It is a great pleasure to have been invited to share my views concerning “Trade Promotion Agencies and U.S. Foreign Policy” with the subcommittee. The invitation asked that I provide thoughts on three broad — and broadly related — topics:

- the impacts on the U.S. economy of trade promotion agencies, specifically the Export-Import Bank of the United States;

- the question of what to do about foreign governments’ trade promotion agencies, and;

- the relationship between the Export-Import Bank and U.S. foreign policy.

Before providing some thoughts on those topics, I would like to applaud the subcommittee for taking up these important issues in a public hearing. Committed oversight of the executive branch by the legislative branch is crucial to our system of checks and balances, which must remain functionally robust to ensure the health of our constitutional republic and protect it from even the most subtle encroachments.

Congress, the president, and the public have turned their attention to so-called trade promotion agencies in recent years, as there have been (and continue to be) reauthorization and funding battles; renewed, post-recession focus on export growth beginning with the announcement by President Obama in 2010 of his National Export Initiative; and, on-again-off-again efforts to consolidate, streamline, or simplify the maze of U.S. federal agencies that seem to have some overlapping responsibilities, functions, and missions with respect to trade policy.

To the extent that today’s hearing will help clarify some of these issues and prompt a serious effort to reform and retire some of the redundant, distortionary, and, frankly, scandal-prone agencies among the panoply of federal offerings, I am pleased to be of assistance.

The General Folly of Export Promotion Programs

Let me begin by offering some clarity about what is meant by “trade promotion” in Washington. Whereas trade includes both the selling to foreigners (exports) and purchasing from foreigners (imports) of goods and services, trade promotion is exclusively about promoting exports. There are no federal programs devoted to import promotion and, in Washington, the benefits of exports are what most people have in mind when they talk about the benefits of trade. U.S. trade promotion agencies are in the business of promoting exports, not trade in the more inclusive sense.

That is worth noting because despite some of the wrongheaded mercantilist presumptions undergirding U.S. trade policy — that exports are good, imports are bad, the trade account is the scoreboard, and our trade deficit means that the United States is losing at trade — the economic fact of the matter is that the real benefits of trade are transmitted through imports, not through exports. As Milton Friedman used to say: imports are the goods and services we get to consume without having to produce; exports are the goods and services we produce, but don’t get to consume.

The purpose of exchange is to enable each of us to focus on what we do best. By specializing in an occupation — instead of allocating small portions of our time to producing each of the necessities and luxuries we wish to consume — and exchanging the monetized output we produce most efficiently for the goods and services we produce less efficiently, we are able to produce and, thus, consume more output than would be the case if we didn’t specialize and trade. By extension, the larger the size of the market, the greater is the scope for specialization, exchange, and economic growth.

When we transact at the local supermarket or hardware store, we seek to maximize the value we obtain by getting the most for our dollars. In other words, we want to import more value from the local merchant than we wish to export. In our daily transactions, we seek to run personal trade deficits. But when it comes to trading across borders or when our individual transactions are aggregated at the national level, we forget these basics principles and assume the goal of exchange is to achieve a trade surplus. But, as Adam Smith famously observed: “What is prudence in the conduct of every private family, can scarce be folly in that of a great kingdom.”

The benefits of trade come from imports, which deliver more competition, greater variety, lower prices, better quality, and innovation. Arguably, opening foreign markets should be an aim of trade policy because larger markets allow for greater specialization and economies of scale, but real free trade requires liberalization at home. The real benefits of trade are measured by the value of imports that can be purchased with a unit of exports — the so-called terms of trade. Trade barriers at home raise the costs and reduce the amount of imports that can be purchased with a unit of exports. Yet, holding firm to those domestic barriers while insisting that foreign markets open wider is both the U.S. trade negotiating strategy and the rationale for the existence of our export promotion agencies.

Nowhere among the web of federal agencies is import promotion found to be a program objective or mission. In Washington, “import” is a four-letter word. Whereas exports are associated with increased economic output and job creation, imports are presumed to cause economic contraction and job loss. But that is demonstrably false.

