Executive Summary

Growing numbers of legislators and policy experts charge that tech firms such as Amazon, Google, Facebook, Apple, and Microsoft are “monopolies,” with the potential power to harm consumers.

Many economists, lawyers, and politicians say that economic features of these companies’ product markets—such as network effects, economies of scale, data collection, tying of complementary goods, or operating online marketplaces—create unfair competition or insurmountable entry barriers for new competitors. They conclude that “forward-looking” antitrust policy is needed to prevent persistent market dominance from undermining consumer welfare.

Economist Joseph Schumpeter warned against such monopoly fatalism. He recognized that the most important long-term competitive pressure comes from new products cannibalizing incumbent businesses through marked product quality improvements. An antitrust policy that second-guesses the future based on the present ignores this unpredictable margin of competition, to the detriment of consumers.

Over the past century, large businesses operating in industries similar to today’s tech firms were regularly labeled as unassailable monopolies. Retailers, social networks, mobile phone producers, camera manufacturers, and internet browser and search engine companies have all been thought likely to dominate their sectors perpetually, based on similar economic reasoning to that heard about tech companies today.

Yet historical case studies of the Great Atlantic and Pacific Tea Company, Myspace, Nokia, Kodak, Apple’s iTunes, Microsoft’s Internet Explorer, and more show that none of these features ensured continued dominance. All these businesses saw their market shares disintegrate in the face of innovative new products and companies, as Schumpeter theorized.

This suggests that we should be extremely skeptical about predictions of entrenched monopoly power for Amazon, Google, Facebook, Apple, and Microsoft today. Basing antitrust policy on overcoming market features that “tip” markets toward one-firm dominance or legislating to prevent highly speculative “future harms” is a fool’s errand.

Introduction

Tech firms such as Amazon, Google, Facebook, Apple, and Microsoft are regularly and pejoratively referred to as “monopolies”—implying that their dominance harms consumers.1

Economists find the certainty of such pronouncements troubling.

The companies are no doubt extremely valuable (see Table 1). But they have become profitable by offering free or inexpensive high-quality products popular with users and customers.2 The businesses generate vast amounts of consumer surplus, and their true value is undercounted in conventional GDP estimates.3

Even assessing whether the companies have dominant positions is difficult, because this largely depends on how one defines the relevant market. Is Google, for example, competing in the market for advertising revenue, digital advertising revenue, or user search engines? Is Facebook an advertising space seller or a social network? Is Amazon a retailer in individual product lines, an online digital retailer, a marketplace platform, or all three?

The broad sectors in which the firms operate appear contestable over long periods, with dynamic innovation and competition.4 But economic phenomena, such as network effects, economies of scale, and access to extensive data, can create “winner-take-all” markets that tip toward one company being persistently successful for a period.5 Even in sectors or subsectors where the firms appear to have very high market shares, then, it’s unclear whether this is an efficient outcome given available technologies, or something that poses a genuine future threat to consumers.

What we know for certain is that these tech companies engage in extensive research and development spending and are continually diversifying into new product markets.6 All regularly outline their fears of being disrupted by insurgent firms and technologies. They compete with one another in serving nonconsumers or the low ends of markets.7 None of this behavior would be expected from entrenched monopolies planning to harm consumer welfare.

Nevertheless, the tech firms occupy “psychological monopoly” status in our political discourse. Commentators seem unable to perceive the possibility of viable substitutes or competitors to the firms at a similar scale either now or in the future.8 Many lawmakers, lawyers, economists, and commentators worry that the large size, value, and extensive conglomerate-like activity of these companies brings a future threat of higher prices, less innovation, and worse customer experiences if left untouched by antitrust authorities.

In her influential article, “Amazon’s Antitrust Paradox,” lawyer Lina Khan explicitly argues that “the current market is not always a good indication of competitive harm” and that antitrust authorities should “ask what the future market will look like.”9 In particular, Khan worries that the current “consumer welfare standard” interpretation of antitrust law—focusing on the short-term quality, price, and output effects of firm behavior—cannot capture the potential longer-term harm to consumers. Given the future advantages of building a large network or an online intermediary platform, Khan believes companies such as Amazon have an incentive to pursue growth over near-term profits. The result is that they deliver what looks like a great service in a contemporary sense, but their dominance can undermine the competitive process in the long run. This need for antitrust or competition policy to be forward looking was recently echoed by economist Jason Furman in a digital competition review for the UK government.10

It is beyond the scope of this analysis to critique Khan’s work, or indeed the broader intellectual movement pushing for antitrust policy to consider a host of other policy objectives, including but not limited to “rising inequality, employee wage concerns, and the concentration of political power.”11 Much of the current debate is baffling, with different schools arguing about how to interpret existing laws rather than determining what the law should be from first principles. Instead, this paper will limit its focus to one aspect: the call for antitrust policy to be forward looking.

Given that a quarter century ago Facebook, Google, and Amazon did not even exist, such a task is unenviable. As the great Austrian political economist Joseph Schumpeter argued, it is difficult to predict future developments of companies and technologies. The only way to properly judge the effectiveness of market capitalism and associated policy is to review it retrospectively. In Capitalism, Socialism, and Democracy, Schumpeter writes, for example:12

Since we are dealing with a process whose every element takes considerable time in revealing its true features and ultimate effects, there is no point in appraising the performance of that process ex visu [from its appearance] of a given point of time; we must judge its performance over time, as it unfolds through decades or centuries.

