While it requires some attention to detail, most issuers acting in good faith can refrain from making untrue statements of material facts. It is trickier to ensure that disclosures do not leave out necessary information, the omission of which may make them misleading. To see the difference, consider, for example, a manufacturing company with two factories. It would be plainly misleading to state that the company had three factories when it had only two. But what if the second factory was currently shut down due to a broken piece of machinery that would cost $1 million to replace? Now the company, if it discloses the existence of two factories (where clearly manufacturing capability is a material fact), must also disclose the fact that one is currently shut down and will require $1 million to fix so that its statements are not misleading.

The traditional 506(b) private placement does not require any specific disclosures if the offering is limited to accredited investors. But the investors typically receive a private placement memorandum (PPM), which includes all the information the issuers feel the investors would want to know before investing in the company. While the information can be quite sensitive, it is not made publicly available and is provided only to those eligible to invest in the company. As discussed in the context of the IPO on-ramp earlier, the ability to keep information secret from competitors is one of the great advantages of remaining a privately-held company.

It may be that issuers conducting a new 506(c) offering will choose to provide interested investors with a private placement memorandum. But it is unlikely that they will want to make it widely available. While any company conducting any kind of offering can fall afoul of Rule 10b‑5, it will be especially challenging for a company to provide sufficient information to entice investors through general solicitation while simultaneously ensuring the information is not misleading due to an omission.

As with Title I, the changes that Title II makes to the securities laws are relatively small—506(c) offerings are still available only to accredited investors, and securities sold through these offerings are still restricted. But they provide a flexibility that will enable new companies that might have otherwise been shut out of the market for reasons unrelated to the quality of their business models to access capital. And they allow investors new opportunities and options in allocating their funds and permit those outside the venture capital hot spots to influence the development of new products and services through investment. The 506(c) offering may appeal equally to an established company and to a start-up. Most important may be the company’s ability to convert existing relationships into investment or to appeal to an audience broader than what has traditionally been the source of early stage investment. While less glamorous than Title III, which creates the new crowdfunding exemption, Title II may result in a greater impact on capital access.

Policy Recommendations

The current definition of accredited investor is too limited. The best solution would be to do away with the accredited/non-accredited distinction entirely, and permit individuals to make their own decisions about how they want to spend their money. In the alternative, the accredited investor standard should be revised to ensure it reflects an investor’s actual ability to evaluate an investment. Wealth alone has little bearing on whether a person is well-informed, or even well-advised, on investment matters. Even if it did, using a fixed number with no reference to variances in cost of living gives preference to people living in certain parts of the country. It also favors age over other measures of experience. Under existing law, for example, a retired physician living in New York City might be able to invest in a start-up developing new mining technologies while a young mining engineer, who is much better informed about mining itself and about the industry in general, would be excluded.

The current method of calculation also excludes the primary residence. This recent change means that two people, each with say $2 million, would be treated differently if one chose to buy a $1.5 million house and invest the rest, while the other decided to rent a house and invest the whole $2 million. Each would have the same net worth, but the investment the first individual made in a house would not be considered in the same way that the second individual’s first $1.5 million investment would be considered.

The accredited investor calculation should be revised to again allow investors to include the value of the primary residence. There should be an additional method of qualifying as an accredited investor that allows an individual to demonstrate knowledge of basic finance and investing concepts. Finally, an individual should be able to invest in specific offerings upon a showing that the investor has knowledge of the issuer’s industry. A certain amount of work experience in that industry, a professional qualification, or a university-level degree in a field directly related to the issuer’s industry would be presumed to confer the relevant knowledge.

Title III: Investment Crowdfunding

Title III of the JOBS Act is by far the most ambitious of the act’s titles. While every other title simply tweaks elements of existing securities law, Title III, through a collection of interwoven exemptions, creates an entirely new kind of offering. Included in its exemptions are: an exemption for the offering from registration under Section 5 of the Securities Act of 1933 even though it is an offering to the public; an exemption for the company from registration under the Securities Exchange Act of 1934 even if the company would otherwise trigger the requirement that it register once it exceeds a certain number of shareholders of record; and exemption from registration as a broker-dealer for a new type of entity, the “funding portal.” The novelty of this title, and the genesis of this collection of exemptions, have created a number of challenges for the SEC in developing implementing regulations—challenges that, to a large extent, remain unresolved.

Origins of the Crowdfunding Exemption

The genesis of a crowdfunding exemption was not the SEC or even the financial industry. Its origins lie in the tech start-up world. In 2006, a new version of an old concept emerged, built on the Internet’s ability to radically reduce transaction costs across a wide geographic area. In its current incarnation, the concept is called “crowdfunding.” In general, crowdfunding refers to a means of raising funds by which small amounts are solicited from a large number of people.

The concept predates the Internet by hundreds of years. Long before the Internet was developed, people took up “subscriptions,” commitments to provide small amounts of money, to support public projects. Arguably the Statue of Liberty itself stands in New York Harbor thanks to a “crowdfunding” project.71 The Internet, however, has made this method easier to use, as reaching hundreds or even hundreds of thousands of people has become extremely cheap. A number of platforms have sprung up to facilitate the process. The most prominent is Kickstarter, followed closely by Indiegogo and Rockethub, among others. While these platforms tend to focus on actual projects, others such as GoFundMe allow individuals to seek funding for almost any purpose.72

In recent years, even before passage of the JOBS Act, a number of companies have turned to crowdfunding to obtain seed money. Because of existing securities regulation, however, companies are currently restricted in how they may use crowdfunding. They may solicit money from individuals, and they may provide benefits in exchange for that money—but not offer investment. Successful crowdfunding campaigns have included preferred status on a waitlist for the forthcoming product, a T‑shirt, or a handwritten letter of thanks from the company’s founder.73 They may not, however, offer a means by which investors can receive a return on investment.74 Given the nature of the rewards that companies may offer, the type of company that can currently use crowdfunding successfully is limited. Generally only a company with a certain level of charisma, either because it offers an innovative consumer product or because it exudes a coolness that people find attractive, will be successful in attracting this type of capital.

Frustrated by the inability to use crowdfunding more broadly, several entrepreneurs initiated a campaign to create an exemption to allow investment crowdfunding for small businesses.75 With the assistance of the Sustainable Economies Law Center, a nonprofit organization focused on developing local economies, they submitted a proposal for rulemaking to the SEC.76 Other entrepreneurs drafted proposed legislation, which they presented to lawmakers in late 2010.

This was when two very different worlds—the entrepreneurial world and the deeply complex world of SEC regulation—collided. Part of the appeal of crowdfunding is its grassroots nature. Early proponents of investment crowdfunding remarked on how ludicrous it was that such a simple form of investment was illegal.77 The investment crowdfunding concept was therefore intended to be extremely simple. The proposal submitted to the SEC envisioned a $100,000 cap on the offering and a $100 limit per investor. It suggested that issuers might be a local café looking to expand, a community garden, or a bookstore interested in adding a stage and public address system for small performances—all very small businesses whose owners may not have a high level of financial sophistication. Embedded in the concept was the idea that issuers could do a crowdfunded offering without the raft of legal and financial experts typically needed for even a small private offering, and certainly without the army of experts employed by the issuer planning an IPO.

How the Crowdfunding Exemption Will Work

Unfortunately, given the complexity of the federal and state securities laws and their attendant regulations, even a simple exemption for a very simple type of offering cannot ultimately be done simply. Although the exemption is entirely new, it is built into the same complex securities law framework that has existed for the last 80 years. The version of the exemption that was ultimately included in the JOBS Act will require, for most issuers, some professional guidance to navigate successfully. This may be its downfall. There is a $1 million cap on any offering using this exemption. Given the cost of professional assistance, any money raised under this exemption becomes extremely expensive and most issuers will likely find other exemptions more attractive.

