Externality is a well-known concept in academic journals of economics and law as well as among government bureaucrats and consultants. In a nutshell, an externality is a spillover cost that is not compensated or a spillover benefit that is not paid for. The existence of externalities (once called “external effects”) is often used to justify government intervention to either diminish the spillover costs or increase the spillover benefits.

The nature of externality is not well understood by the general public and intelligent laymen. Even policymakers and non-specialized scholars are often confused as they think through the concept. As we will see, the theory behind externalities is shakier than is generally recognized.

An Idealized Economy

Standard (neoclassical) economic theory suggests that if externalities did not exist, free and perfectly competitive markets would be sufficient for economic efficiency and maximizing “social welfare.” Economic efficiency has a more precise definition in terms of “Pareto optimality,” after Italian economist Vilfredo Pareto (1848–1923). Pareto optimality means that the economic system is so efficient that there is no way to increase the utility of one person without reducing the utility of someone else. (Remember that in modern economics, “utility” refers to subjectively preferred situations.) In other terms, net social benefits, which are the “sum” of net private benefits, are maximized because every individual strives to maximize his own private benefits.

Externalities, it is argued, prevent the realization of this happy world. The concept of externality goes back to A.C. Pigou’s book The Economics of Welfare (1920 for the 4th edition). The British economist theorized that some economic activities carry a social cost greater than their private cost. Today, the main example would be pollution. Other activities, such as creating or maintaining private parks (an example used by Pigou) or other neighborhood amenities, have social benefits greater than their private benefits. We thus have, respectively, negative and positive externalities.

Externality is a major form of market failure. The market fails because some costs or benefits are not “internalized” (taken into account) by their originators, who do not pay those costs or are not compensated for those benefits. To solve this problem, Pigou proposed to tax negative externalities (a “Pigovian tax”), which would force a reduction in the originating activity, thereby reducing social cost. Inversely, he would subsidize activities generating positive externalities, thereby increasing their level and increasing social benefits.

In the New Palgrave Dictionary of Economics, Jean-Jacques Laffont gives a formal definition of what is today considered an externality: an indirect effect of a consumption activity or a production activity on third parties, where “indirect” means that the effect does “not work through the price system.” To repeat: an externality is a spillover, either good or bad for its receiver, that is not compensated or paid for, and thus not internalized by private actions.

Pollution, defined as the unwelcomed projection of physical objects on somebody else’s property, is a form of negative externality. For example, a papermill discharges chemicals into a river and thus reduces the production of services (swimming, fishing, canoeing) offered by a resort hotel downstream. For a positive externality, think of a nice house and lawn that (like Pigou’s private parks) make the neighborhood more enjoyable for neighbors. Note that the direct effect in this last case is from consumer to consumer.

Market Solutions to Externalities

The first problem with this standard theory of externalities is that they can often be solved through private bargaining and trade of the relevant property rights, which means the market can internalize them. This idea, which is commonly called the Coase Theorem, was demonstrated in a famous 1960 article by Ronald Coase, who later won a Nobel economics prize. (See “The Power of Exchange,” Winter 2013–2014.)