Schumpeter is famous for coining the term “creative destruction” to describe the process through which firms innovate to capture consumers, in turn achieving market share, only to be eventually usurped themselves. Too often, he argues, we think about market competition too statically. We utilize a textbook understanding of it—a notion of similar firms competing for sales of largely undifferentiated products. Schumpeter recognized that what really drives the economy over time is the development of “the new commodity, the new type of organization—competition which commands a decisive cost or quality advantage and which strikes not at the margins of the profits and the outputs of the existing firms but at their foundations and their very lives.“13

The rest of this paper uses Schumpeter’s astute observations and historical examples to warn against monopoly or technological fatalism in relation to tech firms today.

Looking back over the past century, it reviews case studies of businesses in industries related to today’s tech giants (retail, social networks, mobile, photography, music, browsers and search engines), themselves widely considered unassailable “monopolies” or potential monopolies, that in some cases faced resultant antitrust lawsuits or investigations. In many of the examples, there are uncanny parallels in the economic arguments used to justify policy action. Problems identified include the supposedly insurmountable barriers created by network effects, economies of scale, predatory pricing, bundling the sale of a product to a complementary good (tying), or a company’s acting as an intermediary marketplace for competitors to its own products. In every case, the monopoly pessimism associated with these claims ultimately proved ill founded: new technological innovations or rival competitors with differentiated products knocked the firms from their supposedly dominant position.

When it comes to industrial change, past performance is not necessarily an accurate guide to future outcomes. This time the tech firms might buck historical trends, as Furman argues, owing to their scale, the enhanced ease of data collection, and their acquisition strategies. But historical research suggests that press coverage of the emergence of supposed monopolies is much more extensive than that of the same businesses’ disappearance.14 The past century is replete with warnings of “this time is different.” Fears of entrenched monopoly power echo through time, often using near-identical arguments to those used against the tech giants today.

The Great Atlantic and Pacific Tea Company (A&P)

The Great Atlantic and Pacific Tea Company—A&P—was the Amazon of its day.15 The company revolutionized retail, disrupting the grocery sector into the chainstore model that evolved into the modern supermarket. In doing so, it was accused of all the charges currently leveled at Jeff Bezos’s tech company. This included accusations it was harming local economies by usurping sole-proprietor retailers, engaging in predatory price cutting, giving preference to its own products over those of rivals within its marketplace, and exacting “unfair” monopsony pressure on wholesalers and suppliers.

In the 19th and very early 20th centuries, customers purchased their groceries from small, independent (often specialist) retailers, such as butchers and bakers. Goods were usually sold on credit and often delivered to customers, having been obtained wholesale by retailers from (often corrupt) jobbers and middlemen. This low-volume, high-cost, expensive distribution model meant relatively high grocery prices for customers.

A&P completely overturned this. It standardized its stores and went about vertically integrating food production in areas such as bakeries, canneries, and dairy plants, producing its own brand of products. It founded its own distribution network of trucks and shifted to a cash-and-carry model. For products it did not produce, it bought directly and in bulk from food producers, obtaining discounts for regular, predictable custom and savings from cutting out the middlemen. Consumers overwhelmingly benefited from these cost reductions through lower retail prices. One estimate suggests chain-store prices were 4.5 to 14 percent lower than traditional grocers’.16

As a result, throughout the 1920s and early 1930s, A&P (and, indeed, other chain stores that replicated its techniques) saw explosive growth. Marc Levinson’s biography of A&P estimated that by 1929, it “owned nearly 16,000 grocery stores, 70 factories, and more than 100 warehouses. It was the country’s largest coffee importer, the largest butter buyer, and the second-largest baker.”17 Elsewhere, its store numbers reportedly increased from 4,244 in 1919 to 14,926 by 1935—leaving it with more stores than its next four chain-store competitors combined (see Figure 1).18 During that period, the market share of the top five chain stores in 1935 had increased to 25.7 percent from just 4.2 percent in 1919.

As A&P and others blew away competitors and displaced or squeezed wholesalers, they suffered blowback that would sound familiar today to those who have followed the media coverage of Amazon’s impact on bookstores and other retailers. As early as 1928, chain stores such as A&P were slammed by the Virginia Wholesale Grocers’ Association for “their effort to create monopoly, by attempting to freeze out the independent wholesaler and retailer with indiscriminatory cut prices of standard advertised merchandise and advertising these prices as bait to the public, thereby monopolizing local business.”19 Critics denounced the effects of chain stores on traditional grocery sellers, and lamented A&P’s market power and use of hard data collected from sales across the country—allowing it to regionally vary products held in stores.

By 1936, the lobbying for protection from traditional retailers and wholesalers had resulted in a policy backlash. State and local taxes and price control laws had been imposed on chain stores and wholesalers with the intention of propping up other independent retailers and the wholesalers. The Robinson-Patman Act of that year—originally known as the Wholesale Grocer’s Protection Act—prohibited wholesalers from offering different prices to different buyers except in ill-defined circumstances, disabling the consumer-friendly deals A&P could demand down the supply chain, in turn hitting A&P’s profitability and raising retail prices. Similar to the way some commentators advocate with tech giants today, these two senators pushed for an industry-specific chain store tax in 1938 and 1939, which, had they not failed to get it passed, almost certainly would have raised consumer prices significantly, or else driven A&P out of business entirely.20

It is now widely acknowledged that the Robinson-Patman Act, though notionally still on the books, is mostly unenforced, and for good reason. But after its introduction, A&P and other chain stores were already trying to keep up with the disruption to their profits from the proliferating big-box supermarkets and were themselves engaged in substituting toward that model. The barrage of economic illiteracy from antitrust authorities did not help them in transitioning.

