In his 2022 Labor Day address, President Joe Biden said that the United States “has the highest drug prices in the world, and there is no reason for it.” Similar statements were made by former president Donald Trump. These statements are undoubtedly true when applied to patented, “branded” drugs. But does that mean those prices are unfair to Americans?

To answer that, we employ here the economic theory of public goods. By interpreting new scientific information, embodied in innovative pharmaceuticals, as a global public good, we derive important implications for international prices and quantities. Other economists have considered pharmaceutical prices through this lens, including the US Council of Economic Advisers, William Comanor in a 2021 Regulation article, and economists (and frequent Regulation contributors) Charles L. Hooper and David R. Henderson in a 2022 Wall Street Journal op-ed. We develop these ideas further and implement them empirically.

Promoting Innovation

Current drug research and development costs are estimated at more than $3 billion per new pharmaceutical agent. In addition, extensive product promotion is required to assure the rapid, widespread use of new pharmaceuticals. The information, created by pharmaceutical or biotech company research and development, is effectively embodied in the resulting products.

Past R&D costs are already paid, so they do not influence the prices charged for existing pharmaceuticals. Instead, R&D efforts depend on the anticipated profits to be gained from future new pharmaceuticals, taking account of the long-run sunk cost of inventing, testing, obtaining approval for, and promoting new pharmaceuticals. As discussed in Comanor 2021 and Dubois et al. 2015, there is substantial empirical support for connections among pharmaceutical prices, R&D outlays, and the resulting innovation. We consider revenues exceeding production and distribution costs as incentivizing the investment in pharmaceutical R&D and not as excess monopoly returns. Therefore, these revenues are appropriately designated as “quasi-rents” that incentivize sunk costs rather than monopoly profits.

Global Public Good

Information is a classic example of a public good. The use of new information by one entity does not limit its use by others. Indeed, this presence of “non-rivalry” is the essential feature of all public goods. Furthermore, information is both readily disseminated and difficult to control, so often information is also “non-excludable” to nonpayers. Patents on new pharmaceuticals permit the information embodied in them to be excluded for the term of patent protection, but the information is, itself, still a public good. In other words, rival firms can access the patent-holder’s information but cannot exploit it commercially until the patent expires.

Were pharmaceuticals sold under a single legal and regulatory system, a single body could regulate patent exclusivity to incentivize the preferred supply of industry R&D, considering both the welfare benefits of new knowledge and the welfare loss due to monopoly pricing of the products while patented. These issues, however, are far more complicated when there are separate national markets.

Global public goods are approached through the economic theory of alliances, developed by Mancur Olson and Richard Zeckhauser in a classic 1966 article. In our analysis, we use the pharmaceutical quasi-rents received in each country to measure its national contribution to the global public, and then consider how national decision-making affects the global optimum and actual behavior.

One can achieve global optimality using the marginal benefit payment model (also called the Lindahl model, after its Swedish discoverer, Erik Lindahl) where each country contributes an amount toward the public good equal to its marginal benefit. That is, if the regime of marginal benefit payments could be imposed, the quantity of the public good would be globally optimal. Unfortunately, there is no higher authority to enforce marginal benefit payments. Each country’s commitment to serve its own population’s interests leads to underprovision of the global public good.

Olson and Zeckhauser derived two important features of alliances. The first is that countries acting independently have an incentive to provide suboptimal amounts of public goods, possibly even zero. The second feature is the tendency for the larger countries—those that place a higher absolute value on the public good—to bear a disproportionate share of the burden. This is known as the “exploitation hypothesis.”

New pharmaceuticals can lead to improved health status for all countries’ populations. This suggests the possibility of an implicit, if not explicit, alliance among nations to foster the development of beneficial new pharmaceuticals. In their pioneering study of global public goods and alliances, Olson and Zeckhauser emphasized that it is not a signed agreement that signifies an alliance but rather the economic reality that all members benefit from communal efforts.

In our analysis, we consider that countries behave as private actors and are motivated entirely by national self-interest. Each country pursues a pricing strategy that maximizes its own social welfare without considering any benefits that accrue elsewhere. It doesn’t take account of the external benefits it bestows on other countries. As a result, countries provide less than the optimal amount of the global public good.

