This article is condensed from their paper “The Effects of Liberalizing Price Controls on Local Telephone Service: An Empirical Analysis,” February 2012 (SSRN #2006594). The authors thank Chris Holt and Carey Ransone for research support.

The views expressed are the authors’ and do not necessarily represent those of Navigant Economics LLC or its parent, Navigant Consulting Inc., nor of their officers, principals, affiliates, or employees.

After more than half a century of monopoly and public utility–style regulation of retail telephone rates, in the early 1980s the United States embarked on a path of regulatory liberalization. Monopolies on long distance service and, later, local service were eliminated, allowing new entrants to compete for customers by lowering prices and offering new and improved services. As competition has developed, price controls have been removed gradually, allowing both entrants and incumbents to compete head-to-head to win customers. The evidence strongly suggests that the combination of de-monopolization and price deregulation has generated substantial benefits for consumers.

Nearly two decades after liberalization began, the process is now nearing completion. Federal price controls on long distance service are a distant memory and state-administered price controls on local services have been removed for most services in most areas. There are two main exceptions: First, most rural carriers, which typically face less robust competition than those serving urban areas, remain subject to either rate-of-return regulation or price caps. Second, most states continue to impose price controls on "basic" service, i.e., a local access line capable of receiving calls from anywhere and of making an unlimited number of calls within a local calling area (but not including either long distance service or "enhanced" services such as voicemail or call-forwarding). Since 2006, however, 12 states have removed price controls on basic service for at least some carriers in at least some areas.

What are the effects of liberalizing price controls on basic telephone service? Proponents of continued regulation charge that incumbent telephone companies—even in highly competitive urban areas—continue to have market power over basic service and, on that basis, argue that regulation should remain in place. They contend that the removal of price controls will result in substantial rate increases, making even a basic telephone line "unaffordable" or leading to "excessive" rates, despite the continued availability in all states of subsidized telephone service for low-income customers. Liberalization advocates, on the other hand, argue that the removal of price controls will facilitate entry, enhance competition, promote investment and innovation, and ultimately lead to both lower costs and prices.

The removal of price controls in some states but not others constitutes a natural experiment that can be used to assess the actual effects of this policy change. In this article we do just that. We conclude that in terms of rates and utilization, consumers in deregulated states are at least as well off as consumers in regulated states.

Liberalization and Telecom Prices

Regulatory liberalization of telephone services has taken place in two primary stages, each associated with the de-monopolization of a major industry sector. First, the breakup of AT&T and the termination of its monopoly on long distance service led to the elimination of price controls on long distance services. Second, the Telecommunications Act of 1996, building on the efforts of some states, ended the statutory monopoly on local service. The ensuing competition prompted state public utility commissions (at varying paces and to different extents) to remove price controls on various local services, again reflecting the development of competition. There is widespread agreement that liberalization has led to lower prices, improved performance, and substantial consumer benefits.

The AT&T breakup | Competition in the long distance telephone business began in the 1970s after the Federal Communications Commission's 1969 approval of a petition by startup Microwave Communications Inc. (later known as MCI) to compete with AT&T by offering "specialized" long distance services via microwave between St. Louis and Chicago. In the ensuing years, AT&T fought aggressively against the further expansion of competition, sometimes with the apparent support of the FCC. Ultimately, it took an antitrust lawsuit by the U.S. Department of Justice to inject competition fully into the marketplace, resulting in the famous 1982 Modified Final Judgment, leading to the 1984 breakup of AT&T into a long distance company and seven "regional Bell operating companies" (RBOCs).