In 1940, A&P came under more pressure from government for engaging in “price discrimination” between regions.21 By 1946, A&P had been found by federal judge Walter C. Lindley to be in violation of the Sherman Act, not because it had actually raised prices or excluded competition, but because the “power exists to raise prices and exclude competition,”22 which stemmed from A&P’s dominance in some cities. The company had been criminally prosecuted on spurious economic grounds in regard to supposed predatory pricing and buying power over wholesalers and because of its vertical integration. There was no evidence this had harmed consumers, but it had harmed its competitors.

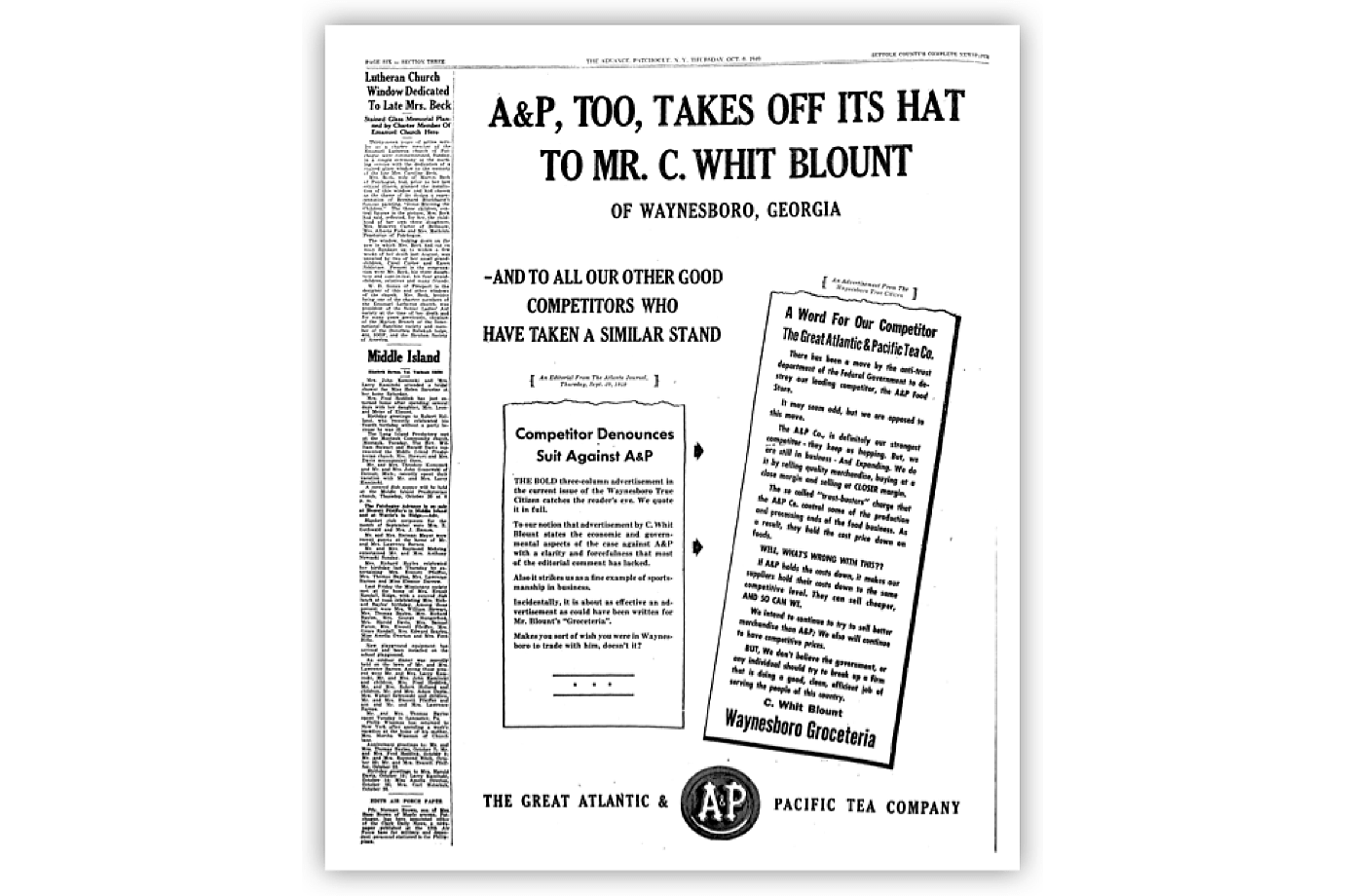

A&P fought back, and in 1949 took out advertisements in 2,000 newspapers asking, “Do the American people want A&P out of business?” One ad stated: “Do they want to continue to enjoy lower prices and better living, or do they want to break up A&P?...Nobody has ever shown we have anything even approaching a monopoly of the food business anywhere. Nobody has ever said we charge too high prices—just the opposite…If the antitrust lawyers succeed in destroying A&P, the way will be cleared for the destruction of every other efficient large-scale distributor.”23 The case against A&P was upheld, though, and the federal government sought the company’s breakup before eventually settling for A&P’s closing some parts of its brokerage business that sold products (for some reason, deemed unfairly) to rivals.