The new exemption works as follows. A company may offer up to $1 million in securities, whether debt, equity, or some combination, to the general public over the course of one year without registering the offering with the SEC, provided the offering meets all of the requirements to qualify for the exemption. These include the following: the issuer may not be a public company and must be a U.S. entity. The issuer must provide certain information to the SEC, including the issuer’s name and address, the identities of its officers and directors, and a description of the issuer’s business plan. It must also disclose its financial condition, provide financial statements and information regarding its capital structure, and disclose how much it wants to raise, what it will do with the proceeds, and what the price of the securities will be. The issuer must meet its full funding goal for the raise to close; if it fails to meet its target by a set deadline, no sales occur.

After the offering closes, the issuer must comply with ongoing reporting requirements. It must make annual disclosures to the SEC and its investors regarding business operations, and must produce its financial statements.

The exemption also imposes certain restrictions on investors. Prospective investors must pass a financial literacy test, which must include an acknowledgment of the fact that the investor could lose the entire investment. The amount any one investor may invest in crowdfunding securities in one year is capped at an amount based on the individual’s annual income and net worth, but investment for any investor, regardless of wealth, is capped at $100,000 annually.

Finally, the offering must be made through either a registered broker or dealer, or through a new entity termed a “funding portal.” Under the Securities Exchange Act of 1934, any person “engaged in the business of effecting transactions in securities for the account of others,”78 or “engaged in the business of buying and selling securities” for that person’s own account79 is a broker or dealer and therefore must register with the SEC.80 Registration as a broker or dealer is an onerous process. It requires registration with the SEC itself and with the Financial Industry Regulatory Authority (FINRA). While nominally a private entity, FINRA functions in a quasi-governmental role, writing and enforcing a number of rules for the financial services industry, the violation of which can result in loss of license and fines. Among FINRA’s rules for broker-dealers are that broker-dealers and their employees must pass certain examinations, written and administered by FINRA; that the broker-dealer must maintain established capital levels; and that the broker-dealer is subject to a fiduciary duty standard in certain transactions and relationships, exposing the broker-dealer to substantial litigation risk.

The JOBS Act provides an exemption from these requirements for persons “acting as an intermediary in a transaction involving the offer or sale of securities for the account of others”81 as long as those transactions are exclusively within the crowdfunding exemption. But the funding portal loses its designation—and therefore its exemption—if it provides investment advice; solicits purchases, sales, or offers for the securities on its platform; pays commissions for the sale of the securities it has listed; or holds or manages investor funds or securities.

This is not to say that, by virtue of being exempt from registration as brokers or dealers, funding portals are unregulated. In fact, Title III clearly intends for funding portals to act as gatekeepers for the crowdfunding industry. They must register with the SEC and with FINRA, provide investor education, ensure that investors do not exceed the individual investment cap, and protect confidential information. They are also given the task of ensuring that funds are not released to issuers until and unless they have reached their funding target.

Then there are the anti-fraud provisions, which apply both to funding portals and to issuers. Both are subject to the wide-ranging liability of Rule 10b‑5. Additionally, the JOBS Act includes a provision creating a new cause of action specific to crowdfunding offerings, imposing liability on the issuer for a material misstatement or omission of a required statement. Once again, the securities laws interpret a term so broadly as to create a number of regulatory hurdles. Although “issuer” would seem to apply only to the company actually issuing the securities, in fact the securities laws define issuer to include the company, its directors and partners, its principal executive, and its financial and accounting officers.

The definition of “issuer” also includes “any person who offers or sells the security in such offering.”82 The Supreme Court has construed the term “issuer” broadly enough that a funding portal arguably falls within the definition of “seller” in this context.83 Unlike Rule 10b‑5, which requires a finding of scienter, or an intent to defraud, the new provision in the JOBS Act requires no such intention; if there is a finding that there was a material misstatement or omission, liability attaches unless the seller can show that reasonable due diligence would not have uncovered the error. Of course, that does not mean that any misstatement will result in liability. The misstatement must be “material,” which, under the securities laws, means that there is “a substantial likelihood that the disclosure of the omitted fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available.”84

The Final Rules

How this exemption will work in practice is yet to be seen. The exemption requires implementing regulations from the SEC and FINRA, and the SEC only just issued final rules in October 2015, which will become effective on May 16, 2016—several years after the JOBS Act directed the SEC to issue regulations.85

Neither the delay nor the exemption’s complexity is surprising. The concept of investment crowdfunding was met with considerable apprehension, by lawmakers and by some within the industry and academia, when first proposed.86 Securities regulation exists, in part, to protect investors. If portions of the rules are rolled back, one of two things must happen: either investors lose needed protection and are thereafter defrauded or otherwise unjustly parted from their wealth, or those portions of the rules were unnecessary and therefore many assumptions underlying the architecture of the securities laws are incorrect.

One of those assumptions is that any offering sold to the public must provide certain required disclosures. Under this assumption, the SEC must prescribe the disclosures because retail investors are not sophisticated enough to know what information they should request before investing. There is some validity to this assumption. Many retail investors may not know enough about corporate finance or governance to know what information exists, never mind which pieces of information they should consider before investing. The benefit of having the information provided through SEC-mandated disclosures is that every company’s filing will look similar, making it easy for the investor to compare disclosures across companies.

While it may be beneficial for some investors to have assistance in obtaining information about potential investments, it is not clear that all of the disclosures required for a public company would be valuable for a potential crowdfunding investor. Despite the talismanic properties sometimes attributed to this body of disclosures, it is unlikely that a crowdfunding investor looking to invest $100 or $1,000 would benefit from such a large volume of information.

Additionally, SEC-mandated disclosures are not the only way for an investor to obtain information. The nature and structure of crowdfunding encourages information-sharing and engagement. Some in the industry argue that there will be no fraud in crowdfunding because the “crowd”—that is, the online investing community—will quickly identify and report fraudsters.87 Such a blanket dismissal of the risk of fraud is naïve, as there is nearly always fraud where there is money to be made, but the ability of investors and potential investors to share information seamlessly online will likely check some illicit activity. The proposed rules include a specific provision allowing for communication through the funding portal, including communication between the issuer and investors.88 Moreover, the issuer’s ability not only to provide information to investors, but to interact and engage with them, offers a new means of responding to specific requests. An issuer need not anticipate all investors’ requests and satisfy them with one data dump. The disclosures can be an ongoing, interactive process.

As for the need for guidance in understanding what information is relevant to making an informed investment decision, the SEC is not the only source for such assistance. Private sector actors can provide help, too. For example, CrowdCheck (of which the author is a founder and owner) is a company founded specifically to help investors conduct the due diligence necessary to making an informed decision when investing in a crowdfunding offering.

The second assumption behind the securities laws’ approach to protecting retail investors is that they must be prevented from investing in companies and participating in transactions deemed to be risky. The near ban on retail investment in private placements is the best example of this type of investor protection. The IPO process itself functions as another such restriction. The process of conducting an IPO is almost entirely focused on preparing, filing, and disseminating disclosures. The disclosure process therefore also serves a gatekeeping function in that only certain companies—generally those that are above a certain size and relatively well established—will find an IPO worthwhile. Seen through this lens, the burden of preparing for an IPO is a plus. It weeds out the smaller, younger, riskier companies and thereby prevents retail investors from investing in them.

Given these assumptions, it is not surprising that, before the JOBS Act, there were no meaningful opportunities for retail investors to invest in a company at the very start of its lifecycle. The fact that retail investors have not typically been a part of this market has made the task of designing appropriate regulations for crowdfunding offerings difficult. The exemption does not work if the issuer must make the same disclosures it would make for an IPO. Those disclosures are simply too burdensome for offerings and companies of this size. The exemption would be unusable.