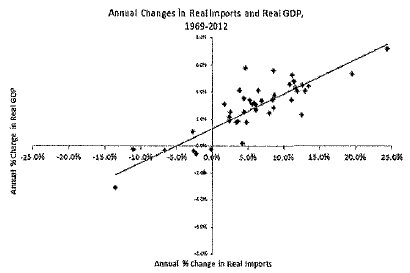

The first1 of the two charts below plots manual changes in imports and annual changes in GDP for 44 years. If imports caused economic contraction, we would expect to see most of the observations in the upper left and lower right quadrants — depicting an inverse relationship. Instead, we see a strong positive relationship. In 43 of 44 years, imports and GDP moved in the same direction.

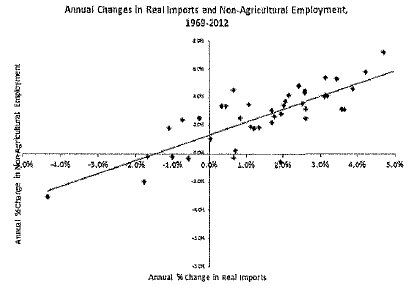

The second2 chart plots annual changes in imports and U.S. employment. Similarly, there is a fairly strong positive relationship between these variables, as well.

In keeping with the conventional Washington wisdom that exports are Team America’s points and imports are the foreign team’s points, in his January 2010 State of the Union address President Obama set a national goal of doubling U.S. exports in five years. That goal was subsequently enshrined as the “National Export Initiative,” which decreed establishment of an Export Promotion Cabinet “to develop and coordinate the implementation of the NEI.” Six months later, the new cabinet produced its recommendations in a 68-page report titled “The Export Promotion Cabinet’s Plan for Doubling U.S. Exports in Five Years,” which became the centerpiece of the administration’s trade policy agenda.

Though the NEI missed its target of $3.14 trillion of annual exports by the end of 2014, some of its objectives were laudably atypical of the average five-year plan. For example, the goal of clarifying, simplifying, and streamlining U.S. export control procedures — though unattained — offered the promise of reducing regulatory obstacles and spurring meaningful export growth without imposing new burdens or diverting resources from elsewhere in the economy. Likewise, the goal of passing long-pending bilateral trade agreements with South Korea, Colombia, and Panama (which was achieved), and concluding the Trans-Pacific Partnership negotiations (which is in progress) to reduce trade barriers were worthy components of the NEI.

But most prominent in the plan was a larger role for government in promoting exports, including expanded non-market lending programs to finance export activity, an increase in the number of the Commerce Department’s foreign outposts to promote U.S. business, an increase in federal agency-chaperoned marketing trips, and other sundry subsidies for export-oriented business activities. U.S. trade promotion agencies suddenly had more prominent roles to play.

Shortsightedly, the NEI systemically neglected a broad swath of opportunities to facilitate exports by contemplating only the export-focused activities of exporters. The NEI presumed that the only barriers impeding U.S. exporters were foreign made. But before companies become exporters, they are producers. And as producers, they are subject to a host of domestic laws, regulations, taxes, and other policies that handicap them in their competition for sales in the U.S. market and abroad.

For example, nearly 60 percent of the value of U.S. imports in 2014 comprised of intermediate goods, capital goods, and other raw materials — the purchases of U.S. businesses, not consumers.3 Yet, many of those imported inputs are subject to customs duties, which raise the cost of production for the U.S.-based companies that need them, making them less competitive at home and abroad. Indeed, U.S. duties on products like sugar, steel, magnesium, polyvinyl chloride, and other crucial manufacturing inputs have chased companies to foreign shores — where those crucial impediments are less expensive — and deterred foreign companies from setting up shop stateside.4

The potential dividends from removing these and other impediments to a more competitive domestic production environment are surely greater than any benefits derived from export promotion.

