House Speaker Paul Ryan (R‑WI) last year tasked Rep. Doug Collins (R‑GA) with chairing a working group to examine budget reforms to constrain the growth in federal government debt.1

The need is pressing. Sustained budget deficits have seen debt held by the public explode from 32.6 percent of gross domestic product (GDP) in 2002 to 77 percent in 2016—a level only previously seen following World War II.2 Whereas that debt spike was reduced quickly due to huge military spending cuts and sustained high growth and inflation, projections show that in the future, the U.S. debt-to-GDP level will rise rapidly absent entitlement reform or major cuts to discretionary spending.

The Congressional Budget Office previously estimated that getting the debt-to-GDP ratio back to its historic average of 40 percent by 2047 would require permanent spending cuts starting today equal to 3.1 percent of GDP (15 percent of non-interest federal spending). They calculated that delaying any cuts until 2028 would instead require reductions of 4.6 percent of GDP to achieve the same goal.

Despite widespread acknowledgement of this looming fiscal crisis, politicians have so far seemed unable or reluctant to act. In fact, they have recently exacerbated the problem. Congressional legislation for tax cuts in December, a spending-cap busting budget deal in February, and a previously forecasted deficit increase means the overall deficit is expected to near-double in the coming years as a proportion of GDP.

The Republican working group has therefore considered explicit restraints on spending or deficits in the budget process in the hope that rules might overcome Congress’s apparent “deficit bias.” In the past three decades, 96 countries have used fiscal rules, defined as “a long-lasting constraint on fiscal policy through numerical limits on budgetary aggregates.”3 Well-designed restraints can enhance budget discipline if there is political buy-in. A key lesson across countries, though, is that if rules are to endure, they must be flexible enough to withstand temporary recessions and adjust to new trends.

This bulletin examines the experience of the federal government, state governments, and three foreign countries (Chile, Switzerland, and the United Kingdom [UK]) with explicit fiscal rules. It draws on these case studies to outline 11 principles under which a fiscal rule is most likely to achieve sustained reductions in debt relative to GDP.

Why Consider Budget Rules?

U.S. federal debt is high and on an unsustainable trajectory. Debt held by the public is currently 77 percent of GDP, the highest level since 1950.4 Whereas after World War II the debt-to-GDP ratio fell substantially for three decades, it is now projected to rise ever upward on unchanged policies.

The Congressional Budget Office previously projected that the federal budget deficit would widen to 5.2 percent of GDP by 2027, ballooning public debt to 91.2 percent of GDP. But recent legislation has worsened this outlook considerably. The CBO estimated the recent tax cuts alone would raise the deficit to 4.9 percent of GDP by 2019. Combined with huge near-term increases in spending in the recent budget deal increasing the deficit to 5.6 percent of GDP, the Committee for a Responsible Federal Budget estimates that if new policies are made permanent, federal debt levels would exceed 100 percent of GDP by 2027.5

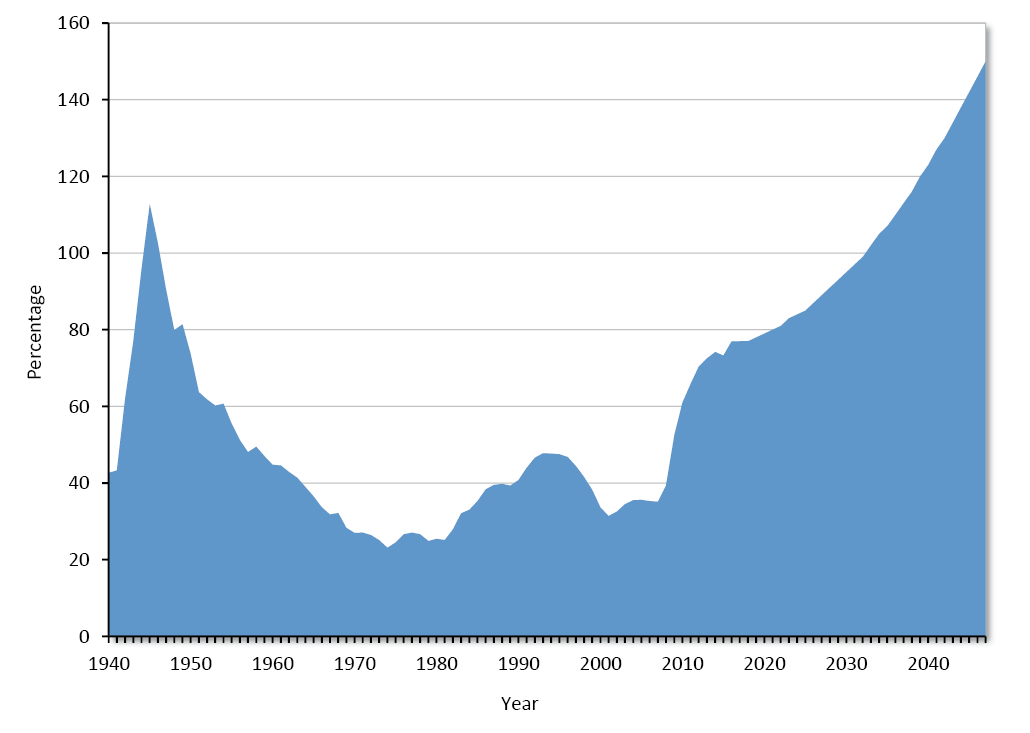

Beyond the next 10 years, the fiscal outlook will deteriorate further (see Figure 1). Debt held by the public was already projected to rise to 150 percent of GDP by 2047, driven by a surge in spending on Social Security and Medicare (an annual increase of 4.4 percent of GDP) and increased annual debt interest payments (an increase of 4.8 percent of GDP).6

Figure 1: Federal debt held by the public (percentage of GDP)

Source: Congressional Budget Office (CBO), Historical Data on Federal Debt Held by the Public, 2010, and An Update to the Budget and Economic Outlook: 2017 to 2027, June 2017.

This projected increase in debt is unsustainable. In fact, there are good economic reasons to desire a lower debt burden than even current levels.

First, high government debt levels are associated with slower economic growth. Carmen Reinhart and Kenneth Rogoff’s controversial paper found that growth slows substantially when government debt exceeds 90 percent of GDP.7 But Reinhart and Rogoff were not alone. Stephen Cecchetti, M. S. Mohanty, and Fabrizio Zampolli identified a debt-to-GDP threshold of about 85 percent as a point beyond which growth tends to slow.8 Even Thomas Herndon, Michael Ash, and Robert Pollin, who countered Reinhart and Rogoff’s stronger findings, found that, on average, growth was 1 percentage point per year lower when government debt exceeded 90 percent of GDP than when debt levels were between 60 and 90 percent.9

Second, high debt levels increase economic vulnerability. When government debt is already high, a rise in debt resulting from an unforeseen shock risks destabilizing falls in investor confidence in a country. It is prudent to reduce debt and create “fiscal space” in good times as insurance against this outcome.

Third, high debt levels have significant intergenerational consequences. The burden on future taxpayers will rise from sustained high borrowing. This problem is particularly acute given the demographics of an aging population and federal promises on Social Security and Medicare.

Ideally, policymakers should aim for a declining debt-to-GDP ratio in good times, interrupted only by temporary recessions or emergencies. This would result in a roughly stable debt-to-GDP ratio over the long run. Such stability need not require budget surpluses. Small annual deficits would keep the debt-to-GDP ratio falling over time with sustained economic growth.

