The nation’s federal budget deficit gets a lot of attention from policy wonks and political commentators, and for good reason. Most people agree that the rapid rise in deficit spending in the last several years represents a genuine threat to our long-term economic well-being. But government affects the economy not only by taxing, borrowing, and spending, but also by telling businesses how they need to spend their money, via the issuance of regulations. This can have just as much of an effect on the economy as the government’s fiscal policies. And just like government spending, the cost to the economy from the expanding regulatory state has been steadily increasing as well. In the last decade, regulations issued by the federal government have forced businesses, individuals, and various state and local governments to spend at least $570 billion on compliance—and probably a lot more.

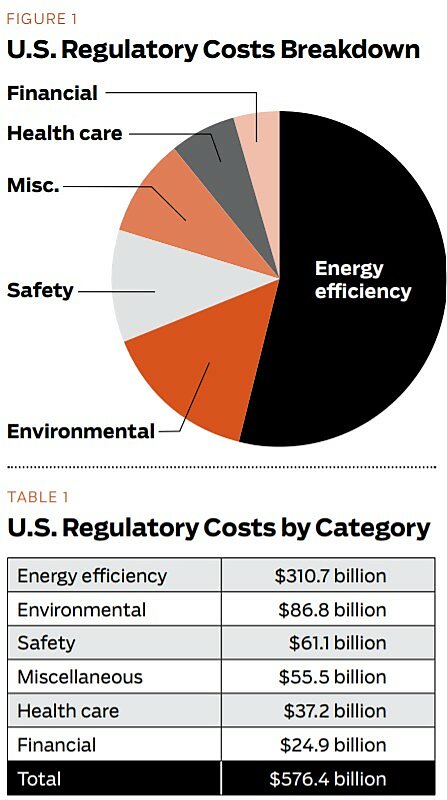

While that number by itself is instructive, it’s even more illustrative to look at where regulations direct private spending. We examined 10 years of data and more than 230 regulations issued during that period, and we found that the bulk of the costs of regulations involve mandates to improve energy efficiency, with various environmental edicts coming in second place. Together, these two categories account for roughly two-thirds of the economy-wide cost of complying with various federal regulations.

The data | For the costs of various regulations, we compiled the regulatory costs reported in the Federal Register, which is the most inclusive source that exists for federal government regulatory activity. However, it does have a couple of important holes.

For starters, independent federal agencies routinely omit quantified cost-benefit analyses in their regulations. They are free to do this because Executive Order 12866, which mandates that executive branch agencies conduct such analyses for “economically significant” regulations, does not apply to independent agencies. This omission results in some obvious lacunae; for instance, the reported costs of complying with various financial regulations comprise only $24.9 billion, or less than 5 percent of the total regulatory compliance costs. The Federal Communications Commission, Consumer Product Safety Commission, Office of the Comptroller of the Currency, and the new Consumer Financial Protection Bureau are among the independent agencies that do not have to estimate the costs imposed by their regulations.

The other problem is that the agencies issuing the regulations are the ones tasked with estimating the costs and benefits. Given that the Office of Information and Regulatory Affairs has the power to return proposed rules to the agency and request that changes be made, the agencies have an incentive to do everything they can to inflate benefits and deflate costs to keep that from occurring. Thus, we suspect that a wholly inclusive, objective analysis of the costs of regulation would be significantly larger and skew more toward those areas of the economy that our government largely regulates through independent agencies.

And while we include the costs that regulations impose on federal, state, and local governments to implement new regulations, we do not consider the cost of maintaining the bureaucracy that creates those regulations in the first place—a cost that is not trivial. Susan Dudley of George Washington University and Melinda Warren of Washington University in St. Louis estimate that cost as roughly $59 billion, or enough to support nearly 300,000 regulators.

Below, we divide the regulations that we examined into six categories and rank the categories by aggregate cost.

Energy efficiency | It might surprise some readers that energy efficiency regulations, including several recent changes to the Corporate Average Fuel Economy (CAFE) standards, provide the top regulatory cost burden, especially given that the recently passed Affordable Care Act (ACA) and Dodd-Frank finance law promise to significantly increase regulatory compliance costs for businesses in the health care and financial services industries. These latter laws are just now being implemented and, so far, have had a relatively small effect on our list. The energy efficiency legislation is more mature and its costs are better measured.

The combined cost of the last four increases in the CAFE standards alone eclipses $250 billion. The Regulatory Impact Analyses (RIAs) for the legislation note that these costs are initially borne by manufacturers, but are ultimately passed down to consumers. For example, for the 2017–2025 CAFE standards, the “technology costs” to producers will top $121 billion. Consumers will thus see higher vehicle costs as a result of the manufacturers’ regulatory compliance. By 2025, the average cost per vehicle will have increased by more than $2,200, for a total economy-wide cost of $154 billion.

