The Tax Cuts and Jobs Act of 2017 was the largest overhaul of the federal income tax in decades. The law changed deductions, exemptions, and tax rates for individuals, while reducing taxes on businesses.

More than 86 percent of middle- and higher-income households received an individual tax cut.1 Most lower-income households do not pay income taxes, but many of them received increased benefits from refundable credits. The average benefit across all households in 2018 is $1,260.2

This report looks at changes to individual income taxes, particularly the state and local tax (SALT) deduction. The 2017 tax law cut individual tax rates and roughly doubled standard deductions, but it also imposed a $10,000 cap per return on SALT deductions. Those changes are expected to reduce the number of households that deduct state and local income, sales, and property taxes from 42 million in 2017 to 17 million in 2018.3

Millions of households will feel a larger bite from state and local taxes and will thus become more sensitive to tax differences between the states. The tax law may prompt an outflow of mainly higher-earning households from higher-tax states to lower-tax states.

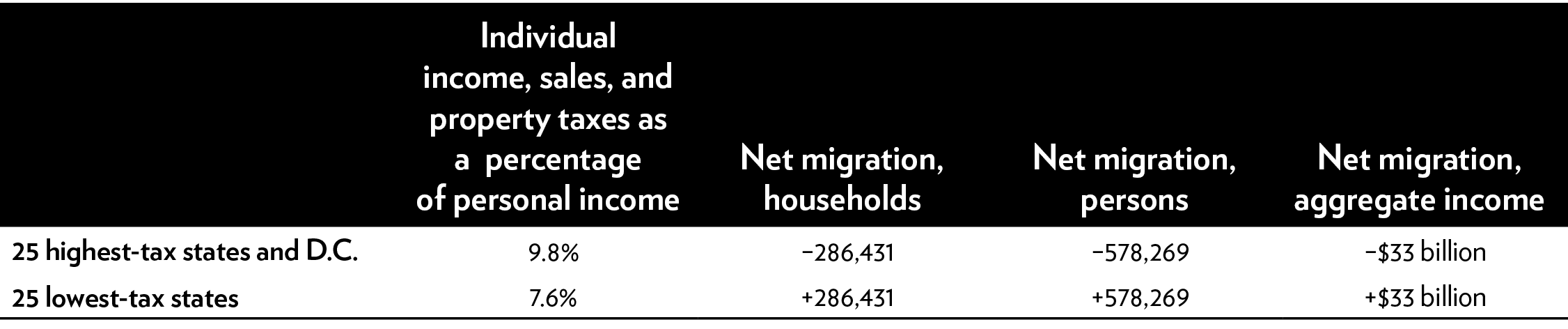

Even before the new tax law, a substantial number of Americans were moving from higher-tax to lower-tax states. Looking at migration flows between the states in 2016, almost 600,000 people with aggregate income of $33 billion moved, on net, from the 25 highest-tax states to the 25 lowest-tax states in that single year.

Interstate migration flows are influenced by many factors, including retirement, job opportunities, housing costs, and climate. Experts disagree about how large a role taxes play in migration, but that role will certainly be increased by the new tax law.

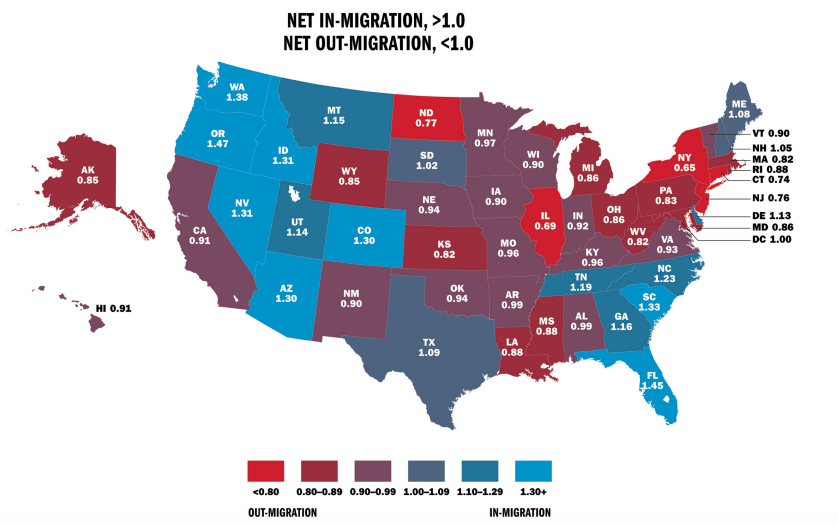

The raw data suggest that taxes do influence migration. Of the 25 highest-tax states, 24 of them had net out-migration in 2016. Of the 25 lowest-tax states, 17 had net in-migration. The largest out-migration is from high-tax New York, whereas the largest in-migration is to low-tax Florida. Florida is enjoying an influx of wealthy entrepreneurs and retirees looking for a tax climate that boasts no income tax or estate tax.

The following sections discuss changes to the SALT deduction and examine trends in interstate migration. Then, the report looks at the relationship between taxes and migration. The out-migration of high earners is a serious threat to high-tax states because those individuals pay a large share of state income taxes, invest in new businesses and generate jobs, and are heavily engaged in philanthropy.

In this new era of intensified tax competition, state policymakers should rethink their tax codes with an eye toward retaining and attracting residents. They should improve the efficiency of government services to give taxpayers more value for their money. And they should reduce regulations on individuals and businesses, given that Americans are migrating, on net, to states that provide more economic freedom.

State and Local Tax Deductions

Before the passage of the 2017 tax law, individuals had no direct limit on the amount of state and local taxes they could deduct on their federal returns.4 The deduction was available to households that itemized deductions, which in 2017 was 27 percent of tax filers. The other 73 percent took the standard deduction.5 Of households that itemized, 93 percent took the SALT deduction.

The effect of the SALT deduction was to soften the blow of state and local income, property, and sales taxes. For example, taxpayers in New York in the 33 percent federal bracket in 2017 who paid $30,000 in state and local income and property taxes could reduce their federal taxes by $10,000. The federal government essentially gave them a rebate of that amount.

Meanwhile, high-income taxpayers in California subject to the 39.6 percent federal tax rate and a state rate of 13.3 percent effectively faced just an 8.0 percent state rate because of federal deductibility. The higher the household’s income, the larger the effective federal subsidy.

The 2017 tax law changed that. Most higher-income taxpayers will now face the full brunt of state and local taxes—the full $30,000 cost in New York and the full 13.3 percent rate in California.

Before the law change, federal deductibility subsidized high-tax states and encouraged them to load their taxes onto higher earners. The SALT deduction induced “shifting of the jurisdiction’s tax burden to those individuals best positioned to receive the federal tax subsidy,” which were high earners because they were generally the ones who itemized.6

Taxes are the “price” residents pay for state and local services such as police and schools, but the SALT deduction effectively reduced that price, thus inducing residents to demand too much spending. The Congressional Budget Office noted of the SALT deduction, “Because of the subsidy, too many of those services may be supplied, and state and local governments may be bigger as a result.”7

The prior SALT deduction mainly benefited higher earners. Before the law change, 91 percent of the benefit went to households with incomes above $100,000.8 The deduction favored higher-income and higher-tax states over other states. In California, 96 percent of state and local deductions that exceeded $10,000 were taken by households with incomes above $100,000.9

The new SALT limit is a long-needed reform. Leading up to the Tax Reform Act of 1986, the Reagan administration proposed eliminating the deduction, with President Reagan arguing, “Perhaps if the high-tax states didn’t have this federal crutch to prop up their big spending, they might have to cut taxes to stay competitive.”10 The 1986 law did eliminate the deductibility of sales taxes, but Congress added back that deduction in 2004.

The 2017 law capped the SALT deduction at $10,000 per year, for both single and married tax filers. It also nearly doubled standard deductions. Those changes will reduce the number taking the SALT deduction from 42 million in 2017 to 17 million in 2018.11 For people who continue to take it, the average benefit will be less than half as large. The $10,000 cap is not adjusted for inflation.

The full weight of state and local taxes will now be felt by an additional 25 million households. The states where SALT deductions were the largest relative to incomes were New York, New Jersey, Connecticut, California, Maryland, Oregon, Rhode Island, Massachusetts, and Minnesota.12 Those are generally high-tax states.

Governments in high-tax states are worried that the SALT reform will induce additional high-earning taxpayers to move out. If they move in substantial numbers, it would be a blow to state budgets. In New York, the top 1 percent of highest earners pay 41 percent of state income taxes; in New Jersey, the share is 37 percent.13 In California, the top 1 percent pay a remarkable 50 percent of state income taxes.14

Under the new federal law, some states are becoming more cautious about raising taxes. New Jersey’s legislature passed bills to raise taxes on millionaires five times under former governor Chris Christie. Christie vetoed them. But now that New Jersey has a governor eager to raise taxes on millionaires, the legislature has shied away. State Senate President Steve Sweeney (D), who previously supported higher taxes, earlier this year cautioned, “This state is taxed out” and the federal tax law “changed the game for us.”15 But in July, Sweeney caved, agreeing with the governor to raise the top individual income tax rate from 8.97 percent to 10.75 percent.

To shield themselves from the SALT changes, some states are considering converting part of their mainly nondeductible income taxes into deductible employer payroll taxes. Other states are trying to convert state tax payments into charitable contributions, which continue to be fully deductible. New York has enacted limited versions of those mechanisms, but the schemes may not be effective or pass muster under federal tax law. The U.S. Treasury has issued a notice saying that it will be imposing regulations.

A more productive response to the federal tax changes would be for high-tax states to reduce their tax rates so that people have less incentive to migrate. State policymakers should use federal tax reform as an opportunity to rethink their state budgets to ensure that residents receive high-value services at minimum cost.

Will more people in higher-tax states move to lower-tax states under the new federal tax law? The next section looks at current migration trends to provide some clues.

Trends in Interstate Migration

This report examines interstate migration data produced by the Internal Revenue Service (IRS).16 The IRS flags when a tax filer’s address changes and has built a database aggregating moves in and out of every county and state. The database includes each tax filer’s adjusted gross income (AGI).