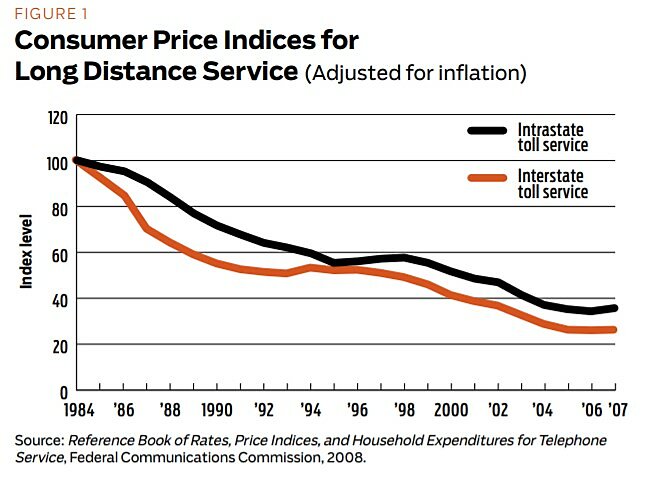

Regulation of the long distance industry did not end with the breakup. The FCC continued to regulate AT&T's long distance prices until 1995 and RBOCs were not permitted to offer long distance services in any states until 1999. There is substantial disagreement among academics about whether price liberalization should have occurred sooner than it did, and also about whether the RBOCs' entry into long distance service should have been delayed as long as it was. There is no disagreement, however, that long distance prices have fallen sharply since liberalization. As shown in Figure 1, in real terms, the price of long distance service fell by more than 70 percent between 1984 and 2006.

The 1996 Telecom Act | The success of long distance liberalization led directly to efforts in some states to open local markets. Those efforts, in turn, led to the Telecom Act of 1996, which was signed into law by President Bill Clinton in February of that year after having passed both houses of Congress with large, bipartisan majorities. The act eliminated any statutory monopoly on local telephone service previously held by the RBOCs and other incumbent local exchange carriers (ILECs), opening the market to competition from competitive local exchange carriers (CLECs), cable companies, and various other competitors. In order to encourage the RBOCs to open up their local markets, it allowed them to enter the lucrative long distance market only after demonstrating they had opened their local markets to competition by completing a "14-point checklist."

The course taken by the FCC in implementing the act was highly controversial, but the end result is not in dispute: the market today is far more competitive than when the act was passed. Indeed, state regulators from coast to coast have concluded that competition from cable, wireless, CLECs, and internet "VoIP" providers effectively disciplines prices in most areas and for most products. In 2006, for example, the New York State Public Service Commission found:

Today, cable providers, using the infrastructure that they constructed over the past several decades to provide video services, now offer telephone and internet services as well. Companies are also providing internet-based phone services that enable customers to call anywhere in the world at dramatically reduced prices, or, in some cases, for free. These services are generally less expensive for customers and incorporate value-added innovations ranging from caller ID to the ability to use one's home telephone at any internet connection. Wireless networks have also evolved and some consumers have adopted cell phones and other wireless communication devices as a replacement for their traditional wireline voice service. In short, the provision of telephone service is no longer a natural monopoly.

In response to arguments sometimes made by regulation advocates that the telecommunications market is really a "duopoly" between cable and telephone companies, the New York PSC concluded:

We are also not convinced that our actions should be restrained by a concern that the telephone market is or is becoming a duopoly. There are three, not two, major pathways into the customer's premises: traditional wire, wireless, and broadband via cable. Furthermore, within each pathway there are multiple providers of telephone services, especially so for providers of telephone service over broadband.

New York’s findings were repeated nearly verbatim by the California Public Utilities Commission later the same year. In deciding to remove public utility–style regulation from virtually all telephone services (except Lifeline and other services supported by state universal service funds), the commission addressed the contention that simply because two services are not identical, they cannot be competitors. To the contrary, the commission found:

[A] service need not be identical to provide a competitive substitute. For example, we see that ballpoint pens, fountain pens, roller pens, and pencils all serve as writing instruments in the marketplace today. While no one pen or pencil is a perfect substitute for another, they often compete in serving a customer’s need for a writing instrument. Similarly, a landline telephone, a wireless telephone, and a VoIP telephone all may compete to serve a consumer’s need for voice communications.

The California PUC also directly addressed and rejected another concern sometimes raised by critics of liberalization: that competition would somehow work for everyone except those with lower incomes. According to the PUC:

We also find no compelling reason to segment the market further by user characteristics, such as income or use characteristics (e.g., business or residential use, or level of use). In particular, there is no persuasive evidence that the patterns of use by low-income customers differ enough from other customers to be considered a separate market, or that competition in voice communications market will not benefit low-income customers.

Other states have reached similar conclusions. In 2007, for example, the Virginia State Corporation Commission lifted price regulation for nearly all telephone services, including for basic rates in the vast majority of the state. The Virginia commission specifically addressed the role of wireless service, ruling that “while wireless is not a perfect substitute for Verizon’s landline service…, a competitor does not have to be a perfect substitute to Verizon’s landline service to act as a price regulator of Verizon’s local telephone service.” Accordingly, the commission found “that it is appropriate to include wireless competition to Verizon in the geographic market areas in which it is available.”

