The National Flood Insurance Program (NFIP) was established by the National Flood Insurance Act of 1968, with the intent of reducing the need for post-disaster federal aid by offering flood insurance and providing mitigation incentives to properties that have significant flood risks. The NFIP holds over five million flood insurance policies—roughly 5 percent of all households in the country—that amount to over $1.2 trillion in coverage. The program collects about $3.5 billion in premium revenue annually.1 It has grown over the past half century, even though no sound economic justification exists for government involvement in flood insurance.

The NFIP is currently about $25 billion in debt to the Treasury, because the premiums do not accurately reflect real risk for a sizable fraction of the program’s clientele.2 The inaccurate pricing of risk not only exacerbates short-term losses but also engenders potentially costly long-term risks by obscuring the true cost of building in flood-sensitive areas. Moreover, the NFIP is a fiscally regressive program, with its beneficiaries primarily being wealthy owners of high-value waterfront property in the Southeast.3

Moral hazard, regressive subsidies, and unnecessary debt, among other problems, have prompted lawmakers to consider reforming the NFIP on several occasions over the past 15 years, but without lasting success. However, the current iteration of the NFIP is set to expire before the end of 2017, and debates around its reauthorization will offer Congress a new opportunity to make important changes. The NFIP’s myriad flaws and costly failures should encourage lawmakers to bring forward measures that would allow a robust private market to flourish in place of government-provided insurance.

This policy analysis examines the NFIP’s history, structure, and current problems, as well as the failures of recent reform efforts. It also explores the recent growth of the private market for flood insurance and evaluates the conditions that have enabled that market to emerge. The evidence suggests that, by all salient criteria, a private market is superior to a government-run flood insurance program. Accordingly, this analysis concludes by outlining various steps that Congress could take to encourage the continued growth of a robust and competitive private insurance market.

A Short History of the National Flood Insurance Program

Flood insurance came under federal policymakers’ purview as part of a general trend during the mid-20th century of government increasingly serving as a backstop against large-scale public risks.4 A 1934 New Deal provision that offered low-interest federal loans to people affected by natural disasters, including floods, was the first federal policy offering financial compensation to flood victims. The Disaster Relief Act of 1950 created a formal system whereby states and localities could petition the federal government for disaster relief.5

Policymakers proposed the government provision of flood insurance throughout the 1950s and 1960s. President Harry S. Truman suggested that the federal government act as a reinsurer for private flood insurers to encourage more private flood policy writing. President Dwight D. Eisenhower signed into law the Federal Flood Insurance Act of 1956, which provided funds for a federal insurance and reinsurance (that is, insuring the insurers) program, but the government never completed the requisite feasibility studies, and no policies were ever underwritten.

Extensive flooding in the 1960s led Congress to direct the Department of Housing and Urban Development (HUD) to conduct a study on constructing and implementing a national flood insurance program.6 The study concluded that, if constructed correctly, a federal flood insurance program could help individuals living in floodplains bear the risk of floods while also encouraging future mitigation efforts, all while discouraging further building in the most flood-prone areas. Congressional drafters designed the NFIP largely according to the HUD report’s core recommendations.7

Some notable aspects of the current program were not part of that original version. For example, the original program did not require homeowners with government-backed mortgages to buy NFIP insurance if they lived in high-risk areas; Congress added that provision in the 1970s in an attempt to counteract low enrollment.8 And it was the Federal Emergency Management Agency (FEMA) that initiated the policy of grandfathering properties transferred from lower-risk to higher-risk areas during remapping, rather than charging such homeowners the market price for their insurance.9

Unfortunately, Congress did not sufficiently appreciate that the limited availability of private flood insurance indicated the steep underlying cost of living in a floodplain. The risk of flood damage served to limit people’s interest in living in or developing flood-prone areas, which Congress should have recognized as a good thing, not a “market failure” that government needed to address.

FEMA bases the prices for NFIP policies on a nationwide system of flood insurance rate maps that mark floodplains and help gauge flood risk. FEMA uses a categorical system to determine the amount of flood risk in a given area, which notes the type of body of water nearby, the elevation, the presence of levees or other mitigating structures, and various other factors material to determining risk.

NFIP insurance is available to property owners only if their local government decides to participate in the program, which entails its agreeing to the FEMA risk map and accepting floodplain management and a community-wide mitigation standard devised by the agency.10

FEMA encourages risk mitigation through its community rating system, which allows policyholders located in a community’s higher-risk areas to pay lower rates if that community implements mitigation efforts, such as enforcing strict building codes, enacting zoning rules that limit development in floodplains, and building or improving flood control structures such as dams and levees. FEMA rates communities on the basis of their flood mitigation efforts, and its ratings determine the cost of insurance, with the best communities receiving a nearly 50 percent discount.11

FEMA designates properties participating in the NFIP that have a 1 percent or greater risk of flooding in a given year as being in special flood hazard areas (SFHAs). Owners of such properties are required to purchase flood insurance if they have a mortgage issued or guaranteed by the government. Lawmakers introduced this mandate to counteract adverse selection problems and to reduce potential free riding on expected post hoc federal aid.

FEMA cannot deny coverage to anyone who purchases a policy for a property located within an SFHA.12 Owners and renters of property located within a community participating in the NFIP, but outside an SFHA, have the option of purchasing preferred risk policies (PRPs), which receive discounted rates relative to standard NFIP policies based on risk. In contrast to policies written for properties within an SFHA, FEMA can deny coverage to a PRP applicant if the property has a significant history of flood loss.

About 20 percent of all NFIP policies receive an explicit subsidy. By law, FEMA is required to subsidize policies for properties constructed or substantially renovated before 1975, or before the date FEMA published the first rate map for the community that the property is in.13 FEMA refers to this subsidy as the pre–flood insurance risk map, or pre-FIRM, subsidy. The logic behind offering this subsidy was that the owners of properties built before the mitigation incentives of the NFIP took root needed an extra incentive to participate in the program and deserved to be protected from falling property values resulting from the insurance mandate.

Congress expected these subsidies to be temporary, believing that old properties would gradually be replaced by buildings better designed to withstand flood risk. However, the subsidies have effectively discouraged the replacement of these properties, as well as any mitigation efforts. Premiums for pre-FIRM subsidized policies are just 35 to 40 percent of comparable nonsubsidized rates.14

FEMA also subsidizes policyholders of properties that are reclassified into a higher risk zone when FEMA issues new maps. An estimated 10–20 percent of all NFIP policies are grandfathered into a lower rate.15

Policies that do not receive an explicit subsidy are referred to as “full-risk policies.” Despite the name, their premiums are not high enough to allow for sufficient profits in years with below-average flood damage to compensate for years with flood damage that is well above average.16

The NFIP is plagued by myriad structural problems. Although some of these problems could theoretically be ameliorated by legislation, the reality is that they are endemic to any government insurance scheme. An objective examination of the NFIP’s problems and their causes shows the importance of a growing private flood insurance market as an alternative to government-run insurance.

