Concerns about climate change have led many to advocate for future reliance on nuclear power, a constant, low-carbon energy source. Historically, nuclear’s high upfront capital costs have precluded its being cost-competitive with coal and natural gas generators. Turbines fueled by coal and natural gas, of course, emit greenhouse gases and other pollutants, prompting calls that they and other emission sources be assessed a Pigouvian tax equal to their damage to the environment. That raises the question, would nuclear power be cost competitive if such a tax were adopted?

At the nuclear construction cost levels most recently experienced in the United States and Western Europe, the answer is no. Over the past two decades, projects in the United States, France, and Finland have suffered substantial construction delays and cost overruns, resulting in astronomical upfront costs. The reasons for these delays and cost increases are numerous. The projects have had problems with labor force management, supply chains, and quality control caused by a mix of the high level of nuclear regulation, design choices, and mismanagement.

Calculating the lifetime costs of a new nuclear power plant built at these construction costs finds that nuclear could be cost-competitive with coal power if there is a reasonable-sized carbon tax. The most efficient natural gas plants are a different story, requiring a carbon tax of over $200 per metric ton of carbon dioxide, an amount well outside the tax levels recommended by the U.S. government and academic experts. This suggests that nuclear power’s current construction costs are not offset by the value of the avoided carbon emissions.

If the current high cost is a requirement of building an acceptably safe nuclear generator, then it is unlikely that carbon taxes within widely accepted ranges could induce private investors to invest in nuclear power rather than natural gas generation. However, many nuclear advocates argue that these high costs are primarily the result of overly burdensome regulations or poor design and construction choices. If this is the case, it is possible that nuclear costs could be reduced.

Comparing the costs of nuclear to fossil fuels at construction costs substantially lower than recent U.S. nuclear projects shows that nuclear power could be a viable option for private investors, but only if other conditions are just right. Namely, if nuclear had construction costs 65% lower than the Vogtle Electric Generating Plant, now under construction near Waynesboro, Georgia, and if future natural gas prices are high, nuclear would be cost-competitive with natural gas generation if there is an average carbon tax of roughly $70 per metric ton over the next 30 years. This is in line with carbon tax recommendations from the U.S. government and academic experts. At lower natural gas prices, however, the carbon tax would need to be higher than currently recommended carbon taxes.

Thus, if the climate damages of carbon emissions are included in electricity prices, nuclear’s appeal to private investors still relies on substantial reductions in construction costs and a high natural gas price. Though the long-term path of natural gas prices is unclear, the history of nuclear plant construction in the United States does not support hopes that nuclear’s high cost will be reduced enough to make nuclear energy competitive with gas.

Nuclear Plant Costs

Can nuclear power’s high construction costs be reduced? Nuclear plants are massive, complex structures built to precise standards. They require some of the largest cranes in the world to assemble and they incorporate enormous amounts of piping, valves, cables, concrete, and steel. However, the scale and difficulties of reactor construction are not entirely exceptional. Other projects such as chemical plants and coal power plants are also large and complex. And nuclear construction in Asia has had a more positive track record.

The costs of building nuclear reactors are typically quantified as “overnight construction costs” (OCC), estimated as dollars per unit of electrical capacity of the reactor. OCC only considers the engineering, procurement, and construction costs and other owner’s costs, but excludes the financing costs incurred during the duration of the project. In other words, OCC estimates the cost of construction as if the reactor were built overnight. OCC’s benefit is that it allows for an easier direct comparison between construction projects that take different amounts of time to complete (and between projects with different financial profiles).

Historically, the United States and Western Europe have experienced increasing OCC trends for nuclear. In the United States, early demonstration reactors built in the 1950s and ’60s saw costs decrease over that period. But during the era when the majority of U.S. reactors started construction, between 1967 and 1978, construction costs increased astronomically. The 48 reactors that began construction during this period and were finished before the Three Mile Island nuclear accident in 1979 saw construction costs increase by 190% over the era. An additional 51 reactors that were completed after Three Mile Island had an increasing OCC trend of 50%–200%.

Experiences in France, Canada, and West Germany are similar, though the scale of cost escalation is smaller. Early reactors started in the 1950s to early 1970s saw construction cost declines over time. But all countries had a later era, from the 1970s into the 1980s, when the bulk of their nuclear fleets was built, with large cost increases. The general story in the West is that nuclear construction costs increased as nuclear capacity increased. This result is the opposite of what would be anticipated for most technologies. As capacity is increased and more construction experience is gained, construction costs are expected to decline as firms learn how to build more efficiently. In the case of nuclear, it seems that some combination of managerial factors and increasing regulations offset any learning done by individual utilities and construction firms.

