The American economy is sluggish, the government is running large deficits, and the public is frustrated with the poor performance of federal bureaucracies. One reform that can tackle all of these problems is privatizing federal businesses and assets. This study discusses a dozen advantages of privatization and describes government activities that should be moved to the private sector.

A privatization revolution has swept the world since the 1980s. Following the United Kingdom’s lead, governments in more than 100 countries have transferred thousands of state-owned businesses to the private sector. Railroads, airports, energy companies, postal services, and other businesses valued at more than $3 trillion have been privatized. Governments of both the political right and left have unloaded state-owned businesses.

Despite the global success of privatization, reforms have largely bypassed our own federal government. Indeed, many activities that have been transferred to the private sector abroad remain in government hands in this country. That creates an opportunity for U.S. policymakers to learn from foreign privatization and enact proven reforms here.

This study describes why the federal government should privatize the U.S. Postal Service, Amtrak, the Tennessee Valley Authority, the air traffic control system, lands, buildings, and other businesses and assets. Such reforms would increase efficiency, spur innovation, create greater transparency, and improve the environment.

Privatization would allow entrepreneurs to take on challenges at which federal bureaucracies are failing. The United States is a land of huge talent and diversity. But to take full advantage of those assets, we should divest the government of activities that individuals and businesses can perform better by themselves.

Introduction

A privatization revolution has swept the world since the 1980s. Governments in more than 100 countries have moved thousands of state-owned businesses and other assets to the private sector. Airports, airlines, railroads, energy companies, postal services, and other businesses valued at about $3.3 trillion have been privatized over the past three decades.1

Privatization has improved government finances by raising revenues and reducing spending. More important, it has spurred economic growth and improved services because privatized businesses have cut costs, increased quality, and pursued innovation.

In a 1969 essay, management expert Peter Drucker said that politicians in the 20th-century had been "hypnotized by government . . . in love with it and saw no limits to its abilities."2 But he said that the love affair was coming to an end as the mismanagement of state-owned businesses was becoming more apparent everywhere. In his essay, Drucker called for a "reprivatization" of government activities, but he was a bit ahead of his time.

The privatization revolution was launched by Margaret Thatcher's government in the United Kingdom, which came to power in 1979. Prime Minister Thatcher popularized the word privatization, and her successful reforms were copied around the globe.3 She was determined to revive the stagnant British economy, and her government privatized dozens of major businesses, including British Airways, British Telecom, British Steel, and British Gas. Other nations followed the British lead because of a "disillusionment with the generally poor performance of state-owned enterprises and the desire to improve efficiency of bloated and often failing companies," noted a report on privatization by the Organisation for Economic Co-operation and Development (OECD).4

Privatization swept through other developed countries in the 1980s and 1990s, with major reforms in Australia, Canada, France, Italy, New Zealand, Portugal, Spain, Sweden, and other nations. A Labour government elected in New Zealand in 1984 privatized dozens of state-owned companies, including airports, banks, energy companies, forests, and the national airline and telecommunications companies. Australia privatized dozens of companies between the mid-1990s and mid-2000s, generating proceeds of more than $100 billion.5

During the 1980s and 1990s, Canada privatized more than 50 major businesses, including electric utilities, a railway, an airline, and the air traffic control system. France sold 22 major companies in 1986 and 1987 under the conservative Chirac government.6 In the 1990s and 2000s, both conservative and socialist governments continued to privatize. The number of companies in which the French government holds a majority stake plunged from 3,000 in the early 1990s to about 1,500 mainly smaller companies today.7

Privatization swept through many developing nations. In Latin America, Chile, Mexico, and Panama had particularly large and successful privatization programs. Mexico, for example, slashed the number of state-owned firms from 1,155 in the early 1980s to just 210 by the early 2000s.8 In Eastern Europe, huge privatizations were pursued after the fall of communism, and the government share of total economic output in that region fell from about three-quarters in 1990 to about one-quarter today.9

Privatization has gained support from both the political right and left. Left-of-center governments in Australia, the United Kingdom, France, Canada, and New Zealand all pursued privatization.10 Privatization has attracted opposition from the public in many countries, but very rarely have reforms been reversed once put in place. Privatization works, and so the reforms have lasted.

Privatization has "massively increased the size and efficiency of the world's capital markets," one finance expert found.11 As of 2005, the 10 largest share offerings in world history were privatizations.12 By 2010, about half of the global stock market capitalization outside of the United States was from companies that had been privatized in recent years.13 Privatization has had a huge effect on the global economy.

Today, many countries have privatized the "lowest hanging fruit." But there is much left to sell, and global privatization is continuing at a robust pace. Over the past four years, governments worldwide have sold an average $203 billion of state-owned businesses annually.14 China is now the largest privatizer, but Western nations continue to pursue reforms. The British government, for example, sold a majority stake in Royal Mail in 2013 and then unloaded the final block of shares in 2015.15

Privatization has been a very successful reform. An OECD report reviewed the research and found "overwhelming support for the notion that privatization brings about a significant increase in the profitability, real output and efficiency of privatised companies."16 And a review of academic studies in the Journal of Economic Literature concluded that privatization "appears to improve performance measured in many different ways, in many different countries."17

Despite the success of privatization, reforms have largely bypassed our own federal government. President Ronald Reagan's administration explored selling the U.S. Postal Service, Amtrak, the Tennessee Valley Authority, the air traffic control system, and federal land, but those efforts stalled.18 President Bill Clinton had more success. His administration oversaw the privatization of the Alaska Power Administration, the Elk Hills Naval Petroleum Reserve, the U.S. Enrichment Corporation, and Intelsat.19

Little action on federal privatization has been pursued since then, but there are many federal activities that should be turned over to the private sector. The United States has a government postal system, but European countries are privatizing their systems and opening them to competition. The United States has a government air traffic control system, but Canada and the United Kingdom have privatized their systems. Our federal government owns electric utilities and a passenger rail service, but other countries have privatized those businesses.

The first section of this study examines the path-breaking British privatizations of recent decades. The second section discusses 12 advantages of privatization. The third section describes six businesses and assets that federal policymakers should privatize: the U.S. Postal Service, Amtrak, the Tennessee Valley Authority, the air traffic control system, land, and buildings. That section also highlights other businesses and assets to sell.

This study mainly uses privatization in a narrow sense to mean fully moving ownership of businesses and assets to the private sector. The term is often used more broadly to include government contracting, public-private partnerships, vouchers, and other forms of partial privatization. Those are all worthy reforms, but they are not the focus here.

When the next president comes into office in 2017, the time will be ripe for privatization reforms. Privatization would help spur growth in our underperforming economy and modestly reduce rising budget deficits. Privatization would also create qualitative benefits, such as increasing transparency and improving environmental stewardship. After decades of privatization abroad, U.S. policymakers have a wealth of foreign experience to guide their reform efforts.

Margaret Thatcher Blazes the Trail

Margaret Thatcher was elected Conservative Party leader in the United Kingdom in 1975, and her party gained a majority in parliament in 1979. Prime Minister Thatcher came into office promising to "denationalize" the government-dominated economy.20 However, Thatcher faced numerous crises her first few years in office that limited her privatization efforts, including a deep recession, high inflation, labor union strife, and the Falklands War.

At first, Thatcher and the Conservatives did not have a detailed agenda for privatization. They were cautious, but they learned as they went, and the early successes generated momentum for further reforms. One important early reform was the popular "Right to Buy" law, which allowed people to buy the government-owned "council" houses that they lived in. With that successful reform, the share of British households in council housing plunged from 31 percent in 1981 to just 7 percent today.21

With the economy recovering in the early 1980s and with Thatcher reelected with a large majority in 1983, the British privatization program kicked into high gear. Campaigning in 1983, the Conservatives promised wide-scale privatizations, and that created a strong mandate for them to move boldly after their landslide election victory.