Unfortunately, U.S. policymakers have not been prudent. Deficit spending under President George W. Bush led to federal debt rising modestly as a share of GDP during his tenure. The shock of the financial crisis, and the policy response to it (including President Barack Obama’s 2009 stimulus bill), then nearly doubled the debt-to-GDP ratio, taking it to record high levels for peacetime. Now, with the economy growing, debt should be falling, but under current policies it will continue to rise, and recent decisions have worsened this baseline substantially.

This fiscal unsustainability is widely acknowledged, yet politicians have been reluctant to act.10 They have failed to get the debt-to-GDP ratio on a downward path in anticipation of the coming entitlement crisis, or to reform entitlements to prevent it.

Economists have speculated on why politicians might be prone to this “deficit bias.”11 Politicians often want to appease lobby groups that favor spending programs, while pushing the costs onto future taxpayers. The politicians all want to spend on their favored programs, but no one has the overall responsibility to balance the budget. This is called a “common pool problem,” and it may have worsened in recent decades.12 For one thing, a larger share of federal spending goes to entitlements, which are on autopilot and are difficult to cut, especially because politicians have promised benefits to people over future years.13 The polarization of the two parties about the proper scale and scope of the government also makes it difficult to create a consensus for fiscal repair.

Explicit rules or restraints in the budget process could help overcome causes of this “deficit bias” by imposing binding constraints on politicians. By setting targets or limits for budget aggregates—such as spending, deficits, or debt—politicians may be constrained through fear of the costs of failing to meet targets (directly, through an enforcement mechanism, or indirectly, through political or electoral losses).

The near-term benefits of new spending for politicians often seem to outweigh the long-term costs of higher debt. But fiscal rules can provide political cover for reform-minded politicians to focus attention on the longer-term considerations against the ever-present demands for government activity.

The Failures of the Debt Ceiling

The growth of federal debt is currently notionally restrained by the debt limit, or debt ceiling, which was created in 1917. The U.S. Treasury explains the debt ceiling as “the total amount of money that the United States government is authorized to borrow to meet its existing legal obligations, including Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments.”14

But the debt ceiling has not been an effective means of constraining federal debt because Congress keeps voting to raise it. According to the Treasury, “Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit—49 times under Republican presidents and 29 times under Democratic presidents.”15

Congress’s actions are not surprising. Failure to raise the debt ceiling in the face of ongoing commitments would represent a form of default by the U.S. government. Although this result need not mean formal default to creditors, given that tax revenues far exceed interest payments, it would mean reneging on promises the government has made on its spending programs.16

It is widely thought that the economic consequences of having to prioritize revenues to pay interest first would be severe, raising U.S. borrowing costs substantially. This potential outcome makes the prospect of failing to raise the debt ceiling fairly unlikely, begging the question: What does the current debt ceiling actually achieve?

In recent years, the debt ceiling has been used for political brinkmanship, raising the possibility of prompting a fiscal crisis. The Government Accountability Office found that the debt ceiling standoff in 2011 raised interest costs on federal debt.17 Consumer and business confidence plummeted during that period. Even the use of extraordinary budgeting measures to skirt the limits can have real-world consequences for programs and financial markets.18 For all these reasons, economists dislike the current debt ceiling: in a 2013 Initiative on Global Markets poll, 97 percent of them agreed that the debt ceiling brought “unneeded uncertainty and can potentially lead to worse fiscal outcomes.”19

Quite simply, it makes little sense for Congress to vote to increase deficit spending but then to vote later on whether to increase the debt limit for the commitments already made. There is little economic logic to an arbitrary nominal debt limit anyway, when what really matters for sustainability is a measure of debt relative to the size of the economy.

Although the debt ceiling may periodically bring public attention to the rising debt, it is a poor fiscal restraint. Any new fiscal rule should seek instead to shape the framework under which Congress makes budget decisions in the first place.

Evidence on the Effectiveness of Budget Rules

The academic evidence and historical record show that formal fiscal rules are neither necessary nor sufficient to obtain sound public finances.

Bill White’s America’s Fiscal Constitution: Its Triumph and Collapse documents how for decades an informal U.S. political consensus existed that politicians should balance the federal books in ordinary times.20 This outcome was largely delivered for decades, particularly before the 1930s, indicating that formal fiscal rules were not necessary to curb deficit bias.

At the same time, the experience of Eurozone countries with the Maastricht targets for deficits and debt shows that fiscal rules do not in themselves ensure good budget outcomes.21 They may even worsen outcomes by creating the illusion that the debt is under control when it is not.

There are good reasons to think budget deficits reflect political norms and expectations about what government spending is supposed to achieve. James Poterba showed that wide international variation in budget deficits cannot be explained by short-term spending needs or the marginal costs of raising revenue.22 Peter Calcagno and Edward López likewise argue that altered public perceptions about the purpose of the U.S. federal budget are key to explaining the modern penchant for deficit financing.23 Unlike in the 19th century, the public now sees the federal budget as a tool to ensure macroeconomic growth and provide entitlements, both of which appear to have grown government overall. The professionalization of politics also provides incentives to use the budget to improve electoral prospects.

Fiscal rules that fail to correct for this underlying “demand and supply” for government are ultimately doomed to fail, in this view. Absent political will for fiscal conservatism, targets will be missed or abandoned, creative accounting and overoptimistic forecasts will be used to hit targets, exceptional needs for spending will be declared, and transition periods to hit targets will be lengthened.

Acknowledging that fiscal rules are no panacea, however, does not mean that such rules cannot improve the functioning of fiscal policy.24 Effective rules can create clear targets and budgeting frameworks, imposing costs on politicians who deviate from them. The key is to design rules that are simple enough to be well understood and monitored, but flexible enough to be durable against unforeseen economic shocks that temporarily derail that goal. Doing so requires well thought-through procedural details and means of enforcement.25

The rest of this bulletin examines the experience of U.S. states, the federal government, and other countries to determine the principles most likely to make explicit fiscal or budget rules successful and enduring.

State Balanced Budget Rules

All 50 states except Vermont have a form of balanced budget rule, although the stringency varies greatly. In some states the legislature has to pass a balanced budget, whereas in others the governor merely has to propose one. Requirements vary by state on whether budget balance has to be achieved at the end of every year or merely be planned for at the start.26

Studies of states’ experiences with balanced budget rules have found that more stringent rules tend to lead to more effective deficit control.27 Tamim Bayoumi and Barry Eichengreen, for example, found that states high on a stringency index had deficits least sensitive to shocks to the economy and had reduced spending after negative economic shocks.28 James Poterba likewise found that states high on a stringency index were much more likely to cut spending in reaction to an unexpected deficit, though Jurgen von Hagen showed that this often comes at the expense of a burgeoning off–balance sheet debt.29

Which particular design features deliver the most control? Robert Inman shows that the most important characteristic is a “no-carryover” provision, according to which budgets must be balanced at the end of the year, rather than merely being planned for at the start.30 States that allow carryovers seem to overestimate revenues and underestimate expenditures, then appear to be surprised that projections are not realized. Rules that are constitutional, enforced more independently, and costly to amend also tend to lead to better deficit outcomes.

