In the view of the American public, media, and politicians, the Organization of Petroleum Exporting Countries (OPEC) sets oil prices by adjusting the amount of crude oil its members produce. However, the geological and engineering realities of oil extraction, the inconclusive academic evidence on the relationship between OPEC production and oil prices, and the cheating on oil production quotas by OPEC members and lack of enforcement all indicate that OPEC is more a political club than an effective oil cartel.

In fact, three key members—Saudi Arabia, Kuwait, and the United Arab Emirates (UAE)—have oil production volatility similar to the United States over the past three decades. This implies that these three important and politically stable OPEC nations do not possess, or do not utilize, a unique short-term capability to alter their oil production to regulate oil prices.

Altogether, the evidence suggests that the attention paid to OPEC is mostly about political benefits to both OPEC members and Western leaders, not an actual ability to control the oil market. The OPEC members use their oil production as an international bargaining chip and the perception of influence over the West to gain domestic legitimacy. Western leaders are happy to reciprocate by using OPEC as a scapegoat for unpleasant oil supply or demand shocks. Based on this picture of OPEC, U.S. concerns about OPEC behavior are unfounded and legislative proposals to punish OPEC are misguided.

Introduction

There is perhaps no economic indicator more prominent in American politics than oil prices. When they rise, gasoline price hikes are advertised on street corners and felt by consumers at the pump. Plummeting prices lead to bankruptcies and layoffs and turn boomtowns in U.S. oil fields into ghost towns.

In the scramble to do something about shifting oil prices, the ire of the public, media, and politicians is frequently directed toward the Organization of Petroleum Exporting Countries (OPEC), which currently consists of 13 member nations that produce about 40 percent of the world’s crude oil (including Saudi Arabia, which alone accounts for about 13 percent). The available evidence, however, suggests that this ire is misplaced and that there is little reason for U.S. policymakers to concern themselves with OPEC production behavior.

The widespread perception of OPEC is that it is a cartel whose large share of global oil production endows it with an ability to regulate oil prices by adjusting the amount of oil it supplies (i.e., increasing the amount of oil that members produce to lower oil prices and decreasing the amount produced to raise prices). On the surface, OPEC members periodically meet to determine an overall production level, with different individual production amounts allocated to each country. And OPEC members are assumed to hold nearly all of the world’s “spare capacity,” which is idle oil production capacity that OPEC can quickly ramp up or down to control oil prices or to stabilize oil markets by offsetting fluctuations in the amount of oil supplied and demanded. Because of OPEC’s perceived influence over oil prices, the organization often receives the blame for unpleasant oil price shocks.

Last year, for example, OPEC and its allies (10 non-OPEC countries, including Russia, collectively known as OPEC+) angered U.S. politicians and commentators after deciding to cut oil production. In the summer of 2022, amid the war in Ukraine, oil prices rose to more than $120 per barrel, their highest inflation-adjusted price in nearly a decade, in spite of large increases in OPEC+ production targets during the first half of the year.1 Western leaders, including President Biden during a July visit to Saudi Arabia, urged further production increases. Instead, OPEC+ announced a two million barrel per day reduction in members’ targeted production levels as prices fell to a little more than $90 per barrel in October 2022.2

The move was seen as a snub to the United States and Biden and a decision by Saudi Arabia to align with Russia. Editorials in the Washington Post and Wall Street Journal criticized Biden, calling the situation a “failure” and “diplomatic humiliation,” while a New York Times opinion headline lamented that Russian president Vladimir Putin and Saudi crown prince Mohammed bin Salman were “laughing at us.”3 Saudi Arabia maintained that the decision was motivated purely by economics, but members of Congress introduced legislation to punish Saudi Arabia by ending arms sales and allowing lawsuits against OPEC for price fixing. The Biden administration said it would reevaluate the U.S.-Saudi relationship and that there would be “consequences.”4

Despite the uproar, the announced production cut had no obvious effect on oil prices. In May 2023, six months after the allocated reduction took effect, prices continued to decline to around $75 per barrel and OPEC+ implemented an additional cut of more than 1.6 million barrels per day.5

The whole affair raises questions about OPEC’s behavior and capabilities, and whether OPEC actions actually have any implications for U.S. policy. In fact, a deeper examination of the evidence uncovers significant reasons why U.S. decisionmakers should pay little attention to OPEC’s surface behavior. Geological and technical obstacles to quickly changing oil production rates, the mixed academic findings on OPEC collusion and market power, and the cheating and lack of enforcement on OPEC quotas by members all suggest that OPEC is more a political club than an effective oil cartel.

In fact, from 1993 to 2022 the production volatility of three key OPEC members, Saudi Arabia, Kuwait, and the United Arab Emirates—whose production levels are determined by monolithic nationalized oil companies—was rarely different from that of the United States and its decentralized oil industry.

But OPEC membership has less to do with controlling oil prices and more to do with geopolitical and domestic political benefits.6 The OPEC nations appear to use oil production as an international bargaining chip to provide the regimes with domestic legitimacy. Politicians in Western nations, including the United States, are more than happy to cooperate with the perceived role of OPEC in oil markets because it provides them with a convenient scapegoat. When oil prices skyrocket—an event that politicians cannot control—they respond by calling on OPEC members to change their oil production, thus effectively shifting the blame for the high prices.