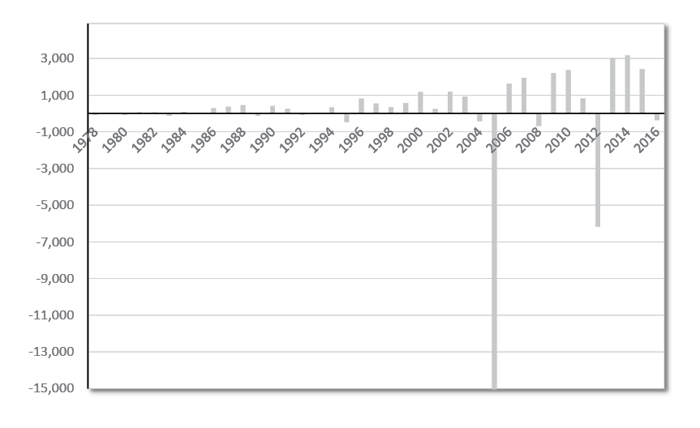

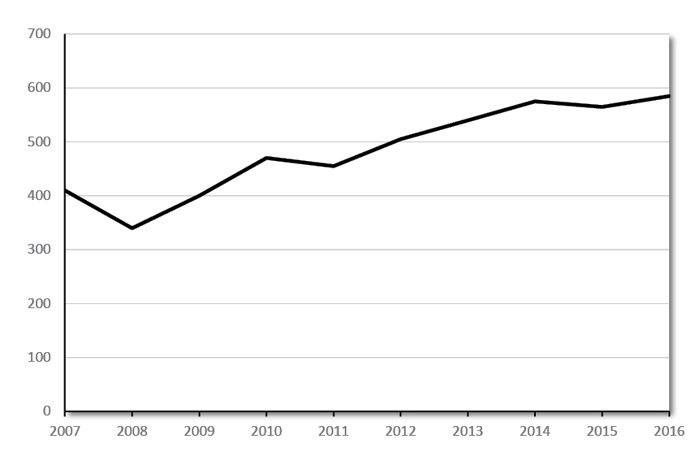

The NFIP is currently $25 billion in debt, which reflects the nonactuarial pricing of the full-risk policies as well as the effects of the pre-FIRM and grandfathering subsidies. The NFIP’s pricing of a full-risk premium does not include a catastrophe loading surcharge, a typical feature of private disaster insurance in which the insurer builds reserves in low-cost years to cover losses in high-cost years. As a result, the NFIP unavoidably accrues massive debt in especially bad years that it cannot repay.17 The NFIP’s current debt burden comes largely from two events—Hurricane Katrina in 2005 and Superstorm Sandy in 2012. The NFIP was nearly solvent before Katrina, but that storm left it with $18 billion of debt. The aftermath of Sandy accounts for most of the rest.18 Figure 1 summarizes the NFIP’s annual net income since 1978.

In 2011, the Property Casualty Insurers Association of America conducted a study on the difference between NFIP pricing and private flood insurance pricing. It concluded that NFIP coverage is offered at half the standard price of comparable private coverage, on average. Although subsidies account for some of the difference, the study still determined that private insurance would on average be priced about 25 percent higher than an NFIP plan in low-risk areas, where subsidies are minimal.19

The NFIP also differs from private insurance companies in that it cannot deny coverage to especially risky properties with histories of repeated extensive flood damage, so long as they are located in an SFHA. These especially risky properties—which FEMA refers to as repetitive loss properties and severe repetitive loss properties—are a significant source of the NFIP’s debt.20 A Government Accountability Office study found that from 1978 to 2004, repetitive and severe repetitive loss properties comprised only 1 percent of all NFIP insured properties, but accounted for 38 percent of all claims paid by the program.21

Figure 1

National Flood Insurance Program Annual Net Income, 1978–2017 (millions of dollars)

Source: “Loss Dollars Paid by Calendar Year,” Federal Emergency Management Agency, https://www.fema.gov/loss-dollarspaid-calendar-year; “Earned Premium, Total by Calendar Year,” Federal Emergency Management Agency, https://www.fema.gov/total-earned-premium-calendar-year.

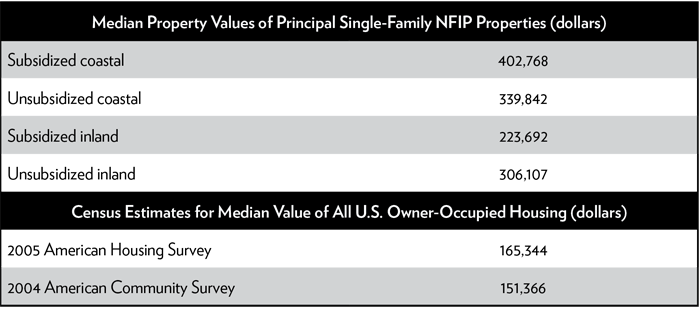

Wealthier households benefit disproportionately from the reduced average cost of flood insurance brought about by government intervention. Of course, not all NFIP-insured properties are high value, but insured homes are on average more valuable than noninsured homes. Conclusions about the program’s regressive effects are in line with the intuitive proposition that property near water, especially along the coast, is more valuable than property without a water view, on average.22

Table 1

Median Property Values, National Flood Insurance Program vs. All Owner-Occupied

Source: “Value of Properties in the National Flood Insurance Program,” U.S. Congressional Budget Office, June 2007, p. 6.