Although the SEC has sought to balance these concerns and develop a workable exemption, it does not seem to have been successful. The final rules have significant defects, all of which derive from using a template created for large public companies to develop a regulatory regime for what are extremely small offerings. For example, the rules require issuers to follow U.S. Generally Accepted Accounting Principles (GAAP). Among other requirements, this requires the use of accrual-based accounting. In accrual-based accounting, debits and credits are recorded as they accrue. If, for example, a company orders inventory in June with payment due in August, the debit is recorded in June. Most small businesses, however, use cash-based accounting, in which credits and debits are recorded as the money flows into or out of the company’s accounts. Under cash-based accounting, the inventory ordered in June but paid for in August would be recorded in August.

In some ways, accrual-based accounting provides a more accurate picture of the company’s financial situation. If a company has $50,000 in cash on hand but must pay $45,000 in the next few weeks, it is more accurate to say that the company has $5,000 rather than $50,000. In a large company that always has a number of substantial orders and payments outstanding, accrual-based accounting is essential to understanding the company’s health. In a very small company, however, there are likely to be only a small number of credits or debits outstanding and disclosing individually any that are of significant size is easily done. Accrual-based accounting is unnecessary.

Under the rules, issuers must also make annual disclosures to the SEC and on the company’s own website until the company goes out of business or acquires all of the outstanding crowdfunding securities it issued. An issuer must therefore calculate the cost, not only of preparing for the offering itself, but also of annual disclosures on an ongoing basis.

The SEC, in accordance with administrative law, first published proposed rules on which the public was invited to comment, and subsequently issued the final rules. While it is the agency’s prerogative to make changes to final rules as it sees fit, some of the changes between the proposed and final rules for Title III were surprising. For example, the final rules have introduced a risk that a crowdfunding issuer may be forced to register as a public company. Most companies go public by choice, but a provision of the securities laws mandates that a company register with the SEC if it has more than 2,000 shareholders or 500 non-accredited shareholders, and $10 million in assets.89 It is essential to the crowdfunding model that an issuer be able to raise money from a crowd of investors. Requiring issuers to register as public companies if they have more than 500 non-accredited investors, including crowdfunding investors, would make the crowdfunding exemption unworkable and would fundamentally undermine its premise.

The proposed rules therefore included a provision that would not count crowdfunding investors toward the 500-shareholder total. Unfortunately, the final rule introduces a risk. The issuer can exclude the crowdfunding investors, but only if it complies with certain requirements. If the issuer, for example, misses filing its ongoing disclosures, it loses the exemption, meaning that it would have to file as a public company if it has more than 500 non-accredited investors. This could wreak havoc with small crowdfunding issuers. In the tumult that characterizes the daily operations of a start-up, where a handful of people fill the roles that require dozens at a larger enterprise, and where legal and compliance issues may fall to the overburdened CEO, missing an SEC filing is a real possibility. Even if one believes that these ongoing filings are necessary to investor protection, a single lapse should not invalidate the exemption for all crowdfunded securities the company has issued.

Not all of the changes to the proposed rules were bad, however. For example, the proposed rules had prohibited platforms from using subjective criteria to select the offerings listed on their sites. The rationale was that such curation was akin to making investment recommendations—I’ve listed this security on my site because it’s a good investment and you should therefore buy it—and that platforms should not engage in such activities. Commenters, however, rightly noted that this was in considerable tension with the liability such platforms will shoulder and the structure of the act, which places them in a gatekeeping role for the industry. Under the final rules, platforms may “[d]etermine whether and under what terms to allow an issuer to offer and sell securities in reliance on Section 4(a)(6) of the Securities Act (15 U.S.C. 77d(a)(6)) [the JOBS Act provision that allows crowdfunding] through its platform, provided that the funding portal otherwise complies with Regulation Crowdfunding (§§ 227.100 et seq.).”90 Funding portals may not make any assertions about the quality of the investments on their sites, but they may use whatever methods they choose to select the offerings they will list. This change provides not only a means for platforms to reduce liability exposure, but also a certain level of investor protection. A platform, by creating a carefully curated list of offerings, can cultivate a reputation for listing only well-run companies, making its offerings more attractive to investors and issuers alike and providing a useful service to investors.91

Given the complexity of the legislation and of the surrounding securities regulations, it is ultimately unlikely that most issuers will be able to successfully complete a crowdfunding offering without some assistance from legal or financial professionals. With the amount of money a company can raise in a crowdfunding offering capped at $1 million, companies may have little room in the budget to spend on these services. If the cap were raised, which would require an act of Congress, the exemption might be more attractive, but given the changes to Regulation A (described below) and Regulation D, there might simply be no need for Regulation CF (the crowdfunding exemption).

Additionally, crowdfunding involves receiving investment from the crowd or from a large and broadly dispersed group of investors. This means that, for companies that choose to issue equity, any future investment will have to wrangle with a large and unwieldy assortment of shareholders. The easiest solution would be to create a fund that would invest in crowdfunded offerings. Unfortunately, the JOBS Act explicitly forbids the use of special-purpose vehicles (SPVs) or other funds under Title III.92 Even if funds were permitted, they would need an exemption from the Investment Company Act of 1940, which imposes certain registration and other requirements on funds, to be viable. This is yet another area where the law simply is not built for companies the size of crowdfunding issuers. It is almost impossible that any fund specializing in crowdfunding would be well-funded enough to justify the expense of registration under the Investment Company Act.

With better underlying legislation and better implementing regulation, investment crowdfunding might have provided a useful contribution to capital formation for the smallest companies. Properly done, investment crowdfunding would provide small, quick injections of cash into very early stage or very small companies. For example, a local coffee shop looking to buy new equipment or a two-person start-up needing cash to allow its founders to quit their day jobs and spend a year or two building the business until it can bring in revenue might be good candidates for an effective form of crowdfunding. Unfortunately, the current exemption is too unwieldy to be viable for such uses.

Even so, it is not realistic to believe that, whatever its form, investment crowdfunding would bring quite the number of new ventures and jobs that some of its advocates imagined.93 In its current incarnation, it is unlikely to change very much at all. However, its greatest benefit may not be its ability to assist in capital formation directly. The greatest benefit the new exemption provides may be the simple fact that it is new. Regulation in general, and securities regulation in particular, has a tendency to discount, and therefore stifle, innovation. Regulation CF is valuable simply in its willingness to venture into the unknown. It is too bad it was not better done, but it opens the door for more innovation in the future.

Policy Recommendations

Both the implementing regulations and the underlying legislation creating the crowdfunding exemption have significant flaws. A few changes, some more ambitious than others, could make crowdfunding a viable option for capital formation:

- Creating a de minimis exemption for crowdfunding. Informal—extralegal—crowdfunding has always existed. It’s what happens when someone opens a new restaurant and invites mom, dad, some cousins and a few buddies to “go in on” the restaurant and become “part owners,” which is often structured (albeit unwittingly) as a sale of stock and not as the creation of a partnership. These types of arrangements, despite the headaches they give attorneys who later need to unwind the sales, will persist whether they are legally sanctioned or not. Rather than create unnecessary complexity, it would be simpler to create an exemption for offerings under, for example, $500,000. To the extent investor safeguards were deemed necessary, the exemption could include restrictions either on the amount any one investor could invest (similar to those that exist under Regulation CF) or restrictions on how the offering could be advertised.

- Permitting the use of special purpose vehicles (SPVs) under Regulation CF, removing the restriction on crowdfunding by investment companies, and providing an exemption under the Investment Company Act that would make the creation of a crowdfunding investment fund feasible. This would allow the development of funds created for the purpose of investing in crowdfunding offerings, giving investors the opportunity to diversify and to leverage the expertise of a fund manager. Ultimately, this change would improve investor protection. One of the biggest criticisms of investment crowdfunding has been the fact that the businesses seeking crowdfunding are almost guaranteed to be small and young, and therefore risky. An investor could, instead of holding shares of one risky asset, hold a diverse basket of crowdfunding securities.94 Additionally, the fund manager would have an incentive to provide more thorough vetting and diligence on the securities to be included in the fund, leading to potentially better investments for the investors. Finally, crowdfunding is, more than most types of investing, about investing in more than simply a business enterprise. Crowdfunding imparts a certain emotional benefit on investors who may invest in a company because of personal beliefs or affiliation. The availability of crowdfunding funds could enable the creation of, for example, a fund comprised of businesses within a specific town, or businesses devoted to a certain cause, allowing investors to invest broadly in places or concepts they cherish.