Thatcher had a strong personal belief in privatization. Privatization was crucial for "reversing the corrosive and corrupting effects of socialism," she said, and central to "reclaiming territory for freedom."22 The purpose of privatization was to ensure "the state's power is reduced and the power of the people enhanced."23 Thatcher was heavily influenced by economist F. A. Hayek and by her key adviser, Keith Joseph.

Thatcher blazed the trail, but there were some international precedents for her reforms. In the 1950s, the British Conservatives privatized some activities — including the steel industry — that had been nationalized by the previous Labour government. And in the 1950s and 1960s, West German political leaders Konrad Adenauer and Ludwig Erhard began "denationalizing" industries to improve efficiency and broaden public share ownership. The German government, for example, sold a majority stake in Volkswagen in a public share offering in 1961.

Another influence on Thatcher's government was a Canadian privatization effort. Some of Thatcher's key advisers, including Alan Walters, were familiar with the privatization of a huge resources company in British Columbia in 1979.24 That process included a distribution of free shares to all citizens in the largest share offering in Canadian history to that date. A 1980 book describing that reform was the first with the word privatization in its title.25

Numerous privatization methods have been used in the United Kingdom and other developed nations.26 The dominant method has been share issue privatizations. The government proceeds with an initial public offering (IPO) of all or a portion of company shares, usually followed with the later sale of remaining shares. British Aerospace was privatized in 1981 with an IPO of 52 percent of its shares, with remaining shares unloaded in later years.

The British Telecom (BT) IPO in 1984 was a mass share offering, which "did more than anything else to lay the basis for a share-owning popular capitalism in Britain," said Thatcher.27 The government ran high-profile television ads to encourage the purchase of BT shares, and more than two million citizens participated in the largest share offering in world history to that date.28

Selling the 250,000-worker BT was a bold decision, and its success generated momentum for further reforms. The OECD called the BT privatization "the harbinger of the launch of large-scale privatisations" internationally.29 In the years following, the British government proceeded with huge public share offerings in British Gas, British Steel, electric utilities, and other companies. In the gas privatization, two million individuals who bought shares had never held corporate equities before.30

A second privatization method is a direct sale or trade sale, which involves the sale of a company to an existing private company through negotiations or competitive bidding. For example, the British government sold Rover automobiles and Royal Ordnance to British Aerospace. Other privatizations through direct sale included British Shipbuilders, Sealink Ferries, and The Tote.

A third privatization method is an employee or management buyout. The United Kingdom's National Freight Corporation was sold to company employees in 1982, and London's bus services were sold to company managers and employees in 1994. Management and employee buyouts were also popular in Eastern Europe after the fall of communism. The mass issuance to citizens of free or low-cost share vouchers was also a popular privatization method in Eastern Europe.

In most cases, British privatizations went hand-in-hand with reforms of regulatory structures. The government understood that privatization should be combined with open competition when possible.31 British Telecom, for example, was split from the U.K. post office and set up as an arm's-length government corporation before shares were sold to the public. Then, over time, the government opened up BT to competition.

The British government opened up intercity bus services to competition beginning in 1980. That move was followed by the privatization of state-owned bus lines, such as National Express. British seaports were privatized during the 1980s, and the government also reformed labor union laws that had stifled performance in the industry.

Studies in the United Kingdom and elsewhere have found that opening industries to competition is important to maximizing productivity gains from privatization.32 When possible, privatization should be paired with the removal of entry barriers — open competition is preferable to either government or private monopolies. However, the British experience also shows that even when industries have natural monopoly elements, privatization combined with improved regulatory oversight spurs gains to efficiency and transparency.33

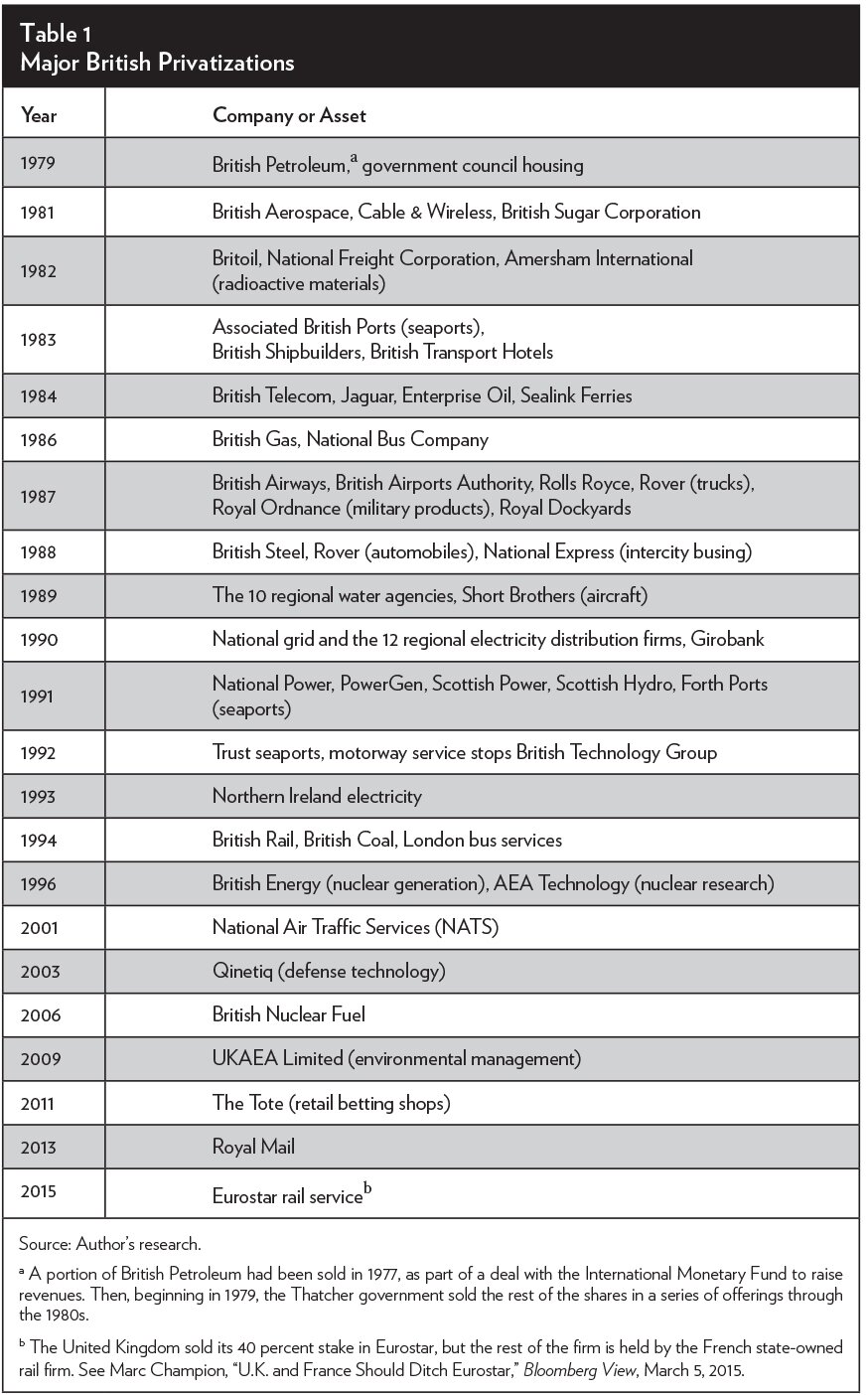

Table 1 lists the major privatizations in the United Kingdom since 1979.34 It shows company names at the time of privatization and the year that the first portion of each business was privatized. For less-familiar companies, the industry is noted in parentheses.

Table 1.