The increased attention paid to flood risk management policy in the aftermath of Hurricane Katrina provided an impetus for policy researchers to consider the distributional effects of the NFIP. In 2007, the Congressional Budget Office (CBO) published a report containing statistics on the average and median values of properties in the NFIP. The CBO divided properties into four categories: full-risk coastal properties, subsidized coastal properties, full-risk inland properties, and subsidized inland properties. The median value of properties in the NFIP exceeded the median value of an American home across all four categories, as shown in Table 1. Coastal properties with NFIP policies, both with and without explicit subsidies, had a median value roughly $200,000 higher than the median American home. Moreover, the CBO report emphasized that many subsidy recipients own properties with well above average values; 40 percent of coastal properties receiving subsidies were worth more than $500,000 and 12 percent were worth more than $1 million.23

In a recent Stanford Law Review article, Omri Ben-Shahar and Kyle Logue argue that the NFIP is regressive because any insurance scheme that cross-subsidizes on the basis of risk exposure will inescapably benefit those who are most exposed to risk—and, in the case of flooding, the disproportionately wealthy residents of coastal areas tend to face the most risk. Comparisons of NFIP premiums with potential private premiums show that NFIP policyholders with the most risk exposure tend to receive the largest subsidy, with 80 percent of explicit subsidy recipients living in counties in the top income quintile.24

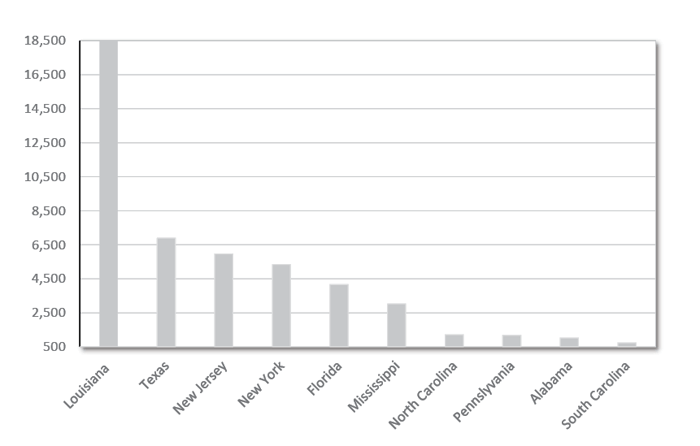

Since the premiums of policyholders do not fully support the NFIP, it necessarily entails distributing taxpayer money to coastal areas. A 2010 study published by the Institute for Policy Integrity, which is affiliated with the New York University School of Law, shows that about half of the residential properties covered by the NFIP are located in either Florida or Texas. That study also examined the coverage amount of claims paid per capita since 1978 by state and found that the Gulf Coast in general is disproportionately represented in each metric. As the authors conclude, “The largest benefit of the program—namely, access to below-market rate coverage—represents a significant shift in resources to the hurricane-vulnerable states along the Gulf and Atlantic coasts.”25 Figure 2 shows the 10 states that have received the most money since 1978.

Figure 2

States with the Most Payments Received, 1978–2015 (millions of dollars)

Source: “Claim Information by State, 1978–Present,” Federal Emergency Management Agency, https://bsa.nfipstat.fema.gov/reports/1040.htm.

The clearest evidence of the moral hazard caused by the NFIP is the slower-than-expected rate of demolition and renovation of subsidized pre-FIRM properties. One reason lawmakers enacted the pre-FIRM subsidies was that they expected the properties to be quickly replaced or subjected to mitigation efforts; the 1966 HUD study that motivated the creation of the NFIP predicted that most preexisting properties would be replaced within 25 years of the legislation’s enactment. Contrary to that expectation, the number of existing pre-FIRM flood-prone buildings has declined at a rate of about 1 percent a year since the NFIP was established. More than 3.5 million of those buildings were still in existence at the time of the most recent survey.26 The slow rate of demolition reflects the fact that the availability of subsidized insurance makes pre-FIRM properties more valuable.27

The moral hazard engendered by the NFIP also distorts decisions about new building. The NFIP requires participating communities to ensure that all new buildings since the adoption of the insurance program conform to minimum mitigation standards, which has reduced insurance payouts by a considerable sum. However, the underpricing of most flood insurance has still inflated property values and encouraged more building in dangerous areas. Because the NFIP has increased the value of many properties at risk of flood damage without forcing those costs to be fully internalized, it unwittingly increased the real and social costs of flood risk.28

In addition to nonactuarial pricing and explicit, non-need-based subsidies, the NFIP’s premium pricing is maddeningly imprecise. Full-risk rates are set using a formulaic approach that assumes that flood risks in a given risk zone are more or less consistent, and that historical claims data can serve as a good proxy for estimates of future risk. As a result, premium rates for individual policies are less accurate than they would be in an insurance system that used granular data and forward-looking probabilistic modeling.

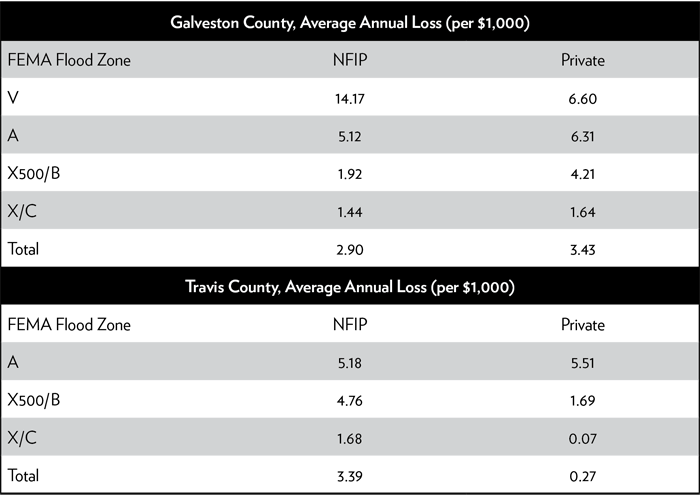

Table 2

NFIP Average Premium Loss vs. Private Market

Source: Erwann Michel-Kerjan, Jeffrey Czaijowski, and Howard Kunreuther, “Could Flood Insurance Be Privatised in the United States? A Primer,” Geneva Papers on Risk and Insurance 40, no. 2 (2014): 17, 18.

In 2014, researchers from the Wharton School’s Center for Risk Management and Decision Processes compared the NFIP’s premiums with those yielded by a private-sector model.29 The researchers—Erwann Michel-Kerjan, Jeffrey Czaijowski, and Howard Kunreuther—used comprehensive property-level data from Travis and Galveston Counties in Texas.30 They chose Texas because of the state’s significant exposure to both coastal and riverine flood risk.

To calculate standard private-sector premiums, the researchers used a catastrophe model for floods provided by international reinsurer Swiss Re and data provided by the firm CoreLogic.31 Premiums yielded by the catastrophe model differed from the premiums the NFIP charges for two reasons. First, the NFIP gauges risk using only historical data. Solely relying on historical data is a deterministic approach: it assumes that the past is indicative of the future. By contrast, the catastrophe model is stochastic: it accounts for the fact that flood occurrences are random and quantifies risk according to probability of occurrence. Second, the catastrophe model yields individualized results for each single property measured. The NFIP, by contrast, charges the same price per coverage amount for each property within a risk zone. The only factor mediating this generic pricing is the elevation of a property’s base floor.