A long and winding downturn in fortunes followed. Some pin this failure on the antitrust proceedings distracting the company from its core business. But the truth is chain stores themselves were disrupted by big-box warehouse-like supermarkets, the rise of television promoting national brands for certain products, and the significant reduction in transportation and refrigeration costs in the postwar era, which changed the types of stores consumer preferred. Creative destruction then came in the form of stores embedded within shopping center locations, the introduction of nongrocery products to supermarkets, and then later again, with the rise of IT, big data, and revolutions in logistics. Over time, A&P simply failed to keep up with these changes and was disrupted in the same way it had disrupted the grocery retailers of the early 20th century. The company filed for Chapter 11 bankruptcy twice—in 2010 and 2015.24

Myspace

“Will Myspace ever lose its monopoly?” asked Victor Keegan in the Guardian’s technology section in early 2007.25 The journalist was riffing off a TechNewsWorld article by John Barrett that claimed Myspace was not just a monopoly, but a natural one.26

The arguments for such claims were similar to those made about Facebook today. Keegan and Barrett argued that social networks inevitably tend toward monopoly because of the extensive network effects associated with social media. The time invested in uploading content, coupled with the utility of the product rising with the number of users on the network, supposedly made Myspace’s dominant position unassailable.

This was particularly true, Barrett argued, because Myspace had more unique users than other social media platforms at the time, including Yahoo 360, Friendster, and Facebook. Keegan even implied (ironically, given trends since) that the time and effort required by social network users to upload content meant that social network websites were much “stickier” than search engines such as Google, where just one click could take someone to a competitor’s site.

Myspace had been founded in 2003 and quickly saw a rapid expansion of users. The website was a social network with individual profiles, creating networks of friends and opportunities to embed or connect to music.

Even after Facebook was founded, commentators worried that Myspace was a natural monopoly because of its extensive network effects.

Observing its explosive growth, Rupert Murdoch’s NewsCorp bought the site in 2005 for $580 million, and just a few months after the acquisition agreed to a $900 million advertising revenue contract with Google. The Financial Times reported that “within 15 months of the acquisition, revenues had leapt from about $1m a month to $50m a month.” By June 2006, the site was the most visited in the United States, overtaking Google.27

In early 2008, the web measurement firm Hitwise estimated that MySpace enjoyed 73.4 percent of all traffic on social networking sites.28 At its December 2008 peak, the site attracted 75.9 million monthly unique visitors in the United States alone—about a quarter of the country’s entire population.29 So widespread was the perception of its market dominance that LiveUniverse (a company that produces and distributes corporate videos) brought and lost a case against Myspace alleging it had monopoly power. LiveUniverse accused Myspace of engaging in exclusionary conduct simply for refusing to deal with the firm (a charge sometimes invoked against today’s tech giants).30

Yet by the time Keegan and Barrett penned their articles, there was a new competitor on the rise. By 2008, Myspace had already been overtaken in terms of worldwide users by Facebook.31 By May 2009, Myspace had been overtaken by Facebook in unique U.S. visitors too. The Financial Times estimated that Myspace’s overall market share fell to just 30 percent by the end of 2009.32

A more user-friendly interface on Mark Zuckerberg’s site and a less cluttered advertising space allowing more onsite innovation spurred Facebook’s rapidly rising user numbers. Facebook also adopted an email address importer tool that boosted user rates, accelerating its own network effects. Since that time, MySpace has never really recovered.

By 2016, Myspace was estimated to have just 15 million unique global visitors per month; with 5.5 million unique visitors from the United States.33 In February 2018, global monthly traffic fell further, to just 7.6 million visits per month.34 Myspace was back in the news in March 2019 when it announced that a server migration error had lost “any photos, videos and audio files” uploaded to the site before 2016.35

Network effects certainly make competing with existing firms more difficult for those producers selling very similar products or services at a given point in time. But while those effects might tip a market toward one firm enjoying extraordinarily high market share, the Myspace example shows that network effects need not create insurmountable monopolies, not least because competition can still occur “for the market.”

These days, accusations of the “monopolization” of social networking by Facebook are undermined by extensive evidence of users multihoming (i.e., actively using a number of platforms at once). Facebook and others are constantly looking for new ways to improve their offerings to maintain active users too, including recent promises about improving privacy.

Importantly, the Myspace history shows that the very network effects that lead to massive growth can also lead to a rapid demise when a superior product comes along. All social networks face a difficult balancing act between providing an attractive and innovative user experience, on the one hand, and monetizing the platform by competing for the real “customers”—digital advertisers—on the other. The Myspace example shows the degree of interdependence between the two. Getting the balance wrong can have significant consequences.

Nokia

In discussion about the tech giants, Apple’s dominance in the U.S. mobile vendor market is often taken for granted.36 It shouldn’t be. Just 12 years ago, on November 13, 2007, Forbes ran a front cover entitled “One Billion Customers—Can Anyone Catch the Cell Phone King?”37 The article was referring not to Apple, but to the growing global dominance of mobile handset company Nokia.

In 2007, the Finnish firm sold approximately 430 million mobile handsets worldwide—estimated to be equal to the volume sold by Motorola, Samsung, and Sony Ericsson combined. It self-reported that it had a 40 percent market share of the global handset market, including over half the smartphone market.38

Though its U.S. footprint at the time was much smaller, the company itself had grand plans to expand into internet services on its handsets and become as big a global brand as Google or Yahoo! The Forbes story confidently pronounced that given its investment in location services and other apps, “no mobile company will ever know more about how people use phones than Nokia.” Today, it is Apple’s extensive data collection, through mobile and other sources such as Echo spots, that regularly causes gnashing of commentators’ teeth.

“Mobile Monopoly?” Germany’s Der Spiegel asked in January 2008, as it reported “Nokia Rockets Past Rivals.”39 According to the newspaper, the sheer volume of phones sold by Nokia was creating economies of scale that would act as a significant barrier to entry for rivals. The higher profits generated through these unit cost savings were generating “more money to invest in research and development,” it was said, making it “very difficult for competitors to manufacture as many different models of phones as cheaply and still make a profit.”

