The experience of the National Monetary Commission points to the particular importance of having as chair of any new commission someone—whether a politician or a “thinker outside Congress”—with a reputation for independence and open-mindedness.

It is also encouraging, in light of past experience, to note that Brady seems determined to have the new commission avoid the Wall Street influence that tainted its predecessor’s proceedings. “Among our problems right now,” he writes, “is that our current monetary policy has tilted the playing field in favor of Wall Street and away from average working families in America.”172 Awareness of the Fed’s origins suggests that the tilt, far from being a recent development, is a defect built into the Fed’s very foundation.

Calling for avoidance of undue Wall Street influence is one thing. Achieving it is another. What practical steps must a Centennial Monetary Commission take if it is to avoid becoming a plaything of powerful vested interests within the financial industry? Most obviously a new commission must avoid letting representatives of major financial firms from Wall Street and elsewhere, and especially ones whose firms have benefitted from the Federal Reserve’s largesse, sit on the commission or otherwise play any direct part in shaping its report or proposal. Instead, the commission’s members, whether congressmen or outside experts, should be free of any close ties to Wall Street or of any affiliation with financial industry special interests.

But that’s not all. The overseers of the new commission must also recognize in the Federal Reserve itself an extremely powerful financial institution that has a stake greater than all others in the monetary status quo, and that is likely to oppose any reform that might reduce its current discretionary and regulatory powers and privileges. The alacrity with which Fed officials recently opposed legislation that would merely have allowed for unrestricted U.S. Government Accountability Office “audits” (that is, investigations) of the Fed’s activities supplies ample proof of this.173

Yet forming a new monetary commission that avoids undue Federal Reserve influence will be anything but easy. In its current form the proposed Centennial Monetary Commission provides for two nonvoting members, one of whom is to be appointed by the Secretary of the Treasury, and the other of whom is to be “the president of a district Federal Reserve bank appointed by the Chair of the Board of Governors of the Federal Reserve System.”174 This provision alone must introduce some status quo bias into the commission’s proceedings. But even if it didn’t, and even if no other Federal Reserve officials took part, the danger of such a bias would not necessarily be avoided. As Lawrence H. White has shown, the Fed employs more monetary economists full time than all the major academic research departments combined, while employing many others either part time or as occasional visitors.175 Fed-associated economists also dominate the editorial boards of the leading scholarly monetary economics journals, thereby indirectly influencing the research agendas of monetary economists not otherwise connected to the Fed, especially (according to Boston College Professor Ed Kane) by encouraging them to take for granted the existing, Fed-dominated monetary control system, while ignoring “the broader principal-agent conflicts comprised in the information and incentives subsystems of monetary policy-making.”176 Of all the hurdles the proposed Centennial Monetary Commission must overcome, none is likely to prove more challenging than that of locating qualified participants who, though well informed about the monetary status quo, are also prepared to objectively assess reforms that do more than tinker with it.

Notes

1. The House measure is H.R. 2912; its Senate companion is S. 1786. The House passed H.R. 3189, in which much of H.R. 2912 is incorporated as Sec. 16, in November 2015.

2. Kevin P. Brady, “The Case for a Centennial Monetary Commission,” Cato Journal 34, no. 2 (Spring/Summer 2014): 393.

3. The present effort is, in fact, the second to be so inspired. In 1949 the Senate referred a bill (S. 1559) calling for the establishment of an 18-member National Monetary Commission with authority to undertake studies to determine “what changes are necessary or desirable to the banking and monetary system of the United States, or in the laws relating to banking and currency, by reason of domestic or international considerations or both,” to its Committee on Banking and Currency. Although that committee reported favorably on the measure, the House recommended against it.

One notable difference between the 1949 measure and the present effort, beside the composition of the proposed committee, was the fact that the former’s establishment had been long urged by Federal Reserve officials themselves.

4. Richard H. Timberlake, Jr., “Mr. Shaw and His Critics: Monetary Policy in the Golden Era Reviewed,” Quarterly Journal of Economics 77, no. 1 (February 1963): 40–54.

5. Nelson W. Aldrich, “The Work of the National Monetary Commission,” address before the Economic Club of New York (Washington: Government Printing Office, 1910), p. 4.

6. For a review of the history of the gold standard in the United States, see George Selgin, “The Rise and Fall of the Gold Standard in the United States,” Cato Institute Policy Analysis no. 729, June 20, 2013.

