For decades, the federal government has been operating a program to control the production and importation of sugar. One of the program’s main purposes is to ensure minimum price levels for sugar that are typically significantly higher than those found on international markets, leading to higher costs for U.S. consumers. As a result, the federal government is, in essence, the leader of a nationwide sugar cartel.

This paper examines how this situation came to be, providing an overview of the sugar program’s history and its essential elements. As will be shown, the program’s overriding goals are the provision of a minimum income to sugar producers and a higher price for the product than would otherwise be the case through the use of various measures that restrict supply. This clear gain to producers, however, comes at a notable economic cost both to U.S. consumers and to businesses that use sugar as an ingredient in their products. U.S. sugar policy also justifiably furthers suspicions among the citizenry that the federal government is more concerned with advancing the narrow interests of well-connected groups such as sugar producers than promoting the country’s general welfare.

The paper concludes by scrutinizing the rationalizations typically offered for the sugar program’s existence, which are largely found wanting. Claims that the program’s demise would result in catastrophic consequences for the industry are similarly found to be overstated at best. Recently introduced legislation, meanwhile, would likely curb some of the program’s worst excesses. Although it falls short of ideal by failing to abolish the program wholesale, this legislation is perhaps the best option for reform in recent memory.

Introduction

Those familiar with the intricacies of the federal government’s sugar program could be forgiven for wondering whether they have been led astray by their history books and it was actually the Soviet Union’s ideology that prevailed in the Cold War. Replete with measures designed to achieve certain price targets — including decisions about how much sugar producers in the United States and abroad can supply to the market in a given year — the U.S. sugar program is a prime example of discredited economic central planning in action. Despite the popularized image of the United States as a bastion of capitalism and free trade, the unfortunate reality is that the price of sugar and the sources of its production are determined in this country as much by bureaucrats and politicians as by consumers and producers.

A bipartisan group of lawmakers recently decided that enough is enough and has introduced legislation that would significantly limit the program’s size and scope. Combined with the arrival of a president with debatable reformist credentials, who nonetheless has loudly and profusely promised to “drain the swamp,” this effort to pare down the sugar program is perhaps the best prospect for genuine reform in recent memory.

But first, it’s worth examining how this situation was created in the first place. How is this seemingly bizarre system justified, and what problems was it meant to solve? What is its impact on consumers and sugar-using industries? And can we do better? Answering these and other related questions will be the focus of this policy analysis.

An Overview of U.S. Sugar Policy

Barriers to imports of sugar have been employed nearly since the republic’s founding; a tariff on the product was first passed in 1789. Duties remained in place almost continuously save for a four-year period from 1890 to 1894, but modern-day sugar protectionism can be traced back to the 1934 passage of the Jones-Costigan Amendment.1 This legislation, passed as an emergency measure to provide assistance to sugar farmers and later incorporated into the Sugar Act of 1937, had as its key provisions domestic production quotas, subsidies, tariffs, and import quotas, all designed to restrict sugar supplies and boost prices.

As noted by the Yale Law Journal in 1938, the result of this market meddling was to harm consumers, while failing to serve as the industry savior the legislation’s backers imagined it to be:

Protection of the domestic beet and cane producers costs the American consumer three hundred million dollars a year even after the duties collected by the Treasury have been discounted. No attempt is made in the present scheme of regulation to encourage production in those fields which can produce sugar most economically and to discourage it in the fields which require subsidization. Thus, despite the inefficiency and expensiveness of the beet sugar industry and the well nigh intolerable working conditions in the beet fields, the latter area is the only one not really restricted by the quotas which have been imposed.

The most efficient producing areas have received the most drastic restrictions. A proration system has been devised which prohibits the State of Florida, the only area on the continent which could produce sugar profitably without a tariff or direct subsidy, from producing more than fifty percent of its own intrastate consumption. Moreover, the federal government has assisted in increasing the supply of sugar by spending enormous sums on research, irrigation, and reclamation during a period when production was already far outstripping consumption. As a consequence of these measures, legislation ostensibly enacted for the relief of domestic farmers results in a net loss to them.2

Despite such documented costs even at this early date, the system persisted with only minor adjustments through 1974, when a tripling in the price of sugar coincided with the expiration of the Sugar Act of 1948, and Congress decided against renewal. A decline in sugar prices then led to the temporary creation of price support loans, that is, government loans secured by sugar as collateral, which the borrower can either repay with interest or, if prices are too low, default on. These were enacted for the sugar crops of 1977–1979 and lapsed in 1980 and most of 1981 in the wake of a dramatic sugar price increase. A sugar support program reappeared in the 1981 Farm Bill following a price retreat.3

Officially known as the Agriculture and Food Act of 1981, the Farm Bill featured the reintroduction of price support loans that continue today and form one of the U.S. sugar program’s four key pillars. Extended through the U.S. Department of Agriculture’s (USDA) Commodity Credit Corporation, these loans are made to sugar processors at an average national rate of 18.75 cents for every pound of raw sugarcane provided as collateral (rates vary slightly by region of the country) and 24.09 cents per pound of refined beet sugar.4 These rates effectively serve as a price target for the USDA. Because processors will simply forfeit their sugar collateral if the market price dips below that set by the loans, the USDA must ensure that supply is sufficiently restricted — thus boosting prices — so that sugar used as collateral will be sold instead of surrendered. The nonrecourse nature of the loans, by which liability for the loans does not extend beyond the provided collateral, also encourages this.