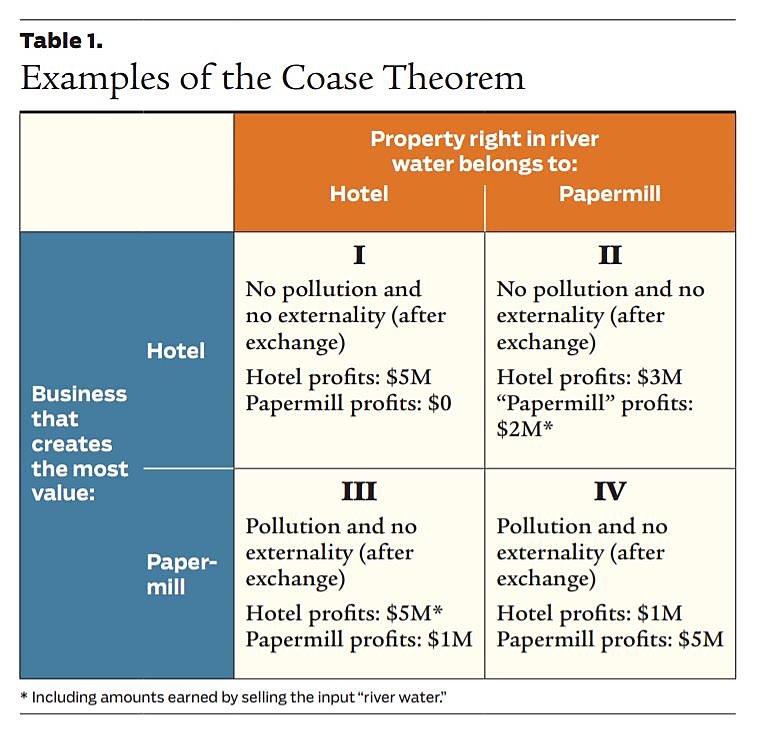

Take the above example of the papermill and the hotel. Assume that property rights on the river are well-defined: it is clear who has the right to the river water. Assume also that the emitter and the receiver of the pollution externality are in a position to exchange — that is, to make mutually beneficial deals with one another. We will distinguish four possible cases, as shown in Table 1.

In Quadrant I of Table 1, the hotel owns the property right to the river water. We further assume that the conditions of market demand and production imply that the hotel can create the most value, measured by its value added, which is equivalent to its profits. Assume that without pollution from the papermill, the hotel can sell its services for a profit of $5 million a year, while it would only earn $2 million with a polluted river. Assume that the papermill only creates a value of $1 million. It follows that the papermill will not be able to buy the right to pollute the hotel because it would have to pay the equivalent of at least $3 million a year. So, only the hotel will operate after it enjoins the papermill from polluting the river. (For now, it is assumed that there is no economical way for the papermill to clean its effluent.)

Quadrant II shifts the property right to the papermill, which becomes free to discharge effluents into its river. It is in the interests of the hotel to offer up to $3 million per year to incentivize the papermill to stop production. Suppose the price of this side-payment is negotiated at $2 million. The papermill owners accept because they make more profit by selling their input (the clean water) than they would earn producing paper. The hotel earns less profit, but still more than if it were polluted by the papermill. Despite its initial locus, the property right has been exchanged. It is still the producer who produces the most value — the hotel — that operates without any pollution or externality.

Note that the profit numbers in Table 1 include those from the sale of the input “river water” whenever this transaction occurs (in Quadrants II and III). In Quadrant II, the papermill does not operate; its owners make their profits by selling their right to pollute.

This sort of bargaining happens in the real world. Outside the externality framework proper, companies often sell themselves to a competitor because the latter, being more efficient, offers shareholders of the former more than they can make from their own company. Even more often, companies poach employees from their competitors because the poachers can use the talents more profitably and thus offer the employees an enticing remuneration. Companies occasionally sell brand names. Pieces of land are purchased by the most efficient users; so are licenses to use frequencies on the electromagnetic spectrum, an idea directly influenced by Coase. More generally, the price of any input — say steel — is bid up on the market (which is a continuous and invisible auction) until only the buyers who value it enough get it.

Within the externality–pollution framework, businesses pay waste disposal companies in exchange for accepting their waste. Last December in Detroit, Marathon Petroleum offered to purchase a patch of neighboring residential properties that could be adversely affected by the expansion of its refinery; nobody would be forced to sell, but the purchase would create a pollution buffer (DBusiness Magazine, December 18, 2020). Manufacturers generally buy pieces of land large enough to create some buffers around their factories. Oil and gas producers buy the right to use the land where they install their rigs. And so forth.

Conservation organizations often purchase pieces of land or easements from landowners because the former attach more value to the land than the latter. The “profit” here corresponds to how much the association’s members or benefactors are willing to pay for what is in their minds the positive externality of conservation. In 2003, for example, the Appalachian Mountain Club acquired land with private funds under its Maine Woods Initiative. (See “Producing Public Goods Privately,” Fall 2012.) Such environmental bargaining would likely expand if governments contented themselves with defining and enforcing private property rights instead of trying to control and monopolize what they define as environmental protection.