Based on findings such as these, most states have now determined that incumbent telephone companies face sufficient competition, at least in urban areas, to warrant the relaxation or removal of incumbent price controls on nearly all types of telephone service. (Prices charged by telephone competitors, such as cable companies and wireless telephones, have never been subject to price controls.) Many states have completely removed price controls on bundled offerings (defined as packages containing, e.g., local service, long distance service, and “discretionary” offerings such as caller ID) and created significant flexibility for discretionary offerings purchased “a la carte,” while leaving in place caps on basic local exchange telephone service (BLETS) prices. Beginning in 2006, however, several states have decided to liberalize all telephone prices, including BLETs. Thus, although some states have gone further than others, there has been a clear and accelerating progression in the direction of increased pricing freedom for local telephone service.

Throughout this period, critics have argued that incumbent telephone companies continue to have monopoly power and predicted that loosening or removing price controls would result in large price increases. The evidence demonstrates otherwise. Trends in telephone price indices show that state regulators were correct in concluding that competition would discipline the price of telephone service. Indeed, prices for telephone service, including both wireless service (which has never been subject to price controls) and landline service, have fallen consistently in real terms since the mid-1990s. Telephone prices have also declined relative to income, while expenditures on telephone service have remained stable as a share of total consumer expenditures.

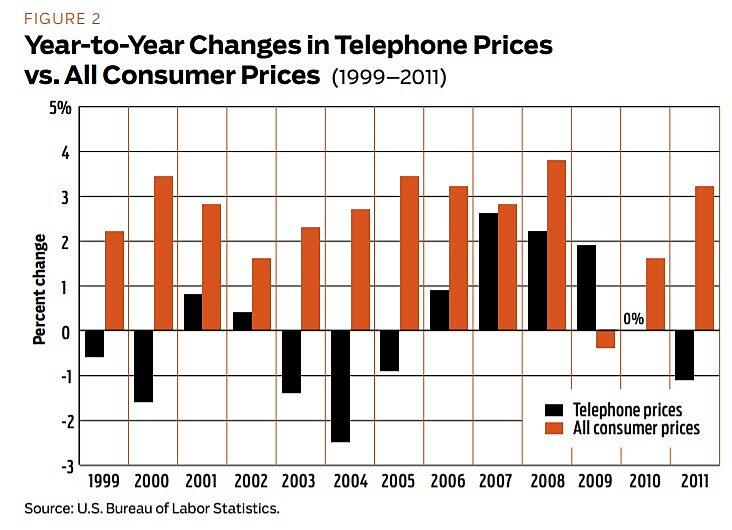

For example, the U.S. Bureau of Labor Statistics has reported a general price index for telephone services (incorporating both landline telephony and wireless telephony) since the late 1990s. Figure 2 compares the annual year-to-year change in the BLS telephone services price index with the yearly increases in the Consumer Price Index. Telephone prices have actually dropped in six of the 13 years for which data are available and have risen less than overall consumer prices in every year but one (2009). In 2011, the latest full year for which data are available, consumer prices increased by 3.2 percent, while the telephone price index fell by 1.1 percent.

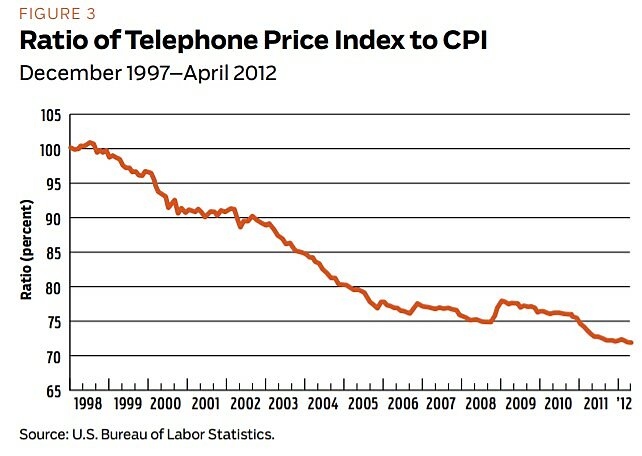

Figure 3 shows the BLS data on a monthly basis from December 1997 to the present, showing that telephone prices have fallen consistently relative to consumer prices generally. As of April 2012, real telephone prices had fallen by nearly 30 percent in the years since passage of the 1996 Telecom Act.