Keynesian economists believe that balanced budget requirements might exacerbate downturns because when a negative shock hits the economy, a fall in tax revenues might require spending cuts to keep the budget balanced, sapping the economy of demand. Yet Alberto Alesina and Tamim Bayoumi find that stringent state budget rules do not increase output volatility. This finding implies either that state policy plays a limited role in economic stabilization, or that balanced budget rules help protect against destabilizing, politicized use of government borrowing.31

This evidence might have limited applicability where the federal government is concerned, of course. The federal government undertakes a lot of countercyclical spending, and its revenue sources are heavily dependent on the state of the economy. Furthermore, the federal government is perhaps better placed than the states to allow debt to act as a “shock absorber” to enable stable tax rates.32 States, of course, have greater reason to be worried about debt ratings, and they suffer direct costs of spending because they cannot mint money. Nevertheless, the paper by Inman shows that balanced budget rules that merely require a plan for balance can lead to overoptimism and poor deficit control. Strong enforcement mechanisms for rules matter in their effectiveness.

Federal Experience with Rules

The federal government has had some experience with fiscal rules since the 1980s. The Balanced Budget and Emergency Deficit Control Act of 1985, often referred to as Gramm-Rudman-Hollings (GRH), created explicit annual deficit targets to balance the federal budget by 1991.

Under this framework, annual deficit targets were set out. Budgets had to hit those targets, given forecasts for economic growth. Failure to plan a budget that got within $10 billion of the deficit target activated a sequester of mandated cuts to discretionary spending (half from defense and half from other programs) to ensure that the target was hit in that year. But there were a host of other limitations on where cuts could be made, with the result that certain programs would face severe cuts in the event that sequestration was triggered.

The first row of Table 1 sets out the original nominal deficit targets. In the initial years, planned budgets hit the deficit targets only by using one-time asset sales and moving other expenditures off the balance sheet. Although federal government asset sales might be beneficial in their own right, they do not ensure long-term improved deficit outcomes. Robert Reischauer estimated, for example, that approximately half of the deficit reduction achieved in these years came through one-off measures.33 There is also evidence that OMB growth projections got more optimistic, and hence more helpful to policymakers, given that the rules applied only to planned expenditures rather than to actual outcomes.

Nevertheless, although there was deficit reduction in the early years, as shown in Table 1, the targets were not hit.34 In 1986 the deficit came in higher than planned, and the rule did not require any adjustments to future spending for this failure. As they were to become binding for 1988 projections, the deficit targets were revised upward in 1987. The targets were abandoned entirely in 1990, leaving actual deficits much, much higher than initially planned.35 Enforcement of the rules was simply not credible when circumstances changed.

Table 1: Federal deficit (billions of dollars)

|

1986 |

1987 |

1988 |

1989 |

1990 |

1991 |

1992 |

1993 |

|

|

GRH, 85 |

172 |

144 |

108 |

72 |

36 |

0 |

||

|

GRH, 87 |

144 |

136 |

100 |

64 |

28 |

0 |

||

|

Actual |

221 |

150 |

155 |

153 |

221 |

269 |

290 |

255 |

|

Actual percentage of GDP |

4.9 |

3.1 |

3.0 |

2.7 |

3.7 |

4.4 |

4.5 |

3.8 |

Source: Byron Lutz and Glenn Follette; Congressional Budget Office.

Note: GDP = gross domestic product; GRH = Gramm-Rudman-Hollings.

Sung Deuk Hahm and coauthors present evidence that the introduction of the rules marked a regime shift from rising to falling deficits.36 And it is true that discretionary spending rose more slowly in the second half of the 1980s than in the first half. But the passing of the GRH rules themselves may have reflected a shift in attitude from Congress that the status quo of sustained deficits was unsatisfactory, unsustainable, or both. Given that the rules were ultimately changed and abandoned when they began to bind, there is not much evidence to commend the specific framework.

The GRH rules were replaced with new rules under the Budget Enforcement Act (BEA) of 1990, which primarily sought to restrain new budget decisions. The Act included a pay-as-you-go rule so that overall new tax and mandatory spending laws across a session could not increase the deficit. A breach would result in a sequester in mandatory spending. The Act also imposed annual limits for discretionary spending, which if breached led to a sequester across all discretionary spending. But it did nothing to deal with increases in the costs of existing mandatory programs such as Social Security and Medicare.

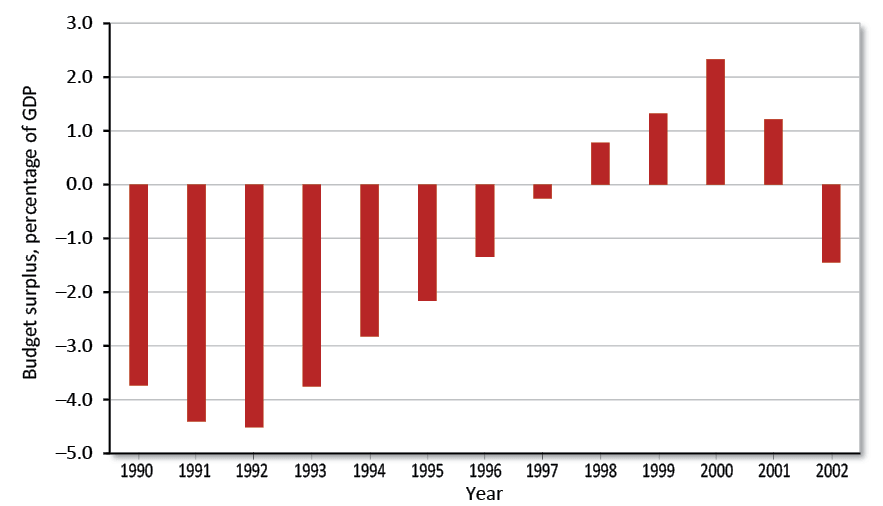

Figure 2 shows what happened to the deficit during the period in which these rules were in operation.

As can be seen, the deficit actually worsened in the initial BEA period, because economic projections proved wildly optimistic and had not forecast the deep recession of the early 1990s. The rule had no mechanism to account for this. President Bill Clinton then put forward a budget plan in 1992 to halve the budget deficit, even though this was not required by the rules. The subsequent significant deficit reduction then owed more to political will than to the rules, particularly given that Congress repeatedly revised upward the discretionary spending targets.

Byron Lutz and Glenn Follette see 1998–2002 as the key period by which to judge the framework.37 During this period, stronger-than-expected growth led to a large budget surplus. Although this outcome had little to do with the BEA rules, the rules did ensure that the extra tax revenues generated during this boom were not fully spent or used for tax cuts, as had been the case in the 1960s.

Gradually, though, the caps on discretionary spending were loosened by various techniques, such as designating it as “emergency” spending. Economic growth mainly caused the falling deficits of the late 1990s, but the BEA rules did create some discipline against significant fiscal loosening around the turn of the 21st century. The BEA framework expired in 2002, and large deficits reappeared under President George W. Bush as he cut taxes and increased spending.

Figure 2: Federal Budget Deficit (percentage of GDP)

Source: Congressional Budget Office, An Update to the Budget and Economic Outlook: 2017 to 2027, June 2017.

International Experience

The international evidence on the use of fiscal rules is a mixed bag, not least because so many approaches have been tried.38 Countries have experimented with spending, revenue, deficit and debt targets (with different degrees of stringency), varying escape clauses, rules applied to both plans and hard outcomes, and exemptions for various types of spending and revenue. Given all these confounding factors, it is difficult to come to generalized conclusions about which aspects of rules are effective and which are harmful.

