The current U.S. immigration system favors non-economic immigrants. About 81 percent of new immigrants are family members of American citizens or green card holders, whereas only 5 percent earn green cards for employment or investment purposes. Our rapidly changing economy requires a more dynamic immigration system that allows in types of economic immigrants who are barred under the current system. Congress should create an additional visa category that would allow foreigners to work and live legally in the United States after paying a tariff. Immigrants who pay the immigration tariff would receive a “gold card” that does not directly lead to citizenship, but allows the immigrant to live and work legally in the United States. Congress could adjust the tariff rate on the basis of the immigrant’s estimated fiscal impact, as determined by the individual’s level of education or other relevant demographic factors. Several other countries charge high fees for visas or sell the right to immigrate, which offer excellent lessons in how to design a well-functioning immigration tariff for the United States. An American immigration tariff would create a dynamic, market-based, merit-based, relatively more economically efficient, and self-regulating system that would serve the ever-changing American economy.

Background

Under the current immigration system, foreign-born people can initially work and reside legally in the United States as immigrants with lawful permanent residency on a green card or as nonimmigrants on temporary visas. Congress sets the number of green cards via a numerical cap, last adjusted in 1990, and apportions them by type: family, employment, and diversity.

Of the 1,183,505 green cards issued in 2016, 81 percent were for family members of U.S. citizens or green card holders. Only 5 percent were in the worker or investor category.1 Most family-sponsored and diversity immigrants do work and they are increasingly skilled, but their skills, education, and the demands of the U.S. labor market are not legal considerations in granting them green cards.2 Temporary nonimmigrant work visas — such as the H-1B for specialty skilled workers, the H-2B for seasonal nonagricultural workers, and the H-2A for seasonal agricultural workers — either are numerically capped or are so highly regulated and expensive that they have low de facto caps. No functional visa exists for entrepreneurs.

America’s current immigration system is more restrictive than those of most other developed nations. Of the 35 member countries of the Organisation for Economic Co-operation and Development that reported immigration data for 2015, the United States had the 26th most open immigration policy measured by the number of new immigrants as a percentage of the population — right between Israel and Greece.3

Relative to the size of its population, Canada allowed in 2.3 times as many immigrants in 2015 as the United States did; Chile and Australia allowed in 2.9 times as many; and New Zealand allowed 6.1 times as many.4 The bulk of immigrants in those nations are skilled workers, entrepreneurs, or meet other government-determined economic qualifications.5 Relative to the employment-based green card system in the United States, the economic visa programs in Australia, Canada, and New Zealand allow for more immigrant workers and entrepreneurs of different types.

The current U.S. immigration system stunts economic growth and reduces tax revenues. A recent proposal to address the paucity of economic immigrants is to create a merit-based immigration policy with the RAISE Act, a bill introduced in 2017 by Sen. Tom Cotton (R-AR).6 Cotton touted his bill as a merit-based points system under which immigrants get green cards if they earn a certain number of points based on education, language ability, job experience, and other qualifications.

Contrary to Senator Cotton’s claims, the RAISE Act would actually reduce the number of skilled immigrants because it cuts the number of family-sponsored immigrants, diversity visa recipients, and refugees while maintaining the same number of employment-based green cards.7 Furthermore, had the RAISE Act been law in 2000, it would have kept out about a quarter of American Nobel Prize winners, demonstrating the faults of its points system.8 Merit-based points systems in Canada and Australia allow in more economic and family-sponsored immigrants, as a percentage of their populations, than the current U.S. immigration system does. If Senator Cotton wanted to emulate the merit-based immigration systems of other countries, he would support expanding legal immigration rather than curtailing it.9

A fundamental flaw with a points-based immigration system is that it would rely on Congress to decide what types of skills, education levels, or other qualifications should be awarded points. A points-based immigration system could even make the current employment-based immigration system more rigid by granting more points to specific occupations among a fixed number of green cards rather than relying on employer sponsorship.

Nobel Prize–winning economist Gary Becker, among others, proposed another way to produce a more merit- and market-based immigration system that would avoid the problem of government selection of winners and losers. Becker argues that selling the right to immigrate would boost economic efficiency, raise tax revenue, and improve the average quality of immigrants to the United States.10 Such a sale could take the form of an auction if the number of admissions is artificially capped or of a tariff for which the government sets a price and allows the quantity to adjust according to market conditions.

Immigration Tariffs and Fees around the World

Fees and tariffs already play an important role in many immigration systems around the world. Singapore has a monthly levy for workers based on their skill level and the concentration of foreign workers by economic sector. The United Kingdom, Australia, Canada, and New Zealand all levy substantial fees to defray social service costs.11 For instance, the fee for the permanent Contributory Parent visa category in Australia is AUD$31,555.12 Antigua allows anybody to qualify for citizenship in exchange for a US$250,000 direct payment to the government, a US$400,000 real-estate purchase, or a business investment of US$1.5 million.13 Turkey offers citizenship to foreigners who buy property worth at least US$300,000.14

The United States. The United States has also charged fees well in excess of administrative costs or has required levels of investment in exchange for a visa. In 1882, the government imposed a head tax of $0.50 per immigrant that it raised to $4 in 1907, and then to $8 in 1917.15 In 1959, the U.S. government levied a $12 tariff on farmers for every bracero guest worker they hired under that short-lived visa program.16 In 2016, the United States allocated 3,422 EB-5 green cards to applicants who invested $500,000 to $1 million under various conditions.17 The government charges $4,000 for each H-1B petition submitted by H-1B dependent employers, as well as a whole host of other protectionist fees.18 Taking the current H-1B fee policy a step further, some American firms, such as Microsoft, have even proposed that they should be able to pay $10,000–$15,000 to sponsor each worker on an H-1B visa or green card.

The current immigration system extracts resources from immigrants and their sponsors in ways that are more destructive than a tariff. Currently, green card applicants and their sponsors can pay up to $35,000 in lawyer and government fees to navigate the legal minefield for green cards or H-1B visas.19 Immigrants also pay by waiting in decades-long queues.20 If they are in visa limbo, they have more difficulty buying a house, enrolling their children in school, and making investments or starting businesses. Both the uncertainty of the current numerical cap-and-regulation–dominated immigration system and the deadweight loss from preventing most legal immigration that would occur in a free market impose heavy costs on immigrants, their sponsors, and Americans. An immigration tariff would reduce all of those burdens, diminish the uncertainty of the legal immigration process, and produce a fairer and more transparent immigration system for all.