If OPEC is a political club with limited influence on oil prices, then the level of attention paid to OPEC by the United States is counterproductive and specific proposals to punish OPEC are misguided. The benefits of OPEC membership are only conferred as long as the West acts as if OPEC has power. Thus, the best way to undermine OPEC would be for U.S. politicians to stop playing along with the theatrics.

Instead, American politicians frequently look for visible ways to confront OPEC, but such actions are risky and ill-considered. Legislation designed to directly punish OPEC nations, such as the No Oil Producing and Exporting Cartels (NOPEC) Act, a bill that would extend U.S. antitrust law to foreign countries and allow them to be sued in U.S. courts for oil price fixing, has a low probability of altering OPEC behavior—and little upside, if OPEC’s ability to control oil prices is, at best, limited or nonexistent. By targeting a specific group of countries or potentially opening up U.S. industries to similar accusations and lawsuits abroad, such directed legislation may have the potential downside of diplomatic blowback. Indirect actions, such as legislation that would punish Saudi Arabia and the United Arab Emirates for the recent production cuts by ending arms sales and removing U.S. troops and defenses systems, are similarly unlikely to achieve much.7 American policy toward OPEC nations and diplomatic decisions involving them, whether positive or negative, should be evaluated based on their own merits, separate from historic misunderstanding of OPEC’s behavior and capabilities.

The Origin of OPEC Misperceptions

The perception of OPEC today is largely a legacy of the oil crises of the 1970s and the 1973 Arab oil embargo. Gasoline shortages, rationing, and long lines at gas stations created an enduring impression of OPEC’s ability and willingness to use oil as a political weapon. According to economists, however, the collective memory misunderstands the causes of the crises and the efficacy of the embargo.

OPEC was founded in 1960 by Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela (joined over the next decade and a half by Qatar, Indonesia, Libya, the United Arab Emirates, Algeria, Nigeria, Ecuador, and Gabon). Initially, the organization functioned as a coalition of the oil-producing countries in their struggle for power with the oligopoly of vertically integrated multinational oil companies that controlled much of the world’s oil supply (the “Seven Sisters”: Anglo-Iranian Oil Company, Gulf Oil, Shell, Standard Oil of California, Standard Oil of New Jersey [Esso], Standard Oil of New York [Mobil], and Texaco).8 The Seven Sisters bought oil concessions through taxes and royalties based on a posted price per barrel of oil that they set unilaterally. The motivation for the founding of OPEC was the Seven Sisters’ decision to reduce the posted price, and for most of its first decade the organization’s main goal was to increase that price through negotiations with the multinational companies.

The posted price did not reflect the fundamental value of each barrel of oil. There was a large discrepancy between the revenues OPEC nations received and the market price that the Seven Sisters received.9 OPEC’s ultimate goal was to wrest control from the multinational oil companies, which it succeeded in doing in the early 1970s. In 1972, the Seven Sisters agreed to give OPEC members a 25 percent equity share in their private oil companies. In 1973, after negotiations between OPEC and the Seven Sisters broke down, OPEC asserted a four-fold increase in the posted price.10 And, over the course of the 1970s, most OPEC members nationalized their oil companies.

The most prominent display of the power shift was the 1973 oil embargo. In protest of U.S. support for Israel in the Yom Kippur War, the Organization of Arab Petroleum Exporting Countries (OAPEC), which included the Arab members of OPEC, announced a freeze on sales of oil to the United States and a large reduction in oil production.11 To many, this signified OPEC’s willingness to use the newfound control of their oil as a weapon against the West, and the subsequent oil crisis of 1973–1974 seemed to affirm the success of the embargo.

Economists, however, have concluded that the embargo had no effect because other importers simply resold some of their oil to the United States. In 1990, energy experts Thomas Lee, Ben Ball Jr., and Richard Tabor noted: “It was no more possible for OPEC to keep its oil out of U.S. supply lines than it was for the United States to keep its embargoed grain out of Soviet silos several years later. Simple rerouting through the international system circumvented the embargo. The significance of the embargo lay in its symbolism.”12

The United States did experience gasoline shortages at the time, and they are commonly attributed to the embargo. However, economists agree that the actual cause was the United States’ price controls on crude oil.13 Beginning in August 1971, President Richard Nixon froze all prices to control inflation. Over the next three years, the price controls for other goods were repealed while the controls on crude oil and petroleum products evolved into a system of complicated and counterproductive rules. The gasoline shortage arose because provisions that applied to the large vertically integrated oil companies prevented them from recouping the rising costs of crude imports if they refined the crude into final products. Because of the price controls, not reductions in OPEC supply or the Arab oil embargo, the large companies reduced their imports of crude and their sale of refined products to independent retail stations.14

As shown in Figure 1, oil prices shot up in 1973 and 1979, but the underlying cause of the increases had little to do with OPEC. Economists Christiane Baumeister and Lutz Kilian reviewed oil price shocks and concluded that the 1973–1974 shock was driven by growing demand for oil rather than reduced supply.15 Not only was the decrease in oil produced by the Arab nations not the cause of the crisis, but their decision to decrease their supply was also a reversal of an unusual increase in oil production earlier that year.

Likewise, Baumeister and Kilian have argued that the subsequent 1979–1980 oil crisis was also the result of increasing demand. Historically, this price shock has been attributed to a drop in oil supply caused by the Iranian revolution. Through the crisis, though, the overall level of OPEC production was mostly unchanged. Baumeister and Kilian concluded that the rising oil price was again caused by growing demand, mostly from a strong global economy and, perversely, partly owing to a scramble to expand oil inventories in expectation of an oil shortage caused by the revolution. Gasoline shortages and lines in the United States were once more caused by government price controls.

