Bare store shelves and waiting lines for goods began appearing in the early months of the COVID pandemic in 2020. More recently, another economic problem has appeared: inflation. Official statistics show there was a drop in U.S. gross domestic product in the first quarter of 2022. And rippling throughout the global economy, disruptions in production have followed strict lockdowns in China and the war in Ukraine.

All these problems and others have been or are being blamed on “the supply chain.” But as we will see, this concept is not very useful in economic analysis.

“Supply chain” (also called “value chain”) is a relatively new expression. Google Books Ngram Viewer shows the term wasn’t used much until the 1980s, reached a peak in 2008 and, after a lull, began growing again in the mid-2010s. Now it’s everywhere. A few weeks after entering the White House, President Joe Biden issued Executive Order 14017 on “America’s Supply Chains” and a few months later created a Supply Chain Disruption Task Force. We are told that Americans need “resilient, diverse, and secure supply chains.” It seems that each time some economic problem is perceived, “the supply chain” becomes the incantatory explanation.

The New Palgrave Dictionary of Economics first devoted an entry to “supply chains” in 2008, stating that the concept “encompasses all the resources and processes required to fulfill the demand for a product.” Thus, it basically corresponds to what economists call “production.” Recall that in economic parlance, “production” means transforming intermediary products into final goods and includes transportation, distribution, and sales. One can argue that the new expression is useful as a management concept for planning supplies at the level of the firm, but the danger is to think that supply chain analysis reveals secret recipes for government to plan the economy just as executives and managers run a business enterprise. Economics suggests looking at these things differently.

The supply chain seems to be visualized as a network of pipes through which goods move. When a pipe gets clogged, the flow stops, deliveries back up, and users see out-of-stock notices and face a shortage. Yet, this vision of the economy is very misleading because it ignores price signals, a crucial component of a market economy.

Supply Chains Don’t Create Shortages

Basic microeconomic theory, also called “price theory,” suggests that shortages are not caused by “the supply chain.” It offers a more meaningful explanation for why shortages appeared during the COVID pandemic. The accompanying sidebar (pp. 28−29) presents a formal explanation, but the ideas can be intuitively summarized as follows.

Suppose that, in a market for a specific good or service, supply (that is, the whole schedule of quantities produced and supplied at different prices) decreases for some reason. The price for available units of the good will be bid up by buyers who prefer to have some (or more) of it instead of none (or less). Suppliers rapidly realize that they can ask for a higher price and still sell everything they have. At the higher price, suppliers will find it profitable to increase the quantity they provide. A new supply–demand equilibrium results, where the market-clearing price is higher and the quantity demanded and supplied are lower than before. Note that a free market and a free economy work like a continuous and invisible auction where any consumer can get anything by bidding up its price or, what amounts to the same, paying the price paid by the highest bidders.

What is a shortage? / If price increases were prohibited or limited by some constraint external to the market, a shortage would appear because producers would not increase their quantity supplied and demanders would not decrease their quantity demanded. This is how economics defines a shortage: a situation where the quantity supplied falls short of the quantity demanded, and consumers (or users, if we are considering the market for an input) cannot get what they want even if they are willing to pay more. Would-be buyers must wait in line for the good (in a physical or virtual queue), hoping that there will still be some left when their turn comes.

A shortage does not simply mean that the price of something is “high,” because the price of anything is deemed high by some consumers. Although diamonds are too expensive for most consumers, there is no shortage of them; anybody can walk into a jewelry store and buy one if he is willing to pay the going price. Of course, one can define “shortage” however one wants, but if it is defined as “high price,” we would need another word to label what economists call a shortage. Note also that “shortage” is not synonymous with “price increase”; on the contrary, a price increase eliminates a shortage.

An increase in demand (that is, the whole schedule of quantities demanded at different prices) will, other things being equal, cause a similar effect on the equilibrium or market-clearing price. The reason is the same: consumers bid up the price until the quantity demanded matches the quantity supplied. Quantity supplied will increase only if incentivized by a higher price. When the price increase is caused by higher demand instead of lower supply, the equilibrium quantity demanded and supplied will be higher. (The sidebar below explains more precisely why we need to distinguish between demand and quantity demanded and, similarly, between supply and quantity supplied.)