Nash Non-Cooperative Model

The Nash non-cooperative model (for which John Nash shared the 1994 Nobel Economics Prize) provides a framework for analyzing this situation. Consider a world of several countries, with each one potentially purchasing pharmaceuticals for its citizens at prices above the marginal cost of production and distribution. In these circumstances, each country potentially contributes to the quasi-rents that motivate industry R&D. But will countries choose to do so or do so optimally?

Each country is viewed as having preferences for its own consumption of a composite private good (all non-pharmaceutical consumption) and also its consumption of the global aggregate of pharmaceuticals that results from the global pharmaceutical R&D. Each country makes the conventional Nash assumption that its contribution will not influence the contributions of any other country. In other words, a country’s contribution represents its “best response” to the contributions of all other countries.

Therefore, we can define a Nash equilibrium as the choices of the public good and the composite private good chosen by each country. In a Nash equilibrium, there are several possibilities:

- All countries contribute toward the global public good.

- One country contributes to the global public good while no other country contributes anything. (This is the most extreme version of free riding.)

- Some countries contribute while others do not.

The Nash theory predicts an undersupply of the global public good of R&D because each country ignores the benefits to other countries.

Country Contributions to the

Global Public Good

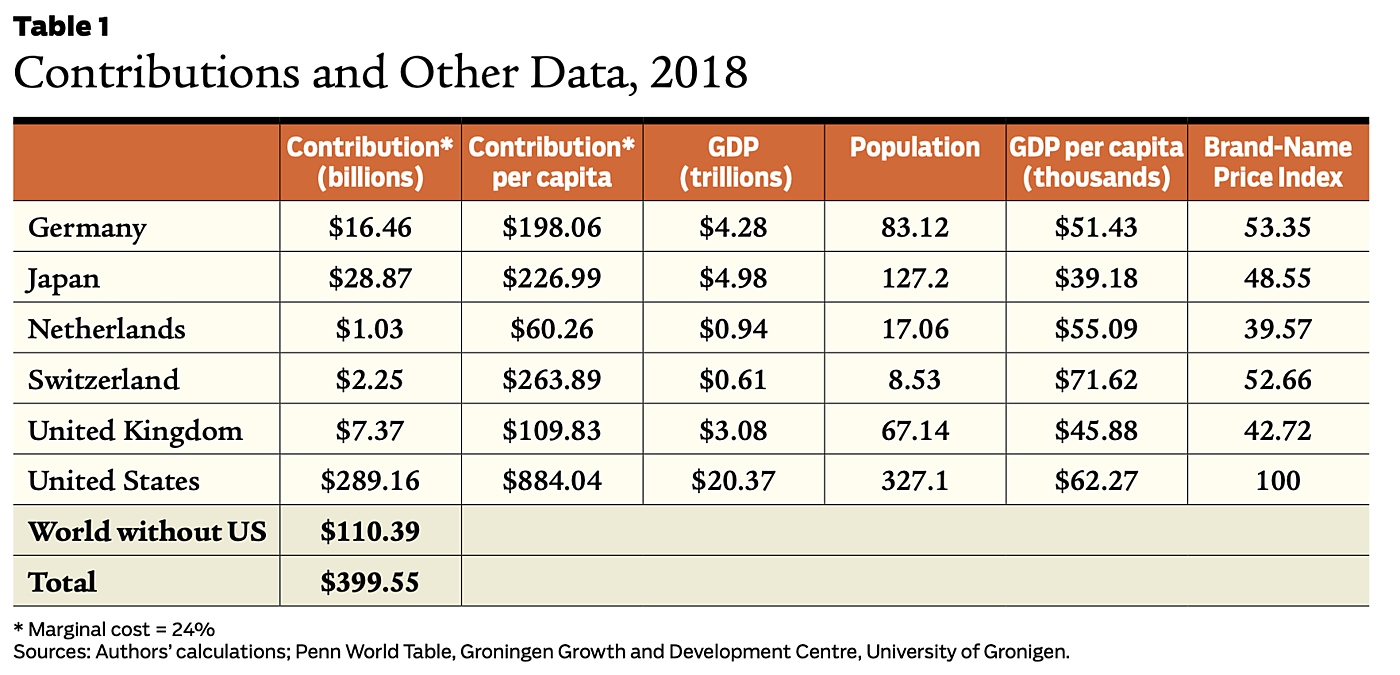

We calculate the actual country contributions to the global public good of pharmaceutical R&D using data on the 2018 price indexes and sales of new branded pharmaceuticals based on Mulcahy et al. 2021 that covers member countries of the Organisation for Economic Co-operation and Development (OECD). To this we add an estimate of the marginal cost of production and distribution, (as 24 percent of US prices) based on the economic literature. For details and calculations with a lower estimate of marginal costs (14.2 percent of US prices), see Frech et al. 2023. These price indices and calculations refer to brand-name originator pharmaceuticals—new patented pharmaceuticals.