Although the 1970s oil crises defined the U.S. perspective of OPEC, the organization’s own impression of its ability to control oil price, and the consequences, is informed by its experience in the 1980s. After taking control of their oil concessions from the Seven Sisters, OPEC adopted essentially the same price-setting system of the international oil companies. They administered an oil price and defended this price by adjusting oil production levels.

In the early 1980s, global oil demand stagnated while non-OPEC supply increased. To maintain high oil prices, OPEC began reducing production. As shown in Figure 2, the tradeoff was a sharp decline in OPEC’s share of the world oil market. In 1973, OPEC produced 58 percent of the world’s crude oil, but by 1985 this share had sunk to 28 percent.16 (And OPEC’s share of world oil exports fell from 71 percent in 1980 to 48 percent in 1985.)17 The decline was partially caused by political events, such as the Iran-Iraq War beginning in 1980. But the largest factor was the attempt to keep prices high.

The penalties of OPEC supply adjustments were not felt uniformly despite the introduction of the quota system in 1982 to allocate production changes across the OPEC members. Total OPEC oil production peaked in 1977 shortly before the Iranian revolution. Between 1977 and 1985, Saudi production declined by about 60 percent, while the rest of OPEC’s production declined by 40 percent.18 Along with the decrease in market share, the production declines were ineffective in stopping the price slide. The experience led OPEC to abandon attempts to explicitly set oil prices and has made Saudi Arabia reluctant to unilaterally adjust oil production to affect oil prices.

The OPEC and Saudi oil supply began to recover as prices stabilized during the late 1980s and 1990s, although today OPEC’s market share is still substantially lower than the level it enjoyed in the 1970s. Since 1993, OPEC’s total share of world oil production has hovered around 40 percent.

The level of OPEC production has also steadily increased, albeit slowly. The total OPEC and Saudi production did not consistently surpass their 1977 levels until 2004 and 2011, respectively. In 2019, before the start of the COVID-19 pandemic, the total OPEC and Saudi production was roughly 7 and 8 percent higher than in 1977, respectively, while the total non-OPEC production had more than doubled in the same period.19

Since the 1980s, OPEC membership has changed as countries have left (Ecuador, Indonesia, and Qatar) and joined (Angola, Congo-Brazzaville, and Equatorial Guinea).20 And in 2016 OPEC and its non-OPEC allies created the informal OPEC+ coalition. At various times, such as during the Asian financial crisis of the late 1990s or the price war with U.S. shale producers in 2014, OPEC was again presumed to be adjusting production to manipulate oil prices.

What Can Oil Producers (OPEC) Do?

Popular discourse about OPEC emphasizes quota announcements and market power. Allegedly, OPEC members, especially Saudi Arabia, can decrease or increase oil production in the short term as easily as one would vary the water flow from a spigot. However, this conception is inaccurate because it ignores geological and engineering constraints on the production of oil.

Featured Media

Even if oil producers cannot increase and decrease oil production easily in the short run, the evidence suggests that OPEC nations could invest more money and produce more oil in the long run. They do not do this because the nationalized oil companies lack adequate market incentive; their profits are taken by governments and used for social and military spending. And because Middle East producers have low average costs, investment in spare capacity would increase the incentives for hostile takeover through revolutions or coups of the oil fields and the economic rents they provide.

Constraints on Production at the Oil Well and Reservoir Level

An oil reservoir is a formation of porous rock where oil has accumulated and is trapped by surrounding nonporous rock. The oil is extracted by drilling into the reservoir and allowing it to flow to the surface, which is initially driven by natural pressure and then forced to the surface through artificial methods such as pumping or injecting water or gas (such as carbon dioxide) into the reservoir.21

Petroleum engineers consider numerous factors, including the oil’s viscosity, the permeability of the rock, and the natural reservoir pressure, when they plan reservoir development. Oil wells and reservoirs follow a typical production path: the production rate peaks early, plateaus, and then declines because the reservoir pressure drops as oil is extracted (this is known as the “decline curve”). The rate of decline depends on geological factors and can be moderated through the use of technology (e.g., pumping, injecting water or gas, and enhanced oil recovery techniques) but ultimately cannot be prevented.22 Because production from individual oil wells and reservoirs declines, simply maintaining a constant rate of oil production requires the drilling of additional wells and the development of new reservoirs, and increasing the rate requires even more drilling and development.

Furthermore, although technology can sometimes be used to temporarily increase production, prolong an oil field’s production plateau phase, or moderate the decline, it comes with additional investment and involves temporal tradeoffs. For example, maintaining a field’s plateau production level for longer typically leads to a higher rate of decline when the plateau phase eventually ends.23 One extreme example of the tradeoffs is Mexico’s offshore Cantarell field. As the production rate of Cantarell began to decline in the 1990s, Pemex, Mexico’s state-owned oil company, invested in a nitrogen injection project to maintain the reservoir pressure. This brought the field’s production up to a peak of more than two million barrels per day in 2004, making it the second-most productive field in the world.24 Production then crashed, reaching an annual decline rate of nearly 14 percent. Recent Pemex reports put the field’s production rate at 160,000 barrels per day, less than 8 percent of its peak.25

Most reservoirs are also “rate-sensitive,” meaning the production rate affects the ultimate amount of oil extracted.26 Drilling too many wells or allowing wells to produce at too high a rate can cause a quick drop in reservoir pressure, causing some of the oil to be trapped in the reservoir. And drilling too few wells also can reduce output because of friction in the reservoir.27 Petroleum engineers calculate how many wells they should drill and the production rate of the wells in order to maximize the amount of oil extracted over the lifetime of the reservoir.