The IRS data show that 2.8 percent of tax filers—essentially households—moved between states in 2016. Tax-filing households may be either singles or married couples, with or without children. An average household comprises 2.1 people in the IRS data.17

The IRS data do not include households that do not file tax returns, so it misses about 13 percent of the population.18 However, the data are quite precise because they are not based on survey data, as are migration data produced by the U.S. Census Bureau.

Experts agree on the basics of interstate migration.19 The migration rate has dropped since the 1980s, although the IRS data show a smaller drop than the census data.20 The internal migration rate is higher in the United States than in most other high-income countries. Migration rates decline with age. Renters are more likely to move than homeowners. Singles are more likely to move than married couples. Migration is somewhat pro-cyclical.

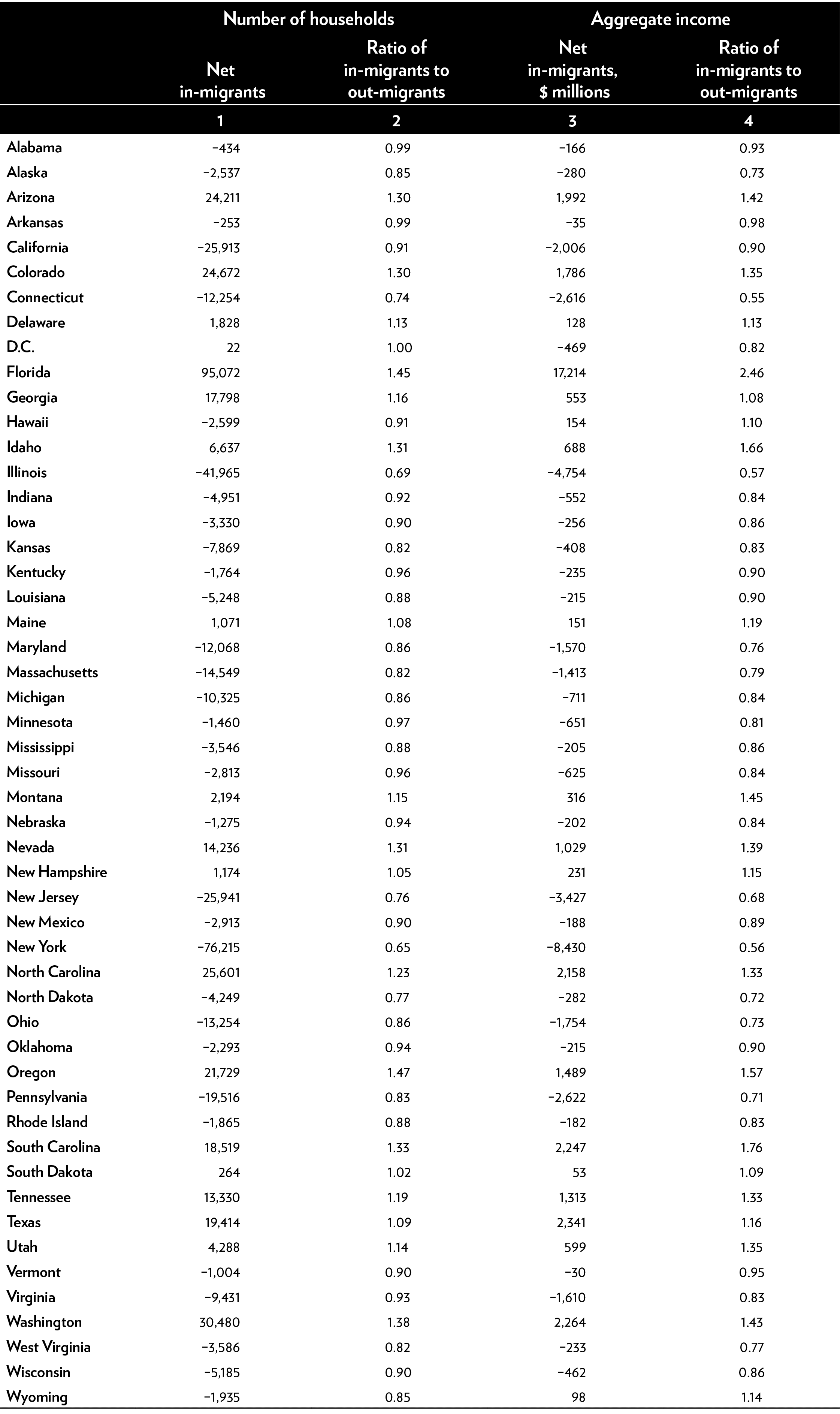

Table 1, column 1, shows the number of net domestic in-migrants (in-migrants less out-migrants) for each state in 2016, based on the IRS data. All data in this report exclude international immigration and emigration.

New York lost 218,937 households to other states in 2016, gained 142,722 households from other states, and thus had a net loss of 76,215.

The other states with the largest net migration losses were Illinois (41,965 households), New Jersey (25,941), California (25,913), Pennsylvania (19,516), Massachusetts (14,549), Ohio (13,254), Connecticut (12,254), Maryland (12,068), and Michigan (10,325).

Where did those domestic migrants go? The largest net inflows were to Florida (95,072), Washington state (30,480), North Carolina (25,601), Colorado (24,672), Arizona (24,211), Oregon (21,729), Texas (19,414), South Carolina (18,519), Georgia (17,798), and Nevada (14,236).

For nearly all states, the 2016 migration flows represent extended trends. For 48 of the 50 states, the net direction of migration (in or out) in 2016 matched the direction of the total net flows over the past five years. The two states that were different were oil producers Oklahoma and North Dakota, which used to have net in-migration but now have net out-migration. Also note that Texas had abnormally low in-migration in 2016—its net inflows over the past five years have been larger than Florida’s.

For many states, recent trends extend back decades. The largest net migration losers between 1993 and 2010 were New York, California, Illinois, Michigan, and New Jersey. The largest net migration winners over that period were Florida, Arizona, Texas, North Carolina, and Georgia.21

Table 1, column 2, shows the ratio of gross in-migration to gross out-migration in 2016. States losing population have ratios of less than 1.0. States gaining population have ratios of more than 1.0. New York’s ratio is 0.65, meaning that for every 100 households that left, only 65 moved in. Florida’s ratio is 1.45, meaning that 145 households moved in for every 100 that left.

Table 1: Interstate migration flows, 2016

Source: Author’s calculations based on Internal Revenue Service data.

The IRS database includes AGI, so we can see how much aggregate income is migrating between the states. The AGI is the income reported in the first year a household is at a new address. Strictly speaking, AGI does not migrate; people do. An individual’s income may be higher or lower after moving to a new state. Nonetheless, saying that income is “migrating” is rough shorthand for saying that the earning power of households is moving between states.22

In 2016, households with $227 billion of income moved between states. Looking at Table 1, column 3, New York lost a net $8.4 billion in income to other states in 2016, whereas Illinois lost $4.8 billion. Florida gained $17.2 billion.

The ratios in column 4 are similar to those in column 2, except that they are ratios of income, not households. Florida’s household ratio is 1.45, and its income ratio is 2.46. The larger income ratio means that in-migrants to Florida have much higher incomes than out-migrants do. Other states with a much higher income ratio than household ratio include Idaho, Montana, South Carolina, Utah, and Wyoming. Those states are attracting large numbers of high-income in-migrants compared with their out-migrants.

When the column 4 ratio is lower than the column 3 ratio, it means that the state has net out-migration particularly of higher-income households. Connecticut is a good example.