We calculate each country’s price index as a percentage of the US price index. For example, the price index for the United Kingdom is calculated as 0.43, which indicates the UK price index is 43 percent of the US index. Coincidentally, 43 percent is also the value for the total of the rest of the world’s (ROW) countries. US prices and quantities are higher, so the US market makes the largest contribution to the pharmaceutical R&D global public good.

A country’s contribution to the global public good is calculated as the proportion of a country’s sales revenues that exceeds marginal costs multiplied by total sales. For example, for the UK we find a contribution of $7.37 billion. For the United States we find $289.16 billion, as shown in Table 1 The UK’s contribution is about 2.6 percent of the US total contribution. On a per capita basis, it is about 13 percent of the US contribution. Thus, the United States is the major source of incentives for worldwide pharmaceutical innovation, but not the only source.

Table 1 shows our estimates of contributions toward the global public good of pharmaceutical R&D for the United States, five other OECD countries (out of 33), and the totals for the rest of the world. The US contribution is $289.16 billion. The ROW contribution is $110.39 billion. So, the US contribution represents about 73 percent of the total. These figures are broadly consistent with prior estimates. Furthermore, analyzing a different global public good, government and private support of basic medical research, Kyle et al. 2017 find a similar proportion.

Given this pattern, we see that some other countries make a smaller, but still substantial, contribution to the global public good of pharmaceutical innovation. The ROW countries provide $110.39 billion per year, about 27 percent of total support for the R&D global public good. The average ROW country pays prices about 80 percent higher than marginal cost. Thus, many ROW countries do not negotiate the lowest possible prices. Apparently, bilateral bargaining and perhaps a degree of altruism are at work. See Frech et al. 2023 for more on this topic.

Contributions and Size of Economy

Further exploring the data, we estimate regression models explaining differences in national contributions among the countries. Our primary explanatory variable is the size of the economy as measured by its national gross domestic product. A country’s economic size determines the total value of the public good consumed by its citizenry because larger populations imply more people to benefit from a new pharmaceutical and because higher GDP per capita is associated with higher monetary values of improved health. Indeed, the demand for health itself has generally been found to approximately scale up with income.

Size, measured by GDP, explains much of the contribution to the global public good of pharmaceutical R&D. The regression explains 83 percent of the variation in contributions across countries and is highly statistically significant. The size effect is large, with an elasticity of 1.29. This means that a country with five times larger GDP is predicted to contribute 645 percent more to the global public good, far more than proportionate to the size difference. Many of the size differences among countries are even larger than this. For example, by this measure, the United States is 1,119 percent larger than Canada.

This result provides support for the exploitation hypothesis, the tendency for the “small” to exploit the “large.” National contributions to the global public good increase more than proportionately with increases in a country’s GDP; larger countries make disproportionate contributions. (If the effect of size were not disproportionate, the estimated coefficient would be much lower at 1.0.) So, the empirical result supports the Olson and Zeckhauser “exploitation” hypothesis. The results are not driven by the United States. Eliminating its influence, the result still showed a large, disproportionate effect of size, with only a slight change in the coefficient, going from 1.29 to 1.21. Other sensitivity tests, described in Frech et al. 2023, show the findings are robust.

Discussion and Conclusions

We view pharmaceutical revenue above marginal production and distribution costs through a lens that emphasizes countries’ support of the global public good of pharmaceutical R&D. These revenues are considered as “quasi-rents” rather than monopoly profits in that they both incentivize and guide essential sunk costs. Indeed, we consider this manner of incentivizing such costly efforts as the only practical way to accomplish that result.