- Reverting to the proposed rule that would have made all securities issued under Regulation CF exempt from the 12(g) requirements regardless of future behavior on the part of the issuer. The current final rule introduces too much uncertainty and creates a substantial risk that an issuer will be required to file as a public company because of an innocuous lapse in compliance. At the very least, there should be a grace period during which an issuer can cure the deficiency and retain its private status.

Title IV: Regulation A Revisited—the Backdoor to Crowdfunding

Although most discussion of securities crowdfunding has, understandably, focused on the new exemption in Title III, another exemption can also provide a crowdfunding-like option for issuers. Regulation A is an old exemption in the securities laws, dating back to 1936. It has been dubbed the “mini IPO” because it permits small offerings of freely tradable securities to the general public without full registration with the SEC. It has historically been challenging for companies to use because of the cap on how much can be raised in an offering under this exemption—pre–JOBS Act, the cap was $5 million—and because of restrictions related to state law, which will be discussed in this section. In fact, companies have found it so challenging to use that it has been deemed unworkable and fallen almost entirely out of use.

In 2011, there was only one qualified Regulation A offering. By way of comparison, there were 8,194 Regulation D offerings (private placements) for less than $5 million and even 312 registered public offerings for less than $5 million in the same year. Exemptions from full registration, as Regulation A is, are intended to be easier and more cost-effective than a full public offering. The fact that there were more than 300 times the number of sub-$5 million IPOs in 2011 than Regulation A offerings suggests that Regulation A was not working as intended.95 Even one of the most robust years for Regulation A, 1997, produced only 56 qualified offerings.96

What was wrong with Regulation A? Two things: the $5 million cap and lack of federal preemption. At first blush it seems strange that the $5 million cap would be problematic since there have been IPOs for less than $5 million. The reason is that the lack of federal preemption made the legal and other compliance requirements so costly that they quickly ate into the $5 million issuers were allowed to raise under the exemption.

An offering under Regulation A is, even post-JOBS Act, more complicated than raising money under Regulation D. First, the company must be an eligible issuer. Unlike Regulation D, Regulation A places restrictions on which companies can use the exemption. It cannot be used by a reporting company, that is, a company that has had an IPO, lists its securities on a national exchange, or has more than 2,000 shareholders of record (or more than 500 non-accredited shareholders of record). The issuer must also be either a U.S. or Canadian company. Second, the company must complete a scaled-down version of the more robust registration process required before an IPO. Third, the company cannot, as in the case of Regulation D, raise an unlimited amount of money using this exemption. Finally, the offering must be accompanied by a disclosure document known as an offering circular. An offering circular, while more modest in scope than the prospectus that accompanies an IPO, is nonetheless a significant undertaking requiring the assistance of legal counsel. For example, the circular that accompanied one of the very few recent Regulation A offerings, conducted by Fundrise in 2012, was 40 pages, not including the audited financial statements and seven appended exhibits.

Also, unlike Regulation D, Regulation A is an exclusive safe harbor. In the case of Regulation D, which is not an exclusive safe harbor, an issuer may fail to meet all of the requirements to qualify for the Regulation D exemption and yet still be exempt from registration. Regulation D carves out space in the very vague statutory exemption for issues not involving a public offering. The rationale behind Regulation D is that we will say “well, a lot of things might be a non-public offering, but we will say that if you meet the requirements of this Regulation, your offering will definitely be non-public.” Regulation A, however, is not a carve-out within a broader exemption; it is the exemption. Any deviation from its requirements means that, if the offering cannot qualify for another exemption and yet is not fully registered, it is in violation of the Securities Act. 97

Even after the necessary materials have been filed with the SEC, the issuer’s work is not done. The SEC staff review the materials and may return to the issuer with questions and requests for additional information or changes to the offering materials. These changes often must be addressed by the issuer’s lawyers and, in the case of questions about the company’s financial statements, by its accountants. There may be a number of written communications back and forth between the SEC staff and the issuer and its team, plus informal conversations as the details of the offering materials are ironed out. Due to the cost and effort required to respond to SEC questions, many issuers who begin the process of conducting a Regulation A offering never finish it. For example, in 2011, there were 19 initial Regulation A offerings filed but only one qualified.98

Lack of Federal Preemption

If issuers had only to comply with federal law, more might have found it worthwhile to meet these obligations to be able to raise a few million dollars. However, they have to comply with state regulations as well. In legal terms, the federal government may, where it has jurisdiction, elect to preempt state law. In 1996, Congress provided federal preemption for a wide range of securities through the National Securities Markets Improvement Act (NSMIA). Pursuant to this act, securities listed on the New York Stock Exchange and NASDAQ, as well as securities sold in reliance on the Regulation D exemptions, are exempt from state registration requirements.

Securities sold under the Regulation A exemption, however, were not included in the act and have therefore been subject to state registration requirements.

Each state has its own agency that regulates the sale of securities within its borders. These agencies oversee state securities laws, known as “blue sky” laws. At the federal level, every offering of securities must be registered with the SEC, or qualify for an exemption. Similarly, for every offering of securities in the United States, the issuer must register that offering with the state securities regulator, unless the offering either qualifies for an exemption under state law, or federal law has preempted the state’s regulation of the offering.

While there are similarities among the 51 jurisdictions (the 50 states plus the District of Columbia), each jurisdiction has its quirks. An issuer subject to these rules must therefore carefully review the laws of each jurisdiction in which it plans to offer securities to ensure compliance. Offering documents must also be submitted to each jurisdiction, and each set of documents must comply with that jurisdiction’s requirements, which include not only the content of the required disclosures and filings, but also the format in which these disclosures must be made.

Moreover, a majority of states include “merit review” as part of the offering process. This means that the state securities board reviews the offering to determine whether the terms are, in the words of many state statutes, “fair, just, and equitable” to the investor and, in some cases, ascertains whether the securities are likely to present a return on investment to the purchaser.99 While the existence of merit review does not necessarily impose additional compliance costs on the issuer, it does introduce uncertainty. An issuer may complete all necessary documentation, comply with all relevant requirements, and incur all applicable costs associated with preparing an offering for a particular state only to be rejected by the state securities board as too risky.100 Even if the state board accepts the offering, however, the process at the state level typically mimics that at the federal level, requiring several rounds of communication between issuer and regulators, and the input of the issuer’s lawyers and accountants. Each iteration costs both time and money for the issuer.

Certainly one reason for the paucity of Regulation A offerings is the availability of Regulation D. As discussed earlier, Regulation D has no cap and requires no specific disclosures. There is no back-and-forth with the SEC, and no risk that the offering will not be accepted (although, of course, any offering carries the risk of liability if it fails to comply with regulations). Regulation D offerings also benefit from federal preemption. And, now that Rule 506 offerings may be advertised via general solicitation, the public nature of Regulation A offerings may be even less attractive. Regulation D offerings tend to be cheaper than Regulation A offerings. While the cost of each can vary considerably based on the size of the offering, the complexity of the issuer, and other factors, a pre–JOBS Act Regulation A offering tended to cost somewhere around $100,000 while a Regulation D offering can sometimes be done for as little as $20,000 or $40,000.

Given the benefits of a Regulation D offering, why would a company choose Regulation A? There are two reasons. First, securities sold pursuant to a Regulation A offering are freely tradeable in the secondary market. This liquidity increases their value and lowers the cost of capital. Second, issuers are not indifferent to who buys their securities, especially when the company is very small.