The next few sections examine the experiences with fiscal rules in three countries. The rules in Chile and Switzerland are widely regarded to have been effective. By contrast, the UK has tried a wide variety of fiscal rules since 1997 with little apparent success.

Chile’s Structural Balance Rule

Economists such as Jeffrey Frankel have written glowingly about Chile’s fiscal rule, which appeared, up until 2011, to have constrained government debt while maintaining enough flexibility to allow automatic stabilizers to operate.39

In 2000 the Chilean government voluntarily adopted a structural balanced budget rule, which aimed to run a cyclically adjusted budget surplus of 1 percent of GDP each year, lowered to half a percent of GDP in 2007 and then to straight balance in 2009 once government debt had essentially been paid off.

In practice, a committee of independent experts meets once a year to provide the government with assumptions about potential GDP. A separate committee assesses whether copper prices are higher or lower than trend. These two opinions are put together to determine an estimate of government revenues for the year if the economy was operating at its potential. This determines the total maximum spending level allowed in budget plans. In other words, spending is capped on the basis of an estimate of tax revenues if the economy was at potential.

Unlike strict balanced budget proposals, this rule allows automatic stabilizers to operate and allows the overall budget balance to fluctuate with the state of the economy. The government runs a deficit if output and revenues are below potential, and it runs a surplus if output and revenues are above potential. Debt therefore acts a shock absorber for unforeseen deviations in economic activity. Provided the potential of the economy is estimated accurately, this rule balances the overall budget over the economic cycle. With economic growth, such a rule means that debt-to-GDP should gradually fall.

Crucial to the rule’s success, then, are accurate and unbiased estimates of the country’s economic potential. Chile’s independent committees are designed to mitigate the politicization of this process. It is hoped they will reduce the incentive to be overoptimistic about the economy to justify higher spending. Given this independence, under Chile’s rule no sanctions are imposed if the structural balance requirement is breached within a year, and no adjustment in future budgets is required from worse-than-expected deficits.40

This fiscal framework was not formalized into law until 2006, after a relatively long period of voluntary fiscal discipline. At first it was political will, rather than a legislated rule, that led to steps taken to close the structural balance. Nevertheless, the government at the time clearly thought it important to delineate its fiscal aims through this framework.

How has the rule performed? Before the financial crisis, Chilean central government debt fell sharply as a result of running sustained structural surpluses, and Chile’s sovereign debt rating improved. In fact, Guillermo Le Fort showed that even the announcement of the rule in 2000 improved Chile’s creditworthiness.41 Public spending fluctuated much less than in previous decades, and GDP volatility declined substantially between 2001 and 2005.42

The virtues of such a rule really became apparent, though, just before the financial crisis. President Michele Bachelet was under pressure to substantially increase government spending given sustained strong GDP growth and a high world price of copper. Yet unlike in the United States in the early 2000s, International Monetary Fund (IMF) data show that in 2007 Chile resisted these pressures and ran an overall budget surplus as high as 7.9 percent of GDP, with the independent experts judging most of the strong budget performance as cyclical.43

This proved prescient. By 2009 the budget had swung to a 4.2 percent deficit as the global recession hit. General government debt did increase again, but Chile had been so fiscally prudent before the crash that even today general government debt is only 21.3 percent of GDP and net debt is just 1 percent of GDP.44

In recent years, however, there have been signs of the limitations of rules linked to potential GDP. Chile raised its corporate income tax rate from 17 to 20 percent under President Sebastián Piñera in 2011, and it raised the rate further to 25.5 percent under President Bachelet, with the intention to raise revenues for education and social spending.45 But during this period of higher taxes and steep spending increases (overall spending has increased by 3.8 percentage points of GDP since 2011), annual real GDP growth has performed consistently below the expectations of the independent committee and copper prices have been low. The result has been unforeseen deficits, with gross government debt nearly doubling between 2013 and 2017 and net debt drifting back into positive territory, despite a pickup in global growth.

The problem with linking rules to potential GDP is that doing so is inherently difficult to assess, particularly when major supply-side policy changes occur. Calculating “potential revenues” to determine spending caps requires accurate assessment of (a) the health of the economy in real time, (b) the “output gap”—that is, how far the economy is away from its potential, and (c) how moving to potential affects revenues. All these factors are highly uncertain and difficult to calculate.

Despite the existence of Chile’s fiscal rule at the time, slower-than-expected growth after the crisis led President Piñera to downgrade its stringency—aiming to hit a structural deficit of 1 percent of GDP by 2014. President Bachelet, in the face of sluggish growth and structural deficits being revised upward, has since begun basing fiscal targets instead on a trajectory for the structural deficit (which should fall by 0.25 percent of GDP per year) rather than on specific levels. The IMF therefore now believes that Chile’s slow growth reflects lower potential GDP and that the country was running a structural deficit of 2.2 percent of GDP in 2016. Standard & Poor’s this year downgraded Chile’s credit rating.46

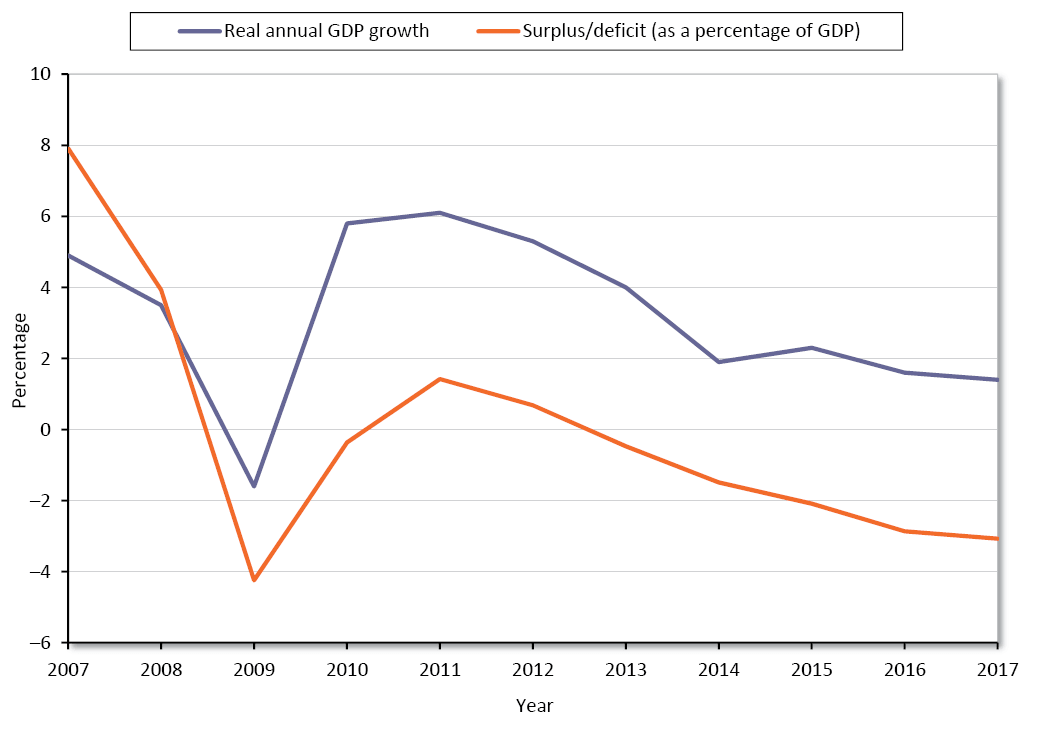

Chile’s experience shows the strengths and weaknesses of fiscal rules that are based on potential GDP. In theory, and when potential GDP is estimated accurately, a structural balance rule (a) delivers countercyclical fiscal policy (the correlation between Chile’s budget surplus and real GDP growth is 0.65; see Figure 3), (b) balances budgets over the economic cycle, and (c) leads to a gradual reduction in the debt-to-GDP ratio.