Back to our numerical examples in Table 1. Quadrant III reverts to a legal situation where the property right in the river water belongs to the hotel, but it is now the papermill that creates the most value. Assume the papermill can earn a profit of $5 million and the hotel can earn only $3 million without pollution or $1 million with pollution. The hotel is thus willing to accept anything over $2 million to sell the right to pollute to the papermill, while the latter would be ready to pay up to nearly $5 million. Suppose a deal is made at $4 million. As a result, both producers operate, with (net) profits of $1 million for the papermill and $5 million for the hotel (after the paid transfer of the property right).

In Quadrant IV, where the papermill is again assumed to produce the most valued output, it now owns the property right on the river water. The hotel cannot bribe the papermill into stopping its operations because it would have to pay more than $5 million for that. It is willing to pay up to $2 million, but the offer will be rejected by the papermill. Therefore, the papermill pollutes and produces a value of $5 million, while the hotel produces a value of $1 million.

The Coase Theorem / The interesting result, which is the essence of the Coase Theorem, is that when property rights are well defined, the allocation of resources remains the same in the sense that the same quantity of goods (hotel services and paper in our example) is produced and the value of production is maximized, whomever the initial property rights belong to. Given our illustrative numbers, total production is $5 million of hotel services when the hotel is the most profitable (row 1 of Table 1); and $6 million when the papermill is the most profitable (row 2), of which $5 million is of paper and $1 million of hotel services. Don’t forget that the figures represent the net or final profits, after purchase of the property right as the case may be.

Which party is the most profitable depends on market demand and the conditions of production (costs). Whichever producer can create the most value ends up owning the resource (the river water) irrespective of the initial assignment of property rights. Well-defined and tradable property rights may affect how profits are distributed, not the allocation of resources.

A related result is that well-defined and tradable property rights abolish externalities, even if the pollution remains. The externality has disappeared either because a property right owner has prevented pollution from happening on his property (Quadrants I and II); or the polluter created enough value to either compensate the polluted (Quadrant III) or to refuse a side-payment from the latter (Quadrant IV).

It is important to understand that a payment declined (by the hotel in Quadrant I and by the papermill in Quadrant IV) is an opportunity cost and is internalized as much as a payment made (by the hotel in Quadrant II and by the papermill in Quadrant III). That way, the social cost (the value of production and consumption lost) is automatically incorporated in private decisions.

Disregarding any moral consideration, an externality is reciprocal or symmetric in the sense that both the emitter and the receiver are partly responsible for it. If there were no pollution emitter, there would be no pollution externality; but if there were no receiver (that is, nobody within reach of the pollution), there would be no pollution externality either.

Going back to our example, the papermill could move downstream from the hotel; alternatively, the hotel could move upstream from the papermill. Other methods of prevention or mitigation are possible for both parties, including for the hotel to create an artificial lake with treated water away from the river. It is all a matter of cost. With bargaining between the emitter and the receiver of a negative externality, the least costly solution will be adopted and paid for by one or the other depending on existing property rights. All that without bans or injunctions from the government.

Inefficiency of a Pigovian tax / One intriguing corollary follows. If a Pigovian tax (say, per ton of chemicals discharged) equivalent to the damages caused to the hotel is imposed on the papermill, the former’s profits will increase, not because it gets the tax money, but because the papermill will reduce its discharge. A Pigovian tax is not meant to make the polluter compensate the polluted; instead, the tax makes the polluter internalize the externality up to the point where the private cost has been pushed up to the social cost of pollution. The government gives the resulting money to whomever it wants.

One problem with this Pigovian tax is that all the cost of reducing the reciprocal externality has been forced on the papermill. The hotel has not been similarly forced to internalize the “damage” it causes to the papermill by being there and causing a tax to be imposed on the other business. The non-taxed party has no incentive to try and minimize the part of the social cost of pollution that is due to its own behavior or presence. Even if the hotel’s cost of reducing the damages of pollution — say, by moving — is lower than it is for the papermill to move or to clean up its effluent, the hotel will not take this consideration into account — except if it is charged a Pigovian tax higher than the cost of moving. A double Pigovian tax is necessary!

If you think that government cannot realistically calculate such a double Pigovian tax, you are right. It would require — even more than a single tax and from all parties — precise information on production costs, demand and utility, and prices. That is information the government does not have and that many are not incited to reveal truthfully or even not able to provide. Implementing the tax would also require that politicians be pure angels insensitive to special interests and electoral clienteles.