The costs of oil production are largely fixed: the initial capital costs of exploration and the development of reservoirs. Once wells are drilled, the marginal operating costs are very low, typically much lower than the price of oil. Thus, most wells produce oil at a rate that maximizes the lifetime output of the reservoir regardless of changes in price.28 In other words, in most cases, oil production decisions for existing wells are a binary choice between operating or ceasing production entirely rather than increasing or decreasing their output.29

Ceasing production (“shutting in”) involves plugging a well with thick mud and cement. Restarting production requires a drilling rig to remove the cement and pump out the mud. And there is a risk that once production is stopped, the porous rock containing the oil will be clogged.30 A restarted well may not return to the same level of production that it once had and it may not restart at all.

Finally, not all crude oil is created equal. Different oils from different reservoirs and fields have varying densities and sulfur contents. Refineries are configured with specific crude sources in mind, considering both dimensions. Any investment into new oil wells or restarting of shut-in wells requires anticipating the quality of oil that will be extracted and where and how it will be refined.31

Thus, production expansion requires substantial planning and management. In general, growing production requires investment in new wells and/or reservoirs rather than increasing the output of existing wells. And that expansion takes time. For example, a Saudi capacity expansion of one million barrels per day took four years, from 2005 to 2009.32

What about Spare Capacity?

So, oil production from existing wells cannot be easily increased and investment in new capacity takes time. Do producers invest in new capacity ahead of time so that it can be activated quickly when positive demand shocks occur? Spare capacity has various definitions but, in general, is the difference between a maximum amount of oil production that can be brought online relatively quickly and then sustained for some period, and the current oil production level. The U.S. Energy Information Administration (EIA) defines spare capacity “as the volume of production that can be brought on within 30 days and sustained for at least 90 days.”33 Saudi Aramco defines its maximum sustainable capacity as “the average maximum number of barrels per day of crude oil that can be produced for one year during any future planning period … after being given three months to make operational adjustments.”34

OPEC, especially Saudi Arabia, had spare capacity in the 1980s and 1990s, but it was largely the result of happenstance, not policy choices. Declining oil demand and concurrent increases in non-OPEC supply in the 1980s created a large amount of idle OPEC capacity.35 As oil demand rebounded and the growth in non-OPEC supply slowed in the 1990s, OPEC’s spare capacity eroded, culminating in a real, binding short-run supply constraint from 2004 to 2008 caused primarily by rapidly increasing demand from China and India.36 Since then, there has been little excess capacity.

The EIA data suggest that most OPEC nations seem to operate at or near capacity except during periods of political turmoil.37 Table 1 presents the average capacity utilization (oil production as a percentage of the EIA-estimated total production capacity) from 2003 to 2022 of nine core OPEC members (nations that were members for the entire period). While Saudi Arabia on average utilized 84 percent of its capacity, OPEC as a whole averaged a utilization rate of roughly 91 percent; OPEC excluding Saudi Arabia averaged nearly 96 percent, and OPEC excluding Saudi Arabia, Kuwait, and the United Arab Emirates averaged 98.5 percent. Much of the underutilization occurred during the historic drop in world oil demand caused by the COVID-19 pandemic beginning in 2020. During the pre-COVID-19 period of 2003–2019, the average capacity utilization of OPEC increased to roughly 92 percent, while the utilization of OPEC excluding Saudi Arabia, Kuwait, and the United Arab Emirates was nearly 100 percent.

Why is spare capacity so scarce? It is expensive. And as the Saudi 2005–2009 capacity expansion suggests, it takes time to develop. But equally important is that if spare capacity existed in the politically unstable Middle East, the incentives for a military takeover of that capacity would increase. According to economists Robert Cairns and Enrique Calfucura, “having excessive capacity may not be prudent.… Making the industry vulnerable to a relatively easy and quick take-over, with overly high levels of wealth in developed assets providing overly rich net cash flows, may raise the immediate rewards to revolution.”38

Could Saudi Arabia Produce More and, If So, Why Doesn’t It?

The academic consensus is that Saudi Arabia is the low-cost producer in the world and that its production rate relative to its oil reserves is low.39 Saudi Arabia has very low average costs because it produces so much oil from so few wells. In 2017, for example, the United States produced roughly 8.9 million barrels of oil per day from about 440,000 oil wells (as well as associated oil production from an additional 560,000 natural gas wells). On average, each oil well produced 18 barrels of oil per day.40 The same year, Saudi Arabia produced 1.7 million more barrels per day than the United States from only 3,648 wells, implying an average daily production rate of 2,900 barrels per day per well.41

Why doesn’t Saudi Arabia invest more to increase output? Saudi, and OPEC overall, underdevelopment of oil fields is sometimes viewed, in and of itself, as evidence of collusion. Considering the constraints on increasing and decreasing production and the difficulty in convincing countries to leave expensive existing capacity idle, the argument is that OPEC holds back oil supplies by getting its members to underinvest in capacity relative to the amount of reserves they hold.42 Compared to non-OPEC nations, OPEC members seem to deplete their reserves at a slower rate.43 One analysis found that OPEC membership was associated with lower depletion rates, but when other factors were included, such as a country’s investment risk and financial strength, there was no statistical difference between expected OPEC and non-OPEC depletion rates.44 In other words, differences in how quickly OPEC nations deplete their oil reserves are explained by factors unrelated to their OPEC membership.