Assisting in this effort is the sugar program’s second element, marketing allotments. In this arrangement, the USDA annually determines an overall allotment quantity (OAQ) — effectively a limit on how much sugar can be sold — which is designed both to avoid loan forfeitures and reserve 85 percent of the sugar market to domestic producers as mandated by law. This OAQ, in turn, is further divided up, with refined beet sugar receiving 54.35 percent of the overall quantity and raw cane sugar 45.65 percent.

Among the portion reserved for cane sugar, Florida, Louisiana, and Texas are assigned allotments based on the production histories of both the collective state and individual processors. (Hawaii had been allotted 325,000 short tons, but its last remaining sugar mill produced its final harvest in late 2016.5) Beet sugar, which is grown in 11 different states, has allotments assigned to processors based on their sugar production histories.6 Should new processors enter the market or factories be sold between processors, allocation conditions would be addressed through regulations in the 2014 Farm Bill.

Also serving to maintain elevated price levels and avoid loan forfeitures is the Feedstock Flexibility Program, an arrangement introduced in the 2008 Farm Bill by which the USDA is given the option of making purchases in order to remove sugar from the market and sell it to bioenergy companies for fuel production. That is, the USDA plays the role of both buyer and seller of sugar in order to ensure the supply available for human consumption is reduced, thus driving prices higher than they would be otherwise and reducing the possibility of loan defaults.

The last, and arguably most important, part of the sugar puzzle is tariff rate quotas (TRQs), without which imports would drive down U.S. sugar prices and undermine the policy goal of a sugar price sufficient to discourage loan forfeitures. Under this approach, a limited amount of raw and refined sugar, currently set at a minimum of 1.231 million tons due to a U.S. commitment to the World Trade Organization, is allowed to be imported duty free through preference programs, or at the rate of 0.625 cents per pound.7 Any sugar imported beyond the quota amount, meanwhile, is subject to a tariff of 15.36 cents per pound for raw cane sugar and 16.21 cents per pound for refined sugar. To put this in context, the world price of refined sugar in 2017 generally fluctuated between 17 cents and 25 cents per pound.

Further complicating matters, the TRQ for raw cane sugar is divided among 40 countries by the Office of the U.S. Trade Representative, with quantities assigned based on the period 1975–1981, during which trade was relatively unrestricted. The refined sugar TRQ, meanwhile, is currently allocated to Canada and Mexico, with an additional quantity available to all countries on a first-come, first-served basis.

With government planners forced to juggle all of these considerations, as well as a directive that the USDA provide adequate supplies of raw and refined sugar in the domestic market, it is no surprise that their efforts are subject to periodic revision. In July 2017, for example, the USDA announced an increase in the OAQ for domestic sugar; the reassignment of beet sugar marketing allotments among processors; the reassignment of unused cane sugar marketing allotments to imports; and an increase in the raw sugar TRQ by 269,724 tons.8

The end result of these market manipulations is domestic sugar prices that are typically twice those of the world sugar market. This, in the eyes of many legislators in Congress, is what passes for a policy success.

Yet, it is an approach that would surely draw deserved howls of protest from elected officials were the scheme operated without the government playing the role of puppet master. Indeed, at this moment voices on the left such as the Nation, the New Republic, and Washington Monthly are expressing increasing worry over alleged signs of monopoly within the U.S. economy and calling for more aggressive enforcement of anti-trust measures.9 Barely remarked upon, however, is the fact that Washington is operating a sugar cartel in our midst. As Karl T. Muth and Katheryn DeVelvis argue:

If the activities financially encouraged under the American sugar program were instead done by a group of producers of some other good, this would almost certainly be illegal. For instance, if producers of cars or carrots mandated a certain price be charged by downstream distributors, this would be a violation of the Sherman Act, the most comprehensive and oft-used antitrust mechanism in federal law. Additionally, if producers with substantial market power colluded (as sugar producers do, with the government’s help) to constrain the supply of a good, thus increasing the good’s market price, this would also be a violation of the Sherman Act.10

We have, in effect, the absurd situation in which the federal government, the country’s lead enforcer in halting anti-competitive actions, simultaneously finds itself in the position of cartel ringleader. This approach is the very opposite of the advice given by Adam Smith, who warned that conversations among people of the same trade typically end “in a conspiracy against the public, or in some contrivance to raise prices,” and advised that “though the law cannot hinder people of the same trade from sometimes assembling together, it ought to do nothing to facilitate such assemblies, much less to render them necessary.”