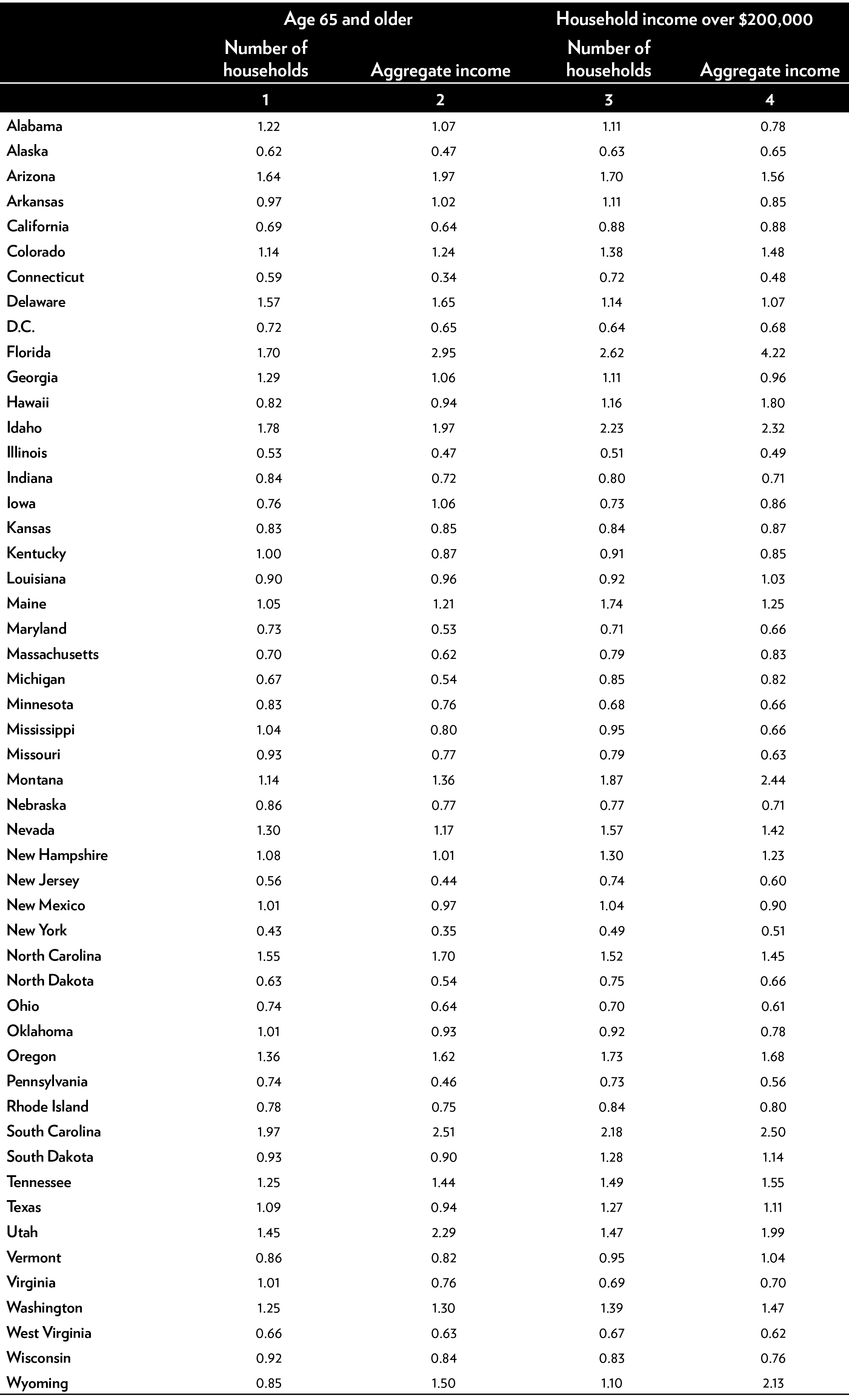

Table 2 shows net migration ratios for households headed by persons age 65 and older and for households with incomes of more than $200,000. Some of the places that both seniors and high earners are leaving, on net, are Alaska, California, Connecticut, Illinois, Maryland, New Jersey, New York, North Dakota, Pennsylvania, and West Virginia. Some of the places that the two groups are moving to, on net, are Arizona, Colorado, Florida, Idaho, Montana, Nevada, North Carolina, Oregon, South Carolina, Tennessee, Utah, and Washington State.

Table 2: Ratios of in-migrants to out-migrants, seniors and high earners, 2016

Source: Author’s calculations based on Internal Revenue Service data.

Why Do People Move?

An annual Census Bureau survey asks people who move any distance the main reason for their decision out of 19 choices. The most popular choices in 2017 were “wanted new or better home” (16.0 percent), “to establish own household” (11.5 percent), “other family reason” (11.3 percent), “new job or job transfer” (9.9 percent), and “wanted cheaper housing” (8.3 percent).23

The Census Bureau does not ask movers about taxes. But some of the 19 choices may reflect the influence of taxes. For example, people moving for housing reasons may consider the level of property taxes since those taxes are a standard item listed on housing sale notices. Similarly, people moving for new jobs may consider the effect of income taxes if they are, for example, moving between a high-tax state such as California and a state with no income tax such as Nevada.

A national survey by Bankrate found that taxes play a substantial role in retirement location decisions.24 Based on their survey, Bankrate weighted the location choice factors as follows: cost of living (20 percent), taxes (20 percent), health care quality (15 percent), weather (15 percent), crime (10 percent), cultural vitality (10 percent), and well-being (10 percent). Bankrate found that 47 percent of Americans would consider moving when they retire.

Figure 1 shows that many people are moving from northern states to southern states. Liberal analysts typically attribute that fact to people wanting to live in warmer states. Conservative analysts typically attribute it to people wanting to live in lower-tax states. Looking at the Census Bureau survey data for interstate moves only, of the 19 choices, only 2.2 percent chose “change of climate” as the move reason.25 That is surprisingly low. Apparently, there is more to the popularity of many southern states than just higher temperatures.

Figure 1: Interstate migration flows, ratios of in-migrants to out-migrants, 2016

Source: Author’s calculations based on Internal Revenue Service data.

Americans Are Moving to Lower-Tax States

Americans are moving from higher-tax states to lower-tax states in substantial numbers. That is clear from the raw migration data discussed here.

State and local tax revenues averaged 10.1 percent of personal income in the nation in 2015, according to the Census Bureau.26 Sales taxes were 3.5 percent, property taxes were 3.1 percent, individual income taxes were 2.4 percent, and corporate and other taxes were 1.1 percent. Sales taxes include general sales taxes and selective sales taxes on products such as gasoline, alcohol, and cigarettes.

Which of those taxes might influence individual migration decisions?

Polls have asked Americans their “most disliked” taxes.27 The most disliked state and local tax has long been the property tax. After that, Americans dislike sales taxes and individual income taxes. Other polls have asked which taxes are the least “fair.” Property and various selective sales taxes are often the top responses, followed by individual income and general sales taxes.

Thus, sales, property, and individual income taxes likely have the most influence on migration decisions, as they are the largest state-local taxes and the most disliked. Corporate taxes are less disliked in polls, which is not surprising because they are less visible to the public.

Table 3 shows data for the combined net migration flows for the 25 highest-tax and 25 lowest-tax states. Taxes are measured as state and local sales, property, and individual income taxes as a percentage of state personal income. In 2016, 578,269 people moved from the highest-tax states and the District of Columbia to the lower-tax states, on net. Of the 25 highest-tax states, 24 had net out-migration. Of the 25 lowest-tax states, 17 had net in-migration.

Table 3: Net migration from high-tax to low-tax states, 2016

Source: Author’s calculations based on Internal Revenue Service data.

The tax gap between the 25 highest and 25 lowest states may not seem large at 2.2 percentage points of income. But many of the largest migration flows are between the states with the very highest and very lowest taxes. The largest outflow state, New York, has a tax burden by this measure of 13.0 percent, whereas the largest inflow state, Florida, has a tax burden of 6.6 percent.

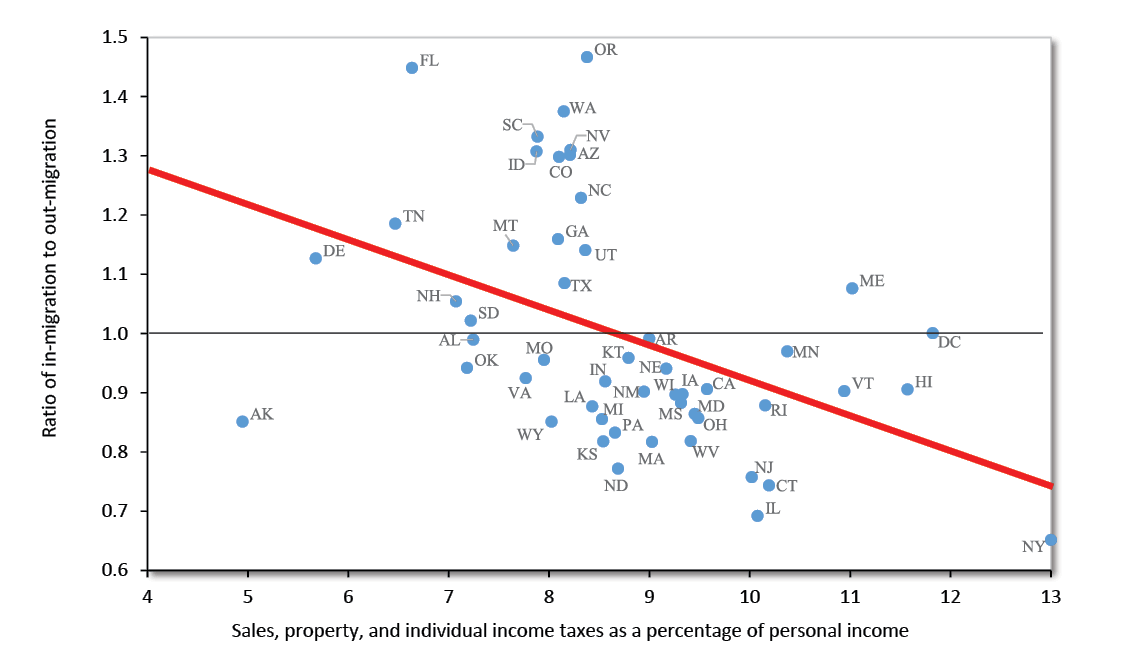

Figure 2 shows the relationship between tax levels and migration ratios. The migration ratios are from Table 1, column 2. The tax variable is the average state and local sales, property, and individual income taxes as a percentage of personal income.28

Figure 2: Tax levels and net migration ratios, 2016

Source: Author’s calculations based on data from the Internal Revenue Service and U.S. Census Bureau.

The figure shows a clear negative relationship between tax levels and migration. On the left, states have lower taxes and net in-migration (a ratio greater than 1.0). On the right, states have higher taxes and net out-migration (a ratio less than 1.0).

There were 17 states that had net in-migration in 2016 (a ratio of more than 1.0). Of those, 17 had a tax burden of less than 8.5 percent.

Of the 26 states with a tax burden of 8.5 percent or greater, 25 of them had net out-migration. The only high-tax state with in-migration was Maine. (The District of Columbia had a migration ratio of 1.0.)

Figure 2 shows a fitted regression line. A simple regression of the migration ratio on the tax variable produces a highly statistically significant fit. The F-statistic (12.1) and t-statistic (3.5) are significant above the 99 percent level. State tax levels and net migration flows are highly correlated.

Here are some patterns in the interstate migration flows:29

- The Northeast. New Hampshire enjoyed net in-migration in four of the past five years of IRS data (2012 to 2016). It is a low-tax state with no personal income tax or general sales tax. Nearby, higher-tax Massachusetts, Rhode Island, and Vermont suffered net out-migration all five years. New Hampshire enjoys net in-migration from all three of those states.

- The Midwest. South Dakota has enjoyed net in-migration in four of the past five years. By contrast, its higher-tax neighbors Nebraska, Iowa, and Minnesota had net out-migration all five years, and each had a migration deficit with South Dakota. South Dakota is one of the lowest-tax states and has no income tax.

- The Southeast. Kentucky has suffered net out-migration in each of the past five years, whereas Tennessee has enjoyed net in-migration every year, including from its neighbor. Kentucky is a relatively high-tax state, whereas Tennessee is one of the lowest-tax states and has no personal income tax.

- The West. The three largest destinations for California out-migrants in 2016 were Texas, Washington State, and Nevada—all low-tax states with no income taxes. California has a large migration deficit with all three states.