Fundrise, for example, is a real estate development company that, according to its website, seeks to “democratize local investment” by facilitating investment in real estate by local investors. Given the company’s mission, having unaccredited but local investors for its projects is crucial to its vision. The company has used Regulation A in the past to enable unaccredited investors to participate in its offerings. However, it found the exemption’s compliance requirements unworkable. According to Fundrise, the filing process took six months to complete, required the assistance of eight attorneys, and cost more than $50,000 in legal fees.101 The company also notes that its final filing document weighed 25 pounds. Until recently, it had reverted to relying exclusively on accredited investors and Regulation D offerings. In late 2015, however, it announced a new Regulation A offering, under the new post-JOBS Act rules.102

As for that sole Regulation A offering in 2011, its issuer has also spoken out about the challenges of complying with the regulation’s requirements and with numerous state regulatory regimes. The 2011 Regulation A offering was for $5 million to fund a Broadway revival of the musical Godspell. In an interview at the time, the lead producer, Ken Davenport, expressed his interest in having “a community of investors since the musical is about a community of people.”103 This community came at a cost, however. Davenport later recounted the efforts required to comply with various state regulatory regimes. Texas requested a $250,000 bond, he reported, while Maryland required that he pass FINRA’s Series 63 Uniform Securities State Law Examination.104 The legal and other costs of completing the $5 million raise, he said, totaled $200,000. Although The Godspell LLC successfully completed its round of funding, other production companies have not followed suit, preferring to use the more efficient Regulation D exemption to fund Broadway shows.

JOBS Act Changes to Regulation A

Title IV of the JOBS Act aimed to revitalize this exemption by raising the cap to $50 million, with a periodic review to determine if the cap should be raised further, and by classifying the securities sold under the exemption as “covered” if offered or sold to “qualified purchasers.” Under the Securities Act of 1933, a covered security is exempt from state registration requirements.

Qualified purchaser is a term that has been around for a while but that has never been definitively defined. As part of the process of drafting rules to implement this title of the JOBS Act, the act directed the SEC to define this term and, in the end, the SEC defined the term quite broadly indeed. First, the SEC created two tiers of offerings under Regulation A. Tier 1 looks a lot like old Regulation A, but with a $20 million cap instead of a $5 million cap. Offerings must comply with all Blue Sky (that is, state) laws, but ongoing reporting requirements are minimal and financial statements need not be audited unless the company has already prepared audited statements for other purposes. (As many state regulators require audited statements, most issuers using Tier 1 will wind up needing audited financials in the end.) Anyone can buy securities sold in a Tier 1 offering and can invest as much money as they wish.

Tier 2 offerings, meanwhile, have a $50 million cap and are exempt from state registration requirements. However, financial statements must be audited. Additionally, Tier 2 offerings impose ongoing reporting obligations, including semi-annual and annual reports, and reports necessary to ensure information is current. Non-accredited investors may invest only 10 percent of the greater of income or net worth in any one offering.

Finally, under Tier 2, securities may only be offered and sold to “qualified purchasers.” The final rule states that a qualified purchaser is “any person to whom securities are offered or sold pursuant to a Tier 2 offering of this Regulation A.”105 That is to say, anyone at all. The SEC could not have defined the term any more broadly than this.

The SEC’s liberality has not gone unchallenged. Several state regulators, through their representative association, the North American Securities Administrators Association (NASAA), have objected to the SEC’s definition of qualified purchaser, arguing that the SEC’s interpretation is “clearly contrary to the plain language and intent of the applicable statutes.”106 State officials from Montana and Massachusetts have filed suit against the SEC, seeking to enjoin the agency from permitting offerings to go forward under the new rules. These suits are currently pending.

Although the SEC certainly acted boldly in defining qualified purchaser as it did in Tier 2 offerings, its actions are supported by a careful consideration of the JOBS Act. The purpose of the JOBS Act is “to increase American job creation and economic growth by improving access to the public capital markets for emerging growth companies.”107 Congress included changes to Regulation A in the act, liberalizing its terms. The act also included a provision ordering the Government Accounting Office (GAO) to conduct a study on “the impact of State law regulating securities offerings, or ‘Blue Sky law,’ on offerings made under Regulation A.”108 The GAO study concluded that state registration requirements were “costly and time-consuming for small businesses” and that Regulation D’s federal preemption made that exemption more attractive for small issuers.109 Congress’s inclusion of the GAO study in the JOBS Act ties the changes to Regulation A to issuers’ concerns with state-level compliance. The GAO’s findings confirm that the lack of federal preemption for Regulation A contributed to small companies’ strong preference for Regulation D. It is therefore neither arbitrary nor capricious for the SEC to conclude that broad federal preemption would promote the goals of the JOBS Act.

Only a handful of issuers have filed paperwork for Regulation A offerings since the new rules became effective. Some of these filings have fundamental flaws that make it unlikely they will qualify. Some other issuers, however, have filed papers recently or have expressed interest in the exemption but are taking a more measured approach before jumping in. A key consideration for issuers is the speed with which the SEC reviews and qualifies offerings; many companies are unwilling to wait more than 90 days to start fundraising, especially given the fact that Regulation D offerings require no paperwork to be filed with the SEC and no approvals. However, while there is no limit on the amount of capital that can be raised under Regulation D, the limitations Regulation D imposes on investors can make raising larger amounts more difficult. If the SEC can review and qualify the offerings quickly enough, the new Regulation A may be a useful source of capital for companies that need a large injection of funds but that are not quite ready to enter the public markets. This category includes a large swath of small business models. While a successful Regulation A offering does need the assistance of lawyers, the amount that can be raised under the exemption is sufficient to make such an expense worthwhile. It may be that the changes to Regulation A are the most important of all the JOBS Act’s provisions.

Policy Recommendations

On the whole, the changes to Regulation A are very welcome and promising. But if the SEC were to make two changes, the new Regulation A would be even more effective:

- extending federal preemption to all Regulation A offerings; and

- providing explicit federal preemption of state Blue Sky laws for registered broker-dealers trading in securities originally issued under Regulation A. Currently, while securities sold pursuant to Regulation A are freely tradable, restrictions remain at the state level on how a registered broker-dealer can handle these securities. Removing those restrictions on secondary trading would make the securities more liquid.

Given the fact that Regulation A’s unpopularity was due overwhelmingly to the need to comply with state as well as federal regulators, it seems unlikely that the new Tier 1 offering under the revised Regulation A will be very popular. It is difficult to see how state-level review adds appreciable investor protection, and there is therefore no need for the Tier 1/Tier 2 distinction. The disclosure requirements currently applicable to Tier 1 should apply to all Regulation A offerings, including those above $20 million, and all Regulation A offerings should be exempt from state registration requirements.110

Additionally, making the initial offering exempt from state registration is, at best, a half measure if the securities cannot be easily traded in the secondary market.

Titles V And VI: Staying Private Longer

As discussed earlier, companies typically decide to go public because they need access to the kind of capital that is only available in the public markets. This is a big decision in the life of a company and not one that is taken lightly. In addition to the considerable cost of the IPO and ongoing compliance costs, a public company simply must be run differently than one that is privately held. The company loses control over who holds its stock, and its board and executives now have outsiders looking over their shoulders. Its inner workings, previously open only to shareholders and creditors, are now laid bare for inspection by any member of the public who can access the SEC’s online filing system, including competitors. Many companies, although highly successful, choose nonetheless to stay private.

There are, however, circumstances that require a company to go public. The two triggers are total assets and shareholders of record; if both exceed an established limit, the company will be considered a public company and must register or be found in violation of the securities laws.111 Before the passage of the JOBS Act, these thresholds were assets exceeding $10 million and more than 500 shareholders of record. The JOBS Act raises the threshold for shareholders of record to 2,000, as long as these shareholders are accredited; the threshold for non-accredited shareholders remains at 500.

It should be noted that the threshold considers only shareholders of record in making the calculation. The distinction between shareholders and shareholders of record is an important one. Most individual investors’ securities are held in brokerage accounts. The brokerage is the shareholder of record for these securities, not the brokerage clients, who are the beneficial owners of the securities. Therefore a brokerage may hold shares in a company for 100 account holders (the beneficial owners) but only the brokerage will count as the shareholder of record. In the industry a brokerage holding securities in this way is said to hold securities “in street name” for its clients. So the threshold is actually much higher than it initially appears.