The catastrophe model yields the average annual loss for properties examined by measuring the frequency and severity of flood risk and applying that risk measurement, as stochastically modeled, to the vulnerability (that is, the ability to withstand risk) of each property. Average annual loss represents a pure private insurance premium—the amount a private insurer would charge to cover its risks perfectly, without accounting for “loading.” Loading refers to any additional charge a private insurer might include in a premium beyond expected average annual loss—so as to make a profit, for example, or to pay administrative fees or build a reserve fund. The Wharton researchers compared the pure private premium with the NFIP rates. That allowed for an accurate comparison of price accuracy, as the NFIP does not include a loading charge in its premiums.

In both Galveston and Travis Counties, premiums determined by the catastrophe model displayed significantly more variance than the NFIP premiums. In Travis County, the distribution of NFIP premiums somewhat resembles a bell curve, as about 65 percent of premiums cost between $2.50 and $5.51 for a thousand dollars’ worth of coverage. By contrast, the distribution of premiums determined by the catastrophe model is much more even. If anything, the private premium distribution resembles an “inverted bell curve,” as over 35 percent of premiums are priced at less than $2.50, and about 30 percent of premiums are priced over $10. In Travis County, the NFIP undercharged on average in the riskiest zones while overcharging on average in low-risk zones. In Galveston County, the pattern reversed, with the NFIP overcharging the riskiest V zone but undercharging all others.32 The paper’s results are summarized in Table 2.

The researchers emphasized that premiums yielded by the catastrophe model displayed a greater variance than the premiums charged by the NFIP for each risk zone, regardless of whether the average catastrophe model premium exceeded or fell below the NFIP average premium for that zone. As they noted, “We find important elements of cross-subsidization within each of the risk categories where some high-risk properties are actually over-priced and some low-risk properties are underpriced.”33 In essence, the Wharton study shows that the NFIP premiums are less accurate than they could be, and that to an extent it is random whether a policyholder pays too much or too little. It is, of course, seriously problematic that NFIP premiums are much less accurate than today’s technology and insurance methodology allow.

The effects of Katrina and Sandy made the long-run unsustainability of the NFIP clear to policymakers and catalyzed discussions of significant reform. Those discussions led to Congress passing a large-scale reform in 2012, but most of the changes made did not last long, being largely repealed just two years later.

The 2012 Flood Insurance Reform Act, cosponsored by then Rep. Judy Biggert (R-IL) and Rep. Maxine Waters (D-CA), attempted to address the NFIP’s accrual of debt as well as the unintended effects of improperly priced premiums. The legislation enacted a series of premium increases that would end the pre-FIRM and grandfathering subsidies, established an initiative to improve risk mapping, mandated that premiums reflect catastrophic loss probabilities, and contained measures to encourage the development of a primary private market, including allowing residents of SFHAs to meet mandatory purchase requirements through buying private insurance.34

However, a political backlash ensued only one year after enactment, when a first round of premium increases was scheduled to take place. Affected policyholders expressed concerns to their political representatives, and politicians representing coastal areas portrayed the premium increases as disparately affecting working-class Americans with little budgetary flexibility. Industry groups with a stake in maintaining existing property values also applied political pressure.35 As a result, Congress passed the Homeowner Flood Insurance Affordability Act in 2014, which rolled back many of the Biggert-Waters reforms while subjecting others to a delayed implementation contingent on further studies.36

The Biggert-Waters backlash demonstrates the applicability of core public choice insights about public policy in modern democratic states to the NFIP. Public choice would say that policy often concentrates benefits on a small, vocal interest group while spreading corresponding costs across society as a whole. The combination of concentrated benefits and diffused costs makes rolling back policy much more difficult than enacting it, as the interest group receiving large benefits is likely to place much more pressure on political representatives than the general citizenry bearing the diffused costs.37

Essentially, reforming the NFIP so that it operates like an actuarially sound private insurance company entails imposing a large cost on those policyholders receiving highly subsidized insurance while granting only a limited benefit to society at large. A more direct and politically palatable approach to reducing the debt and moral hazard wrought by the NFIP would be to encourage the growth of the private insurance market.

In the 1977 article that led to their Nobel Prize in Economics, economists Finn Kydland and Edward Prescott explained that an optimal public policy discretionarily chosen by government officials can result in suboptimal long-term results. If policy is static, then economic agents can adjust their behavior in a way that undermines the longer-term goals of policy. Kydland and Prescott demonstrated their point through a formal (mathematical) model, but they also included a few hypothetical qualitative examples.

One of those hypotheticals was government flood policy. Kydland and Prescott described a discretionary government flood policy of restricting new building in a floodplain but also protecting preexisting structures. Such policy would be optimal in the short run, but rational agents would surmise that so long as the government is committed to protecting existing structures now, it will likely come to protect new structures constructed in the future. If the government did not adopt a specific, hard-to-breach rule prohibiting building or restricting the provision of aid in the future, optimal short-run flood policy would actually encourage more building and result in a suboptimal long-term result.38 And, the authors added, that ostensibly hard-to-breach rule would be almost impossible for a government to stick to.

Kydland and Prescott’s hypothetical accurately describes the course of U.S. flood insurance policy. The NFIP has had some success in reducing post hoc federal aid and encouraging the adoption of mitigation technology. But by making the NFIP available to all property owners in flood-prone communities, the government unwittingly encouraged the continued overdevelopment of at-risk areas.39

To counteract forward-looking economic agents undermining discretionary government policy, Kydland and Prescott recommended dynamic policy rules that incorporated a fixed feedback mechanism, thus institutionalizing a response to changing future conditions. In the case of flood policy, that sort of dynamism can best be accomplished by private insurance. Private insurers engage in many of the same tasks as government regulators of safety. They measure the probability of harm and gauge the effectiveness of mitigation measures and behavior. They also impose private insurance premiums that function like a Pigouvian tax—that is, a charge that internalizes a negative externality.40 The profit motive of private insurers serves as a dynamic feedback rule, encouraging continued socially optimal risk management.

The ideal “reform” to the NFIP would be to fully privatize flood insurance. That would be more likely to fix the system in a way that would limit the long-run government liability than any alternative legislative approach. Today, financial innovation and risk modeling technology improvements make broad-scale private insurance more feasible than when the NFIP was adopted. Moreover, concerns about affordability can be addressed more accurately and fairly through a means-tested subsidization program than under the current system.

Before discussing the practical benefits and feasibility of private insurance, it is worth emphasizing that government should not have become involved in the flood insurance market to begin with.

