Traditional defined benefit pension plans sponsored by state and local governments are dramatically underfunded, requiring large infusions of public funds in future years if they are to deliver promised benefits. This poses a threat to the ongoing ability of many of these governments to continue providing core services.

The total underfunding nationally is usually reported to be in the range of $1–$1.5 trillion. But even that large sum understates the shortfall by trillions of dollars. Economists Joshua Rauh and Oliver Giesecke of Stanford University and the Hoover Institution estimate that the funding shortfall as of 2021 was roughly $6.5 trillion, about six-fold the total amounts reported. An updated Rauh–Giesecke measurement reflecting current market conditions would show a lower deficit. Regardless, massive amounts of state and local debt are missing from their financial statements.

While there may be some questionable figures on the asset side of the ledger resulting from lagged appraised values for private assets, for example, the bulk of the mismeasurement is from understated “actuarial liability”—the present value of future pension benefit payments earned to date by plan members. In essence, actuaries have for years been helping the public officials who hire them hide trillions of dollars of public debt.

Financially Indefensible Discount Rates

How do actuaries seemingly make trillions of dollars of public debt vanish? The trick is to discount future pension payments at a higher discount rate than justified by basic finance principles. Higher discount rates translate to lower liabilities, just as higher market discount rates translate to lower bond values.

Public pension actuaries discount using the “expected” long-term annual return (over 10–20 years) of the investment portfolio, which is around 7 percent these days. “Expected” typically means the return is about the 50th percentile of an assumed distribution developed by an investment consultant or some other financial modeler.

Financial markets place a value on financial instruments like bonds based on the amounts, timing, and default risk of their promised future cash flows. For future pension payments, which resemble bonds’ financial characteristics but are not traded, discount rates are inferred based on the market yield of a portfolio of high-quality (that is, very low probability of default) bonds that have cash flows similar in timing to the pension payments being discounted. The logic is that two sets of cash flows with the same financial characteristics—in this case, pension payments and matching bond payments—have the same value.

Expected investment return has essentially nothing to do with proper discounting. An unfunded “pay-as-you-go” pension plan should use the same discounting for calculating a liability as an identical plan with trust funding that has the same probability of defaulting on promised benefits. If anything, the presence of a trust is likely to lower the risk of default, implying a lower appropriate discount rate.

Discount rates consistent with finance principles change moment-to-moment. As of October 2023, after the recent run-up in market interest rates, appropriate pension discount rates should be around 5 percent, much higher than in recent history, though still below actuarial expected-return rates. Discount rate differences are significant. A 1 percentage point decrease results in liability increases of 10–20 percent.

By overwhelming consensus, financial economists and even a good number of actuaries have understood for decades that traditional expected-return discount rates are inconsistent with finance principles. But binding actuarial professional standards promulgated by the Actuarial Standards Board—members of which are appointed by the major U.S. actuarial organizations—endorse using unjustifiable expected-return discount rates.

Federal pension law and accounting standards have forced actuaries to use more appropriate discounting for private sector pensions. But state and local governments, to which those laws and standards do not apply, along with their actuaries, and—so far at least—their accounting authority, the Government Accounting Standards Board, have held on tightly to the discredited methodology.

Misleading the public? / More appropriate discounting would have profound effects on plan contributions, government financial statements, the public’s understanding regarding the level of funding deficits and, ultimately, the level of benefits provided by government employees’ pension plans—which explains the generally extreme opposition to its adoption on the part of so many stakeholders. This discounting disconnect for public pensions has been the subject of debate and controversy within the actuarial profession for over 20 years. Some actuaries view their public pension peers as having abetted governments in misleading the public.

In reaction to these concerns, pension actuaries will soon be required under a new professional standard, Actuarial Standard of Practice No. 4 (ASOP 4), to disclose an economically meaningful liability that will shed some light on actual plan finances. These numbers may not show up in governmental financial statements, but the actuarial funding reports where they must appear are usually public. Unfortunately, judging by public statements and a public relations “toolkit” developed by public pension advocacy groups with the guidance of many of the most prominent public pension actuaries, the disclosure seems likely to be downplayed and accompanied by misleading explanations.