But potential GDP is inherently difficult to measure. In Chile, the independent committees recently overestimated the growth potential of the economy, but no additional constraints were placed on spending to correct for these mistakes. Then when potential GDP was revised down, and structural deficits up, successive governments chose not to adjust spending accordingly but to aim for structural balance over a longer period. This decision highlights something we have seen already: the need for political will in ensuring that rules are not abandoned.

The implications of letting bygones be bygones in this way and adjusting spending decisions only on a forward-looking basis might not be significant for a country starting with low levels of government debt, such as Chile. But a rule that allowed such mistakes without consequence could cause considerably more damage in a country with already high debt-to-GDP levels.

Rules based on potential GDP are theoretically appealing and work well if estimates of potential are accurate. But that is a big “if.”

Figure 3: Chile’s countercyclical fiscal policy

Source: International Monetary Fund, Fiscal Monitor, October 2017.

Note: GDP = gross domestic product.

Swiss Debt Brake

Proponents of fiscal rules often hold up Switzerland as an example of a country with a rule that works. The Swiss “debt brake” was approved in a referendum by 85 percent of voters in 2001, and it was subsequently inserted into the country’s constitution to apply from 2003 onward.47

The law requires a balanced structural budget. This is achieved by capping annual federal spending to estimated tax revenues multiplied by a business cycle adjustment factor (trend real GDP growth divided by expected GDP growth for the year). In theory, the consequence is that spending levels stay relatively independent of the near-term state of the economy and are instead stabilized around a smoothed revenue trend. The rule is countercyclical by construction. When real GDP is expected to be below trend, spending can exceed expected revenues, and when real GDP is expected to be above trend, the public finances are planned to be in surplus.

The Swiss rule is different than the Chilean rule in a few key respects, however.

First, the Swiss Federal Department of Finance uses backward-looking trends in real GDP, alongside estimates in actual real GDP, to estimate planned spending caps. Spending caps are therefore calculated formulaically from hard data and near-term forecasts to a larger extent, rather than through more speculative assumptions about potential.

Second, certain expenditures that are highly sensitive to the health of the economy, such as unemployment insurance, are excluded from the scope rule, as are social security expenditures (though the latter is bound by its own spending targets).48

Third, the Swiss rule has mechanisms to deal with outcomes differing from planned balance. Any deviation in actual outcomes from plans is chalked up as a debit or credit in a so-called compensating account, which then has to be adjusted for across an unspecified time period. But once debits exceed 6 percent of government spending, the excess above this level must be eliminated in the next three budget cycles by cutting spending. Whereas in Chile there are no consequences for deviations from forecasts and bygones are bygones, in Switzerland deviations are factored into future policy to ensure that the budget really does balance over time.

Finally, there is an escape clause for exceptional circumstances, if a qualified majority in both houses of the Swiss parliament approves the exceptional spending. Yet even these emergency measures are “debited” to a special “amortization account” and have to be compensated for during the six years after the exceptional spending.

This rule, if adhered to, again practically guarantees a decline in the debt-to-GDP ratio over time, unless social security spending—outside of the rule—increases significantly. The rule also helps tame government size. Because the main tax rates are constitutionally restricted in Switzerland (and require a majority of voters in a majority of cantons to change), the rule largely operates through restricting expenditure growth to trends in tax revenues.

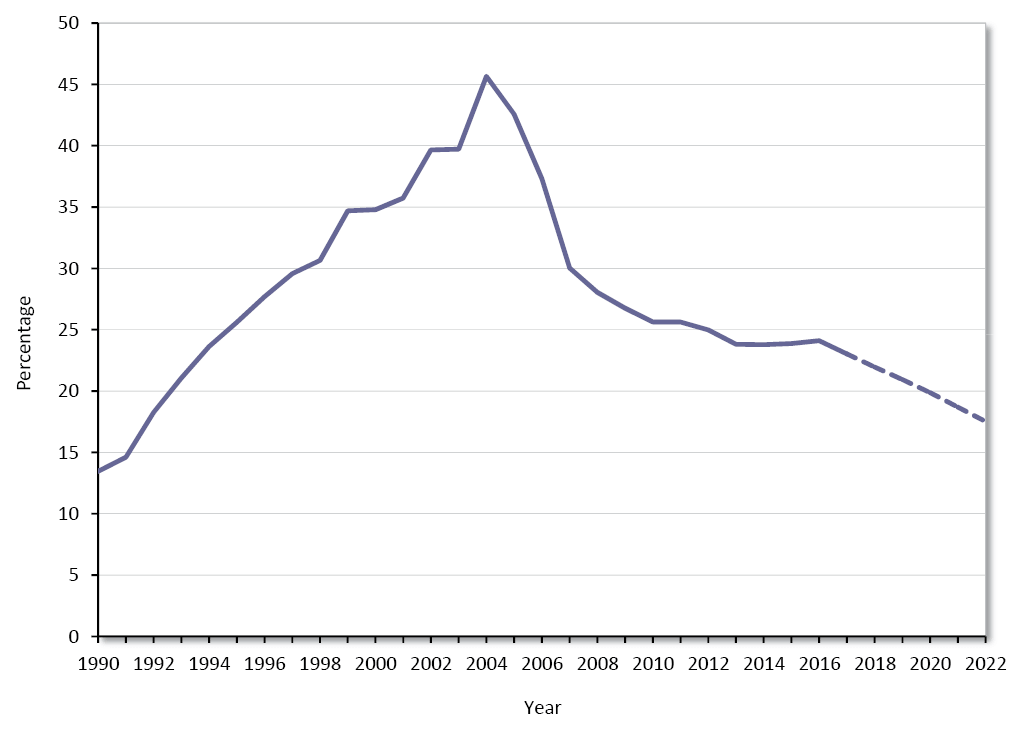

How has the debt brake performed since 2003? IMF data show that after peaking in 2004 (the year after the rule began to apply) government net debt has continually fallen—substantially initially, and then more shallowly thereafter (see Figure 4). Even a modest recession in 2009, when the economy shrank by 2.2 per cent of GDP, did not result in net debt rising. Swiss fiscal policy has been moderately countercyclical during this period, though not to the extent of Chile’s. Overall, crucially, Switzerland has averaged a budget surplus of 0.5 percent over the 10 years between 2007 and 2017.

Although in the longer term the exclusion of social security measures from the rule is likely to put upward pressure on debt (a problem that almost all Western countries face as a result of an aging population), so far the rule has helped entrench significant fiscal discipline.

Its constitutional backing, especially given the overwhelming democratic mandate, obviously gives the rule more authority and permanence than ordinary legislation would have. But the Swiss rule is also simple and formulaic, and it adjusts over time to outcomes differing from plans, meaning that it is robust to mistakes in extrapolating trends and cannot be manipulated using overoptimistic assumptions.

Figure 4: Switzerland government net debt (percentage of GDP)

Source: International Monetary Fund, Fiscal Monitor, October 2017.

