U.S. businesses spend billions of hours each year in an effort to comply with the reams of regulations issued by government. The “billions” figure is not guesswork: federal regulatory agencies are required to produce a good-faith estimate of the amount of time a newly issued regulation will require us to spend doing paperwork in order to comply with the law. The Office of Information and Regulatory Affairs (OIRA) calculates that the federal government currently imposes more than 10.3 billion hours of paperwork compliance annually. To put that number in perspective, New York could build more than 1,400 Empire State Buildings in the equivalent amount of time.

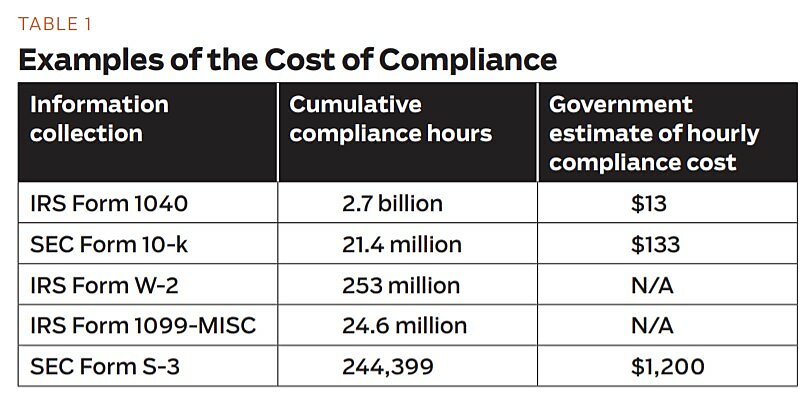

Calculating the monetized cost for those hours of paperwork is a bit dicey, however. OIRA estimates that the associated cost of compliance for those 10.3 billion hours comes to $77.2 billion, which means that the government believes an individual’s time is worth $7.45 per hour. That is less than the minimum wage in Washington, D.C.

This raises the question of how exactly the federal government quantifies its paperwork burden on businesses. The answer usually depends on the particular agency involved and whether it wants to monetize paperwork costs or conveniently ignore them. Typically, agencies would rather skip the exercise altogether if possible or, failing that, find the lowest wage rate it can justify and use that to low-ball the true compliance cost.

One place an agency could find data on the cost of a compliance hour would be in the Bureau of Labor Statistics’ (BLS) Occupational Employment Statistics. It specifies a wage rate for a general compliance officer (who can “examine, evaluate, and investigate eligibility for or conformity with laws and regulations”) of $30.66 an hour. If this rate were applied to the nation’s cumulative compliance burden, the associated costs of doing the required paperwork necessary to comply with federal regulations would tally $317.4 billion, more than four times the cost that OIRA lists. However, a cursory examination reveals few agencies bother to use this $30.66 figure.

Dodd-Frank burdens vary | The most egregious contributor to the unrelenting rise in the number of hours spent complying with federal paperwork has been the mountain of new regulations resulting from the 2010 Dodd-Frank legislation. While various financial regulatory agencies are far from done generating all the regulations that the law requires, the total time needed to comply with the regulations already issued eclipses 50 million hours, much of which the government has not bothered to monetize.

One of these agencies, the Consumer Financial Protection Bureau, is guilty of one of the more egregious failures to estimate a regulatory compliance cost: it omitted important data from its remittance transfer rule (Regulation E). This rule imposes a compliance burden that the agency estimates will take private businesses more than 7.6 million hours to satisfy. If we value each hour spent complying with paperwork at the hourly wage of a compliance officer, the total compliance cost for this one regulation alone is roughly $225 million. However, if we use the median hourly wage rate for Dodd-Frank compliance (roughly $100), compliance costs climb to $760 million.

Given the breadth of Dodd-Frank regulations and the plethora of regulated entities issuing them, it is no real surprise that there is no set hourly wage used for estimating the law’s compliance costs. For instance, the Federal Reserve has listed an hourly rate as low as $42.95 for some of its regulations, while the Commodity Futures Trading Commission routinely uses $100 per hour. The Securities and Exchange Commission once estimated a compliance hour to be worth as much as $400, while acknowledging that regulating large financial institutions likely means that the employees in charge of ensuring compliance may be paid somewhat over the mean hourly wage rate. Most of the other agencies continue to low-ball hourly wages whenever possible.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.