising the corporate tax rate from 21 to 28 percent, raising the top capital gains tax rate from 23.8 to 43.4 percent, and raising the top individual income tax rate from 37 to 39.6 percent.

There are numerous contradictions in such tax increases.

Biden has proposed large subsidies for infrastructure, but his corporate tax increase would reduce private infrastructure investment. About 65 percent of America’s infrastructure is owned by the private sector, much of it by corporations, including broadband, the electric grid, pipelines, factories, and much else.7 Biden would subsidize broadband, the electric grid, manufacturing, and electric vehicles by hundreds of billions of dollars, but corporations in those and other industries would likely cut their own investments if faced with higher corporate taxes. The Tax Foundation estimates that Biden’s proposed tax increases would reduce investment in fixed assets, including infrastructure, by about $1 trillion.8

There is a similar contradiction with respect to innovation. Biden’s Jobs Plan would invest hundreds of billions of taxpayer dollars in research, “innovation hubs,” “small business incubators,” and other such efforts. But the proposed increase in the top capital gains tax rate would likely dry up financing for innovative businesses. Capital gains are the reward for risky investments in startups that usually take years to pay off, so when capital gains tax rates rise, investors move their funds to safer investments such as tax-free municipal bonds.

Another contradiction is that the Jobs Plan is supposed to mitigate climate change, but the green way to fund infrastructure is user charges, not income taxes. User charges include gas taxes which restrain automobile use, water charges which restrain water use, and airport passenger charges which restrain airline use. The Jobs Plan includes subsidies for automobiles, water systems, airports, and other facilities — all funded by income taxes, not pro-environment user charges. An advantage of leaving infrastructure funding to the states and private sector is that they are more likely to use pro-green user charges, which limit energy and resource use.

Lastly, while Biden’s proposals include subsidies for the states, his tax increases would risk crowding out or displacing state tax bases making it harder for the states to fund their own programs. Increases in federal tax rates on corporations and individuals would shrink tax bases and likely reduce state tax revenues. In California, about 50 percent of individual income and capital gains tax revenues are from the top 1 percent of households, so that state’s budget would suffer if those top-end taxpayers reported less income and gains.9

Federal Taxes by Income Level

President Biden says his Families Plan is “paid for by making sure corporate America and the wealthiest 1 percent just pay their fair share.”10 He further argues, “Working families pay taxes they owe on the wages they earn, while some of the wealthiest Americans avoid paying anything close to that fair share.” At a recent Senate Finance subcommittee hearing, Senator Elizabeth Warren said, “We can let our roads and bridges crumble, not upgrade broadband, make no investments in childcare, or getting lead out of drinking water, and let rich people keep paying taxes at about half the rate as everyone else.”11

The figure below is from the most recent CBO analysis of household income and taxes covering 1979 to 2017.12 These are average effective tax rates, which include federal individual income, corporate income, payroll, and excise taxes.

The average tax rate for the top 1percent of households has hovered around 30 percent since 1979, but with some ups and downs along the way. The average tax rate on the bottom fifth of households has plunged to near zero, and the average tax rate on the middle three-fifths has fallen. Thus, in terms of overall averages, Senator Warren’s claim is not correct. If “rich people” are the top 1 percent, their tax rate is about twice the rate of households in the middle and many times the rate of households at the bottom.

The CBO data show that the top 1 percent paid 25 percent of all federal taxes in 2017, up from 14 percent in 1979.13 The president has not said what he means by “fair share,” but that 25 percent share seems far more than fair if fair means redistribution away from the top.

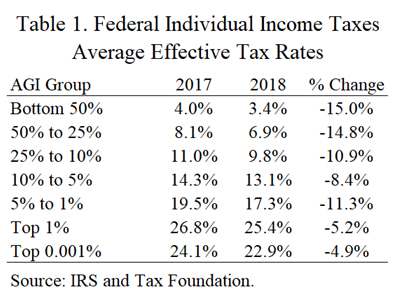

What about the effect of the 2017 Tax Cuts and Jobs Act? IRS data for average effective individual income tax rates for 2017 (pre-TCJA) and 2018 (post-TCJA) show that the legislation cut taxes across the board.14 Table 1 shows that the top-end tax cuts of about 5 percent were smaller in percentage terms than cuts in the middle and the bottom. (Note that the top 0.001 percent included 1,443 tax returns in 2018).