In the 21st century, it is inaccurate to characterize international trade as a competition between “us” and “them.” Because of foreign direct investment, joint ventures, and other equity-sharing arrangements, quite often “we” are “they” and “they” are “we.” And as a result of the proliferation of disaggregated, transnational production and supply chains, “we” and “they” often collaborate in the same endeavor. As trade barriers have diminished, opportunities for new combinations of labor, investment, and human capital have emerged in defiance of what were once formidable obstacles to wealth creation. “Autonomous” or “unilateral” liberalization of trade barriers has accounted for most of the trade liberalization in developing countries over the past two decades and, on average, applied tariff rates globally are well below their maximum allowable rates or “bound” rates under World Trade Organization agreements. Global economic integration has enabled enterprises to flourish on scales unimaginable just a generation ago.

To nurture the promise of our highly integrated global economy, policymakers should stop conflating the interests of exporters with the national interest and commit to policies that reduce frictions throughout the supply chain — from product conception to consumption. Why should U.S. taxpayers underwrite — and U.S. policymakers promote — the interests of exporters, anyway, when the benefits of those efforts accrue, primarily, to the shareholders of the companies enjoying the subsidized marketing or matchmaking? There is no national ownership of private export revenues. And the relationship between revenues (domestic or export) and jobs is today more tenuous than in years past.

Globalization means that companies have growing options with respect to where and how they produce. So governments must compete for investment and talent, which both tend to flow to jurisdictions where the rule of law is clear and abided; where there is greater certainty to the business and political climate; where the specter of asset expropriation is negligible; where physical and administrative infrastructure is in good shape; where the local work force is productive; where there are limited physical, political, and administrative frictions; and so on.

The crucial question for U.S. policymakers is: why not focus on reforms that make the U.S. economy a more attractive location for both domestic and foreign investment?

Relative to attracting domestic investment, export promotion is a circuitous and uncertain path to economic growth and job creation. If policymakers seek a more appropriate target for economic policy, it should be attracting and retaining investment, which is the seed of all economic activity, including exporting.

What is the impact on the U.S. economy of U.S. Trade Promotion Agencies, specifically the Export-Import bank?

According to the Congressional Research Service, there are approximately 20 federal government agencies involved in supporting U.S. exports, either directly or indirectly. Among the nine key agencies with programs or activities directly related to export promotion are the Department of Agriculture, the Department of Commerce, the Department of State, the Department of the Treasury, the Office of the U.S. Trade Representative, the Small Business Administration, and the three agencies that are the subject of this hearing: the Export-Import Bank, the Overseas Private Investment Corporation, and the U.S. Trade and Development Agency.

The mission of the Ex-Im is “to support American jobs by facilitating the export of U.S. goods and services.” OPIC’s mission is “to [mobilize] private capital to help solve critical development challenges and in doing so, [advance] U.S. foreign policy and national security objectives.” The U.S. Trade and Development Agency’s mission is to “[help] companies create U.S. jobs through the export of U.S. goods and services for priority development projects in emerging economies.”

Although the three subject agencies have slightly different missions, each uses U.S. export sales supported as its chief success metric. Given the exalted status of exports in Washington’s economic policy narrative, it is understandable why agencies would want to portray themselves as indispensable to U.S. export success. It’s a reasonable survival strategy. But on the metric of contribution to export success, none of these agencies is scarcely relevant. Ex-Im supported $27.4 billion in exports in 20145; USTDA supported approximately $2.5 billion6; and, OPIC supported less than $2 billion7.

In aggregate, these three agencies “support” less than 2 percent of all U.S. exports. Of course, $32 billion is nothing to sneeze at, but the implication that most, if not all, of those sales would never have happened in the absence of these federal middlemen agencies is unrealistic. But the relevant economic question is not whether these agencies support U.S. exports. That’s the political question. The relevant economic question concerns the costs and benefits of these agencies to the U.S. economy.

Supporters of Ex-Im and OPIC limit their analyses to the impact their agencies’ operations have on taxpayers. In recent years, both programs have generated positive returns to the Treasury, but their myopic focus doesn’t come close to approximating the appropriate cost-benefit analysis.