7. For a review of the motives behind, and consequences of, the 10 percent tax, see George Selgin, “The Suppression of State Banknotes: A Reconsideration,” Economic Inquiry 38, no. 4 (October 2000): 600–15.

8. See Kevin Dowd, ed., The Experience of Free Banking (London: Routledge, 1992), which gathers studies reviewing some of the more successful competitive currency systems, together with a survey of the history of plural note issue systems by Kurt Schuler.

9. O. M. W. Sprague, “Branch Banking in the United States,” Quarterly Journal of Economics 17, no. 2 (February 1903): 242.

10. Richard T. McCulley, Banks and Politics during the Progressive Era: The Origins of the Federal Reserve System, 1897–1913 (New York: Routledge, 1992), pp. 13–14.

11. Ibid., p. 14.

12. See Eugene Nelson White, The Regulation and Reform of the American Banking System, 1900–1929 (Princeton: Princeton University Press, 1983), p. 66ff.; and Charles W. Calomiris and Stephen H. Haber, Fragile by Design: The Political Origins of Banking and Scarce Credit (Princeton: Princeton University Press, 2014), p. 184.

13. See Edward O. Graves, “The Need for an Elastic Currency,” Sound Currency 10, no. 3 (1903): 88–89; McCulley, Banks and Politics during the Progressive Era, p. 18; and White, The Regulation and Reform of the American Banking System, pp. 69–71.

14. O. M. W. Sprague, History of Crises under the National Banking System (Washington: National Monetary Commission, 1910), p. 13.

15. Benjamin Haggott Beckhart and James G. Smith, The New York Money Market, Volume II: Sources and Movements of Funds (New York: Columbia University Press, 1932), p. 155.

16. Sprague, “Branch Banking in the United States,” pp. 243–44.

17. . Robert Craig West, Banking Reform and the Federal Reserve, 1863–1923 (Ithaca, NY: Cornell University Press, 1977), p. 43.

18. Elmus Wicker, The Great Debate on Banking Reform: Nelson Aldrich and the Origins of the Fed (Columbus, OH: Ohio State University, 2005), p. 2.

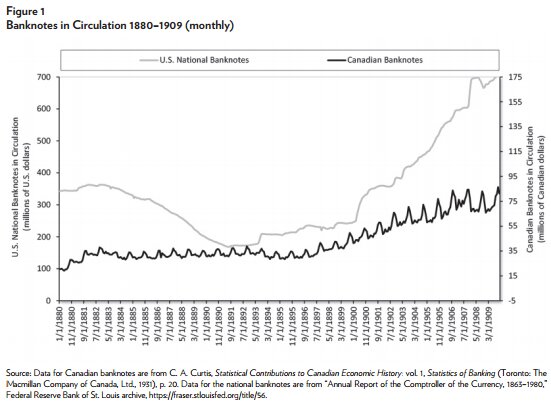

19. L. Carroll Root, “Canadian Bank-Note Currency,” Sound Currency 2, no. 2 (1894): 322.

20. Ibid. See also Roeliff Morton Breckenridge, The History of Banking in Canada (Washington: Government Printing Office, 1910); and Joseph French Johnson, The Canadian Banking System (Washington: Government Printing Office, 1910).

21. James Livingston, Origins of the Federal Reserve System: Money, Class, and Corporate Capitalism, 1890–1913 (Ithaca, NY: Cornell University Press, 1986), p. 80.

22. That is, against a proposed re-opening of the U.S. mints to unlimited coinage of silver, which threatened to undermine the gold standard.

23. Gabriel Kolko, The Triumph of Conservatism: A Reinterpretation of American History, 1900–1916 (New York: The Free Press, 1963), p. 148.

24. J. Laurence Laughlin, Report of the Monetary Commission of the Indianapolis Convention (Chicago: University of Chicago Press, 1898).

25. J. Laurence Laughlin, “The ‘Baltimore Plan’ of Bank-Issues,” Journal of Political Economy 3, no 1 (December 1894): 101–5.

26. Roger Lowenstein, America’s Bank: The Epic Struggle to Create the Federal Reserve (New York: Penguin Press, 2015), p. 24.

27. For a detailed account of the fate of pre-1900 asset currency reform efforts, see McCulley, Banks and Politics during the Progressive Era, pp. 42–75.