One interesting pattern that affects high-tax states across the nation is that the net migration ratio gets worse for older age groups. For example, California’s migration ratio for people age 26–34 is 0.92, but the ratio for age 55–64 is 0.60.30 Connecticut, Illinois, Maryland, Massachusetts, Minnesota, New Jersey, New York, and Ohio show this same pattern. It appears that older people with higher incomes and higher taxes are even less willing to move to such states than young people with lower incomes and lower taxes.

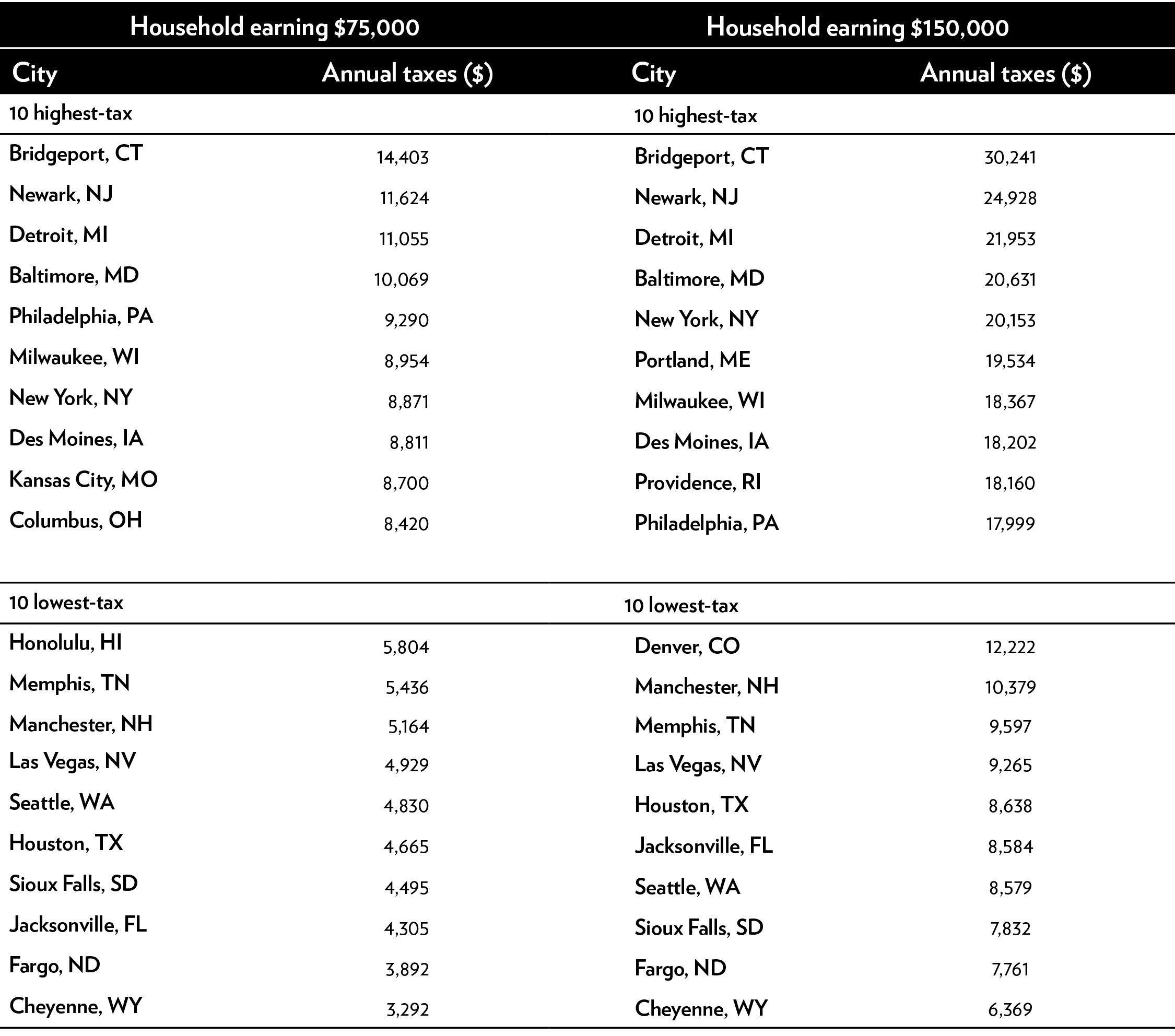

Taxes are more likely to influence moves when interstate differences are large—and the differences between the highest- and lowest-tax states are large. The District of Columbia government produces an annual study comparing state and local taxes on hypothetical households at various income levels in the largest city in each state.31 The study includes sales, property, individual income, and automobile taxes.

Table 4 highlights some of the results. Families earning $75,000 a year could save about $5,000 a year by moving from a high-tax city to a low-tax city. Families earning $150,000 could save about $10,000 with such a move.32 Those differences would seem to be large enough to influence some people to move.

Table 4: Household taxes for the largest city in each state

State and local sales, property, individual income, and automobile taxes, 2016

Source: Government of the District of Columbia, “Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison, 2016,” December 2017.

People who are thinking about moving can easily learn about state tax differences. Two recent Kiplinger.com stories were “Best States to Move to in 2018 for Lower Taxes” and “The 10 Most Tax-Friendly States in the U.S.”33 Another resource is WalletHub’s “2018’s Tax Burden by State,” which compares income, sales, property, and excise taxes.34

Of course, many other factors influence interstate migration, and those factors are complex and sometimes interrelated. If high taxes in a state buy high-quality services such as good schools, then those services will draw migrants willing to put up with the higher taxes. That said, no clear relationship exists between tax levels and the quality of government services across the states.35 In some states, tax revenues may be used efficiently to pay for quality services that residents and in-migrants want. In other states, tax revenues may be dissipated on high-cost bureaucracies or misallocated to activities that most people do not want.

Presumably, most people consider a combination of factors when moving. A recent CNBC article (“Californians Fed Up with Housing Costs and Taxes Are Fleeing State in Big Numbers”) suggests that high costs for housing, taxes, and gasoline were all pushing people out of California.36 Comparable apartments cost twice as much in Los Angeles as in Las Vegas and Phoenix, and gasoline is a dollar a gallon more expensive in California than in Texas, partly because of taxes.37 Although California is viewed as having perhaps the nicest weather in the nation, it has suffered from domestic out-migration for many years.

Economists have used regression analysis to determine the specific factors that drive interstate migration. However, the research has not come to any clear answers with respect to taxes—numerous studies have found substantial migration effects, but some have not.

Since the 1970s, economist Richard Cebula has been publishing statistical studies that attribute interstate migration flows to a range of factors, including state economic growth, housing costs, taxes, climate, crime rates, and public school spending.38 Cebula has consistently found that income and property tax burdens are statistically significant in explaining interstate migration.

A 2012 study by Cebula and Usha Nair-Reichert, for example, performed regression analyses on the determinants of interstate migration between 2000 and 2008.39 Controlling for state employment growth, unemployment, January temperatures, education spending, and the cost of living, they found that income and property taxes per capita were significant in explaining migration. Their results, they say, confirm the Tiebout hypothesis that people “vote with their feet” and move to jurisdictions offering better fiscal bargains.40

Numerous other statistical studies have found that state and local taxes affect interstate migration, including those by Mark Gius; Yu Hsing; Robert Preuhs; Karen Conway Smith and Andrew Houtenville; David Clark and William Hunter; Antony Davies and John Pulito; and Roger Cohen, Andrew Lai, and Charles Steindel.41

New Jersey increased its top individual income tax rate from 6.37 percent to 8.97 percent in 2004. A statistical study by economists in the state’s Department of Treasury found that the hike induced net out-migration of 80 or more millionaires a year.42 That would be a modest effect, but the drain would add up over time if sustained.

With federal deductibility, the 2004 New Jersey increase of 2.6 percentage points was equivalent to an effective increase of 1.6 percentage points. By comparison, the 2017 tax law ended deductibility for most taxpayers, thus increasing the effective top New Jersey income tax rate by 3.6 percentage points.43 Then in 2018, New Jersey hiked its top individual income tax rate from 8.97 percent to 10.75 percent, so we should expect larger outflows in coming years than after 2004.

Economists Cristobal Young and Charles Varner found a smaller effect from the 2004 New Jersey tax increase, and Young and coauthors on other studies have found that taxes have only small effects on the interstate migration of millionaires.44 The authors argue that millionaires are not particularly footloose because they are “embedded” in their communities. That is, they often have social and business dealings in their states that make moving difficult.

In sum, numerous statistical studies have found that taxes affect interstate migration, but some studies have contrary findings. One reason for the mixed findings could be the mechanism of “capitalization.” A tax increase in one jurisdiction may cause an initial out-migration to other jurisdictions. That flow will reduce property values in the tax-increasing jurisdiction and raise property values in other jurisdictions. Those property value changes will ultimately stem the migration flow as the economy enters a new equilibrium. If differences in state taxes are mainly capitalized, then the related migration flows will be mitigated.

Wage adjustments may also offset the migration effects of taxes.45 An income tax increase in a state may cause individuals to out-migrate over time. As that happens, gross wages would rise in the tax-increasing state relative to other states, and that would eventually stem the outflow.

A wide range of policy and amenity differences between states—not just taxes—may be capitalized in asset prices or offset by gross wage differentials. To the extent that those market adjustments occur, migration would decrease.

Nonetheless, migration does happen, as we have seen. State policies, individual preferences, and other factors are always changing, and incentives apparently change enough each year for more than 2 percent of U.S. households to move to a different state.

A Closer Look at High Earners

Households with incomes of more than $200,000 were 5 percent of all interstate movers in 2016, but they accounted for 36 percent of the income of all interstate movers.