The United Kingdom’s Ever-Changing Fiscal Rules

The phrase “rules are made to be broken” could describe the UK’s fiscal experience over the past two decades.

Under New Labour between 1997 and 2007, the government was supposedly bound by a “golden rule” that said the government would only borrow for investment over the economic cycle. The Labour government at this time also operated a “sustainable investment rule” that said the government debt-to-GDP ratio should be kept below 40 percent.49 These rules were formalized in the Code for Fiscal Stability, approved by the House of Commons in December 1998.

Although these rules were enshrined in law, by 2007 a New Year’s survey of economists by the Financial Times concluded that “Almost none use the chancellor’s fiscal rules any more as an indication of the health of the public finances.”50 It is widely acknowledged that the government used creative accounting and changed the goalposts to hit the golden rule. Some government consumption was redefined as investment (a problem long identified in the literature on fiscal rules). The government’s growth forecasts were generated by the Treasury—the same department tasked with overseeing the rules—and were continually overoptimistic about tax revenues. The methodology used to calculate cumulative budget surpluses for noninvestment spending was changed and, according to the Institute for Fiscal Studies, “the estimated start date for the economic cycle was moved by two years at precisely the point at which, without this change, the government looked on course to break rather than meet the golden rule.”51

The financial crisis led to a complete abandonment of the rules, as debt soared when the recession hit. But reassessments from the IMF found that very overoptimistic estimates for potential GDP under the Labour government had meant that the UK actually went into the crisis running a huge overall structural deficit of around 4.6 percent of GDP.52 As a result, public sector net debt since the crisis has exploded and is now more than double the threshold of 40 percent of GDP that Chancellor of the Exchequer Gordon Brown aimed for.

After the recession and a discretionary stimulus package, the government’s budget deficit stood at a whopping 10 percent of GDP by 2009–2010. The incoming Conservative government adopted two new fiscal rules in June 2010 as part of its fiscal mandate to reduce the deficit. Those rules had no legal standing, but it was thought that failing to meet them would have political costs.

The first rule aimed to eradicate the structural deficit, excluding investment spending, within five years. The second, a firmer rule, pledged that the debt-to-GDP ratio would be falling by 2015. The government therefore planned a deficit reduction package of tax increases and spending restraint to hit those deficit and debt targets, given the outlook for economic growth. It created an Office for Budget Responsibility to provide independent growth forecasts and assessments of whether the government would hit the rules.53

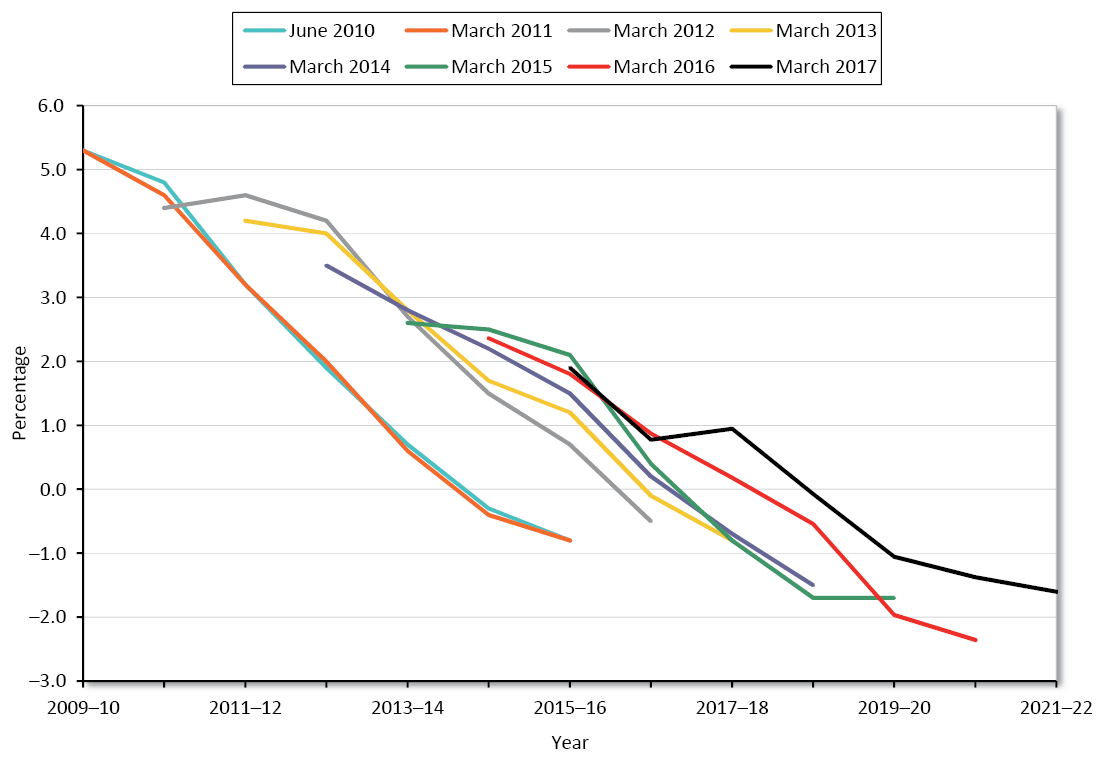

In the end, the two new rules did not prove durable. In 2011, the Office for Budget Responsibility revised down the growth potential of the economy, meaning that its estimate for the structural deficit rose. But the government chose not to cut spending further and thus pushed back its aim of structural balance, weaseling out of the rule by claiming the rule had always been a rolling five-year target. The end result was that the structural deficit, excluding investment, was only halved over the period in which it was supposed to have been fully eliminated (see Figure 5), and even now the figure is not forecast to move into surplus until 2018–2019.

The firmer net debt rule was also abandoned when it became clear it was going to bind. But even before that, headline figures for net debt were giving a false impression of long-term fiscal sustainability as the government improved the debt position through one-off asset sales.

Nevertheless, although the rules proved unattainable, they were a big talking point around annual budgets and did keep political focus on spending restraint. The failure to hit deficit targets was a result of productivity growth being much weaker than expected. Despite huge political pressure to change course and abandon so-called austerity, the government stood firm on spending and actually saw spending lower at the end of the session of Parliament in 2015 than originally planned.54

The Conservative government subsequently adopted a new fiscal framework in 2015 to finish the job. Plans were laid out to achieve an overall budget surplus by the end of the decade. Once that was achieved, the government would be bound to run a surplus in every subsequent year, except when the economy encountered a negative shock (defined as when annual real GDP growth fell, or was forecast to fall, below 1 percent). The government presented accompanying evidence showing that running modest surpluses was the only way to get the debt-to-GDP ratio down to historic levels over the long term.

Economists roundly criticized this new framework for being both too stringent and too lenient at the same time. On the one hand, as with all hard balanced budget rules, it would have resulted in large within-year changes to spending if growth differed from forecasts. The government would also have had to target a large budget surplus to account for forecasting uncertainties. On the other hand, when growth did fall below the 1 percent threshold, the rule gave the government complete flexibility to spend however it wished and to decide about how and when the rule would be reinstated.

None of this mattered in reality because the rule was abandoned before it ever proved binding. After the Brexit vote, the new UK Chancellor Philip Hammond twice pushed back the aim of reaching a budget surplus, and he now merely promises to do so by the middle of the next decade. The electorate appears fatigued by years of deficit reduction being the central economic aim, and demands for increased spending now proliferate, despite the tax burden being set to rise to its highest level in three decades.

