Mr. Chairman and members of the committee, thank you for inviting me to testify. My comments will examine the history of federal debt and reasons to balance the budget and reduce debt going forward.

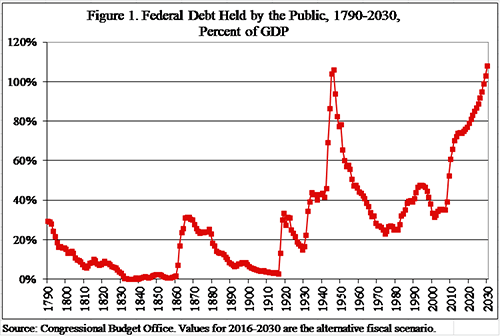

Looking at federal debt compared to the size of the economy since 1790, today's level is remarkably high. During peacetime, federal debt has never been nearly as high as it is today. Federal debt has often spiked during wars, but has always been cut dramatically afterwards.

Before the 1930s, policymakers strongly believed that high debt was immoral and bad for the economy. Those beliefs kept in check the basic political incentive to spend more than the available revenue. But in recent decades, Keynesian theory has informed policymakers that deficit spending is beneficial, while automatic growth in entitlement programs has allowed policymakers to sidestep responsibility for rising spending.

However, federal borrowing imposes an unfair burden on future generations, and it should be avoided except during major crises such as wars. Cutting spending to balance the budget would reduce the damage from future taxes, increase macroeconomic stability, and potentially increase capital formation. Ending deficit spending would also spur economic growth by leaving more resources in the productive private sector.

Small Government and Fiscal Prudence, 1790-1930

America was born with a substantial load of government debt, which had been issued to finance the Revolutionary War. Following Alexander Hamilton's plan, Congress transferred state debts to the federal government in 1790, creating a total federal debt of $75 million. Hamilton and the Federalists were in no rush to pay down the debt, and by the end of the John Adams administration in 1800, it had edged up to $83 million.

Thomas Jefferson assumed the presidency in 1801 promising to end internal taxes, restrain spending, and pay down the debt. In a 1799 letter to Elbridge Gerry, Jefferson said, "I am for a government rigorously frugal & simple, applying all the possible savings of the public revenue to the discharge of the national debt."1 Jefferson followed through on his promises with the help of his Treasury Secretary Albert Gallatin. They kept total spending roughly flat, and were able to pay down a substantial part of the debt, even with the added borrowing for the Louisiana Purchase.

Federal debt soared during the War of 1812, but soon afterwards political leaders began focusing on the goal of being "wholly free" of debt.22 By the James Monroe administration, debt was starting to fall as the government began running surpluses in most years. In his final state of the union message, Monroe said that the debt could be fully paid off by 1835.

That prospect caught the imagination of many leaders who believed in the moral and practical benefits of debt freedom. They associated government debt with corruption and the erosion of liberty. Debt freedom was also favored by the public, which strongly supported frugality in the federal government.3

With policymakers focused on debt elimination, numerous efforts to expand spending during the 1820s and 1830s were foiled. Some members of Congress — such as Henry Clay of Kentucky — wanted the government to fund "internal improvements." President John Quincy Adams had grand plans to fund roads, canals, a national university, and many other items. But such spending plans conflicted with the goal of debt freedom, and they were blocked in Congress. Opposition to spending came from members such as Martin Van Buren of New York and John Randolph of Virginia.

Adams was replaced in 1829 by Andrew Jackson, who was a firm believer in debt freedom. In his first inaugural address, he promised "extinguishment of the national debt, the unnecessary duration of which is incompatible with real independence." Jackson succeeded in his goal, making the period from 1835 to 1837 the only time in our history that the government has been debt-free.4 Unfortunately, borrowing resumed when the economy plunged into recession after the Panic of 1837.

Figure 1 shows federal debt as a share of gross domestic product (GDP) back to 1790.5 Debt fell from 30 percent of GDP in 1790 to 6 percent by 1811, but then rose to 10 percent during the War of 1812. Debt then declined for two decades to reach zero by 1835. The measure of debt used in this testimony is "debt held by the public."

After the economy recovered, Congress began running surpluses again in many years, and debt remained below 3 percent of GDP all the way to the Civil War. The war caused debt to spike to 31 percent of GDP, but then the Jeffersonian tradition reasserted itself, and policymakers steadily reduced debt to 3 percent of GDP by the beginning of World War I. The government balanced its budget every single year from 1866 to 1893.