Are regulations to blame? / Disentangling the effect of regulations from management problems and design decisions is difficult. It is apparent that during the 1970s and ’80s, the expanding nuclear industry experienced a large growth in safety regulation, requiring increases in both the materials and labor needed to build power plants. In the worst cases, regulatory instability compelled extensive reworking mid-construction to meet new, higher standards, creating especially large delays and cost overruns. But whether the increased number and stringency of regulations is cost-effective is unknown.

Some of the regulations are based on actual experience, implying that there is at least some justification for the standards. For example, a 1975 fire at Browns Ferry Nuclear Plant in Athens, Alabama, burned a cable spreading room that contained cables for several redundant safety systems. The incident led the Nuclear Regulatory Commission (NRC) to create new fire protection standards. Ever since, the nuclear industry has argued that the standards are excessive and costly.

Other regulations are based on hypothetical accidents with exceedingly low probability but with potentially devastating damages. For example, in 2009 the NRC imposed a new rule requiring that the reactor containment structure of new designs be able to withstand the impact of a large commercial aircraft. The probability of a nuclear plant needing to survive an airliner crash is very small, though there are potentially large damages if such a strike were to happen and the integrity of the reactor would not be maintained. The containment structure of a nuclear reactor is a significant part of the overall cost, and building to such a high standard adds a considerable amount to construction costs.

In general, more expensive reactors have been safer reactors according to some measures of reactor reliability and accident risk. But it is not known whether the expensive safety measures are worth their costs, especially considering that a major nuclear accident is both incredibly unlikely but also potentially very damaging.

Is management to blame? / While nuclear regulations have increased, nuclear construction has also faced problems with managing labor forces. Studies find that nuclear construction productivity has declined more rapidly than general U.S. construction productivity, largely because of construction management problems. Craft laborers on nuclear projects were unproductive for 75% of working hours because of issues like lack of tool availability and overcrowded workspaces.

The most recent nuclear projects in the United States and Western Europe have been uniformly defined by cost overruns and construction delays. That further affirms that the nuclear cost problem will be hard to fix. In the United States in 2013, construction began on four new Westinghouse-designed reactors, two each at Vogtle and at the V.C. Summer Nuclear Generating Station in Jenkinsville, South Carolina. After extensive cost increases and delays, Westinghouse declared bankruptcy in 2017, leading to the cancellation of the V.C. Summer project. The Vogtle project has continued, though the commercial operation date keeps getting pushed back and, at more than $11,000 per kilowatt of electrical capacity, it now costs more than double original projections. Similarly, new reactors being built at Olkiluoto, Finland, and Flamanville, France, have taken more than three times as long to complete and, at more than $8,000 per kW, cost more than three times as much as expected.

The specific reasons for the delays and cost overruns vary by project, but the common themes have been issues with construction management, problems with manufacturing plant components and supply chains, and a low level of design completion at the outset of construction. At Vogtle, construction schedule and cost projections overstated the ability of new, unproven construction techniques and innovative reactor design features to address the problem of high construction costs. At the same time, the projections underestimated the difficulty of achieving the high quality control standards of nuclear construction.

Asia’s experience / These recent projects clearly show that Western utilities, construction firms, and vendors have yet to fix nuclear’s capital cost problem. Unlike the West, however, evidence from Asia suggests that countries like China, South Korea, and Japan have managed to at least contain nuclear capital costs, if not reduce them over time. Before the 2011 Fukushima Daiichi nuclear accident stopped nuclear construction, Japan had stable costs. Available evidence on construction costs from China and South Korea suggest that construction costs there have been around $2,800 per kW, substantially lower than the costs seen in the West (though questions of data transparency mean these estimates should be interpreted cautiously). A major question for future nuclear construction in the West is what Asia does differently and whether its practices can be implemented elsewhere.

Nuclear advocates often point to the fact that much of the nuclear construction in Asia has been part of top-down, government-led efforts to expand reliance on nuclear energy. The result has been more reactor standardization and, thus, a greater ability to learn and implement cost-reduction practices. Evidence on construction in France and the United States does indicate that design standardization helps keep costs down. This is further supported by anecdotal evidence from South Korea, where nuclear designs have remained largely standardized and evolved only incrementally.

