With this understanding of the purpose of the Securities Act and of the exemption from its requirements, the Court found that Ralston Purina’s offering was indeed a public offering. The company had several hundred employees throughout the country who were eligible to buy the stock. Crucially, although these employees worked for the company, they were not sufficiently close to upper management to have any significant advantage over the general public when it came to having knowledge about the company’s operations, strategy, or finances.

The SEC’s Interpretations

Although Ralston Purina attempted to determine what constitutes a “transaction . . . not involving any public offering,” the definition remained murky even post-Ralston. In 1962, the SEC issued a release intended to clarify the correct use of the private placement exemption. The relevant section of the Securities Act was intended, the release noted, to “provid[e] an exemption from registration for bank loans, private placements of securities with institutions, and the promotion of a business venture by a few closely related persons.”20 The increased use of the exemption for “offerings of speculative issues to unrelated and uninformed persons” prompted the SEC to issue the release in an attempt to “point out the limitations” on the exemption’s availability.21 However, the release simply stated that “[w]hether a transaction is one not involving any public offering is essentially a question of fact and necessitates a consideration of all surrounding circumstances, including such factors as the relationship between the offerees and the issuers, the nature, scope, size, type and manner of the offering”22—which is to say, a consideration of everything. This provided little guidance to those considering whether a planned offering would later be determined a public offering and therefore illegal if unregistered.

Beginning in 1974 and continuing through 1982, the SEC promulgated a series of rules intended to bring further clarity to the private offering exemption and promote small business capital formation. These rules continued on the path laid by Ralston Purina, focusing on protecting investors viewed as vulnerable. The new rules, however, went beyond Ralston Purina’s concern for investors who can fend for themselves and began to assess whether investors could afford a loss.

The SEC’s Rule 146 was one of the first attempts to define private offerings through regulation. It could be used by any issuer and had no limit on the amount an issuer could raise.23 Before Ralston Purina, courts had focused on the number of offerees, reasoning that an offering made widely and indiscriminately strongly suggested a public nature. Rule 146 followed this logic, restricting the offering to a total of 35 purchasers.

Rule 146’s chief innovation was the inclusion of a prototype “accredited investor,” restricting offers and sales to those who have “such knowledge and experience in financial and business matters that [they are] capable of evaluating the merits and risks of the prospective investment” or are individuals who are “able to bear the economic risk of the investment.”24 That is, there were two sufficient conditions: an investor had to be either sophisticated or able to bear the risk. To put it bluntly, a sharp poor person or a dull rich person was as eligible as a sharp rich person. The rule also required that offerees have access to or be provided with information that would have been included in a registration statement.

Yet Rule 146 failed to provide the stability the SEC had wanted. The SEC tried again in the late 1970s, issuing Rules 240 and 242.25 Rule 240 permitted companies with fewer than 100 beneficial owners (both before and after the offering) to raise up to $100,000 per year, but restricted advertising and solicitation.26 Rule 242 further developed the concept of the “accredited investor.” In addition to company insiders like directors and executives and certain entities, accredited investors were those individuals who purchased $100,000 or more of an issuer’s securities. Rule 242 permitted sales to up to 35 non-accredited investors; however, if the offering were limited to accredited investors, no specific disclosures were required. As with similar rules, Rule 242 prohibited general solicitation and advertising.

To introduce greater certainty into the process, the SEC promulgated Regulation D in 1982, and in the process repealed Rules 146, 240, and 242. Regulation D marries two related but statutorily distinct exemptions: the exemption for private placements and another exemption for small offerings. It includes several rules under which offerings may be made, but Rule 506 addresses the private placement exemption, providing a safe harbor for private offerings.27 Specifically, if an offering adheres to the requirements of Rule 506, it will be deemed to be a private one; it will not be subject to a separate inquiry as to its size, number of offerees, or any of the other factors otherwise used to determine private status.

It is important to note that this safe harbor is nonexclusive. That means that an offering that does not adhere to the requirements of Rule 506 may still be found to be private by the courts; the nonpublic offering exemption as a whole is broader than Regulation D, and issuers can still rely on the original legislative language and subsequent judicial interpretations if they prefer. In reality, however, issuers like the certainty that Regulation D’s safe harbor provides, and as a result the majority of today’s private offerings are conducted under the terms of Rule 506.28

Whereas Rule 506 closely mirrors the earlier Rule 146, it sweeps away the remaining pre-Ralston requirements for private offerings. Rule 506 firmly entrenches the notion that a private offering is distinguished by the sophistication and economic standing of its purchasers. Although Rule 146 introduced the concept of the sophisticated accredited investor, it also retained the pre-Ralston understanding of a private offering as one that is limited in size. Rule 506 includes no such limitations. As long as the offering is sold only to accredited investors, there is no limit on the number of offerees or number of purchasers.

Regulation D Today

The current version of Rule 506 contemplates two related types of private offerings. The first, known as Rule 506(b) offerings, comprises the original 1982 version of Rule 506 offerings. The second, Rule 506(c) offerings, reflects recent changes to the rule that were enacted through the Jumpstart Our Business Startups (JOBS) Act of 2012.29

Under Rule 506(b), an issuer may raise an unlimited amount of capital through the sale of any type of securities to any number of accredited investors. Accredited investors are defined as certain corporate insiders, large institutional investors, and individuals who meet certain wealth criteria. Although the sophistication of institutional investors has not been immune from scrutiny,30 it is the application of the definition to individual investors that has both caused the most mischief and attracted the most scholarly attention.31

Doing away with early formulations that relied on investors’ access to information about the issuer or their ability to leverage potential investment to obtain access, Regulation D’s accredited investor is defined by one characteristic: money. Individuals are considered accredited investors if they have at least $1 million in assets (excluding their primary residence) or at least $200,000 in annual income (or $300,000 jointly with a spouse). In the latter case, they must have earned that much in the past two years and reasonably anticipate earning the same amount going forward. The wealth criterion reflects a recent change in the law that has further constricted the pool of potential investors. Before 2012, a person who had $1 million in any assets qualified as an accredited investor. The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, however, directed the SEC to change this rule to exclude the primary residence from the calculation. The new rule went into effect at the beginning of 2012.32 Because the family home is often a large portion of a household’s assets, this change had a considerable effect on the number of people who fit the definition of an accredited investor.

The issuer may also offer its securities to up to 35 non-accredited investors, provided that those investors are nonetheless “sophisticated.” The regulation deems non-accredited investors to be sophisticated if they, or their representatives (such as an adviser), “ha[ve] such knowledge and experience in financial and business matters that [they are] capable of evaluating the merits and risks of the prospective investment[.]”33 If the offering is made only to accredited investors, there is no requirement as to the disclosures that must be made to potential or actual investors. If, however, the securities are offered to even one non-accredited investor, the issuer must provide disclosures similar to those provided in a registered public offering. Given that issuers who opt to use this exemption are generally trying to avoid the cost and burden of producing the disclosures required of a registered offering, this requirement means that these offerings almost never include non-accredited investors.34

Rule 506(b) also includes a proscription on “general solicitation.” The rule states that general solicitation includes, but is not limited to, “any advertisement, article, notice or other communication published in any newspaper, magazine, or similar media or broadcast over television or radio; and. . . [a]ny seminar or meeting whose attendees have been invited by any general solicitation or general advertising.”35 This proscription applies even if no non-accredited person was exposed to the advertisement. Generally, if the issuer has a “preexisting and substantial relationship” with anyone to whom the securities are offered, the SEC will find that there was no general solicitation.

The result of both the broad definition of “offer” and the blanket prohibition on general solicitation for 506(b) offerings has been to restrict the ability of issuers to locate potential investors absent existing networks. Many issuers turn to brokers to serve as intermediaries, but this can freeze out smaller issuers because brokers may not find such offerings sufficiently profitable to merit their attention. For smaller companies, the ability to tap individual investment through the private placement exemption may be the key not only to growth but also to survival. Any changes to regulation that increase the pool of investors stand to benefit not only the investors themselves, but also the issuers who rely on private offerings. Given the current limitations on the pool of potential investors, those who are able and willing to invest in small companies wield considerable power over both the companies themselves and the consumers who may be interested in the products or services the companies wish to sell. Expanding the investor pool would increase the diversity of potential investors and may result in an allocation of funding that better reflects consumers’ interests.