One lesson from the UK is that fiscal repair must be undertaken while there is political and electoral buy-in. Promises to be responsible sometime in the future are susceptible to abandonment as circumstances change and political will subsides. The UK’s approach, as with the U.S. experience in the early 1990s, shows that deficit targets are hard to hit, given that tax revenues fluctuate with the economy. Perhaps the most important lesson from the UK, though, is that whereas fiscal rules can help shape budget frameworks by providing aims, politicians often abandon those rules when they begin to bind. In the UK, there were no consequences to doing so.

Figure 5: UK cyclically adjusted budget deficit forecasts

Source: UK Office for Budget Responsibility.

Lessons for a U.S. Fiscal Rule

The following are 11 lessons stemming from the academic literature on fiscal rules and the country examples previously given.

- Political will is needed to achieve fiscal discipline and sustain rules. There are many examples of governments abandoning or circumventing rules when they bind. But well-designed rules can improve the functioning of a disciplined fiscal policy and provide cover for politicians making tough budget decisions. So far there is little direct evidence that Congress is interested in fiscal restraint. But hopefully budget reform—including a fiscal rule—could improve decisionmaking at the margin.

- Rules must have provisions to deal with recessions. Inflexible rules, such as strict deficit targets or hard balanced budget rules, tend to be abandoned or revised in difficult circumstances. If constraints are too tight, rules will not prove politically durable.

- Rules should aim to get debt-to-GDP on a downward path. This is important given the current high level of U.S. debt and projections of ballooning deficits driven by entitlement spending.

- Fiscal rules should cap spending because that is the variable that politicians directly control. Tax revenues are, to a large extent, determined by the health of the economy, the prospects for which can be uncertain. Deficits, likewise, are merely a byproduct of spending and tax revenues.

- Falling debt-to-GDP can be achieved through a rule that balances spending and revenues over the economic cycle. This can be roughly achieved by capping annual spending either to a trend in revenues or to an estimate of what the revenues would be if the economy was operating at full potential.

- The rule should cap overall spending to minimize creative accounting and ensure debt sustainability. It is better to include as much spending as possible within the cap to minimize scope for redefining spending. If there is a concern that governments will find it easier to cut certain spending to hit targets, such as spending on investment or defense, then a supplementary rule can be added to protect that expenditure. But it is preferable that there are no “ring-fenced” areas, as this can undermine the case for broader restraint.

- Entitlement spending should be included in the cap, and a secondary rule could restrain new spending. If structural balanced budget rules are implemented over long periods, then politicians are eventually forced into entitlement reform. But structural balanced budget rules do not restrict politicians today, worsening the long-term fiscal imbalance by making entitlements more generous for future generations. This is a concern if the political consensus around fiscal discipline is expected to change. Therefore, restrictions that prevent new entitlement promises in future years are beneficial too.

- Formulaic rules, which use trends to estimate revenues, tend to be the simplest and most transparent way of setting spending caps. Predicting potential GDP requires estimating a host of unknowns, and it risks politicians leaning on forecasters to be optimistic. Economist Jeffrey Frankel has found that the further into the future forecasts are made, the more governments engage in optimistic thinking55. If rules rely heavily on forecasts, then, it may be preferable to charge an independent economic body with the task of providing them.

- The rule should not allow bygones to be bygones. Deviations in actual deficit outcomes from projections should not be ignored. As with the Swiss debt brake, deviations should be used to adjust future spending caps to ensure that the overall budget really does balance over the cycle. This prevents the problem of continual overoptimism leading to rules that fail to deliver fiscal sustainability.

- There should be a clear but limited escape clause for genuine emergency situations. Otherwise, there is a risk that the legislation will be abandoned entirely if difficult circumstances arise. But this should require a high-threshold vote, with a well-acknowledged pathway back to achieving structural balance.

- The best way to obtain credibility for a fiscal rule is to get to the stage at which it binds. As the British example shows, preaching fiscal discipline like St. Augustine (“Lord give me fiscal discipline, but not yet!”) is not credible. Pushing targets for achieving balance further into the future is especially dangerous given the risk of a changed political consensus and new economic downturns. Prior to the tax cuts and budget deal, the IMF estimated that the United States was running a structural budget deficit of 2.3 percent of GDP. With political will, that could have been eliminated over a period of three to four years to achieve structural balance early in the next presidential term. Doing so would have made structural balance the new norm, with politicians needing to justify abandoning it. Now, of course, the deficit has widened, and obtaining a starting point of structural balance would take longer to achieve.

Conclusion

Fiscal rules are neither necessary nor sufficient for fiscal discipline. But a well-designed U.S. federal rule could improve the functioning of a disciplined fiscal policy and provide political cover for unpopular decisions. Such a rule should operate through controlling spending to achieve reductions in the government debt-to-GDP ratio.

A balanced budget rule has long been the aim of many U.S. fiscal conservatives. But a completely inflexible annual balanced budget rule, as with strict deficit targets, would require large within-year changes to spending or taxes to adjust to unforeseen economic circumstances. Given the difficulties this would cause for budgeting, it is unlikely such a rule would prove politically durable, especially without constitutional backing.

The challenge (which the current task force is considering) is to design and implement restraints that mimic the effects of a balanced budget requirement over the economic cycle. Such a rule should be strong enough to address an inherent political deficit bias but flexible enough to adjust to changing circumstances and endure economic downturns.56 The principles set out in this bulletin provide a framework through which to assess any proposals emanating from Congress. The first step, though, is for U.S. politicians to take fiscal conservatism seriously.

Notes

- Lindsey McPherson, “Are Trump, GOP on Same Page on Bipartisan Outreach?,” Roll Call, September 27, 2017.

- Congressional Budget Office, “The 2017 Long-Term Budget Outlook,” March 30, 2017.

- Victor Lledó et al., “Fiscal Rules at a Glance,” International Monetary Fund, March 2017.

- Congressional Budget Office, “An Update to the Budget and Economic Outlook: 2017 to 2027,” June 29, 2017.

- Committee for a Responsible Federal Budget, “Bipartisan Budget Act Means the Return of Trillion-Dollar Deficits,” Committee for a Responsible Federal Budget (blog), February 9, 2018, http://www.crfb.org/blogs/bipartisan-budget-act-means-return-trillion-d….

- Congressional Budget Office, “The 2017 Long-Term Budget Outlook,” March 30, 2017.

- Carmen M. Reinhart and Kenneth S. Rogoff, “Growth in a Time of Debt,” National Bureau of Economic Research Working Paper no. 15639, January 2010.

- Stephen G. Cecchetti, M. S. Mohanty, and Fabrizio Zampolli, “The Real Effects of Debt,” Bank for International Settlements, September 2011.

- Ryan Bourne, “In Defence of Reinhart and Rogoff,” Pieria, April 25, 2013.

- In 2010, President Obama even set up the National Commission on Fiscal Responsibility and Reform to examine policies to improve the country’s long-run fiscal health, but there was no bipartisan consensus for the recommendations it produced.

- A comprehensive overview is given in Jonathan Portes and Simon Wren-Lewis, “Issues in the Design of Fiscal Policy Rules,” University of Oxford Department of Economics Discussion Paper Series no. 704, May 2014, Section 2.