The 2017 tax law changed migration incentives for this group. The large gap between New York City’s 12.7 percent top income tax rate and Florida’s 0 percent has been laid bare, as has the gap between California’s 13.3 percent top rate and the 0 percent rate in Texas, Nevada, and Washington State.46

IRS data for 2016 show that the highest interstate migration rates are for households with the very lowest incomes, but that is because most of those households consist of young and often single people. When you look within each particular age category, the migration rate is much greater for high earners than it is for middle-income earners. For example, for people between ages 45 and 54, the migration rate for households with incomes between $50,000 and $200,000 was 1.4 percent, but the rate for households with incomes above $200,000 was 2.1 percent. So the highest earners are relatively mobile.

Another important fact about high earners is that they are more responsive to tax rates in general than are other individuals. Empirical academic studies generally agree that high earners respond more in their working, entrepreneurial, investing, and avoidance activities than do other people.47 So we would expect them to be responsive to interstate tax differences.

High earners are often entrepreneurs, and they may move their businesses and related jobs with them when they migrate. Very wealthy entrepreneurs have been gravitating to Florida, which has no income tax or estate tax, as these examples illustrate:

- New Jersey’s richest person, David Tepper, moved with his hedge fund business Appaloosa Management to Florida in 2016. In a single move, the government of New Jersey lost as much as $100 million a year in income taxes, as Tepper sometimes makes more than $1 billion a year in income.48 The state also lost the high-paying jobs that Tepper’s business creates.

- Electronic stock trading entrepreneur Thomas Peterffy moved from Connecticut to Florida in 2016. Peterffy’s firm Interactive Brokers is the largest electronic broker, and he has a net worth of about $20 billion.49 Taxes were reported to have been a factor in his move.50

- Investor and executive C. Dean Metropoulos left Connecticut for Palm Beach in 2014.51 Metropoulos has a controlling interest in Hostess Brands. He has a net worth of more than $2 billion earned from buying and turning around dozens of companies.

- Hedge fund manager Paul Tudor Jones moved from Connecticut to Palm Beach in 2015. Jones has a net worth or more than $4 billion and has earned up to $600 million a year.52 Connecticut lost up to about $30 million a year in annual income taxes from his move.

- Founder of Paychex business services firm Thomas Golisano moved from New York to Florida for lower taxes in 2009. The Associated Press reported: “The 67-year-old philanthropist from the Rochester area has long criticized the state’s government and high taxes. . . . [H]e decided to change his residency after lawmakers increased taxes on wealthy New Yorkers in the new state budget. Golisano says moving to a state without a personal income tax will save him $13,800 a day.”53 That amounts to $5 million a year.

- Real estate investor Barry Sternlicht, who runs Starwood Capital Group, moved from Connecticut to Florida in 2016. He cited tax savings for his decision and said: “There’s a massive exodus from Connecticut. . . . As of July 1 . . . I’ve become a resident of Florida.”54 When asked if he left because of high taxes, he responded, “Yeah.”

- Edward Lampert moved with his hedge fund ESL Investments from Connecticut to Miami in 2012. Lampert was worth about $3 billion at the time. A state representative and friend of Lampert’s said, “ESL’s departure . . . represents the loss of [not only] wonderful people and philanthropy, but also a large amount of state tax revenue.”55

High-tax states are losing not just the income taxes paid by wealthy entrepreneurs moving out, but sometimes the income taxes paid by the people they employ. The head of Palm Beach County’s Business Development Board says good weather and low taxes have drawn 60 or 70 private equity and hedge fund firms to her city in the past few years.56

Florida cities are aggressively courting wealthy individuals and their businesses from high-tax states. Florida gains not just the initial jobs that move but also incremental jobs added as relocated businesses grow. And Florida’s low taxes are drawing not just U.S. financial firms but also international firms that might otherwise have located in the Northeast.57

Recent articles suggest that the new federal tax law is accelerating moves to Florida. A June Wall Street Journal article quoted a Palm Beach real estate expert as saying there is a boom in wealthy buyers looking to purchase to gain tax residency.58 And a June Bloomberg story said: “Florida’s long-running effort to lure Wall Street hotshots is gaining traction thanks to a provision in the federal tax law that hits residents of high-tax states. . . . That’s because Florida doesn’t have a state income tax and its property taxes are relatively low, whereas the tri-state area has among the highest property taxes in the country. . . . ‘SALT has been the No. 1 theme when we speak with finance companies’ about relocating or opening branch offices in Miami, said Nitin Motwani, a lead developer of a $2 billion skyscraper in Miami.”59

Some entrepreneurs have moved their financial firms out of high-tax California. Hedge fund Universa Investments moved its headquarters from California to Florida in 2014. The firm’s founder, Mark Spitznagel, “cited Miami’s favorable tax policies, emerging financial sector and access to Latin American and European investors as primary reasons for the move. . . . ‘Florida’s business-friendly policies, which are so different from California’s, offer the perfect environment for us as we expand,’ he said.”60

Billionaire investor Ken Fisher moved with his investment firm Fisher Investments from California to the state of Washington in 2011. Fisher has a net worth of more than $3 billion, and his company employs more than 2,000 people. Before the move, Fisher had expressed his frustration with California’s high taxes, and he was looking for a lower-tax location not just for himself but also for his employees.61 Washington has no income tax.

As a zero-income-tax state, Tennessee is also booming. The Wall Street Journal reported in May: “AllianceBernstein Holding LP plans to relocate its headquarters, chief executive and most of its New York staff to Nashville, Tenn., in an attempt to cut costs. . . . In a memo to employees, AllianceBernstein cited lower state, city and property taxes compared with the New York metropolitan area among the reasons for the relocation. Nashville’s affordable cost of living, shorter commutes and ability to draw talent were other factors.”62 The company has about 3,400 employees, and it considered 30 different cities in its search for a new home.

Wealthy professional athletes are responsive to state tax differences. After California hiked its tax rate on millionaires in 2012, golfer Phil Mickelson said that he had to take “drastic action” because of the hike.63 Mickelson moved from California to Texas in 2014. He earns about $60 million a year, so the move would have saved him millions of dollars a year.64 In commenting on Mickelson’s tax situation, golfer Tiger Woods said he himself moved from California to Florida in the 1990s to reduce his tax burden.65

Concern exists about the effect of the 2017 tax law on professional sports.66 Even before the law, statistical research found that teams in low-tax cities outperform teams in high-tax cities because it is easier to recruit top players to the former.67 With the tax law, the United States will become a little more like Europe, where large tax differences between countries drive wealthy athletes, entertainers, and other millionaires to Switzerland.68

In their book An Inquiry into the Nature and Causes of the Wealth of States, Arthur Laffer and coauthors present data from 1993 to 2010 suggesting that the nine states without income taxes (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming) are a particularly strong draw for high earners.69

Recent IRS data support that view. In 2016, 166,000 interstate migrant households had incomes of more than $200,000, and their aggregate income was $86 billion. In that group, households with income totaling $32 billion moved to the nine states without income taxes. Thus, among those high-income migrants, 37 percent of the income moved to 18 percent of the states.

In 2016, the average in-migration ratio for the nine states with no income tax was 1.13 (Table 1, column 2). But the average ratio for those states in the over $200,000 group is much higher at 1.41 (Table 2, column 3). Thus, the zero-income-tax states are a net migration draw, but they are a particularly strong draw for high earners. The one exception is Alaska.

The average income level within the over $200,000 group can indicate the presence of very high earners. In 2016, the average income of all interstate migrants in that top group was $518,000. But the averages for in-migrants to Wyoming and Florida were $897,000 and $849,000, respectively, which were by far the highest averages among the states. Wyoming and Florida do not have income taxes or estate taxes, and they draw very-high-income migrants.

Some analysts say that high earners hesitate to move out of high-tax states because that is where their business and social relationships are. But New York residents who are sick of paying high taxes can establish a new permanent residence in Florida and continue to undertake business and social activities in New York for part of the year. Generally speaking, they can spend up to 183 days in New York without being a tax resident of that state. They need to carefully document their time and activities in Florida to withstand a challenge by New York tax authorities, but that is a common tax-reduction strategy by high earners.70

When state policymakers think about the taxation of high earners, they should recognize that their states lose more than just income taxes when high earners leave. Many wealthy businesspeople are angel and venture investors. They plow their wealth back into young, growing companies, often in the region where they live. If a state loses wealthy individuals, it may also lose startup and entrepreneurial activities down the road.

The wealthy also make large contributions to health, education, and cultural charities in their states. You can see that pattern in a recent Philanthropia.com report that profiles the largest givers in each state.71 Phil Knight, cofounder of Nike in Oregon, gave $500 million to the Oregon Health and Science University. Phillip Frost, a Florida pharmaceutical billionaire, has given hundreds of millions of dollars to Miami-area health facilities, universities, and art and science museums. Jon Huntsman, founder of a chemical company, gave $175 million to the Huntsman Cancer Center in Utah. Darla Moore, a partner in the investment firm Rainwater Inc., has donated tens of millions of dollars to education and arts institutions in her state of South Carolina.

Individuals gave $280 billion to charity in 2016, and foundations gave $58 billion.72 The top 1 percent of earners make one-third of the nation’s charitable contributions.73 The wealthiest 1.4 percent of Americans give 86 percent of all charitable donations made at death.74 If high-tax states lose wealthy individuals to lower-tax states, they will likely lose a share of their state’s philanthropy.

A New Jersey report prompted by the possible loss of charitable giving because of taxpayer flight noted: “Wealthy households contribute disproportionately more to charitable causes both from their household assets and from their foundations, trusts, and donor advised funds. Our analysis indicates that in recent years wealth has been leaving New Jersey in larger amounts than wealth has been entering the state due to household migration.”75

In sum, the wealthy are important to the states they reside in for many reasons. They pay a large share of state income taxes; they run businesses and create jobs; they invest in growth companies; and they engage in philanthropy. Time will tell how large the migration effect will be from the 2017 tax law. But even a modest increase in moves by top earners could be a substantial blow to high-tax states.

A Closer Look at Retirees

People age 65 and older accounted for 10 percent of interstate movers and 13 percent of the income of movers in 2016. States are increasingly putting out a welcome mat for this group by reducing taxes on retirement income and estates. The thinking is that seniors have substantial wealth to spend and they impose little cost on governments for services such as public schools.

