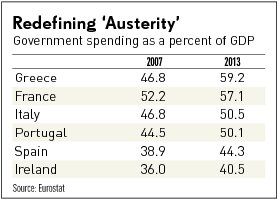

Government spending in the euro countries rose from 45.3% of GDP in 2007 to 49.5% in 2013, according to Eurostat, with particularly huge increases in Greece, France, Italy and Portugal. The table below shows how little austerity there has been in euro public sectors.

Stiglitz writes: "Austerity had failed repeatedly, from its early use under U.S. President Herbert Hoover, which turned the stock-market crash into the Great Depression, to the IMF 'programs' imposed on East Asia and Latin America in recent decades. And yet when Greece got into trouble, it was tried again."

In reality, those are all examples of the failure of higher tax rates, not government spending restraint.

In 1931, Herbert Hoover increased federal spending by 43% in a single year — to $4.3 billion from $3 billion in 1930. In June 1932, however, Hoover greatly increased all income-tax rates, with the top rate rising from 25% to 63%. Federal revenues fell from 4.4% of GDP in 1930 to 3.0% in 1933, but the private economy fell even more.

Similarly, the austerity of "IMF programs imposed on East Asia and Latin America" invariably meant higher income and/or value-added tax rates, and sometimes higher tariffs.

For instance, the IMF required suicidal tax hikes as a condition of loans to South Korea in 1980, Thailand in 1997, Argentina 1998-2001 and Russia 1998-2000.

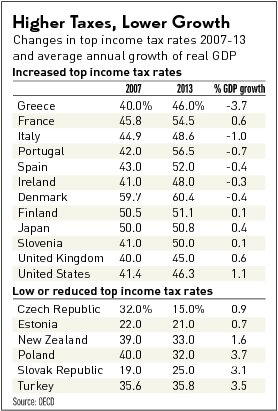

Europe is suffering under Herbert Hoover/IMF tax policy. Since 2007, the top tax on personal income was increased by six to 15 percentage points in the most troubled economies of Europe — from 40% to 46% in Greece, from 41% to 48% in Ireland, from 43% to 52% in Spain and from 42% to 56.5% in Portugal (to name just a few). Meanwhile, VAT rates also rose from 19% to 23% in Greece, 16% to 21% in Spain, 20% to 22% in Italy and 20 to 23% in Portugal.

Why have mainstream Keynesian economists been so strangely silent about the infliction of punitive tax rates on depressed European economies? What accounts for this blind spot?

One explanation, articulated by former Obama economist Christina Romer, may be that "supply-based theories of the effects of tax changes imply that the output effects depend mainly on the impact of the changes on marginal rates, while demand-based theories imply that they depend mainly on the revenue effects."

High marginal tax rates rarely raise more revenue, which means they don't matter in this view because only smaller deficits are defined as austerity. If judged by revenue effects, higher tax rates in 1932 and 1991 look like big tax cuts.

Another explanation for mainstream silence about huge increases in top tax rates among collapsing European economies is the trendy fetish about the "top 1%" income share. "Toppling the top 1%," as Hillary Clinton put it, supposedly justifies punitive tax rates regardless of any adverse behavioral impact on work effort, investment, entrepreneurship or migration to low-tax countries.

The following table puts six troubled euro countries that raised top tax rates in context by adding six other OECD countries that made the same mistake. The last column shows average annual growth of real GDP during those seven years. At the bottom are six other OECD countries that reduced top tax rates or kept them low. This is a small sample and short time period (I'm working on a big sample for 1979-2013). Yet economic growth in countries that raised top tax rates to 45%-56% was generally much weaker than for those that cut top tax rates to 15%-36%.

Higher value-added taxes clearly depressed demand, but so did raising top income-tax rates: Higher-income people account for most sales of consumer durables.

Higher marginal tax rates had the additional bad effect of depressing supply: They undermine incentives to make the extra effort and investment needed to raise personal income and therefore national income. The highest marginal tax rates cause the most crippling distortions and disincentives — fostering brain drain and capital flight while driving much of the remaining economy underground.

Since 2007, the austerity imposed on the weakest economies of Europe was not from spending cuts, but from higher tax rates.

If Keynesian critics of European austerity would shift focus away from invisible spending cuts to highly visible tax increases, then we could all join forces to support less destructive tax policies at home and abroad.