Virginia v. Sebelius

Learn more about Cato’s Amicus Briefs Program.

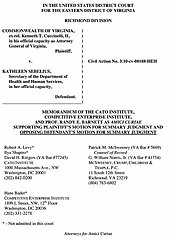

The legal battle against Obamacare continues. In June, a district court in Richmond denied the government’s motion to dismiss Virginia’s lawsuit (in opposition to which Cato filed a brief). Despite catcalls from congressmen and commentators alike, it seems that there is, after all, a cogent argument that Obamacare is unconstitutional! Having survived dismissal, both sides filed cross motions for summary judgment — meaning that no material facts are in dispute and each side believes it should win on the law. Supporting Virginia’s motion and opposing the government’s, Cato, joined by the Competitive Enterprise Institute and Georgetown law professor (and Cato senior fellow) Randy Barnett, expands in a new brief its argument that Congress has gone beyond its delegated powers in requiring that individuals purchase health insurance. Even the cases that have previously upheld expansive federal power do not justify the ability to mandate that individuals buy a product from a private business. Those cases still involved people that were doing something — growing wheat, running a hotel, cultivating medical marijuana. The individual mandate, however, asserts authority over citizens that have done nothing; they’re merely declining to purchase health insurance. This regulation of inactivity cannot find a constitutional warrant in either the Commerce Clause, the Necessary and Proper Clause, or Congress’s taxing power. Such legislation is not “necessary” to regulating interstate commerce in that it violates the Supreme Court’s distinction between economic activity (which often falls under congressional power as currently interpreted) and non-economic activity (which, to date, never has), it is not “proper” in that it commandeers citizens into an undesired economic transaction. Finally, the taxing power claim is a red herring: (a) neither the mandate nor the penalty for not complying with the mandate is a tax, and is not described as such anywhere in the legislation; (b) even if deemed a tax, it’s an unconstitutional one because it’s neither apportioned (if a direct tax) nor uniform (if an excise); (c) Congress cannot use the taxing power to enforce a regulation of commerce that is not authorized elsewhere in the Constitution.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.