Until recently, Rule 506 still hewed to the one principle on which courts and regulators had always agreed: any offering that is widely advertised is not a private placement. However, in response to a provision of the JOBS Act of 2012, the SEC recently introduced a new category of private offerings for which “general solicitation” is permitted.36 These Rule 506(c) private offerings may be advertised by any means whatsoever, provided that they are sold only to accredited investors.37 Moreover, whereas Rule 506(b) allows investors to self-certify their accredited status, Rule 506(c) requires issuers to take reasonable steps to verify that an investor has the requisite income or net worth. That increased compliance burden may partly explain why Rule 506(c) offerings have not yet become widespread.

Ultimately, although the private placement exemption initially focused on the offering and the market more broadly, it has now evolved into a restriction focused on protecting the individual investor. No matter the size of the offering or the information the investor may obtain about the issuer, current law recognizes a public interest in protecting even a single investor from making a risky investment if that investor is not wealthy.

Why We Need Reform

The current approach to the private placement exemption, as embodied in Regulation D, rests on a series of assumptions. The first is that investment in private offerings is a universally risky endeavor and therefore not suitable for ordinary investors—who should be excluded from private markets for their own good. But are private offerings really so dangerous? It is not readily apparent that this is the case.

The second assumption follows from the first: if private offerings are indeed universally risky, then only sophisticated investors who are able to withstand a loss should be allowed to participate. The accredited investor standard relies on a wealth or income criterion, to determine whether a given investor makes the grade, and thereby it assumes that the relatively well-off are more financially sophisticated and better able to withstand a loss than are ordinary investors. Superficially, such an assumption seems reasonable; in fact, things are far less clear-cut than advocates of the accredited investor standard imagine.

A third assumption harkens back to the pre-Ralston era and revolves around access to information. Specifically, it is thought that wealthy individuals know what information they need to make a wise investment and that they are uniquely able to gain access to it. In other words, well-off investors do not need the mandatory disclosures that public registration requires, whereas ordinary investors, being inherently less powerful and less well-informed, do. Yet this assumption is also questionable, especially in the context of an ongoing technological revolution that makes ever more information available to all, much of it for free and at the click of a button.

So what if private offerings are not, in fact, universally risky? And what if wealth and income are not necessarily good proxies for financial sophistication and the ability to withstand a loss? What if concerns about access to information actually belong to a pre-internet age? And what if, finally, you have a changing corporate funding landscape in which more and more of the most dynamic investment opportunities are hidden from most investors?

Should all these things turn out to be true, current public policy toward private offerings is not only inappropriate, and based on false assumptions, but also has the potential to be economically harmful—both to those trying to raise capital and to those seeking a decent return on their investment. In other words, public policy toward private securities offerings is sorely in need of reform.

Are Private Offerings Universally Risky?

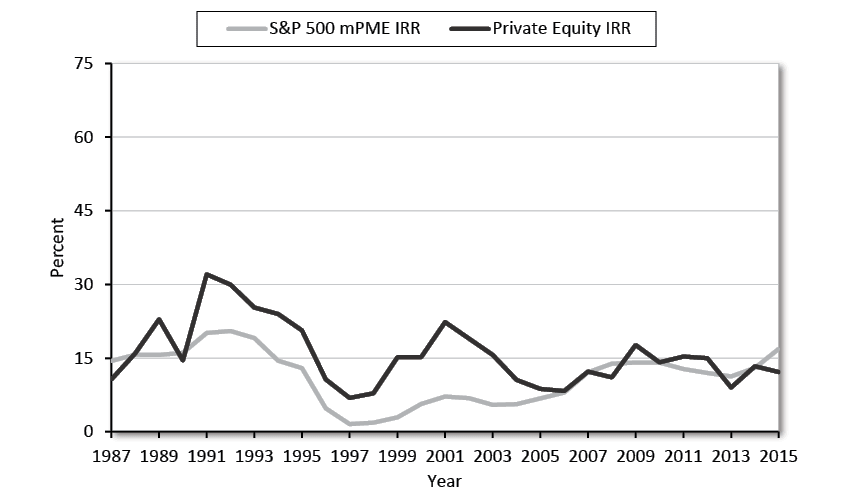

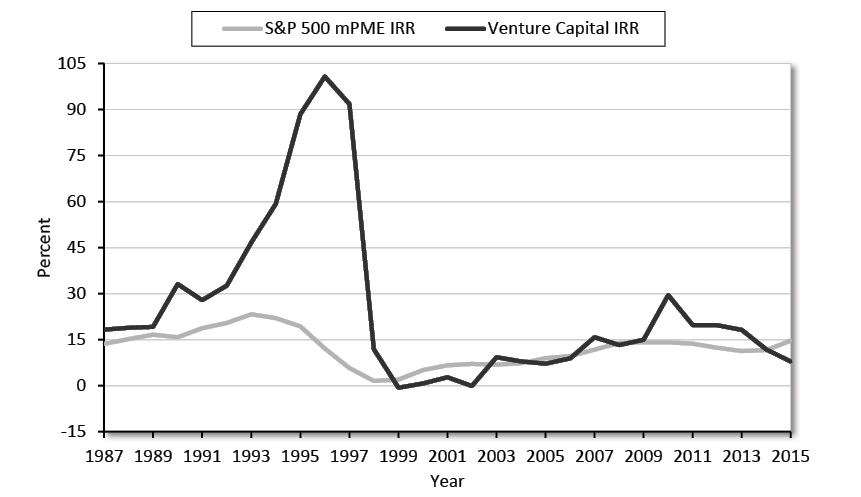

Restrictions on private offerings are often justified by assertions that private offerings are inherently risky, presenting investors with a greater chance of loss. But the numbers are not so clear. Cambridge Investments provides an index of available private investment performance data and constructs benchmarks of public indexes that allow for a comparison of the internal rate of return (IRR), that is of the projected profitability of potential investments.38 Figures 1 and 2, drawn from this data, compare the IRR for private equity funds and venture capital funds with the S&P 500 Index between 1987 and 2015.39 Private equity and venture capital funds invest in private offerings, whereas the S&P 500 is an index of 500 publicly traded companies. Private equity and venture capital funds are, of course, actively managed, which means that simply comparing the performance of these three asset classes is not comparing apples to apples. Nevertheless, excluding investors from the private markets necessarily excludes them from the kinds of investments that private equity and venture capital funds pursue. And, as figures 1 and 2 illustrate, private equity and venture capital funds can obtain results that frequently surpass what an index fund might offer, although they also demonstrate greater volatility. Additionally, these funds are often able to hedge market risk—that is, make investments that protect the funds’ assets even when the entire market tumbles.

Figure 1: Private Equity vs. S&P 500 Index Internal Rate of Return, 1987–2015

Source: Cambridge Associates, “US Private Equity Index and Selected Benchmark Statistics,” March 31, 2017,

https://40926u2govf9kuqen1ndit018su-wpengine.netdna-ssl.com/wp-content/uploads/2017/08/WEB-2017-Q1-USPE-Benchmark-Book-1.pdf.

Note: IRR = internal rate of return; mPME = Modified Public Market Equivalent calculation.

Figure 2: Venture Capital vs. S&P 500 Index Internal Rate of Return, 1987–2015

Source: Cambridge Associates, “US Venture Capital Index and Selected Benchmark Statistics,” March 31, 2017,

https://40926u2govf9kuqen1ndit018su-wpengine.netdna-ssl.com/wp-content/uploads/2017/08/WEB-2017-Q1-USVC-Benchmark-Book.pdf.

Note: IRR = internal rate of return; mPME = Modified Public Market Equivalent calculation.