During the pandemic, we have often observed a combination of lower supply and higher demand. Supply decreased because producers (individuals and corporations) in lockdown or in voluntary isolation produced less. Demand increased for certain goods: sanitizer, masks, home computers, etc. Both factors pushed prices up. If the free-market price adjustment is prohibited or limited by government — by an “anti-price-gouging” law, for instance — then a shortage appears.

As an illustration that a price must increase in some way for producers to increase their quantity supplied, consider the case of toilet paper at the beginning of the pandemic. Paper goods manufacturer Georgia Pacific, for example, could only produce more toilet paper by supporting a higher marginal cost. A new worker added to the production line adds less productivity than the previous one did. The newly added night shift imposes additional cleaning and maintenance costs. More overtime needs to be paid. Retooling production lines that produced lower-quality, bulk-sale toilet paper for work restrooms so they instead produce softer toilet paper in packaging convenient for home use also implies higher unit costs.

Note that a potential or temporary shortage is normally resolved by both a reduction in quantity demanded and an increase in quantity supplied. The only exception occurs in the very short run, until suppliers increase production by boosting their capacity utilization. How short this “very short run” is depends on the specific industry.

If entrepreneurial individuals expect an event to lead to a price increase, they will buy and hoard the affected good, hoping to make a profit from selling it later. If their forecasts are wrong, they will lose money. If they are right, their action will smooth the price increase over time, starting it earlier (through their purchases) and tempering it when they sell their stocks. If effective price controls and a shortage are expected instead, it is the consumers themselves who will do the hoarding through “panic buying.”

Pandemic Price Controls

Price controls — that is, price ceilings — were imposed during the COVID crisis. By early April 2020, all state governments had declared emergencies, which in some cases lasted two years. These declarations triggered the anti-price-gouging regulations that were on the books in 34 states. (See “Anti–Price Gouging Laws: Why a Pandemic Is Different from Other ‘Emergencies,’ ” p. 8.) Eight other states (plus at least one local government, New York City) rushed to adopt similar controls. These different regulations target goods and services related to an emergency, often vaguely and widely defined as what is “vital and necessary for the health, safety and welfare of consumers or the general public” (New York State) or, more simply, as “necessities” (Texas). The laws may apply to the whole “chain of distribution” and even to hotel rooms and housing rents. What is “necessary” or “vital” varies among consumers: Texas Attorney General Ken Paxton accused an online ammunition retailer of price gouging, for instance. Depending on the state, price-gouging laws call for civil or criminal penalties.

The federal government also imposed price controls. On March 23, 2020, President Donald Trump issued Executive Order 13910 on “Preventing Hoarding of Health and Medical Resources to Respond to the Spread of COVID-19” under the authority of the 1950 Defense Production Act (DPA). The Department of Health and Human Services published a list of goods that buyers were forbidden to accumulate “in excess of the reasonable demands of business, personal, or home consumption, or for the purpose of resale at prices in excess of prevailing market prices.” Besides hospital equipment, the goods included face masks and other personal protective equipment (PPE). Penalties consist of fines of up to $10,000, one year in jail, or both, for each count. Both at the federal and state levels, citizens were encouraged to denounce the so-called “price gougers.” (I put this term in scare quotes because any trading of these goods is voluntary and exchange occurs only because of an otherwise unsatisfied demand.)

Evidence of shortages / Not surprisingly, and as economic theory predicts, price-controlled products rapidly disappeared from store shelves and major online platforms. Because of the caps, they were relatively inexpensive — yet they were nowhere to be found or else could only be had by consumers at the front of long queues.

The intuitive and experience-driven expectation that price controls lead to shortages incentivized hoarding by consumers and thus worsened the shortages. A recent econometric analysis by Rik Chakroberti of Christopher Newport University and Gavin Roberts of Weber State University confirmed that this panic hoarding occurred specifically in the states that had previous price-gouging laws.