28. Economist Horace White assailed this last step as a “needless and costly extension of the national debt,” while accusing the Republicans of resorting to it solely “to spare themselves the trouble of dealing with the whole bank question in a rational manner.” See Horace White, “The Currency Question,” Sound Currency 10, no. 2 (1903): 50.

29. McCulley, Banks and Politics during the Progressive Era, p. 99.

30. Ibid., p. 43.

31. Ibid.

32. Ibid.

33. Robert H. Wiebe, Businessmen and Reform: A Study of the Progressive Movement (Chicago: Quadrangle Books, 1962), p. 62.

34. Cornelius A. Pugsley, “Emergency Circulation,” in Practical Problems in Banking and Currency, ed. Walter Henry Hull (New York: Macmillan, 1907), p. 305.

35. Charles W. Fowler, “The Fowler Financial and Currency Bill,” speech in the House of Representatives (Washington: Government Printing Office, 1902), p. 56.

36. Wiebe, Businessmen and Reform, p. 65.

37. H. Parker Willis, “The Status of the Currency Reform Movement,” Sound Currency 10, no. 4 (1903): 137–8.

38. Wiebe, Businessmen and Reform, p. 62.

39. Louis R. Ehrich, “Assets Currency,” Sound Currency 9, no. 1 (1903): 13.

40. McCulley, Banks and Politics during the Progressive Era, p. 90.

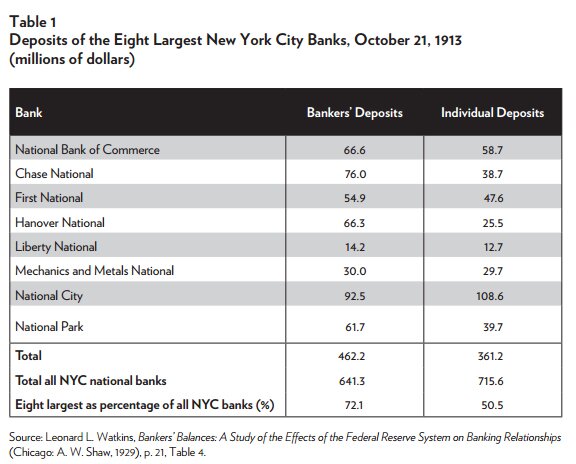

41. See Ellis W. Tallman and Jon R. Moen, “Liquidity Creation without a Central Bank: Clearing House Loan Certificates in the Banking Panic of 1907,” unpublished manuscript, June 2011, table 1. The other three members of the “big six” were the National Park Bank, the Hanover Bank, and Chase National Bank.

42. See Wiebe, Businessmen and Reform, p. 63. The “unquestioned leader” of the country bankers in their effort to oppose asset currency generally, and branch banking especially, was Wisconsinite Andrew J. Frame, “a tenacious and ill-informed man who could not accept the twentieth century.”

43. Paolo E. Coletta, “William Jennings Bryan and Currency and Banking Reform,” Nebraska History 45 (1964): 33.

44. Gerald T. Dunne, A Christmas Present for the President (St. Louis: Federal Reserve Bank of St. Louis, 1964), p. 9.

45. Ibid.

46. William Jennings Bryan, “The Asset Currency Scheme,” The Commoner 7, no. 43 (1907): 1–2.

47. Ibid.

48. McCulley, Banks and Politics during the Progressive Era, p. 224.

49. Ibid., pp. 224–5.

50. Lowenstein, America’s Bank, p. 33.

51. Willis, “The Status of the Currency Reform Movement,” p. 141. Fowler himself deserves part of the blame for his first effort’s failure. According to Willis (ibid., p. 122), his “bill was so skillfully worded as to incur the hostility of nearly every group of men who would be affected by currency legislation.” The bill especially suffered from attempting to achieve too many reforms at once. Besides providing for some asset backed currency and for branch banking, it also called for “a change in the status of gold certificates, a readjustment of the basis for greenbacks, and the reorganization of the clearing-house system.” Consequently it became all too easy “for men who disliked some special feature of the bill to condemn the whole on that ground alone.”

52. Lowenstein, America’s Bank, p. 38.

53. On the bond-backing requirements of antebellum “free banking” laws and their contribution to bank failures and “wildcat” banking, see Gerald P. Dwyer, Jr., “Wildcat Banking, Banking Panics, and Free Banking in the United States,” Federal Reserve Bank of Atlanta, Economic Review(December 1996): 1–20, and sources cited therein.