As for the risk presented by specific private securities, it is not clear that these are universally riskier than those offered publicly. Many publicly offered securities fail spectacularly. For example, many of the companies that failed in the late 1990s were public. These failures suggest that a company’s public status does not guarantee its value. An investor can see stunning losses with investment in these companies as well. For example, General Motors, once considered a blue-chip stock—among the most well-established and financially sound public companies—traded above $40 in 2007 before falling to $20 in May 2008. A year later, in May 2009, the stock price had fallen below $1; by June, the company was bankrupt.40

Moreover, even if a given private offering is riskier than a public one, it is worth noting that current law permits anyone to invest any amount of money in public offerings. If the purpose of current securities regulation is to prevent unsustainable losses, it is logically inconsistent to permit unlimited investment in one type of offering while effectively prohibiting even a small investment in another.

Three additional points about risk should be borne in mind. First, while any single offering may indeed be risky—and there may be very risky investments in the private offering world—it does not necessarily follow that all investment in the private markets is riskier than investment in public companies. Appropriate risk should not be determined on the basis of a single investment but rather on an entire portfolio. A risky investment may be a prudent option if it balances an investor’s portfolio as a whole. If an investor is unable to access an investment that would provide the correct hedge, that may actually expose the investor to increased risk.

Second, to the extent that the perceived riskiness of private offerings arises from their connection to smaller and newer companies, some of that risk may be decreasing now that more companies are deferring IPOs or forgoing them altogether. This shift should result in a cadre of older, larger, and more stable companies that have nonetheless remained private.

Third, in some cases, it is precisely the riskiness—or dynamism—of private offerings that make them appealing to investors. Investors are compensated for risk with the chance at higher returns. If some investors are categorically excluded from a type of investment specifically because it presents a greater risk, then they are not just protected from exposure to the potential downside; they are also prevented from realizing the potential upside. Additionally, a trend toward companies deferring their IPOs in recent years means that the company’s greatest growth—and greatest dynamism—has already passed by the time the company is public. The public is therefore excluded from the opportunity to capture the returns generated by that surge in growth.41

Other concerns about private offerings center on the fact that the securities tend to be illiquid or difficult to sell, that the issuers are not compelled to provide comprehensive disclosures to the market, and that certain types of liability do not apply to the issuer.

Yet these properties of private securities offerings are not beyond the comprehension of the average investor. In fact, they are no more complicated than many aspects of investing in publicly offered securities. The fact that there may not be a buyer for the security at the time the investor would like to sell is straightforward. The fact that the issuer is not required by law to provide information is similarly simple. Illiquidity and limited disclosure both equally apply to many transactions ordinary Americans complete every day. Buying a house involves assessing the ability to sell the house at a later date. Individuals who buy items through private transactions facilitated by websites such as eBay or Craigslist contend with the potential for limited disclosure.

Liability is perhaps a more sophisticated concept, but—once explained—it too should be comprehensible to the average investor. The most notable difference in disclosures between a public and private offering is the lack of a registration document for the latter, as well as the lack of ongoing mandatory reporting. These materials, filed with the SEC in a public offering, are the source of much liability for issuers—arguably excessive liability at times, because an issuer is liable for any material misstatement in a registration document.42 Investors need not even show that they relied on the mistaken document in making their investment; the mere presence of the error is sufficient for liability. Other provisions provide further liability on the basis of misstatements or omissions in other documents filed with the SEC, for failure to file these documents in the first place, or for other errors committed in complying with filing and reporting requirements.43

Because there are no materials filed with the SEC in a private offering, there cannot be liability for misstatements in such materials. Yet despite these limits on liability, there is still substantial liability for any type of fraud related to private securities transactions. General prohibitions on fraud apply, and there are also specific rules that prohibit fraud in securities transactions. For example, under Rule 10b-5—the great catchall provision in federal securities regulation—it is unlawful to use any type of fraud or deceit in connection with the purchase or sale of a security. This rule sweeps broadly and includes any actor: issuer, underwriter, buyer, or intermediary. It also includes a crucial provision that expands its reach beyond common law fraud. It is not only unlawful to make untrue statements of material fact when buying or selling securities, it is also unlawful to “omit to state a material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading[.]”44 In other words, although there is no obligation to provide disclosures when selling a security through a private offering, a seller is not permitted to make false promises—and investors have legal recourse if they do.

Although there are no required disclosures for a private offering, most investors demand relevant information from issuers. It is therefore customary for issuers to provide what is known as a private placement memorandum, a document that provides the information that most investors would want to know before buying any securities. The statements made in this document are subject to Rule 10b-5 and so must be accurate, not misleading, and must not omit information that is necessary to make any other statements not misleading.

The principal difference between liability under Rule 10b-5 and other federal securities rules is that plaintiffs must prove that not only was the statement or omission false or misleading but also that the defendant intended to mislead the plaintiff. By comparison, in a public (registered) offering, a material misstatement can mean liability even if its inclusion was entirely innocent. Whereas Rule 10b-5’s intention requirement is a higher bar, it is no higher than what is required for claims of fraud in other commercial transactions.45

As to securities fraud more generally, it is not easy to determine whether fraud is more common among private offerings than public ones. Certainly a criminal who creates an entirely fraudulent offering—one in which there is no actual company issuing the securities and investors’ money is going directly into the criminal’s pockets—will not attempt to register the offering. Thus the offering may appear indistinguishable from a private offering. To the extent that the concern is not about offerings that are wholly fraudulent, but rather about fraud within legitimate organizations, history shows that registration is not necessarily a bulwark against that type of fraud: Enron and WorldCom, for example, were public companies at the time they engaged in considerable fraudulent activities.

To sum up: investment in private offerings can be risky, but that risk must be assessed as part of a whole portfolio. It is usually unwise to invest too heavily in any one company—whether public or private—given that all businesses can fail. Private securities may be illiquid, but illiquidity is not a difficult concept for ordinary investors to understand—as is evidenced by people’s ability to understand real estate purchases. Private offerings involve some limitations on liability, but these limitations are not overly complex and are similar to limitations on liability for other commercial transactions. And although many of the rules applicable to public offerings are aimed at preventing fraud, many major frauds have nevertheless occurred at public companies.

None of this is to say that allowing wider participation in private markets is some sort of silver bullet. Opening up private offerings would obviously not result in instant riches for new investors. On the other hand, it would allow access to new opportunities that are currently hidden behind locked gates.

Does the Accredited Investor Standard Make Sense?

The theory underlying the accredited investor standard requires the SEC to use broadly applicable regulations to identify those investors least likely to cause themselves harm through imprudent investment. Yet regulation is a blunt instrument and is badly suited to this task. In using wealth or income as the only criterion, the SEC has created a standard that is both under-inclusive and over-inclusive, excluding investors entirely able to fend for themselves while opening the gate to investors with little sophistication. Attempts to fix the wealth threshold at the right level only tie the SEC in knots. In reality, wealth is not necessarily tied to its regulatory objective—that is, identifying those who are able to withstand a financial loss46 and are sufficiently knowledgeable to appreciate the risks inherent in certain investments.47

For one thing, whereas it may be true that a wealthy individual can withstand a much greater financial loss than a person of lesser means, no one’s wealth is unlimited. A person with a net worth of $50,000 may lose $100 without adverse consequences. But a person with $1 million could be ruined by a loss of $900,000. Under current law, however, the first person would be barred from making even a very modest investment whereas the second person could freely wipe out a life’s savings.

The wealth/income requirement also privileges age because people tend to amass wealth as they approach retirement and tend to earn higher incomes later in their careers than when they are just starting out. Yet age does not make a person better able to withstand a loss. In fact, a 30-year-old worker who earns a middle-class income could likely bounce back from even a substantial loss, given decades of future earning potential. A 70-year-old retiree, however, has little or no serious opportunity to recoup even moderate losses in wealth. And for many retirees, even a net worth of $1 million is not enough for a lavish lifestyle; a decrease in that figure could have a noticeable effect on the retiree’s standard of living.

Finally, the wealth cutoff makes no distinction among costs of living in various parts of the United States. Nor does it account for other differences in lifestyle. A single person living in Omaha with a $300,000 income has much more disposable income than someone living in Manhattan earning the same amount and supporting a spouse and three children.