The U.S. Justice Department created a COVID-19 Hoarding and Price Gouging Task Force to coordinate criminal prosecutions of DPA cases. Many prosecutions were launched, though totals are hard to find and many cases are still before the courts. The enforcement of state price-gouging laws further increased the legal risk faced by black-market and gray-market entrepreneurs. Price controls disrupted supply chains much more than price increases and heightened competition would have.

For example, Tonatiuh Antonio Leal-Matos of Puerto Rico was indicted and convicted of two counts of violating the DPA for selling face masks and disinfecting wipes online at illegal prices when many consumers were desperately trying to find some in April–July 2020. A California-based grocery chain, Smart & Final, was fined $175,000 for selling organic and cage-free eggs at higher prices than the state price-gouging law allowed. Naively admitting that price controls created shortages, California Attorney General Rob Bonta declared about the illegal eggs, “Remember that during this time, shelves were often bare, there weren’t a lot of choices. Consumers had few if any options.” He thus punished a company that was offering one more option.

Even auctions were banned if the resulting prices were above the government-mandated ceiling. As Iowa Attorney General Tom Miller explained, “Sellers who accept excessive prices on online auction sites are not exempt from Iowa’s price-gouging law.” Texas’s Paxton stopped an online auction of hand sanitizer, cleaning supplies, and 750,000 masks. The auctioneer, Auctions Unlimited, sensibly argued that “it is literally impossible to price gouge using the auction method when ALL bids start at $1” and the bidders themselves “decide the price.” In reality, “price gouging” simply means selling at a price that government officials don’t like.

The Role of Prices

Supply chains don’t create shortages, price controls do. Ignorance of how the price mechanism works leads many people to espouse public policies that are the source of shortages and supply chain problems.

Flexible prices are a central feature of free markets. The role of prices is to efficiently allocate resources; “efficiently” means according to what individual consumers want and the cost of producing it. The idea that shortages and allocation by government regulation are somehow more just than allocation by prices is mistaken, if only because the poor are not necessarily the first ones in queue. On the contrary, it is “the rich” who are most likely to avoid long waiting lines when getting what they want. In another paper, Chakraborti and Roberts estimate that under the pandemic price controls, consumers in the highest quartile of the income distribution spent less time searching for the disappearing goods in physical retail stores (and were consequently less at risk of being infected by the coronavirus).

Historical experience has shown that queueing for goods, as opposed to the price mechanism, is a major difference between a socialist or war economy and a free-market economy. An oft-cited example concerns the former Soviet Union and its Eastern European satellites, where not enough cars were produced given demand at the state-determined prices. Like for most goods, the car shortage was endemic: it took about 10 years for an ordinary citizen to get the car he ordered, with a deposit that could reach 50%.

When government prevents economic markets from adjusting via the price mechanism, the political market will adjust. Politicians and high-level bureaucrats will use their allocation powers to jump the queues and reward their patrons and favorites with similar privilege. In the Soviet empire, state apparatchiks did not have to wait for a car like ordinary people. Leibniz Institute researcher Luminita Gătejel reports one telling example: In 1979, the president of the East German Supreme Court complained that he was to receive a Russian-built Lada 1500 as his official car while top functionaries got the more impressive French Peugeot 305. “Please, make sure I am given a Peugeot 305,” he respectively wrote to his government. His request was honored.

Economic illiteracy / In the public health literature, examples of ignorance of the salutary role that prices play in allocating resources are easy to come by.

For example, the authors of an article published in a prestigious medical journal during the first COVID-19 wave noted that the “substantial” shortages of PPE were endangering health care professionals. They looked for causes in supply chains. They did mention, but without following up with economic analysis, that “distributors are unwilling to pay the higher asking price given concerns that they may not be able to recover added costs.” They did not explain that PPE distributors were forbidden by law from charging what their customers were willing to pay.

Instead of price controls, the authors blamed the market system’s focus on “efficiency and price” and proposed more government allocation power in “reshaping the supply chain.” Somebody in government should be in charge of the supply chain for PPE, at least in an emergency, they concluded. This reminds us of the Russian official who, after the breakup of the Soviet Union, asked a British economist, “Who is in charge of the supply of bread to the population of London?” After all, providing the roughly 22,000 tons of food that the residents of London consume every day in a great variety of diets must be as complicated as finding PPE, and Londoners having no food would be a major health emergency.