54. Paul M. Warburg, The Federal Reserve System: Its Origin and Growth (New York: Macmillan, 1930), p. 19.

55. Willis, “The Status of the Currency Reform Movement,” p. 125.

56. McCulley, Banks and Politics during the Progressive Era, pp. 106–7.

57. Livingston, Origins of the Federal Reserve System, p. 171–2.

58. Wicker, The Great Debate on Banking Reform, p. 39.

59. McCulley, Banks and Politics during the Progressive Era, p. 91.

60. Jacob Schiff, “Demand for an Elastic Currency,” Bankers Magazine 72 (January 1906): 114–5.

61. Wicker, The Great Debate on Banking Reform, p. x.

62. See Lowenstein, America’s Bank, p. 74. “Even most bankers,” Lowenstein observes, remained “fixated on an asset currency.” In fact there was nothing unreasonable about the bankers’ preference, unless by “unreasonable” one means “inconsistent with the direction events would ultimately take.”

63. Ibid., p. 75.

64. J. Laurence Laughlin, “The Aldrich-Vreeland Act,” Journal of Political Economy 16, no. 8 (1908): 490.

65. Lowenstein, America’s Bank, p. 73.

66. Laughlin, “The Aldrich-Vreeland Act,” p. 493.

67. Ibid., p. 490.

68. Ibid., p. 494.

69. Ibid.

70. McCulley, Banks and Politics during the Progressive Era, p. 153.

71. Ibid.

72. Lowenstein, America’s Bank, p. 79.

73. Ibid.

74. Outstanding Aldrich-Vreeland emergency currency notes were subject to a 5 percent tax for the first month after they were placed into circulation, and to a tax of 1 percent every month thereafter.

75. William L. Silber, “The Great Financial Crisis of 1914: What Can We Learn from Aldrich-Vreeland Emergency Currency?” American Economic Review 97, no. 2 (2007): 285.

76. Ibid. See also Wicker, The Great Debate on Banking Reform, pp. 44–49. Although five years after the Act had passed only 21 Aldrich-Vreeland currency associations had been organized, comprising 325 national banks, during August and September 1914 over 2000 national banks had formed 44 associations, 41 of which issued emergency notes (ibid., p. 46). According to Milton Friedman and Anna Jacobsen Schwartz, A Monetary History of the United States, 1867–1960 (Princeton: University of Princeton Press, 1963), p. 172, had the Aldrich-Vreeland provisions remained in place in 1930, they would have been more effective than the Fed turned out to be in averting that year’s banking crisis. For further details see Silber, “The Great Financial Crisis of 1914.”

77. United States Congress, “Hearings and Arguments on H.R. 20835,” Committee on Banking and Currency, House of Representatives (Washington: Government Printing Office, 1908), p. 9.

78. In all, four different bills calling for the establishment of a “Banking and Currency” or “National Currency” commission, including two introduced by Charles Fowler, were referred to the House Committee on Banking and Currency between December 1907 and April 21, 1908. The one that actually made it into the Aldrich-Vreeland bill was introduced by William Lovering of Massachusetts on January 30, 1908.

79. Text of the Aldrich-Vreeland Act of May 30, 1908, as quoted in A. Piatt Andrew, “Letter from the Secretary of the National Monetary Commission Transmitting, Pursuant to Law, the Report of the Commission” (Washington: Government Printing Office, 1912), p. 3.

80. A. Piatt Andrew, “The Work of the National Monetary Commission,” American Economic Association Quarterly, 3rd ser., 10, no. 1 (April 1909): 378.

81. Livingston, Origins of the Federal Reserve System, p. 182.

82. Lowenstein, America’s Bank, p. 99.

83. Cited in Andrew Gray, “Who Killed the Aldrich Plan?” Bankers Magazine 54 (Summer 1971): 73.

84. Ibid.

85. Ibid.

86. Ibid., p. 63.

87. Ibid., p. 64.

88. Lowenstein, America’s Bank, pp. 41–42.

89. David Graham Phillips, “The Treason of the Senate,” Cosmopolitan Magazine 40, no. 5 (March 1906).

90. Then spelled “Jekyl.” The current (and correct) spelling became official in 1929.

91. Lowenstein, America’s Bank, p. 97.

92. Morgan had personally recommended Davison’s services to Aldrich, his intent—revealed in an unguarded cable sent to Morgan by George Perkins, another Morgan partner—having been to make sure the firm’s interests were properly represented (Lowenstein, America’s Bank, p. 80). In August 1909 Davison arranged to have Aldrich acquire $50,000 worth of Bankers Trust stock for just $40,000, presumably to further encourage Aldrich to assign adequate weight to his advice (ibid., p. 96).