Of the 41 states that impose broad-based income taxes, 36 provide special breaks for pension income.76 A few states offer full exemptions, but most have partial exemptions with a dollar cap. More states offer breaks for public pension income than for private pension income. But Illinois, for example, exempts nearly all public and private pension income, including income from 401(k) plans.77 The National Conference of State Legislatures says that states use such breaks as “an economic development tool by attracting retired people to, or retaining them in, a state.”78

Nearly all the states with an income tax used it to fully tax pension income. But beginning in the 1970s, states began adopting pension tax exemptions, often in regional patterns. They adopted them when neighboring states did so as a “weapon of policy competition,” said Karen Smith Conway and Jonathan Rork.79 Over time, exemption amounts have increased as states have raised the competitive bar to attract retirees.

A parallel trend has been the reduction of estate and inheritance taxes, as states have competed to attract wealthy retirees. All 50 states used to impose one or both of those “death taxes,” but today just 17 states and the District of Columbia do so.80 The remaining death-tax states are in the Northeast (Connecticut, Maine, Maryland, Massachusetts, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont), the Northwest (Oregon and Washington), and the Midwest (Illinois, Iowa, Minnesota, and Nebraska). Kentucky and Hawaii also impose them.

Before 2005, the federal government provided individuals a credit against state death taxes up to a fixed amount, so it made sense for states to adopt a death tax up to that level. In earlier decades, many states imposed excess death taxes beyond the federal credit amount. In the 1960s, many states imposed taxes on estates of as little as $10,000.81 But since the 1970s, a competitive trend for states has been to reduce these excess death taxes.82

Then in 2005, the repeal of the federal credit accelerated the downsizing of death taxes. Since then, competition to attract wealthy retirees has prompted most states to completely repeal these taxes.83 Many of the states that have retained them have increased the exemption amounts.

Clearly, state policymakers believe that retirees are responsive to tax differences. Retirees are often footloose, and they can consult sources such as Kiplinger’s “10 Most Tax-Friendly States for Retirees, 2017” and SmartAsset’s “Most Tax Friendly Places for Retirees.”84 The latter is an interactive site with detailed tax information down to the county level, and it provides a “retirement tax friendliness index” for each location.

On its website, AARP discusses “Which States Provide the Best Tax Breaks for Retirees?”85 The organization is a vigorous lobbyist for reducing state taxes on retirement income, and it informs its 38 million members about state tax differences.86

Do taxes influence interstate moves by seniors? Statistical studies generally find that they do, but the results are mixed.

A 1992 study by David Clark and William Hunter finds that high inheritance and estate taxes deterred state in-migration.87 A 2004 study by Jon Bakija and Joel Slemrod finds that “high state inheritance and estate taxes and sales taxes have statistically significant, but modest, negative impacts on the number of federal estate tax returns filed in a state.”88 In 2001 and 2003 studies, Karen Smith Conway and Andrew Houtenville find that low income, property, and death taxes attract elderly migration.89 But in 2006 and 2012 studies, Smith Conway and Jonathan Rork find that death taxes and pension tax breaks have little, if any, effect on migration.90

However, the simple patterns of senior migration suggest that taxes do influence location decisions. Consider Kiplinger’s “State-by-State Guide to Taxes on Retirees,” which classifies each state as “most tax-friendly,” “tax-friendly,” “mixed,” “not tax-friendly,” and “least tax-friendly.”91 The classification considers income taxes, sales taxes, property taxes, motor vehicle taxes, and taxes on pension income and Social Security benefits.

Those categories can be compared with the elderly migration ratios in column 1 of Table 2. For the 20 states that are “most tax-friendly” or “tax-friendly,” the average ratio is 1.11, meaning net in-migration. For the 20 “not” and “least” tax-friendly, the ratio is 0.90, meaning net out-migration. Thus, seniors are gravitating toward states that have the best retirement tax climates.

To get an idea of where the very wealthiest retirees are moving, we can look at federal estate tax returns. In 2016, federal estate taxes were potentially payable above exemption amounts of $5.45 million for singles and $10.9 million for married couples. Florida has 6 percent of the U.S. population, but its residents paid 17 percent of federal estate taxes in 2016.92 That figure is up from 12 percent 20 years ago. Meanwhile, the estate tax share in four high-tax northeastern states has fallen, as more of the wealthiest elderly Americans are living elsewhere.93

What Should States Do?

The passage of the 2017 federal tax law has heightened tax competition between the states. The capping of federal deductibility has increased the state and local tax bite on millions of households in high-tax states. At the same time, today people can easily find information to compare state tax burdens.

Some analysts say that people are migrating from northern states to southern states for the warmer climate, not lower taxes.94 Yet, as noted, only 2 percent of interstate movers say climate is the main reason for their move. The next few years under the new tax law should give us a clearer view.

More importantly, policymakers in northern states cannot do anything about the warm and sunny climate in southern states. But they can do something about taxes, housing costs, school quality, and other standard-of-living factors affected by government policy. By providing government services more efficiently at lower cost, states can both attract in-migrants and benefit current residents alike.

To grow, states need in-migrants of all types, not just retirees and the wealthy. Urban economist Edward Glaeser argues that attracting younger, educated people with modest incomes is perhaps more important than attracting older, wealthier people.95 He says that cities with young and brainy populations are best able to generate growth in our dynamic economy.

To attract all types of people and investment, states should create simple, neutral, low-rate tax codes. They should reduce regulations that dissuade entrepreneurship, and they should pursue land-use reforms to keep housing prices down.96 States should also inject more competition into public schooling to improve quality and attract families.

State policymakers should focus on increasing individual freedom. The Cato Institute publishes Freedom in the 50 States, which scores the states on 175 variables covering fiscal, regulatory, and personal freedom.97 The variables generally measure the ability of individuals to act without government restraint.

In the 2016 edition of the report, William Ruger and Jason Sorens find that interstate migration flows are strongly correlated with state freedom scores after controlling for climate, the cost of living, and other factors. Numerous studies have confirmed a link between economic freedom and interstate migration.98 Americans are gravitating toward states offering greater individual freedom.

Those results are not surprising. Historically, the United States has been a huge draw for international migrants seeking economic and personal freedom. Freedom is a migration draw not just because it has intrinsic value but also because it fosters innovation and growth, which in turn attracts businesses, entrepreneurs, and job seekers.

Some U.S. states have been losing people from out-migration for decades. The new federal tax law should be a wake-up call for such laggard states to improve their tax codes, slim down their governments, and allow residents more economic and personal freedom.

Notes

1. Frank Sammartino, Philip Stallworth, and David Weiner, “The Effect of the TCJA Individual Income Tax Provisions across Income Groups and across the States,” Tax Policy Center, March 28, 2018.

2. Frank Sammartino, Philip Stallworth, and David Weiner, “The Effect of the TCJA Individual Income Tax Provisions across Income Groups and across the States,” Tax Policy Center, March 28, 2018.

3. Joint Committee on Taxation, “Tables Related to the Federal Tax System as in Effect 2017 through 2026,” JCX-32R-18, April 24, 2018, Table 7.

4. However, SALT deductions were limited for taxpayers subject to the alternative minimum tax and those subject to the “Pease” limitation on itemized deductions.

5. Joint Committee on Taxation, “The Taxation of Individuals and Families,” JCX-41-17, September 12, 2017, Tables 2 and A-1.

6. Kirk J. Stark, “Fiscal Federalism and Tax Progressivity: Should the Federal Income Tax Encourage State and Local Redistribution?,” University of California Law Review 51, no. 1 (2004): 1418.

7. Congressional Budget Office, “The Deductibility of State and Local Taxes,” February 2008, p. 7.

8. Joint Committee on Taxation, “Tables Related to the Federal Tax System as in Effect 2017 through 2026,” JCX-32R-18, April 24, 2018, Table 7.

9. State of California, Franchise Tax Board, “Preliminary Report on Specific Provisions of the Federal Tax Cuts and Jobs Act,” March 20, 2018, Table 3.

10. Ronald Reagan, “Remarks and a Question-and-Answer Session with Economic Editors during a White House Briefing on Tax Reform,” June 7, 1985,http://www.presidency.ucsb.edu/ws/index.php?pid=38740.

11. Joint Committee on Taxation, “Tables Related to the Federal Tax System as in Effect 2017 through 2026,” JCX-32R-18, April 24, 2018, Table 7.

12. Jared Walczak, “The State and Local Tax Deduction: A Primer,” Tax Foundation, March 2017.

13. State of New Jersey, Department of Treasury, “Statistics of Income,” January 12, 2018, Tables B and 3.1b. Also see New York State, Department of Taxation and Finance, “Analysis of 2014 Personal Income Tax Returns,” Table 21. New York data are for 2014; New Jersey data are for 2015.

14. Justin Garosi and Jason Sisney, “Top 1 Percent Pays Half of State Income Taxes,” California Legislative Analyst’s Office, December 4, 2014.

15. Jeff Stein, “N.J. Backs Down on Millionaire’s Tax,” Washington Post, May 29, 2018.

16. IRS migration data are at https://www.irs.gov/statistics/soi-tax-stats-migration-data. And see Kevin Pierce, “SOI Migration Data: A New Approach,” Statistics of Income Bulletin, Internal Revenue Service, Summer 2015.

17. The IRS data include the number of tax exemptions, which measures the number of people in each household or tax filing unit.

18. Raven Molloy, Christopher L. Smith, and Abigail Wozniak, “Internal Migration in the United States,” Journal of Economic Perspectives 25, no. 2 (Spring 2011): 173–96.

19. Raven Molloy, Christopher L. Smith, and Abigail Wozniak, “Internal Migration in the United States,” Journal of Economic Perspectives 25, no. 2 (Spring 2011): 173–96. And see Greg Kaplan and Sam Schulhofer-Wohl, “Understanding the Long-Run Decline in Interstate Migration,” Federal Reserve Bank of Minneapolis, October 2015.

20. U.S. Census Bureau, “CPS Historical Migration/Geographic Mobility Tables,” Table A-1. The Census Bureau reported that 1.7 percent of Americans moved between states in 2017.