British privatization has been a big success. Entrepreneurs and competition have transformed the British economy. Bloated workforces at many formerly state-owned firms were slashed. Employment in the electricity and gas industries was cut in half between the mid-1980s (before privatization) and mid-1990s (after privatization).35 Privatization has typically generated large improvements in labor productivity, particularly for firms in competitive industries, such as British Steel, British Coal, British Telecom, British Airways, and Associated British Ports.36

Just knowing that privatization was coming spurred efficiency reforms in many companies, as Thatcher herself had predicted in a 1981 speech.37 British Steel hugely chopped its workforce and improved its productivity leading up to its 1988 privatization, as did British Airways before its 1987 privatization. After privatization, with revenues and profitability rising, British Airways increased its employment to serve expanding markets. That pattern of cost cutting, increased efficiency, and then growth is common among privatized firms.

British consumers benefited as privatization and competition reduced prices and improved service quality. A British Treasury study found that real prices after a decade of privatization had fallen 50 percent for telecommunications, 50 percent for industrial gas, and 25 percent for residential gas.38 A decade after electricity privatization, real prices were down more than 25 percent.39 The environment gained from the latter privatization as well, as the privatized electricity industry moved rapidly to adopt natural gas as a fuel and replace coal.40

The Treasury study found that "most indicators of service quality have improved" in privatized businesses.41 Economist David Parker found, "There is no substantial evidence that lower manning and price reductions in the public utilities have been at the expense of service quality."42 The share of British Telecom service calls completed within eight days soared from 59 percent to 97 percent in the decade after privatization.43 Before privatization, it had taken months and sometimes a bribe to get a new telephone line.44 By various measures, safety also improved in the privatized industries, including gas, electricity, and water.45

Millions of British savers gained from investing in the privatized companies. The government made share offerings appealing to small retail investors, which fit with Thatcher's belief in "popular capitalism." She wanted to create a "capital-owning democracy . . . a state in which people own houses, shares, and have a stake in society, and in which they have wealth to pass on to future generations."46 Under Thatcher, the share of British citizens owning equities soared from 7 percent to 25 percent.47 Many middle-income savers bought shares of companies such as British Gas, and they generally earned solid returns.48

The government itself gained from privatization because money-losing companies, such as British Steel, were removed from the budget. Also, the government gained revenues from the share offerings and direct sales, and from the taxes paid by the newly privatized firms. The British government has raised more than 70 billion pounds (more than $100 billion) from privatization.49

A few British privatizations were particularly controversial. State-owned British Rail had long consumed taxpayer subsidies, and it faced a long-term decline in its transportation market share. In 1994 the government split up the company and privatized separate pieces: Railtrack took control of tracks and stations; 3 firms took control of rail freight; and 25 firms received franchises to operate passenger services.50 The British rail industry went from being vertically integrated to being split into separate pieces.

In the late 1990s, a few high-profile rail accidents raised concerns about the industry's new structure. Some accidents may have been due to insufficient track maintenance — in both the years before and the years after privatization. Those problems led to the renationalization of Railtrack in 2002 as Network Rail. Some experts believe that undoing the industry's vertical integration was a mistake.51 Before nationalization in the 1940s, British passenger rail was vertically integrated as four regional private rail firms owning both track and rolling stock.52

Despite uncertainty about the optimal structure for the industry, British rail has flourished since passenger services were privatized in the 1990s.53 Unlike elsewhere in Europe, rail ridership in Great United Kingdom has soared. Total passenger trips bottomed out in 1995 and then began rising. By 2014, total passenger trips had more than doubled since privatization, from 740 million to 1.5 billion.54 Rail ridership is now hitting levels not seen since the early 1920s.55

Despite the rise in passengers, the on-time performance of British passenger rail improved after privatization.56 Also, surveys find fairly high levels of customer satisfaction with rail travel.57 And despite the few high-profile accidents in the 1990s, the overall safety record of British rail has steadily improved since privatization.58

In a 2013 study, the European Commission found that the United Kingdom's railways were the "most improved" in all of Europe since the 1990s and were second only to Finland's in customer satisfaction.59 In sum, British rail reform has been a success, not the failure that some critics have claimed.

The privatization of British water and sewer provision has also been criticized. The government privatized 10 regional water and sewer agencies in 1989 and created a new regulatory authority to oversee them. After the reforms, people complained that water prices rose. But those increases stemmed from the private firms' increased capital investment to modernize very old government infrastructure and from increased European regulation. Privatization gave the companies access to the capital they needed to upgrade.60 Put another way, water prices had been kept artificially low under government ownership, which led to underinvestment and inefficient overconsumption. After increases in the first six years following privatization, British water prices have risen just 9 percent in real terms over the past two decades.61

Furthermore, water industry efficiency and service quality have increased. Wasteful leaks in the British water system have fallen by one-third since privatization, supply interruptions are down, and the number of customers with low water pressure has plummeted.62 Drinking water quality has improved, and pollution has fallen. In sum, the overall quality of the British water system has substantially improved since privatization.

Advantages of Privatization

Since Margaret Thatcher got the ball rolling in 1979, more than 100 countries have raised about $3.3 trillion by selling off thousands of state-owned businesses.63 The revolution spread from the United Kingdom to Continental Europe, Latin America, Australia, Canada, Israel, and many other places. In dollar value, the bulk of privatization has occurred in developed nations. In those countries, some of the largest reformers relative to the size of their economies have been Australia, New Zealand, Portugal, Spain, and the United Kingdom.

For governments, a main benefit of pursuing privatization is to raise revenue. But for citizens, the main benefit is the positive effect on economic growth from increased efficiency and greater innovation. Businesses that are more productive can pay workers better and cut prices for consumers. Also, by reducing waste they are better environmental stewards.

Many statistical studies have examined the performance of businesses before and after privatization. A 1994 study in the Journal of Finance looked at 61 privatizations in 18 countries and found "strong performance improvements, achieved surprisingly without sacrificing employment security. Specifically, after being privatized, firms increase real sales, become more profitable, increase their capital investment spending, improve their operating efficiency, and increase their work forces."64

A 1999 study in the Journal of Finance compared the performance of 85 firms across 28 countries before and after privatization. It found that privatization increased "profitability, output, and operating efficiency."65 Firms increased sales per employee an average of 23 percent. The statistical results "strongly suggest that privatization yields significant performance improvements," concluded the authors.66

A 2003 study on privatization in the Journal of Public Economics found that "the empirical literature has provided systematic evidence that privately-owned companies outperform state-owned enterprises."67

A 2004 study by the Inter-American Development Bank of Mexico's reforms found that "privatization leads to dramatic improvements in firm performance and that they are the result of efficiency gains, not transfers from workers or exploitation of consumers."68 The study found other social benefits: "greater access to services, which usually follows privatization, leads to welfare gains for the poorest consumers that outweigh any increase in prices."69 Mexico privatized hundreds of companies during the 1980s and 1990s.

A 2012 study looked at more than 50 Canadian businesses privatized during the 1980s and 1990s, including an airline, a railroad, manufacturers, and energy and telecommunications firms. It found, "[T]he overall impacts have been largely positive, in many cases impressively so. Key economic indicators such as capital expenditures, dividends, tax revenues and sales per employee tended to increase."70 One sign of the success of reforms is that very few privatized firms in industrial countries have been renationalized, even when political parties changed. In Canada, none of the more than 50 major privatizations have been reversed.71 Privatization works, which is why even left-of-center governments generally accept reforms once the dust has settled.