The Australian Proposal. Australian Senator David Leyonhjelm asked the Productivity Commission, a government think tank, to analyze how an immigration tariff modeled on Gary Becker’s proposal would affect Australia. The commission released several reports on the topic — the latest in September 2016 — and ultimately concluded that an immigration tariff would be inappropriate for Australia.21 As the commission pointed out, “No other country allocates permanent visas on the basis of price.”22

The commission argued that a price-based immigration system similar to a tariff would place Australia at a competitive disadvantage compared with other nations seeking to attract skilled immigrants. It assumed that a price would be a deterrent relative to legal immigration avenues under the current Australian system. Furthermore, the commission was concerned that the type of immigrants who would enter under a price mechanism would be less well suited to assimilation and integration than those selected according to the rules already in place.

There are reasons to doubt the conclusion of the Australian Productivity Commission, but the country’s immigration system is far more open than that of the United States — especially for skilled immigrants demanded by the labor market. Thus, the gains for Australia to switch from a relatively open immigration system to a price-based system are smaller than they would be for the United States.23 America’s long wait times and relatively restricted immigration system multiply the benefits of an immigration tariff.

The Design of the Immigration Tariff and Gold Card

Under this proposal, foreigners can pay an immigration tariff to the federal government in exchange for a gold card visa that would allow the holders to reside and work in the United States so long as they are not inadmissible under existing criteria and do not commit a deportable offense.24 The gold card would not provide a new path to citizenship, but its holders could adjust their status to a green card and eventually earn citizenship through any other currently existing legal means. The immigrants would not be eligible for means-tested welfare benefits upon entry, or even after five years of residency, because they would not be lawful permanent residents.25 Gold card immigrants who commit deportable offenses would not receive a refund of the tariff that they had paid. The Citizenship and Immigration Services would administer the tariff and distribution of gold card visas while Customs would collect the revenue.

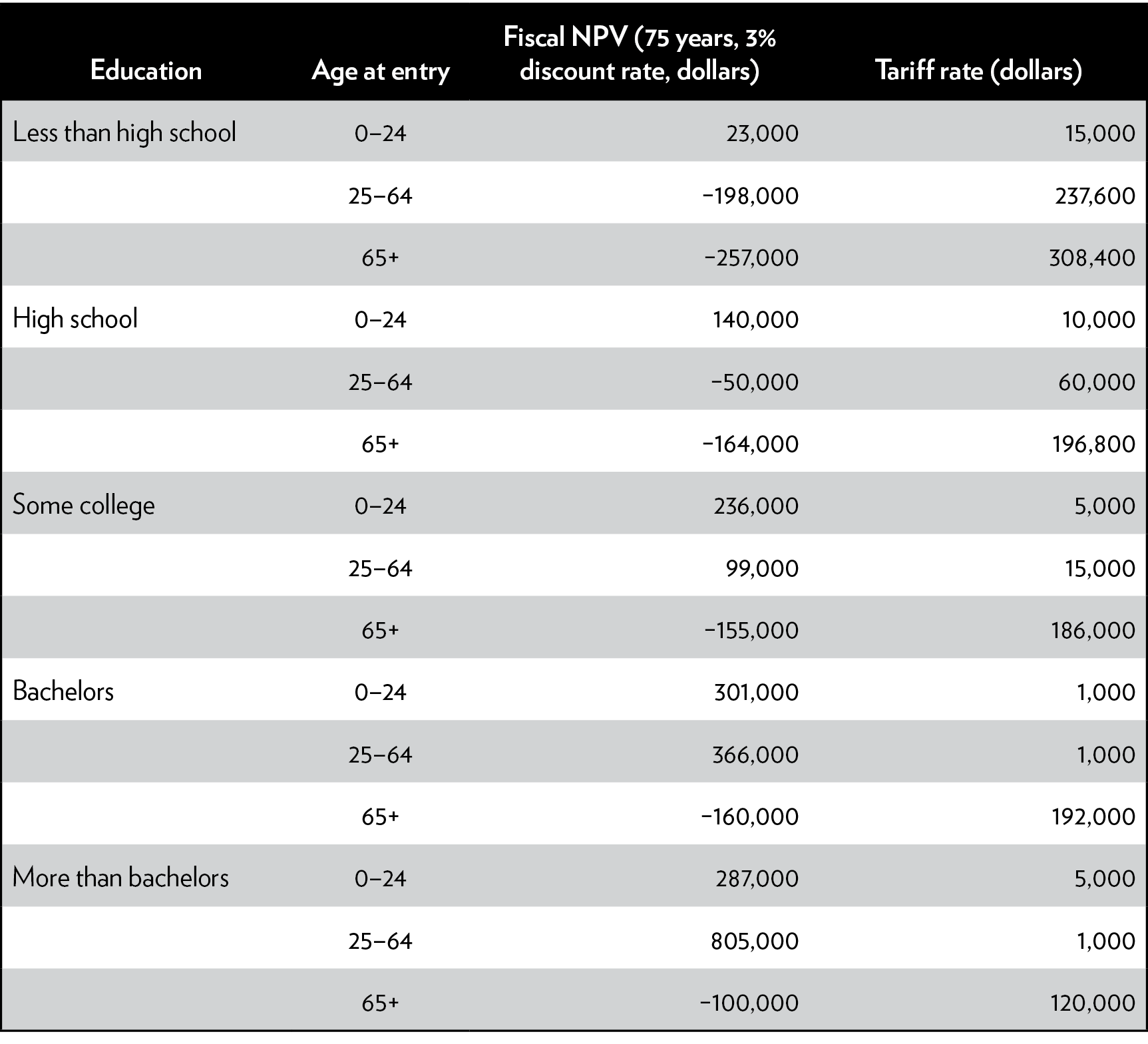

Congress could set an immigration tariff schedule with any goal in mind, but covering the worst-case net fiscal impact of the marginal gold card purchaser should be a prime consideration. The National Academy of Sciences (NAS) estimates that younger and more educated immigrants are more fiscally positive because they have more work years ahead of them, will earn higher incomes and pay more in taxes, and are less likely to consume public benefits.26

Congress could thus adjust tariff rates by age and education to guarantee that all immigrants make a positive net fiscal contribution to avoid a negative externality on U.S. taxpayers. Table 1 is a mock tariff schedule based on the NAS results, where rates are adjusted to produce a fiscal surplus. For categories with a negative fiscal impact, the schedule flips the sign and adds 20 percent to the price to guarantee that the net fiscal impact is positive. The choice of a 20 percent buffer is arbitrary but intended to err on the side of producing a larger fiscal surplus. For immigrants whose estimated net fiscal effect is positive but less than $100,000, the tariff is $15,000. For those with an estimated positive net fiscal effect over $100,000 but less than $200,000, the tariff is $10,000. For those with a positive net fiscal effect over $200,000 but under $300,000, the tariff is $5,000. Those with an estimated net fiscal impact that is greater than $300,000 face a rate of only $1,000.

Table 1: Mock tariff schedule

Sources: National Academy of Sciences, Table 8-14, and author.

