When it comes to hyperinflation, we can measure it with great accuracy. But, it is impossible to produce meaningful hyperinflation forecasts. During episodes of hyperinflation, their courses and durations change so rapidly, and so dramatically, that predictions are a fool’s errand. Indeed, hyperinflations are so unstable and unpredictable that even forecasting the inflation rate for a coming month with any degree of accuracy is impossible. However, this has not deterred the International Monetary Fund (IMF).

The IMF repeatedly produces forecasts (read: finger in the wind guesses) of Venezuela's inflation rate. These guesses appear regularly in the IMF's bi-annual World Economic Outlooks (WEO). What does not appear in the WEO reports, however, are inflation measurements.

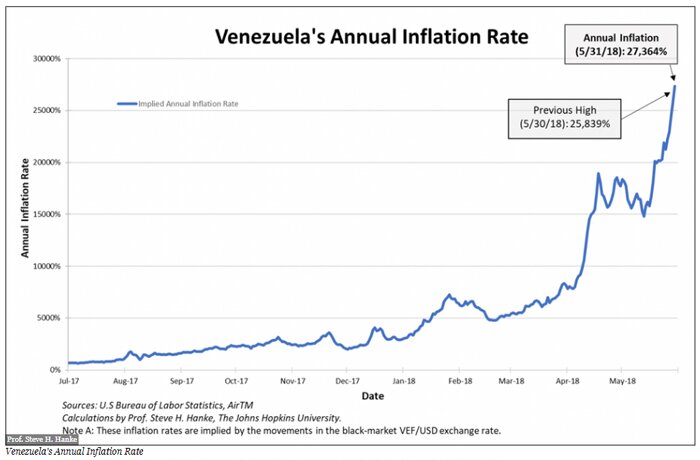

Just how looney are the IMF's guesses? To answer that question, consider that the IMF forecast for Venezuela's 2018 year-end annual inflation rate is 12,874.6%. On May 30th, I accurately measured Venezuela's annual inflation rate, and for the first time, it breached 25,000%, and today, May 31st, it sits at 27,364% (see chart below). That's more than double the IMF's year-end inflation forecast, and there are still seven months left to go until year-end.

And this is only one example of the IMF’s carelessness. In the same April 2018 WEO report, the IMF forecasts that Venezuela’s inflation rate at the end of 2019 will be exactly the same as the IMF estimate for the end of 2018, namely 12,874.6%. And when I say “exactly,” I mean “exactly.” Down to the last decimal point. Talk about spurious accuracy.

Why does the IMF’s carelessness matter? After all, who cares if the IMF is delivering faulty forecasts? Well, the financial press should care. The Central Bank of Venezuela no longer reports annual inflation rates. So, there is no official Venezuelan source for information on what is, in fact, currently the world’s highest inflation rate. So where can the financial press turn for an “official” number? As is often the case, the press turns to the IMF. The problem is that the press, for the most part, merely reports the IMF’s forecasts, without so much as a mention of the fact that inflation forecasts during an episode of hyperinflation are nonsense.

So, where can we find accurate measurements of Venezuela’s hyperinflation? There are two ways to measure inflation during episodes of hyperinflation. One way, which is practical, accurate, and cost-effective, is to employ Purchasing Power Parity (PPP) theory. That’s what I do. Using high-frequency, black-market exchange rate data, I am able to calculate an implied annual inflation rate for Venezuela on a daily basis. The PPP approach has time and again proven to be extremely accurate in hyperinflationary environments. My daily measurements of Venezuela’s inflation rate are posted on my Twitter.

The second method for measuring hyperinflation involves going out in the field and actually sampling the prices of a “basket” of goods that make up a price index, such as a consumer price index. When prices of goods in the index are compared over time, an inflation rate can be calculated for the individual items that make up the index, as well as for the index itself.

This second method represents the standard approach for measuring inflation. It is suitable for situations in which prices are not moving too rapidly. But, this is not the case during an episode of hyperinflation. In Venezuela, for example, prices, by my measure, using high-frequency data, are doubling every 29 days. This makes measurements based on data gathered from the field inaccurate, simply because the samples can’t be taken frequently enough. For example, when the standard method is used, measurements for some goods in a consumer price index are taken at the start of the month, while others are taken at the end. In consequence, the inflation rate represented by changes in the consumer price index will be way off the true rate of inflation. Therefore, accurate measurements during an episode of hyperinflation require high-frequency (read: daily) data.

That said, since December 2016, the opposition-controlled National Assembly of Venezuela (NA) has attempted to use the standard approach to construct a consumer price index, and to calculate inflation. How well has the NA done?

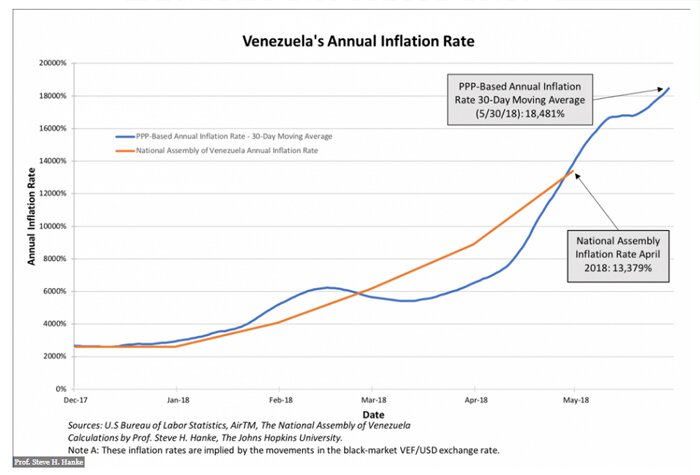

The chart below compares the results of the NA’s standard approach with a 30-day moving average of my PPP-based approach. We can see that the NA’s measurements are roughly in line with my PPP-based method, which is the “gold standard” for measuring hyperinflation.

While the National Assembly’s measurements have been credible, the problems inherent in their methodology will become more apparent if Venezuela’s hyperinflation accelerates. With an acceleration, the National Assembly’s measure will probably begin to underestimate and lag behind the PPP “gold standard” measurement.