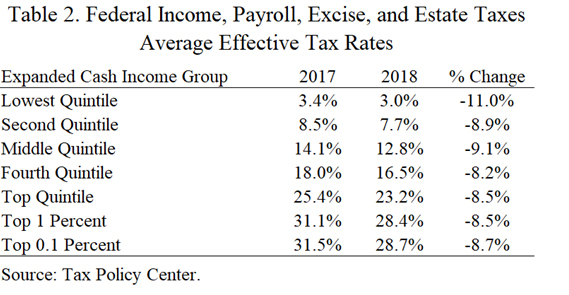

Another angle on the TCJA comes from Tax Policy Center estimates of incomes and total federal taxes, including taxes on individual income, corporate income, payroll, estates, and excises. Table 2 shows average effective tax rates by income group in 2017 and 2018, before and after the TCJA.15 Tax rates were reduced across the board by a similar percentage.

The table shows that the tax rates in 2018 ranged from 3 percent at the bottom to 29 percent at the top. Biden’s comments about “fair share” and Warren’s about the rich having low rates are clearly off base. The highest earners have tax rates twice the rates of those in the middle and almost ten times the rates at the bottom.

At the very top end, individual income tax rates dip a bit, which is evident in Table 1. The reason is mainly the large amount of capital gains realized by some individuals in particular years. The IRS tracked the top 400 highest earners in the country from 1992 to 2014 and found large dynamism in that group.16 Of all the taxpayers who appeared in the top 400 over that 23-year period, 71 percent appeared only once. The reason is that large capital gains realizations are rare events that rocket people to the top of the income heap, such as when entrepreneurs sell their businesses after years of ownership.

Problems with High Taxes on Capital or Wealth

President Biden’s Families Plan includes the subtitle, “Tax Reform That Rewards Work—Not Wealth.” But that statement suggests a misunderstanding of the role of wealth in the economy. Wealth or capital is just accumulated savings. It supports the operations and investments of business enterprises, which employ America’s workers. To grow and hire, economies need access to pools of savings held by wealthy people and everyone else.

Many policymakers are concerned that wealth is “concentrated.”17 But the savings of the wealthy is mainly dispersed across the economy in the form of productive business assets. Looking at the savings of the top 0.1 percent of the richest Americans, about 36 percent is equity in private businesses, 33 percent is equity in public businesses, 19 percent is fixed income assets, and 5 percent is pensions, which would be mainly invested in businesses.18 Just 8 percent of this group’s wealth is held in housing and other assets. So the great majority of wealth of the wealthiest Americans consists of equity and debt in businesses, which hire workers and generate output for the economy.

Capital and labor are complements in the economy—workers are more productive and better paid when they are supported by more capital. From an average worker’s point of view, it is beneficial if the wealthy are frugal and maximize their savings or capital. A basic problem with taxes on capital—including taxes on corporations, capital gains, and estates—is that they bias people toward consumption and away from savings and investment, thus undermining prosperity for all of us.19

Furthermore, many of the wealthy play unique roles in the economy. About 7 in 10 of the wealthiest Americans have self-made wealth, not inherited wealth.20 The annual Forbes 400 rich list contains a continually changing group of people who have launched innovative companies that have created new products, generated competition, and driven down consumer prices. Hitting this group with higher taxes would damage a key source of progress and opportunity in society.

All that said, capital income taxation can be improved. The Families Plan proposes to “end capital income tax breaks and other loopholes for the very top.” Taxation of capital income is uneven, with some income taxed heavily, such as the returns from corporate equity, and other income is taxed more lightly. Uneven taxation distorts investment flows. One break that should be eliminated is the tax exemption on municipal bond interest, the benefits of which are tilted toward the top end.

Taxation in the Global Economy

When making reforms to the federal tax system, policymakers should be aware of trends around the world. We live in a global economy with large flows of cross-border investment and substantial flows of highly skilled labor. Policymakers should focus on making America the best place in the world for entrepreneurship and investment. Unfortunately, the president’s proposed increases in corporate taxes and capital gains taxes would make the U.S. tax system much less competitive.

According to KPMG, the average corporate tax rate for 173 countries in 2021 is 23.7 percent, taking account of both national and subnational taxes.21 The average rate in Asia is 21.4 percent and the average in the European Union is 20.7 percent. The current U.S. federal-state rate is 27 percent. With the president’s proposed increase, the U.S. rate would rise to 33.4 percent, thus far above the averages of our trading partners.