- See Charles Wyplosz, “Fiscal Rules: Theoretical Issues and Historical Experiences,” National Bureau of Economic Research Working Paper no. 17884, March 2012; see Peter Calcagno and Edward López, “The Evolution of Federal Budget Rules and the Effects on Fiscal Policy: How Informal Norms Have Trumped Formal Constraints,” Mercatus Working Paper, Mercatus Center at George Mason University, November 2015.

- Peter Calcagno and Edward López, “The Evolution of Federal Budget Rules and the Effects on Fiscal Policy: How Informal Norms Have Trumped Formal Constraints,” Mercatus Working Paper, Mercatus Center at George Mason University, November 2015.

- “Debt Limit,” U.S. Department of the Treasury, www.treasury.gov/initiatives/Pages/debtlimit.aspx.

- “Debt Limit,” U.S. Department of the Treasury, www.treasury.gov/initiatives/Pages/debtlimit.aspx.

- Daniel Mitchell, Cato Institute, testimony before the Joint Economic Committee on subject of the economic costs of debt-ceiling brinkmanship, September 18, 2013.

- Government Accountability Office, “Debt Limit: Analysis of 2011–2012 Actions Taken and Effect of Delayed Increase on Borrowing Costs,” July 23, 2012.

- See examples given by Jason Furman and Rohit Kumar, “Don’t Raise the Debt Limit—Repeal It,” Wall Street Journal, June 19, 2017.

- “Debt Ceiling,” IGM Economic Experts Panel, January 15, 2013.

- Bill White, America’s Fiscal Constitution: Its Triumph and Collapse (New York: PublicAffairs, 2014).

- Jeffrey Frankel, “Over-Optimism in Forecasts by Official Budget Agencies and Its Implications,” National Bureau of Economic Research Working Paper no. 17239, July 2011.

- James Poterba, “Do Budget Rules Work?,” National Bureau of Economic Research Working Paper no. 5550, April 1996.

- Peter Calcagno and Edward López, “The Evolution of Federal Budget Rules and the Effects on Fiscal Policy: How Informal Norms Have Trumped Formal Constraints,” Mercatus Working Paper, Mercatus Center at George Mason University, November 2015.

- See Charles Wyplosz, “Fiscal Rules: Theoretical Issues and Historical Experiences,” National Bureau of Economic Research Working Paper no. 17884, March 2012.

- David Primo, Rules and Restraint: Government Spending and the Design of Institutions (Chicago: University of Chicago Press, 2007).

- Robert Krol, “The Role of Fiscal and Political Institutions in Limiting the Size of State Government,” Cato Journal 27, no. 3 (2007): 431–45.

- See a summary of the literature in Robert Inman, “Do Balanced Budget Rules Work? U.S. Experience and Possible Lessons for the EMU,” National Bureau of Economic Research Working Paper no. 5838, November 1996.

- Tamim Bayoumi and Barry Eichengreen, “Restraining Yourself: The Implications of Fiscal Rules for Economic Stabilization,” IMF Staff Papers 42, no. 1 (1995): 32–48.

- James Poterba, “State Responses to Fiscal Crises: The Effects of Budgetary Institutions and Politics,” Journal of Political Economy 102, no. 4 (1994): 799–821; see Jurgen Von Hagen, “Fiscal Rules, Fiscal Institutions, and Fiscal Performance,” The Economic and Social Review 33, no. 3 (2002): 263–84.

- Robert Inman, “Do Balanced Budget Rules Work? U.S. Experience and Possible Lessons for the EMU,” National Bureau of Economic Research Working Paper no. 5838, November 1996.

- Alberto Alesina and Tamim Bayoumi, “The Costs and Benefits of Fiscal Rules: Evidence from U.S. States,” National Bureau of Economic Research Working Paper no. 5614, June 1996. A similar result has been found more recently in Antonio Fatas and Illian Mihov, “The Macroeconomic Effects of Fiscal Rules in the U.S. States,” Journal of Public Economics 90, no. 1–2 (2006): 101–17.

- Robert Barro, “Notes on Optimal Debt Management,” World Bank, 1999.

- Robert Reischauer, “Taxes and Spending Under Gramm-Rudman-Hollings,” National Tax Journal 43, no. 3 (1990): 223–32.

- Alan Auerbach, “Federal Budget Rules: The US Experience,” National Bureau of Economic Research Working Paper no.14288, August 2008.

- For a full discussion, see James Poterba, “Do Budget Rules Work?,” National Bureau of Economic Research Working Paper no. 5550, April 1996.

- Sung Deuk Hahm et al., “The Influence of the Gramm-Rudman-Hollings Act on Federal Budgetary Outcomes, 1986–1989,” Journal of Policy Analysis and Management 11, no. 2 (1992): 207–34.

- Byron Lutz and Glenn Follette, “Fiscal Rules, What Does the American Experience Tell Us?,” Federal Reserve Board Finance and Economic Discussion Series, May 1, 2012.

- Alberto Alesina, “Fiscal Adjustments—Lessons from Recent History,” Economic and Financial Affairs Council meeting, April 15, 2010.

- Jeffrey Frankel, “A Solution to Fiscal Procyclicality: The Structural Budget Institutions Pioneered by Chile,” National Bureau of Economic Research Working Paper no. 16945, April 2011.

- Charles Wyplosz, “Fiscal Rules: Theoretical Issues and Historical Experiences,” National Bureau of Economic Research Working Paper no. 17884, March 2012.

- Guillermo Le Fort, “Structural Fiscal Policies to Target in the Chilean Experience,” Latin American Debt Management Specialists, April 2006.

- Jeffrey Frankel, “A Solution to Fiscal Procyclicality: The Structural Budget Institutions Pioneered by Chile,” National Bureau of Economic Research Working Paper no. 16945, April 2011, p. 7.

- Data from IMF World Economic Outlook Database, October 2017.

- Data from IMF World Economic Outlook Database, October 2017.

- KPMG, “Corporate Tax Rates Table,” n.d.

- Gram Slattery, “S&P Downgrades Chile Sovereign Debt for First Time in Decades,” Reuters, July 13, 2017.

- For a full description of the Swiss debt brake, see Alain Geier, “The Debt Brake—the Swiss Fiscal Rule at the Federal Level,” Working Paper of the FFA no. 15, February 2011.

- John Merrifield and Barry Poulson, Can the Debt Growth Be Stopped? Rules-Based Policy Options for Addressing the Federal Fiscal Crisis (Lanham, MD: Lexington Books, 2016).

- Robert Chote, Carl Emmerson, and Gemma Tetlow, “The Fiscal Rules and Policy Framework,” IFS Green Budget, January 2009, pp. 81–112.

- “Cut Spending to Reduce Borrowing,” Financial Times, January 2, 2007.

- Robert Chote, Carl Emmerson, and Gemma Tetlow, “The Fiscal Rules and Policy Framework,” IFS Green Budget, January 2009, pp. 81–112.

- IMF World Economic Outlook Database, October 2017.

- HM Treasury, Budget 2010, June 2010, pp. 1–2.

- UK Office for Budget Responsibility, historical forecasts database, September 12, 2017.

- Jeffrey Frankel, “Over-Optimism in Forecasts by Official Budget Agencies and Its Implications,” National Bureau of Economic Research Working Paper no. 17239, December 2011.

- John Merrifield and Barry Poulson, Can the Debt Growth Be Stopped? Rules-Based Policy Options for Addressing the Federal Fiscal Crisis (Lanham, MD: Lexington Books, 2016).

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.