The remainder of these written remarks will be devoted to the Export-Import Bank, which I have studied more closely and for which I have recent data. Moreover, the problems identified below are generally problems associated with the other agencies, as well. Namely, while the benefits of each program’s activities are visible (the value of exports supported, projects financed, insurance policies underwritten), the costs imposed on non-beneficiaries go unseen — or at least unacknowledged by Ex-Im and its supporters. Identifying and quantifying those costs are necessary to measuring the net benefits of the respective programs.

Ex-Im supporters claim that the bank fills a void left by private sector lenders unwilling to finance certain riskier transactions and, by doing so, contributes importantly to U.S. export and job growth. Moreover, rather than burden taxpayers, the Bank generates profits for the Treasury, helps small businesses succeed abroad, encourages exports of “green” goods, contributes to development in sub-Saharan Africa, and helps “level the playing field” for U.S. companies competing in export markets with foreign companies supported by their own governments’ generous export financing programs. So what’s not to like about Ex-Im?

First, by dismissing the risk assessments of private-sector, profit-maximizing financial firms and making lending decisions based on nonmarket criteria to pursue often opaque, political objectives, Ex-Im misallocates resources and puts taxpayer dollars at risk. That Ex-Im is currently self-financing and generating revenues is entirely beside the point. Ex-Im’s revenue stream depends on whether foreign borrowers are willing and able to service their loans, which is a function of global economic conditions beyond the control of Ex-Im. Given the large concentration of aircraft loans in its portfolio, for example, Ex-Im is heavily exposed to the consequences of a decline in demand for air travel. Recall that Fannie Mae and Freddie Mac also showed book profits for years until the housing market suddenly crashed and taxpayers were left holding the bag.

Second, even if taxpayers had tolerance for such risk taking, the claim that Ex-Im exists to help small businesses is belied by the fact that most of Ex-Im’s loan portfolio value is concentrated among a handful of large U.S. companies. In 2013, roughly 75 percent of the value of Ex-Im loans, guarantees, and insurance were granted on behalf of 10 large companies, including Boeing, General Electric, Dow Chemical, Bechtel, and Caterpillar.

Third, the claim that U.S. exporters need assistance with financing to “level the playing field” with China and others doesn’t square with the fact that the United States is a major export credit subsidizer that has been engaged in doling out such largesse since well before the founding of the People’s Republic of China. It implies the United States is helpless at the task of reining in these subsidies. And it implies the United States lacks enormous advantages among the multitude of factors that inform the purchasing decision. But, somehow, 98 percent of U.S. export value is sold without the assistance of trade promotion agencies.

Fourth, and perhaps most importantly, by trying to “level the playing field” with foreign companies backed by their own governments, Ex-Im “unlevels” the playing field for many more U.S. companies competing at home and abroad. This adverse effect has been ignored, downplayed, or mischaracterized, but the collateral damage is substantial and should be a central part of the story.

A proper accounting reveals that Ex-Im’s practices impose significant costs on manufacturing firms across every industry and in every U.S. state. When Ex-Im provides financing to a U.S. company’s foreign customer on terms more favorable than he can secure elsewhere, it may be facilitating a transaction that would not otherwise occur. That is the basis for Ex-Im’s claim that it helps the U.S. economy by increasing exports and “supporting” jobs. But the claim is questionable because those resources might have created more value or more jobs if deployed in the private sector instead. If that is the case, Ex-Im’s transaction imposes a net loss on the economy. But suppose it could be demonstrated that Ex-Im transactions grow the economy larger or create more jobs than if those resources had been deployed in the private sector instead.

Would Ex-Im then be correct in its claim? No. Further analysis is required.