However, nuclear power also has favorable economic conditions in Asia that would be hard to replicate in the United States. Labor costs in South Korea and China are substantially lower than in the United States. A large portion of nuclear power construction costs is the wage bill for both laborers and engineers. Labor costs in the West can be reduced by shortening construction times and reducing the amount of project management and engineering services needed during construction. But, to some extent, the construction costs of nuclear in the West will always be high relative to Asia if there continue to be labor cost differences.

It should be noted that Asia’s lower labor costs also reduce the OCC of other types of generation. In South Korea and China, the overnight costs of nuclear reactors are roughly 2–3 times higher than a coal power plant and 3–4 times higher than a natural gas plant. So, even if these countries have managed to cut construction costs down to their bare minimum, nuclear plants still cost significantly more to build than fossil fuel generators.

Nuclear plants in Asia also benefit from the fact that their competitors, especially natural gas generators, have higher relative costs than in the United States. Because of the fragmentation of global natural gas markets, natural gas prices are very low in the United States, higher in Europe, and significantly higher in Asia. Therefore, the cost–benefit analysis in Asia may favor nuclear because of both lower construction costs and higher relative costs of alternatives.

Nuclear construction in Asia has faltered since the 2011 Fukushima Daiichi nuclear accident. Japan has essentially stopped construction of new nuclear plants and only some of its existing plants have resumed operation. South Korea canceled plans for new construction, though its recently elected president has reversed the phase-out. And though construction in China has continued, the country did not meet nuclear targets set for 2020.

Despite these uncertainties about its future, the story of nuclear power in Asia over the past several decades has been one of general success. And it has spread beyond the Pacific Rim: a South Korean contractor is currently building four reactors in Barakah, United Arab Emirates, that could potentially have project costs of around $4,000 per kW. This is higher than the costs in South Korea and China, but much less than costs in the West, suggesting that some of the construction lessons in Asia can be transplanted elsewhere. These lessons are, of course, still subject to differences in labor rates and regulation in the United States and Europe, and the competitiveness of nuclear power in the West still depends on the relative costs of alternatives.

Nuclear Plant Costs vs. Fossil Fuel Plants

Whether nuclear power is a viable option for private investors depends on how its costs compare to alternatives. In the United States, nuclear plants operate as baseload generators, meaning they produce electricity nearly constantly at capacity to help meet the base demand on the electricity grid. In this function, nuclear’s primary competitors are coal power plants and natural gas combined cycle plants (NGCCs). The latter produce electricity both through a combustion turbine and by using waste heat to turn a steam turbine. This increases the electrical output per unit of fuel of NGCCs and allows them to operate as baseload generators.

The costs of nuclear, especially at the construction cost levels most recently seen in the West, are substantially higher than fossil fuel generators. However, it is possible that imposing a Pigouvian tax to account for climate damage from carbon emitted by burning fossil fuels could raise the cost of fossil fuel generation enough to equal nuclear costs.

Levelized costs / The primary tool used to compare the costs of different electricity generating technologies is the levelized cost of electricity (LCOE). It models the cash flows of a plant over its construction period and operational lifetime and determines the average price of electricity (in cents per kilowatt-hour of electricity generated) required for the plant to break even when accounting for investment costs, operational costs, and a market return to investors.

The LCOE allows for comparisons between different generating technologies with differing cost profiles. For example, nuclear has high initial investment costs but low operating costs, whereas natural gas generators are relatively cheap to build but have larger operating costs, especially if the price of gas is high. The LCOE makes it possible to compare the overall costs of technologies with different types of costs incurred at different points in time.

When assessing nuclear costs, the most important variable is the construction costs. To test the competitiveness of nuclear at various cost levels, our LCOE calculations use three levels of nuclear OCC. The high OCC is $9,000 per kW, which is around the average of the costs at Vogtle, Olkiluoto, and Flamanville; the middle OCC is $6,700 per kW, representing a scenario where U.S. nuclear costs can be contained and reduced by a substantial amount; and the low OCC is $4,000 per kW, reflecting an ideal, but unlikely, scenario where U.S. nuclear costs are brought in line with costs in Asia (assuming that some conditions, like different labor costs, are not possible to change).