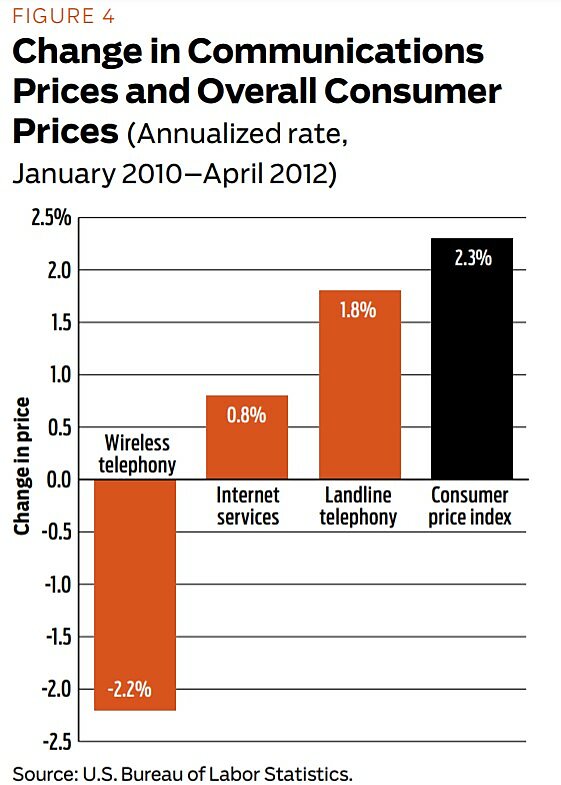

More recently, the BLS has begun to publish indices that explicitly differentiate between landline telephony, wireless telephony, and internet service. Although these revised communications price indices span a relatively short time period, the data are nonetheless consistent with the patterns observed in the traditional BLS telephone pricing index. As seen in Figure 4, the prices of all three services are falling compared to the CPI.

State public utilities commissions that have studied the effects of liberalization have reached similar conclusions. For example, the Florida Public Service Commission tracked rate changes in the wake of 2009 legislation permitting rate flexibility and found that—even for basic rates, which had failed to keep up with inflation for many years—none of the state’s incumbent carriers increased rates by more than 2 percent, leading it to conclude that “these rate increases and price regulation, in general, have had a negligible impact on the overall affordability of telephone service.” Similarly, the California PUC reported in 2010 that while basic telephone service rates had gone up in nominal terms, “the rate increases approved for 2009 and 2010 result in rates that are less than or equal to prior rates approved by the CPUC.” Indeed, a late-2010 survey by the commission found that the top reason given by California consumers for their concerns about the affordability of telephone service was “Fees, taxes and surcharges,” which concerned 54 percent of respondents—exactly twice as many as expressed concern about their local phone bill.

It is also worth noting that telephone prices have declined relative to household income, while the share of consumer expenditures on telephone service (both wireless and landline) has remained stable. Since 1998, the BLS telephone price index has fallen approximately 20 percent relative to median household income, as reported by the Census Bureau. In addition, according to the BLS, expenditures on telephone services—including both landline and wireless telephony—have remained stable as a share of total consumer expenditures since 1996, fluctuating between 2.2 and 2.4 percent.

In summary, predictions that prices would increase with the elimination of price controls have proven not just unfounded, but completely wrong. As the FCC unanimously concluded in 2008, “Competition has resulted in dramatically lower prices for telephone service, and the introduction of innovative broadband products and services has fundamentally changed the way we communicate, work, and obtain our education, news, and entertainment.”

Liberalization and Usage

While telecommunications deregulation clearly has not led to higher telephone prices overall, opponents of liberalizing price controls on basic rates have argued that ending price regulation would lead to higher BLETS prices, make basic service unaffordable for at least some consumers, and thus lead to lower utilization. As we explain below, we conducted a regression analysis that shows that BLETS liberalization has not led to higher rates. Before reporting on that analysis, however, we first discuss the current status of BLETS regulation, and then provide some comparative statistics indicating that liberalization has not led to lower utilization.

Liberalization of price controls | We classify the states' regulatory treatment of BLETS prices as falling into one of three reasonably well-defined categories:

- Rate-of-return regulation

- Price cap regulation

- Liberalization (i.e., no price controls)

In some states, incumbent carriers remain bound by rate-of-return regulation, although there is some variation in the degree of pricing flexibility afforded to individual services. For example, Qwest/CenturyLink in Arizona is subject to a rate-of-return regime that allows some pricing flexibility for non-basic services but none for BLETS. In other states, such as Alaska and Montana, rate-of-return regulation is coupled with substantial pricing flexibility for a range of services, including basic local exchange service. However, even revenues derived from "flexibly priced" services still count against a carrier's allowable rate of return. For example, Qwest in Montana found itself obliged to lower rates substantially to both business and residential subscribers in 2009 after the carrier was determined to have earned excess returns. Rates in other rate-of-return jurisdictions have still less flexibility. In Hawaii, rates for even non-basic services lack upward pricing flexibility and full rate cases take place very infrequently. In Washington state, Frontier Communications is subject to a similar regime.

