On March 16th, the New York Times carried reportage by Peter S. Goodman, Keith Bradsher and Neil Gough, which was titled “The Fed Acts. Workers in Mexico and Merchants in Malaysia Suffer.” The theme of their extensive reportage is that U.S. monetary policy is the elephant in the room. It is the elephant that swings exchange rates and capital flows to and fro in emerging-market countries, causing considerable pain.

The real problem that all of the countries mentioned in the New York Times reportage face is the fact that they have central banks that issue half-baked local currencies. Although widespread today, central banks are relatively new institutional arrangements. In 1900, there were only 18 central banks in the world. By 1940, the number had grown to 40. Today, there are over 150.

Before the rise of central banking the world was dominated by unified currency areas, or blocs, the largest of which was the sterling bloc. As early as 1937, the great Austrian economist Friedrich von Hayek warned that the central banking fad, if it continued, would lead to currency chaos and the spread of banking crises. His forebodings were justified. With the proliferation of central banking and independent local currencies, currency and banking crises have engulfed the international financial system with ever-increasing severity and frequency. What to do?

The obvious answer is for vulnerable emerging-market countries to do away with their central banks and domestic currencies, replacing them with a sound foreign currency. Panama is a prime example of the benefits from employing this type of monetary system. Since 1904, it has used the U.S. dollar as its official currency. Panama’s dollarized economy is, therefore, officially part of the world’s largest currency bloc.

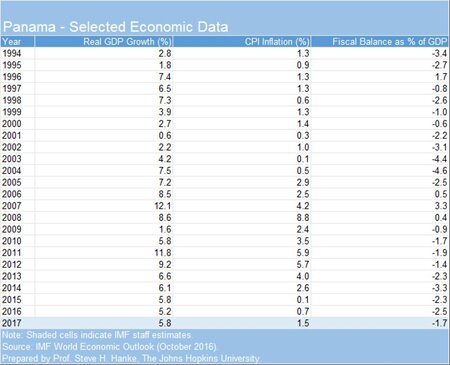

The results of Panama’s dollarized monetary system and internationally integrated banking system have been excellent (see accompanying table).

- Panama’s GDP growth rates have been relatively high. Since 1994, when the Mexican tequila crisis commenced, real GDP growth has averaged 5.8% per year.

- Inflation rates have been somewhat lower than those in the U.S. Since 1994, CPI inflation has averaged 2.3% per year.

- Since Panama’s fiscal authorities can’t borrow from a central bank, the fiscal accounts face a “hard” budget constraint dictated by the bond markets. In consequence, fiscal discipline is imposed, and since 1994, Panama’s fiscal deficit as percent of GDP has averaged 1.7% per year.

- Interest rates have mirrored world market rates, adjusted for transaction costs and risk.

- Panama’s real exchange rate has been very stable and on a slightly depreciating trend vis-à-vis that of the U.S.

- Panama’s banking system, which operates without a central bank lender of last resort, has proven to be extremely resilient. Indeed, it weathered a major political crisis between Panama and the United States in 1988 and made a strong comeback by early 2000.

To avoid the pain described in the New York Times reportage, emerging-market countries should dump their central banks and local currencies. They should follow Panama’s lead and adopt a stable foreign currency. Or, they could install a competitive currency regime, which would allow for more than one foreign currency to be used.