The basic metric that reflects all this is the level of federal spending. In 2013 the government of the United States spent 55 percent more money — in real, inflation-adjusted terms — than it did in 1999. Economic growth in that 14-year span has been 30 percent. Where government at all levels soaked up 32 percent of national economic output in 1999, it took in 37 percent in 2013 — an increase of nearly a sixth, in less than a decade and a half. By way of comparison, for the first 125 years of this nation’s existence under the Constitution, through 1914, government spending was largely parked between 3 percent and 6 percent of national output.

The gorging on the part of government in our recent past has been so unrelenting that aside from flashes from the likes of the Tea Party, the public is meeting the development with quiescence. At $6.4 trillion per year, total government spending is now so immense that any yearning for something smaller and more reasonable from our minders in the state runs the risk of appearing as quaint and otherworldly. Government that is huge and ever-expanding is a matter of concern in its own right. But perhaps less understood is an additional problem: the developments of the current millennium are inuring a rising generation of Americans to the immovable fact of big government.

We now not only have Leviathan, but also a crucial intellectual component of its perpetuation: government’s enormous growth ensures that memory of something different is harbored by fewer and fewer persons, getting older every year.

RECLAIMING A TRADITION

The moment is apt, then, to reclaim a tradition of our recent history, a tradition that the big-government 21st century is striving to suppress. This is the great successful effort to slow Leviathan of a generation and a half ago — the effort that gave us the Ronald Reagan revolution of the 1980s.

For despite the still large displacement of the economy, the market, and private life that the government brought about in the 1980s and 1990s, even in the wake of President Reagan’s major reforms, the scope of government in that era pales in contrast to what prevails today. From the early 1980s to the late 1990s, the Fed largely stuck to keeping the dollar sound against gold. Regulatory expansions planned in the 1970s did not come to pass thereafter. And the major spending initiatives tended to involve cuts, such as in welfare and defense.

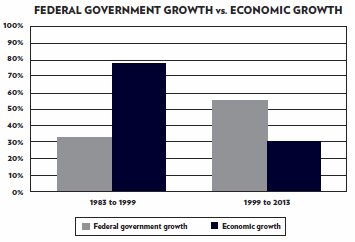

Again, the outlay picture tells a tale. The federal government grew by 33 percent in real terms from 1983 to 1999, while the economy grew by 78 percent. Before the current millennium, we had a government that got bigger all right, but comfortably less than the economy did. Now, we have a government that leaves the economy in the dust when it comes to growth.

The achievements of the 1980s and 1990s stemmed from one source above all: the centerpiece of Ronald Reagan’s economics, the bill that Congress passed in the summer of 1981. This was the great tax cut that had been originally sponsored in Congress in the 1970s by Rep. Jack Kemp of New York and Sen. William V. Roth of Delaware, “Kemp-Roth.”

The tax cut of 1981 — which took all rates of the income tax down by an average of 23 percent, lowered the capital gains rate by 29 percent, and reduced business taxes — was the point of origin of the renaissance of the 1980s and 1990s whereby the economy expanded well in excess of the government.

The tax cut made everything else easy. First of all, it took the heat off the Fed. The Fed did not have to worry about stimulating the economy, because growth flowed from the tax cut. Furthermore, lower tax rates made loopholes less important as a source of profit, so business focused more on real entrepreneurship.

Competition, efficiency, and product development reached soaring new heights in the 18 years after 1981. And government spending at last decelerated. Forty million new jobs reduced the welfare rolls, while the collapse of Soviet communism made a portion of the defense establishment redundant.

The example of 1981 proves that efforts to constrain government to the benefit of the real economy can succeed. It remains the greatest resource that our recent history provides as we seek motivation and precedent to expand prosperity and freedom by shrinking government.

The scholarly discipline of history has not been helpful in terms of relating to us the achievements of the 1980s and 1990s, in particular the victory of the great tax cut of 1981. Professors write books with titles such as “Zombie Economics” and “Peddling Prosperity” when it comes to retelling the profound revolution that brought Kemp-Roth to the fore. I strove to correct this condition myself by authoring Econoclasts (2009), a narrative history of supply-side economics, the movement that seeded Kemp-Roth and the Reagan Revolution. Also, Larry Lindsey’s classic, countercultural study of the first benefits of the 1981 tax cut, The Growth Experiment, has now thankfully been re-released in a new and updated edition.