That, of course, was written just after the launch of the Apple iPhone, described as a “wild card” in the mobile-phone industry in these articles. The iPhone was a much more expensive product than Nokia’s top range N95 at the time. But it was becoming increasingly recognized that Nokia’s operating system was no match for Apple’s app-based platform.40

Nokia’s strength was in hardware, but Apple advanced into the sector by shifting the key dimension of competition toward software. Nokia had become a market leader, launching the first smartphone in the 1990s and ploughing money into research and development, even producing prototypes for internet-enabled touchscreen technologies. But it did not foresee the importance of apps to the appeal of the phones until it was too late.41 That recognition led to a host of managerial recriminations and soul-searching. Yet Nokia didn’t have the technological competence in software to counter Apple’s and later, Samsung’s, Android phones.42

Looking at the global market shares of these three firms for the past decade shows this clearly. In Q4 2009, Nokia still had a 38.6 percent global market share in sales.43 Apple had accelerated to 16.1 percent, while Samsung was a bit player with just 3.3 percent. By Q1 2012 though, Nokia had dropped to just 8.2 percent of the global market, while Apple and Samsung combined had 53.3 percent of the market (see Figure 2). Since then the large Chinese players such as Huawei and Xiaomi have diluted these global market shares, but Apple and Samsung were still estimated to have a combined global market share of 36.9 percent in Q4 2018. In the United States, their combined market share is higher still, at 79 percent (55 percent Apple and 24 percent Samsung).

Microsoft bought out Nokia in 2013, at a time when it had just 3 percent global market share and had seen its market capitalization fall to a fifth of what it was in 2007.44 The story of how the company was completely usurped by Apple and Samsung suggests that present economies of scale are no barrier to a fundamentally better product outcompeting on the strength of its quality or new features, irrespective of price. Competition in the mobile market used to be along the hardware dimension. Now it occurs primarily across the software dimension on smartphones. Who knows how the market will develop in future?

Kodak

So dominant had Kodak been in the film- and photo-processing business through much of the 20th century that eventually a beautiful image or scene was commonly referred to as “a Kodak moment,” after one of the company’s advertising campaigns.45 Modern echoes of this can be found in the internet search engine market, where searching online for a product is commonly referred to using the verb “to Google.”

A “Kodak Moments” Commercial originally aired in 1993.

As with Google and search engines, Kodak really was the personal photography industry for a sustained period. It was the first to pioneer mass-market cameras and set up a business model that incorporated the whole film, photo development, and printing value chain. In 1976, Kodak was estimated to have 90 percent of the U.S. film market and 85 percent of the market for cameras. The firm had built a successful model predicated on film and processing sales delivering high revenue, allowing the company to sell camera units at relatively low prices.46

This dominance in film was particularly long-lived. As far back as 1923, the Federal Trade Commission had filed a complaint against Kodak on the grounds of conspiracy of restraint of trade. A contemporaneous Time article remarked that “the company had manufactured and sold, up to March 1920, 94 percent of all film, and sold 96 percent of all film, produced in the United States.”47 The company was also regularly described as a monopoly. In 1978, a federal jury even labeled the company a monopolist in the color print paper amateur photography business, albeit not finding the company guilty of obtaining that position unlawfully.48

Mass-market, inexpensive cameras, like the Instamatic line, helped Kodak dominate the U.S. camera market in the 1960s and ’70s. Source: Jacek Halicki [CC BY-SA 4.0 (https://creativecommons.org/licenses/by-sa/4.0)].

Kodak’s domestic position in photography was even more dominant than Apple’s position in the mobile vendor market today. Yes, Kodak faced challenges from other competitors such as Fujifilm and camera manufacturers such as Olympus and Nikon. But, like Apple, Kodak was an innovative firm, developing new products in competitive submarkets, including instant and single-use cameras.

Fujifilm, in particular, began competing aggressively against Kodak in the late 1980s and 1990s, capitalizing on the rise of big-box retailers replacing film and photography stores. These new retailers were squeezing manufacturers and demanding a broader range of products for their shelves. The Japanese company engaged in robust marketing and generated extensive price competition in the late 1990s, which ate into Kodak’s market share.49

But it was a new type of product—the consumer digital camera—that completely revolutionized the industry and led to a decline in Kodak’s fortunes. Rather than sending off a raft of film images to be developed, this new technology meant customers were now able to review shots on camera, upload to a computer to save or edit, and ultimately print or share with others through email or the internet. Digital photography was instantaneous and safer to store. Complementary services sprang up, delivering inexpensive printing, copying, or sharing of digital images from a range of photofinishing companies, many of which developed products better suited to digital material than Kodak.

Kodak was never able to fully embed itself in this digital marketplace, despite one of its engineers—Steve Sasson—having invented the first digital camera back in 1975. In fact, the company had engaged in extensive research and development into the digitization of photography for decades, but it used the insights to serve niche high-end markets rather than the mainstream amateur photography industry.50

The story here is not about consumers no longer wanting to take pictures, just as Nokia’s fall was not evidence of consumers giving up on mobile phones. What happened with Kodak was that the technology had shifted from chemical film to digital electronics, in turning creating demand for new types of products.51 So dependent had Kodak’s business model been on film and film processing that the company found it hard to shift corporate culture and truly embrace the digital world. The specialists it employed were, overwhelmingly, experts in film- and photo processing. Indeed, there appears to have been internal resistance to going all-in on the digital technology that would cannibalize the traditionally profitable business.52 That reluctance, plus underestimation of the growth prospects of the digital market, left Kodak playing catch-up to rivals when it made its big push into the digital market in 2001. It was a classic case of an incumbent being slow and misjudging the scale of changing consumer demands.