Investment necessary to increase production capacity is large and irreversible. With uncertain projections of future oil demand, the risk of optimistic forecasts leading to overinvestment is that the high capital costs will not be recouped as oil prices decline. On the other hand, underinvestment is partially hedged by the fact that forgone oil revenues are offset by higher oil prices in an undersupplied market. Thus, there is an inherent incentive for conservative investment decisions.45

There are additionally competing demands for the profits of national oil companies in OPEC member countries, including Saudi Arabia, which rely on their oil revenues to fund most of their government spending. Although Saudi Aramco is one of the most profitable companies in the world, most of its earnings go directly to the Saudi government through high income taxes (roughly 50 percent of profits); royalty payments (20–50 percent of revenue according to a sliding scale based on oil price); and dividends.46 One estimate claims that 93 percent of Aramco profits have been paid to the government in taxes and dividends, leaving little behind for investment into increasing capacity.47

Because Saudi Arabia does not have open capital markets, additional investment would come from the Ministry of Finance and compete with other domestic political considerations, such as high levels of social and military spending. Saudi citizens are supported by the government in a variety of ways, including many high-paying government jobs, low taxes, welfare programs, and subsidies for energy and water.

The government has recently begun a program to diversify the Saudi economy to move it away from reliance on oil revenues and to reduce budget deficits by increasing taxes and cutting subsidies.48 Despite these efforts, high government spending persists, and to offset the burden of these reforms the government created a new welfare program to give cash transfers to roughly half the population of Saudi Arabia.49

The International Monetary Fund estimates the fiscal break-even price—the price of oil required for a nation to cover its spending needs each year—for oil-exporting countries, including Saudi Arabia. From 2018 to 2022, the average fiscal break-even price for Saudi Arabia was roughly $83 per barrel, while the average Brent oil spot price (a benchmark used in pricing oil) was $70 per barrel.50 The high break-even price is driven by the social programs and military spending and demonstrates the high demand for oil revenue for purposes other than expanding oil production.

What Does OPEC Do?

There are constraints on the rapid change of oil production and long-run investment in OPEC oil fields’ capacity. The important question for the United States is, given these constraints, how does OPEC behave and how does its behavior affect oil prices?

A review of OPEC quotas and production provides reason to be skeptical of OPEC’s effectiveness as a price-setting cartel. Academic research does not strongly support the view that OPEC quotas determine production and prices. In our own evaluation of OPEC quotas we conclude that members’ production exceeded their quotas nearly 80 percent of the time and, on average, members adjusted production by less than a third of the allocated reductions or increases. Additionally, for the last 30 years the short-run variation of the oil production of three of the most stable OPEC members (Saudi Arabia, Kuwait, and the United Arab Emirates) has been similar to that of the United States.

Evaluations of OPEC Behavior

Academic research on the behavior of OPEC (i.e., whether it acts competitively or as a cartel) and the existence and magnitude of its ability to influence oil prices (as opposed to OPEC production decisions being based on exogenously set oil prices) has been inconclusive.51 The results depend on the period studied.52 For example, in a 2005 paper, economist James Smith argued:

Much of the evidence that has been cited regarding OPEC’s behavior is mutually consistent with a wide range of apparently conflicting models. This lack of conclusive and systematic evidence is especially remarkable in light of the pervasive view (held by laymen and experts alike) that OPEC does indeed engage in collusive behavior.53

He contends that the empirical literature on OPEC suffered from low statistical power, making it difficult to distinguish between competitive and collusive behavior. His own analysis of OPEC behavior from 1973 through 2001 concludes that it falls somewhere between perfectly competitive and perfectly collusive. (He argues that it is a “bureaucratic syndicate,” a cartel impaired by the costs of coming to agreement on and enforcing production levels, with its position on the spectrum of perfect competition to perfect collusion dependent on the magnitude of these costs.)

Robert Kaufmann and colleagues examine quarterly data on OPEC capacity utilization, quotas, and cheating from 1986 to 2000 and find that changes in OPEC production cause changes in oil prices.54 However, an extension of their analysis using monthly data and broadening the time span to 2006 was unable to confirm the original finding of a strong influence of OPEC production on prices.55 Additional research by Kaufmann and colleagues investigating the relationship between OPEC production and quotas and oil prices found inconsistent results: OPEC quotas do have a measurable effect on production, suggesting that there is some degree of cooperation among members, but that price also has a positive effect on OPEC production, implying that members are acting competitively.56

Because OPEC (and the oil market more broadly) has evolved over time, the research most applicable to questions of OPEC’s present role should ask whether OPEC behavior has changed—especially during the 1970–1980 period and subsequent decades.57 Vincent Brémond, Emmanuel Hache, and Valérie Mignon investigate the relationship between OPEC production and oil price in five subperiods between 1973 and 2009.58 OPEC production is found to affect oil prices in only one of the subperiods, May 1986 to February 1993. Conversely, they find that OPEC production is responsive to oil prices in most other periods. Other research has also found that OPEC alternates between cooperative and noncooperative behavior or that, although OPEC may once have had market power, it has diminished over time.59

Khalid Kisswani examines OPEC production from 1994 to 2014 and finds no evidence of cooperation between members.60 And the data indicate that not only does OPEC not set oil prices, but its production instead responds to externally set oil prices. An analysis of the effect of OPEC+ on prices between 2017 and early 2020 does find an effect, but it is modest: without OPEC+ production cuts the price of oil would have been $4 (6 percent) lower than it was.61

Evaluations of behavior are mixed. At most, OPEC seems to be an imperfect cartel that is subject to costs related to appeasing its members and external constraints.62 Evidence of OPEC collusion and its ability to set prices is based mostly on OPEC behavior of the 1970s and 1980s. Recent empirical research suggests that if OPEC once exhibited cartel behavior, it has not done so in the last 30 years.