Note: NPV = net present value.

Suppose Congress adopted the mock tariff schedule in Table 1, and 250,000 immigrants with the same educational characteristics as those who entered from 2013 to 2016 paid the tariff; if so, the Treasury would collect about $10.9 billion in extra revenue in the first year.27 That upfront tax revenue would be in addition to taxes paid by gold card workers through existing tax laws.

One problem with relying on the NAS fiscal impact estimates is that the age ranges are too large for fine-tuning tariff rates. For instance, the second age category is 25 through 64. Controlling for education, a 25-year-old will have a more positive net fiscal impact than a 64-year-old, but the NAS does not allow us to view the estimates for smaller age ranges. However, Congress could mandate frequent fiscal impact studies for more detailed age ranges to fine-tune tariffs with the intent of guaranteeing a large fiscal surplus.

Congressional Options for Setting Tariff Rates

Congress could change tariff rates or adjust the schedule using criteria other than the age and education of the immigrant. Other options include parallel tariff schedules based on national security, trade, or other international priorities. For instance, Congress could charge a lower tariff for citizens of nations that have signed free trade agreements with the United States or extend tariff reductions to the citizens of U.S. allies.

Congress could also lower the tariff for gold card holders who voluntarily forgo eligibility for Social Security, Medicare, or other government benefits available to noncitizens.28 Forgoing benefits in exchange for a lower tariff would be particularly attractive to temporary and lower-skilled migrants who do not intend to retire in the United States because they would not receive Medicare anyway. Congress could also make the gold card an explicitly temporary work and residency permit or sell a more restricted temporary version, perhaps called a silver card, alongside a permanent version. A temporary or more restricted version of the gold card — with or without the suggested silver card name — would have to cost less because the purchasers would have lower expected future earnings in the United States.

The options open to Congress are virtually unlimited if it chooses to create an immigration tariff. The range of options comes with potential downsides, as the immigration tariff schedule could quickly balloon to ridiculously complex proportions because of rent seeking and regulatory capture. A less complex tariff schedule with lower prices is superior to a complex one with higher prices, but both are improvements over the current system if they result in a net liberalization of immigration.

Family Reunification

Family reunification is an important issue when it comes to designing an immigration tariff. The number of family members that principal gold card immigrants can bring with them will affect the price they are willing to pay and tariff revenue. The more family members who can enter with the principal gold card purchaser, the higher the price the government can charge. Current immigration law allows the spouses, unmarried minor children, and parents of American citizens to earn green cards outside the numerical cap. Many green card holders can also sponsor their immediate relatives, but those numbers are capped.29

Ideally, all principal gold card purchasers would be able to bring their minor children without paying the tariff for them. That does not change the fiscal effects because immigrants who enter under the age of 24 are a net fiscal positive.30 Spouses are older and more likely to have a negative net fiscal impact. Every other argument in favor of a tariff for the principal gold card immigrants applies equally well to their spouses. Congress could charge a discounted tariff rate for spouses or adjust the price down and charge a single tariff for the entire household. Congress could also allow a certain number of sponsored family members to accompany the principal gold card immigrant without an additional charge, but then implement an escalating fee structure based on age and education for each additional family member beyond a certain number. Congress would most likely implement a hybridized tariff system that combines it with components of the current family-sponsored immigration system.

Clearing the Green Card Backlog

An immigration tariff does not have to be a separate visa category like a gold card to improve the immigration system. For example, Congress could sell green cards at the end of every year to any remaining applicants in the queue who did not receive one because of the numerical limitations but who are otherwise eligible. Green cards sold in this manner should not count against the numerical cap. This system would allow those who have a legal claim to permanent residency to gain it sooner by paying a tariff. Allowing green card applicants to pay to jump the queue would shorten the wait times for those who refuse to pay by removing those ahead of them. The potential fiscal and economic benefits from a tariff that clears the green card backlog are smaller relative to a new uncapped visa category. But this approach may be an excellent starting point for Congress to test the potential of an immigration tariff. Either auctioning a fixed number of green cards each year or setting a price would raise more revenue and shorten the wait times for employment-based green cards.31

Other Benefits of an Immigration Tariff

A tariff would significantly increase the economic and fiscal benefits of immigration, reduce illegal immigration, and allow more foreigners access to visas at a functionally lower and more transparent price. Immigration tariffs are not perfect, but no marginal improvement to public policies is. Adam Smith, the intellectual father of free trade, endorsed a British export tariff on wool because it was an improvement over the United Kingdom’s outright ban on the export of wool at the time.32 Just as an export tariff on wool was an improvement over an export ban, an immigration tariff is an improvement over the current immigration system’s caps and numerical quotas.33 The immigration tariff’s gold card would be a more market-based visa than any current visa because it charges a price and allows the quantity of visas to automatically adjust on the basis of domestic supply and demand.34 The tariff would distort the price of the visa and create deadweight loss, which is the value of goods and services not produced as a result of market distortions such as taxes. But it would be less distortionary and destructive than a visa-rationing scheme based on inflexible numerical quotas.

Harvard economist George Borjas wrote that selling visas and letting the market regulate their price, quantity, or both would create a more economically efficient immigration system.35 If a price system works well for the proverbial widget, then it should also work for visas.36 An immigration tariff could allow more individuals to immigrate legally, to earn a substantial wage premium in the United States, and to transfer wealth to American taxpayers.37 The economic gains and fiscal transfers might overcome much anti-immigrant bias.38

Immigrants, firms, financial institutions, and civil society would rapidly adjust to a tariff. An immigration tariff would reduce bureaucratic uncertainty and liberalize the immigration system. Many potential immigrants would choose to pay because of the large internalized economic gains from working legally in the United States.

Market- and Merit-Based Immigration

Changing economic conditions in the United States would automatically alter the type of economic immigrants who would pay the tariff. If the wages for some occupations rise, then immigrants and firms would be more willing to pay the tariff for foreign workers in those occupations, whereas they would be less willing to do so for workers in occupations with falling wages. That response would mirror the actual labor market, channeling new immigrant workers to occupations that demand their services without the aid of a government bureaucracy or economic formula.

Congress attempted to use a complex formula to simulate a market-based system for the issuance of new guest worker visas in the failed 2013 immigration reform bill.39 A tariff would achieve the desired result automatically, more transparently, and without creating a formula that could be manipulated by special-interest groups. The labor market has changed dramatically since Congress last overhauled the economic visa and green card system in 1990.40 A simple immigration tariff with rates pegged to inflation would make the immigration system more dynamic and sustainable in the long decades between reforms.