Titles V and VI of the JOBS Act raise the thresholds for, respectively, issuers generally and for bank holding companies specifically to $10 million in assets and 2,000 total shareholders of record or 500 non-accredited shareholders of record. The effect of this change is to permit companies to remain privately held further into their lifecycles or to remain private indefinitely.

This seems to present a paradox: the JOBS Act both promotes early stage IPOs by creating an IPO on-ramp and encourages companies to stay private longer by raising the assets and shareholder thresholds. These goals are not contradictory, however, as they give more flexibility for smaller companies both in how they raise capital and how they govern themselves. Additionally, companies that wait longer to go public and can more carefully choose when an IPO makes sense for their business may present a higher quality IPO at the point they do enter the public markets. And there will always be companies that need to go public. Companies that receive private equity funding, for example, are under a great deal of pressure to provide an exit for their investors. Sometimes this exit can be through acquisition by another company, but often it’s through an IPO. Other companies, because of the culture of their industry, may need to go public to demonstrate they have achieved a certain level of success and maturity. These are appropriate reasons for a company to enter the public markets because they depend on the company’s own internal decisionmaking. Titles V and VI assist in letting companies make these decisions themselves, in line with their own business models and projections.

Policy Recommendations

The decision to register an offering and to access the public capital markets should be one a company makes because it is in the best interest of the company. It should not be either a step a company is forced to take, or a barrier to growth for companies that do not wish to operate as a public company. Congress should repeal Section 12(g) of the Securities Exchange Act of 1934.

Conclusion

The JOBS Act provides some of the innovation and flexibility required to provide adequate capital access for the wide range of small business models that exist in our economy. The JOBS Act achieves this, in large part, by departing from the traditional approach to securities regulation at the federal level. The SEC has a three-part mandate: (1) to facilitate capital formation; (2) to protect investors; and (3) to maintain fair, orderly, and efficient markets.112 In finding a balance between facilitating capital formation and protecting investors, the SEC has typically taken the position that less-sophisticated, less-wealthy investors are best protected through exclusion from investment in the riskiest companies. And early stage companies are risky. According to data from the Bureau of Labor Statistics, 20 to 25 percent of new businesses failed in the first year during the period 1994 to 2010, and roughly 50 percent fail by the fifth year.113

Preventing people from investing in risky companies may protect them from loss, but it also may protect them from gain. Investment is risk. People invest to increase their wealth. The reason investment increases wealth is twofold. First, there is the time value of money. Investors buying bonds, for example, allow the issuer to use their money now and forgo using it themselves because the issuer will return the money with interest in the future. Second, there is risk. Investors buying bonds not only forgo the use of the money for a period of time, they also risk losing it if the issuer is unable to repay the money. To make the risk worthwhile, the issuer offers interest. If there is no risk, there is no reward. “Riskiness” does indeed mean that there is a high likelihood of failure, but it also means that, if the business succeeds, the return is likely to be high.

Before the JOBS Act, the ability of the least-sophisticated, least-wealthy investors—retail investors—to invest in very early stage companies was almost nonexistent. Meanwhile, the investment available to early stage companies was similarly limited. Some have argued that these limitations are beneficial. There is concern that adverse selection will leave only the companies that have been rejected elsewhere to seek investment through online offerings, whether through 506(c) of Regulation D, Regulation A, or Regulation CF. Or that the ability to solicit investment online will attract outright fraudsters to prey on investors. Will there be fraudsters? Almost assuredly. As mentioned above, where there’s money, there’s fraud. But thieves never needed legitimate exemptions for an opportunity to dupe would-be investors; they can ply their cons online with or without Regulations A, D, or CF. As for adverse selection, this assumption at best betrays a certain stuffiness—is there anything worthwhile on that Internet thing?—or at worst, elitism. The availability of online investing provides improved access for both investors and issuers who reside outside the financial strongholds of the northeastern and Pacific cities. Some issuers may go online as a last resort, but many may choose to offer securities online because of its convenience, ability to reach a broader audience, and because the issuer or its potential investors are young enough that they expect to do everything online (and preferably from their smartphones).

The JOBS Act has made some changes that may open up such investment to new investors. The JOBS Act, however, is far from perfect:

- While Title I streamlines the IPO process, the question remains whether many of the deferred disclosures are necessary at all.

- Title II makes it easier for issuers to find investors for private placements, but offerings are still largely restricted to accredited investors and there is little to support the notion that a certain level of income or assets renders a person either financially sophisticated or especially knowledgeable about any given industry.

- Title III crowdfunding will be hamstrung by the very low $1 million cap on the amount that an issuer can raise, and most issuers will likely find the ongoing reporting requirements and other disclosures to be unduly onerous, especially given the other options presented by Regulations A and D.

- Title IV provides a much-needed update to Regulation A and Tier 2 will likely prove to be valuable. However, a better solution would have been to provide full federal preemption for all offerings under the exemption. It is unclear what benefit state review of these offerings provides and, for any offering, merit review is anathema to a properly functioning market, as demonstrated by Massachusetts’s regulators’ inability to recognize the value in the Apple IPO.

- Titles V and VI will assist companies by making the decision to go public one that the company can make based on its own business needs, although it is unclear that requiring a company to go public at any point provides benefits either to the company, its shareholders, or the market as a whole.

Clearly, the JOBS Act is not all that is needed to provide robust growth in the small-business sector. As new technology emerges and innovation in connecting investors with issuers follows, additional changes will be needed. The JOBS Act, however, provides a useful template for how regulators can work to accommodate regulation to the needs of the market instead of the other way around. Instead of approaching new technology as a jungle that needs to be tamed by government intervention, a better approach, attempted but not fully realized in the JOBS Act, would be for regulators to look for ways to remove obstacles to economic growth. This is especially true in the small-business sector, where firm diversity and quick proliferation of new ideas requires equally nimble financial solutions.

A. Appendix: Summary of Policy Recommendations

Title I

The SEC should:

- Establish a process for determining whether disclosures required as part of the IPO process are valuable to the market and whether their value merits the burden of compliance.

- Use this process to conduct a review of the current IPO process, with the goal of repealing requirements that are unduly burdensome.

- Conduct regular reviews of existing and new requirements using these criteria, repealing requirements that are unduly burdensome.

Title II

Eliminate the accredited/non-accredited investor distinction or, if that is not possible, Congress should:

- Broaden the current definition of accredited investor to include individuals who can demonstrate through a brief and simple test an understanding of basic finance and investment concepts.

- Create a new category that would include individuals who can demonstrate, through work experience, a professional qualification, or a university-level degree in a relevant field, knowledge of a specific industry. These individuals would be eligible to invest in companies within each individual’s area of expertise.

- Permit the primary residence to be included in the calculation of accredited investors’ assets.

Title III

Congress should:

- Create a de minimis exemption for offerings under $500,000 that would require no filings with, or disclosures to, the SEC. Restrictions on how much an investor can invest and/or on advertising of the offering could be included if necessary.

- Lift the restriction on crowdfunding investment companies and create an exemption under the Investment Company Act to permit such funds to operate with limited registration and disclosure requirements.

The SEC should:

- Remove the conditionality from the 12(g) exemption to ensure that any securities properly issued under Regulation CF remain exempt, regardless of the issuer’s compliance with ongoing disclosure requirements (or anything else).

Title IV

The SEC should:

- Extend federal preemption to all offerings under Regulation A.

- Provide explicit federal preemption of state Blue Sky laws for transactions in the secondary market by registered broker-dealers for securities properly issued under Regulation A.

- Apply the disclosure regime currently applicable to Tier 1 offerings to Tier 2 offerings.

Titles V and VI

- Congress should repeal the requirement that companies must register once they have reached a certain shareholder and asset threshold.