21. Arthur B. Laffer et al., An Inquiry into the Nature and Causes of the Wealth of States (New York: Wiley, 2014), Table 2.7. See also Tax Foundation, “State to State Migration Data,” https://interactive.taxfoundation.org/migration.

22. The website www.howmoneywalks.com maps the IRS AGI data for the period from 1993 to 2016.

23. U.S. Census Bureau, “CPS Historical Migration/Geographic Mobility Tables,” Table A-5.

24. Taylor Tepper, “These Are the Best and Worst States for Retirement,” Bankrate.com, July 12, 2018.

25. Tabulation from the U.S. Census Bureau, Current Population Survey, Annual Social and Economic Supplement, 2017, https://cps.ipums.org/cps/index.shtml.

26. U.S. Census Bureau, “State and Local Government Finance,” https://www.census.gov/govs/local/.

27. Karlyn Bowman, “Public Opinion on Taxes: 1937 to Today,” American Enterprise Institute, April 2016.

28. The state tax ratios for 2015 are Alabama (7.2 percent), Alaska (4.9 percent), Arizona (8.2 percent), Arkansas (9.0 percent), California (9.6 percent), Colorado (8.1 percent), Connecticut (10.2 percent), Delaware (5.7 percent), District of Columbia (11.8 percent), Florida (6.6 percent), Georgia (8.1 percent), Hawaii (11.6 percent), Idaho (7.9 percent), Illinois (10.1 percent), Indiana (8.6 percent), Iowa (9.3 percent), Kansas (8.5 percent), Kentucky (8.8 percent), Louisiana (8.4 percent), Maine (11.0 percent), Maryland (9.5 percent), Massachusetts (9.0 percent), Michigan (8.5 percent), Minnesota (10.4 percent), Mississippi (9.3 percent), Missouri (7.9 percent), Montana (7.6 percent), Nebraska (9.2 percent), Nevada (8.2 percent), New Hampshire (7.1 percent), New Jersey (10.0 percent), New Mexico (8.9 percent), New York (13.0 percent), North Carolina (8.3 percent), North Dakota (8.7 percent), Ohio (9.5 percent), Oklahoma (7.2 percent), Oregon (8.4 percent), Pennsylvania (8.7 percent), Rhode Island (10.2 percent), South Carolina (7.9 percent), South Dakota (7.2 percent), Tennessee (6.5 percent), Texas (8.2 percent), Utah (8.4 percent), Vermont (10.9 percent), Virginia (7.8 percent), Washington (8.1 percent), West Virginia (9.4 percent), Wisconsin (9.3 percent), Wyoming (8.0 percent).

29. State-to-state flows are available on the IRS “U.S. Population Migration Data” webpage, https://www.irs.gov/statistics/soi-tax-stats-migration-data.

30. Detailed data by age are available on the IRS “U.S. Population Migration Data” webpage, https://www.irs.gov/statistics/soi-tax-stats-migration-data. The age is the age of the primary taxpayer, which the IRS derives by matching Social Security numbers on tax returns to data from the Social Security Administration.

31. Government of the District of Columbia, “Tax Rates and Tax Burdens in the District of Columbia: A Nationwide Comparison, 2016,” December 2017.

32. Note that Bridgeport and Newark have extraordinarily high property taxes, and that some of the other high-tax cities, such as Detroit and Philadelphia, impose city income taxes on top of state income taxes.

33. “Best States to Move to in 2018 for Lower Taxes,” Kiplinger.com, November 21, 2017. See also Sandra Block and David Muhlbaum, “The 10 Most Tax-Friendly States in the U.S.,” Kiplinger.com, October 4, 2017.

34. Adam McCann, “2018’s Tax Burden by State,” WalletHub, April 9, 2018.

35. Laffer et al., An Inquiry into the Nature and Causes of the Wealth of States (New York: Wiley, 2014), pp. 229–43. The authors look at the relationship between state and local taxes, spending, and quality of services for schools, police, corrections, highways, and other services. They find, for example, that taxpayers in higher-tax California get less bang for their buck than taxpayers in lower-tax Texas. One reason is the excess compensation of employees in California government. Another reason is the excess regulation in California, which, for example, results in a mile of highway costing twice as much to build as in Texas.

36. Jeff Daniels, “Californians Fed Up with Housing Costs and Taxes Are Fleeing State in Big Numbers,” CNBC.com, March 20, 2018.

37. American Automobile Association, “Gas Prices,” https://gasprices.aaa.com.

38. Richard J. Cebula, “Migration and the Tiebout-Tullock Hypothesis Revisited,” Review of Regional Studies 32 (2002): 87–96; Richard J. Cebula and Usha Nair-Reichert, “Migration and Public Policies: A Further Empirical Analysis,” Journal of Economics and Finance 36, no. 1 (2012): 238–48; Richard J. Cebula, Usha Nair-Reichert, and Christopher K. Coombs, “Total State In-Migration Rates and Public Policy in the United States,” Regional Studies, Regional Science 1, no. 1 (2014): 101–15; Richard J. Cebula and Gigi M. Alexander, “Determinants of Net Interstate Migration, 2000–2004,” Journal of Regional Analysis and Policy 36, no. 2 (2006): 116–23; Richard J. Cebula, “The Impacts of State Government Tax and Spending Policies on Domestic Migration in the United States,” Journal of Economics 42, no. 2 (2016): 1–22.

39. Richard J. Cebula and Usha Nair-Reichert, “Migration and Public Policies: A Further Empirical Analysis,” Journal of Economics and Finance 36, no. 1 (2012): 238–48.

40. The Tiebout hypothesis is named for Charles Tiebout. See Charles Tiebout, “A Pure Theory of Local Expenditures,” Journal of Political Economy 64 (1956): 416–24.

41. Yu Hsing, “A Note on Interstate Migration and Tax Burdens: New Evidence,” Journal of Applied Business Research 12 (Winter 1995/1996): 12–14; Karen Smith Conway and Andrew J. Houtenville, “Elderly Migration and State Fiscal Policy: Evidence from the 1990 Census Migration Flows,” National Tax Journal 54 (March 2001): 103–23; Karen Smith Conway and Andrew J. Houtenville, “Out with the Old, In with the Old: A Closer Look at Younger versus Older Elderly Migration,” Social Science Quarterly 84 (May 2003): 309–28; Mark Gius, “The Effect of Income Taxes on Interstate Migration: An Analysis by Age and Race,” Annals of Regional Science 46 (February 2011): 205–18; David E. Clark and William J. Hunter, “The Impact of Economic Opportunity, Amenities and Fiscal Factors on Age-Specific Migration Rates,” Journal of Regional Science 32 (August 1992): 349–65; Robert R. Preuhs, “State Policy Components of Interstate Migration in the United States,” Political Research Quarterly 52 (September 1999): 527–47; Roger Cohen, Andrew Lai, and Charles Steindel, “Tax Flight Has Tangible Effects on Income Tax Revenue,” State Tax Notes, February 20, 2012; Antony Davies and John Pulito, “Tax Rates and Migration,” Mercatus Center at George Mason University, August 2011.

42. Roger S. Cohen, Andrew E. Lai, and Charles Steindel, “A Replication of ‘Millionaire Migration and State Taxation of Top Incomes,’” Public Finance Review 43, no. 2 (2015): 206–25.

43. Assuming that the taxpayer was in the top federal bracket of 39.6 percent, the effective rate prior to 2018 was 5.42 percent (8.97–8.97*0.396).

44. Cristobal Young and Charles Varner, “Millionaire Migration and State Taxation of Top Incomes,” National Tax Journal 64 (2011): 255–84; Cristobal Young et al., “Millionaire Migration and Taxation of the Elite,” American Sociological Review 81, no. 3 (2016): 421–66; Charles Varner, Cristobal Young, and Allen Prohofsky, “Millionaire Migration in California: Administrative Data for Three Waves of Tax Reform,” Stanford Center on Poverty and Inequality, July 2018. Young and Varner’s studies are critiqued in Antony Davies and John Pulito, “Tax Rates and Migration,” Mercatus Center at George Mason University, August 2011.

45. Sally Wallace, “The Effect of State Income Tax Structure on Interstate Migration,” Georgia State University, Fiscal Research Program, December 2002. See also Martin Feldstein and Marian Vaillant Wrobel, “Can State Taxes Redistribute Income?” Journal of Public Economics 68, no. 3 (1994): 369–96; and Seth H. Giertz and Mehmet S. Tosun, “Migration Elasticities, Fiscal Federalism, and the Ability of States to Redistribute Income,” National Tax Journal 65, no. 4 (December 2012): 1069–92.

46. New York City’s top rate is 3.876 percent, which is on top of New York State’s top rate of 8.82 percent.

47. For example, see Emmanuel Saez, Joel Slemrod, and Seth H. Giertz, “The Elasticity of Taxable Income with Respect to Marginal Tax Rates: A Critical Review,” Journal of Economic Literature 50, no. 1 (2012): 3–50; Martin Feldstein, “The Effect of Marginal Tax Rates on Taxable Income: A Panel Study of the 1986 Tax Reform Act,” Journal of Political Economy 103, no. 3 (1995): 551–72; Robert Carroll et al., “Entrepreneurs, Income Taxes, and Investment,” National Bureau of Economic Research Working Paper no. 6374, January 1998; Jonathan Gruber and Emmanuel Saez, “The Elasticity of Taxable Income: Evidence and Implications,” Journal of Public Economics 84, no. 1 (2002): 1–32; Gerald Auten and David Joulfaian, “The Taxable Income Elasticity of High-Income Taxpayers: Evidence from a Long Panel,” May 2009; Robert Carroll, “Do Taxpayers Really Respond to Changes in Tax Rates,” Working Paper no. 78, U.S. Treasury, Office of Tax Analysis, November 1998; Bradley Heim, “The Effect of Recent Tax Changes on Taxable Income: Evidence from a New Panel of Tax Returns,” Journal of Policy Analysis and Management 9, no. 1 (2009): 147–63; and Aspen Gorry, R. Glenn Hubbard, and Aparna Mathur, “The Elasticity of Taxable Income in the Presence of Intertemporal Income Shifting,” National Bureau of Economic Research Working Paper no. 24531, April 2018. A number of studies on the responsiveness of high earners are summarized in Alan Reynolds, “Of Course 70% Tax Rates Are Counterproductive,” Wall Street Journal, May 7, 2012.