An immigration tariff would also boost efficiency by slightly liberalizing immigration. Current immigration restrictions reduce economic output by trapping immigrants in nations where they have low productivity. Foreign workers from the median developing country can increase their real earnings about fourfold, purchasing power parity adjusted, just by moving to the United States.41 That translates to an absolute wage gain that exceeds $13,600 per worker per year. Assuming no adjustment in relative wages, that worker would make $272,000 more over a 20-year working life in the United States than he would in his home country.

Congress could decide to set different tariff rates based on the immigrant’s occupation, but such a system would eliminate many of the economic benefits of an immigration tariff. Different tariff rates for workers in different occupations would favor some sectors of the economy over others and would ultimately diminish the benefits of an immigration tariff, reduce the degree to which it rewards merit, slash its market-friendly nature, and make it less adaptive to changes in the American economy. Regardless, even allowing a tariff for a handful of occupations is still an improvement over the current system if it allows for additional immigration.

Tax Revenue

A gold card immigration tariff could raise tax revenue by liberalizing the economy and collecting revenue directly from the tariff. Accepting more immigrants would add workers and entrepreneurs, two of the four factors of production, which would then increase income and economic output that would be taxed under current laws. The federal government would collect revenues directly through the sale of the gold cards, with the only realistic limit to collecting tax revenue directly through an immigration tariff being the number of gold cards it wants to sell and the price it sets. The government would not incur additional administrative costs for the sale of gold cards, as those would be borne by existing administrative fees. Because many of the legal complexities that clog the current immigration system would not exist under a tariff, most immigrants could navigate the process without having to hire an attorney. Thus, the money that immigrants currently spend on lawyer fees and smuggling would instead be redirected to the federal government.

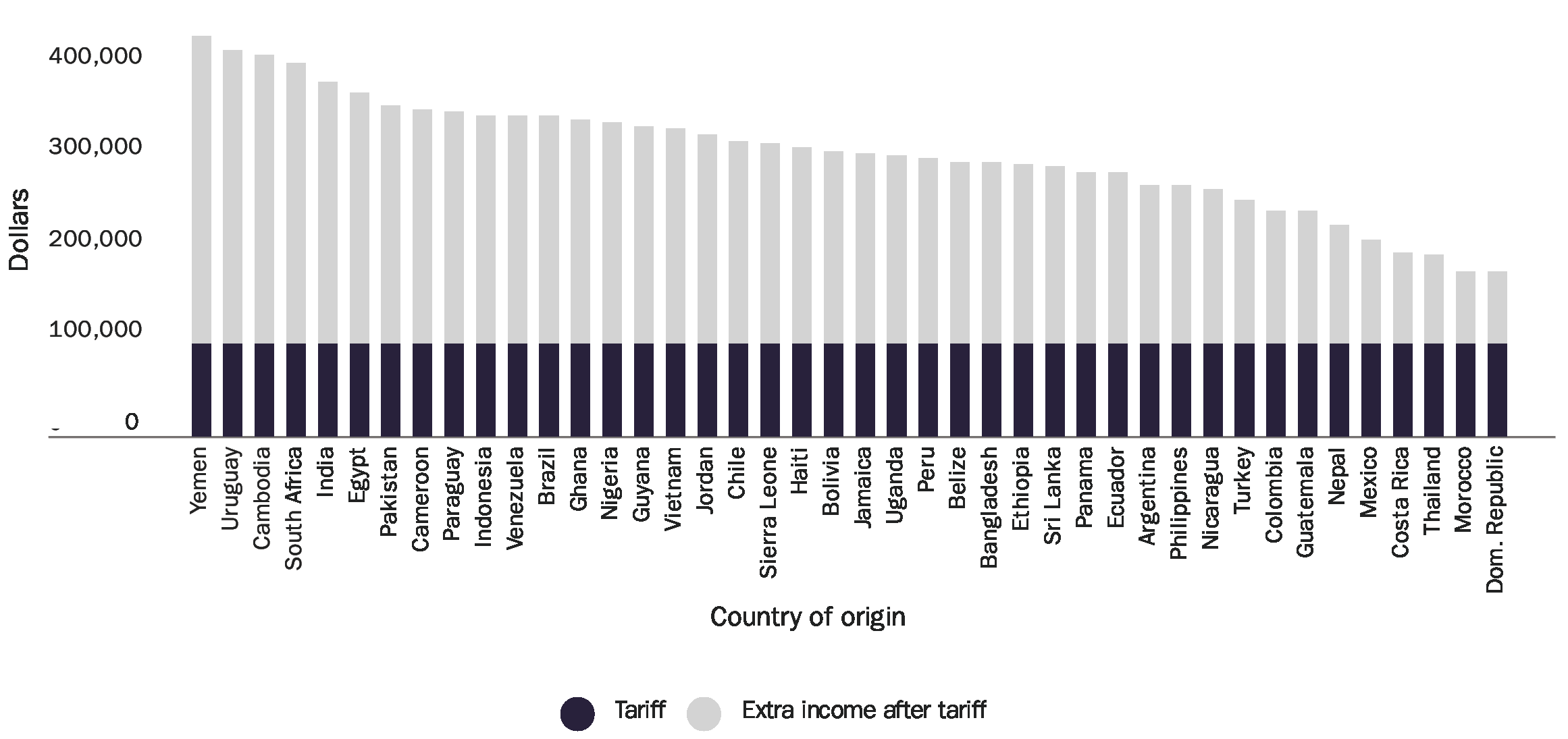

Many poor and lower-skilled immigrants would be able to pay the immigration tariff. Each entire bar in Figure 1 shows the extra income that high school–educated immigrants can expect to earn over a 20-year period in the United States based on their countries of origin.42 The bottom portion of the bar represents the amount of extra income that the gold card worker would pay to the government as an immigration tariff if the rate were set at $100,000.

Figure 1: Increase in income and tariff revenue from high school–educated immigrants who pay a $100,000 tariff by country of origin

Sources: Center for Global Development and author’s calculations.

Although such a high tariff rate would greatly diminish the expected economic benefit of immigrating to the United States, workers would still earn far more than they would have in their home countries. The government would collect the bottom portion of each bar in Figure 1 in tariff revenue up front and the top portion would accrue to the gold card user over a 20-year period of working in the United States, excluding other state, local, and federal taxes. Even with a very high tariff rate, it would be economically beneficial for many lower-skilled immigrants to pay the tariff as their expected future income would greatly exceed the upfront cost of the gold card.

At higher tariff rates, immigration from countries with smaller wage gaps relative to the United States would shrink as the opportunity cost would be too great. A modest 6 percent compounded annual return on $100,000 would grow into $302,560 over 20 years, which is more than the gain from immigrating for most workers in the world. Furthermore, the tariff does not even include the other costs, such as transportation, housing, and homesickness. Regardless, the benefits of paying the tariff would exceed the costs for large numbers of immigrants.