Sugar and Economic Decay

While the U.S. sugar industry no doubt toasts to the high domestic sugar prices that result from government manipulations of the market, too often overlooked are the many costs of the current approach. The most straightforward of these is the higher prices borne by retail consumers of sugar, as well as intermediate users, ranging from bakers to confectioners to soft-drink makers.

Predictably, this approach has resulted in a steady stream of candy manufacturers shifting production to take advantage of cheaper sugar prices outside the country. In 2002, Kraft Foods announced the closure of its Life Savers plant in Holland, Michigan, and its relocation to Canada. Sugar may not have been the only motive behind the move, but the $90 million the company said it would save over 15 years as a direct result of lower sugar prices no doubt figured prominently in the decision.11 In 2003, Spangler Candy moved half of its production to Mexico, citing cheaper sugar, which accounts for 70 percent of its ingredient costs,12 and Los Angeles–based candy maker Adams & Brooks also shifted about two-thirds of its production to Mexico. “It’s really not that much of a choice,” says company president John Brooks. “You move or you go out of business.13

A 2002 Wall Street Journal article examining the shift of candy production to Mexico noted that while lower labor costs were a consideration, the decisive factor was a desire to escape high U.S. sugar costs:

An even bigger reason [than labor costs] for the flight of the lollipop and sourball makers is the U.S. price of sugar. Candy manufacturers operating in Mexico and Canada pay world rates for raw sugar — about half the federally supported U.S. cost — and can easily undercut U.S. competition. “I just got tired of paying welfare to Big Sugar,” explains Greg McCormack, president of Bob’s Candies Inc., of Albany, Ga., which recently opened a plant in Reynosa.14

The evidence goes beyond anecdotes. A Wall Street Journal analysis of U.S. Census Bureau data found that total U.S. confectionary manufacturing employment declined by 22 percent from 1998 through 2011,15 while a 2006 Commerce Department study concluded that “for each sugar growing and harvesting job saved through high U.S. sugar prices, nearly three confectionery manufacturing jobs are lost”; every sugar job saved was at a cost of $826,000.16 A 33 percent rise in the amount of sugar contained in imported products from 2002 to 2012 is also suggestive of an overseas production shift by sugar-using companies.

Other sugar-using firms that have remained in the United States have opted to change their business practices or alter their products because of high domestic sugar prices. In 1984, for example, both the Coca-Cola Company and PepsiCo announced plans to massively increase the amounts of high fructose corn syrup (HFCS) in their soft drinks in order to cut their sugar usage.17 The Cola-Cola Company notes that among HFCS’s advantages is that it has “historically cost substantially less than cane or beet sugar” in the United States — a factor explained by restrictions on sugar imports and the subsidized production of corn.18

That Coca-Cola is produced with sugar instead of HFCS elsewhere in the world (cane sugar in Australia and Mexico and beet sugar in Europe) points to the likelihood that the uniquely high cost of sugar in the United States was the culprit behind the move. Thus it has come about that consumers living in the country where Coca-Cola was invented drink an adulterated version of the beverage, while consumers abroad are able to enjoy it closer to the way it was originally conceived. This has brought about the phenomenon of rising imports to the United States of Coca-Cola botted in Mexico — perhaps akin to Mexicans drinking imported American tequila.19

Although the added difficulty of procuring a Coca-Cola with genuine sugar in the United States merely rankles, the dollar cost to both businesses and consumers from artificially inflated sugar prices likely reaches into the billions. According to the U.S. International Trade Commission, the removal of import restrictions would produce average annual welfare gains of $342.7 million,20 while economist Michael K. Wohlgenant of North Carolina State University has calculated that the artificially high cost of U.S. sugar imposes an average burden on consumers of $2.4 billion per year — a benefit to producers of $1.4 billion per year — with a resulting net cost of $1 billion.21 A 2017 paper by John Beghin of North Carolina State University and Amani Elobeid of Iowa State University found the cost to be even higher, placing the burden on households and users at $2.4 billion to $4 billion. In addition, it also concluded that the sugar program results in the annual loss of 17,000 to 20,000 jobs in the food industries.22

Arguably more offensive than the direct burden imposed by the sugar program is the crony capitalist nature of the arrangement. The U.S. sugar program’s function as a net wealth transfer from consumers to the sugar industry is not really in dispute. Indeed, the title of a June 2000 report issued by the Government Accountability Office summed up the situation: “Sugar Program: Supporting Sugar Prices Has Increased Users’ Costs While Benefiting Producers.”23 That it persists is a tribute to the phenomenon of concentrated benefits and diffused costs, whereby a relatively small group of industry members reaps billions in extra revenue and the costs are dispersed among tens of millions of consumers. It is therefore no surprise that the sugar industry is heavily invested in the program’s continuation, while average consumers, whose individual financial stakes are comparatively slight, have little incentive to advocate for its demise. Indeed, they may even be unaware of its existence.