The federal government’s rationale for providing flood insurance stemmed from a belief that limited private-market flood insurance constituted a market failure, as well as from faith in government’s own ability to centrally plan an optimal mix of development and conservation in flood-prone areas. In a 1966 executive order, President Lyndon B. Johnson expressed confidence that a centralized flood management system could “preclude the uneconomic, hazardous, or unnecessary use of flood plains,” while also “reducing future Federal expenditure for flood protection.”41

The HUD report that provided a blueprint for the NFIP contained similar thinking. It also expressed the idea that near-universal access to flood insurance for floodplain residents was socially beneficial. The report went on to suggest that it was “unlikely, based on past experience” that a fully private market could provide such access. Government-run insurance would, the report continued, “limit future flood damages without hampering future economic development.” If designed correctly, such insurance would “prompt an adjustment in land use to reduce individual and public losses from floods.”42

Unfortunately, the government’s thinking in the late 1960s turned out to be misguided. Limited private flood insurance did not constitute a market failure, and the government’s flood management goals would have been easier to meet if market forces had continued to hold sway. Exposure to flood risk depends on one’s choice of where to live, which means there is no “market failure” argument to justify intervention. In economics, market failure refers to instances where a condition inherent in the structure of a market for a given good or service results in an inefficient outcome. Some economists argue that government regulation can competently address the problems brought about by a market failure. Types of market failure include information asymmetry, adverse selection, and public goods.

Nothing, however, is inefficient about insurance being prohibitively expensive in a risky area, especially when viable alternate locations to live or operate a business exist. If anything, the limited availability or expense of insurance before the enactment of the NFIP was a sign of a properly functioning market, which accurately reflected the costs of living in a flood-prone area at that time. The government’s decision to intervene should be understood as a social, rather than economic, policy choice. And by any reasonable social perspective, intervention was a poor choice, as the NFIP has imposed costs on society at large while disproportionately benefiting wealthier Americans.

Moreover, the federal government does not offer insurance for other natural disaster risks such as wind or earthquake. The disparity between the government’s treatment of tornado risk and its treatment of flood risk is especially telling. Tornadoes are, of course, a natural disaster, and the private market for wind insurance faces similar pitfalls as those for flood: the riskiest properties are uninsurable, individuals facing risks may expect post hoc federal aid or otherwise choose not to buy insurance, and less wealthy people living in risky areas may not be able to afford market-based premiums. In fact, some analysts have confessed their surprise that the government offers flood but not wind insurance, given that areas with tornado risk tend to be in less desirable regions with less wealthy residents than areas with flood risk. What’s more, tornadoes are a more random occurrence.43

Modern financial and geographic modeling technology means that private insurers can profitably offer insurance against most flood risk today. That doesn’t mean, however, that the private insurance market was deficient in 1968. Just as we would reasonably consider the development of new homebuilding technology as altering the calculus about building in flood-prone areas, so we should also consider the development of insurance technologies as altering the real price of risk.

Private-sector involvement in the flood insurance market increased significantly after Biggert-Waters allowed property owners to meet mandatory insurance requirements with private plans. Along with increasing premiums on subsidized policies, the law encouraged insurance firms to investigate the competitiveness of private alternatives. Results of catastrophic modeling suggest that such alternatives would be competitive.44

Syndicates of high-profile international insurance companies—including Lloyd’s of London, AIG, Chubb, Allianz, and Berkshire Hathaway—began offering primary insurance in competition with FEMA soon after the law passed.45

The results have been encouraging: private insurers have taken not only the least risky properties in the NFIP, as some suggested might happen, but also the riskier coastal properties as well. In some instances, private insurers have even been able to compete with the NFIP on properties eligible for subsidized rates.

Only a small number of primary NFIP policyholders have switched to private insurance so far, but leaders of the insurance and reinsurance firms involved in the market have expressed confidence that they can take on most NFIP policies. A 2014 Wall Street Journal article quoted Edward Noonan, CEO of international reinsurer Validus Group, on the capacity for privatization: “The flood-insurance program [NFIP] shouldn’t exist. . . . The private sector can provide all the capacity required. . . . There’s just nothing unique about flood that requires a government program today.”

A 2016 report by Aon Benfield, a leading global provider of consulting and advisory services to reinsurance firms, dedicated a section to private-sector opportunities in flood insurance, which was aptly titled “Flood Remains a Major Global Growth Opportunity.” Discussing opportunities specifically from U.S. risk held by the government, the report went on to state:

The reinsurance market is showing that there is confidence in the analytics to price these risks and to reinsure portfolios of flood risk. This is primarily based on the flood models that are becoming readily available and the confidence in the science underlying these models. There is now an opportunity for insurers to evaluate the flood risk and look to provide coverage for these properties. . . . This is an exciting time in the flood risk analysis space and the opportunity for insurers is substantial.46

In January 2017, the NFIP made its first significant purchase of private-market reinsurance, for over $1 billion in coverage (which the 2012 Biggert-Waters Act authorized). The interest of global reinsurers in American flood risk will persist if a competitive private market is allowed to develop.47

Recent congressional testimony by Evan Hecht, CEO of Lloyd’s of London subsidiary The Flood Insurance Agency (TFIA), drove home the promise and potential benefits of large-scale private flood insurance. Hecht noted that a majority of the policies TFIA has underwritten so far qualified for the NFIP’s pre-FIRM subsidies, and that the properties in FEMA’s riskiest zones tend to be easier to insure privately than those with “preferred risk” policies. Hecht also claimed (without providing evidence) that private insurers offer a better customer service experience than the NFIP, a contention that’s perfectly consistent with people’s experience in other places where the government has competed against private companies.48

The 2014 Wharton School research outlined earlier demonstrated that private insurance firms have the technical capacity to price insurance more accurately than the NFIP. A proliferation of private insurance offerings could thus lead to savings for those NFIP homeowners who are currently paying overpriced premiums because of overly broad risk aggregation. The Wharton researchers noted several factors that could discourage private insurers from entering the flood insurance market: possible risk correlation; difficulty in distinguishing flood damage from wind damage, which requires different risk calculations; various regulatory constraints; and logistical difficulties inherent in transitioning from the NFIP to a private market. Nevertheless, those same researchers concluded that the entry of private firms into the market suggested that free enterprise “seemed to have solved some of these issues.”49 A 2014 report from Deloitte emphasized that flood insurance is the largest area for property and casualty insurance growth in the United States, with billions in potential annual premiums, and it stressed that private insurers will be interested in the market so long as the market is profitable and government policy does not hinder fair competition.50

That said, given that NFIP insurance is underpriced in aggregate, it is unreasonable to assume that private insurers could offer cheaper premiums for the majority of NFIP policies without a change to the NFIP’s premium structure. Other advantages that private insurers wield relative to the NFIP may allow those insurers to compete even in instances when they cannot win on price, however. First, NFIP coverage is limited in important respects. Residential policyholders can insure only up to $250,000 worth of building contents property, and most personal basement property is not covered under NFIP plans.51 Some policyholders will likely prefer to purchase a comprehensive plan and not worry about gaps in NFIP coverage.