Stylized Example

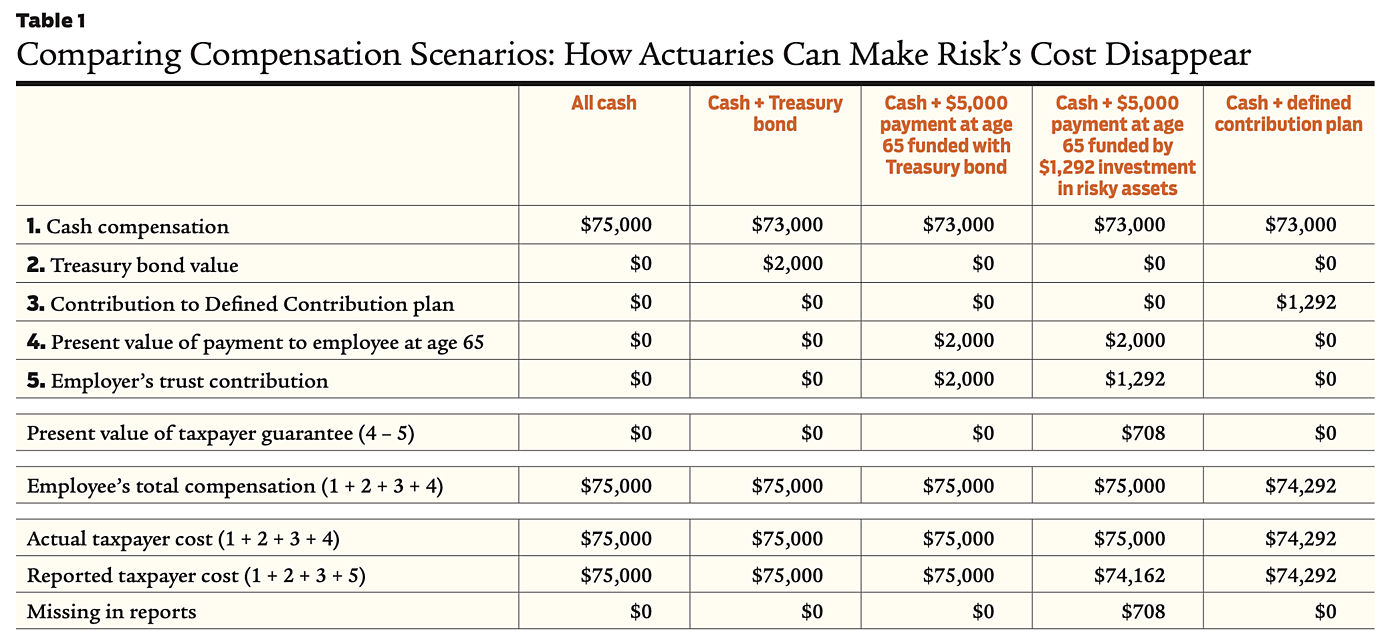

To appreciate the significance of using inappropriate discounting, consider this example: A 45-year-old public sector employee earns $75,000 per year with no pension plan or other benefits. To help secure her retirement, her employer considers changing her compensation to $73,000 in salary plus a U.S. Treasury zero-coupon bond that pays $5,000 in 20 years. The bond is selling in the market at $2,000. The Treasury bond’s implicit annual “discount rate” is thus 4.69 percent, i.e., $2,000 plus 4.69 percent interest compounded for 20 years equals $5,000.

The total compensation cost to the employer would remain $75,000. The employee, in turn, has three options:

- She can sell the bond and be in an identical position as before.

- She can accept her employer’s nudge and keep the bond until retirement.

- She can sell the bond and invest the $2,000 in other assets, e.g., stocks, in the hope of generating additional retirement income, albeit taking the risk that she may end up with less than $5,000.

Now suppose the public employer decides to be more paternalistic. Instead of giving the employee the Treasury bond worth $2,000, it promises her that in 20 years it will pay her $5,000. To fund this liability, the employer could deposit the $2,000 in a trust and have the trust buy the Treasury bond. The promise would then be fully funded by the trust. In 20 years, the Treasury bond would be redeemed for $5,000 and the proceeds forwarded to the employee. In the intervening 20 years, before the bond redemption and payment to the employee, the value of the future payment would increase with the passage of time, and increase (or decrease) as market interest rates decrease (or increase). But the value of the bond held in the trust would change identically to the liability, and the contractual obligation to pay $5,000 at age 65 would remain fully funded at every instant until paid, regardless of what happens in financial markets. Ignoring frictional costs and taxes, the employer’s cost of those actions would be the same as if it had paid the employee $75,000 in cash. And the employee’s total compensation would still be $75,000: $73,000 in cash plus a promise worth $2,000.