Ignorance about the sugar program, however, does not mean that voters are blind to the existence of forces in Washington that seek to promote the narrow interests of powerful groups over the general welfare. That many policies advanced by Congress are primarily aimed at accommodating the clients of well-connected lobbyists, such as those who work for the sugar industry, may help explain the current appetite for populism and the oft-heard refrain of “Drain the swamp!” during the 2016 election campaign. The continued existence of such arrangements — despite their well-documented costs — helps advance the notion of a broken system, raising the appeal of political forces that promise more radical solutions.

Beyond stoking voter ire and furthering a perception that the U.S. government caters to the whims of narrow interest groups, the sugar program also comes at considerable cost to U.S. moral authority on trade policy. As much as U.S. officials, including President Donald Trump, seek to portray the United States as a free trade exemplar beset by trading partners engaged in practices that are supposedly neither fair nor reciprocal, the existence of arrangements such as the sugar program expose this rhetoric as at best overwrought. How can the United States bemoan closed foreign agriculture markets when it engages in such protectionism in the same sector?

In addition to the loss of moral authority, U.S. insistence on preserving the sugar status quo has also served to undermine its leverage at the negotiating table. During negotiations with Australia over the free trade agreement eventually reached with that country in 2004, for example, the U.S. government’s refusal to cede ground on sugar prompted Australia to maintain protectionist policies on goods such as wheat and on broadcasting and audio-visual services.24 This is an example of bad policy begetting further bad policy, to the detriment of American and foreign consumers alike.

Sugar Program Rationalizations

All of this raises the question of why such a costly and counterproductive program is kept in place. While numerous factors help explain its continued existence, one of the foremost justifications proffered is an alleged need for price stability to avoid the boom-and-bust cycle of past years. Certainly such thinking figured prominently in the minds of legislators and sugar farmers alike in the early 1980s when price supports were reintroduced in the 1981 Farm Bill. As the Congressional Research Service notes, a report from the Senate Committee on Agriculture, Nutrition, and Forestry about the legislation “cited the importance of sugar imports to U.S. sugar supplies, pointing out that volatile world market prices of sugar contributed to sharp fluctuations in U.S. sugar prices.”25

Similar arguments were advanced outside of Capitol Hill. A May 1981 letter to the editor published by the New York Times from the president of the Rocky Mountain Farmers Union, for example, argued that “[sugar] producers and consumers have been victimized by the wild price swings of the so-called free market” since the end of price supports in 1974, and it hailed the 1981 Farm Bill for “seeking to free domestic producers and consumers from booms and busts.”26 The same newspaper published a letter to the editor from the vice president of the Hawaiian Sugar Planters Association the following year that deemed any higher prices resulting from the federal sugar program to be a “very small price to pay for the increased stability and assurance of continued reasonable prices provided by maintaining the domestic production of more than half of our sugar needs.”27

More than 30 years later this line of argument is still being used. The American Sugar Alliance, a special interest representing the various groups that compose the domestic-sugar supply chain, claims the federal government’s sugar policy is “based on the common-sense notion that supply and demand should be in balance. . . . By avoiding oversupplies and shortages, sugar prices stay stable.”28

