The view that private sector lobbying influences trade policy has long been central to the theoretical groundwork explaining both protectionism and trade negotiations. More specifically, the argument often runs as follows: whereas the gains from trade liberalization are shared broadly, the costs are concentrated among a few import-competing producers.1 In the absence of trade negotiations, a concentrated and better-organized import-competing sector will therefore triumph over consumer interests. By introducing reciprocal trade negotiations, export interests are mobilized in a way that allows mutually beneficial trade liberalization to take place.

During the latter part of the 20th century, this political-economy rationale for trade negotiations was largely validated. Since then, however, success with trade negotiations has been rare and evidence is mounting that private sector pressure has eroded (Mattoo and Subramanian, 2005).

As trade becomes increasingly fragmented through global value chains (GVCs), a key question is whether reciprocity can remain an effective instrument of trade liberalization. Analytically, the GVC effect on trade negotiations can be divided into two categories:

- A direct impact on stakeholder interests in trade negotiations

- An indirect impact on trade negotiations through changes in the negotiating agenda from market access to behind-the-border issues

The Direct GVC Effect on Stakeholder Interests

An analysis of the direct GVC effects on stakeholder interests starts with the observation that a fragmentation of production implies a fragmentation of interests. Firms that are responsible for only one or a few tasks in the value chain become "price takers" in the political economy of trade negotiations. A fragmentation of production thus dilutes the influence of both export interests and import-competing interests.

Secondly, the growth of GVCs creates a broader base for free-trade stakeholders because firms whose production depends on imported goods and services join export interests in supporting trade liberalization. While interest fragmentation dilutes both export interests and import-competing interests, free-trade stakeholders gain in relative terms from this broadened-base effect.

Another potential effect from interest fragmentation associated with GVCs is that both export interests and import-competing interests become weaker in relation to other trade-policy stakeholders, in particular NGOs.

Finally, the role of multinational enterprises (MNEs) is of particular interest in this context. MNEs that outsource their production can be expected to shift their focus from market access issues to broader strategic issues related to supply chain control, capital management and intellectual property rights. This suggests that market access issues receive a lower priority for MNEs. By contrast, small and medium-size enterprises that depend on arm's length trade have a greater interest in market access but typically wield less influence to achieve it.

Indirect GVC Effects Through Changes in the Negotiating Agenda

Some trade analysts argue that GVCs have changed the trade-negotiation agenda from shallow to deep integration. The mechanism for this is described as an evolution in the main role of the trading system from selling to producing (Baldwin, 2014). This shifts private sector interests from market access issues to deep integration issues, such as investment, services and various regulatory measures. As stakeholder demand changes, the trade-policy agenda shifts with it. The result is the deep integration agenda of 21st century trade negotiations, such as TTIP. In this sense, GVCs have already had an indirect impact on trade negotiations.

The next critical question becomes: How effective is reciprocity as an engine of trade negotiation for deep integration issues? While many trade agreements contain deep integration provisions, this does not necessarily mean that they are effective in the sense that the disciplines reduce trade barriers in previously protected markets.

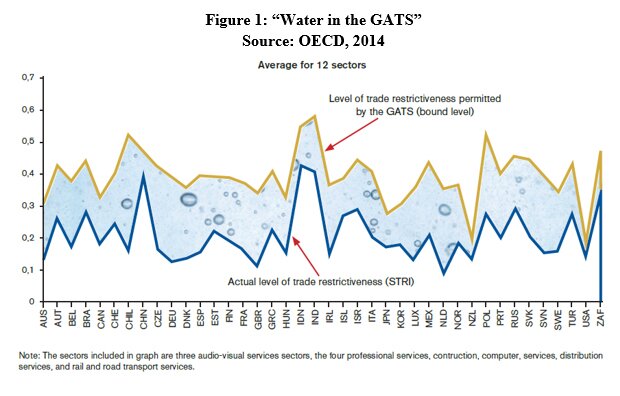

There are a few examples of deep integration issues being negotiated in a more comprehensive fashion between equal partners, such as the Eurpean Union and the United States. One such example, however, is service negotiations under the WTO. So far, WTO services negotiations have produced little new trade liberalization. The best offers in the Doha Development Agenda (DDA) are on average more than twice as restrictive as actual policy (Hoekman and Mattoo, 2011). The OECD's newly launched services restrictiveness index (STRI) yields a similar result (see figure 1).

One explanation for this emphasizes three groups that resist service liberalization: firms with market power (at home or abroad), consumer groups, and regulators themselves.

- Firms with market power may be the familiar import-competing interests. But they may also be firms that have already jumped borders and see their sheltered status abroad as a competitive advantage.

- While consumers have undoubtedly benefitted from open service markets, organized consumer groups tend to fear weaker consumer protection and greater market power for firms as a result of service trade liberalization.

- Finally, regulators often fear regulatory competition and a reduced ability to enforce domestic regulatory standards. They also sometimes share in rents from protected markets. The latter aspect is particularly important in the United States, where the standards system is highly decentralized.

What Lessons Can Be Drawn from Negotiations on Trade in Services?