OPEC’s Quotas and Cheating

Since 1982, OPEC’s alleged method of coordination is to set production allocations, or quotas, for each member. The quotas are set at OPEC meetings, typically a few times a year—although they were set roughly monthly during the COVID-19 pandemic.63 The process by which the quotas are determined, and the factors considered, are opaque, but some evidence suggests that production allocations are linked to each member’s production capacity.64

There are significant incentives for members to cheat on their quotas. OPEC nations are highly reliant on oil revenues, and producing more oil would allow them to earn more revenue, especially when oil prices are high. There is little OPEC can do to stop members from cheating: it has no system to monitor oil production by its members and no established mechanism to enforce the production allocations.65 While Saudi Arabia is traditionally seen as OPEC’s enforcer, its only means to punish cheating by other members is to engage in a price war, flooding the world oil market and undercutting its own, and the rest of OPEC’s, oil revenues. At a few times—namely, the mid-1980s and late 1990s—Saudi Arabia did seem willing to punish excessive cheating, but neither Saudi Arabia nor other OPEC members have the ability or willingness to systemically enforce production allocations.66

Cheating on the quotas is common among OPEC members, although the degree to which the members cheat is not homogenous, and when and why they cheat is not obvious.67 Table 2 presents the average monthly difference between production allocations and actual production in terms of both thousands of barrels per day (mb/d) and percentage of the quota. The data cover two periods: January 1993–October 2007 and January 2017–December 2022 (from November 2007 to December 2016, OPEC published its overall production targets but did not release individual member allocations).

During the earlier period, all the included members of OPEC produced more than their quotas on average. And the cheating was frequent and large: members’ production exceeded their quotas nearly 80 percent of the time, exceeded their quotas by more than 5 percent nearly 45 percent of the time, and exceeded their quota by more than 10 percent nearly 30 percent of the time.

Along with substantial differences between the level of quotas and production, there was also limited adherence to changes in allocated production. The average compliance rate (i.e., the actual production change as a percentage of the change in allocated production in the month the new quota took effect) was 29 percent. OPEC members adjusted their production by less than a third of the prescribed cuts or increases.68

At first glance, the more recent 2017–2022 period suggests a greater level of adherence to the quotas. However, much of this can be explained by the historic drop in demand for oil caused by the COVID-19 pandemic. The low prices reduced members’ incentives to cheat on their quotas. And the quotas did not constrain some members’ behavior because they exceeded the countries’ actual production capacity. Out of the 11 OPEC members, 3 had quotas that exceeded their total production capacity for more than half of the months included and another 2 exceeded capacity more than two-fifths of the time. The 6 countries that had quotas below their capacity for the large majority of this period produced more than their quota 66 percent of the time, only slightly lower than the overall OPEC average of 77 percent during the 1993–2007 period.

Table 2 also includes the 5 largest of the 10 non-OPEC countries that constitute the expanded OPEC+ coalition. Starting in late 2016, OPEC has coordinated with these nations and instituted voluntary production allocations for both the OPEC and non-OPEC members. While this would nominally give OPEC more market power, especially through cooperation with Russia, one of the world’s largest oil producers, the data suggest minimal adherence by the non-OPEC allies. From 2017 to 2022, these five nations were more likely to overproduce their quotas and had lower levels of compliance.

Thus, cheating by OPEC members is rampant and, crucially, there is little compliance with changes in production levels. Even if a certain amount of cheating were expected, the fact that there is little attempt to adhere to the size of production cuts and increases undermines any attempt by OPEC to influence oil prices through concerted changes in the amount of oil that member countries supply. Additionally, for extended periods, some members have no specific production allocations because of domestic turmoil, war, or sanctions.69 For example, Iraq had no quota from 1998 until at least 2007, Libya has not had a quota since 2011, and Iran and Venezuela have not had quotas since 2019.

If there has been only limited compliance with the quotas, what purpose do they serve? One theory is that OPEC uses its production announcements as a signal to financial investors to indirectly control oil prices. Available research into this theory has so far had mixed results and suggests that, at most, the effect of the announcements on price is limited.70

Alternatively, the announcement of quotas could be used to support the perception that OPEC adjusts oil production to control oil prices. If, as political scientist and international affairs scholar Jeff Colgan contends, OPEC is a political club that provides its members with domestic clout and international prestige, then the quotas are the pretense that grants OPEC its perceived power.71 In that case, the quotas would likely be based on the amount of oil that members intended to produce and OPEC nations would pay little attention to violating the quotas. For example, from 1981 to 2008, Venezuela’s level of oil production generally dictated its OPEC quota, not the other way around.72

OPEC Production Levels and Volatility

Although there is widespread cheating, some observers claim that OPEC utilizes its excess production capacity to adjust production levels to balance world oil markets and affect prices when it is advantageous. Conventional wisdom claims that OPEC (and especially Saudi Arabia) could increase supply when oil prices are high or decrease supply when they are declining.73

OPEC output does vary, but most large swings are a result of political turmoil (e.g., wars in Iraq and civil unrest in Libya, Nigeria, and Venezuela) rather than output management. Over the past several decades, the most politically stable nations, which also have the highest estimated levels of excess production capacity, have had a production variation that is similar to the production variation in the United States.