An immigration tariff paid at the point of entry would overturn the false public perception that immigrants are a fiscal drain and would directly address any legitimate concerns about the fiscal cost of immigration. More directly, the extra revenue could be used to pay down the national debt or to provide a tax refund at the end of every year.43

More Economically Efficient Labor Market Protection

If Congress decides to create an immigration tariff, then it will likely feel compelled to include some protections for the domestic labor market despite the small and mostly positive effects of immigrants on the wages of native-born Americans.44 If such protections are deemed politically necessary, Congress should structure them in the least economically destructive way possible. An immigration tariff provides low-cost protection for the American labor market as it incentivizes employers to hire American workers first by putting an additional price on immigrants. It also raises revenue while avoiding the destructive inflexibility of numerical caps.45

If American wages fell, fewer immigrants or employers would pay the tariff because the benefits of doing so would diminish. Congress could also adjust the tariff rate in response to immigrant flows or economic conditions. The economic inefficiency created by an immigration tariff would be less than that created by a numerical cap, unless the tariff rate were so high that even fewer immigrants would enter relative to the current system.46

Reduced Wait Times for Lawful Permanent Residency

Because of per country numerical caps on green cards, many immigrants can wait decades or generations for lawful permanent residency.47 Congress should remove the per country green card caps and issue more employment-based and family green cards. But an immigration tariff could also help by creating an option for immigrants who want all the benefits of lawful permanent residency but do not intend to naturalize. Allowing those individuals to purchase a gold card rather than wait for a green card is a compromise position that would shorten the wait and improve the quality of life for all immigrants.

Reduced Illegal Immigration

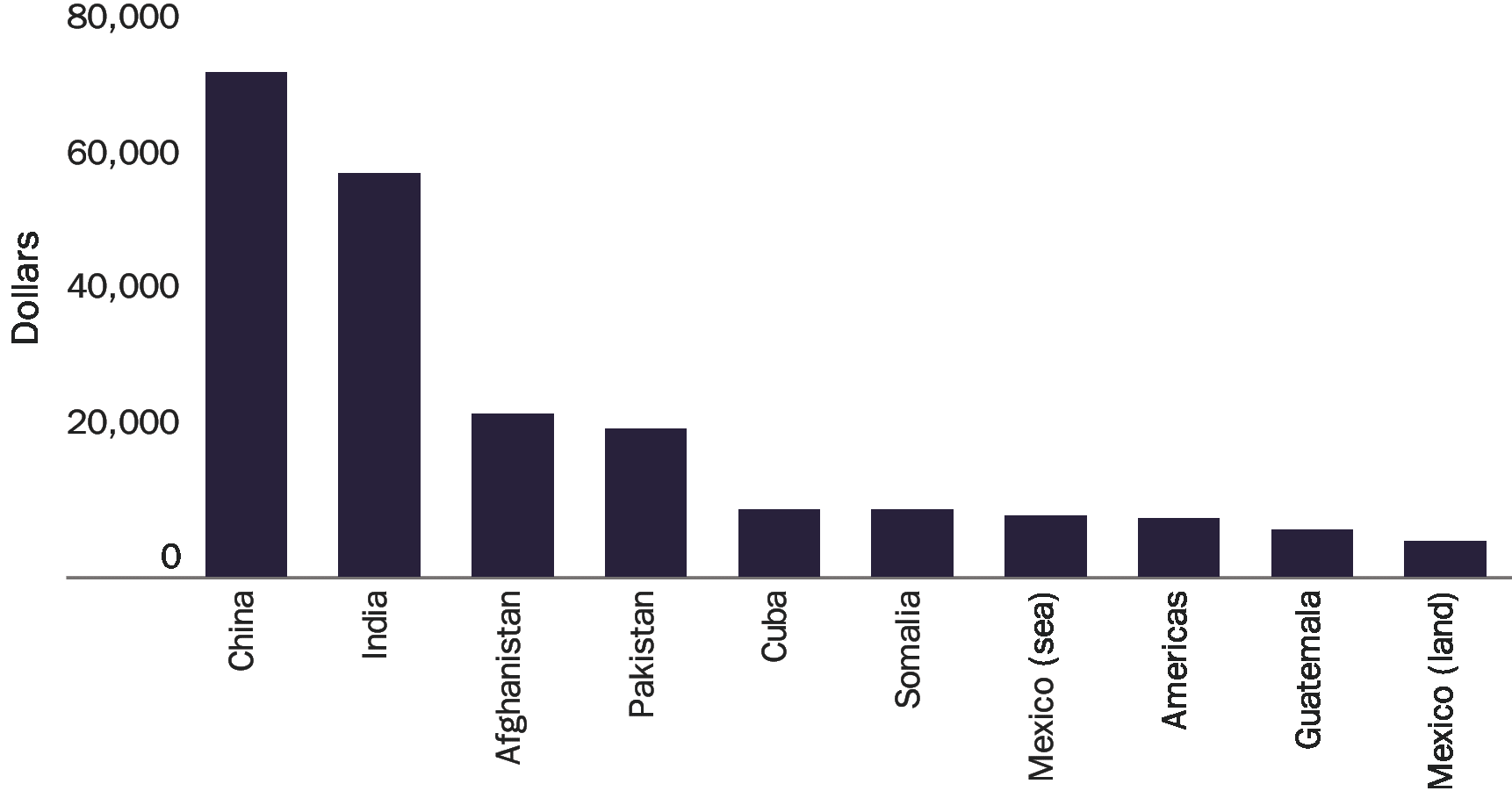

Congress should also seek to set a tariff rate that undercuts human smugglers and drives them out of business. Most new illegal immigrants enter lawfully and overstay their visas, but a substantial percentage still enter illegally, and many of them hire smugglers. In 1983, the average Southwest border smuggling fee was $300 and a bare majority of crossers paid.48 By 2006, the price was about $2,000 and about 90 percent of crossers hired a smuggler.49 Since then, the smuggling price has doubled to about $4,000.50

In 2008, the U.S. government and outside researchers estimated that between 30,000 and 100,000 Chinese immigrants were smuggled into the United States annually at around $55,000–$75,000 per person — a price that includes fake documents, airplane tickets, and bribes.51 Individually reported smuggling prices are even higher and vary according to distance, destination, danger, and the chance of apprehension (Figure 2).

Figure 2: Estimated smuggling prices to the United States

Source: Havocscope Global Black Market Information.

Even if the tariff rate were set higher than the current smuggling price, many immigrants would prefer to pay the tariff and immigrate legally. Doing so would be far safer and would ensure that they would not waste their investment by being deported shortly after entering the United States. Under an immigration tariff, immigrants would have an incentive to enter legally and remain legal once here, as wages for illegal workers are below those of legal workers and they face the possibility of deportation.52 Higher benefits and fewer dangers will incentivize immigrants to pay the tariff for a gold card rather than pay a human smuggler.