A growing set of jurisdictions has replaced traditional rate-of-return regulation with price cap regulation. Under price cap regimes, incumbents are permitted to adjust rates within the limits specified by the regulator, with earnings and profits no longer subject to regulation. Price cap regulation provides additional incentives for incumbents to operate efficiently because they participate in the upside (downside) of any cost savings (inefficiencies).

Under price cap regulation, rates are sometimes tied to a general inflation index, typically the GDP deflator. Alternatively, rate adjustments may be restricted to a fixed percentage or dollar amount determined by the regulator. As a general rule, basic local exchange services are subject to more stringent caps than non-basic and/or competitive service offerings, which may be granted more extensive pricing flexibility or fully liberalized. For example, the existing price cap plan in North Carolina ties AT&T's BLETS rates directly to the GDP deflator while rates for all other services are liberalized. In Nebraska and Utah, incumbents have broad pricing flexibility for all retail services without any well-defined constraints. However, because the regulator in each state has the power to review rate adjustments, prices are not fully liberalized. In Nebraska, the regulator may initiate a review on its own or ratepayers may petition the regulator to do so. In Utah, price adjustments are subject to review according to a "just and reasonable" standard.

A dozen states have opted to liberalize price controls entirely on all local telephone rates, including BLETS, either through legislation (e.g., the Alabama Communications Reform Act of 2005 eliminated the Alabama Public Service Commission's jurisdiction over telecommunications services) or administrative action (e.g., in its Uniform Regulatory Framework decision of 2006, the California PUC established a liberalization framework for large to medium-sized ILECs, including a phased-in transition to the elimination of price controls on BLETS).

In many cases, liberalization has been phased in after a period of continuing price controls. For example, AT&T in Chicago is currently under a transitory price cap that will expire in 2013, followed by complete pricing flexibility for all retail services. Similarly, under a 2007 order, BLETS prices in Virginia remain subject to price caps until December 31, 2012, at which point rates are slated to be liberalized. (Regulators there are now considering extending the cap for two more years, until 2014.)

Even in liberalized jurisdictions, certain incumbents, such as small rural carriers, may remain subject to price controls. In addition, rates for some services in some liberalized jurisdictions where price caps have been removed remain subject to price floors. For example, the Alternative Regulation Plan governing Verizon in Rhode Island explicitly permits rates and charges “for all regulated retail services” to “increase or decrease in response to market conditions.” However, the plan also specifies that any proposed decreases in retail rates must include “a certification that such reduced rates … are not less than the Long Run Incremental Cost (LRIC) of such services or offerings.”

Utilization | If liberalization has made telephone service less affordable, we would expect to observe differential quantity responses in states that have liberalized price controls relative to those that have not. We examine rates of landline attrition, participation rates in low-income telephone subsidy programs, and rates of substitution toward wireless telephony, and conclude that none have been affected by deregulation.