The accredited investor standard is equally flawed as a means of discerning financial sophistication. First, although it is often argued that the complexity of private offerings makes restrictions necessary,48 it is not clear that all or even most of the investments limited to accredited investors require great sophistication to understand. It is true that some private offerings are complex, but that is the case in public markets too. In fact, the underlying issuers may be considerably less complex when they relate to early-stage or small companies. A publicly traded company such as Coca-Cola, with international operations and a complex supply chain, can be much more difficult for an investor to evaluate than a small company with only a handful of employees.49

Wealth and income requirements also ignore the value of industry experience. Consider, for example, a small company developing a particular type of valve or other medical device. A nurse might have only a basic understanding of how to read a company’s financial statements and yet also have an incredibly sophisticated understanding of how such a medical device would be used and whether there would be significant uptake if the product were available. The nurse’s wealth, or lack thereof, would be immaterial to understanding the value of the company’s product.

Furthermore, although there is some evidence that financial sophistication increases with wealth,50 that evidence is mixed, and there are clearly many ways a person could attain wealth without the least understanding of investments. And, as Felicia Smith of the Financial Services Roundtable has argued, the Madoff Ponzi scheme demonstrates that even very wealthy people are not always able to ask the right questions.51

At the same time, many investment advisers who earn their living advising wealthy clients on which assets to buy are not wealthy enough to qualify as accredited investors themselves, despite their obvious financial sophistication. The same goes for many junior associates in law or underwriting firms—they might work daily on private offerings, preparing and researching the very documents investors will review, but they are still locked out of the private markets.

Ultimately, employing an income or wealth test to decide whether a person is legally permitted to buy an item is an odd restriction that is wholly absent from other areas of commercial life. People may walk into a designer boutique and spend $20,000 on a handbag without any inquiry into their earnings or wealth. They may gamble everything they own in Las Vegas or buy as many lottery tickets as the local convenience store will sell them. Adult Americans can do these things whether they are “accredited” or not, and the law will not prevent them from incurring even an unsustainable loss through such activities. So why can’t they invest in a private offering? After all, investing in a company, even a risky company, is likely to be a more prudent use of an investor’s funds than luxury shopping or high-stakes gambling.52

Should We Worry about Access to Information?

In some ways, the accredited investor standard harkens back to the access criterion pre-Ralston. Wealthy individuals are presumed knowledgeable enough to ask for the right information and powerful enough to induce the issuer of private securities to provide it. As such, they do not need the protections that registration and disclosure requirements provide in the public markets. They, unlike ordinary investors, can fend for themselves.

The first problem with this view is that there is no particular reason why an investor would be able to exert influence simply because of his or her wealth. It is true that a person with $1 million has the potential to invest more than a person with only $50,000. But if both are offering an investment of $10,000, the existence of an additional $990,000—sitting in an account somewhere and not designated for investment in the company—would not necessarily give the holder additional persuasive ability.53

Furthermore, the belief that wealth is required for access and knowledge assumes that the investor is engaging one-on-one with the issuer—and that no one other than the investor can make such a request. In fact, providing retail investors with access to private offerings would encourage the development of third-party providers who focus specifically on obtaining and making available to investors exactly the information needed to make a sound investment decision. Changes in technology, most notably in information technology, make this type of service increasingly easy to provide.

Indeed, arguably the greatest change in daily life in the past several decades—even from the time Regulation D was issued in 1982 to the present—is the increased access to information and the ease with which information can be disseminated to the public. A quick Google search can yield links not only to a company’s website and whatever information it chooses to post, but also to any news articles across the world that may have covered the company. Review sites like Yelp can provide information about customer experiences with the company, and employee sites like Glassdoor reveal information about pay structure, hiring practices, and employee morale. Many organizations conduct and post research about corporate practices that may affect public perception, such as the use of overseas labor, working conditions at company facilities, or the company’s environmental impact.54 And social media sites like Twitter and Facebook allow anyone to share information quickly and cheaply across the entire world, making scandal difficult to keep quiet.

Crowdfunding sites like Kickstarter and GoFundMe have illustrated how this exchange of information can work in practice. These sites do not host securities offerings. People providing funding may receive token gifts in exchange for their money or other benefits such as priority on a waitlist for a new product. But these funders do not share in any wealth generated by the companies. Nevertheless, such sites typically provide robust opportunities for company founders to interact with potential funders.

In fact, it can be easier for companies to provide information in this setting because the regulations surrounding securities offerings do not apply. That may seem counterintuitive—after all, the very point of those regulations is to require the disclosure of important information. However, the flip side is that what companies may say—as well as how and when they may say it—is tightly regulated. As a result, a company’s lawyers may advise its executives to say as little as possible during an IPO, fearing—quite correctly—that a stray remark could have disastrous consequences.

The problem, in simple terms, is that anything a company says during an offering—or even while preparing for an offering—can be construed as effectively marketing that offering. This kind of marketing is strictly regulated, and the rules are easy to break inadvertently. For example, when Google was preparing for its IPO, founders Larry Page and Sergey Brin gave an interview to Playboy magazine. Although they made no mention of the IPO, their participation in the interview was feared to be an effort to condition the market. The IPO had to be delayed while the SEC investigated the ramifications of the interview.55

Kickstarter and GoFundMe campaigns are typically based on donations and so trigger none of the securities laws. Those seeking funds are free to engage in any kind of discussion and provide any information they wish about their enterprises.56 Whereas donations on a crowdfunding site are not perfect proxies for investments in securities, these sites do demonstrate the potential for new technology to connect people in a way unimaginable to Congress in 1933, when the first federal securities laws were passed. None of this information replaces cold, hard financials, of course; but the information does provide excellent context, fleshing out the company’s overall appearance. Such information may once have been available only to those close to a company’s management; now even outsiders have access to it. This access changes the rationale that drove early legal decisions about the private offering exemption, such as Ralston: in some important respects, anyone with internet access can become better informed about a company, its industry, and its prospects than well-connected investors were in the 1930s.

There is certainly still information that only someone very close to a company would have, and there is information that can be gleaned only from a financial statement. But any would-be investor is capable of requesting financials and can withhold investment if the financial information is not forthcoming. Moreover, the current accredited investor standard includes no requirement that the investor be close to anyone in the company at all. If access to company information still matters, it must be reexamined in light of the staggering changes in information access the internet has brought.

Problems in the IPO Market

IPOs in the United States have been in decline. In 2015, there were 152 IPOs raising a total of $25.2 billion.57 Those numbers represent a substantial decline from a high of 677 IPOs raising $42.05 billion in 1996. (See Figure 3.) Whereas that high was almost certainly inflated by the dot-com bubble that burst five years later, the market has been especially anemic in the past 15 years.58 The trend has been especially noticeable among smaller firms. Although there has been some consolidation in the market with larger companies buying up smaller ones—which may have led to fewer IPOs—that does not explain why overall volume has declined to such an extent.59 Another development is that the companies that do go public tend to do so later in their development than similar firms did in earlier times.

Figure 3: Number of Initial Public Offerings, 1981–2015

Source: Jay R. Ritter, “Initial Public Offerings, Updated Statistics,” University of Florida, March 8, 2016,

https://site.warrington.ufl.edu/ritter/files/2016/03/Initial-Public-Offerings-Updated-Statistics-2016-03-08.pdf.

Note: IPO = initial public offering.

These changes in the IPO market make the private markets all the more important to the U.S. economy. At the same time that IPO activity has been down, there has been considerable growth in private offerings.