Debt peaked at 33 percent of GDP in 1919 as a result of the war, but was then reduced once again under Presidents Warren Harding and Calvin Coolidge. The 1920s were the final chapter of the Jeffersonian anti-debt tradition, which had been part of America's unwritten "fiscal constitution," as numerous scholars have called it.6

Big Government and Keynesianism Imprudence, 1930-2015

In his generally superb 2014 book, America's Fiscal Constitution, Texas Democrat and financial executive Bill White argued that the anti-deficit stance of federal policymakers lasted from 1790 through to Bill Clinton's presidency, but then "collapsed" during the presidency of George W. Bush.7 It is true that Bush presided over deficits and increased spending, but so have many presidents and congresses since the Herbert Hoover years. So White's timing is off: the real dividing line in America's fiscal history was the 1930s.

Democracies have a built-in political bias toward deficit-financed spending. Policymakers gain more utility from increasing spending and cutting taxes than from balancing the budget. The deficit bias was kept in check during the nation's first 150 years by a strong anti-debt ethos, which had been supported by scholars, the general public, and most policymakers.

Two developments during the 1930s shifted the federal government strongly toward deficit spending. First, the creation of "entitlement" programs allowed for automatic spending increases without policymakers having to vote for them. Today, entitlement programs account for two-thirds of all noninterest federal spending.8

Second, the rise of Keynesianism in the decades after the 1930s informed policymakers that deficit spending was good for the economy. Nobel Prize-winning economist James M. Buchanan points his finger squarely at Keynesianism for the decline in beneficial "Victorian fiscal morality," which had constrained deficit spending.9 With the rise in Keynesianism, the "modern era of profligacy" was born, he said.10

The immediate cause of the debt spike in the 1930s and 1940s was the Great Depression and World War II. Federal debt peaked at 106 percent of GDP in 1946. But the importance of entitlements and Keynesianism to the budget process grew in subsequent decades, and since the 1970s those elements have paved the way for almost continuous deficit spending.

Figure 1 shows a sharp drop in the debt-to-GDP ratio following World War II. But most of that drop was not due to policymaker prudence. Note, for example, that the government ran deficits in 7 out of 10 years in the 1950s. Instead, strong economic growth in the decades following the war generated a falling debt ratio even as spending was growing.

In addition, the debt load was substantially reduced by inflation. Inflation reduces the real value of outstanding debt, imposing losses on debtholders. The ability to reduce the debt by inflation depends upon the debt's maturity and on whether creditors expect inflation. If the average maturity is long, the government can reduce the real debt load with an unexpected bout of inflation.

That is what happened following World War II. The federal debt-to-GDP ratio was cut almost in half between 1946 and 1955. Economists Joshua Aizenman and Nancy Marion found that nearly all that drop was due to inflation averaging 4.2 percent during that period combined with a long average federal debt maturity of 9 years.11

By the mid-1970s, the average maturity of federal debt had shrunk to 3 years, so the high inflation during that era resulted in less debt shrinkage.12 The debt-to-GDP ratio started rising again in the 1980s and peaked at 48 percent in the early 1990s. Debt fell during the late-1990s as a result of budget restraint and the economic boom.

During the past 15 years, restraint has been put aside, and debt has soared to 74 percent of GDP today. That is easily the highest debt level in our peacetime history. Under CBO's "alternative fiscal scenario," shown in Figure 1, debt is expected to rise to 108 percent by 2030. That would mean World War II levels of debt just 15 years from now.

Figure 2 shows that from 1791 to 1929, the federal government balanced its budget in 68 percent of the years.13 But from 1930 to 2015, the government balanced its budget in just 15 percent of the years.

The bipartisan belief that balancing the federal budget was morally proper and economically prudent disappeared after the 1930s. In his history of the Jackson-era effort to eliminate the federal debt, A Nation Wholly Free, Carl Lane concludes: "Debt freedom, Americans in the Jacksonian era believed, would improve the material quality of life in the United States. It would reduce taxes, increase disposable income, reduce the privileges of the creditor class, and, in general, generate greater equality as well as liberty."14 That is the type of sound fiscal thinking that we need to revive in Washington today.