Positive externality / Positive externalities can also be solved by the market — that is, by trading between emitters and receivers. In a 1952 article, James Meade, another future Nobel economics prizewinner (for his work in a different area), argued that owners of apple orchards provided a positive externality to owners of bees that collect unpaid-for nectar in apple blossoms, nectar being an input in honey production. Meade even detected a second positive externality: while collecting nectar, bees carry pollen from the male organs of apple blossoms to the female organs, a service that is also not compensated. Does this market fail?

Later research by economist Steven Cheung (University of Chicago) and others demonstrated that Meade’s facts were wrong. In the United States, an active commercial market for bee pollination services developed after World War I. Growers of fruit, nuts, and legumes pay a small fee to rent bees (on the order of $145 per colony of bees for a season in the Pacific Northwest). So, apple growers do pay for their pollination input. The market-determined fees are low in part because the second externality identified by Meade (the pollination of apple blossoms) partly compensates for the first one in the other direction (free nectar). A crucial lesson: only markets can compute complex costs and benefits.

The conclusion is that many externalities are solved by private trades and bargains, and probably more reliably than by government intervention.

Transaction Costs

However, there is a snag called “transaction costs.” They are the costs incurred by two or more potential contractual parties in finding the other party or parties, meeting, negotiating, agreeing to a contract, monitoring performance, and enforcing the agreement. When transaction costs are high, goes the argument, an externality may go uncompensated and unresolved. Transaction costs can be high because, for example, there is a large number of paper mills upstream, polluting a large number of hotels. Many instances of pollution fit into this category.

Coase himself pointed out that transaction costs can prevent private bargains from eliminating externalities. What is called the Coase Theorem includes the recognition of transaction costs, which may call for institutions capable of internalizing externalities as much as possible — for example, by determining liability rules as the common law does or did. “With positive transaction costs,” Coase wrote, “the law plays a crucial role in determining how resources are used.”

Yet, Coase added, one must ask if a government solution can solve the problem at a lower cost than the benefit gained — that is, without actually decreasing the total value of production compared to no intervention. In other words, it is easy to build a model of a Panglossian Pareto-optimal world, but if transaction costs prevent that world from being realized, the status quo may be the optimal world.

Problems of Government Intervention

In an article published in 1962, two years after Coase’s seminal article, James Buchanan (then at the University of Virginia) and William Craig Stubblebine (Claremont Graduate School) argued that only Pareto-relevant externalities are worth considering for government intervention. An externality that is not Pareto-relevant means that a trade cannot solve it because none of the parties could gain from an exchange. If the smoke from your neighbor’s chimney does not bother you, there is no bargain to pursue and no beneficial government intervention possible. For Pareto-relevant externalities, Buchanan and Stubblebine reformulated in mathematical terms Coase’s argument against a unilateral Pigovian tax.

Buchanan, also a future Nobel economics prizewinner, strengthened another Coasean argument: Pareto-relevant externalities do not have a clear or operational meaning if they are identified by comparing the real world with an ideal, optimal world that does not exist. In an Economica article, he noted, “To argue that an existing order is ‘imperfect’ in comparison with an alternative order of affairs that turns out, upon careful inspection, to be unattainable may not be different from arguing that the existing order is ‘perfect,’ ” that is, there are no externalities. He added the crucial point that there is “nothing in the collective choice process that will tend to produce the ‘ideal’ solution, as determined by the welfare economist.” (See “Populist Choices Are Meaningless,” Spring 2021.)

In a 1979 Journal of Law and Economics article, Carl Dahlman (University of Wisconsin) extended Coase’s and Buchanan’s arguments. Transaction costs, he noted, are a fact of nature just like transportation costs. Although it is nice to minimize them, according to Dahlman, the absence of a bargain between the emitters and receivers of a certain externality means that the expected costs of the trade are higher than its expected benefits for at least one party, and so the externality is in fact optimal. Like Buchanan, Dahlman denied the usefulness of invoking an ideal optimal world without transaction costs as a criterion of efficiency. Otherwise, “this is much like stating that a world in which apples are costly to produce is inoptimal compared to one in which apples are a free good.”

The invocation of ubiquitous externalities, Dahlman also argued, “simply constitutes a normative judgement about the role of government and the inability of markets to establish mutually beneficial exchanges,” which amounts to a mere “assumption that the government can do better” (emphasis in original).