93. See Frank A. Vanderlip, From Farm Boy to Financier (New York: Appleton-Century, 1935), p. 213. Although Vanderlip claims that Strong was present, other sources do not confirm this. Because Vanderlip’s recollections are quite vivid—he refers to Strong’s horseback riding, among other details—I’m inclined to believe that Strong was indeed there, and that others present at the event refrained from disclosing Strong’s presence owing to the fact that Stephenson himself did not disclose it. Alas, that still leaves a mystery regarding why Stephenson himself failed either to disclose or to discover that Strong was present.

94. Lowenstein, America’s Bank, pp. 117–18.

95. McCulley, Banks and Politics during the Progressive Era, pp. 231–32.

96. Ibid.

97. Lowenstein, America’s Bank, p. 118.

98. William G. Dewald, “The National Monetary Commission: A Look Back,” Journal of Money, Credit, and Banking 4, no. 4 (November 1972): 942.

99. McCulley, Banks and Politics during the Progressive Era, p. 238.

100. Alfred Owen Crozier, U.S. Money vs. Corporation Currency (Cincinnati: The Magnet Company, 1912), p. 90.

101. White, The Regulation and Reform of the American Banking System, p. 86. Compare with Charles W. Calomiris and Stephen H. Haber, Fragile by Design: The Political Origins of Banking Crises and Scarce Credit (Princeton: Princeton University Press, 2014). Although the authors of the latter piece claim that the commission “clearly understood that the unit-banking system was the core problem” and that it only refrained from recommending any reform of “the basic structure of the U.S. banking system” because it held such reform to be “politically infeasible,” these claims appear unfounded. Instead, the decision to not tamper with unit banking reflected a positive preference on the committee’s part.

102. Aldrich, “The Work of the National Monetary Commission,” p. 24.

103. Ibid., p. 27.

104. Ibid.

105. McCulley, Banks and Politics during the Progressive Era, p. 225.

106. Dewald, “The National Monetary Commission,” p. 940. The presumption on the part of Aldrich and his advisers that central banking was an ideal arrangement even in these countries was itself far from being well justified. For a review of the origins of central banking in England, Germany, and France, including the arguments of those who opposed that development, see Vera C. Smith, The Rationale of Central Banking and the Free Banking Alternative (Indianapolis: Liberty Press, 1990).

107. See Johnson, The Canadian Banking System; and Breckenridge, The History of Banking in Canada.

108. See Livingston, Origins of the Federal Reserve System, p. 198. Besides 16 volumes concerning the United States and the ones devoted to England, France, Germany, and Canada, the commission published studies of the currency and banking systems of Holland, Japan, Sweden, Mexico, Austria-Hungary, Russia, and Switzerland. Of these, Switzerland had only recently abandoned decentralized note issue, establishing the Swiss National Bank on June 30, 1907, and calling for its 36 cantonal banks to retire their notes within three years of that date.

109. Calomiris and Haber, Fragile by Design, p. 184.

110. Livingston, Origins of the Federal Reserve System, p. 189.

111. Wicker, The Great Debate on Banking Reform, p. x.

112. Warburg, The Federal Reserve System, p. 56.

113. Gray, “Who Killed the Aldrich Plan?” p. 74.

114. Unlike Warburg, who knew little about banking and currency systems apart from those of the major European powers, Charles Fowler was familiar with numerous banking and currency systems around the world, as well as with those of the antebellum United States. Yet while Fowler paid generous tribute to Warburg during Fowler’s testimony on the Federal Reserve Act, stating that he had “contributed more substantially to the advancement of this [the currency] question than any other one man in the country,” Warburg dismissed Fowler contemptuously: “Fowler has never been a banker, and never been successful, and I am astonished by his courage to advocate a new and untried scheme approved by no practical bankers, against a plan which has been carefully developed on the well-established European principles by the combined banking and business brains of the country.” See Paul M. Warburg, letter to J. Laurence Laughlin, April 22, 1912, in the Paul Moritz Warburg papers, Yale University Library. Besides being unkind, Warburg’s description is a calumny: Fowler was a banker both before and after serving in Congress, and his reform proposals, while unsuccessful, were endorsed by many bankers as well as by other authorities.