The Problems with Government Debt

Over the decades, numerous economists and pundits have argued that federal debt does not matter very much because we "owe it to ourselves."15New York Times columnist Paul Krugman has repeatedly disparaged deficit-worriers, and argued that government debt is not at all like family debt. He urges us not to worry about hurting future generations because government debt is mainly "money we owe to ourselves."16

Krugman's argument misses the point, and fortunately it is a minority view. The Congressional Research Service says that "the current consensus among economists is that the burden of the national debt is largely shifted forward to future generations."17 High government debt will impose real pain on future taxpayers. And contrary to Krugman, the negative effects to families and the government of amassing debt for consumption spending are similar. Economist James Buchanan argued, "For citizens, the national debt is fully analogous to a private debt that has been incurred to finance a consumption spree in some past period."18

First consider a subsidy program financed by current taxes. There are two ways that such a policy would damage the economy:

- Spending Distortions. The subsidy would distort decisions by individuals and businesses, causing the misallocation of resources and a reduction in output. Welfare programs, for example, induce people to work less, while farm subsidies induce overproduction of some crops and underproduction of other more valuable crops. The harms from such distortions are called "deadweight losses."

- Tax Distortions. The taxes to fund the subsidy program may induce people to change their working, investing, and consumption activities. Those changes would create further deadweight losses. The deadweight loss from each dollar increase in federal income taxes is roughly 50 cents.19

If the government spends $10 billion on a new subsidy program, it may cost the private economy $15 billion when the deadweight losses of higher income taxes are included. If the program is inefficient, it may produce benefits of, say, $5 billion. That would create a 3-to-1 ratio of costs to benefits. Economist Edgar Browning examined the effects of federal tax and spending programs in his 2008 book, Stealing from Each Other. Overall, he concluded as a ballpark estimate, "it costs taxpayers $3 to provide a benefit worth $1 to recipients."20

Financing programs with borrowing rather than current taxes would create additional effects:

- More Spending Induced. The spending distortions (deadweight losses) from subsidy programs would be the same if they were debt-financed. But the availability of debt financing may induce policymakers to increase spending on low-value programs. Without a balanced-budget requirement, policymakers have less incentive to prune waste.

- Tax Damage Moved to Future. With borrowing, the tax distortions (deadweight losses) are moved to the future when the interest and principal on the debt are paid. With debt, the pain from funding federal programs is imposed on future taxpayers, which creates intergenerational inequities. Alternatively, governments may try to use inflation to reduce the real debt load, but that is also a form of taxation.

- Reduction in Investment. Government borrowing may reduce national saving, thus crowding out private investment, reducing the capital stock, and reducing future output and incomes.21 James Buchanan said, "By financing current public outlay by debt, we are, in effect, chopping up the apple trees for firewood, thereby reducing the yield of the orchard forever."22 A decline in investment may be partly averted if private saving rises to offset government deficits. 23 But the CBO concludes, "the rise in private saving is generally a good deal smaller than the increase in federal borrowing, so greater federal borrowing leads to less national saving."24

- Borrowing from Abroad. A decline in private investment as a result of government borrowing may be averted by net inflows of capital from abroad. In recent years, huge federal borrowing has been facilitated by global capital markets. As of December 2014, 48 percent ($6.2 trillion of $13 trillion) of federal debt was held by foreigners.25 Borrowing abroad may avert a fall in domestic investment, but it does not avert the shifting of debt costs to future generations. Some share of the future earnings of Americans will be taxed to pay the interest and principal on the debt to foreign creditors. For about half the federal debt, Americans do not "owe it to themselves."

- Macroeconomic Instability. CBO echoes many experts when it warns, "A large and continuously growing federal debt would … increase the likelihood of a fiscal crisis in the United States."26 High levels of government debt tend to result in lower growth and increased financial fragility in the global economy.27 In their study of hundreds of financial crises in history, Harvard professors Carmen Reinhart and Ken Rogoff conclude, "…again and again, countries, banks, individuals, and firms take on excessive debt in good times without enough awareness of the risks that will follow when the inevitable recession hits."28 Government debt, they find, "is certainly the most problematic, for it can accumulate massively and for long periods without being put in check by markets."

James Buchanan uses a simple story to illustrate the error in "we owe it to ourselves."29 Suppose a lender, L, lends $100 to a borrower, B, who spends it on consumption. L will have $100 less in cash but his "notes receivable" will go up $100. B has a liability of $100, but no asset since he has already spent the cash. Now let's say that L and B get married, and they combine their finances. B's liability and L's notes receivable cancel out. L and B "owed it to themselves" and the debt disappears.