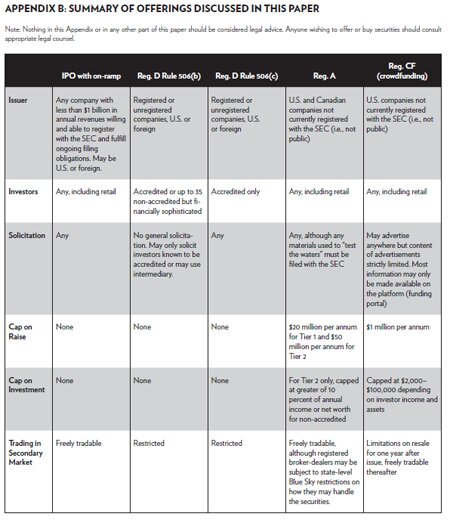

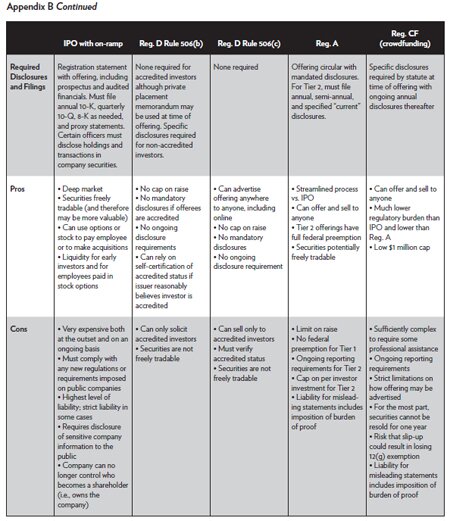

Table B.1. Summary of Offerings Discussed in This Paper

Notes

1. White House Office of the Press Secretary, “Remarks by the President on the Economy,” news release, May 13, 2010, https://www.whitehouse.gov/the-press-office/remarks-president-economy.

2. “Supporting Small Businesses and Creating Jobs,” Office of Management and Budget, 2013, https://www.whitehouse.gov/omb/factsheet/supporting-small-businesses-and-creating-jobs.

3. For a review of the role of individual entrepreneurship in American social thought on prosperity, see Jim Cullen, The American Dream: A Short History of an Idea that Shaped a Nation (Oxford: Oxford University Press, 2002).

4. “Small Business Profile,” Small Business Administration, 2014, p. 1, https://www.sba.gov/sites/default/files/files/UnitedStates13(1).pdf.

5. Karen Mills and Brayden McCarthy, “The State of Small Business Lending,” Harvard Business School Working Paper no. 15–004, July 22, 2014, p. 6, http://www.hbs.edu/faculty/Publication%20Files/15-004_09b1bf8b-eb2a-4e63-9c4e-0374f770856f.pdf.

6. Marshall Lux and Robert Greene, “The State and Fate of Community Banking,” Harvard Kennedy School Mossavar-Rahmani Center for Business and Government Working Paper Series no. 37, February 2015, p. 22, http://www.hks.harvard.edu/content/download/74695/1687293/version/1/file/Final_State_and_Fate_Lux_Greene.pdf.

7. Karen Mills and Brayden McCarthy, “The State of Small Business Lending,” p. 5.

8. Very small companies often fail to realize they are selling securities when, for example, the owner’s aunt puts in some money and in exchange becomes a part owner.

9. “Summary of Size Standards by Industry Sector,” Small Business Administration, https://www.sba.gov/content/summary-size-standards-industry-sector.

10. Small Business Act of 1953 § 632.

11. “IRS Faces Several Challenges as It Attempts to Better Serve Small Businesses,” Government Accountability Office, Tax Administration, August 2000, p. 3, www.gao.gov/archive/2000/gg00166.pdf.

12. This is the definition provided by the main trade association representing small businesses, the Small Business and Entrepreneurship Council. “Small Business Facts and Data,” Small Business and Entrepreneurship Council, 2015, http://www.sbecouncil.org/about-us/facts-and-data/.

13. Although some companies, particularly start-ups, may use credit cards to supplement capital, most small business owners use them as a cash management tool. Congressional Oversight Panel, Emergency Stabilization Act of 2008, “May Oversight Report: the Small Business Credit Crunch and the Impact of the TARP,” at p. 12 (2010) (Conf. Rep.).

14. National Small Business Association, “2014 Year End Economic Report,” February 19, 2015, p. 11, http://www.nsba.biz/wp-content/uploads/2015/02/Year-End-Economic-Report-2014.pdf.

15. “Availability of Credit to Small Businesses, September 2012,” Federal Reserve Board of Governors, http://www.federalreserve.gov/publications/other-reports/availability-of-credit/September-2012-Providers-of-Credit-to-Small-Businesses.htm.

16. National Small Business Association, “2014 Year End Economic Report,” February 19, 2015, p.11, http://www.nsba.biz/wp-content/uploads/2015/02/Year-End-Economic-Report-2014.pdf.

17. “What SBA Offers to Help Small Businesses,” Small Business Administration, https://www.sba.gov/content/what-sba-offers-help-small-businesses-grow.

18. The Small Business Administration, a federal agency, offers some programs to assist small businesses in securing loans. In general the programs operate through traditional lenders, providing a guarantee for qualifying small businesses. This allows the bank to issue a loan to a borrower with a higher risk profile without increasing the bank’s exposure.

19. National Federation of Independent Businesses, “The Small Business Lending Crisis,” Trends Magazine, September 2014, p.7.

20. The average SBA small business loan is approximately $371,000. Natale Goriel, “6 Step Guide—How to Get a Business Loan,” U.S. Small Business Association (blog), September 4, 2013, https://www.sba.gov/blogs/6‑step-guide-how-get-business-loan.

21. Marshall Lux and Robert Greene, “The State and Fate of Community Banking,” p. 11.

22. “Bank Failures in Brief,” FDIC, https://www.fdic.gov/bank/historical/bank/; David Wheelock? “Have Acquisitions of Failed Banks Increased the Concentration of U.S. Banking Markets,” Federal Reserve Bank of St. Louis Review 93 (2011): 155, https://research.stlouisfed.org/publications/review/11/05/155-168Wheelock.pdf.

23. Marshall Lux and Robert Greene, “The State and Fate of Community Banking,” p. 11.

24. Michael Kowalik et al., “Bank Consolidation and Merger Activity Following the Crisis,” Federal Reserve Bank of Kansas City Economic Review 100, no. 1 (2015): 7.

25. The final vote was 390 to 23 in the House and 73 to 26 in the Senate. Pete Kasperowicz, “House Approves JOBS Act in 390–23 Vote,” The Hill, March 8, 2015, http://thehill.com/blogs/floor-action/house/214979-house-passes-jobs-act-sends-to-senate; Seung Min Kim, “Senate Passes JOBS Act with Tweak,” Politico, March 22, 2015, http://www.politico.com/story/2012/03/senate-passes-jobs-bill-with-tweak-074363.

26. Jumpstart Our Business Startups Act (JOBS) Act §§ 77–78 (2012).

27. Michael Dambra, Laura Casares Field, and Matthew T. Gustafson, “The JOBS Act and IPO Volume: Evidence That Disclosure Costs Affect the IPO Decision,” Journal of Financial Economics 116, no. 1 (2015): 122.

28. “Rebuilding the IPO On-Ramp, Putting Emerging Companies and the Job Market Back on the Road to Growth,” Securities and Exchange Commission IPO Task Force, October 20, 2011, pp. 10–13, 19, https://www.sec.gov/info/smallbus/acsec/rebuilding_the_ipo_on-ramp.pdf.

29. Median offering expenses in the period 2007 through 2014 were $3,001,000. Of these, $1,463,500 were legal fees and $867,500 were accounting fees. WilmerHale, “2015 IPO Report,” p. 8, https://www.wilmerhale.com/uploadedFiles/Shared_Content/Editorial/Publications/Documents/2015-WilmerHale-IPO-Report.pdf.