There are a number of theories as to why IPO activity seems to be depressed. One theory is that, as the economy has changed, it has become more profitable for a small company to merge with and become part of a larger organization than it is to gain financing through an IPO.60 Another is that changes in regulation that changed how stocks are quoted resulted in smaller bid-ask spreads. The argument is that that change has reduced the compensation available for trading in the stocks of smaller companies, and that may in turn have resulted in less profitability for small companies that do go public.61 Another theory lays the blame on the Sarbanes-Oxley Act of 2002, which increased regulatory burdens on public companies. Because many compliance costs are fixed and do not correlate with firm size, these costs represent a greater share of operating expenses for a small public company than for a large one. The JOBS Act of 2012 sought to partially address these effects, giving most companies a few years’ hiatus from some of Sarbanes-Oxley’s requirements. While there is evidence that this change had some effect on the number of IPOs, it has not brought the market roaring back to life.62

To the extent that Sarbanes-Oxley or other regulations have made the public markets unattractive, however, the flourishing private market acts as a safety valve. As Brooklyn Law School professor and former SEC Commissioner Roberta Karmel has noted, “the problem with regulating by exemption is that it does not incentivize the SEC to adjust regulations that discourage capital market participants from entering a regulated system.”63 Not only is there little incentive for the SEC to address problems in the public markets, there also are considerable incentives for the agency to retain the status quo.64 As Zachary Gubler, associate professor at Arizona State’s College of Law, has argued, “by expanding the private securities market, the SEC is able to respond to the increased demand for the services provided by a securities market without risking the loss of political slack that would accompany efforts to reform the IPO market.”65 That is, the current regulatory structure does not provide the correct incentive for the SEC. The regulator is rewarded not for expanding its control over the private markets, but for avoiding the glare of public scrutiny by passing ever more stringent regulations, reaping the benefit of showing the public “toughness” without actually stifling capital formation. Of course, the new regulations have little real effect because issuers avoid the regulated market. The people who pay the price for this evasion are not the issuers or the SEC, but the investing public the new regulations are designed to protect. The risk is that new regulations make the public markets so unattractive that the best investments go elsewhere.

It is possible that the heyday of the IPO has passed and that the current market favors large, well-established public companies and smaller, more nimble private ones. But if these trends are driven and continue to be driven by government regulation, then considerable economic harm could come from excluding the vast majority of investors from precisely those private markets that contain the most growth and dynamism.

Reforming Private Securities Markets

A number of proposals have been put forward to reform the private offering exemption. Many of them were discussed in a recent report by the SEC, which examined the accredited investor standard.66 Some of these proposals actually seek to tighten the exemption by increasing the wealth or income requirements that would-be investors have to meet. Other proposals would open up private offerings to potential investors who fail to meet those financial criteria but who can nevertheless prove that they are financially sophisticated. A few of these were endorsed in the U.S. Treasury Department’s recent report on capital markets and have also made their way into a bill introduced in the House in 2017.67

None of the reform proposals, however, grapple with the underlying issue: the SEC should not be the arbiter of what individuals can do with their money. It is this foundational premise, and not its practical implementation, that requires fixing. Without such reform, the securities markets will continue to exacerbate inequalities, perpetuate a singularly undemocratic legal structure, and permit the public markets to atrophy.

Proposals on Wealth and Income Thresholds

The accredited investor standard’s wealth and income thresholds were set at $1 million and $200,000 respectively in 1982. Of course, a person meeting those criteria in the 1980s was, in real terms, much richer than a person with the same amount of money today. In fact, $200,000 in 1983 dollars is equivalent to between $430,000 and $490,000 now; 1983’s $1 million would be more than $2 million. As a result, whereas fewer than 2 percent of households qualified as accredited in 1983, an estimated 10 percent of households do so today.68 Some people therefore advocate increasing those wealth and income thresholds and indexing them to inflation to ensure that they continue to rise apace in the coming years.69

For example, Greg Oguss, formerly of Northwestern School of Law, would increase the net worth threshold to about $2.5 million for a household (excluding the primary residence), raise the income threshold to about $490,000 per year for an individual and $600,000 for a couple, and index both thresholds to inflation going forward.70 The SEC estimates that only about 4 percent of U.S. households would qualify as accredited if wealth and income thresholds were raised to reflect more than three decades of inflation in this way.71

There are, however, three main problems with such proposals. First, their proponents tend to argue that thresholds should be raised because they have remained fixed since 1982. This is not correct: Dodd-Frank actually required a change in 2012, excluding equity in the primary residence from the calculation of a household’s wealth. Given that households with a net worth above $500,000 have, on average, $250,000 in equity in their primary residence,72 this exclusion has effectively raised the wealth threshold by a quarter of a million dollars already.

Second, and more importantly, there was nothing particularly special about the thresholds established in 1982 in the first place. The SEC’s adopting release for Regulation D includes no discussion of why the thresholds were set at $1 million in assets or $200,000 in annual income.73 The only hint of such a discussion comes in a brief explanation of why the asset level was set at a flat $1 million instead of $750,000 with certain assets (home, cars) excluded. The release implies that a flat $1 million is functionally equivalent to $750,000 with exclusions. But this does not explain why $1 million is the sweet spot, as opposed to, say, $100,000 or $100 million.

Finally, it is not clear that increased access to private offerings has had a negative effect on investors. A larger pool of potential investors does not, in and of itself, establish a need for greater restrictions. In fact, eligibility numbers are only relevant if investors who qualify as accredited today, but who would not qualify under an inflation-indexed threshold, show a particular inability to cope with the complexities of private offerings. Advocates of raising the accredited investor standard’s wealth and income thresholds cite no data showing that there has been an increase in fraud or ill-advised investment. If there has been no noticeable harm from the erosion in value of the original threshold, what is the argument for changing it?

Another proposal would exclude retirement savings from the calculation of an individual’s or couple’s net worth. For example, Larissa Lee, a Utah attorney, has proposed lowering income and wealth thresholds while simultaneously requiring that retirement accounts be excluded and that investors be required to diversify their private offering investments. Others recommending the exclusion of retirement assets have argued, first, that individuals should not put their retirement savings at risk by investing in private placements, and second, that retirement accounts are not easily accessible and therefore cannot effectively cushion the blow from a major investment loss.74

It is, of course, probably unwise to heavily invest one’s retirement savings in start-up enterprises. It is also true that tax-preferred retirement accounts tend to be difficult to access because of the heavy penalties early withdrawal can incur. But that does not mean that regulation should be used to force investors to make decisions regulators believe are wise.75

There are other problems with this proposal. For one thing, it could lead investors wishing to buy privately offered securities to refrain from using tax-advantaged retirement savings vehicles, in an effort to ensure that all their assets can be counted toward the accredited investor threshold. Excluding retirement savings from the wealth criterion would also represent an inconsistent treatment of equally illiquid assets. A vacation home, for example, is much less liquid than a retirement account. Where is the sense in counting the former toward the wealth threshold while excluding the latter? It is hard, after all, to cushion an investment loss with a summer cottage.

A further proposal presents even more problems than the two already mentioned. So-Yeon Lee, a Boston attorney, has proposed opening investment in private offerings to non-accredited investors but limiting their investment to “discretionary” income. She defines this as adjusted gross income minus taxes and other necessities, such as mortgage payments, utilities bills, and food costs.76

Lee expressly does not address whether such a rule would be administratively feasible. Prima facie, it almost assuredly would not. Aside from the differences in personal taste that might lead one person to believe she “needs” a six-bedroom house whereas another is content with a studio apartment, there are expenses that, although discretionary, are nonetheless fixed. The excess cost for a luxury car over a simple sedan is a discretionary expenditure, but if the car is financed with a multiyear loan, the monthly car payment is fixed regardless of whether the car itself is a Ford or a Mercedes. It is also unclear whether Lee’s proposed regulatory scheme would consider the number of dependents an investor has, the cost of living in the area where the investor resides, whether any member of the investor’s family has an illness requiring expensive medical treatment, or any of the many costs that individuals may have.

Even if it were possible to create a standard list of what constitutes necessities for all investors, such a standard would require a considerable invasion of investors’ privacy. It is unlikely many would enjoy disclosing to strangers, for example, their monthly grocery bills. Additionally, while income and housing expenses may be somewhat fixed, at least on an annual basis, other necessities can fluctuate considerably—making a precise calculation extremely difficult.

Of course, this all assumes that there must be a specific admonition to use only discretionary income for investment in private offerings. Such a distinction seems strange because investment of any kind is almost by definition discretionary; no one would seriously suggest that an investor should use the mortgage money to buy even the most blue-chip public security. However, if an investor has any discretionary income at all, why shouldn’t she be able to spend it in any way she chooses—whether on a designer dress, a trip to the casino, or securities issued by a start-up? Ultimately, any rule based on Lee’s proposal would be even more paternalistic than the current one.