Transaction costs ultimately exist because of imperfect information. But the government faces the same information problem, multiplied by the scope of its hubristic interventions. As mentioned above, it does not and cannot have the extended information on costs (production functions) and individual preferences (subjective utility functions) that would be necessary to correct apparent externalities. As markets incorporate and transmit more information, we would expect government failures to be worse than market failures.

Ubiquitous Externalities

Distinguishing what is and what is not an externality is tricky. Even economists often disagree.

After a long debate in the 1930s, it was generally accepted that what are called “pecuniary externalities” do not count as externalities properly understood. A pecuniary externality results from market and price adjustments. For example, when more efficient firms drag prices down and push less efficient ones out of the market, this effect would be a pecuniary externality. Sometimes mere transfers between individuals are considered pecuniary externalities — for example, when a public health system transferred to all taxpayers the cost of treating smokers’ diseases. Some economists continue to identify certain pecuniary externalities as market failures.

George Mason University economics professor Tyler Cowen recently suggested that old and rich individuals who spend on health care to postpone their deaths are imposing externalities on their heirs. He admits that this is a mere pecuniary externality (what the heirs lose, the old person gains) and qualifies his statement, but this shows how the concept of externality can justify more or less anything.

Another drift in the concept of externality leads to “internalities,” an idea that seems as contradictory as the oxymoron “internal externalities.” For example, imperfect information that leads an individual (a skydiver or mountain climber, for example) to do things that (in the view of some external observer) he wouldn’t otherwise do is viewed as an externality that the individual imposes internally on himself! (See “The War on Consumer Surplus,” Spring 2017.) Presumably, then, anybody who lacks perfect information on the possible consequences of reading a certain book (he may end up committing suicide or a mass murder) would be victim of an internality to be corrected by perfectly informed politicians and bureaucrats. (See “Smoking’s ‘Internalities,’ ” “The New Cigarette Paternalism,” and “My Future Self and I,” Winter 2002–2003.)

Most economists believe that an externality must be an incidental or unintentional effect, although formal definitions are typically mute on this point. The late E.J. Mishan of the London School of Economics, a well-known welfare economist, only mentions this feature toward the end of his Introduction to Normative Economics. Thus, your neighbors’ loss of utility from your house painted blaze orange does not count as a negative externality if you painted your house that color in order to annoy them. Murder does not count as an externality except in the case of collateral damage; the general fear created by high crime rates remains an externality, though. Similarly, intentional acts of charity would not count as positive externalities.

A typical externality affects — negatively or positively — only some individuals in society. If a positive externality (or the protection against a negative one) is unanimously desired, it can be deemed a “public good,” the paradigmatic case being national defense. Note, however, that the intentional production of a public good by the state does not produce an externality if one insists that the latter must be incidental to some other activity. At any rate, this article discusses externalities as such, not public goods.

Disregarding all these difficulties and even in the ordinary meaning of the term, externalities still appear to be extendable to most, if not all, social activities. Imagine that some individuals in society lose utility from the fact that others smoke tobacco, drink wine, or read Regulation or the New York Times. Mishan acknowledges that a consumption externality can arise “from an awareness of what is happening to others” (emphasis in original). Anything that somebody somewhere does not like can thus be viewed as an externality. Just knowing that some ordinary citizens have guns seems to be an externality for most progressives.

In the same vein, “positional externalities” include the envy or unease that some individuals experience by seeing others with higher incomes or more enjoyment of other benefits. The urge to “keep up with the Joneses” is also said to be an externality, emitted by the Joneses. (See “Ruinous Competition?” Winter 2011–2012.)

Consumption externalities can take the form of pollution as previously defined (the unwelcomed projection of physical objects on somebody else’s property). A large cross on the lawn of a deeply religious Christian deflects photons on his neighbors’ properties. For a militant-atheist neighbor, it is photon pollution. A Puritan who merely catches a glimpse of someone somewhere being happy (to borrow from H.L. Mencken) is also a victim of photon pollution.

A concept that means everything means nothing at all. The term “externality,” write Don Boudreaux of George Mason University and Roger Meiners of the University of Texas, Austin, “has become nearly meaningless due to its ubiquity.” It can be easily invoked by anybody to request the regulation, taxing, or ban of something he personally dislikes.