In a partly free economy, prices can never be totally controlled, if only because suppliers find ways to stealthily increase them and thus partly satisfy customers’ demand. They eliminate sales promotions, stock only their most profitable items, sell products in larger packages (ammo in lots of 500 rounds instead of boxes of 50), etc. They also reduce the diversity of their offerings. The Wall Street Journal reported that, as of June 2020, after a few months of COVID-19 emergency price controls, the typical Independent Grocers Association store carried only four varieties of toilet paper instead of the typical 40 before price controls. The average number of different items sold in grocery stores was down 7.3%. J.M. Smucker paused production of its reduced-sugar Uncrustables sandwich pockets. Coca-Cola discontinued Zico coconut water. As time passes and price controls continue, further reductions in convenience and quality are possible.

The Labor “Shortage” And Others

So-called “labor shortages” that are supposed to hamper the “supply chain” are another misunderstanding. When an employer says he cannot get the labor he needs, he typically means that he cannot get as much as he wants at the on-going remuneration (wages and benefits) rate — that is, without bidding up this price along with other employers. What this really means is the employer does not find it profitable to offer higher remuneration. He does not “need” more labor any more than he needs more Champagne, oil, or a Ferrari — in all cases, he has simply determined the added benefit is not worth the added cost.

The reference to oil reminds us that shortages of gasoline or other petroleum fuels do not happen precisely because their prices are allowed to adjust. Anybody can get as much as he wants if he pays the going market price, including when it is increasing. When gasoline prices were capped below their equilibrium in the 1970s, shortages appeared with long waiting lines at service stations.

When demand for goods and services expands, the demand for their inputs (a “derived demand”) follows. If the demand for labor increases — as it has since the end of the pandemic-induced recession in the second part of 2020 — its remuneration will be bid up. If employers want to hire more labor and retain the workers they have, they must pay more.

Since the pandemic, average hourly earnings have been rising at an annual rate of about 5%, and more in industries where consumer demand has increased more than average. Amazon and other employers have attracted employees by pushing up starting wages to $15 an hour — the long-time dream level of activists for a higher federal minimum wage. Walmart also illustrated the workings of a free labor market when, in response to an increase in demand for its products, it recently announced annual salaries of up to $110,000 for truck drivers. Interestingly and fortunately, virtually nobody criticizes “wage-gouging” by workers.

Considering the whole economy, one may ask where the new workers will come from. The answer: from previously unemployed or discouraged workers, from others who are incentivized by higher wages to enter or return (perhaps part-time) to the labor force such as retired people, and from immigration (to the extent allowed). While the supposed labor shortage was in full swing in April, the Bureau of Labor Statistics announced that 428,000 jobs had been added to private payrolls!

Last Christmas, Walmart provided another illustration of how supply-chain talk is misleading. In November, its shelves were well stocked and ready for the holiday season. Like other retailers such as Home Depot and Target, Walmart chartered its own ships to sidestep congestion at U.S. ports. A New York Times story from early May confirms, perhaps unwittingly, that there is no shortage of maritime shipment, only a rise in its price because of increased demand; customers who don’t pay the bid-up price get stuck in a waiting line.

All this suggests that supply chain problems are solved if consumers are ready to pay for solving them. Otherwise, if consumers are unwilling, there is no supply chain problem.

The microchip shortage / The more complicated microchip “shortage” also shows the importance of prices in understanding the economy. After the dark months of COVID’s first wave in 2020, demand for automobiles increased. But automobile manufacturers had not stocked enough of the microchips that are now omnipresent in cars (in transmissions, engines, electric motors, navigation, Wi-Fi, etc.). In the meantime, other industrial users of microchips whose sales had increased during lockdowns — notably manufacturers of computers and smartphones — had brought to the market a higher demand for chips.

This demand increased faster than the quantity supplied could respond. Microchips are complicated products that have longer production cycles than most goods. It takes time to increase production capacity and a couple of years to build new factories. Car manufacturers thus faced delivery delays.