In many ways, service negotiations resemble negotiations for other deep integration issues. Technical barriers to trade and services both largely concern domestic regulation, for example, and foreign direct investment is the most important mode of service delivery. Services and other deep integration issues therefore seldom fit the familiar market access negotiating template. In fact, it could become counterproductive if the impression from market access negotiations ("my market for yours") is transferred to deep integration issues. The idea of trading consumer protection for environmental protection clearly lacks public support. Instead, deep integration negotiations must be based on transparency, confidence-building and a community of interests.

Traditional 20th-century reciprocity in market access negotiations will thus not be an effective mechanism in the context of 21st-century deep integration negotiations such as TTIP. Instead, deep integration issues require new approaches to trade negotiations.

Updating Trade Negotiations for the 21st Century

An increase in the fragmentation of trade and production could lead to a corresponding fragmentation of interests. This "fragmentation effect" is likely to influence both export interests and import-competing interests. At the same time, the growth of trade in intermediate goods and services means that open-market stakeholders could receive a broader base. This "broadened base effect" unambiguously reduces domestic demand for protection. Altogether it is therefore reasonable to expect that negotiations based on reciprocitycould remain a successful mechanism for market access liberalization in the future.

The analysis in this paper furthermore suggests that it makes sense to separate market access negotiations from behind-the-border negotiations. To a certain extent this message challenges the idea that a supply chain perspective should guide trade negotiations (Hoekman and Jackson 2013; Kommerskollegium, 2013). While a supply-chain perspective makes sense from an economic efficiency point of view, it is also crucial to recognize the political-economy logic of a particular negotiation.

When it comes to deep integration negotiations, "distrustism" is a more important factor than protectionism. Negotiations must therefore focus on building trust in the new common system and in the system of one's counterpart, rather than on trying to exchange one partner's consumer protection for the other's environmental protection. Reciprocity in the traditional GATT sense will not be an effective negotiating mechanism in this context. Instead, a more co-operative approach, based on a community of interests, is required.

Deep integration negotiations also differ from market access negotiations in that supporters are fewer and interests opposing liberalization include regulators themselves. Again, a more co-operative approach is required. Regulators and other stakeholders should be engaged in the negotiations from the outset and be asked to design regulations according to principles such as "least trade restrictive" and "least costly." In addition, confidence-building measures, regular contacts, and the establishment of sister agencies that communicate well and see themselves as mirror images, as well as agreement on scientific approaches, would be useful. Finally, deep integration negotiations require constant transparency and reassurance in relation to stakeholders, business groups, NGOs, and the general public. All these conclusions are relevant for the TTIP negotiating context.

At the multilateral level, the non-discrimination principle continues to be relevant in a world with increasingly complex trade and production patterns. At the same time, the idea of a single undertaking makes little sense when interests are fragmented and the WTO has 160 members. It would be too complex, bordering on artificial, to find a genuine balance of interests across a range of different issues in such a negotiating context.

This indicates that the WTO should adopt a more incremental, step-by-step approach to negotiations in the future. The DDA has clearly not been a success, whereas some incremental progress has taken place at the WTO outside the single-undertaking framework. The analysis thus lends support to the approaches used in the negotiations for an environmental goods agreement (EGA) and an expansion of the Information Technology Agreement (ITA). The fact that international trade is increasingly about production in international supply chains underlines this conclusion. Sector agreements where the main stakeholders work together to reduce cost for their international production processes, is the most intuitive approach from a 21st century political economy perspective. At the same time, the non-discrimination principle is preserved so that the results benefit down-stream consumers world-wide and do not exclude potential future producers in third countries.

Literature

Baldwin, Richard (2014). "Multilateralising 21st Century Regionalism" Paper for the OECD Global Forum of Trade 11-12 February 2014.

Hoekman, Bernard M., and Aaditya Mattoo. Services Trade Liberalization and Regulatory Reform (2011). Policy Research Working Paper 5517. Washington DC: The World Bank.

Hoekman, Bernard M., and Selina Jackson (2013), "Reinvigorating the trade policy agenda: Think supply chain!". VoxEU, available at: http://www.voxeu.org/article/reinvigorating-trade-policy-agenda-think-s…

Kommerskollegium (2013). Global Value Chains and the Transatlantic Trade and Investment Partnership.

Mattoo, Aaditya, and Arvind Subramanian (2005). Multilateralism and the Doha Round: A Stock-Taking. Paper for the Peterson Institute for International Economics (IIE).

OECD (2014). OECD Services Trade Restrictiveness Index (STRI) Policy Brief. Background Report for the Meeting of the Council 6–7 May 2014.Schattenschneider, E.E. (1935), "Politics, Pressure and the Tariff. New York: Prentice Hall.

Notes:

1 This argument was advanced by Schattenschneider as early as 1935 in a classic study of the Smoot-Hawley tariff legislation.

The opinions expressed here are solely those of the author and do not necessarily reflect the views of the Cato Institute. This essay was prepared as part of a special Cato online forum on The Economics, Geopolitics, and Architecture of the Transatlantic Trade and Investment Partnership.