Moreover, many policyholders would likely prefer to have all property and casualty risk covered under the same policy. All-hazards insurance is common in the United Kingdom, and experts note that insurers would benefit from supplying such policies in the United States.52 All-hazards insurance would solve issues related to discerning whether wind or flood caused a given set of damages. Such issues have led to disputes and litigation between policyholders, the NFIP’s Write Your Own contractors, and private property and casualty insurers.53 It is reasonable to expect that some consumers would prefer to pay a slightly higher premium in exchange for the certainty and convenience stemming from having an all-hazards policy.

The surest way to promote the growth of private flood insurance short of completely ending the NFIP would be to couple broad-based premium reform with an active effort to transfer policies to private insurance. The state-run Florida Citizens Property Insurance Corporation, which provides subsidized wind insurance to properties with hurricane risk, transferred about two-thirds of its policies to private insurers from 2012 to 2016 after undertaking these steps.54 However, the inaccuracy of the NFIP’s current pricing system, coupled with the nonprice advantages of private insurance, demonstrates that consumer demand will be strong for private flood insurance even if the NFIP’s distortive premium structure remains intact.

The recent success of private flood insurance has been encouraging and gives hope that future gains might be attainable as well. However, the continued success of private flood insurance depends largely on further gains in financial innovation, and that is problematic, at least from a political perspective.

The accepted narrative of the financial crisis of 2008–9 was that the complexity of advanced financial products contributed to the depth of the crisis; as a result, regulators of late have cast a wary eye on new innovations in financial markets.55 However, taking such a strict approach to financial innovation is both shortsighted and unfair: it overlooks the very real gains advanced financial instruments have brought to the economy by deepening capital markets and allowing risk to be more widely distributed and hedged against.

Floods are a challenge for private insurers because of covariant risk (flood damage hits many properties at the same time), and they also have the potential for high-severity losses. A year in which a substantial number of policyholders in a given risk pool all file maximum claims can bankrupt a flood insurer that’s not sufficiently hedged and diversified. For example, Hurricane Andrew bankrupted nine property and casualty insurers with wind or secondary flood exposure.56 In addition to the difficulty in accurately gauging flood risk, scholars have pointed to covariance and the possibility of deep losses as historically limiting the availability of private flood insurance—and thereby providing a rationale for a government-managed program.57

However, today’s advanced, global capital markets have superseded any barriers to private flood insurance stemming from covariant risk. The experience of Hurricane Andrew motivated academics—and then insurance companies—to investigate the possibility of reinsuring through global securities markets. Advanced risk modeling allowed insurance companies to price and issue catastrophe (CAT) bonds, which are a securitized, tradable financial instrument that entitles the owner to interest payments while stipulating that owners must forfeit their principal if losses from a given catastrophe exceed a predetermined value.58 In the past decade, insurers worldwide have issued CAT bonds as reinsurance against catastrophic risks such as terrorism, war, and natural disasters. An active global trading market in CAT bonds developed over the past 15 years; hedge funds are especially attracted to CAT bonds because risks are mostly uncorrelated with traditional financial assets.59

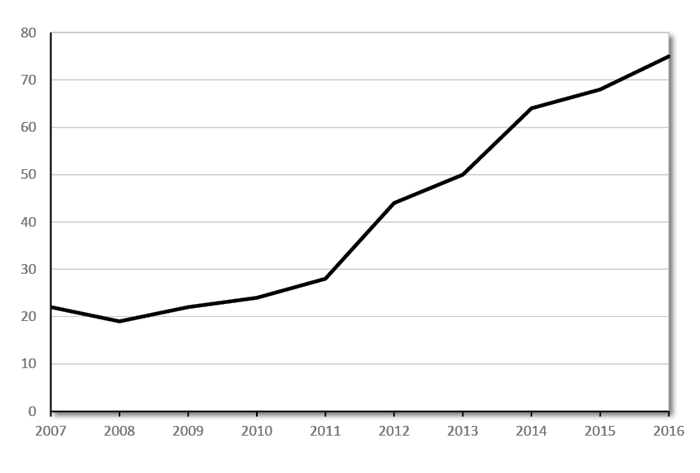

Figure 3

Global Reinsurance Capital, 2007–2016 (billions of dollars)

Source: “Reinsurance Market Outlook,” Aon Benfield, January 2017, p. 2, http://thoughtleadership.aonbenfield.com/Documents/20170105-ab-analytics-rmo.pdf.

The CAT bonds that those insurers issue usually offer protection for multiple severe, catastrophic risks, including winter storms, wildfires, earthquakes, and so on, in addition to floods.60 CAT bonds would play an integral role if private firms were to become the main flood insurers in the United States. Their development is a triumph of private-sector innovation and evidence that, in the words of Wharton’s David Cummins, “government involvement in the market for natural catastrophe insurance should be minimized to avoid crowding-out more efficient private market solutions.”61

Figure 4

Alternative Market Reinsurance Capital, 2007–2016 (billions of dollars)

Source: “Insurance-Linked Securities,” Aon Benfield, September 2016, p. 15, http://thoughtleadership.aonbenfield.com/Documents/20160907-securities-ils-annual-report.pdf.