For natural gas, the most important variable is the fuel price. Like nuclear OCC, we use a range of natural gas prices based on projections in the U.S. Energy Information Administration’s 2022 Annual Energy Outlook.

The LCOE calculations, and especially the estimates for nuclear, are highly sensitive to the choice of discount rate. The costs of the plant over time are converted to a present value using a discount rate representing the time value of money (i.e., a dollar today is worth more than a dollar tomorrow). We use a discount rate of 7%, representing the opportunity cost of capital—the expected rate of return on the capital invested in the power plant if, instead, it was invested in other U.S. public investments.

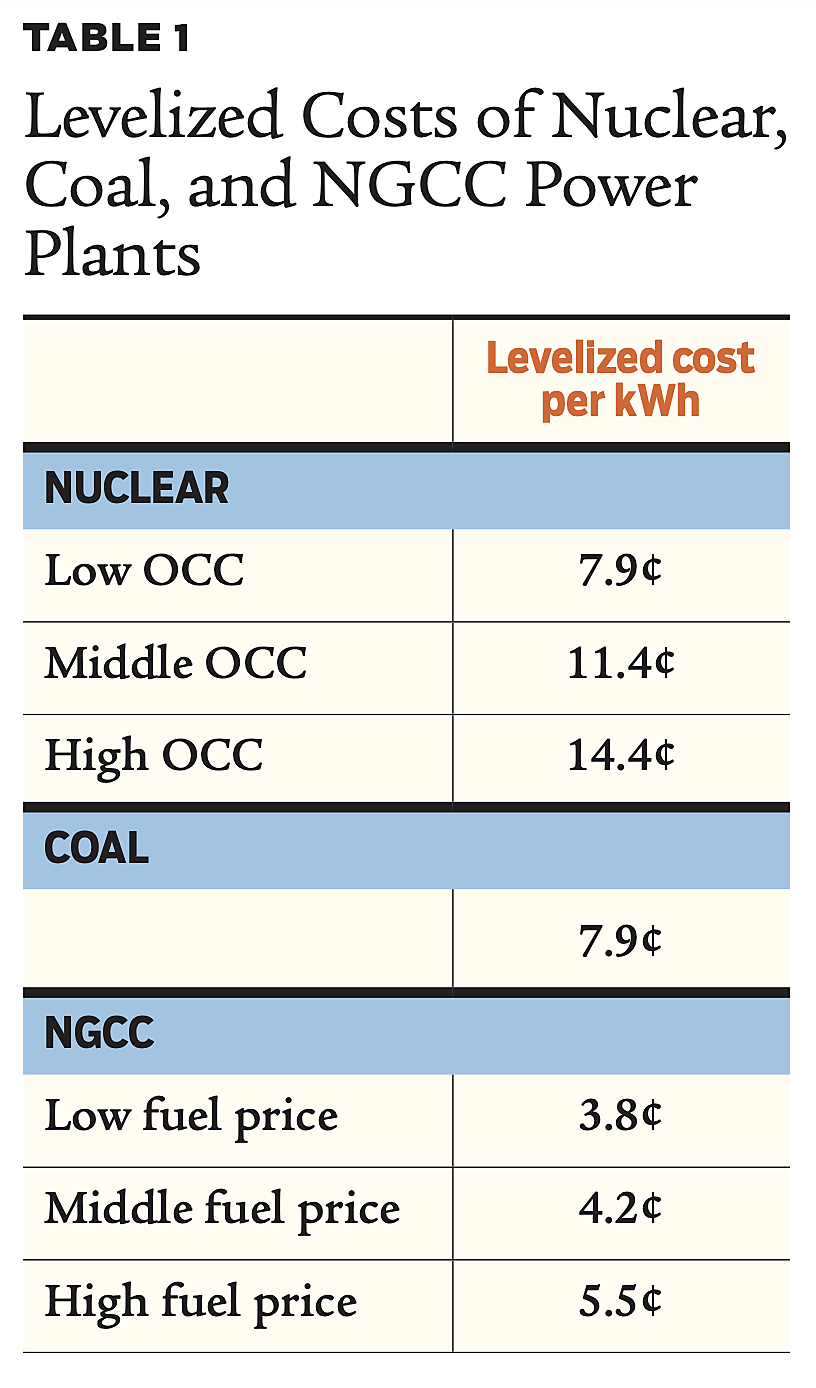

Table 1 reports the estimated levelized costs of the different generating technologies. At the middle and high OCCs, a new nuclear plant is substantially more expensive than coal or natural gas. At the low OCC, however, the nuclear levelized cost equals coal, but is still more than natural gas regardless of projected natural gas price.