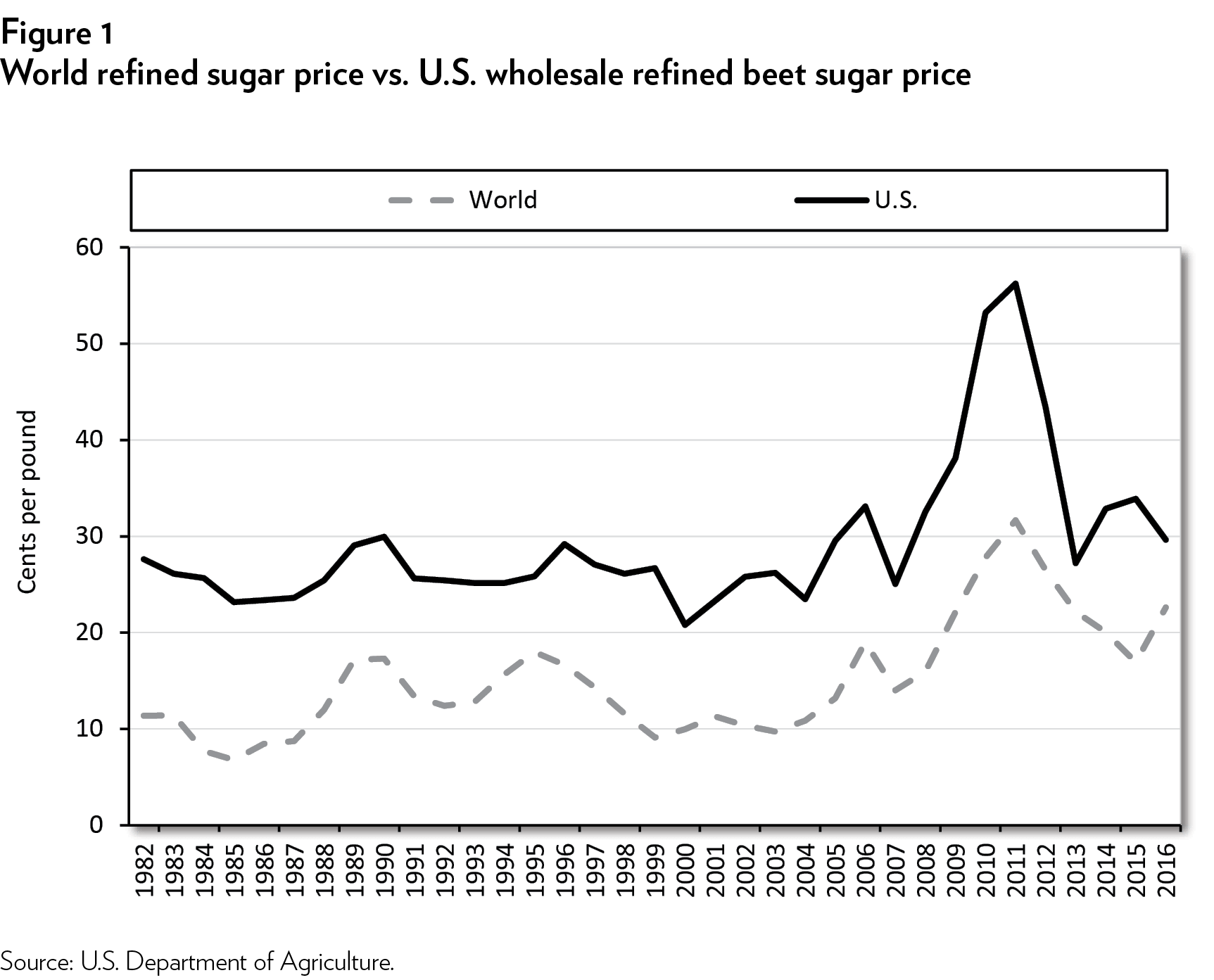

While there is little doubt that price smoothing and reduced uncertainty are beneficial to sugar farmers and processors, it is much less clear why its pursuit is in the public interest, or why government resources should be committed to such a goal. Price instability, it should be noted, is hardly unique to the sugar industry, with unpredictable prices the norm for any number of commodities. It’s also not apparent, since its reintroduction in the early 1980s, that the sugar program has done much to eliminate such volatility in U.S. sugar prices, which appears to largely mirror the fluctuations of the world sugar market. It has, however, fattened profit margins for sugar farmers and producers through the boosting of domestic sugar prices. Indeed, from 1982 through 2016, the average U.S. sugar price was 29.28 cents per pound, nearly double that of the average world price of 15.12 cents (Figure 1).

When confronted with the sharp disparity between U.S. and global sugar prices and the ensuing high costs imposed on American consumers, the sugar industry often responds that it is willing to move away from government supports provided that other countries do the same. This stance, known as “zero for zero,” is reflected in industry support for a bill introduced by Rep. Ted Yoho (R-Florida) in 2017. Calling for the elimination of all direct and indirect sugar subsidies by countries that have exported at least 200,000 tons of sugar in 2014, 2015, or 2016, as well as those with whom the United States has a free trade agreement, Yoho’s bill states that these twin objectives must first be met before “legislation to implement United States sugar policy reforms” is submitted to Congress by the president.29 This constitutes an extreme and unrealistic bar, considering that such criteria apply to at least 30 countries and the issue of what constitutes an indirect subsidy is often in dispute.30 This suggests that the industry’s true interest may lie more in preserving the status quo than in serious movement toward a free market.

The U.S. sugar industry justifies this stance by warning that “unilaterally disarming” — industry-speak for the elimination of sugar supports without regard to the actions of other countries — would result in the United States “becoming dependent on subsidized foreign suppliers.”31 As support for this claim, the American Sugar Alliance reaches back to World War II, citing domestic sugar rationing at the time as evidence that “depending on other countries for a food staple was a recipe for disaster.” (Never mind the fact that a U.S. sugar program had existed for years prior to U.S. involvement in the war.)