The downward trend in corporate tax rates in recent decades has been beneficial for the global economy because corporate taxes are an inefficient source of revenue. An OECD study examining the economic effects of different taxesconcluded, “Corporate taxes are found to be most harmful for growth.”22 Corporate taxes are nontransparent and ultimately land on individuals, so it makes more sense to tax individuals directly.

Some policymakers are concerned that declining corporate tax rates have starved governments of revenue. Treasury Secretary Janet Yellen recently worried about a“30-year race to the bottom on corporate tax rates,” and wants to make sure that corporate taxes “raise sufficient revenue to invest in essential public goods and respond to crises.”23

Despite the decline in corporate tax rates, overall corporate tax revenues have not declined. For 22 OECD countries with good data back to 1980, I calculated the average corporate tax rate and average corporate tax revenues as a percent of GDP.24 The average rate fell from 47 percent in 1980 to 25 percent in 2019. But rather than falling, corporate tax revenues are up since the 1980s. Corporate tax revenues for the 22 countries rose from 2.4 percent of GDP on average in the 1980s to 2.9 percent in the 2010s.

The administration also proposes to raise the federal long-term capital gains tax rate from 23.8 to 43.4 percent. Many economists think that the revenue-maximizing capital gains tax rate is around 28 percent, so the government would likely lose revenues from such a rate increase while undermining investment in growth businesses.25 Note that state capital gains tax rates are loaded on top of the federal rate, such that the average federal-state rate with the administration’s increase would be 48 percent.26

Nearly every nation in the OECD has lower tax rates on capital gains than ordinary income, which makes sense because of the effects of inflation and the importance of entrepreneurship and growth businesses. Also, raising the capital gains tax rate would increase the tax code’s bias against corporate equity in favor of debt, which would result in more corporate leverage and less business stability during downturns. Also, if you view the ideal tax system to be a consumption-based system, then capital gains should not be taxed.27

A 2018 analysis by the OECD looked at combined tax rates on corporate equity, including the individual long-term capital gains tax rate and the corporate income tax rate.28 The analysis included national and subnational taxes. For 32 countries other than the United States, the average tax rate was 36 percent.29 The comparable U.S. rate today is 46 percent. By this measure, the U.S. tax rate on long-term capital gains is already substantially higher than the average of our trading partners, and the president’s proposal would push it up further.

An increase in the capital gains tax rate would undermine entrepreneurship and angel investment in innovative industries.30 Today, there are about 335,000 wealthy angel investors across the nation who fund a diversity of startup businesses.31 They take large risks, invest their time, and often wait five years or more until a small share of their startup investments pay off. They exit, realize a capital gain, and invest in new startup businesses.

Wealthy angels support entrepreneurs in a virtuous growth cycle. Startups that succeed generate returns for investors and entrepreneurs, who then reinvest their wealth into the next round of startups. Higher capital gains taxes would throw a wrench into the works by reducing incentives to invest in startups and by reducing incentives for skilled individuals to leave safer salaried work to take the risks of starting a business.

Since about eight percent of all U.S. companies shut down each year, the creation of new businesses is crucial to sustaining economic growth. Companies with the potential for rapid growth often receive early funding and guidance from angels. Angel-funded startups challenge incumbent businesses, restrain prices, and introduce new products. Some famous angel-funded startups that grew into large businesses include Apple, Amazon, Cisco, Google, Best Buy, Home Depot, Costco, Tesla, and Uber.

If you are worried about the power of big tech companies, the best restraint on them is making sure we have a good climate for angel investment and high-growth startup businesses to challenge dominant companies. Raising capital gains taxes would raise little government revenue and could create serious damage to America’s innovation industries.

In sum, while some of the activities that the Biden administration proposes to fund in the Jobs Act and Families Act may be worthwhile, it makes more sense to fund them at the state, local, or private levels. Federal intervention adds bureaucracy and reduces the freedom and flexibility of nonfederal entities to tackle problems in diverse and innovative ways.

Moreover, the tax increases proposed to fund the Biden proposals would put the United States in an uncompetitive position in the global economy and undermine the growth of startups and technology industries.

Thank you for holding these important hearings.