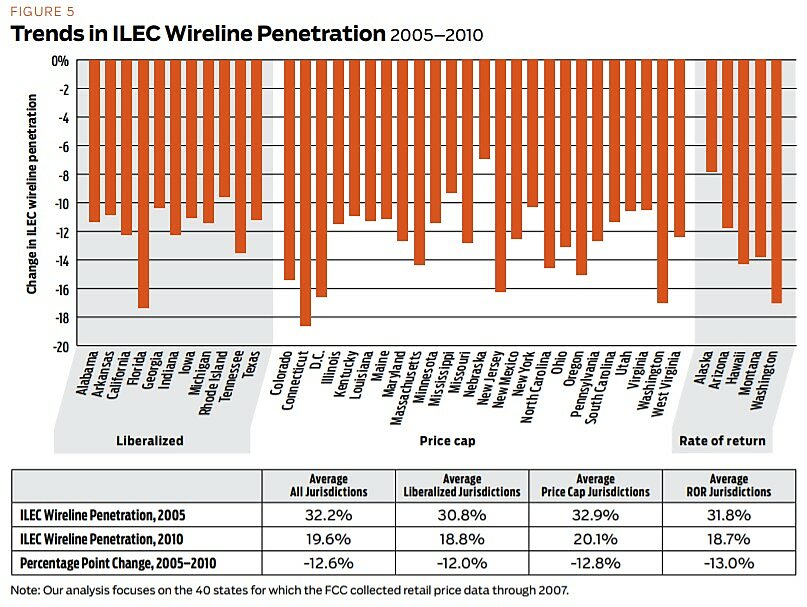

First, if liberalization made telephone service less affordable, then states that liberalized price controls would be expected to experience greater decreases in ILEC wireline penetration (if only ILEC prices have risen) or in overall wireline penetration (if all wireline rates have risen). This hypothesis can be tested empirically using state-level panel data available from the FCC, which reports the number of residential end-user switched access lines in service for both ILECs and CLECs on a uniform basis from 2005 to 2010. To obtain a measure of wireline penetration, we express these data as a fraction of a given state’s population to obtain state-level estimates of wireline penetration. Figure 5 displays state-level trends in ILEC wireline penetration from 2005 to 2010, grouping the states in our sample according their regulatory regime at the end of the period.

Both the observed levels and the changes in ILEC residential wireline penetration are remarkably similar for the states in our sample, regardless of the regulatory environment. On average, ILEC wireline penetration fell from 32.2 percent to 19.6 percent, with the same fundamental pattern observed across liberalized, price cap, and rate-of-return jurisdictions. Although there is some variation from one state to another, there is no indication that the drop in penetration in jurisdictions with liberalized and/or flexible prices is systematically higher or lower than in jurisdictions with more stringent price regulation. A simple statistical test confirms that ILEC penetration declined equally across the three groups.

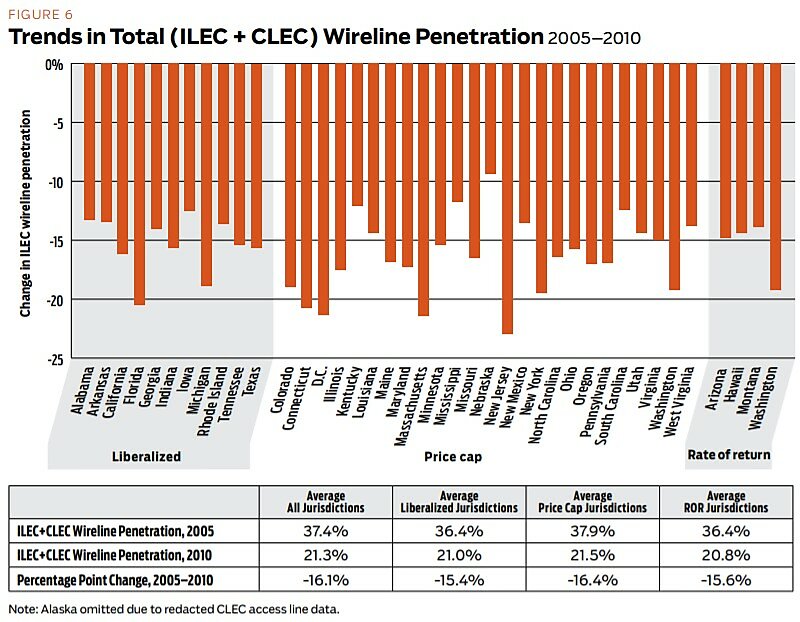

The data on total wireline penetration, defined as the ratio of ILEC and CLEC residential access lines (including cable) to a state’s population, tell a very similar story. As seen in Figure 6, from 2005 to 2010, average wireline penetration declined from about 36–37 percent to roughly 21 percent, regardless of the telecom policy environment. As before, although all states experienced substantial declines in total penetration over this timeframe, there is no evidence that jurisdictions with liberalized and/or flexible prices experienced systematically greater declines than did jurisdictions with more stringent price regulation. On average, the decline was slightly steeper in price cap jurisdictions, but the differences across policy environments are small and statistically insignificant.