Environment | Regulatory authorities estimated that various environmental regulations mandated more than $86 billion in compliance costs across the economy during the last 10 years. For example, the Environmental Protection Agency’s Utility Maximum Achievable Control Technology rule, which regulates mercury and other acid gas emissions, is one of the largest cost drivers, at approximately $10 billion. Federal regulators acknowledged the regulation would result in the closure of numerous coal-fired power plants. Nevertheless, the EPA concluded that the actual consumer impact would be minimal.

The agency did concede—with some nudging from various affected entities—that consumers would be forced to pay $700 million in higher energy prices as a result of the Cross-State Air Pollution Rule, which was recently struck down by the U.S. Court of Appeals for the District of Columbia. If implemented, the rule would have cost approximately $2.7 billion.

Safety | The bevy of rules passed in order to compel businesses to improve the safety of their operations for workers or consumers will add more than $61 billion in costs, according to RIAs produced by various government agencies. The actual cost of all the safety regulations implemented over the past decade is probably much higher than this estimate, because many of the post‑9/11 emergency regulations were never quantified. (Their approvals were expedited on an “emergency” basis, which precluded any cost analysis.) The Department of Homeland Security, the CPSC, and the Federal Aviation Administration issued most of the regulations that make up this category.

Miscellaneous | A few regulations do not fit neatly into the other five categories but, with a cost totaling $55 billion, they merit inclusion and a brief comment. Many of these rules are unfunded mandates on state and local governments. For example, new federal school lunch standards will cost local governments $3.2 billion, while new prison reform regulations will add nearly $6.9 billion.

There are also countless rules designed to benefit favored political classes. In 2011, the National Labor Relations Board passed a regulation forcing employers to post notices about unionization rights. Although the NLRB conducted no formal cost-benefit analysis, it did note that more than 6 million employers would each incur costs of $64 during the first year of implementation, for a combined 12 million hours of impact on the economy. Two federal courts have stayed implementation of the new standards.

Health care | Before implementation of the ACA, health care regulations were often simply “transfer” rules that dictated how federal funds were to be allocated to states or health care providers. However, the implementation of the ACA will boost the long-term costs to states and the private sector by more than $27 billion alone, excluding federal transfers. Many of these burdens are ultimately passed to consumers. For example, a recent rule issued under the title “Adoption of a Standard for a Unique Health Plan” under the ACA will require physicians and hospitals to use new standard transaction formats, with a full implementation cost of approximately $450 million.

Financial regulation | At $24 billion, financial regulation could take a higher spot on the list of affected industries if independent agencies were not exempt from conducting cost-benefit analyses under Executive Orders 12866 and 13563.

The Dodd-Frank law is, of course, contributing to the surge in costs. To date, the law has imposed $14 billion in costs, but few agencies have examined the impact on entities other than large financial institutions. Former Congressional Budget Office director Douglas Holtz-Eakin has estimated that new capital requirements for banks may result in 20 percent fewer loans and 600,000 fewer home sales. By his analysis, the new rules could result in 1 million fewer housing starts by 2015, almost 4 million fewer jobs, and subtract more than 1 percentage point from GDP.

Conclusion | The implementation of federal regulation is still somewhat of a gray analytical area. With dozens of agencies, differing legal standards, and more than 3,000 rules each year, a detailed examination of everything is nearly impossible. Thus, it is difficult for those in the regulatory community to get a clear picture of the true economic impact of the spending mandated by our regulatory bureaucracy.

This snapshot of regulatory costs during the last 10 years reveals the federal government has placed a priority on energy conservation and tougher environmental standards. At a cost to the economy of close to $400 billion between these two efforts, this impact is historic in proportion.

However, it’s important to note that this snapshot is woefully imprecise, owing to the fact that independent agencies do not need to perform cost-benefit analyses of their rules. Other executive branch agencies that are not exempt from this requirement have every incentive to produce an analysis that omits as many costs as they can get away with. The reality is that the true costs of our nation’s regulations greatly exceed our own estimates.

Readings

- “Regulators’ Budget Rising,” by Susan E. Dudley and Melinda Warren. George Washington University, May 18, 2010.

- “Regulatory Reform and Housing Finance: Putting the ‘Cost’ Back in Benefit-Cost,” by Douglas Holtz-Eakin, Cameron Smith, and Andrew Winkler. American Action Forum, October 2012.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.