Carbon taxes / What level of carbon tax would make the levelized costs of nuclear power equivalent to those of natural gas and coal? Or, put alternatively, at what estimated social cost of carbon would the avoided carbon emissions of nuclear power be worth its high costs?

Carbon emissions create costs that are not borne by the emitter. A Pigouvian tax incentivizes producers and consumers to take such costs into account. The carbon tax should be set equal to the social cost of carbon, but in practice that cost is difficult to determine.

The federal Interagency Working Group on the Social Cost of Greenhouse Gases (IWG) estimates that, depending on assumptions made, the social cost of carbon ranges from $14 to $76 (in 2020 dollars) per metric ton of carbon dioxide. The projected average over the next 30 years is $22 to $96 per metric ton, and the average growth rate for these estimates is roughly 2% per year. Similarly, a 2020 survey found that 400 experts across 40 countries had a median recommendation of $40 per metric ton in 2020 and $100 in 2050. Thus, according to the survey, the mean carbon tax over the 30 years should be around $70 per metric ton. In general, according to the U.S. government and climate experts, the range of appropriate average carbon taxes over the next 30 years is roughly $20–$100 ($15–$75 in 2020) per metric ton.

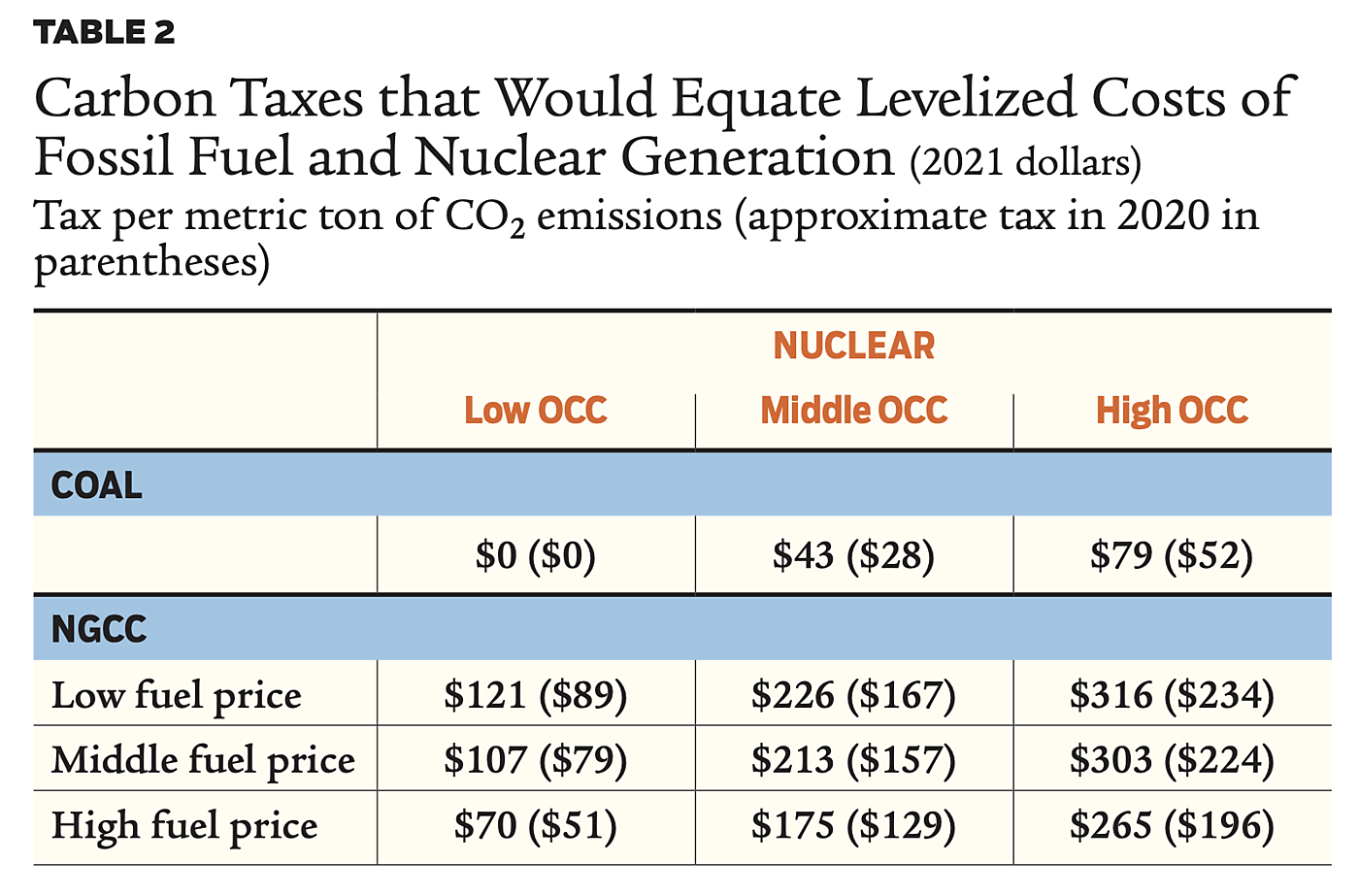

To determine the carbon tax sufficient for nuclear levelized costs to be attractive to a private investor, the LCOEs of nuclear and fossil fuel technologies are compared and the tax necessary to make up the difference based on the carbon dioxide emissions of coal and natural gas is calculated. Table 2 contains the average tax per metric ton of carbon emitted that would equate nuclear, coal, and natural gas generation levelized costs over the lifetime of the fossil fuel plant (30 years for natural gas and 40 years for coal). The values in parentheses reflect the approximate carbon tax in 2020 if the real annual escalation rate of the tax is roughly the same as the IWG’s carbon tax estimates of 2% per year.

The levelized cost of nuclear power at a low OCC is equal to the LCOE of coal, so the carbon tax required to make the levelized costs equal is zero. At middle and high nuclear OCCs, the carbon tax sufficient to make it competitive with coal is $43 (approximately $28 in 2020) and $79 ($52) per metric ton. These estimates are in range with widely accepted estimates of the social cost of carbon, implying that, even at the higher construction costs of recent nuclear projects in the West, it is likely worth building nuclear generation to avoid the carbon emitted by a new coal power plant.