Saudi Arabia, Kuwait, and the United Arab Emirates, relative to other OPEC nations, have been more domestically stable in recent history (excluding the Gulf War, which briefly brought Kuwait production to zero). They are also three of OPEC’s largest producers and contain almost all the excess capacity. From 2003 to 2022, in an average month the three members produced 55 percent of the total oil output and held 95 percent of the spare capacity. Saudi Arabia alone accounted for 35 percent of production and 75 percent of the excess capacity.74

Figure 3 shows these three nations’ month-to-month percentage change in production, with much larger swings in the 1973–1992 period. The 1993–2022 period has a much more consistent profile, with monthly production changes mostly close to zero and occasional spikes, which looks similar to the United States, which is included in the figure.

In Table 3 we compare month-to-month and three-month sustained production changes (based on the EIA’s definition of spare capacity) of Saudi Arabia, Kuwait, and the United Arab Emirates with the United States, using a statistical test to determine if they are different.75 If these OPEC nations alter their production more than the United States, this should be reflected in a larger variance of either of these measures.76

The variances of Saudi, Kuwaiti, and Emirati oil production were much higher than the United States from 1973 to 2022, but the difference stems from the more distant history of the 1970s and 1980s (and, especially for Kuwait, the 1991 Gulf War).77 After 1992 the variances of both metrics cannot be statistically distinguished from the U.S. variance. The exception is the one-month production change of Kuwait, which has a statistically different variance from the United States, but also one that is smaller; its production profile was less volatile.78

Given the conventional wisdom of exceptional, rapid Saudi (and OPEC) production change, these results are surprising. Furthermore, the dissimilarity between the structures of the United States’ and Saudi, Kuwaiti, and Emirati oil industries would seem to suggest different short-term production profiles. For example, except for the amount of oil they produce, the oil industries of the United States and Saudi Arabia are quite different. Saudi production is mostly low-cost, conventional extraction from large reservoirs with long investment cycles, whereas U.S. production is high-cost extraction from tight oil formations with short investment cycles.

However, the profiles of production change suggest that, even with these structural differences, Saudi Arabia, Kuwait, and the United Arab Emirates do not behave differently from the aggregate decisions of U.S. producers.

Conclusion

So, is OPEC an effective cartel? Given the short- and long-term production constraints for oil, mixed academic evidence on OPEC collusion, our own evidence that neither OPEC-announced quota levels nor changes in quotas seem to bind, and variation in OPEC output after 1992 that resembles the United States, it does not seem so. So, what should the United States do about OPEC? The answer, in brief, is nothing.

If OPEC is a political club with no real ability to regulate oil prices, then the geopolitical and domestic benefits of OPEC exist only because its members and outsiders act as if it has power. The quickest way to undermine those benefits would be for U.S. politicians and media to stop playing along. As Jeff Colgan argues:

If [OPEC] ceased to exist tomorrow, not much about the global oil market would change. Its member states would go on producing about as much oil as they did before. The significance of OPEC is not, therefore, in economics but in politics. It operates as a “rational myth”—a fiction that its members help preserve because it increases their status and prestige in international politics. Western policymakers would do well to look past that myth.79

Perhaps, contrary to our findings, OPEC occasionally does have the ability to control its members’ output and affect oil prices, even though it is difficult to identify this ability in OPEC production profiles or in academic research into the relationship between OPEC production and oil prices. In that case, the prudent response is still to do nothing. Any U.S. response would require knowledge of when and what OPEC is doing, as it would be pointless to lash out at OPEC in times when it has no control over members’ output. OPEC’s behavior in real time can be enigmatic, especially considering that, even with the benefit of hindsight, research on OPEC performance is inconclusive.

When OPEC did explicitly adjust short-term output, the results were counterproductive. The last time OPEC explicitly set an oil price and attempted to defend it through output adjustments was in the 1980s, and it abandoned the effort after losing considerable market share. More recently, in 2014, OPEC, especially Saudi Arabia, maintained its production level even as oil prices collapsed. Some believe this was an attempt to discipline higher-cost U.S. shale producers by allowing prices to decline.80 But technological innovation allowed U.S. producers to lower break-even prices, so the decline in shale output was less than predicted.81

Thus, whether OPEC is simply a political club or occasionally attempts to set oil prices, the best course of action is to do nothing. Even in the extreme cases when OPEC seems to overtly try to exercise market power, it is not successful.

But instead of doing nothing, U.S. politicians have typically responded to OPEC actions by proposing to punish OPEC members, especially Saudi Arabia. The most direct suggestion is a long-running legislative proposal to extend U.S. antitrust law to OPEC. First formally proposed in 2000, and most recently reintroduced in 2021, the No Oil Producing and Exporting Cartels Act would eliminate OPEC nations’ sovereign immunity and allow their national oil companies to be sued under the Sherman Antitrust Act.82 It is not clear that the act would have any effect, considering that U.S. federal court judgments against OPEC members or their national oil companies may be unenforceable. Despite the possibility of no effect on OPEC actions, the act could aggravate OPEC nations and lead to diplomatic blowback.83

Other proposals focus on U.S. military aid to Saudi Arabia and other OPEC nations. During the furor following OPEC+’s announced cuts in October 2022, politicians suggested punishment by removing U.S. troops and weapon systems from Saudi Arabia and the United Arab Emirates and ending arms sales to those nations.84 There may be reasons why such measures are warranted, but considering the limited evidence of OPEC control over oil prices, they should be evaluated separately from concerns about OPEC.