A 2012 review by privatization expert John Nellis found that "the vast majority (but not all) of firm studies or surveys in most countries and sectors [have] continued to find positive post-privatization performance changes in terms of lowered costs, improved labor efficiency, increased outputs, higher returns to owners and shareholders, and, very often, increased investment."72 In another study, Nellis found that "contrary to popular conception," privatization "has not contributed to maldistribution of income or increased poverty."73

A 2001 Journal of Economic Literature article by William Megginson and Jeffry Netter provides a detailed international review of academic studies. They found studies "almost unanimously report increases in performance. . . . Privatization appears to improve performance measured in many different ways, in many different countries."74 They concluded that privatized firms "almost always become more efficient, more profitable, increase their capital investment spending, and become financially healthier."75

Megginson examined hundreds of studies for his 2005 book, The Financial Economics of Privatization. He concluded, "Private ownership must be considered superior to state ownership in all but the most narrowly defined fields or under very special circumstances."76 Furthermore, "the weight of empirical evidence on the state versus private ownership question . . . now strongly supports those who believe that private ownership is inherently more efficient than state ownership. This is true even for natural monopolies."77

Most academic studies on privatization examine quantitative factors, such as efficiency and output. But privatization also creates qualitative improvements, such as greater transparency and improved customer service. The following sections describe a dozen advantages of privatization.

1. Promotes Efficiency and Innovation

Private businesses in competitive markets have strong incentives to increase efficiency — to produce more and better products at lower costs. Businesses seek profits, which are a measure of net value creation. If a business performs poorly, it will lose money and have to change course, or ultimately face bankruptcy or a takeover.

By contrast, government entities are usually not penalized for excess costs, misjudging public needs, or other failures. They can deliver bad results year after year and still receive funding. Government workers are rarely fired, and there is no imperative for managers to generate net value.

The superiority of private enterprise is not just a static efficiency advantage. Instead, businesses in competitive markets must pursue continuous improvements. They learn by doing and adjust to changes in society, a process called adaptive efficiency.78 By contrast, governments get ossified by bureaucracy and are slow to adapt.

Businesses routinely abandon low-value activities, but "the moment government undertakes anything, it becomes entrenched and permanent," noted management expert Peter Drucker.79 As an example, the demand for mail has plunged and the U.S. Postal Service (USPS) is losing billions of dollars a year, but Congress has blocked obvious reforms, such as ending Saturday delivery. Private businesses make such adjustments all the time as demand for their products fluctuates.

Government organizations undermine growth by keeping resources employed in low-value activities, even as tastes and technologies change. That is why Drucker said, "[T]he strongest argument for private enterprise is not the function of profit. The strongest argument is the function of loss."80 Losses encourage private businesses to drop less-valuable activities and move resources to more promising ones.

In the 20th century, many economists supported government ownership because they thought that expert planners could efficiently organize production. But they ignored the dynamic role of businesses in continuously improving products and production techniques. In a Journal of Economic Perspectives article, Andrei Shleifer said that many economists did not foresee the "grotesque failure" of government ownership, and they did not appreciate the private-sector role in generating innovation.81

2. Increases Labor Productivity

Lacking incentives to control costs, government organizations tend to employ excess workers. In a survey of its member countries on privatization, the OECD said, "state-owned enterprises (SOEs) tend to be overstaffed. Empirical studies of privatization generally identify the downsizing of a bloated payroll in SOEs among the main sources of efficiency gains."82 Similarly, a World Bank study on privatization noted:

Governments the world over have employed too many workers in their state enterprises. Many of these enterprises were in fact designed as vehicles for job creation and political patronage. Protection from competition, lack of hard budget constraints, and security of tenure of public sector positions have led to chronic overstaffing.83

The OECD suggested that SOEs are sometimes overstaffed by 30 percent to 50 percent.84 With privatization, that sort of bloat can be cut. Surveying international experience, John Nellis found that layoffs of 25 percent are not uncommon after privatization.85 Postal system reforms, for example, often produce job cuts of that magnitude.86 In Canada, the parliamentary library said that state-owned Petro-Canada “was widely regarded as inefficient, oversized and debt-ridden,” and the company’s workforce was slashed 40 percent with privatization.87

When employment falls after privatization, labor productivity (output per employee) generally rises. One study found that the typical labor productivity increase after privatization is about 20 percent.88 In Canada, the air traffic control system has cut its workforce 30 percent since privatization in the 1990s, but it is handling 50 percent more traffic today.89

In the United Kingdom, labor productivity doubled in the electricity and gas industries in the decade after privatization.90 For British railroads, passenger journeys per employee increased 37 percent in the 15 years after privatization.91 That improvement occurred as rail safety increased and customer satisfaction remained high.

Japan privatized much of its passenger rail system in the 1990s. The railroads reformed their rigid union rules and slashed their workforces.92 Labor productivity increased more than 50 percent, on average, in the restructured companies.93 The privatization of Argentina’s national railroad in the 1990s produced remarkable results. Labor productivity shot up 370 percent as the bloated railroad workforce was chopped by four-fifths.94 Despite the workforce reductions, Argentine freight service greatly improved and passenger ridership soared.95

Higher productivity generally translates into higher worker earnings and greater output in the overall economy. One study found that privatized firms in Mexico reduced their employment, on average, by about half.96 But as workforces were cut, labor productivity doubled, and remaining workers at privatized Mexican firms enjoyed substantial wage gains. Surveying the international literature, William Megginson found, “most privatizations result in some employment shedding, but … the workers who remain at privatized companies are usually paid significantly more.“97

Initial job cuts are often just a short-run phenomenon. As productivity improves after privatization, employment often rebounds as companies find new markets and expand sales. A review of privatizations in Canada found that often “employment initially fell, only to rise again over the long term.“98 The study noted, “After many of these companies restructured, which took about five years following privatization, hiring began again.“99

In sum, privatization often dislocates workers at bloated companies in the short run. But over the longer run, privatized companies grow, employment expands, and compensation rises. The overall economy gains because higher productivity translates into rising incomes. Economic change can be difficult, but governments can ease the process with tax and regulatory reforms to spur creation of new businesses that will create new jobs.

3. Improves Capital Investment

In the private sector, businesses have incentives to maintain their facilities in good repair and to invest to meet rising demands. To fund expansions, they reinvest their profits and raise financing on debt and equity markets.

By contrast, government organizations often consume their funding on bureaucratic bloat and have little left over for repairs and upgrades. Government infrastructure is often old, congested, and poorly maintained. Capital investment falls short and tends to be misallocated. This was a common experience with British industries before they were privatized, and access to private funding to increase capital investment was an important factor in the Thatcher government’s privatization drive.100

The same problems of run-down public infrastructure are apparent in the United States today. The National Park Service has many poorly maintained facilities and billions of dollars of deferred maintenance. Urban subway and light rail systems across the nation have tens of billions of dollars of maintenance backlogs. Politicians enjoy launching new parks and rail systems, but they put little effort into maintaining what the government already owns.

Federal agencies cannot count on Congress for funding. Consider the air traffic control system, which is run by the Federal Aviation Administration (FAA). The system needs billions of dollars in investment to meet rising passenger demands, but the FAA has not secured stable long-term funding from Congress. Furthermore, the FAA mismanages its capital investment projects, which often experience delays and cost overruns.

Amtrak’s investment budget is also mismanaged. Because of politics, the company invests in rural routes that have few passengers instead of higher-demand routes in the Northeast. In his book on Amtrak, rail expert Joseph Vranich argued, “Congressional requirements that Amtrak spend money on capital improvements to lightly used routes are outrageous. . . . Throughout Amtrak’s history, it has devoted too much of its budget to where it is not needed, and not enough to where it is.“101

Privatization solves these sorts of problems. Privatized businesses use customer revenues and capital markets to finance upgrades. They do not have to lobby Congress to receive needed funding. And they have strong incentives to invest where the actual demand is, free from political pressures that plague government-owned businesses.

4. Expands Entrepreneurship and Competition

When the government produces goods and services, it tends to squelch competition, either directly by enforcing a monopoly, or indirectly by deterring entrants unwilling to compete with a subsidized government producer.