Commentators and politicians — including President Biden — began blaming a “supply and demand mismatch.” But we know that when prices can adjust freely, quantity supplied and quantity demanded are brought into equilibrium. Indeed, microchip prices were bid up by the different demanders, reducing the quantity demanded by less eager buyers.

A spot market exists on the internet where the highest bidders can obtain generic microchips. To increase production, especially of specialized chips, manufacturers have committed some $150 billion to building new factories in 2022. But until the new production comes online, prices will do most of the work to balance supply and demand. It takes more time to produce microchips than bread.

As a result, the prices for consumer goods containing microchips have increased. Or, more exactly, it is the high demand for these products that motivated their manufacturers to bid up microchip prices. Personal computers, whose demand increased with lockdowns, work from home, and voluntary isolation remained available, but at higher prices.

Car manufacturers, when they came back to the market, were willing to bid up and buy microchips, but only to the point where they thought their customers would support the higher production costs. Many purchasers of brand-new cars were willing to pay more, but there was a limit. In March of this year, the average price paid for a new car in America was $43,700, 26% higher than before the pandemic. If you want a certain car and are willing to pay the same price as the highest bidders, chances are that you will get it or something close to it from dealers who ask more than the manufacturer’s suggested retail price. Prices are high, but that doesn’t mean there are shortages.

Recall that a shortage is different than a high price. Also, complex products have a longer production lead time and it is somewhat misleading to call this delay a “shortage.” In the meantime, prices will ration demand, assuring that the most imperative demands are satisfied. If a car manufacturer were willing to pay $1 million per microchip, it would probably find another carmaker (or a manufacturer of something else) willing to sell its stock. From an economist’s viewpoint, the chip “shortage” looks less like an actual shortage than it does an auction where not everybody is the highest bidder.

The Unbearable Lightness of Supply Chains

Another common misconception is that supply chain disruptions generate inflation. To keep our ideas clear, we must distinguish inflation, which is a general increase in the price level (all prices), from changes in relative prices between goods. To take a simple example from the Consumer Price Index estimates published last April, the inflation rate was estimated at 8.5% between March 2021 and March 2022, while the average price of dairy products increased by 7.0%. If the inflation estimate is correct, it follows that the price of dairy products would have decreased by roughly 1.5% (7% – 8.5%) absent inflation. Airline fares, which increased by 23.6%, would have increased by 15.1% (23.6% – 8.5%) if not for inflation. One “real” relative price increased, the other decreased.

It is true that widespread supply cuts, as happened during the COVID-19 recession, can create a one-time increase in the general level of prices, perhaps with a lag, as the same amount of money chases fewer goods. But if we accept the proposition that inflation is a monetary phenomenon, continuing inflation — the general price level increasing month after month, year after year — results from the central bank continually boosting the money supply. This is indeed what seems to have happened: Between February 2020 and late 2021, the money stock (as measured by M2, which is the sum of all physical currency, deposits in checking, savings, and money market accounts, and similar liquid assets) increased by 41%. The inflation that we have been observing is the result of money creation by the Federal Reserve in large part to finance increased government expenditures. The reversal of this inflationary policy now risks causing a recession.

From an economist’s viewpoint, the microchip “shortage” looks less like an actual shortage than it does an auction where not everyone is the highest bidder.

In brief, supply chain issues and inflation are two different matters. The current inflation cannot be blamed on supply chains.

The several threads we have followed in this article strongly suggest that the supply chain is not a very useful concept except, admittedly, from the point of view of a business manager charged with securing the inputs that his firm wants. While the absence of a bread czar in London does not cause supply chain problems, the production and profits of a single bread maker can certainly suffer if it does not take care of its own supply chain. In a competitive free-market economy, shortages are difficult to imagine without government price controls. But can we find other causes?

Privately induced shortages? / A shelf at your preferred grocery store may be temporarily out of bread until the supply truck returns. For a specialized microchip, the delay will be longer; in the meantime, though, the shortage should be resolved by higher prices. Flexible prices should adjust rapidly, if only to reduce quantity demanded until production picks up.