Sugar-industry favorite Sen. Marco Rubio (R-Florida) meanwhile warned in 2015 that if the United States scrapped its support programs for sugar, absent corresponding moves from other countries, “Brazil will wipe out our agriculture and it’s not just sugar.” Expanding on this line of thinking, Rubio imaginatively added that “these other countries will capture the market share, our agricultural capacity will be developed into real estate, you know, housing and so forth, and then we lose the capacity to produce our own food, at which point we’re at the mercy of a foreign country for food security.”32

Leaving aside the validity of such speculative national security arguments, there is considerable cause for skepticism regarding claims that unilateral dismantlement of the U.S. sugar program would prove devastating to the domestic sugar industry. According to a 2017 study from the U.S. International Trade Commission (USITC), the removal of import restrictions — arguably the sugar program’s most vital pillar — would see “employment in the sugarcane farming and cane sugar manufacturing sectors . . . decrease by 12.4 and 10.7 percent respectively.” Although significant, such an amount hardly counts as catastrophic. Regarding the beet sugar industry, meanwhile, the USITC finds that “employment in the sugar beet farming and beet sugar manufacturing sectors would increase,” with growth seen as “about the same as the growth rates projected without the removal of these import restraints.”33

A 2015 Cato Institute policy analysis also suggests that an end to such restrictions would have less than devastating consequences for the sugar industry, arguing that “most U.S. growers of sugarcane and sugar beets would remain in that business.”34 As support for this position, author Daniel Pearson cites the example of Canada, which features neither sugar import restrictions nor domestic support measures (helping to explain why it has been a destination for candy producers that have located away from the United States). According to the Canadian Sugar Institute, the country produces approximately 1.2 million tons of refined sugar annually, of which roughly 6 percent — or 72,000 tons — is supplied domestically.35 As Pearson says, “Those who argue that the U.S. industry would be destroyed by liberalization have yet to explain how sugar can be produced successfully in the open and competitive Canadian market.”36

Indeed, that the sugar industry is found in countries where such elaborate price support mechanisms do not exist also calls into question the wisdom behind the unilateral disarmament argument, as well as claims regarding price volatility. Australia, for example, provides no government subsidies and began operating at world market prices after the Australian government removed import restrictions in 1988 and tariff protections in 1997. While it should be noted that Canada, with its free market approach, is a minor player in the sugar industry, the same cannot be said of Australia, which is the world’s third-largest sugar exporter.

Beyond the fact that other countries have demonstrated an ability to maintain a sugar industry absent the same level of support granted farmers and producers in the United States, it is also unclear why policy choices in foreign lands that fly in the face of economic logic necessitate the implementation of similar policies in this country. The existence of destructive policies elsewhere is no justification for mimicking them here.

One other oft-heard claim from sugar program supporters is that current policy comes at no cost to the U.S. taxpayer, which is misleading at best and perhaps more accurately characterized as simply false. This argument rests on the fact that high domestic sugar prices help ensure that government loans to sugar farmers are repaid. Ultimately, this is a distinction without a difference, merely resulting in Americans paying for the program circuitously through their purchases of sugar and products containing sugar at artificially inflated prices, instead of more directly through taxation. Furthermore, even the narrowest interpretation of this claim is wrong. In 2013, the USDA was forced to spend tens of millions of dollars to prop up sugar prices to avoid loan forfeitures — a development that provided fodder for late-night comedians — and there’s also the small matter that this argument ignores the salaries of those employed by the USDA to oversee this program.

Regrettably, such arguments — along with a fierce lobbying effort by sugar interests — have thus far carried the day. There is, however, some hope that this may be about to change.

Reform Effort Afoot

Some lawmakers have begun to take notice of the sugar program’s myriad costs, and legislation has been introduced in both the House and Senate that would produce significant reforms. Known as the Sugar Modernization Act of 2017, the House version of this proposed law rests on four key provisions.37 The first of these is the introduction of a mandate that the sugar program operate on a zero net cost basis to the federal government. Should the Agriculture Secretary determine that this provision has been violated, the legislation authorizes the USDA to collect payments from sugar processors to restore the program to balance.

Beyond this mandate, two other significant provisions in the bill are the termination of the feedstock flexibility program and the scrapping of marketing allotments. Slated to take effect beginning in the 2020 crop year, the feedstock flexibility program’s demise would halt USDA purchases of sugar. As to marketing allotments, they are an absurd exercise in central planning by which the federal government determines how much sugar processors can sell each year. The repeal of these programs is both welcome and overdue.

Lastly, the legislation would introduce added flexibility into the tariff rate quota (TRQ) program, allowing countries that have been assigned a share of the overall quota to temporarily transfer all or part of their share to any other country that has been allocated a quota. Currently, the maximization of the TRQ for sugar is ensured by the U.S. Trade Representative’s office, which reallocates unused capacity. More significantly, the bill mandates an adjustment to the TRQs so that the stocks-to-use ratio — the quantity of sugar available at the end of the marketing year (September 30) expressed as a percentage of annual usage — would increase from its current level of 13.5 percent to 15.5 percent by fiscal year 2021. This should translate into increased imports and lower sugar prices for U.S. consumers.