115. Warburg, The Federal Reserve System, p. 25.

116. Walter Bagehot, Lombard Street (London: Henry S. King and Co., 1873), p. 27.

117. Ibid., p. 66.

118. Ibid., p. 67.

119. Ibid., p. 69.

120. Ibid., p. 71.

121. Ibid., p. 330.

122. McCulley, Banks and Politics during the Progressive Era, p. 227.

123. Warburg, The Federal Reserve System, p. 569.

124. Lowenstein, America’s Bank, p. 150.

125. Warburg, The Federal Reserve System, p. 76.

126. Lowenstein, America’s Bank, p. 90.

127. United States Congress, “Hearings on House Resolution No. 314,” Committee on Rules, House of Representatives (Washington: Government Printing Office, 1911), p. 46–47.

128. Lowenstein, America’s Bank, p. 145.

129. Ibid., p. 164.

130. Wicker, The Great Debate on Banking Reform, p. 6.

131. Dewald, “The National Monetary Commission,” p. 931.

132. Wicker, The Great Debate on Banking Reform, p. ix.

133. Warburg, The Federal Reserve System, pp. 178–406. For a summary of the two measures’ other differences, see Kolko, The Triumph of Conservatism, pp. 244–47.

134. See Kolko, The Triumph of Conservatism, pp. 218–25 and 242–47. Laughlin resigned his leadership of the National Citizens’ League in April 1913. The extent to which he directly contributed to the drafting of the Federal Reserve Act remains a matter of some dispute.

135. Dunne, A Christmas Present for the President, p. 9.

136. Ibid., p. 10.

137. Gray, “Who Killed the Aldrich Plan?” p. 74.

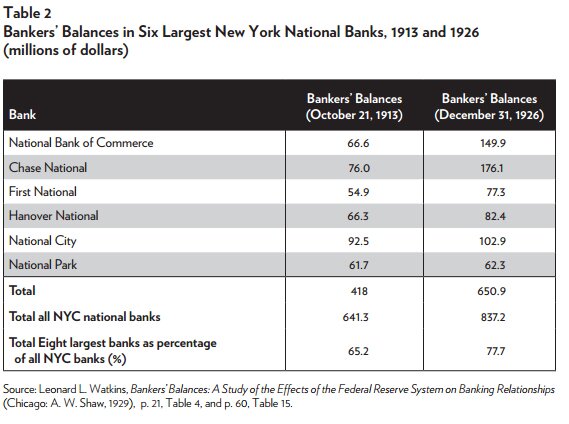

138. Lawrence E. Clark, Central Banking under the Federal Reserve System (New York: Macmillan, 1935), p. 346.

139. Ibid., p. 348.

140. Ibid., p. 358.

141. Ibid., p. 353.

142. Charles W. Calomiris, Matthew Jaremski, Haelim Park, and Gary Richardson, “Liquidity Risk, Bank Networks, and the Value of Joining the Federal Reserve System,” Office of Financial Research Working Paper no. 15–05, April 2, 2015.

143. McCulley, Banks and Politics during the Progressive Era, p. 301.

144. Ibid.

145. James B. Forgan, “Letter to the Texas Bankers Association,” in Sound Currency 10, no. 2 (June 1903): 66.

146. United States Congress, “Hearings on S. 2639 [the Federal Reserve Act],” Committee on Banking and Currency, House of Representatives (Washington: Government Printing Office, 1913), p. 1876.

147. Ibid., p. 1901.

148. Elihu Root, “The Banking and Currency Bill,” speech in the United States Senate, December 13, 1913 (Washington: Government Printing Office), p. 12.

149. Ibid., p. 14.

150. Robert L. Owen, “The Currency Bill and Financial Panics,” The Independent, December 25, 1913, p. 581.

151. Ibid.

152. On the influence of the real-bills doctrine on both the Fed’s original design and its subsequent conduct see Richard H. Timberlake, Jr., Monetary Policy in the United States: An Intellectual and Institutional History (Chicago: University of Chicago Press, 1993), pp. 224–25 and 259–60; and Richard H. Timberlake, Jr., “Gold Standards and the Real Bills Doctrine in U.S. Monetary Policy,” Independent Review 11, no. 3 (Winter 2007): 325–54.