Ex-Im financing helps two sets of companies (in the short-run): U.S. firms whose export prices are subsidized by below market rate financing and the foreign firms who purchase those subsidized exports. It stands to reason, then, that those same transactions might impose costs on two different sets of companies: competing U.S. firms in the same industry who do not get Ex-Im backing, and U.S. firms in downstream industries, whose foreign competition is now benefiting from reduced capital costs courtesy of U.S. government subsidies. While Ex-Im financing reduces the cost of doing business for the lucky U.S. exporter and reduces the cost of capital for his foreign customer, it hurts U.S. competitors of the U.S. exporter, as well as U.S. competitors of his foreign customer by putting them at relative cost disadvantages.

These effects are neither theoretical nor difficult to comprehend. Yet proponents of Ex-Im reauthorization rarely acknowledge, let alone concede, that these are real costs pertinent to any legitimate net benefits calculation. Instead, they speak only of the gross benefits of export subsidies, which they consider to be the value of exports supported by their authorizations.

But there are at least three sets of costs that are essential to determining the net benefits of Ex-Im:

- the “Opportunity Cost,” represented by the export growth that would have obtained had Ex-Im’s resources been deployed in the private sector;

- the “Intra-Industry Cost,” represented by the relative cost disadvantage imposed on the other U.S. firms in the same industry (the domestic competitors) as a result of Ex-Im’s subsidies to a particular firm in the industry, and;

- the “Downstream Industry Cost,” represented by the relative cost disadvantage imposed on the U.S. competitors of the subsidized foreign customer.

Opportunity Cost is difficult to estimate, but suffice it to recognize that opportunity costs exist. Indeed, opportunity costs exist whenever there are foregone alternatives to the path chosen.

The Intra-Industry Cost is somewhat easier to calculate, in theory. If Ex-Im provides a $50 million loan to a foreign farm equipment manufacturer to purchase steel from U.S. Steel Corporation, the transaction may benefit U.S. Steel, but it hurts competitors like Nucor, Steel Dynamics, AK Steel, and dozens of other steel firms operating in the United States and competing for the same customers at home and abroad. The $50 million subsidy to U.S. Steel is a cost to the other firms in the industry, who can attribute a $50 million revenue gap between them (aggregated) and U.S. Steel to a government intervention that picked a winner and made them, relatively speaking, losers. The $50 million “benefit” for U.S. Steel is a $50 million cost to the other steel firms.

But then that distortion is compounded when taking into consideration the dynamics that would have played out had the best firm — the one offering the most value for the best price — secured that export deal instead. Reaching revenue targets, raising capital, and moving down the production cost curve to generate lower unit costs all become more difficult to achieve on account of the original intervention, amplifying the adverse impact on other firms in the industry.

When government intervenes with subsidies that tilt the playing field in favor of a particular firm, it simultaneously penalizes the other firms in the industry and changes the competitive industry dynamics going forward. Every Ex-Im transaction touted as boosting U.S. exports creates victims within the same U.S. industry. Without Ex-Im’s intervention, Nucor might have been able to win that foreign farm equipment producer’s business, which is a prospect that undermines the premise that Ex-Im boosts exports at all and reinforces the point that it merely shifts resources around without creating value, possibly destroying value instead. What is given to U.S. steel is taken from Nucor and the other firms, among whom may be the more efficient producers.

The Downstream Industry costs are those imposed by the transaction on the U.S. companies that compete with the foreign customer. When a foreign farm machinery producer purchases steel on credit at subsidized interest rates, it obtains an advantage over its competitors — including its U.S. competitors. So, when that subsidized rate comes courtesy of a U.S. government program committed to increasing U.S. exports, it only seems reasonable to consider the effects on firms in downstream U.S. industries before claiming the program a success: Has the subsidy to the foreign farm machinery producer made John Deere, Caterpillar, New Holland, or other U.S. farm machinery producers less competitive? Has it hurt their bottom lines?

Delta Airlines has been vocal in its objection to Ex-Im-facilitated sales of Boeing jetliners to foreign carriers, such as Air India. Delta rightly complains that the U.S. government, as a matter of policy, is subsidizing Delta’s foreign competition by reducing Air India’s cost of capital. That cost reduction enables Air India to offer lower prices in its bid to compete for passengers, which has a direct impact on Delta’s bottom line. This is a legitimate concern and it is not limited to this example.