But instead of contributing the $2,000 and using it to buy the bond, the public employer could hire a public pension actuary and invest any trust contributions in a “prudent diversified” portfolio including assets, like equities, exposed to various market risks. The actuary would attest that the “expected” annual earnings of the portfolio over the long term is 7 percent (according to a sophisticated financial model). The actuary would then use the 7 percent to discount the $5,000 future payment and certify that the “cost” to the employer is $1,292, which is 35 percent less than the $2,000 cost of the Treasury bond. The actuary would certify that if the employer contributes the $1,292, its benefit obligation is “fully funded” because, if the trust earns the “expected return” of 7 percent (50 percent probable, after all), the $1,292 will accumulate to $5,000 in 20 years. The public employer can then claim it has saved taxpayers $708 ($2,000 – $1,292) by investing in a prudent diversified asset portfolio.

The question is, does it really cost only $1,292 to provide the same value as a $2,000 Treasury bond? Is $1,292 invested in the riskier portfolio worth the same as a Treasury bond that costs $2,000? Of course not. If it is possible to spin $1,292 of straw into $2,000 of gold, why would the government employer stop at pensions? Why not borrow as much as possible now and invest the proceeds in a prudent diversified portfolio expected to earn 7 percent and use the “expected” gains from taking market risk to pay for future general government expenditures?

The public employer is providing a benefit worth $2,000—a guarantee—and hoping to pay for it with $1,292 invested in a risky portfolio. The $708 difference represents the value of the guarantee that taxpayers will make good on any shortfall when the $5,000 comes due. The cost to taxpayers in total is still $2,000, but $708 is being taken from future generations by the current generation in the form of risk. Risk is a cost (precisely $708 in this example). Its price reflects the possibility as viewed by the market that future taxpayers ultimately may have to pay nothing at all if things go well, or a significant sum if they don’t.

Suppose the employer takes this logic one step further and, rather than promising $5,000 in 20 years, it contributes $1,292 to a defined contribution plan that invests in the same prudent diversified portfolio on the theory that the employee will be breaking even because the $1,292 is “expected” to accumulate to $5,000. The employee would be correct to view that as a cut in pay. The $708 cost of risk is shifted to the employee, reducing her compensation, instead of being borne by future taxpayers as in the case of the defined benefit plan.

The employee might complain. Future taxpayers cannot.

The only way for the employer to keep the employee whole with $73,000 of cash compensation plus a defined contribution plan is to contribute $2,000 to the plan. Whether it is invested in the Treasury bond or in riskier assets in the hope of higher returns, the value of her total compensation would still be $75,000.

Table 1 summarizes all these scenarios. The fourth column is the analog of public pension plans. Both the reported annual cost for the future $5,000 payment ($1,292) and the reported total compensation ($74,292) are understated. Investment professionals are paid well for managing risky assets for which high expected returns can be claimed. The actuary collects a fee. The employee has the value of the guarantee and bears none of the market risk being taken. Along with a happy employee, the public employer gets to report an understated compensation cost, freeing up money for other budget items. It’s good for all involved—except for the taxpayers on the hook for $708 in costs hidden by using the 7 percent discount rate.

Why is all this important? An economically reasonable liability value is needed for the employer to answer some important questions:

- How much in total compensation are we paying our employees? How competitive is it in the labor market?

- Related to the above, how much cash or other forms of compensation would be equivalent to the pension promise?

- How does the level of plan assets compare with the value of the contractual pension promise earned by employees for past services? That is, how well funded is the plan? How much of the expected cost for employee services in the past is being passed onto future generations (the funding deficit, properly measured)?

- How quickly are we paying off our deficit, if at all?

- How should we invest? The amount of investment risk that should be taken is a separate, though related, question.