153. See Livingston, Origins of the Federal Reserve System, p. 187. Although some proponents of decentralized asset currency also subscribed to the real-bills doctrine, the importance that most asset currency proposals assigned to active note redemption supports James Livingston’s opinion that asset currency advocates’ understanding of the forces limiting currency expansion in their preferred arrangement was no different from the conventional understanding, both then and now, of the forces that limited banks’ creation of checkable deposits.

154. Jeffrey A. Miron, “Financial Panics, the Seasonality of the Nominal Interest Rate, and the Founding of the Fed,” American Economic Review 76 (March 1986): 125–40.

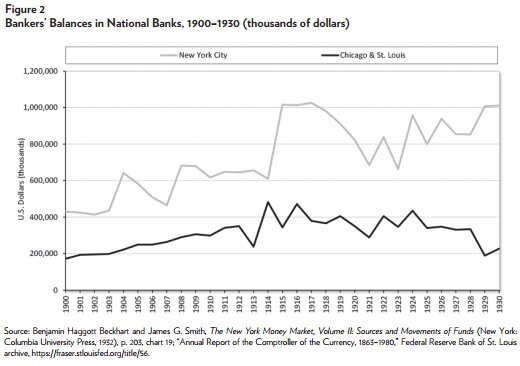

155. Raymond P. H. Fishe, “The Federal Reserve Amendments of 1917: The Beginning of a Seasonal Note Issue Policy,” Journal of Money, Credit, and Banking 23, no. 3 (August 1991): 308–26.

156. Ibid.

157. Ibid., pp. 314–16.

158. James Grant, The Forgotten Depression: 1921: The Crash that Cured Itself (New York: Simon & Schuster, 2014), p. 53. See also Timberlake, Monetary Policy in the United States, p. 258.

159. Friedman and Schwartz, A Monetary History of the United States, p. 221.

160. Victor Zarnowitz, Business Cycles (Chicago: University of Chicago Press, 1996).

161. Michael D. Bordo and David C. Wheelock, “The Promise and Performance of the Federal Reserve as a Lender of Last Resort, 1914–1933,” in The Origins, History, and Future of the Federal Reserve: A Return to Jekyll Island, ed. Michael D. Bordo and William Roberds (New York: Cambridge University Press, 2013), p. 59. On the role of the concentration of bankers’ balances in New York City in the crisis of the early 1930s, see Kris James Mitchener and Gary Richardson, “Network Contagion and Interbank Amplification during the Great Depression.” Unpublished working paper, 2016.

162. Ibid., p. 61.

163. Jeffrey A. Miron, “The Founding of the Fed and the Destabilization of the Post-1914 Economy,” NBER Working Paper no. 2701, September 1988, p. 2.

164. George Selgin, William D. Lastrapes, and Lawrence H. White, “Has the Fed Been a Failure?” Journal of Macroeconomics 20, no. 12 (September 2012): 570.

165. Dewald, “The National Monetary Commission,” p. 932.

166. Wesley C. Mitchell, “The Publications of the National Monetary Commission,” Quarterly Journal of Economics 25, no. 3 (1911): 593.

167. Wicker, The Great Debate on Banking Reform, p. 6.

168. Laughlin, Report of the Monetary Commission of the Indianapolis Convention, p. 3.

169. Ibid.

170. Ibid., p. 6.

171. Brady, “The Case for a Centennial Monetary Commission,” p. 393.

172. Ibid., p. 390.

173. Concerning the Federal Reserve’s status quo bias, see Edward J. Kane, “Politics and Fed Policymaking: The More Things Change, The More They Remain the Same,” Journal of Monetary Economics 6 (April 1980): 199–211; and Edward J. Kane, “Bureaucratic Self-Interest As an Obstacle to Monetary Reform,” in The Political Economy of American Monetary Policy, ed. Thomas Mayer (New York: Cambridge University Press, 1993), pp. 283–98.

174. Centennial Monetary Commission Act, H.R. 2912, 114th Cong. § 5(a)(3)(B) (2015).

175. Lawrence H. White, “The Federal Reserve’s Influence on Research in Monetary Economics,” Econ Journal Watch 2, no. 2 (August 2005): 325–54.

176. Kane, “Bureaucratic Self-Interest as an Obstacle to Monetary Reform,” p. 290.