Several other articles have proposed opening investment in private offerings to non-accredited investors while placing some sort of cap on the amount an individual may invest. Abraham Cable, professor at the University of California Hastings College of the Law, has proposed allowing each investor to have a set amount of “mad money” to invest in high-risk investments, with the amount to be determined in proportion to the individual’s wealth.77 Another proposal, put forward by Syed Haq, formerly of University of Michigan Law School, would set a sliding scale that would allow increased levels of investment as an individual’s wealth or income increased.78 Haq would exclude illiquid assets from the calculation of wealth, including only a “fire sale” value—the assumption being that, if an asset is to cushion a loss, it must be valued at the price the investor could get for it in a hurry.

These proposals are at least more administratively feasible than Lee’s. However, reforming private securities markets must be about more than just building a better mousetrap. There are numerous ways the SEC could attempt to pinpoint what a sustainable investment loss would be. But the truth is that this is an extremely personal determination, based not only on an individual’s expenses but also on the person’s tastes and temperament. A sustainable loss for one person earning $50,000 may be $50, whereas another person with the same income could stand to lose $5,000. Wealth alone does not make a person immune from loss.

Proposals on Financially Sophisticated Investors

Although “financial sophistication” has been tied to wealth since the beginning of the private placement exemption, wealth is only a proxy for knowledge and not a direct measure of an individual’s understanding of financial matters. For this reason, many have argued for expanding the definition to include those who have demonstrated actual financial knowledge or who possess other qualifications that may also serve as a proxy for sophistication.79

One of the most prominent proposals encourages the use of a test of actual understanding of basic financial principles. For example, Stephen Choi, professor at New York University School of Law, has proposed a test administered by the SEC or by another government actor, which would serve as a “financial driver’s license.”80 Whereas there are obvious flaws in the proposal—who would administer the test, and how would “sophistication” be tested?—it would at least avoid some of the most absurd results of the current wealth-based system.

A simple fix, under this theory, would be to deem those who pass certain tests already administered by the Financial Industry Regulatory Authority (FINRA) as demonstrating the requisite sophistication. For example, those who have passed either the test for securities brokers (Series 7) or investment advisers (Series 65) could be dubbed “accredited.”

Using the FINRA examinations does not completely address the problem of identifying “sophisticated” investors, however. These examinations are currently available only to individuals whose employers are FINRA-registered firms or who are otherwise required by a regulator to register with FINRA. Whereas including securities brokers and investment advisers in the definition of accredited investors would at least improve the current system, it would still leave out many individuals who are in fact financially sophisticated.

It is hard to think of a reason why an individual who desires to become an accredited investor, and who undertakes a course of study to that end, should not have an opportunity to demonstrate the attainment of the requisite level of understanding. If a person is in fact financially sophisticated, it is unclear why that person should be excluded from the definition of accredited investor.

Ultimately, of course, improving the definition of accredited investor does nothing to justify the existence of offerings open only to a select few. But it would at least make the process more logical.

A Better Approach to Private Offerings

The current use of the accredited investor standard is illogical. Worse, it exacerbates wealth inequality and places a glaringly undemocratic framework over the securities markets. Current recommendations for reform fail to grapple with the basic question of whether excluding investors from private markets is either just or desirable. A better solution would eliminate the existing accredited investor framework and replace it with a menu of disclosure regimes from which investors and issuers would be free to choose.81

A regime that permits anyone to invest also ensures that it is the market, and not an individual regulator, that determines which companies should receive investment. The alternative—to have the regulator sit in the role of superinvestor, determining which projects should be funded—has been shown to be undesirable. An example from state regulation illustrates the point. In addition to the SEC, each state has its own securities regulator. Although the state regulator’s role in IPOs has been greatly reduced since a 1996 change in the law, each state still maintains laws governing the registration and sale of securities within its borders.82 Many state securities laws require what is known as “merit review.” Securities offerings subject to state regulation have to be reviewed by a state regulator, which determines whether they are, in the words of many state statutes, “fair, just, and equitable” to the investor. In some cases, the regulator also ascertains whether the securities are likely to present a return on investment to the purchaser.83 In 1980, regulators in Massachusetts deemed a young computer company’s IPO to be too risky and refused to allow the company to sell to the Commonwealth’s investors. That “risky” company that regulators “saved” the people from was Apple Inc.84

Congress fortunately chose a different path when passing the Securities Act in 1933. No public offering is off limits to any investor. Investors are free to invest as much as they want in such offerings. Whereas questions remain about whether mandatory disclosures are necessary—and, certainly, the number and type of disclosures currently required may be excessive—the principle underlying federal securities law is that the market, not regulators, should determine which companies receive funding. This is a better approach to government regulation of securities.

When it comes to private offerings, merely refining the requirements of the accredited investor standard is not the answer. If someone has money in the bank, that person should be free to spend it at will. Having assets that are legally deemed to be too risky or complex for one person to purchase but not another is patently paternalistic. Other areas of law that operate this way are those that apply to children. It is legal for an adult to buy tobacco or alcohol but illegal for a child to do so. Such restrictions typically stem from the understanding that children developmentally lack adequate judgment to recognize the harm these products could cause them.85 Adults should not be restricted in the category of purchases they may make based only on the total amount of money they have.

The solution is therefore to open investment in private offerings to all investors. This would not diminish any value that currently exists in having registered “public” offerings with their attendant disclosures. These offerings would continue to exist unchanged.86 What would change is the SEC’s definition of private offerings, or rather, those offerings the Securities Exchange Act described as “not involving any public offering.” Such nonpublic offerings would be redefined as any offering not registered with the SEC. There would be no restrictions on who could invest in the unregistered offerings. Although, if it were deemed necessary, the law could require that the issuer provide investors with a disclosure stating that the offering is unregistered and that the issuer provide a summary of the protections available through registered offerings that the investor would forgo. Those investors who preferred the protections available through registered offerings could restrict their investment to those securities.

The new approach would be a simple rule to administer because it would be crystal clear which offerings were public (i.e., registered offerings) and which were not. Additionally, there would be no need to evaluate the eligibility of investors to invest in specific offerings because all investors would be eligible. Investors could easily distinguish between registered (public) and unregistered (nonpublic) offerings. To the extent that unregistered offerings were deemed riskier than registered offerings, investment advisers and others who offer guidance could steer investors to the registered public offerings. Investors who chose the unregistered nonpublic offerings would do so at their own risk. Issuers who feared that some investors might claim fraud if the investment went sour could screen investors and sell only to those they chose.87

Permitting all investors to purchase securities in unregistered offerings could also open the door to these investors putting their money into hedge funds. There are, of course, additional restrictions that would require exemptions from provisions of the Investment Company Act of 1940.88 Such exemptions would address the current effects of excluding retail investors from funds that can, at a minimum, hedge against market risk. A similar regime could be established to distinguish between funds that are registered and those that are not, with no legal limitations on who could invest in each.

To the extent that concerns remain about retail investors’ ability to assess the quality of private offerings or to demand access to relevant information, opening access to unregistered funds is the best way to provide assistance.89 Fund managers would apply their expertise as sophisticated investors to seek out and evaluate offerings. They could leverage their size to obtain information and access that individual investors might have trouble procuring. It is possible that these funds would need to provide disclosures to potential investors to ensure that investors understood the risks involved in investing and that they were aware of the funds’ potential illiquidity.

Without artificial regulatory barriers, there may be an opportunity for entrepreneurs to develop new means of collecting and disseminating information about offerings. Currently, the disclosures that public companies must make in connection with a public offering are so carefully circumscribed that issuers are often reluctant to convey information about the offering through novel means. A new policy approach, coupled with ongoing technological innovation, may eventually give investors the ability to conduct more detailed evaluation of unregistered offerings than is possible even for public companies today.

Conclusion

Discussions about investor protection too often focus on how to restrict investment. This view undermines the very purpose of investing, which is to put money at risk to gain a reward. Current regulations governing the sale of private securities restrict investors’ access to investment in the guise of protecting them. But in fact this protection often prevents investors from taking the kinds of risks necessary to earn a return.