An important caveat is that an immigration tariff would have to be cheap enough to incentivize most would-be illegal immigrants to buy the gold card. On the one hand, if prices are too high, the status quo ex ante remains, and the human smuggling market would persist. On the other hand, as the economic benefits of liberalized immigration are realized, Congress could gradually cut the price of a gold card.

Fairness and Ability to Pay

One criticism of an immigration tariff is that lower-skilled immigrants would be unable to afford it. Most immigrants are not so poor that they cannot raise money to pay a tariff, assuming the benefits of immigrating are great enough and the tariff is not prohibitively high.53 Smuggled persons tend to be among the more economically and educationally disadvantaged, but many still manage to pay exorbitant fees to smugglers (Figure 2).54 For instance, Immigration and Customs Enforcement deported a group of smuggled Sri Lankan illegal immigrants who had each paid $55,000 to smugglers and, of course, did not receive a refund.55 Many smuggled immigrants currently pay the smuggling price up front, villages and families often pool resources to send a single male immigrant along with enough money to pay the smuggler’s fees, and many pay the price in installments after they arrive.56

Immigrants could pay the tariff through private loans, pooled familial or community resources, or third parties. Financial institutions and employers would happily lend funds to pay a tariff. Immigrants would use their higher U.S. earnings to pay back their loans. According to one estimate, Mexican workers with green cards earn $20,000 more a year in the United States than they do in Mexico.57

One study finds that an employment-based green card leads to an annual wage gain of $11,860 over a temporary work visa.58 Many lower-skilled immigrants would be able to pay off loans incurred to pay a tariff with wage premiums that high. Currently, most lower-skilled would-be immigrants have no way to immigrate. An immigration tariff would make legal immigration a possibility for them for the first time since the early 20th century.

Furthermore, lower-skilled immigrants could reduce their tariff rate by gaining more education. In many cases, that investment will be worth it, given the reduced tariff rate and the expected higher wages that they would earn in the United States. Under a tariff as envisioned here, the price for a gold card would drop as the immigrants gained more education relative to their age. On the margin, it might make personal financial sense for the immigrants to forgo a few years of working in the United States in exchange for acquiring more education in their home countries before paying the tariff.

Some people might believe that it is wrong to sell a visa, but immigrants already pay, directly and indirectly, to enter the United States. Immigrants already pay for lawyers, for travel to and from American consulates for interviews, for filing fees, and for decades of lost income while on waitlists just for the chance to get a visa. Those fed up with the system hire a human smuggler, a document forger, or other unsavory individuals to help them enter the United States and work illegally. Removing the bureaucratic intermediaries, human smugglers, and immigration attorneys from the mix is certainly worth publicly abandoning the fantasy that money is an irrelevant consideration in immigrating to the United States.

Tariffs Preferable to Auctions

Many supporters of a more liberalized immigration system argue for auctions to distribute visas more efficiently.59 An immigration tariff without a numerical cap is superior to an auction for at least three reasons. First, an auction is less economically efficient than an immigration tariff. Auctions would shift the allocation of visas toward more valuable uses but would not alleviate visa scarcity, which is the source of far more inefficiency. Auctions increase efficiency in the same way that auctioning import licenses is better than autarkic trade policy, but a numerically uncapped gold card would be better still.

Second, since the federal government is the sole issuer of visas, it has market power and can set the price by limiting the quantity. Limiting the government’s role to setting the price of visas and allowing quantities to fluctuate according to supply and demand would produce a more flexible system that is responsive to actual market demands, whereas an auction would merely allow price adjustments within bounded quantities.

Third, an auction would not diminish illegal immigration or human smuggling because the quantity of visas would still be severely restricted. Few, if any, lower-skilled immigrants would be able to outbid higher-skilled immigrants in a visa auction.

Tariffs Preferable to Special Internal Taxes on Immigrant Labor

An immigration tariff does have a few downsides. It places a large upfront cost on the immigrants, and Congress will need to adjust it as smugglers adopt new technology and lower their prices. An alternative approach is that any nonexcludable immigrants can come, but they must pay a higher internal tax rate, say via a higher income tax, than native-born American workers.60 Presumably, that would allow poorer immigrants who cannot borrow for a tariff to try their luck working here while also guaranteeing the Treasury windfall tax revenue for extremely successful immigrants. A special tax on some immigrants would likely pass constitutional muster so long as they are noncitizens.61

Implementing special internal taxes instead of an immigration tariff has several downsides. First, special internal taxes for immigrants do not fit well into the current tax or immigration systems. Our current legal immigration system and border checks make enforcement upon entry or initial application administratively cheaper than charging different tax rates after entry. It is notoriously difficult to enforce income taxes, whereas paying a tariff at the border is relatively easy to monitor.

Second, if immigrants who are subject to the specific internal tax naturalize, then their special higher tax rate would vanish because of the equal protection clause of the Fourteenth Amendment.

Third, a special internal tax rate for immigrants does not guarantee higher government revenues over the long run. The immigrant could be an economic failure and pay little tax as a result. However, a tariff guarantees that even immigrants who do not do well are not fiscal drains.

Conclusion

An immigration tariff would expand the economy, boost tax revenues, shrink the black market in human smuggling, and reallocate some of the gains of immigration from immigrants to natives. For the immigrants, the tariff would remove the uncertainty, danger, and criminality of human smuggling by increasing legal opportunities to immigrate. An immigration tariff is an admittedly imperfect solution to those problems, but it is one that could address many of the complaints of immigration restrictionists; it would appeal to proponents of a more liberalized system and that could convince voters and politicians that immigrants really are a net benefit for the United States. As long as economic opportunities exist here, millions of people from around the world would gladly pay a high tariff to legally work and reside in the United States without the risk of human smuggling. Congress should let them do so.

Notes

This policy analysis is an update and expansion of Alex Nowrasteh, “The Conservative Case for Immigration Tariffs: A Market-Based, Humane Approach to Solving Illegal Immigration,” Competitive Enterprise Institute, Washington, February 7, 2012, http://cei.org/onpoint/conservative-case-immigration-tariffs.

1 U.S. Department of Homeland Security, Yearbook of Immigration Statistics (Washington: DHS, 2016), https://www.dhs.gov/yearbook-immigration-statistics.

2 Alex Nowrasteh, “America’s Increasingly Meritocratic Immigration System,” Cato at Liberty, April 7, 2017, https://www.cato.org/blog/americas-increasingly-meritocratic-immigration-system; David Bier, “Family and Diversity Immigrants Are Far Better Educated than U.S.-Born Americans,” Cato at Liberty, January 25, 2018, https://www.cato.org/blog/family-diversity-immigrants-are-far-better-educated-us-born-americans.