Devoid of competition, government organizations resist change and are slow to adopt better ways of doing things. The FAA runs the air traffic control system with outdated technology. The USPS is being undermined by email, but it does not have the flexibility to adapt. Airlines and intercity buses have improved their efficiencies and reduced costs under competitive pressures, but Amtrak’s costs remain high.102

In the economy, major innovations often come from upstarts, not industry-dominant firms. Big advances in industries, from computers to retail, have come from new firms doing things in new ways. So economic progress depends on open entry, on the ability of entrepreneurs to challenge existing providers. That is hard to do when the existing provider is the government.

Privatization abroad has often been paired with the removal of entry barriers. The European Union has urged member countries to open their markets as they privatize their airline, energy, telecommunications, transportation, and postal companies. British postal markets were opened for competition, and then Royal Mail was privatized. The privatization of British Telecom was followed by deregulation and then the rise of competitors such as Vodaphone, which is now one of the largest telecommunications firms in the world.

U.S. policymakers should use privatization as a catalyst for pro-competition reforms. The government should privatize USPS, Amtrak, and other companies, and at the same time open industries to new entrants. Open entry attracts people with new ideas and encourages the dissemination of new production techniques. The best and the brightest do not want to work for moribund bureaucracies such as the USPS and Amtrak. As a result, those companies today are essentially closed to external know-how and global best practices.

The American economy is rapidly evolving, driven by globalization and new technologies. We can keep up with all the changes by making our economy as flexible and open to new ideas as possible, and privatization and competition are the best ways to do that. If America opened its postal industry to competition, there would likely be many entrepreneurs ready to revolutionize it.

5. Increases Transparency

Citizens have difficulty monitoring the activities of government agencies. The goals of agencies are often vague, and their finances are difficult to understand. Government officials are protected by civil service rules and can be secretive in their activities. Even members of Congress have difficulty squeezing information out of agency leaders, as we often see at congressional hearings.

By contrast, private companies have clear goals such as earning profits and expanding sales. Performance is monitored by auditors, shareholders, and creditors. And consumers monitor companies in the marketplace, giving feedback with their purchasing behavior.

Moving government activities to the private sector would make them more “public.” Economist John Blundell said that, where he grew up in England, a government water facility had posted a sign, Public Property: Keep Out. But after the facility was privatized, a new sign went up: Private Property: Public Welcome.103 Private businesses have an incentive to be transparent and promote good community relations.

British privatizations revealed problems that had been hidden inside government businesses, such as unknown debts, pension liabilities, and performance issues.104 With the privatization of the British nuclear industry, the large size of its financial problems was revealed.105 In preparing British Telecom for privatization, the Thatcher government found that the company “had not the faintest idea which of its activities were profitable and which were not.“106 For British Airways, the government found undisclosed losses of hundreds of millions of British pounds as the company was being readied for privatization.107

In the U.S. government, the National Park Service provides few public details about the budgets of its individual parks and sites.108 By contrast, the private, nonprofit Mount Vernon estate in Virginia — home of George Washington — publishes audited financial statements showing how money is raised and spent.109

Or consider the USPS’s accounting. The postal company provides some services in its legal monopoly and other services in competitive markets, but its financial statements make it difficult to determine how much it earns or loses on each.110 The company attributes a large share of costs to overhead, which hides internal cross-subsidies. Economist Robert Shapiro found that the USPS manipulates its accounting to raise prices on letters, and then uses the extra revenues to subsidize its express mail and package delivery.111

Amtrak similarly hides cross-subsidies behind its opaque accounting, so it is difficult to determine the profits or losses on each of its routes.112 Amtrak also has a history of hiding information from investigators and of presenting unrealistic projections to Congress.113

The Tennessee Valley Authority (TVA) has long been a secretive organization and immune from outside criticism, particularly with respect to its safety and environmental record.114 Failures at its Kingston Fossil Plant in 2008 led to the largest coal ash spill in U.S. history. The TVA had been aware of the risk but failed to take needed steps to avert it.115 Why? Federal auditors blamed TVA’s management culture, which focuses on covering up mistakes.116 At the TVA, a “litigation strategy seems to have prevailed over transparency and accountability,” said the auditors.117

A final transparency issue is that federal agencies that operate services are often the same agencies that regulate them. The FAA operates air traffic control and regulates aviation safety. The Transportation Security Administration operates airport security and also regulates it. In such cases, privatizing the operations would eliminate the conflict of interest, and agency decisions that are now made internally would be made externally and publicly. This transparency issue is one reason the Thatcher government figured that — even if an industry had monopoly elements — privatizing that industry would improve it because the government regulator would be split off from the entity being regulated.118 Privatization and transparency go hand in hand.

6. Ensures Efficient Pricing

Economic theory indicates that general welfare is maximized when prices for goods and services are set by supply and demand in competitive markets. With government goods and services, however, prices are often set too high or too low. Setting prices too high induces people to reduce their purchases, and they gain fewer benefits than optimal. Setting prices too low induces wasteful overconsumption.

The government tends to set prices based on political and bureaucratic factors, not market supplies and demands. That results in misallocating resources, meaning that capital, labor, land, and commodities are used in low-value ways that reduce overall welfare in society.

Government-owned resources are often underpriced. Irrigation water from federal dams in the western United States is subsidized, which reduces incentives for conservation. The use of federal lands is also subsidized in many cases. Some government agencies, such as the USPS, underprice some services and overprice others — they cross-subsidize.

An advantage of privatizing water, land, postal services, and other items is that private and unsubsidized providers set prices on the basis of supply and demand. Market pricing is efficient and fair. It is also environmentally friendly because it creates incentives to minimize waste. Privatizing water and opening water markets in the western states would ensure that water is not wasted on low-value crops when the rivers could produce more value by supporting recreation and wildlife. Privatizing Amtrak and ending rail subsidies would discourage the company from wasting energy running trains on low-value routes.

When the United Kingdom privatized its regional water utilities in the 1990s, people criticized the subsequent price increases. But water prices had been too low under government ownership, which encouraged overconsumption and wasteful leaks. Under privatization, leaks have fallen one-third over the past two decades.119 Privatization improves both efficiency and environmental stewardship.

7. Enhances Customer Service

Governments are often the butt of jokes for their poor customer service. Not all government agencies provide poor service, and people have bad experiences with private companies, of course. But public polling shows that Americans have a dim view of the service they receive from federal agencies. One poll found that just one-third of the public thinks that the government gives competent service.120 And an annual survey of the public’s “customer satisfaction” with various public and private services found that satisfaction with federal services is lower than with virtually all private services.121

The problem is one of incentives. Government employees usually receive no tips, promotions, or other benefits for providing good service. Unlike sales people in private companies, they do not have to compete to find customers, so they have free rein to be unfriendly and slow.

A British Treasury study found that “most indicators of service quality have improved” in the privatized industries in that nation.122 When British Telecom was privatized and opened to competition, the wait time for a new phone line fell from many months to two weeks.123

With British passenger rail privatization, on-time performance improved and customer satisfaction has been quite high, despite a huge increase in ridership.124 With Japanese rail privatization, fares dipped modestly, accident rates plunged, and ridership increased.125

In the United Kingdom’s privatized water industry, supply interruptions are down, the number of customers with low water pressure has fallen, and water quality has improved.126 Privatization is not just about efficiency, it is also about better serving public needs.