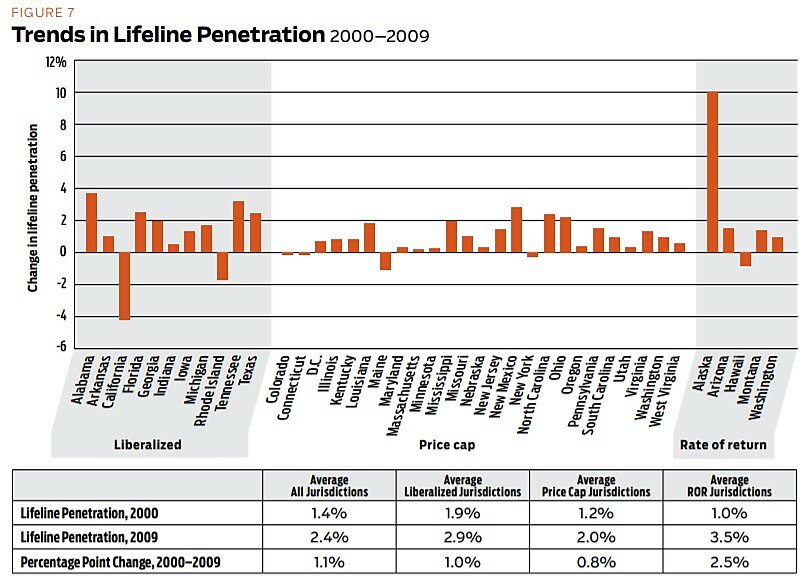

Affordability can also be assessed by examining participation in the subsidy programs that provide low-cost telephone service to low-income consumers. If liberalization has resulted in economically significant rate increases, and if consumers view basic local wireline service as “essential,” one would expect to observe consumers substituting toward subsidized alternatives, which are known as “Lifeline” programs. All else equal, states that have removed BLETS price controls would be expected to experience greater increases in participation. This hypothesis can be tested empirically using state-level data on Lifeline participation, which are available from the FCC’s Universal Service Monitoring Reports.

Figure 7 reports levels and changes in Lifeline penetration for the states in our sample for the years 2000–2009. On average, liberalized jurisdictions began the decade with a Lifeline penetration rate of approximately 1.9 percent, and increased by 1 percentage point by 2009. In contrast, Lifeline penetration in rate-of-return jurisdictions increased by 2.5 percentage points, although the differences across regulatory environments are not statistically significant. Thus, the observed patterns in Lifeline penetration do not support the hypothesis that liberalizing leads to increased dependence on subsidized telephone service.

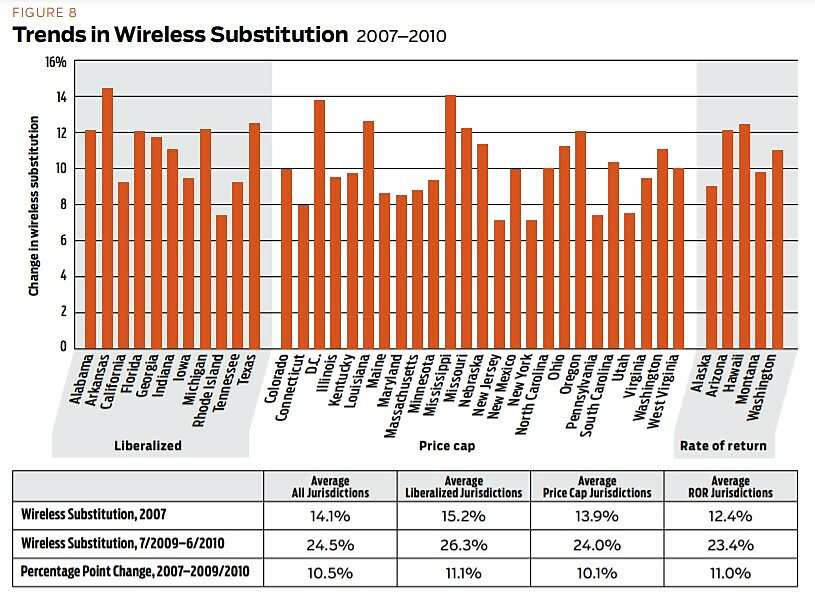

An economically significant rate increase would also be expected to accelerate the rate of substitution toward competitive alternatives such as wireless telephony. This hypothesis can be tested using state-level data on the proportion of households and/or individuals in a given geographic region that have abandoned landline telephony entirely and chosen to rely exclusively on wireless voice service. The Centers for Disease Control has surveyed “wireless-only” households and individuals for several years, and recently released a panel of geographically disaggregated data spanning the time period from 2007 to 2010.

Figure 8 reports levels and changes in rates of wireless substitution (defined as the percentage of adults aged 18 and over living in wireless-only households) for the states in our sample. From 2007 to 2010, average rates of wireless substitution increased from roughly 15 percent to roughly 25 percent, regardless of the telecom policy environment. On average, the observed increase was nearly identical in liberalized jurisdictions (11.1 percentage points) and rate-of-return jurisdictions (11.0 percentage points). Although the increase was slightly lower in price cap jurisdictions (10.1 percentage points), there are no statistically significant differences across regulatory environments.