48. Robert Frank, “Billionaire to Save Hundreds of Millions from Florida Move,” CNBC.com, April 6, 2016. See also Robert Frank, “One Top Taxpayer Moved, and New Jersey Shuddered,” New York Times, April 30, 2016.

49. Rob Wile, “Meet the Richest Man in Florida, a Hungarian Immigrant Who Hates Socialism and Hangs Out at Mar-a-Lago,” Time, October 6, 2017.

50. Dan Haar, “Two Billionaires Head for Florida, Deepening CT’s Cash Crisis,” Hartford Courant, March 3, 2016.

51. Dan Haar, “Two Billionaires Head for Florida, Deepening CT’s Cash Crisis,” Hartford Courant, March 3, 2016.

52. Marc E. Fitch, “Connecticut Billionaire Moves to Florida; Could Add $30 Million to the Deficit,” Yankee Institute, June 30, 2016.

53. Mike Groll, “Rochester Billionaire Tom Golisano Changes Address to Florida to Avoid New York Taxes,” Syracuse.com, May 15, 2009.

54. Svea Herbst-Bayliss and Lawrence Delevingne, “More Investors Leaving U.S. Northeast for Florida: Sternlicht,” Reuters.com, September 13, 2016.

55. Neil Vigdor, “Lampert Folds Up Tent in Greenwich, Moves Hedge Fund to Florida,” Greenwich Time, June 6, 2012.

56. Dan Weil, “Hedge Funds Flock to Palm Beach and WPB, Boosting Office Market,” Real Deal, May 18, 2016.

57. Nicholas Nehamas, “Miami Banks on Future as a Financial Hub,” Miami Herald, February 16, 2015.

58. Robyn A. Friedman, “Tax Laws Have Buyers on the Move,” Wall Street Journal, June 8, 2018.

59. Lynnley Browning and Gillian Tan, “Fund Managers Are Ditching Wall Street for Florida,” Bloomberg, June 4, 2018.

60. Nancy Dahlberg, “California Hedge Fund Universa Moving Its Base to Miami,” Miami Herald, February 9, 2014.

61. Brooke Southall, “The World’s Largest RIA Takes the Cult-on-the-Hill to the Washington State Woods,” RIAbiz, August 19, 2009.

62. Sarah Krouse, “Large New York Money Manager Alliance Bernstein Is Moving to Nashville,” Wall Street Journal, May 1, 2018.

63. “Mickelson Vows ‘Drastic Changes,’” Foxsports.com, January 20, 2013.

64. Stephen Frank, “Is Phil Mickelson Finally Abandoning California for Income Tax-Free Florida?,” capoliticalreview.com, November 11, 2014.

65. “Tiger Woods Admits He Left California Because of High Tax Rates after Rival Phil Mickelson Apologizes for Saying He May Quit West Coast,” DailyMail.com, January 23, 2013.

66. Ronald Blum, “Florida, Texas May Attract Athletes after Tax Law Change,” U.S. News and World Report, December 22, 2017.

67. Erik Hembre, “Income Taxes and Team Performance: Do They Matter?” September 28, 2017, http://dx.doi.org/10.2139/ssrn.2946169. See also Max Ehrenfreund, “Study: Blue-State Politicians Are Undermining Their Home-State Sports Teams,” Washington Post, April 24, 2017.

68. Chris Edwards and Daniel J. Mitchell, Global Tax Revolution (Washington: Cato Institute, 2008), chap. 5.

69. Laffer et al., An Inquiry into the Nature and Causes of the Wealth of States (New York: Wiley, 2014).

70. James Stewart discusses New York audits and the large efforts people put into avoiding New York taxes in James B. Stewart, “Tax Me if You Can,” New Yorker, March 19, 2012, pp. 16–23.

71. Maria Di Mento, “From Alaska to Florida: The Biggest Living Donors in Every State, Philanthropy.com, June 20, 2017.

72. National Philanthropic Trust, “Charitable Giving Statistics,” www.nptrust.org/philanthropic-resources/charitable-giving-statistics.

73. Almanac of American Philanthropy, “Who Gives Most to Charity,”www.philanthropyroundtable.org/almanac/statistics/who-gives.

74. Almanac of American Philanthropy, “Who Gives Most to Charity,”https://www.philanthropyroundtable.org/almanac/statistics/who-gives.

75. John Havens, “Migration of Wealth in New Jersey and the Impact on Wealth and Philanthropy,” Center on Wealth and Philanthropy, Boston College, January 22, 2010, p. 13.

76. National Conference of State Legislatures, “State Personal Income Taxes on Pensions and Retirement Income: Tax Year 2014,” April 3, 2015.

77. Jake Griffin, “How Not Taxing Retirees’ Income Costs Illinois,” Dailyherald.com, August 2, 2017.

78. National Conference of State Legislatures, “State Personal Income Taxes on Pensions and Retirement Income: Tax Year 2014,” April 3, 2015, p. 1.

79. Karen Smith Conway and Jonathan C. Rork, “The Genesis of Senior Income Tax Breaks,” National Tax Journal 65, no. 4 (December 2012): 1056.

80. Jared Walczak, “State Inheritance and Estate Taxes: Rates, Economic Implications, and the Return of Interstate Competition,” Tax Foundation, July 17, 2017.

81. Karen Smith Conway and Jonathan C. Rork, “State Death Taxes and Elderly Migration—The Chicken or the Egg?,” National Tax Journal 59, no. 1 (March 2006): 97–128.

82. Jon Bakija and Joel Slemrod, “Do the Rich Flee from High State Taxes? Evidence from Federal Estate Tax Returns,” National Bureau of Economic Research Working Paper no. 10645, July 2004.

83. Laura Sanders, “Why More States Are Killing Estate Taxes,” Wall Street Journal, June 16, 2017.

84. Sandra Block, “10 Most Tax-Friendly States for Retirees, 2017,” slide show, Kiplinger, November 15, 2017, https://www.kiplinger.com/slideshow/retirement/T006-S001-most-friendly-states-for-retirees-taxes/index.html. See also “Most Tax Friendly Places for Retirees,” SmartAsset, https://smartasset.com/retirement/retirement-taxes.

85. Patrick Kiger, “Which States Provide the Best Tax Breaks for Retirees?” aarp.org, June 5, 2017. See also Carole Fleck, “Tax-Friendly States,” aarp.org, June 2015.

86. Christina Hernandez Sherwood, “A Tax Break on Retiree Income,” AARP, March 1, 2017, https://states.aarp.org/nj-taxes.

87. David E. Clark and William J. Hunter, “The Impact of Economic Opportunity, Amenities and Fiscal Factors on Age-Specific Migration Rates,” Journal of Regional Science 32 (August 1992), 349–65.

88. Jon Bakija and Joel Slemrod, “Do the Rich Flee from High State Taxes? Evidence from Federal Estate Tax Returns,” National Bureau of Economic Research Working Paper no. 10645, July 2004.

89. Karen Smith Conway and Andrew J. Houtenville, “Elderly Migration and State Fiscal Policy: Evidence from the 1990 Census Migration Flows,” National Tax Journal 54 (March 2001): 103–23. See also Karen Smith Conway and Andrew J. Houtenville, “Out with the Old, In with the Old: A Closer Look at Younger versus Older Elderly Migration,” Social Science Quarterly 84 (May 2003): 309–28.

90. Karen Smith Conway and Jonathan C. Rork, “No Country for Old Men (or Women)—Do State Tax Policies Drive Away the Elderly?,” National Tax Journal 65, no. 2 (June 2012): 313–56. See also Karen Smith Conway and Jonathan Rork, “State Death Taxes and Elderly Migration—The Chicken or the Egg?,” National Tax Journal 59, no. 1 (March 2006): 97–128.

91. “State-by-State Guide to Taxes on Retirees,” Kiplinger, November 2017.

92. Internal Revenue Service, “Table 2. Estate Tax Returns Filed in 2016, Deductions, by State of Residence,”http://www.irs.gov/pub/irs-soi/16es02st.xls.

93. Greg Sullivan, “Eight Reasons to Question Professor Cristobal Young’s Conclusions about Millionaire Migration,” Pioneer Institute, May 2018, p. 10.

94. Michael Mazerov, “State Taxes Have a Negligible Impact on Americans’ Interstate Moves,” Center on Budget and Policy Priorities, May 21, 2014.

95. Edward Glaeser, Triumph of the City (New York: Penguin, 2012).

96. Vanessa Brown Calder, “Zoning, Land-Use Planning, and Housing Affordability,” Cato Institute Policy Analysis no. 823, October 18, 2017.

97. William P. Ruger and Jason Sorens, Freedom in the 50 States (Washington: Cato Institute, 2016). And see Cato Institute’s website www.freedominthe50states.org.

98. Nathan Ashby, “Economic Freedom and Migration between U.S. States,” Southern Economic Journal 73, no. 3 (2007): 677–97; Richard J. Cebula and J. R. Clark, “Migration, Economic Freedom, and Personal Freedom: An Empirical Analysis,” Journal of Private Enterprise 27 (Fall 2011): 43–62; Richard J. Cebula, “The Impact of Economic Freedom and Personal Freedom on Net In-Migration in the U.S.: A State-Level Empirical Analysis, 2000 to 2010,” Journal of Labor Research 35 (March 2014): 88–103; J. Matthew Shumway and James A. Davis, “Economic Freedom, Migration, and Income Change in the United States: 1995 to 2010,” Professional Geographer 68, no. 3 (2016): 390–98; J. Matthew Shumway, “Economic Freedom, Migration and Income Change among U.S. Metropolitan Areas,” Current Urban Studies 6, no. 1 (2018): 1–20.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.