Circumscribing Externalities

The concept of externality, then, is far from being as clear or as useful for policy purposes as it may appear at first glance. It needs to be circumscribed to make it relevant to public policy — or at least to public policy in a free society. The question is, what are the externalities that should be considered when considering government intervention?

There are externalities that most people rightly think should be left alone. As an egalitarian redistributionist, Mishan espoused many ideas different from those of classical liberals and libertarians, but his views were not always inconsistent with the ideal of a free society. He argued that the individuals psychologically hurt by the knowledge that others are more successful or happy should not be protected against that sort of envy externality. He also warned against “the less tangible social costs arising from the power-seeking propensities of bureaucrats and the Kafkaesque perversities of bureaucracies,” which we often tend to forget.

Boudreaux and Meiners’s fundamental critique of the standard doctrine of externalities integrates many of the criticisms we have reviewed and will bring us closer to a useful criterion to circumscribe externalities. What is it, the two economists ask, that distinguishes externalities from spillovers that are in fact compensated through explicit or implicit exchange?

Consider the congestion externality that other drivers impose on a suburbanite who commutes to his job in the city. Although this looks to many like an externality (a congestion externality), it is not. Suburbanites were compensated when they bought their houses or rented their apartments for less than what they would have paid in the city. The demand for suburban housing is lower because of the long, congested commutes. Similarly, if someone buys a house near an airport, he expects airplane noise to be annoying and is compensated for that by a lower purchase price.

More generally, Boudreaux and Meiners write, “prices, wages, and other market values adjust to reflect expectations of spillover effects.” The keyword is “expectations.” An expected spillover is not an externality. Under this lens, an externality is a cost (or benefit, for a positive externality) that could not be reasonably expected and that, therefore, has not already been capitalized in asset prices or incorporated in incomes. “Insofar as no one’s legitimate expectations are upset,” Boudreaux and Meiners explain, “no externality occurs.” The bargains have been made and the receivers of negative externalities indirectly compensated.

Legitimacy / That both Mishan and Boudreaux–Meiners resort to the concept of legitimacy supports Dahlman’s claim that “externality” is more a normative-ethical than a positive-economic concept. Government intervention in the name of externalities often aims at income redistribution. Many of the counterarguments to the criticisms I presented above are similarly based on redistributionist values or interests. If we reject the normative assumptions that the government should dominate the market because it knows better, does things better, and should redistribute income (between the consumers of paper and those of hotel services, for example), externalities characterized as a failure to protect people’s legitimate expectations make sense.

But what is legitimate? Asking that question suggests that, ultimately, expectations and externalities are defined by the constitutional or institutional framework of a given society. People’s expectations are not the same in a classical liberal society as in a poor and violent one. A moral underpinning is necessary for any social or political evaluation.

To the extent that we do favor general human flourishing, I would argue, like many economists, that a free society in the classical liberal or libertarian tradition provides the desired legitimacy framework. In the terms of yet another Nobel economics prizewinner, Friedrich Hayek, the protected expectations are associated with an equally “protected sphere” around each individual. Some externalities are defined away because within an individual’s own protected domain, he may do what he wants regardless of the preferences and values of other individuals. We can even conceive of any right as a property right on the actions that the individual controls in his protected sphere. This setup prevents individuals from continuously bumping into, and clashing with, each other.

Hayek showed that individual liberty and the market economy make the mutual expectations of individuals as compatible as possible. It must of course be admitted that individual liberty and the market generate changes that lead to new expectations. Otherwise, no progress would be possible. But such change is gradual, based on voluntary interactions and thus on consent, and allows multiple ways for individuals to adapt according to each one’s own preferences and circumstances.

Sudden changes that violate the expectations of numerous individuals are more-often-than-not generated by governments themselves. Think about when governments suddenly change laws or when a new party comes to power with a thin majority, not to speak of states of emergency, wars, and tyranny. This suggests that governments themselves are the biggest emitters of negative externalities.

There may be moral reasons to assign an initial property right one way instead of another, even if we think that low transaction costs allow it to be freely transferred to whomever values it most. Of two contenders for a property right, there may be good reasons to recognize the owner as the one who was there first. As Boudreaux and Meiners note, somebody who “comes to the nuisance” (in the language of the common law) may not legitimately claim a right against the already present polluter. For example, it does not appear legitimate for somebody to buy a low-priced house near the airport and then try to double-dip by claiming compensation for noise pollution or demanding that new constraints be imposed on the airport owner.