8. Removes Politics from Decisionmaking

Decisions in government organizations often reflect political factors that raise costs and misallocate spending. Comparing government and private ownership in the Journal of Economic Perspectives, economist Andrei Shleifer argued, “Elimination of politically motivated resource allocation has unquestionably been the principal benefit of privatization around the world.“127

A British finance expert said that in the years before Thatcher, “there had been frequent interference in running the nationalized industries,” with politicians often making conflicting demands of companies, such as favoring higher prices one day and lower prices the next.128 Before Thatcher, many coal mines were kept open, not because they made economic or environmental sense, but because the coal mining unions had political power.129

In America, federal businesses are unable to end unneeded spending because members of Congress defend activities in their districts. To please politicians, Amtrak runs low-value routes that lose hundreds of dollars per passenger. And Congress blocks the USPS from consolidating mail processing centers and closing low-volume post offices. The agency’s least-used 4,500 rural post offices average just 4.4 customer visits a day.130

The story of the FAA is similar. Politicians prevent the agency from closing unneeded air traffic control (ATC) facilities, and they prevent the elimination of jobs in FAA facilities in their districts.131 They have even required the FAA “to procure certain hardware and encouraged it to select certain contractors.“132 Then there is the problem of “zombie” ATC towers:

More than 100 U.S. airport towers and radar rooms have so few flights that they should be shut down late at night under the government’s own guidelines, a move that would save taxpayers $10 million a year. Air-traffic controllers, who make a median $108,000 annual wage, have little to do overnight at those locations, which remain open because of pressure from lawmakers who control the Federal Aviation Administration’s budget. Members of Congress from both parties have blocked attempts to cut tower hours or merge radar rooms, according to interviews and documents.133

Such pork barrel politics make us all poorer by raising the costs of services. The environment also suffers because it is wasteful to run low-value trains and to keep open low-value ATC facilities and post offices.

9. Attracts Foreign Investment

One reason nations have pursued privatization has been to attract foreign investment. By selling equity in postal or energy companies, a country can attract foreign capital to help build its economy. A substantial share of privatization proceeds in OECD nations has come from foreign buyers.134

The British were the pioneers. The British Telecom privatization in 1984 was the largest IPO in world history to that date, and it was the first truly global share offering.135 The government set aside tranches of shares for international investors.

New Zealand pursued a large amount of privatization in 2013 and raised billions of dollars by floating shares in numerous companies. Commenting on the sales, a New Zealand finance expert said, “Privatizations help the development of capital markets in terms of liquidity by attracting greater offshore and domestic participation and encouraging other unrelated listings.“136

Foreign investment is not just about attracting money. Capital inflows often come with inflows of foreign technology and management skills. An analysis of European privatization by Deutsche Bank said, “[W]hen foreign investors acquire stakes in companies, the influx of capital is in many cases also accompanied by an inflow of important expertise.“137

Government monopoly companies tend to be cut off from industry innovations occurring abroad. If European postal services adopt new and better practices, the current monopoly USPS could simply ignore them. By contrast, private postal companies would have incentives to adopt innovations from anywhere in the world. They could also hire foreign executives who have unique talents. The executive who led British postal reforms, for example, is a Canadian with experience in both privatization and the postal industry.138 Privatization helps an economy take advantage of globalization.

10. Boosts Exports

Typically, federal government businesses do not export their goods and services. They have no incentive to do so. They are content to quietly fulfill their domestic roles. But that artificially restricts growth opportunities in our economy.

Private businesses that develop specialized products and expertise often pursue sales in both domestic and foreign markets. Those earnings are plowed back into the company, which encourages further research and product development.

Canada privatized its ATC system in 1996. The new company, Nav Canada, has become a leader in ATC innovation and has developed numerous technologies that it exports abroad. One expert noted, “The technical expertise at Nav Canada has led to a thriving business marketing innovative ATC hardware and software and advising other air navigation service providers on modernization.“139 Nav Canada earns income from foreign contracts and royalties, which help fund its research program and benefit its domestic services.

There are other export successes from Canadian privatization. In 1986 the government privatized Canadian Arsenals, which was the entity that manufactured large-caliber ammunition for Canada’s military. Today, the company is owned by General Dynamics; its manufacturing facilities supply not only Canada’s military, but also the militaries of a dozen other countries.140 The company has developed a range of products that it sells internationally.

Canada also has an interesting history with its bank notes and postage stamps. The government has long contracted the printing of those products to the private Canadian Bank Note Company. The company has used its domestic expertise as a base to go global, and today it prints stamps, bank notes, and various high-end security products for more than 60 nations.141 By contrast, bank note printing in the United States is a government monopoly carried out by the U.S. Bureau of Engraving and Printing, an agency that supplies only the domestic market.

The lesson is that we waste the talents of American workers when we keep business activities trapped inside the federal government. Moving in-house government activities to the private sector opens the door for workers to capitalize on their skills and sell their innovations worldwide.

11. Deepens and Broadens Equity Markets

An important goal of privatization in many countries has been to deepen equity markets and widen share ownership.142 Most privatizations include public share offerings, and many of the largest companies on exchanges around the world are formerly state-owned firms. By 2010, about half of the global stock market value outside of the United States was from companies that have been privatized in recent decades.143

William Megginson found that privatization has “massively increased stock market capitalization and trading volume in many developing (and more than a few developed) countries.“144 The number of people who own common stock has increased in countries that have had major privatization programs.145 That point is important because larger and more efficient capital markets promote overall economic growth.146

As a result of British privatizations, the share of British citizens owning equities soared from 7 percent to 25 percent during the 1980s.147 British efforts to broaden share ownership with privatization influenced other countries. Germany, for example, heavily advertised its 1996 privatization of Deutsche Telekom and convinced two million citizens to buy shares.148

Privatizations have created new opportunities for households to save and allowed more people to benefit from economic growth. Investors around the globe have generally earned solid returns from share issue privatizations.149 That benefit of privatization is less relevant to the United States, which already has deep equity markets. Still, it was this “popular capitalism” aspect of Thatcher’s program that helped inspire President Reagan to push for privatization in the United States.150

12. Benefits the Government Budget

America’s economy would gain from federal privatization, and so would the government. The federal budget would benefit in three ways. First, sales of federal businesses and assets would raise revenues, which has been an important political motivator in many countries. As noted, privatizations have raised $3.3 trillion for governments over the past three decades.

Second, subsidies to government businesses could be cut with privatization. Privatizing Amtrak, for example, would allow the rail system to run more efficiently. Money-losing routes could be eliminated, bloat could be reduced, and the government could end its more than $1 billion in annual aid to the company. Similarly, privatizing the air traffic control system would allow it to be fully self-funded without the need for taxpayer subsidies.

Third, privatization would raise money for governments over time as newly privatized entities paid income, property, and other taxes from which they are currently exempt. Government businesses and facilities do not pay federal or state income taxes, and generally they do not pay property taxes to local governments. Privatization would allow governments to broaden their tax bases, thus generating revenues that could be used to reduce overall tax rates.

Without major reforms, the federal government faces a financial crisis down the road as spending on entitlement programs soars in coming decades. Annual budget deficits are expected to rise from more than $500 billion this year to more than $1 trillion by 2022 — and keep on rising after that. Policymakers should cut programs in every federal department. The main focus of reforms should be the major entitlements, such as Medicare and Medicaid, but privatization can make a modest positive contribution to fixing the government’s fiscal woes as well.

Opportunities for Federal Privatization

President Ronald Reagan started a discussion on federal privatization in the 1980s. His administration explored privatizing the postal service, railroads, electric utilities, the air traffic control system, and federal land. A Reagan-appointed commission issued a major report in 1988 proposing various privatization options, but the administration’s efforts mainly stalled.151 The administration did oversee the privatization of the National Consumer Cooperative Bank in 1981 and the freight railroad, Conrail, in 1987 for $1.7 billion.152 Following Reagan, President George H. W. Bush issued an executive order supporting privatization, but he made little progress on reforms.153

President Bill Clinton had more success. During his administration, the Alaska Power Administration was sold in 1996 for $87 million; the Elk Hills Naval Petroleum Reserve was sold in 1998 for $3.7 billion; and the U.S. Enrichment Corporation was sold in 1998 for $3.1 billion.154 In 2000, Congress passed legislation putting Intelsat (owned by a consortium of governments) on the road to privatization.155

The George W. Bush administration proposed partly privatizing the Social Security retirement system, but that effort was blocked in Congress. On the other side of the ledger, Bush signed into law a bill nationalizing security screening at U.S. airports.