30. Skadden Arps, “2014 Insights: a Collection of Commentaries on the Critical Legal Issues in the Year Ahead,” (2014), p. 8, http://www.skadden.com/sites/default/files/publications/Skadden_Insights_2014.pdf.

31. Tiffany Westfall and Thomas Omer, “The Unintended Consequences of Emerging Growth Company Status on IPO: Auditor Risk and Effort, Valuation, and Underpricing,” working paper, Social Science Research Network, April 14, 2015, p. 2 http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2512605.

32. From implementation of Title I of the JOBS Act in April 2012 through the end of 2014, 93 percent of life science companies, 94 percent of tech companies, and 88 percent of all other companies that filed as EGCs chose to utilize the confidentiality provision. WilmerHale,“2015 IPO report,” p. 9, https://www.wilmerhale.com/uploadedFiles/Shared_Content/Editorial/Publications/Documents/2015-WilmerHale-IPO-Report.pdf.

33. Jumpstart Our Business Startups Act (JOBS) Act §§77–78 (2012). A company may lose its EGC status sooner if it has $1 billion in annual gross revenues, it issues more than $1 billion in non-convertible debt in the previous three years, or is deemed to be a large accelerated filer as defined in 17 C.F.R. § 240.12b.

34. To the extent that EGCs find the cost of underpricing to outweigh the benefits of other features of the IPO on-ramp they may either opt not to file as EGCs and therefore use the IPO process as it existed pre–JOBS Act and that still must be used by non-EGCs, or opt to file as EGCs but provide selective additional information such as the market suggests is valuable (which is what seems to be happening in the case of increased financial statement disclosure beyond the required two years).

35. The year 2014, with 169 federal securities class actions, was among the lowest since the 1995 Private Securities Litigation Reform Act. PriceWaterhouseCoopers, “Coming into Focus, 2014 Securities Regulation Study,” April 2015, p. iii, https://www.pwc.com/us/en/forensic-services/publications/assets/2014-securities-litigation-study.pdf.

36. More than 99 percent of Regulation D offerings use Rule 506. Vladimir Ivanov and Scott Bauguess, “Capital Raising in the U.S.: An Analysis of Unregistered Offerings Using the Regulation D Exemption, 2009–2012,” Securities and Exchange Commission, July 2013, https://www.sec.gov/divisions/riskfin/whitepapers/dera-unregistered-offerings-reg-d.pdf.

37. “Proposed Rules: Crowdfunding,” Federal Register 78, no. 214 (November 5, 2013), p. 66509 (col. 2); David Burton, “Reducing the Burden on Small Public Companies Would Promote Innovation, Job Creation, and Economic Growth,” Heritage Backgrounder #2924, June 20, 2014, http://www.heritage.org/research/reports/2014/06/reducing-the-burden-on-small-public-companies-would-promote-innovation-job-creation-and-economic-growth#_ftn10.

38. The rationale behind exempting people with a certain level of wealth from the protections offered by a registered offering is two-fold: (1) people with a large amount of money can more easily absorb a loss; and (2) money buys advice and therefore wealthy people are more likely to have access to paid advisers who can substitute for mandated disclosure.

39. SEC v. Ralston Purina Co., 346 U.S. 119 (1953). The Securities Act states that its registration requirements do not apply to transactions “not involving any public offering.” In Ralston-Purina, the U.S. Supreme Court found that a transaction not involving a public offering was one in which the investors were able to fend for themselves. In the particular facts before the case, the Court found that rank-and-file employees of Ralston-Purina had no special ability as employees to obtain information about the company and therefore their purchase of company securities was a transaction involving a public offering.

40. 17 C.F.R. § 230.501(a). It is important to note the effect these thresholds have on geographic diversity of investors. Given the higher costs of living in cities such as New York and San Francisco, for example, and the attendant higher salaries at all levels, there will be more people in these locations who earn $200,000 annually than in lower cost of living areas. A company located in Nashville or Omaha may have a smaller pool of potential investors, even controlling for differences in population size, just because salaries tend to be lower in these areas.

41. 17 CFR § 230.506(b)(2)(ii).

42. 17 CFR § 230.502(b)(2).

43. In practice, these presumptions are flawed. A person can be very wealthy and yet have little understanding of finance or business. Another person may have a deep understanding of finance or of the issuer’s relevant industry and yet lack $1 million in assets.

44. Only 10 percent of reported Regulation D offerings in the period from 2009 to 2012 included non-accredited investors. Even if the accredited investors ultimately ask for the same disclosures the rule would require for non-accredited investors, the disclosures may be cheaper. This is because any legally mandated disclosure requires an extra level of review, typically by attorneys, to ensure strict compliance with the regulations. A voluntary disclosure, on the other hand, must be accurate but need not conform to any specific regulatory regime. Ivanov and Bauguess, “Capital Raising in the U.S.: An Analysis of Unregistered Offerings Using the Regulation D Exemption, 2009–2012.”

45. 17 C.F.R. § 230.502(c).

46. Ibid.

47. Ivanov and Bauguess, “Capital Raising in the U.S.: An Analysis of Unregistered Offerings Using the Regulation D Exemption, 2009–2012. It should be noted that the SEC uses data from Form D, which must be filed in conjunction with a Regulation D offering. Many issuers, and their counsel, follow the strictures of Regulation D to ensure that the offering is likely to be deemed non-public but do not file Form D, often out of a desire to keep the offering truly private (i.e., away from the SEC’s scrutiny). Therefore there are likely additional offerings not included in these calculations.

48. “Business Employment Dynamics,” Bureau of Labor Statistics, May 7, 2014, http://www.bls.gov/bdm/entrepreneurship/bdm_chart1.htm; National Venture Capital Association and Thomson Reuters, “2015 Yearbook,” March 2015, p. 58, http://nvca.org/research/stats-studies/.

49. An example of a business model unlikely to attract venture capital is a professional services company. The profit margin on one hour of billable time will always be the same, whether the company bills 10 hours or 10 million hours. In comparison, an app developer may invest several million in creating a product, but after the development costs have been recouped, the profit margin will increase substantially as more units are sold.

50. John Mecke, “How Much Equity do VCs Really Get?” DevelopmentCorporate (blog) February 1, 2010, http://www.developmentcorporate.com/2010/02/01/how-much-equity-do-vcs-really-get/.

51. National Venture Capital Association and Thomson Reuters, “2015 Yearbook,” p. 58.

52. Convertible debt reduces downside risk, does not immediately dilute the current shareholders, and offers considerable upside if the company does well.

53. Bureau of Labor Statistics, Business Employment Dynamics, “Entrepreneurship and the U.S. Economy,” http://www.bls.gov/bdm/entrepreneurship/bdm_chart1.htm; Jeffrey Sohl, “The Angel Investor Market in 2010: A Market on the Rebound,” Center for Venture Research, http://paulcollege.unh.edu/sites/paulcollege.unh.edu/files/2010_analysis_report_0.pdf.

54. Bureau of Labor Statistics, “Entrepreneurship and the U.S. Economy”; Sohl, “The Angel Investor Market in 2010.”

55. “More than 49 percent of the U.S.-based companies financed by venture capital firms are located in San Francisco, Boston, and New York, which suggests that venture capital plays a primary role in fostering entrepreneurial communities in their home regions.” Josh Lerner, “Geography, Venture Capital, and Public Policy,” policy brief, Harvard Kennedy School of Government policy brief, March 2010, p. 1, http://www.hks.harvard.edu/index.php/content/download/68616/1247274/version/1/file/final_lerner_vc.pdf.

56. Securities Act of 1933 § 4.

57. Ibid.

58. Securities Act of 1933 § 2(a)(11).

59. Lloyd S. Harmetz, “Frequently Asked Questions About Rule 144a,” Morrison & Foerster, 2009, p. 3, http://media.mofo.com/docs/pdf/faqrule144a.pdf.

60. 17 C.F.R § 230.144A(a).

61. Securities Act of 1933 § 2(a)(3).