The carbon tax that equates nuclear power’s levelized cost to natural gas ranges from $70 to $316 ($51–$234) per metric ton of CO2>, depending on the natural gas price and nuclear OCC. In the best-case scenario for nuclear—when it has a low OCC and the average annual natural gas price is high—the carbon tax is $70 ($51) per metric ton, which is in the range of carbon taxes recommended by the IWG and the survey of experts. At the lower natural gas prices, the estimated tax required is slightly outside the recommended range: more than $107 ($79) per metric ton.

As the nuclear OCC increases, the estimated tax required for it to compete with natural gas quickly grows. At the middle OCC, the carbon tax would need to be at least $175 ($129) per metric ton; at the high OCC it would need to be larger than $265 ($196) per metric ton. This indicates that, unless nuclear construction costs can be significantly reduced, the high capital costs of nuclear power are not worth the avoided emissions of natural gas.

Overall, these results suggest that private investors would consider nuclear power to be a viable generation source under a specific set of circumstances: namely, if nuclear has a low OCC and the average natural gas price is high or the carbon tax is slightly higher than widely accepted estimates. With history as a guide, nuclear overnight costs are unlikely to reach the low OCC level of $4,000 per kW. However, even if they do, nuclear’s appeal to private investors depends on future natural gas prices.

Additional costs and benefits / The LCOE calculations show that nuclear is not competitive with natural gas if we consider only greenhouse gas emissions. But there are additional considerations that the LCOE does not account for that could provide comparative benefits or costs to nuclear and fossil fuel generators. Among these considerations are conventional air pollution emissions, nuclear waste, and nuclear liability. All three factors have substantial uncertainties, but reviewing the available evidence can help provide a sense of the magnitude of their costs and whether they are likely to favor or undermine nuclear.

Pollution and waste disposal / Conventional air pollution, especially particulate matter, emitted by the combustion of fossil fuels may have substantial external damages separate from climate change. The science on the health effects of air pollution is not settled, and estimates of the marginal damages of conventional pollution face uncertainties about the value of a statistical life and different marginal effects by year and location of the pollution source.