In summary, regardless of whether demand is measured in terms of the rate of landline attrition, participation rates in low-income telephone subsidy programs, or rates of substitution toward wireless telephony, the data provide no indication that the relaxation or removal of price controls has led to differential responses in the quantity of telephone service demanded across different jurisdictions. Given that quantity is a function of price (and vice-versa), the data do not support the hypothesis that liberalization of basic telephone rates has made BLETS service less affordable.

Liberalization and basic service

In addition to the comparisons above, we report on the results of our econometric analysis of the effects of price controls on BLETS services based on the natural experiment created by the removal of controls in 12 states beginning in 2006.

We base our analysis on two rich data sets. First, for more than two decades, the FCC collected uniform data on the price of basic local exchange telephone service for a sample of 95 urban areas in 40 states. Unfortunately for researchers, the FCC discontinued the series in 2007, just as many states had begun to liberalize price controls on BLETS. In mid-2011, we gathered directly comparable data on residential BLETS prices for the same sample of 95 cities used by the FCC. While the resulting data set is missing three years of observations (2008–2010), the important fact is that it includes “before” and “after” observations for the recent period of BLETS liberalization and thus allows us to assess the impact of liberalization on prices.

Second, as noted above, we compiled detailed information, over time, on the pricing regulations governing the basic service offerings of incumbent carriers serving the 95 FCC jurisdictions. Specifically, we determined what type of regulatory regime—rate-of-return, price cap, or liberalized—pertained to BLETS prices in each jurisdiction for each year throughout the period 2007–2011. The result is a robust, methodologically sound database of the prices and regulations for basic residential telephone service spanning the recent period of BLETS liberalization.

In addition to liberalization efforts, there are a host of factors—demand characteristics, cost characteristics, the extent of competition, cross-subsidies, etc.—that may affect the price of basic local telephone service. To disentangle those factors from the effects of liberalization, we analyzed a panel dataset spanning five years of basic telephone pricing history (2007–2011, the period during which BLETS liberalization policies have taken effect) for a sample of incumbent carriers serving urban areas across the United States. Our analysis exploits the available variation in policy environments within jurisdictions and over time in order to identify the relationship between various forms of regulation and the evolution of BLETS prices.

We applied several regression models to our dataset. In each specification, the independent variable is the real price of basic local exchange service in a given jurisdiction at a given point in time. The key explanatory variable captures the effects of the policy environment on the price level, using an indicator equal to 1 if the jurisdiction is liberalized at a given point in time and 0 otherwise. Several additional control variables are included to account for several additional factors that may affect telephone prices, including proxies for wireline and wireless competition, cross-subsidization between business and residential rates, lifeline penetration, population density, income, and state fixed effects.

Overall, we find that the elimination of BLETs price controls either results in lower prices or has no statistically significant effect. Simply put, jurisdictions subject to traditional rate-of-return regulation have higher prices, holding other factors constant, than jurisdictions with flexible and/or liberalized regimes for basic local service. More specifically, our regression analysis shows that, after controlling for other factors, rates in liberalized jurisdictions are significantly lower (by about $5.25 per month, or one-third of the average) than rates in price cap jurisdictions. Further, rates are highest (by about $2.46, or one-sixth of the average) in jurisdictions subject to traditional rate-of-return regulation. Accordingly, we conclude that the confluence of competition and liberalization has resulted in lower consumer prices for basic local telephony than would have been the case in the absence of liberalization.

Conclusion

The process of de-monopolization and price liberalization of retail telephone services has been underway in the United States for several decades. Price controls on long distance service were removed many years ago, and liberalization of local service prices began in the 1990s. In recent years, roughly a dozen states have completed the liberalization process by eliminating price controls on basic telephone service. Opponents of price liberalization have claimed that the removal of price controls would lead to higher (even “unaffordable”) rates. Our regression analysis, however, demonstrates that, holding other factors constant, liberalization has led to lower prices. Moreover, looking at several indices of utilization, we find no evidence that rates have become less affordable as a result of liberalization. Given the broad consensus that liberalization contributes to innovation and overall economic welfare, and the strong evidence that the removal of price controls on other telephone services has benefited consumers, we conclude that liberalizing price controls on basic telephone service will benefit consumers and contribute to economic growth.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.