Whereas investing in securities is often a complicated and challenging process, installing the SEC as an investment adviser for all retail investors is not the solution. The SEC’s approach is bound to be too ham-fisted, imposing restrictions where they are not needed and complicating investors’ ability to use their money as they see fit. Presently, the SEC is in the unfortunate business of protecting investors from their own decisions. This is an ill-fitting role for a federal regulator. A more investor-friendly approach considers how to limit barriers that prevent investors from grasping opportunities wherever they may lie. Currently, much of the dynamism is in the private securities market, but there are few ways for retail investors to put their money there. Whereas dynamism also entails risk, one of the core tenets of investing is that reward requires risk.

Current reform efforts in this area have focused on how to better define the category of investors who can “fend for themselves.” This is the wrong question because it rests on faulty assumptions about the role of regulators, how risk should be assessed, and investors’ ability to obtain relevant information about securities without government intervention. The solution is not to fix the definition of accredited investor. The solution is to get rid of the concept altogether.

Instead of delineating a class of investors who are permitted to invest in certain offerings, the SEC should open investment in all offerings to all investors. Investors could then choose whether they prefer a registered public offering or an unregistered nonpublic one. This open investment would not diminish the ability of registration to provide protection for investors: any investors who appreciate the protections that registration provides could limit their investments to only registered securities. But this reform would remove barriers to investment in private offerings for those who are willing to invest without government intervention.

To be perfectly clear, opening investment in private offerings to all investors would not open up all such investment opportunities to them. Privately held companies may not wish to include small investors, preferring a handful of investors who can each put up a large amount of cash over an unwieldy number of small-scale investors. Retail investors may prefer to invest in registered offerings because they prefer the perceived transparency that public filings and heavy trading volume provide. But to the extent that regulation has erected artificial barriers to entry that, as demonstrated here, do not actually provide the investor protections claimed, those barriers need to come down.

Notes

- For a brief discussion of the problems plaguing the current process, see Andrew N. Vollmer, “Investor-Friendly Securities Reform to Increase Economic Growth,” submitted to the Chairman and Ranking Member, Committee on Banking, Housing, and Urban Affairs, U.S. Senate, March 22, 2017, https://www.banking.senate.gov/public/_cache/files/198a02c6-1424-4f9b-8b76-2667296b59c8/4A0DDAFF17AE0C82B2D7D66D209B2477.andrew-vollmer-submission.pdf.

- Angel investors are wealthy individuals, or networks of individuals, who invest in start-up companies, typically providing the first round of outside investment. Investment can be as little as $10,000 or as much as several hundred thousand or even a few million dollars. Angel investors are often entrepreneurs themselves who view their role as part investor, part mentor for young companies. Their investment can help a company reach the maturity needed to attract venture capital.

- Scott Austin, Chris Canipe, and Sarah Slobin, “The Billion Dollar Startup Club,” Dow Jones VentureSource and Wall Street Journal, February, 18, 2015, updated January 2018, http://graphics.wsj.com/billion-dollar-club; see also Telis Demos, “More Startups Aim to Keep It Private,” Wall Street Journal, January 1, 2015, https://www.wsj.com/articles/more-startups-aim-to-keep-it-private-1420159193.

- Telis Demos, “Airbnb Raises $1.5 Billion in One of Largest Private Placements,” Wall Street Journal, June 26, 2015, https://www.wsj.com/articles/airbnb-raises-1-5-billion-in-one-of-largest-private-placements-1435363506; Douglas MacMillan, Matt Jarzemsky, and Maureen Farrell, “Spotify Raises $1 Billion in Debt Financing,” Wall Street Journal, March 29, 2016, https://www.wsj.com/articles/spotify-raises-1-billion-in-debt-financing-1459284467; and Douglas MacMillan, “Uber Raises $3.5 Billion from Saudi Fund,” Wall Street Journal, June 1, 2016, https://www.wsj.com/articles/uber-raises-3-5-billion-from-saudi-fund-1464816529.

- Renaissance Capital, “2016 IPO Market Annual Review,” December 16, 2016, p. 2, http://www.renaissancecapital.com/IPO-Center/News/43040/Renaissance-Capitals-2016-US-IPO-Annual-Review.

- U.S. Securities and Exchange Commission (SEC), “Final Rule: Revision of Certain Exemptions from Registration for Transactions Involving Limited Offers and Sales,” Release no. 33-6389, 47 Fed. Reg., no. 51 (March. 16, 1982), http://cdn.loc.gov/service/ll/fedreg/fr047/fr047051/fr047051.pdf.

- It is important to note that the nonpublic offering exemption as a whole is broader than Regulation D—issuers can still take their chances and rely on the original statutory language if they want to. In practice, however, issuers tend to prefer the certainty that Regulation D provides.

- It is important to note that there are additional barriers to investment in hedge funds and that the changes proposed in this paper would not alone permit increased access to these funds.

- Joseph P. Kennedy report to the executive director, National Emergency Council, February 2, 1935, Securities and Exchange Commission Historical Society, http://3197d6d14b5f19f2f440-5e13d29c4c016cf96cbbfd197c579b45.r81.cf1.rackcdn.com/collection/papers/1930/1935_02_02_JPK_to_National_E.pdf.

- Joseph P. Kennedy, “Address at Union League of Chicago,” February 8, 1935, Securities and Exchange Commission Historical Society, http://3197d6d14b5f19f2f440-5e13d29c4c016cf96cbbfd197c579b45.r81.cf1.rackcdn.com/collection/papers/1930/1935_02_08_JPK_Chicago_Speec.pdf.

- Ibid., pp. 6–7.

- Ibid., p. 7.

- Ibid.

- H. R. Rep. No. 85, at 15–16 (1933) (Comm. on Interstate and Foreign Commerce Rep., to accompany H.R. 5480), Hathi Trust Digital Library, https://babel.hathitrust.org/cgi/pt?id=mdp.39015087658210;view=1up;seq=309.

- H. R. Rep. No. 152, at 25 (1933) (Conf. Rep., to accompany H.R. 5480, Securities Act of 1933), Hathi Trust Digital Library, https://babel.hathitrust.org/cgi/pt?id=mdp.39015087658210;view=1up;seq=703.

- H. R. Rep. No. 1838, at 41 (1934) (Conf. Rep., to accompany H.R. 9323, Securities Exchange Act of 1934), Hathi Trust Digital Library, https://babel.hathitrust.org/cgi/pt?id=mdp.35112104432895;view=1up;seq=44.

- SEC v. Ralston Purina Co., 346 U.S. 119 (1953).

- Ibid.

- Ibid.

- SEC, “Nonpublic Offering Exemption,” Release no. 33-4552 (November 6, 1962), https://www.sec.gov/rules/final/33-4552.htm.

- Ibid.

- Ibid.

- SEC, “Report on the Review of the Definition of ‘Accredited Investor,’” December 18, 2015, https://www.sec.gov/corpfin/reportspubs/special-studies/review-definition-of-accredited-investor-12-18-2015.pdf.

- SEC, “Transactions by an Issuer Deemed Not to Involve Any Public Offering,” Release no. 33-5487, 39 Fed. Reg., no. 86 (May 2, 1974): 15261–68, https://cdn.loc.gov/service/ll/fedreg/fr039/fr039086/fr039086.pdf.

- For Rule 240, see SEC “Exemption for Closely Held Issuers,” Release no. 33-5560, 40 Fed. Reg., no. 30 (February 12, 1975): 6484–88, https://cdn.loc.gov/service/ll/fedreg/fr040/fr040030/fr040030.pdf. For Rule 242, see SEC “Exemption of Limited Offers and Sales by Qualified Issuers,” Release no. 33-6180, 45 Fed. Reg., no. 19 (January 28, 1980): 6362–70, https://cdn.loc.gov/service/ll/fedreg/fr045/fr045019/fr045019.pdf.

- In the securities industry, it is common for a brokerage to hold the securities of its clients in its own name, serving as the holder of record. “Beneficial” owner looks through this structure and counts the clients, not just the brokerages. This is arguably a more accurate count of the shareholders because a brokerage could hold securities for hundreds of beneficial owners.