Could suppliers voluntarily do what price controls would force them to do: charge a price below market equilibrium and ration the goods among their customers in another manner? We do occasionally see this.

Last fall, amid increasing prices for crude oil and gasoline, British service stations were encouraged by their trade association to stop (temporarily) charging what the market would bear (“profiteering”). Long queues appeared at the pump, consumers panicked, and a majority of gas stations ran out of fuel. In the United States, after the government-enforced price controls expired with the end of the declared COVID emergencies, some suppliers continued to charge non-market-clearing prices for some items. If you want to buy ammunition at Cabela’s, you will find a notice such as “Due to increased demand, Cabela’s is limiting pistol ammunition that can be purchased to 5 boxes per item” (seen online in mid-April 2022). You will often find that what you want is out of stock, much like when price controllers were haunting the land.

The standard explanation for this is that suppliers seek to protect their reputation and goodwill by not displeasing their customers. Note, however, that those suppliers displease customers who are willing to pay more to get more of a good or just to get some of it. Or perhaps, instead of reputational egoism, special ethical principles can be invoked in a serious and temporary emergency? But then, the manufactured shortage may harm individuals who consider the scarce good more valuable but cannot spend the time to search in many grocery stores or check the internet every hour — like a working mother who needs something out of stock for her family. (See “The Two Moralities of Outlawing Price Gouging,” Spring 2014.)

Fundamental values / Less noble sentiments may be at play. An anti-capitalist ethics leads many people to prefer that nobody has some good instead of it being unequally distributed. A reported and perhaps apocryphal communist joke went as follows: “There is nothing left,” one comrade said. “We are in deep doo-doo.” “At least,” replies the other, “we all share it equally.” But as we have seen above, allocation by waiting lines or by government bureaus and politicians’ fiat does not guarantee a better distribution.

In the first well-publicized arrest under the DPA in April 2020, a small businessman was charged with selling in his Plainview, N.Y. retail store some “COVID-19 Essentials” that were otherwise difficult if not impossible to find. A Postal Service inspector who had participated in the investigation illustrated the creepy mentality of the communist comrade above by declaring that “the conduct charged in the complaint is reprehensible and against our most fundamental American values” (quoted in the Justice Department’s press release). Perhaps only an economist could foresee that the government’s interference with prices could lead to such an ideological inversion.

Fortunately, competition — especially online competition — tends to reestablish the normal functioning of the market by imposing higher or more visible opportunity costs (profit losses) to for-profit suppliers tempted to sell at below-market-clearing prices. Customers will buy the cheap stuff where they can and go to suppliers who sell at market prices for the rest — if they don’t just resell at market-clearing prices what they have purchased at non-market prices. The Wall Street Journal reported on a Ford–Lincoln dealer in Michigan selling a Bronco at the sticker price to a sympathetic customer who then listed it for sale at $20,000 more.

Given anti-market sentiments and the large government powers that ordinary people still underestimate, suppliers often face political risk and legal threats if they simply follow market signals, as we have seen. Even in the absence of formal price controls, large companies may be at risk if they let their prices be bid up by market conditions. Congressional committees and bureaucratic agencies can bully them and regulation or public relations headaches can follow. Oil companies have known the drill for decades.

To summarize: Supply chain problems are exaggerated when they don’t simply serve as convenient scapegoats for government. Even corporate executives have learned what a good excuse they provide. But supply chains don’t create shortages; formal or informal price controls do. Free markets with freely determined prices are the best mechanism known in history to minimize supply shocks while taking all participants’ preferences into account.

Political interference should be reduced at a minimum, especially regarding the crucial role of freely determined prices. At the very least, supply chain talk in an economy-wide context should always incorporate, and focus on, prices.

Readings

- “A Good Buy — If You Can Get One. Purchasing Cars Under Socialist Conditions,” by Luminata Gătejel. European University Institute working paper, 2010.

- “Appealing for a Car: Consumption Policies and Entitlements in the USSR, the GDR, and Romania, 1950s–1980s,” by Luminata Gătejel. Slavic Review 75(1): 122–145 (Spring 2016).