However, putting those questions aside, models of air pollution damages and estimated power plant emissions can be used to approximate the relative costs of air pollution for coal and natural gas. Coal, which is generally much dirtier than natural gas, could have damages as high as 6¢ cents per kWh. Including those damages in the LCOE would increase the cost of coal by 75% at the levelized cost of 7.9¢ cents per kWh.

Natural gas emits much less air pollution. It could have damages of around 0.3¢ per kWh. Thus, including the external costs of conventional pollution would significantly increase the coal cost estimates but only marginally increase the natural gas estimates.

Exclusion of nuclear waste costs from the LCOE has a similarly small effect on the levelized costs of nuclear. Because of its radioactivity and the long time for which it remains radioactive, spent nuclear fuel incurs costs when it is removed from the reactor, stored, and eventually disposed of. The high energy content of nuclear fuel means very little is required to generate a large amount of electricity, so only a small amount of nuclear waste is produced. Including the costs of removal, storage, and disposal would likely increase the nuclear LCOE by at most a few percentage points.

In the United States, spent nuclear fuel is a statutory responsibility of the federal government. Until recently, nuclear operators were required to pay 0.1¢ per kWh to the Nuclear Waste Fund, which was intended to finance a permanent spent nuclear fuel repository at Yucca Mountain, Nevada. Local opposition stopped construction of the project, and the waste fee has been suspended. Meanwhile, most nuclear fuel is currently stored on site at nuclear power plants. Because the fuel is the responsibility of the federal government, it has been required to pay nuclear operators for the interim storage of the spent fuel. Hence, nuclear operators are currently being subsidized for their nuclear waste. If the nuclear waste fee of 0.1¢ cents per kWh were reinstated, it would increase the nuclear levelized costs by roughly 1% or less.

Risk / By ignoring the risk of nuclear accidents, the LCOE might significantly understate nuclear power’s cost. Both the probability and potential damages of a nuclear accident are difficult to estimate. Depending on assumptions made, the actual risk could be negligible or large enough to preclude private construction of nuclear power plants.

Currently, nuclear accident liabilities are capped under a two-layer system created by the Price–Anderson Act. The first layer is that nuclear power plants must be covered by the maximum amount of private insurance available ($450 million as of 2017). The average annual site premium (depending on number of reactors at a site) is only about $1.3 million. In the case of an accident exceeding $450 million in damages, a second layer of nuclear industry self-insurance would take effect. Each U.S. reactor would be required to cover a share of the excess damages up to a maximum of around $130 million per reactor. If an accident were to exceed both layers of insurance (total coverage of around $13.5 billion), additional payments would need to be approved by Congress and would likely be covered by the nuclear industry or the federal government. (See “The Problem with Price–Anderson,” Winter 2002–2003.)

It is difficult to determine a reactor’s liability without the cap. Within the nuclear industry, reactor safety is estimated using probabilistic safety assessments that rely on simulations and event trees to evaluate the potential for failure in different systems. These assessments are mainly used to identify problems with reactor designs, but they also can be used to estimate the overall probability of a nuclear accident. Assessments of the current reactors under construction estimate a probability of an accident of roughly 1:1 million per reactor-year.

This is substantially lower than the observed frequency of nuclear accidents. Nuclear accidents are very rare, but simply estimating the probability of an accident using the total number of nuclear accidents and the total number of reactor-years of worldwide operation finds a roughly 1:1,000 chance of a nuclear accident per reactor-year. This is 1,000 times more likely than estimated by the PSAs.

However, the observed frequency of nuclear accidents likely overstates the future probability of an accident. Reactor-years are not identical. Reactors differ both in design and location and have different levels of safety regulation and operator compliance. The causes of one accident may not apply to another. And lessons learned from nuclear accidents lead to changes in reactor designs and safety regulations. Thus, the likelihood of the same type of event causing additional accidents is lower as nuclear operators and engineers learn from experience. If learning exists, the observed frequency of nuclear accidents overstates future nuclear accident probabilities. But if future accidents are unrelated to past ones, the frequency will not improve.

Estimates for the potential damages of a nuclear accident are also uncertain. Nuclear accidents don’t always develop into a major nuclear disaster. Most have been core damage accidents (e.g., Three Mile Island), in which the reactor core is uncovered and heats to the point that there is oxidation and fuel damage. Little to no radioactive material is released, but these events can still cost billions of dollars for evacuations, decontamination and cleanup, and damage to the reactor itself. However, in some cases (Chernobyl, Ukraine, and Fukushima, Japan), a core damage accident results in a large radioactive material release outside the containment vessel, causing much larger damages. The core damage incident at Three Mile Island caused damages of around $3 billion; the large-release accidents at Chernobyl and Fukushima cost at least $200 billion (in 2021 dollars).