However, the $100 that was spent in the first period and is now gone. If that money had been put into a productive investment, the married couple would now be $100 or more wealthier. So Buchanan argues that incurring debt "to finance current consumption will permanently decrease the flow of potentially available income."30

It is true that the future net burden of federal debt would be reduced if the borrowing is used for high-value capital investments. But experience shows that much federal investment is mismanaged by the bureaucracy and misallocated by politics. Just last week the Government Accountability Office reported on the government's $80 billion annual investment in information technology (IT), and it found that "investments frequently fail, incur cost overruns and schedule slippages, or contribute little to mission-related outcomes."31 The report's list of IT failures is remarkable, but not surprising. Many federal agencies have wasteful investment records, including the Army Corps of Engineers, Bureau of Reclamation, Federal Transit Administration, and Federal Aviation Administration.32

Finally, note that only a small share of federal spending consists of capital investment. Of the $3.7 trillion federal budget in 2015, the Office of Management and Budget counts just $125 billion (3 percent) as nondefense "major physical capital investments."33 Thus, the nearly $500 billion federal deficit this year was not caused by investment spending, but by massive consumption spending on benefit and subsidy programs.

Conclusions

Without major reforms, federal debt is expected to soar in coming years. CBO's "alternative scenario" shows that spending will grow from 20 percent today to 32 percent by 2040, while debt held by the public will grow from 74 percent to 170 percent.34

Those projections are disturbing enough, but they are optimistic for numerous reasons. In coming years, the United States may face unforeseen military challenges or endure another deep recession, which would increase deficits. Interest rates and other economic variables may not be as favorable as the CBO projects. Also, rising spending and debt will suppress economic growth, which is an effect not accounted for in CBO's basic scenarios after the first decade.

To meet our huge fiscal challenges, Congress should reform entitlement programs and cut spending in every department. Cuts will not be politically easy, which is why many policymakers and scholars over the decades have proposed new institutional restraints to encourage Congress to make tough decisions.

In 1798 Thomas Jefferson wrote, "I wish it were possible to obtain a single amendment to our constitution . . . I mean an additional article taking from the federal government the power of borrowing."35 In modern times, a Balanced Budget Amendment (BBA) has been advocated by James Buchanan and many other scholars. In 1982 the Senate passed a BBA, but it failed to gain two-thirds approval in the House. In 1995 a BBA passed the House, but failed in the Senate.

A BBA would be a good reform, but a superior restraint might be a cap on the annual growth in total federal outlays. Congress directly controls spending, not deficits, so spending is a better target for a legal limit. Policymakers should consider either a statutory or constitutional cap to limit annual outlay growth to the growth in a chosen economic variable, such as output or incomes.36

In sum, Thomas Jefferson was right that, "the multiplication of public offices, increase of expense beyond income, growth and entailment of a public debt, are indications soliciting the employment of the pruning-knife."37

Thank you for holding these important hearings.

Notes:

1 Thomas Jefferson, Letter to Elbridge Gerry, January 26, 1799.

22 Carl Lane, A Nation Wholly Free: The Elimination of the National Debt in the Age of Jackson (Yardley, PA: Westholme Publishing, 2014). Reviewed in Chris Edwards, Cato Journal, Spring-Summer 2015.

3 Carl Lane, A Nation Wholly Free: The Elimination of the National Debt in the Age of Jackson (Yardley, PA: Westholme Publishing, 2014).

4 Carl Lane, A Nation Wholly Free: The Elimination of the National Debt in the Age of Jackson (Yardley, PA: Westholme Publishing, 2014).

5 Congressional Budget Office, "Historical Data on the Federal Debt," July 2010. Since historical GDP has been revised since this CBO study, I've used updated data for recent decades.

6 Economists Richard Wagner and Robert Tollison, for example, say that during America's first 150 years, the prevailing fiscal ethos to balance the budget and cut debt "constituted an unwritten element of our Constitution." Richard E. Wagner and Robert D. Tollison, Balanced Budgets, Fiscal Responsibility, and the Constitution (Washington: Cato Institute, 1982), p. 7.

7 Bill White, America's Fiscal Constitution (New York: Public Affairs, 2014).

8 Congressional Budget Office, "Updated Budget Projections: 2015 to 2025," March 2015.

9 James M. Buchanan, Liberty, Market, and State (New York: New York University Press, 1986), p. 191.

10 James M. Buchanan, Liberty, Market, and State (New York: New York University Press, 1986), p. 196.

11 Joshua Aizenman and Nancy P. Marion, "Using Inflation to Erode the U.S. Public Debt," National Bureau of Economic Research, Working Paper no. 15562, December 2009.