President Barack Obama’s budget for 2014 proposed privatizing the Tennessee Valley Authority. The administration has also pursued the sale of excess federal buildings.

Recent decades have seen more of a focus on partial privatization. Under Presidents Bill Clinton and George W. Bush, for example, the Pentagon moved a large number of military families to 187,000 private housing units. That program has been very successful: housing quality has improved and costs are down.156 Also, recent administrations have encouraged private involvement in the U.S. space program, and a number of firms have won contracts to resupply the International Space Station.

Privatization will likely be on the agenda in coming years. Budget deficits are here to stay, so policymakers will be looking for ways to reduce spending and raise revenues. Policymakers will also be looking for ways to boost America’s sluggish economic growth. As time passes, policymakers will be able to draw on ever more foreign privatization successes. We know that postal services, air traffic control, passenger railroads, and other activities can be successfully moved to the private sector because other countries have now done it.

Any activity that can be supported by customer charges, advertising, voluntary contributions, or other sorts of private support can be privatized. Government activities may be privatized as either for-profit businesses or nonprofit organizations, depending on the circumstances. The important thing is to move activities to the private sector, where they can grow, change, and be an organic part of society connected to the actual needs of citizens.

The following six sections look in detail at privatizing the USPS, Amtrak, TVA, air traffic control, land, and buildings. Following those discussions are shorter discussions of additional businesses and assets that the federal government should privatize.

U.S. Postal Service

The USPS is a major business enterprise operated by the federal government. Revenues from the sale of USPS products are supposed to cover the company’s costs. But with the rise of electronic communications, mail volume has plunged, and the 600,000-worker USPS has been losing billions of dollars a year. Other countries facing falling mail volume have privatized their systems and opened them to competition. America should follow suit and liberalize its postal industry so that it can adjust to changes in the modern Internet-based economy.

Congress confers on the USPS a legal monopoly over the delivery of certain types of mail: first-class mail (letters under 13 ounces) and standard mail (bulk advertising items). The USPS also has a legal monopoly on access to mailboxes, which is a unique protection among postal systems in the world.157 This system prevents entrepreneurs from competing in the postal industry to improve quality and reduce costs for the benefit of consumers.

The USPS also enjoys a range of other benefits:158

- It has been able to borrow $15 billion from the U.S. Treasury at subsidized interest rates.

- It is exempt from state and local sales, income, and property taxes and fees.

- It pays federal corporate income taxes, but those taxes are essentially circulated back to the USPS.

- It is not bound by local zoning ordinances, is immune from a range of civil actions, and has the power of eminent domain.

- It has government regulatory power, which it has used to impede competitors.

Despite those advantages, the USPS has lost more than $50 billion since 2007 and will likely continue losing money unless there are major reforms.159 One problem is that Congress stymies USPS efforts to improve efficiency. It impedes USPS plans to close unneeded post office locations, even though the bottom 4,500 rural locations average just 4.4 customer visits a day.160 It blocks the consolidation of mail-processing centers, and it blocks USPS plans to end Saturday delivery. Private businesses make such adjustments to their operations all the time as demand for their products fluctuates.

The USPS’s costly union workforce is another problem. USPS worker compensation is substantially higher, on average, than that of comparable private-sector workers.161 Collective bargaining agreements — which cover more than four-fifths of the USPS workforce — make it more difficult for management to make cost-saving changes, such as increasing part-time work. And, in some cases, unions have resisted the automation of postal functions.

The postal system’s financial challenges stem from the decline in first-class mail volume, which fell from a peak of 104 billion pieces in 2001 to 62 billion pieces in 2015, a 40 percent drop.162 The decline is driven by the rise of email, Facebook, Evite, and Internet bill paying; a decrease in printed magazines; and the rise of online advertising as an alternative to bulk print advertising.

The USPS’s financial challenges have been compounded by a requirement passed in 2006 to pay down the company’s large unfunded liabilities for retiree health care.163 USPS defenders complain that private companies are not required to prepay retiree health costs. But the vast majority of private firms do not even offer retiree health coverage. Also, since traditional mail faces a continued, long-term decline, it is better to tackle these costs now than to leave them to taxpayers down the road under a possible federal bailout.

Other nations with money-losing mail systems have either privatized them or opened them to competition — or both. Private companies have more flexibility to deal with today’s challenges. And with the rise of the Internet, the claim that mail is a natural monopoly needing special protection is weaker than ever.

The European Union has recognized those realities and pressed its member nations to deregulate their systems. Most European Union countries now have a more entrepreneurial postal industry than we do. The United States ranks near the bottom of the Consumer Postal Council’s 26-country “Index of Postal Freedom.“164

Here is a sampling of postal reforms abroad:

- Sweden in 1993 became the first major European country to repeal its postal monopoly. Sweden’s main postal company (now PostNord) was put into a corporate structure but is still owned by the government.

- The Netherlands partly privatized its national postal company in 1994. Majority control shifted to the private sector in 1995, and the company later became part of TNT, a global delivery company. The Netherlands opened postal markets to competition in 2009.

- New Zealand cut costs at New Zealand Post in the 1980s and put the company into corporate form. The country repealed its postal monopoly in a series of laws during the 1980s and 1990s.

- Germany partly privatized Deutsche Post in a stock offering in 2000. Today, 79 percent of company shares are publicly traded.165 Germany opened its postal markets to competition in 2008.

- The United Kingdom opened postal markets to competition in 2006 and privatized the Royal Mail in share offerings in 2013 and 2015.166

In many countries, dominant national carriers now have some competitors, often focused on niches such as business mail or bulk mail. Some privatized companies, such as Deutsche Post, have expanded internationally. Progress toward full competition has been a slow but steady process.

Experience has shown that both privatization and open competition create efficiency gains. In New Zealand and Sweden, government postal firms slashed their workforces by about one-third when they were restructured and opened to competition.167 Similar job cuts were prompted when Germany and the Netherlands privatized their systems.

Congress should privatize the USPS, repeal its legal monopolies, and give the company the flexibility it needs to innovate and reduce costs. Those reforms would give entrepreneurs a chance to improve America’s postal services. In 1979, when the USPS — under political pressure — lifted its monopoly over “extremely urgent” mail, we saw the growth of innovative private delivery firms such as FedEx.

Instead of privatization, some USPS supporters want the company to expand into banking, payday loans, grocery delivery, and other activities. But rather than solving any problems, such expansions would create more distortions. The USPS would have to find activities in which it could earn above-normal profits to funnel excess cash back to support the mail system. But a government agency — if not subsidized — is not likely to be able to out-compete private firms in other industries. Past USPS forays into nonmail areas, such as electronic bill paying, ended in failure.168 And if the USPS used its government advantages to undercut private firms, it would be both distortionary and unfair.

In a 2015 study, economist Robert Shapiro found that the USPS raises prices on its monopoly products and uses those revenues to subsidize express mail and package delivery.169 The agency is able to do so because consumers are less sensitive to prices for monopoly products than competitive products. Shapiro estimates that the cross-subsidies amount to $3 billion or more a year.

For FedEx, United Parcel Service (UPS), and other private firms, however, such cross-subsidies are unfair because — unlike USPS — they have to pay taxes, borrow at market rates, and follow all the normal business laws and regulations. Shapiro thinks that without receiving special breaks, the USPS “probably could not compete at all” against the more nimble private firms.170

These problems are difficult to solve under the current postal structure because the USPS hides the cross-subsidies in its books by attributing a large share of costs to overhead.171 Thus a benefit of privatization and open competition would be an increase in transparency in postal finances and pricing, and an end to the cross-subsidies.