Consider the generic case. A U.S. supplier sells to both U.S. and foreign customers. Those customers compete in the same downstream industry in the U.S. and foreign markets. Ex-Im is happy to provide financing to facilitate the sale, as its mission is to increase exports and create jobs. The U.S. supplier is thrilled that Ex-Im is providing his foreign customer with cheap credit because it spares him from having to offer a lower price or from sweetening the deal in some other way to win the business. The foreign customer is happy to accept the advantageous financing for a variety of reasons, among which is the fact that his capital costs are now lower relative to what they would have been and relative to the costs of his competitors — including his U.S. competitors, who are now on the outside looking in. Ex-Im helps some U.S. companies increase their exports sales. But it hinders other U.S. companies’ efforts to compete at home and abroad.

Moreover, by subsidizing export sales, Ex-Im artificially diverts domestic supply, possibly causing U.S. prices to rise and rendering U.S. customers less important to their U.S. suppliers. Especially in industries where there are few producers, numerous customers, and limited substitute products, Ex-Im disrupts the relationships between U.S. buyers and U.S. sellers by infusing the latter with greater market power and leverage. Delta was able to connect the dots. Other companies have, too. But most of the time, the downstream U.S. companies are unwitting victims of this silent cost-shifting.

According to the findings in a recent Cato Institute study that I authored, the downstream costs alone amount to a tax of approximately $2.8 billion every year.8 The victims of this shell game include companies in each of the 21 broad U.S. manufacturing industry classifications used by the government to compile statistics. And they are scattered across the country in every state. Among the stealthily taxed were companies such as Western Digital and Seagate Technologies — two California-based computer storage device producers that employ 125,000 workers; Chicago-based Schneider Electric Holdings, which employs 23,000 workers in the manufacture of environmental control products, and; ViaSystems, a St. Louis-based printed circuit board producer with 12,000 employees. These companies haven’t received Ex-Im subsidies, but companies in their supplier industries have, which effectively lowers the costs of their foreign competitors.

While it is relatively easy for a big company like Delta to connect the dots and see that Boeing is being favored at its expense (airplanes constitute a large share of Delta’s total costs), most manufacturing companies are unaware that they are shouldering the costs of government subsidies to their own competitors. But the victims include big and small producers — of electrical equipment, appliances, furniture, food, chemicals, computers, electronics, plastics and rubber products, paper, metal, textiles — from across the country. Companies producing telecommunications equipment incur an estimated collective tax of $125 million per year.

The industries in which companies bear the greatest burdens — where the costs of Ex-Im’s subsidies to foreign competitors are the highest — are of vital importance to the manufacturing economies of most states. In Oregon, Delaware, Idaho, New Jersey, Nevada, and Maryland, the 10 industries shouldering the greatest costs account for at least 80 percent of the state’s manufacturing output. The most important industry is among the ten most burdened by these costs in 33 of 50 states. The chemical industry, which bears a cost of $107 million per year, is the largest manufacturing industry in 12 states.

For all the praise Ex-Im heaps upon itself for its role as a costless pillar of the economy, it is difficult to make sense of the collateral damage left in its wake. Thousands of U.S. companies would be better off if Ex-Im’s charter were allowed to expire, as scheduled, on June 30.

What to do about foreign governments’ trade promotion agencies?

Of all of the arguments put forward by Ex-Im supporters, the “leveling the playing field” rationale is the most difficult to dispense with. It is appealing intuitively. But the implication that the United States is an innocent party that has no choice but to follow suit is laughable. The United States invented this stuff.