- “How Price-Gouging Regulation Undermined COVID-19 Mitigation: Evidence of Unintended Consequences,” by Rik Chakroberti and Gavin Roberts. Center for Growth and Opportunity, March 2021.

- “Learning to Hoard: The Effects of Preexisting and Surprise Price-Gouging Regulation during the COVID-19 Pandemic,” by Rik Chakroberti and Gavin Roberts. Journal of Consumer Policy 44(4): 507–529 (2021).

- “Personal Protective Equipment Shortages During COVID-19 — Supply Chain-Related Causes and Mitigation Strategies,” by Preeti Mehrotra, Preeti Malani, and Prashant Yadav. JAMA Health Forum, May 2020.

Supply, Demand, and Shortages

What is a shortage as economists understand the term? To answer this carefully, we must employ economists’ favorite tool: supply-and-demand graphs.

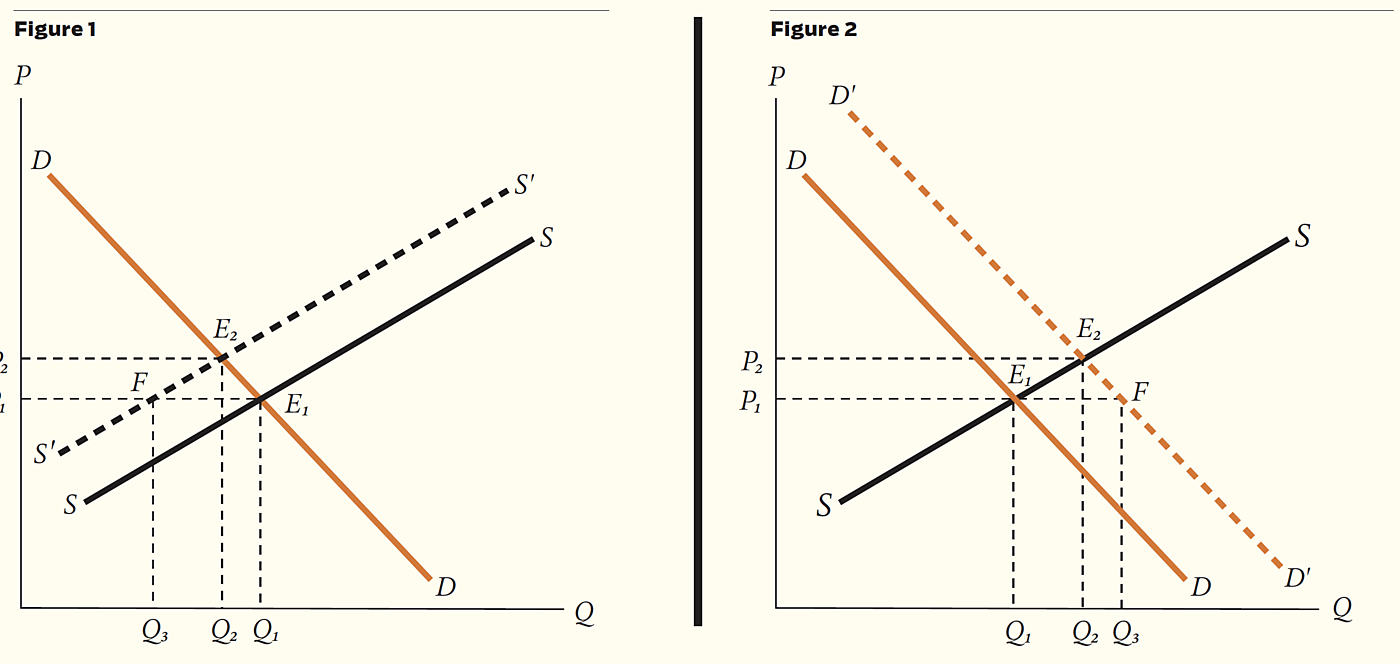

Figure 1 depicts a competitive market for a given good or service, with prices on the vertical axis and quantities on the horizontal axis (the way it is traditionally done in economics).