12 Joshua Aizenman and Nancy P. Marion, "Using Inflation to Erode the U.S. Public Debt," National Bureau of Economic Research, Working Paper no. 15562, December 2009.

13 Author's calculations .

14 Carl Lane, A Nation Wholly Free: The Elimination of the National Debt in the Age of Jackson (Yardley, PA: Westholme Publishing, 2014).

15 The we "owe it to ourselves" view is identified with economist Abba Lerner writing in the mid-20th century. See Jerry H. Tempelman, "James M. Buchanan on Public-Debt Finance," Independent Review, Winter 2007.

16 Paul Krugman, "Nobody Understands Debt," New York Times, January 1, 2012. Paul Krugman, "Debt Is Money We Owe to Ourselves," New York Times, February 6, 2015. Paul Krugman, "Nobody Understands Debt," New York Times, February 9, 2015.

17 Marc Labonte and Gail E. Makinen, "The National Debt: Who Bears Its Burden?" Congressional Research Service, May 1, 2003.

18 James M. Buchanan, Liberty, Market, and State (New York: New York University Press, 1986), p. 198.

19 Christopher J. Conover, "Congress Should Account for the Excess Burden of Taxation," Cato Institute Policy Analysis no. 669, October 13, 2010. See also Edgar K. Browning, Stealing from Each Other (Westport, CT: Praeger Publishers, 2008). And see Martin Feldstein, "How Big Should Government Be?" National Tax Journal, June 1997.

20 Edgar K. Browning, Stealing from Each Other (Westport, CT: Praeger Publishers, 2008), p. 179.

21 CBO says, "Increased borrowing by the federal government generally draws money away from (that is, crowds out) private investment in productive capital in the long term because the portion of people's savings used to buy government securities is not available to finance private investment. The result is a smaller stock of capital and lower output in the long term than would otherwise be the case (all else held equal)." See Congressional Budget Office, "The 2014 Long-Term Budget Outlook," July 2014, p. 72.

22 Quoted in Jerry H. Tempelman, "James M. Buchanan on Public-Debt Finance," Independent Review, Winter 2007.

23 Economist Robert Barro revived interest in "Ricardian Equivalence." He argued that increases in government borrowing would be matched by increases in private saving as individuals looked ahead and sought to offset future taxes. For a discussion, see Robert P. O'Quinn, "Fiscal Policy Choices: Examining the Empirical Evidence," Joint Economic Committee, November 2001. See also Alan Reynolds, "Deficits, Interest Rates, and Taxes," Cato Institute Policy Analysis no. 517, June 29, 2004.

24 Congressional Budget Office, "The 2014 Long-Term Budget Outlook," July 2014, p. 72.

25 Marc Labonte and Jared C. Nagel, "Foreign Holdings of Federal Debt," Congressional Research Service, May 28, 2015.

26 Congressional Budget Office, "The 2014 Long-Term Budget Outlook," July 2014, p. 14.

27 Stephen Cecchetti, M.S. Mohanty, and Fabrizio Zampolli, "The Real Effects of Debt," Bureau for International Settlements, September 2011. And see Carmen Reinhart and Kenneth Rogoff, "A Decade of Debt," National Bureau of Economic Research, Working Paper 16827, February 2011.

28 Carmen M. Reinhart and Kenneth S. Rogoff, This Time is Different: Eight Centuries of Financial Folly (Princeton: Princeton University Press, 2009), p. xxxiii.

29 This example follows loosely James M. Buchanan, Liberty, Market, and State (New York: New York University Press, 1986), p. 202.

30 James M. Buchanan, Liberty, Market, and State (New York: New York University Press, 1986), p. 215.

31 The GAO report is linked at Chris Edwards, "Federal Technology Follies," Cato Institute, June 11, 2015, www.cato.org/blog/federal-technology-failures.

32 See essays at www.DownsizingGovernment.org.

33Budget of the U.S. Government, FY2016, Historical Tables, Table 9.2.

34 Congressional Budget Office, "The 2014 Long-Term Budget Outlook," July 2014.

35 Thomas Jefferson, Letter to John Taylor, November 26, 1798.

36 Possible economic variables for a cap are GDP, personal income, the sum of inflation plus population growth, or a fixed nominal percent. The cap amount should be the average growth over the prior five years or so. See Chris Edwards, "Federal Budget Cap at 3%," Cato Institute, March 9, 2011.

37 Thomas Jefferson, Letter to Spencer Roane, March 9, 1821.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.