Under pressure from the digital threat, Kodak had cut film costs and cycle times, but by 1997 digital camera sales were exploding for new competitors, especially those from Japan. Film camera sales had peaked in 2000 before starting a precipitous decline. They were overtaken by digital camera sales by 2005 (Figure 3 shows similar trends for shipmentsrather than sales, albeit with the overtaking by digital cameras occurring earlier).53 By then, Kodak found itself in a crowded market. It didn’t appear to appreciate how the internet would shape the industry either, further depressing the need for film or even the digital kiosks the company had invested in within traditional stores.

Since the middle of the first decade of the 2000s, of course, the industry has been completely disrupted once again by smartphones containing digital cameras and associated apps such as Snapchat and Instagram. Digital camera shipments worldwide peaked in 2010 and sales have fallen by 80 percent since.54 In the United States, industry estimates show that digital camera sales volumes themselves have fallen from 14.5 million in 2010 to 4.8 million in 2018.55

At the start of 2012, Kodak filed for bankruptcy.56 It announced that it would leave the digital photo capture market to focus on the business printing market. The company sold some of its digital imaging patents. Kodak is now back out of bankruptcy and focuses largely on business packaging, printing, and other professional services, but it has recently invested in new digital imaging and touchscreen technologies and a blockchain cryptocurrency for photographers.57

It is difficult for us to imagine Apple and the iPhone not dominating the mobile phone market or Google the search engine market. As with Kodak and photography, they are currently synonymous with their industries. But technological change can completely revolutionize a sector, leaving behind existing firms that have developed around “tried and tested” business models.

iTunes

Apple itself has already seen the rise, fall, and rise again of its “dominance” in the music purchase sector. “Who Will Break iTunes’ Monopoly?” asked Talia Soghomonian in the British music magazine NME in 2010.58 At the time, this was a common refrain.

The idea that Apple had monopoly power in the digital music download market through its music store, iTunes, had been building for four years. In 2006, technology podcaster Paul Thurrott said, “Apple should be stopped before the abuses get too great and harm too many consumers. That the US DOJ is publicly defending this company and its practices in Europe is, of course, insane.”59 By 2010, a U.S. DOJ inquiry into Apple’s online music presence and digital marketing tactics had been undertaken.60

iTunes had launched in 2003 as an online store where people could buy and download music at the individual song level. In an interview with Rolling Stone, Apple cofounder Steve Jobs dismissed the prospect of serious competition from a subscription music model, saying, “The subscription model of buying music is bankrupt. I think you could make available the Second Coming in a subscription model, and it might not be successful.”61

At an Apple event in 2003, Steve Jobs dismissed the potential of music subscription services.

Jobs had good reason to be confident. The iTunes product itself was revolutionary. It allowed an individual to purchase a track or album to play as he or she wished on a computer, on a personal iPod, or to burn onto a homemade CD. Importantly, record labels were willing to sign up for their music to be placed in the store because iTunes files could be digitally protected from unauthorized redistribution, reducing the problem of piracy. iTunes also contained a library of audiobooks and other complementary features that encouraged use.

The type of music file downloadable on iTunes meant that the only portable device the music could be played on was Apple’s iPod—a form of tying its rivals resented and one that was subject to an antitrust suit launched in 2005 and eventually dismissed in 2014.62 But despite its lesser compatibility across device types, consumers appeared to love the iPod product. Several competitors tried and failed to eat into its market share through 2006.63

The iTunes store had seen explosive growth by that time. It had a market share of anywhere between 72 and 88 percent in the digital music download market.64 The Apple model, which charged 99 cents per song for downloads, seemed incredibly popular with customers. Some economists claimed it had developed the truly optimal pricing model, which would win out against bundled subscription services such as Napster.65

As with modern tech companies, how one viewed iTunes’ success depended on how one defined the market under discussion. Digital music sales, although rapidly growing, still had to compete with physical CDs and records. The market was clearly contestable too, given that companies such as Rio and Creative Technologies and Dell had tried to launch rival MP3 players and eMusic, Napster, MSN Music, and Yahoo Music all ran rival song download stores with much smaller market shares.

But that didn’t stop widespread concern about some of Apple’s practices. French authorities objected to the bundling of the listening device (iPod) with the music store (iTunes).66 Similar concerns relating to this type of tying occur today. Apple is regularly lambasted by developers for disabling substitutes to the app store on the iPhone. Though Apple itself largely innovated the model, it is regularly asserted that this bundling and exclusivity gives itsubstantial power over sellers because of the high iPhone market share, allowing itto take a cut of developer revenue as an “unlawful monopoly.”67

Yet the history of iTunes shows that technological change itself can force unbundling. In fact, 2010 was curious timing for an antitrust investigation into a potential monopoly of iTunes linked to the iPod. By that time, although iTunes sold 25 percent of all music in the United States, its market share for digital music sales had fallen slightly, to 70 percent.68 This subsequently fell further to 64 percent by 2012.69 A whole new form of disruption was well advanced through online streaming and subscription services such as Pandora and Spotify, and through people listening to music on smartphones.70

The subscription model now completely dominates the online music purchase market. In response to rival firms, Apple launched its own streaming service, Apple Music, in 2015. Though subsequently becoming the largest player in this market by U.S. monthly users, there’s no sign of any impending monopoly. As of March 2018, Apple Music had 49.5 million monthly U.S. users, compared with Spotify’s 47.7 million, Pandora’s 36.8 million, SoundCloud’s 34.2 million, and Google Play’s 21.9 million.71 These products have been complemented by the rise of smart speakers, such as Amazon Echo and Google Home.