- Other notable exemptions included in Regulation D are Rule 504, which provides an exemption for purely intrastate offerings, and Rule 505, which provides an exemption for offerings raising less than $5 million.

- SEC, “Report on the Review of the Definition of ‘Accredited Investor.’”

- 17 CFR § 230.506. For more on the JOBS Act, see Thaya Brook Knight, “A Walk through the JOBS Act of 2012: Deregulation in the Wake of Financial Crisis,” Cato Institute Policy Analysis no. 790, May 3, 2016, https://object.cato.org/sites/cato.org/files/pubs/pdf/pa790.pdf.

- Jonathan D. Glater, “Private Offerings and Public Ends: Reconsidering the Regime for Classification of Investors under the Securities Act of 1933,” Connecticut Law Review 48, no. 2 (2015): 355–95.

- See, for example, Kevin Bender, “Giving the Average Investor the Keys to the Kingdom: How the Federal Securities Laws Facilitate Wealth Inequality,” Journal of Business and Securities Law 1, no. 15 (2016): 1–52; Usha Rodrigues, “Securities Law’s Dirty Little Secret,” Fordham Law Review 81 (2013): 3389–437; Jasmin Sethi, “Another Role for Securities Regulation: Expanding Investor Opportunity,” Fordham Journal of Corporate and Financial Law 16, no. 4 (2011): 783–838; and Roberta Karmel, “Regulation by Exemption: The Changing Definition of an Accredited Investor,” Rutgers Law Journal 39 (2008): 681–701.

- SEC, “Net Worth Standard for Accredited Investors,” Release no. 33-9287 (February 27, 2012), https://www.sec.gov/rules/final/2011/33-9287.pdf.

- 17 CFR § 230.506(b)(2)(ii) (2016).

- SEC, “Report on the Review of the Definition of ‘Accredited Investor.’”

- 17 CFR § 230.506(b)(1) (2016).

- 17 CFR § 230.506(c) (2016).

- Jumpstart Our Business Startups Act, Pub. L. No. 112-106, § 201(a)(1), 126 Stat. 306, 313–14 (2012).

- According to Cambridge Associates, their Modified Public Market Equivalent (mPME) calculation “is a private-to-public comparison that seeks to replicate private investment performance under public market conditions.” For more information, see Cambridge Associates, “U.S. Private Equity Index and Selected Benchmark Statistics,” March 31, 2017, p. 26, https://40926u2govf9kuqen1ndit018su-wpengine.netdna-ssl.com/wp-content/uploads/2017/08/WEB-2017-Q1-USPE-Benchmark-Book-1.pdf; and Cambridge Associates, “U.S. Venture Capital Index and Selected Benchmark Statistics,” March 31, 2017, p. 29, https://40926u2govf9kuqen1ndit018su-wpengine.netdna-ssl.com/wp-content/uploads/2017/08/WEB-2017-Q1-USVC-Benchmark-Book.pdf.

- Cambridge Associates, “U.S. Private Equity Index and Selected Benchmark Statistics,” p. 14; and Cambridge Associates, “U.S. Venture Capital Index and Selected Benchmark Statistics,” p. 14.

- Aaron Smith, “GM Stock Touches $1, Lowest since Depression,” CNNMoney, Cable News Network, May 13, 2009, money.cnn.com/2009/05/13/news/companies/gm_stock/.

- Jay R. Ritter, “Initial Public Offerings: Median Age of IPOs through 2015,” University of Florida, 2016, https://site.warrington.ufl.edu/ritter/files/2016/02/Initial-Public-Offerings-Median-Age-of-IPOs-Through-2015-2016-01-06.pdf. From 2001 to 2015, the median age of the 1,662 companies that went public was 10 years at the time of their IPO. From 1980 to 1989, 2,043 companies went public with a median age of 8 years; from 1990 to 1994, 1,720 companies went public with a median age of 9 years; from 1995 to 1998, 1,893 companies went public with a median age of 8; and from 1999 to 2000, 858 companies went public with a median age of 5 years.

- Securities Act of 1933 §11(a), 15 U.S.C. § 77k(a).

- See, for example, 15 U.S.C. § 78r(a); 15 U.S.C. § 77k.

- 17 CFR § 240.10b-5 (2016). An example of such an omission would be the following: Consider a manufacturing company with three factories, one of which just burned down and will be offline for another year as it is rebuilt. It would be truthful to say that the company has three factories, but omitting the fact of the fire would make the statement about having three factories misleading.

- Restatement (Second) of Contracts § 162—When a Misrepresentation Is Fraudulent or Material; The Restatement (Second) of Torts § 525—Liability for Fraudulent Misrepresentation.

- See SEC, “Report on the Review of the Definition of ‘Accredited Investor,’” October 9, 2014, https://www.sec.gov/spotlight/investor-advisory-committee-2012/investment-advisor-accredited-definition.pdf; and William Sjostrom, “Rebalancing Private Placement Regulation,” Seattle University Law Review 36 (2013): 1146–58, for discussions of the importance of ability to withstand loss within the conceptual grounding for the accredited investor standard. Also see Hester Peirce, “Statement of Dissent from the Investor Advisory Committee Recommendation Regarding the Accredited Investor Definition,” SEC, October 2014, https://www.sec.gov/spotlight/investor-advisory-committee-2012/accredited-investor-definition-dissent-pierce.shtml.

- For emphasis on the importance of financial sophistication, see SEC, “Report on the Review of the Definition of ‘Accredited Investor.’”

- See, for example, Jennifer Johnson, “Private Placements: A Regulatory Black Hole,” Delaware Journal of Corporate Law 35 (2010): 151–97; and Luis Aguilar, commissioner, SEC, “Facilitating General Solicitation at the Expense of Investors,” public statement, July 2013, https://www.sec.gov/news/public-statement/open-meeting-statement-laa-3.

- It may be argued that a company like Coca-Cola has a huge number of analysts following it, and so the issue is not that more information is available to the investor, but that that information is efficiently incorporated into the price; the investor can assume the price is accurate. This may be true, but if this is the argument, then the rule should focus on analyst coverage, not availability of information. There are many smaller public companies with little or no analyst coverage at any given time.

- Research showing some connection between wealth and financial knowledge includes Chiara Monticone, “How Much Does Wealth Matter in the Acquisition of Financial Literacy,” Journal of Consumer Affairs 44, no. 2 (2010): 403–22, http://onlinelibrary.wiley.com/doi/10.1111/j.1745-6606.2010.01175.x/full; and Laurent Calvent, John Campbell, and Paolo Sodini, “Measuring the Financial Sophistication of Households,” NBER Working Paper no. 14699, February 2009, National Bureau of Economic Research, Cambridge, MA, pp. 1–7, http://www.nber.org/papers/w14699.

- Felicia Smith, “Madoff Ponzi Scheme Exposes ‘The Myth of the Sophisticated Investor,’” University of Baltimore Law Review 40 (2010): 215.

- Despite claims to the contrary, few would think that spending $12,000 to $223,000 for a purse—even the famously exclusive Hermès Birkin—is a sound “investment.” See Colleen Kane, “Why a $223,000 Hermès Birkin Bag Might Actually Be a Good Investment,” Fortune, June 23, 2015, http://fortune.com/2015/06/23/hermes-birkin-investment.

- It is interesting to recall that an earlier iteration of Regulation D—Rule 242—defined “accredited investor” not by net worth but by the amount the investor intended to invest. This approach, if not ideal, is at least more rational—although it could also have the unintended effect of encouraging larger investments than the investor might otherwise make. Ultimately, however, it may not be possible to determine how much an investor plans to invest and therefore such a rule poses considerable implementation challenges.

- The Business and Human Rights Resource Centre, which tracks more than 7,000 companies online, is but one example, https://www.business-humanrights.org.

- Peter Edmonston, “Google’s I.P.O., Five Years Later,” New York Times, August 19, 2009, https://dealbook.nytimes.com/2009/08/19/googles-ipo-5-years-later.

- These interactions are not, of course, entirely unregulated. As in any interaction, the parties are bound by laws against fraud.