There is worldwide interest in supporting the development of new therapeutically advanced medications, and this commonality of interest provides the foundation for the global public good discussed here. While the United States and some other large countries continue to support more than proportionately the burden of funding this public good, that fact does not mean it is sufficiently supplied. Indeed, there are economic factors that suggest it is undersupplied.

In Frech et al. 2022, we found that average launch prices of US branded pharmaceuticals lie well below $40,000 per Quality Adjusted Life Year (QALY) gained. But studies of consumer and labor decisions estimate that the US public’s revealed “willingness to pay” for an additional QALY well exceed $200,000. This difference of $160,000 or more per QALY suggests that even the United States is, on average, underpaying in support of global R&D, even during the life of the patent. After the end of patent protection, entry by generic pharmaceutical manufacturers typically drives prices far lower. This makes sense as a Nash equilibrium, as mentioned above. Even the largest country takes little account of external benefits. So, the United States would be a conservative model for the correct contribution. If the US contribution is too low, the ROW countries’ even lower contribution exacerbates the problem. This conclusion does not preclude the possibility that some branded pharmaceuticals are overpriced in the United States, but rather suggests that, on average, even the US contribution may be too low.

While the US contribution reflects its GDP and its legal and economic institutions, other ROW countries contribute much less even after accounting for their population and GDP. As a result, the public good of pharmaceutical innovation is further undersupplied. In principle, all countries would gain from an agreement to raise prices to provide further support for the global public good. This is especially true for other high-income countries.

US drug prices are paid for the most part collectively, through taxation or insurance premiums. There is economic inefficiency, extra financial risk, and regressive distributional effects associated with high prices paid by low-income uninsured or underinsured consumers. For such consumers, other policy measures, such as enhanced Medicaid, would make sense. However, the usefulness of such measures is no reason to ignore the worldwide societal benefits gained from pharmaceutical innovation.

Our findings indicate prospective gains from international cooperation—from formal or informal international agreements among high-income ROW countries. If other wealthy countries agreed to contribute more to the global public good of pharmaceutical innovation, they and the world would benefit. There are clear precedents for countries to agree on actions that are good for the world, but not in their narrow national self-interest. Examples include multilateral trade agreements such as the European Union and the World Trade Organization and environmental agreements such as the Montreal Protocol that phased out ozone-depleting refrigerants.

Readings

- Chen, Angela, William S. Comanor, H.E. Frech III, and Mark V. Pauly, 2023, “The Global Distribution of New Drug R&D Cost: Does the Rest of the World Free Ride?” Health Management, Policy and Innovation 8(2), 2023.

- Comanor, William S., 2021, “Why (Some) U.S. Drug Prices Are So High,” Regulation 44(4): 18–23.

- Dubois, Pierre, Olivier de Mouzon, Fiona Scott-Morton, and Paul Seabright, 2015, “Market Size and Pharmaceutical Innovation,” RAND Journal of Economics 46(4): 844–871.

- Frech, H.E. III, Mark V. Pauly, William S. Comanor, and Joseph R. Martinez, 2022, “Costs and Benefits of Branded Drugs: Insights from Cost-Effectiveness Research,” Journal of Benefit–Cost Analysis 13(2): 166–181.

- Frech, H.E. III, Mark V. Pauly, William S. Comanor, and Joseph R. Martinez, 2023, “Pharmaceutical Pricing and R&D as a Global Public Good,” National Bureau of Economic Research Working Paper no. 31272, May.

- Garber, Alan M., Charles I. Jones, and Paul Romer, 2006, “Insurance and Incentives for Medical Innovation,” Forum for Health Economics & Policy, 9(2).

- Hooper, Charles L., and David R. Henderson, 2022, “Expensive Prescription Drugs Are a Bargain,” Wall Street Journal, November 14.

- Kyle, Margaret K., David B. Ridley, and Su Zhang, 2017, “Strategic Interaction among Governments in the Provision of a Global Public Good,” Journal of Public Economics 156: 185–199.

- Mulcahy, Andrew W., Christopher Whaley, Mahlet G. Tebeka, et al., 2021, “International Prescription Drug Price Comparisons: Current Empirical Estimates and Comparisons with Previous. Studies,” RAND Research Report.

- Olson, Mancur, and Richard Zeckhauser, 1966, “An Economic Theory of Alliances,” Review of Economics and Statistics 48(3): 266–279.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.