The demand curve DD has the usual property of a negative slope: reading along the curve, the higher the price, the lower the quantity demanded, and mutatis mutandis in the other direction. The curve is drawn as a straight line only for convenience; it can have any shape or any position, depending on consumer preferences, the number of consumers, their incomes, etc., provided its slope is everywhere negative. The demanders are consumers if we consider the market for a consumer good (or service); they are intermediate users if the market is for an input (say, labor services or material). For ease of exposition, we will consider the market of a consumer good.

The supply curve SS shows a positive slope: the higher the price, the higher the quantity supplied. Provided this condition is satisfied, the curve can have any shape or position depending on production (including distribution) costs. The slope of the supply curve is positive because of the law of diminishing marginal productivity: if all workers are given the same amount of other inputs, the nth worker is less productive than the previous one if only because the previous worker was assigned the most urgent tasks. Thus, every successive unit produced by the firm has a higher marginal cost, especially in the short run where, by definition, the size of a factory or office is fixed.

On one side of the market, consumers who prefer to have some (or more) of the good at a higher price will bid up its price. On the other side of the market, the competition by suppliers who are eager to produce (or sell) a unit as long as its price is above marginal cost will push down the price. These two factors lead to the market-clearing or equilibrium price P1, where quantity demanded is equal to quantity supplied at Q1 units. E1 is the market equilibrium.

Staying on Figure 1, suppose that supply decreases — that is, the supply curve shifts inward to S’S’. Because of cost increases, producers reduce their quantity supplied at any given price. At the old price P1, quantity supplied is now Q3 and faces quantity demanded Q1. (Important note: Quantity supplied is a point on a given supply curve, while supply refers to the whole curve; similarly, quantity demanded is a point on a given demand curve, while demand refers to the whole demand curve.) If the gap persists, we will see a “shortage” of Q3Q1 = FE1.

On a free market, however, the gap FE1 is necessarily a temporary phenomenon. Those consumers who prefer to have more of the good, even at a higher price, rather than less (or none) at a lower price, will bid up the market price. As the price increases, quantity demanded on DD decreases and quantity supplied on S’S’ increases until quantity supplied equals quantity demanded at Q2. A new market equilibrium with market-clearing price P2 is established at E2.

If the government effectively forbids the price increase, however, the price remains at P1. For economists, a shortage is the persistence of the FE1 gap longer than the time necessary for consumers to bid up the price enough to reduce quantity demanded and for suppliers to increase quantity supplied. That is, government price control created the shortage, not some sort of problem with “the supply chain.”

Now, suppose that, starting at the same initial equilibrium E1 with our initial demand and supply curves, it is demand that shifts, increasing from DD to D’D’ as shown in Figure 2. The amplitude of the shift depends on consumer preferences, incomes, and any other factor than price. At any price, consumers are now willing to buy more than previously. At price P1, quantity demanded would be Q3 and face a quantity supplied Q1. If this situation were to persist, we would observe a “shortage” Q1Q3 = E1F.

But again, the gap E1F will not last long on a free market. Those consumers who prefer to have more of the good at a higher price rather than less (or none) at a lower price will bid up the market price to P2. As the price increases, quantity demanded on D’D’ decreases and quantity supplied on SS increases until quantity supplied equals quantity demanded at Q2. The new market-clearing price P2 leads to a new market equilibrium at E2.

If government effectively bans the price increase, P1 is maintained, and we can repeat the analysis from Figure 1. The persistence of the E1F gap (longer than the time it takes for consumers to bid up the price and for suppliers to increase quantity supplied) is what economists call a shortage. This problem is the product of government price control, not supply or demand.

One final note on both Figure 1 and Figure 2: If, in the very short run (imagine one hour), supply is perfectly “inelastic” (that is, the supply curve is temporarily vertical, meaning that quantity supplied cannot increase), the price may temporarily rise higher than P2. While this lasts, it is only the decrease in quantity demanded that will do the work of eliminating the temporary gap with quantity supplied, but there is no shortage properly understood (or we may speak of a temporary shortage, but at the risk of forgetting the difference between a high price and a shortage). As producers increase the quantity supplied, the price will fall to P2.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.