The notion that because Beijing, Brasilia, and Brussels subsidize their exporters Washington must, too, is a rationalization that sweeps under the rug the fact that there are dozens of criteria that feed into the ultimate purchasing decision, including product quality, price, producer’s reputation, local investment and employment opportunities created by the sale, warranties, aftermarket servicing, and the extent to which the transaction contributes toward building a long-term relationship between buyer and seller. To say that U.S. exporters need assistance with financing to “level the playing field” suggests that they lack advantages among the multitude of factors that inform the purchasing decision. Moreover, the fact that less than 2 percent of U.S. export value goes through export promotion agencies suggests this rationale for Ex-Im is bogus. If the offer of cheap financing is the determining factor in these international transactions, what is to stop a growing number of inefficient low-quality producers from contesting these markets with ever-increasing subsidies from their own governments? U.S. companies and the taxpayers that would support them would be better off not competing for business in these markets if the key to winning foreign customers is participating in an endless subsidies race.

There is a way to end the madness. The United States should allow Ex-Im to expire at the end of next month and then announce plans to bring cases to the World Trade Organization against governments operating their export credit agencies in violation of agreed-upon limits under the Agreement on Subsidies and Countervailing Measures. The combination of the carrot of U.S. withdrawal from the business of export credit financing and the stick of WTO litigation would likely incent other governments to reduce, and possibly eliminate, their own subsidy programs.

The Relationship between the Export-Import Bank and U.S. foreign policy

For better or worse, at different times and for different purposes over the years, U.S. trade policy has been a tool of U.S. foreign policy. Trade preference programs, trade agreements, the TransPacific Partnership, investment treaties, trade sanctions, infrastructure funding, and trade financing have all been pursued or deployed for reasons not entirely economic in nature.

Pursuing strategic objectives through trade policy has a long history. Certainly, one of the rationales for preserving the Export-Import Bank is that it provides the U.S. government some leverage to influence policies or actions abroad and to monitor and possibly counter strategic investments underwritten by other foreign governments. That may be true. And there may be convincing evidence to demonstrate that these considerations warrant one or two export promotion agencies. But there are at least 20 such agencies within the U.S. government with overlapping responsibilities and, in some cases, working at cross purposes.

Despite the rhetoric of U.S. decline, the United States maintains enormous commercial advantages over other countries. We have the world’s largest market; strong institutions, including respect for private property and the rule of law; relatively free markets; a highly educated and productive workforce; the world’s best research institutions; a society that encourages innovation and produces deep and broad capital markets to fund it. From these commercial advantages comes security and strength, so it is important that we maintain and build on those advantages.

By subsidizing the export sales of generally large U.S. multinational corporations, Ex-Im’s policies penalize the smaller, dynamic, up-and-coming businesses that are the well springs of new ideas, better mousetraps, and smarter business practices that will spawn subsequent generations of businesses in perpetuity. That process underlies the strength of the U.S. economy, which is crucial to reaching U.S. security and foreign policy goals going forward. On the other hand, U.S. economic strength is undermined when subsidies are deployed in a spiraling race with other nations to the detriment of the next crop of leading U.S. businesses.

Notes:

1 Data from the U.S. Bureau of Economic Analysis

2 Data from the U.S. Bureau of Economic Analysis and the U.S. Bureau of Labor Statistics

3 Bureau of Economic Analysis, U.S. International Trade in Goods and Services, Exhibit 6. U.S. Exports and Imports of Goods by Principal End-Use Category, February 2015, http://www.bea.gov/newsreleases/international/trade/tradnewsrelease.htm

4 Daniel Ikenson, “Economic Self-Flagellation: How U.S. Antidumping Policy Subverts the National Export Initiative,” Cato Trade Policy Analysis No. 46, May 31, 2011, https://www.cato.org/publications/trade-policy-analysis/economic-selffl….

5 http://www.exim.gov/about/facts-about-ex-im-bank.

6 http://www.ustda.gov/about/ataglance.asp.

7 https://www.opic.gov/who-we-are/overview.

8 Daniel Ikenson, “The Export-Import Bank and Its Victims: Which Industries and States Bear the Brunt?” Policy Analysis No. 756, September 10, 2014, https://www.cato.org/publications/policy-analysis/export-import-bank-it….

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.