3 Organisation for Economic Co-operation and Development (OECD), “Key Statistics on Migration in OECD Countries,” 2015, http://www.oecd.org/els/mig/keystat.htm; World Bank, “Population, Total,” 2015, https://data.worldbank.org/indicator/SP.POP.TOTL?end=2015&start=2015.

4 OECD, “Key Statistics on Migration”; World Bank, “Population, Total.”

5 Alex Nowrasteh, “More Family-Based Immigrants in Australia and Canada than in the United States,” Cato at Liberty, April 11, 2017, https://www.cato.org/blog/more-family-based-immigrants-australia-canada-united-states.

6 Reforming American Immigration for a Strong Economy Act of 2017, S. 1720, 115th Cong., 1st sess.

7 Alex Nowrasteh, “The RAISE Act Talking Points Are Deceptive,” Cato at Liberty, August 4, 2017, https://www.cato.org/blog/raise-act-talking-points-are-deceptive.

8 Akhila Satish, “The Nobel Laureate Exclusion Act: No Future Geniuses Need Apply,” Wall Street Journal, September 14, 2017, https://www.wsj.com/articles/the-nobel-laureate-exclusion-act-no-future-geniuses-need-apply-1505431036.

9 Alexander Panetta, “Canada’s Immigration Policy Inspired Donald Trump’s New Plan: White House,” Global News, August 2, 2017, https://globalnews.ca/news/3643835/trump-immigration-canada/.

10 Gary Becker, The Challenge of Immigration: A Radical Solution (London: Institute for Economic Affairs, 2011); Barry R. Chiswick, “The Impact of Immigration on the Level and Distribution of Economic Well-Being,” in The Gateway: U.S. Immigration Issues and Policies, ed. Barry R. Chiswick (Washington: American Enterprise Institute, 1982), pp. 289–313; Jagdish N. Bhagwati and T. N. Srinivasan, “On the Choice between Capital and Labour Mobility,” Journal of International Economics 14, no. 3/4 (1983): 209–21; Melvyn B. Krauss and William J. Baumol, “Guest Workers and Income-Transfer Programs Financed by Host Governments,” Kyklos 32, no. 1/2 (1979): 36–46; Alan O. Sykes, “The Welfare Economics of Immigration Law: A Theoretical Survey with an Analysis of U.S. Policy,” in Justice in Immigration, ed. William F. Schwartz (Washington: Georgetown University Press, 1995), pp. 158–200.

11 Australian Government Productivity Commission, “Migrant Intake into Australia,” Inquiry Report no. 77, April 13, 2016, p. 538, https://www.pc.gov.au/inquiries/completed/migrant-intake#report.

12 Access Economics Pty Limited, “Migrants Fiscal Impact Model: 2008 Update,” April 11, 2008, pp. 23–34, http://s3.amazonaws.com/zanran_storage/www.immi.gov.au/ContentPages/2294022.pdf.

13 David McFadden, “Antigua Starts Program to Sell Citizenship,” San Diego Union-Tribune, October 14, 2013, http://www.sandiegouniontribune.com/sdut-antigua-starts-program-to-sell-citizenship-2013oct14-story.html.

14 “Turkey Soon to Cut Prices for Its Citizenship Program to $300,000,” Citizenship by Investment Journal, May 31, 2018, http://citizenshipbyinvestment.ch/index.php/2018/05/31/turkey-soon-to-cut-prices-for-its-citizenship-program-to-300000/.

15 Ashley S. Timmer and Jeffrey G. Williamson, “Racism, Xenophobia or Markets? The Political Economy of Immigration Policy Prior to the Thirties,” National Bureau of Economic Research Working Paper no. 5867, December 1996, Appendix B.

16 Larry C. Morgan and Bruce L. Gardner, “Potential for a U.S. Guest-Worker Program in Agriculture: Lessons from the Braceros,” in The Gateway: U.S. Immigration Issues and Policies, ed. Barry R. Chiswick (Washington: American Enterprise Institute, 1982), pp. 361–411.

17 U.S. Department of Homeland Security, Yearbook of Immigration Statistics, Table 7.

18 U.S. Citizenship and Immigration Services, Form I-907, Request for Premium Processing Service, https://www.uscis.gov/i-907; U.S. Citizenship and Immigration Services, “H-1B Fiscal Year (FY) 2018 Cap Season,” https://www.uscis.gov/working-united-states/temporary-workers/h-1b-specialty-occupations-and-fashion-models/h-1b-fiscal-year-fy-2018-cap-season.

19 Stuart Anderson, “Regaining America’s Competitive Advantage: Making Our Immigration System Work,” U.S. Chamber of Commerce and American Council of International Personnel, August 12, 2010, p. 6.

20 David Bier, “No One Knows How Long Legal Immigrants Will Have to Wait,” Cato at Liberty, July 28, 2016, https://www.cato.org/blog/no-one-knows-how-long-legal-immigrants-will-have-wait.

21 Australian Government Productivity Commission, “Migrant Intake into Australia,” p. 538.

22 Australian Government Productivity Commission, “Migrant Intake into Australia,” draft report, November 2015, p. 389, https://www.pc.gov.au/inquiries/completed/migrant-intake/draft.

23 OECD, “Key Statistics on Migration in OECD Countries”; World Bank, “Population, Total.”

24 U.S. Citizenship and Immigration Services, “Inadmissibility and Waivers,” https://www.uscis.gov/sites/default/files/USCIS/About%20Us/Electronic%20Reading%20Room/Customer%20Service%20Reference%20Guide/Inadmissibillity_and_Waivers.pdf.

25 Alison Siskin, “Noncitizen Eligibility for Federal Public Assistance: Policy Overview,” Congressional Research Service Report no. RL33809, December 12, 2016, https://fas.org/sgp/crs/misc/RL33809.pdf.

26 Francine D. Blau and Christopher Mackie, eds., The Economic and Fiscal Consequences of Immigration (Washington: National Academies Press, 2017), Table 8-14, https://doi.org/10.17226/23550; Alex Nowrasteh, “The Fiscal Impact of Immigration,” in The Economics of Immigration: From Social Science to Public Policy, ed. Benjamin Powell (New York: Oxford University Press, 2015), pp. 33–35.

27 Alex Nowrasteh, “The RAISE Act Would Hurt U.S. Taxpayers,” Cato at Liberty, August 25, 2017, https://www.cato.org/blog/raise-act-would-hurt-us-taxpayers.

28 Alex Nowrasteh and Sophie Cole, “Building a Wall around the Welfare State, Instead of the Country,” Cato Institute Policy Analysis no. 732, July 25, 2013, https://www.cato.org/publications/policy-analysis/building-wall-around-welfare-state-instead-country.