We have to cut through the academic and political obfuscation about “the last 30 years” (a progressive epithet today) and reexamine the policy clarity and impetus to reform that coalesced in the late 1970s and early 1980s and left in its wake an economy zooming ahead of government.

In particular, we should reflect upon the four major aspects of the movement that brought about the tax cut of 1981: its intellectual origins, its institutional period of development (which occurred in journalism as opposed to government), its capacity to incur political traction, and its relevance to an economy beset with the kind of big government that took hold in the United States in modern times.

FROM THE 1960S THROUGH THE ‘70S TO THE ‘80S: A USABLE PAST

The supply-side economics that culminated in the tax cut of 1981 first arose (avant la lettre: the term was coined in 1976) in the mainstream of academic economics, in the early 1960s work of the economist Robert A. Mundell. Mundell was working for the International Monetary Fund during the first, recession- prone years of the John F. Kennedy administration. Beginning in 1961 he published a series of papers showing that the best way for the United States to slough off bad times was to strengthen the dollar while cutting taxes.

One of these papers from 1963 was a model of insight — in 1999, when Mundell won the Nobel Prize in economics, the prize announcement cited this paper. Its purpose was to show that loose money and high taxes conduce to stagnation. Namely, if profits are to come in a depreciating currency, and be subject to increasing government levies, investors will prove reluctant to take risks to gain them. The result of loose money and high taxes is no-growth and unemployment. In contrast, a dollar solid in value (particularly against its classical metric, gold) and supported by tax cuts will call forth a business and jobs boom. Somehow Mundell’s advice was actually taken, if only by default, in the Kennedy years.

The great tax cuts of 1962 and 1964 — along with a new Federal Reserve vigilance about the dollar — yielded eight years of growth at 5 percent per year. But then the consensus unraveled. In 1968 and 1969, there were tax increases. From 1971 to 1973 the Fed and Treasury conspired with President Richard M. Nixon to untie the dollar from gold as well as from fixed exchange rates with other currencies.

The era of “stagflation” came upon the nation. After a double-dip recession in 1969–70, there was another more severe double-dip episode from 1973–75, and yet another still more severe from 1980–82. From 1969 to 1982, all told, growth was mediocre at 2.4 percent per annum, the price level nearly tripled, and stocks lost half their real value. It was the worst extended performance of the American economy since the Great Depression of the 1930s — and it remains debatable whether our own era of the Great Recession actually exceeds the magnitudes of the economic crisis of the long 1970s.

In the midst of these difficulties, an intellectual transition occurred. Mundell’s ideas, passed over and forgotten in the academy (not to mention policy) in the 1970s, began to resonate in journalism, particularly on the editorial page of the Wall Street Journal. The economist Arthur B. Laffer, a colleague of Mundell’s at the University of Chicago, caught the ear of Jude Wanniski of that page. The two began having extended discussions about how to overcome stagflation via dollar stability and tax cuts. Wanniski’s editor, Robert L. Bartley, took the initiative to convene monthly meetings at a Manhattan steakhouse where the group, including Mundell, now resident in New York at Columbia University, could talk things through.

By the latter part of the nasty 1973–75 stagflation-recession, when unemployment hit 9 percent in the context of double-digit inflation and a stock collapse of 45 percent, the Journal was publishing the insights of Mundell and Laffer on a regular basis. An endrun around the academy had been effected.

If the economic establishment was not going to promote low-tax, stable-money ideas adequately, then the major business media would. As the Journal plugged away, certain quarters of Congress, including the Joint Economic Committee, developed new thinking about economic policy along similar lines.

Kemp, representing a Buffalo, New York, experiencing de-industrialization in the face of stagflation, began crafting a bill to put things into practice. In 1977 Roth lent his name as a co-sponsor, and Kemp-Roth began life. The bill called for three successive yearly cuts in the income tax of 10 percent. The model was the tax cut of 1964, which had taken all rates of the income tax down by 30 percent and occasioned the great economic recovery of that era.

Taxes were particularly onerous in the 1970s because of the way they mixed with inflation. The tax code was not indexed for inflation, meaning when the regular 7 percent increase in prices came every year, a taxpayer was thrown into a higher tax bracket if earnings kept up with prices. If one got only a “cost-of-living” increase, real income was reduced — and the government kept the difference.

The situation was worse with respect to property and capital gains taxes. In the 1970s houses soared in value as hedges against inflation, and so did tax assessments on those houses. Stocks (and real estate) that went up with inflation were subject to a capital gains tax (that reached 49 percent) on the unreal gain.