In fact, the NOPEC Act and threats to reduce military aid are likely just more posturing by politicians, who pretend to do something about high oil prices and then divert the blame to OPEC. Similarly, President Biden’s vow after the October 2022 cut announcement that there would be “consequences” was quietly walked back a couple of months later, implying that the whole episode will prove to be another example of OPEC theater.85 OPEC members bluster to their citizens with the appearance of controlling the West, while Western countries reciprocate by using OPEC as a scapegoat for unpleasant oil supply or demand shocks. The most effective way to undermine OPEC would be for Western leaders to stop paying attention to—and playing along with—the theatrics.

Appendix: Monthly Crude Oil Production Change by Country

Monthly crude oil production (including lease condensate) is taken from EIA International Energy Statistics for the nine largest nations with constant OPEC membership from January 1973 to December 2022 (Algeria, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, United Arab Emirates, and Venezuela).86 Included for comparison are nine non-OPEC oil-producing nations (Brazil, Canada, China, Kazakhstan, Mexico, Norway, Oman, Russia, and the United States) with recent monthly production of more than 1 million barrels per day. (EIA does not have production data for Brazil, Kazakhstan, Oman, and Russia until January 1993.)

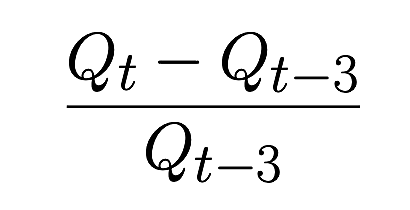

The monthly production change in percentage terms is calculated for each country, as well as the core OPEC (the nine OPEC nations included) and non-OPEC (all non-OPEC nations, not just the nine mentioned separately for comparison). The one-month production change is:

Where Qt is the level of production (in thousand barrels per day) in month t. We also calculate the three-month production change:

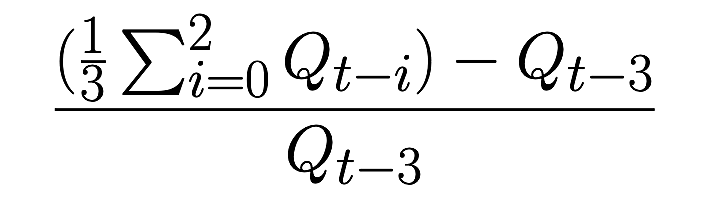

Although these metrics can demonstrate the production level changes in one- and three-month periods, most definitions of total capacity and spare capacity include a requirement that the production change is sustained. To consider this aspect, we include a metric based on EIA’s definition of spare capacity (the capacity that can be brought online in one month and sustained for three months). The three-month sustained production change is the average of three months’ production minus the production level in the preceding month:

The mean and variance for the nine core OPEC nations; the core OPEC nations excluding Saudi Arabia; the core nations excluding Saudi Arabia, Kuwait, and the United Arab Emirates; and for each individual country for different time spans are reported in Appendix Tables 1–3. Periods including data before 1993 universally have a much higher variance for OPEC nations.

Additionally, Appendix Table 4 presents the variance for Saudi Arabia, Kuwait, and the United Arab Emirates compared to the variance for the United States, including results of a statistical test of whether the variances are different. The test used is an F‑test of equality of two variances, and the results are denoted by *, **, and *** for the finding that the variance of these OPEC nations is different from the U.S. variance at 10, 5, and 1 percent confidence levels.

It is important to note that the variances, and therefore the F‑tests, are sensitive to the time period chosen. The 1993–2019 period is included to avoid the COVID-19 pandemic, which began in 2020. Since 1993, the U.S. production change series has much higher variance if 2008 is included because of substantial changes around the start of the 2008 global financial crisis. And Saudi Arabia had large production changes following a terrorist attack on Aramco oil processing facilities in September 2019. In general, time spans that include both or exclude both events have similar variances between the United States and Saudi Arabia, while series that include one or the other do not.

The only time span within which some of the OPEC nations have larger and statistically different variances is 1993–2007. The variance of the one-month production change of the United Arab Emirates is larger and statistically different during this period. This is because of exogenous events rather than conscious output management. Emirati offshore oil fields were offline for maintenance in November 2007 and returned to operation in December 2007.87 When these two months are excluded, the United Arab Emirates variance is not statistically different. Similarly, beginning the time series in 1993 captures the tail end of the recovery of Kuwaiti oil fields following the 1991 Gulf War. If the time series started slightly later (in October 1993) the variance of Kuwait’s three-month sustained production change series is not statistically different from that of the United States. However, the variance of the three-month production change is statistically different, albeit at the 10 percent confidence level.

We believe the longest, most complete time series is the best indicator of whether there is a systemic difference between the production volatilities of the United States and the OPEC members. Given the clear change in volatility between the pre–Gulf War period and since then, this is the 1993–2022 series.

Citation

Kemp, David, and Peter Van Doren. “Misperceptions of OPEC Capability and Behavior: Unmasking OPEC Theater,” Policy Analysis no. 963, Cato Institute, Washington, DC, November 2, 2023.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.