29 U.S. Department of State, “Family-Based Immigrant Visas,” https://travel.state.gov/content/travel/en/us-visas/immigrate/family-immigration/family-based-immigrant-visas.html#1.

30 Blau and Mackie, Economic and Fiscal Consequences of Immigration, p. 445.

31 David Bier, “How Time Can Move Backward for Immigrants Waiting for Green Cards,” Cato at Liberty, October 30, 2017, https://www.cato.org/blog/how-time-can-move-backward-immigrants-waiting-green-cards-4.

32 Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations (Indianapolis: Liberty Fund Inc., 1981) pp. 642–62.

33 James E. Anderson, “The Relative Inefficiency of Quotas,” Journal of Economic Education 19, no. 1 (1988): 65–81, http://www.tandfonline.com/doi/abs/10.1080/00220485.1988.10845244.

34 Howard F. Chang, “Immigration as International Trade: Optimal Tariffs and Quotas,” USC Law Center Working Paper no. 96-3, May 1996.

35 George Borjas, Heaven’s Door (Princeton: Princeton University Press, 1999), p. 177.

36 Borjas, Heaven’s Door, p. 177.

37 Gordon H. Hanson, “The Governance of Migration Policy,” United Nations Development Programme Research Paper no. 2009/2, April 2006, pp. 4–5, http://hdr.undp.org/sites/default/files/hdrp_2009_02_rev.pdf; Becker, The Challenge of Immigration.

38 Richard Vedder, “Invisible Hands: Immigration and American Economic Growth,” George W. Bush Institute, Dallas, March 2013.

39 Alex Nowrasteh, “Costs and Benefits of Guest Worker Visa Quotas Determined by Formulas,” Cato at Liberty, March 7, 2016, https://www.cato.org/blog/costs-benefits-guest-worker-visa-quotas-determined-formulas.

40 David Bier, “State-Sponsored Visas: New Bill Lets States Invite Foreign Workers, Entrepreneurs, and Investors,” Cato Institute Immigration Research and Policy Brief no. 2, May 11, 2017, https://www.cato.org/publications/immigration-research-policy-brief/state-sponsored-visas-new-bill-lets-states-invite.

41 Michael Clemens et al., “Bounding the Price Equivalent of Migration Barriers,” Center for Global Development Working Paper no. 428, June 2016, p. 25, https://www.cgdev.org/sites/default/files/Clemens-Montenegro-Pritchett-Price-Equivalent-Migration-Barriers_CGDWP428.pdf.

42 Clemens et al., “Bounding the Price Equivalent of Migration Barriers,” p. 25

43 Vedder, “Invisible Hands.”

44 Blau and Mackie, Economic and Fiscal Consequences of Immigration, chaps. 4–5.

45 J. Anderson, “The Relative Inefficiency of Quotas”; Charles Kenny, “Coming to America? It’s Going to Cost You,” Bloomberg Businessweek, January 20, 2013, https://www.bloomberg.com/news/articles/2013-01-20/coming-to-america-its-going-to-cost-you; Chang, “Immigration as International Trade,” p. 380.

46 Kevin J. Fandl, “Taxing Migrants: A Smart and Humane Approach to Immigration Policy,” Midwestern Interdisciplinary Law Review 7 (Spring 2014): 130.

47 U.S. Department of State, “Visa Bulletin for January 2018,” vol. 10, no. 13, https://travel.state.gov/content/travel/en/legal/visa-law0/visa-bulletin/2018/visa-bulletin-for-january-2018.html; David Bier, “No One Knows How Long Immigrants Will Have to Wait,” Cato at Liberty, July 28, 2016, https://www.cato.org/blog/no-one-knows-how-long-legal-immigrants-will-have-wait.

48 Christina Gathmann, “The Effects of Enforcement on Illegal Markets: Evidence from Migrant Smuggling along the Southwestern Border,” IZA Discussion Paper no. 1004, January 2004, p. 6, ftp://ftp.iza.org/dps/dp1004.pdf.

49 Bryan Roberts et al., “An Analysis of Migrant Smuggling Costs along the Southwest Border,” Office of Immigration Statistics, November 2010, p. 4.

50 Office of Immigration Statistics, “Efforts by DHS to Estimate Southwest Border Security between Ports of Entry,” September 2017, p. 14, https://www.dhs.gov/sites/default/files/publications/17_0914_estimates-of-border-security.pdf.

51 United Nations Office on Drugs and Crime, Smuggling of Migrants: A Global Review and Annotated Bibliography of Recent Publications (New York: United Nations Press, 2011), pp. 28, 98.

52 Raúl Hiniojosa-Ojeda, “Raising the Floor for American Workers: The Economic Benefits of Comprehensive Immigration Reform,” Center for American Progress and Immigration Policy Center, Washington, January 2010, pp. 7–9.

53 Daniel Chiquiar and Gordon H. Hanson, “International Migration, Self-Selection, and the Distribution of Wages: Evidence from Mexico and the United States,” Journal of Political Economy 113, no. 2 (2006): 239–81.

54 Alexis A. Aronowitz, “Smuggling and Trafficking in Human Beings: The Phenomenon, the Markets That Drive It and the Organizations That Promote It,” European Journal on Criminal Policy and Research 9, no. 2 (2001): 167–68; UN Office of Drugs and Crime, Smuggling of Migrants, p. 59.

55 Frances Robles, “Tamils’ Smuggling Journey to U.S. Leads to Longer Ordeal: 3 Years of Detention,” New York Times, February 2, 2014, https://www.nytimes.com/2014/02/03/us/tamils-smuggling-journey-to-us-leads-to-longer-ordeal-3-years-of-detention.html.

56 Mark Rockwell, “Smugglers Sentenced in Human Trafficking Case Involving Abducted Salvadoran Juveniles,” Government Security News, November 28, 2011, http://www.gsnmagazine.com/node/25093?c=border_security/.

57 Miao Chi and Scott Drewianka, “How Much Is a Green Card Worth? Evidence from Mexican and Puerto Rican Men Who Marry Women Born in the U.S.,” working paper, University of Wisconsin, Milwaukee, p. 20, http://globalnetwork.princeton.edu/publications/fulltext/2.pdf.

58 Sankar Mukhopadhyay and David Oxborrow, “The Value of an Employment Based Green Card,” Demography 49, no. 1 (2011): 219–37.

59 Giovanni Peri, “Rationalizing U.S. Immigration Policy: Reforms for Simplicity, Fairness, and Economic Growth,” Hamilton Project Discussion Paper 2012-01, Brookings Institution, May 2012.

60 Nathan Smith, “Don’t Restrict Immigration, Tax It,” TCS Daily, June 20, 2006, https://openborders.info/driti/.

61 Nowrasteh and Cole, “Building a Wall around the Welfare State.”

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.