The legislation does fall short of ideal, however, by leaving much of the sugar program in place. Price support loans, for example, are made slightly less generous (a pound of sugarcane provided as collateral would garner only 18 cents in loans instead of the current 18.75) but still left intact. Likewise, TRQs are made less onerous instead of abolished. The decision to loosen rather than eliminate such quotas is particularly unfortunate because quotas are one of the most damaging aspects of the sugar program, serving to raise domestic prices far above those found on the global sugar market.

Such complaints aside, the bill represents a significant step forward on sugar policy, which would make possible an expanded role for market forces and serve to lower prices. Indeed, the legislation’s ability to bring needed reform is perhaps best evidenced by the furious reaction of the U.S. sugar lobby, which has labeled it a “Sugar Farmer Bankruptcy Bill.”38 Such overwrought rhetoric is properly viewed as both a testament to the bill’s virtues and a tacit admission that American consumers have been overpaying for the sugar they consume.

Conclusion

For years, the U.S. sugar program has existed as one of the most blatant and grotesque examples of crony capitalism, and one that is securely entrenched in the federal bureaucracy. Best understood as an involuntary wealth transfer from consumers to producers, the sugar program’s economic cost reaches into the billions of dollars. Other downsides, such as lost market-opening opportunities during free trade negotiations, are more difficult to calculate but surely nontrivial.

Justifications offered by supporters of the sugar program, such as the alleged need for predictable prices or the argument that economically destructive sugar policies are required to offset similarly damaging policies in other countries, are less than compelling. The claim that the sugar program comes at no cost to taxpayers, meanwhile, is insulting. That the program continues to exist is a tribute to the familiar story of concentrated benefits and diffused costs, abetted by the rational ignorance of voters.

As none other than the New York Times argued in 1982, a sane sugar policy by the United States would be no sugar program at all.39 Sadly, that’s not currently on offer. What is available, however, is legislation that takes a notable step toward a sugar policy oriented to consumers and markets rather than lobbyists and politicians. While not ideal, it is a very real opportunity to pare down a particularly insidious symbol of narrow self-interest triumphing over the common good.

Notes

- Andrew Schmitz and Douglas Christian, “The Economics and Politics of U.S. Sugar Policy,” in The Economics and Politics of World Sugar Policies, ed. Stephen V. Marks and Keith E. Maskus (Ann Arbor, MI: University of Michigan Press, 1993), p. 50.

- “The Sugar Act of 1937,” Yale Law Journal 47, no. 6 (April 1938): 988–89, https://www.jstor.org/stable/pdf/792093.pdf.

- Schmitz and Christian, “The Economics and Politics of U.S. Sugar Policy,” 51.

- “Policy,” United States Department of Agriculture, https://www.ers.usda.gov/topics/crops/sugar-sweeteners/policy.aspx#price.

- “Policy,” United States Department of Agriculture, https://www.ers.usda.gov/topics/crops/sugar-sweeteners/policy.aspx#mark…; and Lawrence Downes, “The Sun Finally Sets on Sugar Cane in Hawaii,” New York Times, January 16, 2017.

- “Frequently Asked Questions,” Sugar Industry Biotech Council, http://www.sugarindustrybio techcouncil.org/sugar-beet-faq.

- The United States also allows small additional amounts of sugar to be imported from nine countries covered by four free trade agreements. Preference programs that allow sugar to be imported duty free, meanwhile, include free trade agreements as well as the Generalized System of Preferences.

- “USDA Announces Adjustments to Fiscal Year 2017 Sugar Program,” United States Department of Agriculture, July 24, 2017, https://www.fas.usda.gov/newsroom/usda-announces-adjustments-fiscal-year-2017-sugar-program.

- Joseph E. Stiglitz, “America Has a Monopoly Problem—and It’s Huge,” Nation, October 23, 2017; Matt Stoller, “The Return of Monopoly,” New Republic, July 13, 2017; and Barry C. Lynn, “Democrats Must Become the Party of Freedom,” Washington Monthly, January/February 2017.

- Karl T. Muth and Katheryn DeVelvis, “Sweet Nothings: The History, Law, and Economics of American Sugar Subsidies,” Kennedy School Review, March 18, 2016, http://ksr.hkspublications.org/2016/03/18/sweet-nothings-the-history-law-and-economics-of-american-sugar-subsidies/.

- Dean Reynolds, “Costly Sugar Pushes Candy Plant to Canada,” ABC News, http://abcnews.go.com/Business/story?id=87274.

- Oliver Nieburg, “No Country for Hard Candy: Production Stays in Mexico until US Adopts ‘Level Playing Field’ Sugar Regime, Says Spangler Candy,” Confectionarynews.com, March 19, 2014.

- Ron Nixon, “American Candy Makers, Pinched by Inflated Sugar Prices, Look Abroad,” New York Times, October 30, 2013.

- Joel Millman, “U.S. Candy Makers Go to Mexico, Changing the Face of the Industry,” Wall Street Journal, February 13, 2002.