POLICY AND OTHER TAKEAWAYS

To summarize: As a major economic justification for government intervention and regulation, the mainstream concept of externality is plagued by several problems, the first one being its ubiquity. In reality, many externalities can be eliminated through private agreement. Many of the remaining ones represent an artifact of the comparison with an idealized economy where transaction costs are assumed away. When externalities (non-compensated spillovers) seem to persist, one should suspect that the costs of correcting them are higher than the benefits in the sense that there is no voluntary trade that is profitable for all the relevant parties. We must not carelessly assume that an omniscient government knows better and can do better. Externalities must be circumscribed, which is what the constitutional and institutional framework of a free society does.

If we agree that individual liberty and flourishing should be pursued, public policy should presumably aim at three goals:

- Maintain formal or legal equality among individuals.

- Make sure that property rights are well-defined so that their owners can transfer them to anybody else by mutual consent.

- Interfere as little as possible in private contracts and arrangements.

Even in the “free world,” that is a challenging program.

The critique of externality in this article does not necessarily mean that there is no justification for any public policy. But a presumption of individual liberty and private property should exist, not a presumption of ubiquitous externalities and perfect government.

Limitations of Benefit–Cost Analysis

It is tempting to believe that benefit–cost analysis (BCA), a technique derived from the theory of welfare economics, is capable of balancing the costs and benefits involved in externalities. In reality, BCA is only meant to establish whether, in a given government intervention, the benefits accruing to some individuals will be larger or smaller than the costs imposed on other individuals. The actual balancing requires a moral or political judgment.

It must always be remembered that social costs are nothing but the sum of costs to some individuals and that social benefits are just the sum of the benefits of another group of individuals. After all individuals have been included in the analysis, there is nothing left in “society” to account for.

Even when its limited purpose is recognized, BCA is marred by multiple problems. Any serious, state-of-the-art BCA is replete with assumptions and uncertain estimates and forecasts, so that in practice a government intent on adopting a policy measure can produce an analysis showing social benefits higher than social costs. In their article “Externality: Origins and Classifications,” Donald Boudreaux and Roger Meiners report that two serious BCAs of the 2010 BP oil spill in the Gulf of Mexico estimated its cost to vacationers to have been, respectively, $661 million and $17.2 billion — a 26-fold difference!

It seldom happens that a BCA realized by government bureaucrats or outside consultants concludes that a proposed measure has (alas!) more costs than benefits.

It is true, though, that BCA has the advantage of forcing a more rational (or, perhaps better put, less irrational) discussion of a proposed government intervention. The technique may also slow down the process of producing bans and orders, and thus flatten the slippery slope of regulation. But this is a far cry from providing a scientific basis for solving externalities and market failures.

Reading

- “Externality,” by James M. Buchanan and Wm. Craig Stubblebine. Economica 29(116): 371–384 (1962).

- “Externality: Origins and Classifications,” by Donald J. Boudreaux and Roger Meiners. Natural Resources Journal 59(1): 1–33 (2019).

- “Honey Bee Pollination Markets and the Internalization of Reciprocal Benefits,” by Randal R. Rucker, Walter N. Thurman, and Michael Burgett. American Journal of Agricultural Economics 94(4): 956–977 (2012).

- Introduction to Normative Economics, by E.J. Mishan. Oxford University Press, 1981.

- Law, Legislation and Liberty, Vol. 1, Rules and Order, by F.A. Hayek. University of Chicago Press, 1973.

- “Politics, Policy, and the Pigovian Margins,” by James M. Buchanan. Economica 29(113): 17–28 (1962).

- “The Fable of the Bees: An Economic Investigation,” by Steven N.S. Cheung. Journal of Law and Economics 16(1): 11–33 (1973).

- “Notes on the Problem of Social Cost.” In The Firm, the Market, and the Law, by Ronald H. Coase; University of Chicago Press, 1988.

- “The Problem of Externality,” by Carl Dahlman. Journal of Law and Economics 22(1): 141–162 (1979).

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.