So dramatic has the change in the industry been that by 2018, music streaming services contributed three-quarters of the total U.S. music industry revenue, if one tots up both premium subscription services and ad-supported revenue from sites such as YouTube. Digital downloads, which iTunes dominated, now make up just 11 percent of total music sales revenue; a collapse from 42 percent just five years before.72 Revenue from physical product sales once again exceeds digital downloads (see Figure 4).

Last year there were widespread rumors that Apple would completely shut down iTunes sometime this year.73 People today listen to music on their phones and when they are on the move. They want access to huge libraries of songs on demand. New technologies to deliver that and services to provide it completely overhauled the music purchase sector that iTunes dominated.

Netscape and Internet Explorer

Back in 1996, around 90 percent of internet users used variants of one internet browser: the Netscape Navigator.74

The company that launched that product—the Mosaic Communications Corporation—had developed the first browser using clickable buttons rather than text commands. This proved an incredibly popular innovation. Recognizing the potential for huge success, Mosaic released the first Netscape Navigator browser in December 1994. By August 1995, the company had launched a successful IPO. Users commonly referred to surfing the world wide web as “using Netscape.” Cofounder Marc Andreessen appeared on the cover of Time under the heading, “The Golden Geeks.”75 The company seemed unstoppable.

The original Netscape and Internet Explorer browsers.

Yet by 2001, Netscape had a global market share of just 12 percent. It had been completely usurped by Microsoft’s Internet Explorer (IE), which by then had a global browser market share of nearly 88 percent.76 That interim period became retrospectively known as the “browser wars” as Microsoft and Netscape competed extensively to add features in developing a better product to capture the market.

Software giant Microsoft was ultimately able to invest more resources in its offering. In bundling IE into its Windows operating system, the company effectively had set a pre-installed default browser, which gave it a significant competitive edge over rivals whose products had to be downloaded or purchased and installed separately. The rising market share of IE earned Microsoft the attention of the Department of Justice’s (DOJ) antitrust division by 1998. The DOJ charged the company with violating the Sherman Act for operating a monopoly and using supposedly anti-competitive practices, not least in bundling IE with its Windows operating system.

Initially the DC District Court ordered the breakup of Microsoft into an operating system unit and a unit for other software. But by 2004, the Department of Justice and Microsoft had settled for the company having to disclose its application programming interfaces and protocols for three years. The last Netscape browser, Netscape Navigator 7, was released in 2003, at a time when IE still dominated.77

Today, the notion that continued dominance for Microsoft in the browser market was inevitable seems almost quaint. Yet even in 2006, experts such as Harvard Business School professor Pai-Ling Yin believed that sustained monopolization by the software giant in the browser market was likely. Her research, written with Timothy Bresnahan, had concluded that it was Microsoft’s advantage in tying and distributing IE that had won the browser wars, rather than some technological superiority of the product. Crucially, they believed that Microsoft had launched IE just at the right time, with the explosion of the PC market increasing the importance of network effects in browsers and making it more difficult for other competitors to do to IE in the future what Microsoft had done to Netscape.78

In an interview for Harvard Business School’s Working Knowledge series, Yin explained that a large “second-mover” into the browser market such as Microsoft had a window of opportunity to compete with Netscape in the mid-to-late 1990s because the market was still growing substantially. This allowed Microsoft to focus on winning new users rather than switchers.79 Through the complementary Windows operating system, Microsoft was able to establish itself as a default browser on PCs. This slowed the rise of Netscape and allowed Microsoft to obtain critical mass.

Yin thought it would be extraordinarily difficult to displace IE’s market share in a mature mass market. Once IE had achieved dominance, companies chose to optimize their websites in IE, meaning that the user experience was worse for many major sites on alternative browsers. It was also costly for webmasters to write code for different types of browsers, leading them to focus on IE, which had more end users. These indirect network effects, thought Yin, therefore represented a large barrier to entry. When asked, “So Firefox and other new browsers, no matter that they have new features and refinements that IE lacks, remain at a competitive disadvantage?” Yin responded, “Game over.”

But it wasn’t “game over.” In fact, it was from roughly 2006 onward that new competition in the browser market really took off. By July 2008, Mozilla Firefox had been eating into IE’s market share in the desktop browser market, as had Apple’s Safari. Then Google Chrome was released. By the end of 2019 it is estimated that Chrome will have a global market share of close to 64 percent, followed by Safari with 15 percent, and IE with just 3 percent (see Figure 5 below).

By 2016, Microsoft had stopped offering support for Internet Explorer versions 7 through 10 on its operating systems.80 Late last year, it effectively announced it would cease developing its own browser technology, instead adopting the Chromium project, the technology that underpins Google Chrome.

How did Chrome become so dominant? As had Microsoft before it, Google had brand recognition and a complementary product, in this case its search engine, which allowed it access to users to encourage them to download Chrome. This gave it a clear path into the market and an opportunity to break down some of the network effects described above. Microsoft, in a comfortable and dominant position, saw little incentive to innovate, allowing Google the opportunity to develop a browser that was clean and integrated with the company’s other services. Microsoft had rested on its laurels, and subsequently found itself behind the curve on cloud computing, mobile browsing, and collaborative browser-based software.

These days Google’s web presence, including in the browser and search engine markets, is a cause of much consternation. Yet the Netscape and IE examples suggest that sustained dominance based on product complementarity is not inevitable.