Thus, by 1978 the inevitable happened: a national tax revolt. In California, where house prices had leapt some five-fold as people bid up land to hedge the dollar, property taxes increased proportionately. A movement organized by Los Angeles businessman Howard Jarvis brought a ballot measure requiring a permanent reduction in California property taxes. Proposition 13 won big in June 1978.

In Congress that same year, a little-known representative from Wisconsin, William A. Steiger (who would die that December at age 40) proposed a capital gains rate cut of 21 points. It became so popular that President Jimmy Carter signed it into law, though on the condition that Kemp-Roth be tabled. These first electoral and legislative moves in the direction of tax cuts gave way to four of the strangest years ever in the American economy.

From 1979 to 1981 inflation was above 10 percent each year, even though a recession occurred and growth totaled only 1.2 percent per annum. In 1982 inflation moderated to the still excessive level of 6 percent, but growth crashed to ‑1.9 percent. It was stagflation with a vengeance: a motionless — indeed, shrinking — economy in the context of intolerable increases in prices. In the latter portion of this quite terrible period, with the Journalhammering away at the taxcut, stable-money solution, Reagan pushed Kemp- Roth into law seven months into his presidency, in August 1981. However, the first year’s tax cut was reduced by half, to 5 percent. When the full 10 percent tax-cut installment arrived in the middle of 1982, the economy turned, and big, for the long term.

Stocks bottomed in August 1982, went up 30 percent the rest of the year, and over the next 18 years soared another eleven-fold. Inflation, intractable for a dozen years at an 8 percent average, plummeted to 3 percent immediately and stayed there to date. Unemployment tumbled from 11 percent to 5 percent, then to 4 percent, as the labor force expanded magnificently by 40 million. The amount of time spent in recession in the 18 years following 1982 was onefifth that lost to recessions in the 13 years of stagflation.

MAKING USE OF THE LEGACY

The great Reagan tax cut of 1981 stands as one of the most successful policy initiatives of modern American history. It was borne into existence by the determination of a cadre of intellectuals, political organizers, unsung members of Congress, and a president who had had enough — as well as a proud and ambitious nation yearning once again to breathe free after a long decade of harsh experience. Indeed its scope was broadened to an extent in 1986, when further legislation also sponsored by Kemp brought the top rate of the income tax all the way down to 28 percent, one of the lowest ceilings in the entire hundred-year history of the income tax.

There were compromises along the way. In terms of money, 3 percent inflation, while a vast improvement over what had come before, still ate away at the dollar’s value, to the tune of a 40 percent devaluation each generation. In terms of taxes, Presidents George H. W. Bush and Bill Clinton both raised the marginal income tax rate. However, Clinton, at the behest of the Republican-led Congress, cut the capital gains rate. The result was that the paltry eight months’ worth of recession over the 18-year run from 1982 to 2000 was part of Bush’s record, not Clinton’s.

In all, there was consensus in these years that the tax code was supposed to get out of the way of an American economy brimming with potential. That potential had gone un-tapped and unrealized in the previous era of stagflation, when so much useful capital had to hide out in inflation and tax hedges on account of overweening government.

As for problems during this era of American renaissance, they showed themselves to be perfectly manageable, if not ephemeral. The wealth tossed off by the country over the long boom overwhelmed the “Reagan deficits” of the 1980s. The growth in “inequality” coincided with historic increases in living standards among lower earners.

And totally underappreciated today, the consensus on low and unobtrusive taxes took the pressure off the Federal Reserve. It was only when tax cuts did not come in the face of the huge 1999 and 2000 federal budget surpluses that the Fed began its contemporary activism, an activism which grew to an unimaginable extent in the aftermath of the Great Recession.

This is not to mention the unholy tide of regulation and spending, from Dodd-Frank to Obamacare, which has washed upon us since 2008. Given the resurgence of big government in the 21st century, private enterprise in this country has proven reluctant to explore the full extent of its legendary ambition.

Instead of conceding long-term mediocrity under Leviathan, we should take inspiration from our past, indeed our recent past. The last time we were stuck with 2 percent growth for the long term, the 1970s and the early 1980s, we mustered a means of narrowing government. The real results were so stellar that to recite them is to take us back to a world we have lost — but only 15 years ago.

Tax cuts, stable money, and the rendering of spending and regulation as superfluous are the formula of the supply-side revolution — the Reagan Revolution. They stand sentinel right there, not long ago in our history, as the way to advance through our sluggishness and purposelessness today.