- Alexandra Wexler, “Cheaper Sugar Sends Candy Makers Abroad,” Wall Street Journal, October 20, 2013.

- “Employment Changes in U.S. Food Manufacturing: The Impact of Sugar Prices,” U.S. Department of Commerce International Trade Administration, https://www.trade.gov/mas/ian/build/groups/public/@tg_ian/documents/webcontent/tg_ian_002705.pdf.

- Lee A. Daniels, “Coke, Pepsi to Use More Corn Syrup,” New York Times, November 7, 1984.

- “FAQs,” Coca-Cola Company, http://www.coca-colacompany.com/contact-us/faqs.

- Erin Geiger Smith, “An Imported Soda That Comes with Buzz,” New York Times, October 3, 2014.

- “The Economic Effects of Significant U.S. Import Restraints,” United States International Trade Commission, September 2017, p. 59, https://www.usitc.gov/publications/332/pub4726.pdf.

- Michael K. Wohlgenant, “Sweets for the Sweet: The Costly Benefits of the US Sugar Program,” American Enterprise Institute, November 2011, p. 2, http://www.aei.org/wp-content/uploads/2011/11/-sweets-for-the-sweet-the-costly-benefits-of-the-us-sugar-program_153001980761.pdf.

- John Beghin and Amani Elobeid, “Analysis of the US Sugar Program,” American Enterprise Institute, November 2017, p. 1, http://www.aei.org/wp-content/uploads/2017/11/Analysis-of-the-US-Sugar-Program.pdf.

- “Sugar Program: Supporting Sugar Prices Has Increased Users’ Costs While Benefiting Producers,” United States General Accounting Office, June 2000, https://www.gao.gov/assets/230/229176.pdf.

- Aaron Lukas, “A Sticky State of Affairs: Sugar and the U.S.–Australia Free Trade Agreement,” Cato Institute, February 9, 2004, https://www.cato.org/publications/free-trade-bulletin/sticky-state-affairs-sugar-us-australia-free-trade-agreement.

- Mark A. McMinimy, “U.S. Sugar Program Fundamentals,” Congressional Research Service, April 6, 2016, https://fas.org/sgp/crs/misc/R43998.pdf.

- John Stencel, “The Sugar Industry Has Taken Its Lumps,” New York Times, May 30, 1981, http://www.nytimes.com/1981/05/30/opinion/l-the-sugar-industry-has-taken-its-lumps-137343.html.

- Eiler C. Ravnholt, “Sugar Subsidies,” New York Times, August 8, 1982, http://www.nytimes.com/1982/08/08/business/l-sugar-subsidies-070536.html.

- “U.S. Sugar Policy,” American Sugar Alliance, https://sugaralliance.org/us-sugar-policy.

- Expressing the sense of Congress that all direct and indirect subsidies that benefit the production or export of sugar by all major sugar producing and consuming countries should be eliminated, H. Con. Res. 40, 115th Cong. (2017), https://www.congress.gov/bill/115th-congress/house-concurrent-resolution/40/text.

- “Sugar: World Markets and Trade,” United States Department of Agriculture Foreign Agricultural Service, November 2017, https://apps.fas.usda.gov/psdonline/circulars/sugar.pdf.

- “ASA Releases New Sugar Policy Video, Touts ‘Zero-for-Zero’ Strategy,” American Sugar Alliance, May 22, 2013, https://sugaralliance.org/asa-releases-new-sugar-policy-video-touts-zero-for-zero-strategy/4409.

- Timothy P. Carney, “At Kochfest, Rubio Defends Sugar Subsidies on National Security Grounds,” Washington Examiner, August 2, 2015.

- “The Economic Effects of Significant U.S. Import Restraints,” United States International Trade Commission, September 2017, p. 59, https://www.usitc.gov/publications/332/pub4726.pdf.

- Daniel R. Pearson, “Toward Free Trade in Sugar,” Cato Institute, February 11, 2015, https://object.cato.org/sites/cato.org/files/pubs/pdf/pa-768-updated-6-30-17.pdf.

- “Canadian Sugar Today,” Canadian Sugar Institute, http://www.sugar.ca/International-Trade/Canadian-Sugar-Industry/Canadian-sugar-today.aspx.

- Pearson, “Toward Free Trade in Sugar,” 9.

- Sugar Policy Modernization Act of 2017, H.R. 4265, 115th Cong. (2017), https://www.congress.gov/bill/115th-congress/house-bill/4265.

- “‘Sugar Farmer Bankruptcy Bill’ Introduced to Outsource U.S. Sugar Production,” Press Release, American Sugar Alliance, November 7, 2017, https://sugaralliance.org/sugar-farmer-bankruptcy-bill-introduced-outsource-u-s-sugar-production/13742.

- “A Shameful Sugar Policy,” editorial, New York Times, May 10, 1982, http://www.nytimes.com/1982/05/10/opinion/a-shameful-sugar-policy.html.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.