Using these estimated damages, the observed frequency of nuclear accidents suggests that nuclear liabilities would increase the levelized cost of nuclear power by about 0.3¢ cents per kWh. This would be a 4% increase of our low-end levelized nuclear cost of 7.9¢ per kWh.

Higher estimated damages would increase the nuclear liability. For example, independent estimates put the total damages of the Fukushima Daiichi accident at more than $320 billion and up to $760 billion. Using the worst-case probability (the observed frequency of accidents) would put the costs at 0.5¢–1¢ per kWh. However, the best-case probability estimates from safety assessments would mean even at the high $760 billion total cost, the levelized cost of nuclear would only increase by about 0.001¢ per kWh.

And while this analysis considers the estimated damages of past nuclear accidents, it is possible that future accidents at reactors in more densely populated areas could be much more expensive because of the higher costs of evacuation, decontamination, and compensation to victims. Considering this, some analyses find that there is a risk of extreme events that precludes private insurance for nuclear accidents. In other words, the possible accident severity is so high that private insurance for such an accident could not be financed. This would imply that, without a cap on nuclear liabilities and thus a government guarantee to cover accident costs beyond the cap, the liability costs of nuclear power would be too high for it to be feasible. It would also mean that the LCOE ignores a sizable negative externality of nuclear power that, if included, might substantially tip the analysis in favor of coal and natural gas.

Currently, the two layers of the Price–Anderson Act provide coverage of up to about $13.5 billion. This would cover an accident the size of Three Mile Island but would be well below the hundreds of billions in damages potentially caused by an accident on the scale of Chernobyl or Fukushima, or larger. In that case, the federal government would most likely cover the damages, meaning there is an additional cost to nuclear that the LCOE does not consider.

Conclusion

Though the levelized costs exclude factors like conventional air pollution, nuclear waste, and nuclear liability, when comparing nuclear to natural gas the additional consideration of these factors is likely to cancel each other out or further increase the costs of nuclear. Thus, the LCOE calculations show that at current cost levels, nuclear power is not economically justified by the value of its avoided emissions.

At the middle and high assumed overnight costs of $6,700 and $9,000 per kW, the social cost of carbon would need to be well above the levels recommended by the U.S. government and academic experts to make nuclear capital costs worthwhile. Even if overnight construction costs were only $4,000 per kW—a decrease of 55% compared to this study’s high OCC of $9,000 per kW and of nearly 65% compared to the costs at Vogtle—nuclear power’s levelized cost would equal natural gas only if the natural gas price is high or there is an excessive carbon tax.

We do not claim that a cost-effective reactor is impossible to build. But, to date, a remarkably diverse set of countries and contractors have failed to do so.

Readings

- “Ambiguity Aversion and the Expected Cost of Rare Energy Disasters: An Application to Nuclear Power Accidents,” by Romain Bizet and François Lévêque. Interdisciplinary Institute of Innovation Working Paper no. 16-CER-01, April 2016.

- “Construction Cost Overruns and Electricity Infrastructure: An Unavoidable Risk?” by Benjamin K. Sovacool, Daniel Nugent, and Alex Gilbert. Electricity Journal 27(4): 112–120 (May 2014).

- “Historical Construction Costs of Global Nuclear Power Reactors,” by Jessica R. Lovering, Arthur Yip, and Ted Nordhaus. Energy Policy 91: 371–382 (April 2016).

- “Prospects for Nuclear Power,” by Lucas W. Davis. Journal of Economic Perspectives 26(1): 49–66 (Winter 2012).

- The Economics and Uncertainties of Nuclear Power, by François Lévêque. Cambridge University Press, 2014.

- The Future of Nuclear Energy in a Carbon-Constrained World, by Jacopo Buongiorno, Michael Corradini, John Parsons, et al. MIT Press, 2018.

- “What History Can Teach Us about the Future Costs of U.S. Nuclear Power,” by Nathan E. Hultman, Jonathan G. Koomey, and Daniel M. Kammen. Environmental Science & Technology 41(7): 2088–2093 (April 1, 2007).

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.