As former Mozilla Chief Technology Officer Andreas Gal put it in 2017:

Browsers are what the Web looked like in the first decades of the Internet. Mobile disrupted the Web, but the Web embraced mobile and at the heart of most apps beats a lot of JavaScript and HTTPS and REST these days. The future Web will look yet again completely different. Much will survive, and some parts of it will get disrupted.81

Other Examples

The case studies so far demonstrate that monopoly and technological fatalism are not new features of discussions about dominant businesses. In retail, social networks, mobile phones, cameras, music, and web browsing—industries in which today’s tech giants operate—companies assumed to have entrenched dominance have themselves been overwhelmed by the process of creative destruction Schumpeter described.

Nor are these cherry-picked stories. There are numerous other examples in related industries where the same dynamic prevailed:

Xerox

Xerox, for example, invented the first modern photocopier in 1960 and then dominated the sector, with nearly 100 percent of the market in 1970.82 So complete was the firm’s dominance that photocopying informally became known as “xeroxing.” In 1973, an antitrust complaint filed by a rival alleged that Xerox had violated the Sherman and Clayton Acts.83 A five-year struggle cost the company millions of dollars. But the eventual settlement came about just as IBM, Eastman-Kodak, Canon, Minolta, Ricoh, and others entered the market with smaller and cheaper machines, following the expiration of Xerox’s patents. By 1976, Xerox’s market share had fallen to 59 percent, and by 1978 it had fallen to 54 percent.84 Since then, of course, the margins of competition in the industry have been disrupted again by digital copiers, home printers, computers, e‑mail, and instant cameras.

Yahoo!

Yahoo! used to dominate the search engine market. These days, a lot of people labor under the misapprehension that Google “invented” search. In fact, Google was the 35th search engine to enter the sector. Though the firm was founded in 1997, until 2000Yahoo! was by far the most popular search engine, with around 34 percent of all unique search engine users in August 1997.85 In 1998, Fortune wrote up “How Yahoo! Won The Search Wars.”86 Yet, by 2000 it was obvious that Google would overtake Yahoo! due to better technology that took account of cross-references and the popularity of pages for searching, unlike Yahoo!’s card catalogue–like system.87 By June of that year, Yahoo! and Google had come to an agreement that Yahoo! would use Google’s search results.88 Google today is estimated to have 92 percent of worldwide search engine market share, with Bing at 3 percent, and Yahoo! at just 2 percent (see Figure 6).89

AOL

AOL was thought to have a “monopoly” in instant messaging at the turn of the millennium, with an estimated 90 percent share of that market.90 Despite Microsoft, Yahoo!, Tribal Voice, and iCast all developing their own services, network effects meant that the market tipped towards AOL’s AIM. Other firms were greatly concerned by this: more than 40 companies asked the Federal Communications Commission to “encourage” AOL to make its network compatible with others as a condition for approving its merger with Time Warner.91 As with firms such as Facebook today, a “free” service with extensive network effects was the cause of considerable consternation. But such fears were misplaced. We’ve since seen the rise and fall of MSN messenger and Myspace, which contained an instant messenger service. In 2008 Facebook chat (later named Facebook Messenger) was launched; then later came WhatsApp, iMessage, GChat, WeChat, Snapchat, and Slack.92 AIM simply got blown away by new forms of competition.

IBM

IBM was the subject of a 13-year antitrust lawsuit that was ultimately dismissed “without merit” in 1982.93 Analysts debate the extent to which this focus on the company aided the entry of competitors into its markets. What is perhaps less well-known is that for two years between 1976 and 1978, the Federal Trade Commission investigated whether IBM had monopolized the “office typewriter industry” in making, purchasing, renting, and repairing office typewriters and parts.94 Ultimately, it decided to take no action. But that an investigation was even taking place shows the inherent danger of trying to forecast market trends. After all, it was around this time that personal computers were just taking off and with them word processors.

Conclusion

Two important lessons can be drawn from the case studies presented here.

First, the predictions of unassailable market dominance that we hear in relation to today’s tech giants, often explained by appeals to economic phenomena such as network effects, economies of scale, tying of products, or other cost barriers to entry, have been heard many times before in similar industries. The forecasts have proven ill-founded. The predictions of sustained dominance by Amazon, Google, Facebook, Apple, and others should therefore be taken with extreme skepticism. Yes, the nature of technologies and markets can result in one firm enjoying large market share, sometimes persistently. But this does not mean that the firm’s dominant position will endure, nor that the firm’s dominance is bad for consumers—either now or in the future. As Schumpeter understood, the most important margin of competition in the long term is not many firms delivering very similar products at a single point in time, but innovations that entirely change the type of products demanded.

Second, shaping antitrust policy to deal with highly speculative “future harms” is likely to be a fool’s errand. It is almost impossible to predict market evolutions or technological transformations. But a host of commentators, lawyers, and economists try to do it anyway, often claiming that, left unimpeded by authorities, present companies have such an overwhelmingly dominant position that consumers are at risk of higher prices and dramatic welfare costs through reduced innovation.

None of the above analysis suggests, of course, that the tech giants are incapable of anti-competitive behavior or harming consumer welfare. However, history serves as a warning that extrapolation of the future based upon the present could lead to wasteful lawsuits absorbing resources that could otherwise fund innovative products or product features. If today’s monopoly fatalism leads to associated regulatory clampdowns too, such as treating incumbent firms as public utilities, it might even entrench existing positions and deter entry into sectors that over longer periods would otherwise be incredibly dynamic.95