- What is our overall level of indebtedness? Pension benefit promises are a form of taxpayer debt.

Some further observations and takeaways:

- Proper discounting is independent of amounts funded as well as how assets are invested. The appropriate discount rate depends on the financial characteristics of the liabilities. Investing aggressively does not lower liabilities unless participants’ benefits are at risk when investments perform poorly.

- Creative discounting does not make costs disappear. It does, however, decrease cost figures shown in financial reports.

- Liability, measured properly, is volatile, varying with market interest rates. If this volatility is unacceptable, the solution is investing in assets that move in tandem with liabilities (a hedge) or changing the structure of the benefit promise, not using clever math to hide economic reality.

- Not fully funding the actual cost of benefits as they are earned results in taxpayer intergenerational inequity, with later generations paying for the services received by earlier generations.

It is possible that economically appropriate discount rates will come to exceed 7 percent. It has happened in the past, and we’re closer now than in recent memory. Wherever economically reasonable discount rates happen to be now, financially appropriate discounting is needed for transparency and to develop optimal policies.

Will the Current Deceptions Continue?

ASOP 4 requires actuaries to calculate and disclose a liability measure called the “low-default-risk obligation measure” (LDROM), accompanied by an explanation of its meaning for funded status, contributions, and benefit security. The LDROM is imperfect and won’t be calculated identically across plans (there are allowable variations), but if properly understood, it will provide much greater insight than anything currently available into the amount of pension debt owed by taxpayers. Unfortunately, there is no requirement to disclose a meaningful annual cost measure, i.e., an appropriately measured value of benefits accruing in the current year that is a component of current compensation. Also, the LDROM has no required effect on contributions or accounting; it is just a disclosure.

Readers of the new disclosures seeking a better understanding of pension obligations and underfunding in many cases will have to correct for the misdirection of public plan actuaries and industry groups in their explanations of LDROM’s meaning. Those actuaries and interest groups have joined forces to develop and promote a line of messaging by way of webcasts, podcasts, and conference presentations. The messaging downplays LDROM’s significance and includes incorrect and/or misleading descriptions and interpretations.

Four of those groups—the National Conference on Public Employee Retirement Systems, the National Association of State Retirement Administrators, the National Council on Teacher Retirement, and the National Institute on Retirement Security—with the assistance of their (named) actuary collaborators, have published the aforementioned “ASOP 4 Toolkit” that includes suggested language for the required LDROM explanation in actuarial reports. For example, the toolkit describes the LDROM as what the liability would be if the investment portfolio consisted entirely of low-default-risk matching bonds

significantly lowering expected long-term investment returns.… Since the assets are not invested in an all-bond portfolio, the LDROM does not indicate the funding status … nor provide information on necessary plan contributions…. The difference between the … liability and the LDROM can be thought of as … the expected taxpayer savings from investing in the plan’s diversified portfolio compared to investing only in high quality bonds.

The reality, of course, is much different and more worrisome when the spin is removed. The LDROM’s meaning derives from the nature of liabilities regardless of how assets are invested. Investing aggressively does not reduce cost (which includes risk). The difference between the LDROM and the liability used for funding and accounting is not “savings,” but represents otherwise hidden costs of promised pension benefits.

Not all public pension actuaries will mislead. Many will act in good faith. A few were involved in developing the new requirement, taking career risk and possibly damaging relationships within their professional community. But some of the most prominent public pension actuaries who should, and likely do, know better continue in their efforts to undermine their profession’s standard-setters and mislead the public, with trillions of dollars at stake. One hopes that the new disclosure improves understanding despite their efforts.

Readings

- “Financial Economic Principles Applied to Public Pension Plans,” by Edward Bartholomew, Jeremy Gold, David G. Pitts, and Larry Pollack. SSRN Working Paper no. 3120726, April 18, 2018.

- “Public Pension Crisis: Role of the Actuarial Profession,” by Jeremy Gold. In the Public Interest 12: 15–19 (2016).

- Report of the Blue-Ribbon Panel on Public Pension Plan Funding. Society of Actuaries, 2014.

- “Trends in State and Local Pension Funds,” by Oliver Giesecke and Joshua Rauh. Annual Review of Financial Economics 15(1) (2023).

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.