Policy experts are coming around to the need for major reforms. Economist Robert Atkinson proposed that the USPS focus on delivering the “final mile” to homes, while opening collection, transportation, and the processing of mail to competition.172 Elaine Kamarck of the Brookings Institution has also proposed partial privatization.173 She would split the USPS into a government piece that fulfills the “universal service mandate” for delivering mail to every address, and a privatized piece that would compete with other firms for activities such as collecting mail.

The Atkinson and Kamarck proposals move in the right direction, but foreign reforms show that full privatization is both feasible and consistent with universal service. In Germany, the United Kingdom, and the Netherlands, the dominant firms continue to provide universal service. Postal companies have a strong incentive to provide universal service because, as a network industry, the value to customers of the service increases the more addresses that are served.

USPS supporters fear that rural areas would be left out if the government no longer required universal service. But economist Richard Geddes argues that is probably not the case.174 Rural postal routes can be as cost-effective to serve as urban routes because rural letter carriers stay in their trucks and use roadside boxes, whereas urban letter carriers often walk their routes.

Economists Robert Carbaugh and Thomas Tenerelli looked at nations that have privatized or opened their postal systems to competition. They found that, rather than the price increases and service reductions that some people fear, “liberalizing countries have shown the ability to offer affordable, reliable, universal, and increasingly efficient postal-delivery services.“175

U.S. policymakers should be more flexible with the idea of “universal service.” For example, if delivery was reduced from six days a week to every second day, that change would allow the USPS to slash its massive fleet of 211,000 vehicles, which would reduce both costs and energy consumption. Other countries interpret universal service more narrowly than we do — some countries have cluster boxes for communities, some exclude bulk mail from universal service requirements, and some allow more flexibility in pricing.176

All that said, a universal service obligation for paper mail is not needed in the modern economy. Electronic communications bind the country together without it. Household-to-household personal letters have plunged to just 3 percent of total mail volume today.177 Advertising represents 60 percent of the entire household mail volume. Bills and other business statements are the second largest type of mail, but those are being replaced by electronic bill payments, which now account for 63 percent of all bill payments.178

Essentially then, Congress imposes a rigid monopoly on the nation so that we can continue to receive mainly “junk mail” in our mailboxes six days a week — while 205 billion emails blast around the planet every day.179 Retaining special protections for the government’s old-fashioned paper delivery system makes little sense.

In a Washington Post op-ed, former U.S. Postmaster General William Henderson said, “What the Postal Service needs now is nothing short of privatization.“180 He is right. Congress should wake up to changes in technology and to postal reforms around the world. Other countries have shown that postal liberalization works, and it would work in America as well.

Amtrak

Private passenger rail service thrived in the United States between the mid–19th century and the early–20th century. By the late 1950s, however, passenger rail was struggling because of the rise of automobiles, buses, and airlines. Railroads faced large tax, regulatory, and union burdens not faced by other modes of transportation.181 The Interstate Commerce Commission micromanaged the railroads and prevented them from cutting excess costs. Railroads also paid heavy property taxes, and the federal government imposed a special excise tax on rail tickets from the 1940s until 1962.

After a number of major railroads, including Penn Central, went bankrupt, Congress stepped in to take over passenger rail by creating Amtrak in 1970. Amtrak is structured like a corporation, but the government owns virtually all the stock. It was supposed to become self-supporting and begin earning profits after a transition period. But it has never earned a profit and has consumed more than $40 billion in federal subsidies over four decades. In 2014 it had revenues of $3.2 billion and expenses of $4.3 billion, and it received direct federal subsidies of $1.5 billion.182

Amtrak has many woes. Its operations are so inefficient that it even loses tens of millions of dollars a year on its food service.183 Amtrak’s on-time service performance is poor. For the overall system, only about three-quarters of Amtrak’s trains are on time, and its long-distance routes have a particularly bad record.184 The entire Amtrak system accounts for only a tiny fraction of America’s passenger travel.

Amtrak has an expensive and inflexible workforce. It has 20,000 employees earning an average $105,000 a year in wages and benefits.185 The company pays a huge amount of overtime, a substantial amount of which seems to be unnecessary and improper.186 More than a dozen collective bargaining agreements cover 86 percent of the workforce.187 Unions undermine efficiency by protecting poorly performing workers and pushing for larger staffing levels than required. They resist innovation and create a more rule-laden workplace. Former Amtrak head David Gunn complained that at Amtrak’s maintenance facilities, workers from different unions were not allowed to share work on projects outside their narrowly designated specialties.188

With a rail system plagued by late trains and endless losses, Amtrak’s management has been subject to much criticism. Over the years, federal auditors have charged Amtrak with a lack of strategic planning, inefficient procurement policies, weak financial management, and insufficient accountability.189 Auditors found that the company manipulated its financial statements to obscure unfavorable data.190

However, most of Amtrak’s problems are created by Congress, which prevents the company from making rational business decisions. In particular, Congress insists on supporting an excessively large nationwide system of passenger rail that does not make economic sense. Nor does it make environmental sense for Amtrak to run many routes that have low ridership.

Amtrak operates 44 routes on 21,000 miles of track in 46 states. Amtrak owns the trains, but freight rail companies own about 95 percent of the track. A 2008 analysis by the Pew Research Center found that the system loses money on 41 of its 44 routes, with an average loss per customer of $32.191 A 2012 analysis by Randal O’Toole found similar results — only four Amtrak routes earned an operational profit.192 Some Amtrak routes lose hundreds of dollars per passenger and fill less than 40 percent of the seats.

The few routes that earn a positive return are in the Northeast, whereas the biggest money losers are the long-distance routes, such as New Orleans to Los Angeles.193 The Government Accountability Office (GAO) found that the long-distance routes account for 15 percent of Amtrak riders but 80 percent of its financial losses.194 In sum, Amtrak spends a lot of money maintaining high-loss routes at the expense of routes with heavier traffic.

Privatization would increase rail efficiency and bring costs down. A private rail company could prune excess workers, base worker pay on performance, and end harmful union rules. It could close the routes that are losing the most money. Passenger rail makes sense in the Northeast corridor between Boston and Washington, D.C., but that corridor accounts for less than 500 miles within a 21,000-mile system. Other routes may also make sense within a lower-cost privatized system. A privatized Amtrak could close the most uneconomic routes and shift investment and maintenance efforts to the core routes to improve service quality.

Reforms abroad show that privatizing passenger rail works. In a 2004 book, rail expert and former Amtrak spokesman Joseph Vranich counted dozens of nations that had either partly or fully privatized their passenger rail systems.195 He found that privatized rail systems generally provide better service, increased ridership, and more efficient operations.196

In the United Kingdom, rail privatization brought entrepreneurial innovation to the industry. Vranich noted that “private operators have demonstrated more initiative, imagination, and visionary planning than state-run British Rail did in its prime or Amtrak does today.“197 As already discussed, British rail ridership more than doubled in the 20 years since privatization, from 740 million passenger trips to 1.5 billion, far surpassing growth elsewhere in Europe.198

Japanese rail privatization provides useful lessons as well. In the 1980s, Japanese National Railways (JNR) was stagnating as a result of bloated labor costs, labor strife, and political manipulation. The government-owned JNR was “conservative, indolent, and fearful of change.“199 The government broke up JNR into six regional and vertically integrated passenger rail companies in 1987, then started privatizing them in the 1990s.

The JNR companies reformed their rigid union rules and slashed their workforces by roughly one-third following the reforms.200 A National Bureau of Economic Research study found that labor productivity in the Japanese passenger rail companies increased, on average, about 50 percent with the restructuring and privatization of the 1990s.201 It also found that accident rates were cut in half. The study concluded, “The Japanese approach to rail restructuring has succeeded in many ways, by improving productivity, cutting operating deficits, decreasing fares, and providing better services.“202