Catastrophe bonds, along with other forms of insurance-linked securities (ILS), have increased the capacity for primary insurers to hedge flood risk through the reinsurance market. As Figures 3 and 4 show, ILS have contributed significantly to a rapid expansion in the total amount of global capital dedicated to reinsurance.62 Consulting firm Aon Benfield recently predicted that total ILS capital will continue to grow rapidly, to between $120 billion and $150 billion by 2018. CAT bonds and other ILS are especially advantageous (compared with traditional equity capital) for insuring against low-probability, high-damage events.63 Moreover, the securities markets allow for reinsurers to access new capital much more quickly if a shock drains existing levels. Underwriting cycles have dampened since Hurricane Andrew, the last global shock to occur before the development of CAT bonds and other ILS.64

A common objection to any reform of the NFIP is that attempts to fix debt and moral hazard issues will punish working-class Americans who cannot afford higher insurance premiums. During the 2014 floor debate over the Homeowner Flood Insurance Affordability Act, the legislation that rolled back the 2012 premium increases under Biggert-Waters, Rep. Bill Cassidy (R-LA) expressed that objection thus: “Now, is this a bailout for rich people? The people in Louisiana who will benefit . . . are working people.” Sen. Robert Menendez (D-NJ) likewise spoke of “families who could lose their homes due to crushing flood insurance premiums.”65

Although it may be true that some lower-income people benefit from the NFIP, the program, as a whole, is highly regressive. It is worth emphasizing that private insurance, coupled with a means-tested subsidy, would be less regressive than what currently exists under the NFIP. The NFIP’s financial weakness reflects the randomness of the premium structure and is not evidence of any system-wide subsidy for the working class.

Although private insurance might result in higher premium payments on average as a consequence of the need to include a “catastrophe loading” charge, premiums will more closely reflect real risk. Kunreuther’s study comparing private insurance with NFIP rates in Texas suggests that some policyholders would, in fact, pay lower rates with private insurers, despite the catastrophe loading charge. In other words, both rich and poor homeowners could receive rate cuts.

Moreover, although subsidized insurance premiums might ease financial burdens for those receiving subsidies, they also exacerbate the collective exposure to risk, which leads to greater damages and a higher cost to taxpayers. If the government is to subsidize the provision of flood insurance, it should be done in a way that maximizes benefits to the truly needy while minimizing costs to society. The NFIP’s rate structure is far from meeting that ideal. Transitioning to a private insurance system with carefully implemented, means-tested subsidies would allow for a more efficient and fairer flood insurance system.66

Congress’s decision to create the NFIP in 1968 was not economically or socially justified. This year’s reauthorization deadline should prompt a reconsideration of the program and discussions of reform. The most important initial steps that policymakers can take in reforming the NFIP are those that improve the viability of private insurers and allow them to compete with the NFIP on a level playing field.

Congress took a major step in 2012 toward normalizing private flood insurance by requiring that federally backed lenders accept private insurance, but legal impediments to private flood insurance penetration remain. Congress can and should address those impediments in conjunction with the September 2017 reauthorization deadline. First, restrictions on coverage terms—as well as criteria that private insurance plans must meet to qualify for the mandatory purchase requirement—should be eased. Currently, private insurance must contain all coverage requirements present in NFIP plans to meet the mandatory purchase requirement. However, that approach overlooks the NFIP’s one-size-fits-all approach to policy writing; the greater flexibility of private insurers to tailor coverage to specific characteristics of the properties they insure is a feature, not a bug.

Second, statutes governing the NFIP prevent private firms that sell and manage policies through the Write Your Own program from selling competing insurance. Congress should eliminate that noncompete clause. Ideally, in a fully privatized system, private insurers would not have to compete with the government at all. In the transition stage, it is reasonable to expect a robust private market developing parallel to the NFIP (as is the case in, say, the mortgage market). It is therefore imperative that all potential private insurers be given the opportunity to offer insurance—the goal being to create a deeper and more competitive market.

Third, FEMA should release all historical property-level data related to flood risk to private insurers and modeling companies. Such data are necessary for private insurers to develop the most accurate and precise risk models and to price insurance plans accordingly. As private insurers have a greater incentive and capacity to use historical and scientific data to determine the most accurate and fair premiums, no good reason exists to deny data sharing. Adequate steps can be taken to ensure that any sensitive information on specific individuals is not revealed.

Fourth, Congress should clarify rules on whether mortgage lenders are required to accept surplus lines insurance—that is, insurance purchased from a firm that is not licensed in the policyholder’s state of residence. Usually, surplus lines insurance is purchased when consumers cannot find an insurer licensed in their home state.

Surplus lines insurance is a significant component of the private flood market. In 2014, the surplus lines market accounted for $126.6 million in premiums from six states that collect data. By comparison, the NFIP collected about $3.5 billion in premiums in 2014.67 As of now, proposed rulemaking designed to clarify the requirement that lenders accept private insurance—issued jointly by the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, the Federal Reserve, the Farm Credit Administration, and the National Credit Union Administration—would exclude surplus lines insurance policies that offer narrower coverage than an NFIP policy.68 Congress should explicitly clarify that lenders must accept a surplus lines policy so long as the provider is approved by any state-level regulator.69

These measures and any others that encourage a more robust, deep, and penetrating private flood insurance market should be Congress’s priority during the upcoming reauthorization debate. Congress should lay the groundwork for the gradual privatization of the NFIP, as a private system offers the best way of addressing the problems of moral hazard, excessive debt, regressive subsidies, and imprecision that plague our flood insurance system today.

RECENT STUDIES IN THE

CATO INSTITUTE POLICY ANALYSIS SERIES

816: Withdrawing From Overseas BasesWhy a Forward-Deployed Military Posture Is Unnecessary, Outdated, and Dangerous by John Glaser (July 18, 2017)

815. Cybersecurity or Protectionism? Defusing the Most Volatile Issue in the U.S.–China Relationship by Daniel Ikenson (July 13, 2017)

814. Step Back: Lessons for U.S. Foreign Policy from the Failed War on Terror by A. Trevor Thrall and Erik Goepner (June 26, 2017)

813. Commercial Speech and the Values of Free Expression by Martin H. Redish (June 19, 2017)

812. Would More Government Infrastructure Spending Boost the U.S. Economy? by Ryan Bourne (June 6, 2017)

811. Four Decades and Counting: The Continued Failure of the War on Drugs by Christopher J. Coyne and Abigail R. Hall (April 12, 2017)

810. Not Just Treading Water: In Higher Education, Tuition Often Does More than Replace Lost Appropriations by Neal McCluskey (February 15, 2017).

809. Stingray: A New Frontier in Police Surveillance by Adam Bates (January 25, 2017).

808. Curse or Blessing? How Institutions Determine Success in Resource-Rich Economies by Peter Kaznacheev (January 11, 2017)

807. Surveillance Takes Wing: Privacy in the Age of Police Drones by Matthew Feeney (December 13, 2016)

806. Will China Solve the North Korea Problem? The United States Should Develop a Diplomatic Strategy to Persuade Beijing to Help by Doug Bandow (December 6, 2016)

805. Apprenticeships: Useful Alternative, Tough to Implement by Gail Heriot (November 17, 2016)

804. The Repeal of the Glass-Steagall Act: Myth and Reality by Oonagh McDonald (November 16, 2016)

803. Twenty-Five Years of Indian Economic Reform by Swaminathan S. Anklesaria Aiyar (October 26, 2016)

802. The New Feudalism: Why States Must Repeal Growth-Management Laws by Randal O'Toole (October 18, 2016)

801. The Case Against a U.S. Carbon Tax by Robert P. Murphy, Patrick J. Michaels, and Paul C. Knappenberger (October 17, 2016)

800. A Costly Commitment: Options for the Future of the U.S.-Taiwan Defense Relationship by Eric Gomez (September 28, 2016)

799. Dose of Reality: The Effect of State Marijuana Legalizations by Angela Dills, Sietse Goffard, and Jeffrey Miron (September 16, 2016)

798. Terrorism and Immigration: A Risk Analysis by Alex Nowrasteh (September 13, 2016)

797. Five Myths about Economic Inequality in America by Michael Tanner (September 7, 2016)

796. Freedom of Speech under Assault on Campus by Daniel Jacobson (August 30, 2016)

795. 25 Years of Reforms in Ex-Communist Countries Fast and Extensive Reforms Led to Higher Growth and More Political Freedom by Oleh Havrylysyn, Xiaofan Meng, and Marian L. Tupy (July 12, 2016)

794. Options for Federal Privatization and Reform Lessons from Abroad by Chris Edwards (June 28, 2016)

793. New York's Bank: The National Monetary Commission and the Founding of the Fed by George Selgin (June 21, 2016)

792. The Problem with the Light Footprint: Shifting Tactics in Lieu of Strategy by Brad Stapleton (June 7, 2016)

791. Hate Speech Laws: Ratifying the Assassin's Veto by Robert Corn-Revere (May 24, 2016)

790. A Walk Through the JOBS Act of 2012: Deregulation in the Wake of Financial Crisis by Thaya Brook Knight (May 3, 2016)

789. Menu Mandates and Obesity: A Futile Effort by Aaron Yelowitz (April 13, 2016)

788. Japan's Security Evolution by Jennifer Lind (February 25, 2016)

787. Reign of Terroir: How to Resist Europe's Efforts to Control Common Food Names as Geographical Indications by K. William Watson (February 16, 2016)

786. Technologies Converge and Power Diffuses: The Evolution of Small, Smart, and Cheap Weapons by T. X. Hammes (January 27, 2016)

785. Taking Credit for Education: How to Fund Education Savings Accounts through Tax Credits by Jason Bedrick, Jonathan Butcher, and Clint Bolick (January 20, 2016)

784. The Costs and Consequences of Gun Control by David B. Kopel (December 1, 2015)

783. Requiem for QE by Daniel L. Thornton (November 17, 2015)

782. Watching the Watchmen: Best Practices for Police Body Cameras by Matthew Feeney (October 27, 2015)

781. In Defense of Derivatives: From Beer to the Financial Crisis by Bruce Tuckman (September 29, 2015)

780. Patent Rights and Imported Goods by Daniel R. Pearson (September 15, 2015)

779. The Work versus Welfare Trade-off: Europe by Michael Tanner and Charles Hughes (August 24, 2015)

778. Islam and the Spread of Individual Freedoms: The Case of Morocco by Ahmed Benchemsi (August 20, 2015)

777. Why the Federal Government Fails by Chris Edwards (July 27, 2015)

776. Capitalism's Assault on the Indian Caste System: How Economic Liberalization Spawned Low-caste Dalit Millionaires by Swaminathan S. Anklesaria Aiyar (July 21, 2015)

775. Checking E-Verify: The Costs and Consequences of a National Worker Screening Mandate by Alex Nowrasteh and Jim Harper (July 7, 2015)

774. Designer Drugs: A New, Futile Front in the War on Illegal Drugs by Ted Galen Carpenter (May 27, 2015)

773. The Pros and Cons of a Guaranteed National Income by Michael Tanner (May 12, 2015)

772. Rails and Reauthorization: The Inequity of Federal Transit Funding by Randal O'Toole and Michelangelo Landgrave (April 21, 2015)

771. Beyond Regulation: A Cooperative Approach to High-Frequency Trading and Financial Market Monitoring by Holly A. Bell (April 8, 2015)

770. Friends Like These: Why Petrostates Make Bad Allies by Emma M. Ashford (March 31, 2015)

769. Expanding Trade in Medical Care through Telemedicine by Simon Lester (March 24, 2015)

768. Toward Free Trade in Sugar by Daniel R. Pearson (February 11, 2015)

767. Is Ridesharing Safe? by Matthew Feeney (January 27, 2015)

766. The Illusion of Chaos: Why Ungoverned Spaces Aren't Ungoverned, and Why That Matters by Jennifer Keister (December 9, 2014)

765. An Innovative Approach to Land Registration in the Developing World: Using Technology to Bypass the Bureaucracy by Peter F. Schaefer and Clayton Schaefer (December 3, 2014)

764. The Federal Emergency Management Agency: Floods, Failures, and Federalism by Chris Edwards (November 18, 2014)

801. The Case Against a U.S. Carbon Tax by Robert P. Murphy, Patrick J. Michaels, and Paul C. Knappenberger (October 17, 2016)

800. A Costly Commitment: Options for the Future of the U.S.-Taiwan Defense Relationship by Eric Gomez (September 28, 2016)

799. Dose of Reality: The Effect of State Marijuana Legalizations by Angela Dills, Sietse Goffard, and Jeffrey Miron (September 16, 2016)

798. Terrorism and Immigration: A Risk Analysis by Alex Nowrasteh (September 13, 2016)

797. Five Myths about Economic Inequality in America by Michael Tanner (September 7, 2016)

796. Freedom of Speech under Assault on Campus by Daniel Jacobson (August 30, 2016)

795. 25 Years of Reforms in Ex-Communist Countries Fast and Extensive Reforms Led to Higher Growth and More Political Freedom by Oleh Havrylysyn, Xiaofan Meng, and Marian L. Tupy (July 12, 2016)

794. Options for Federal Privatization and Reform Lessons from Abroad by Chris Edwards (June 28, 2016)

793. New York's Bank: The National Monetary Commission and the Founding of the Fed by George Selgin (June 21, 2016)

792. The Problem with the Light Footprint: Shifting Tactics in Lieu of Strategy by Brad Stapleton (June 7, 2016)

791. Hate Speech Laws: Ratifying the Assassin's Veto by Robert Corn-Revere (May 24, 2016)

790. A Walk Through the JOBS Act of 2012: Deregulation in the Wake of Financial Crisis by Thaya Brook Knight (May 3, 2016)