Revolutionary extraction technologies have helped increase the supply of fossil fuels in the United States, driving down prices, spurring economic activity, and potentially reversing the longtime status of the United States as a net energy importer to a significant exporter. Impeding that transition are outdated federal regulations—in particular discretionary export licensing systems for natural gas and crude oil—that restrict exports, distort domestic energy prices, deter investment, and encourage graft. They also subvert some of the Obama administration stated policy objectives and could run afoul of U.S. international trade obligations.

Despite the potential economic windfall, opposition to exporting natural gas and crude oil has materialized among certain domestic consuming industries and environmental groups, causing the administration to delay any approvals on pending export-license applications. But there are compelling reasons to approve those applications and to overhaul our disjointed, anachronistic, export license systems to properly reflect the new energy landscape. This paper describes those reasons and provides a basic roadmap for reform.

The New American Energy Landscape

Fossil-fuel extraction technologies, such as hydraulic fracturing ("fracking") and horizontal drilling have revolutionized the U.S. energy market. According to the U.S. Energy Information Administration, domestic production of crude oil and natural gas has skyrocketed in recent years and is projected to stay at relatively high levels for decades, even assuming existing state and federal restrictions on production and transport.1 As summarized by economist Mark Perry, "U.S. oil production reached a 15-year high in 2012 with a yearly increase that was the largest in history, net oil imports fell to a 21-year low, and U.S. energy self-sufficiency rose to a 22-year high last year."2

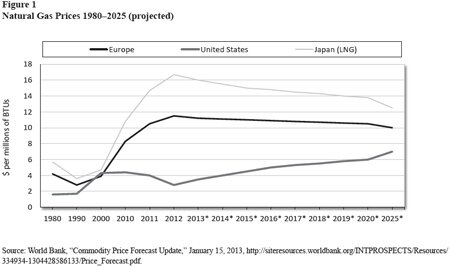

The production spike has driven down domestic gas and oil prices, creating a significant gap between U.S. and international market prices. As shown in the chart, natural gas prices in Japan, the world's largest liquid natural gas (LNG) consumer, were more than five times higher than U.S. prices in 2012, and European prices were three to four times higher.

The increase in domestic energy supplies and resulting decline in prices has been a boon to downstream industries, such as electricity generators and petrochemical producers that rely on fossil fuels for energy or feedstock. According to the Boston Consulting Group, low energy prices have contributed, and will continue to contribute, to an American "manufacturing renaissance" in terms of domestic employment and export competitiveness in these sectors.3

The resulting price differentials have U.S. energy producers positioned to become a global exporting powerhouse, and could reverse the United States's historic position as a net energy importer. According to a November 2012 report by the International Energy Agency, the United States could become a net exporter of natural gas by 2020 and will be "almost self-sufficient in energy, in net terms, by 2035."4 That same report estimates that the United States will become the world's largest oil producer by around 2020, causing North America to emerge as a net oil exporter by 2035.5

Fossil Fuel Export Restrictions and Pending Applications

It would be difficult for those market projections to materialize under the current regulatory environment. In particular, natural gas and crude oil exports continue to be governed by licensing systems adopted when the United States was a net energy importer and dependent on fossil fuels for energy production—a picture far different from the production, price, and trade realities that exist today.

The U.S. government regulates natural gas imports and exports under the Natural Gas Act of 1938 and its amendments. Under the current law, all natural gas exports must be authorized by the Department of Energy (DOE), and authorization will be granted unless exportation "will not be consistent with the public interest." Exports to free-trade-agreement (FTA) partner countries are deemed to be consistent with the public interest, and DOE must therefore grant license applications "without modification or delay" when the customer is in a country that is an FTA partner.

Exports to non-FTA partners are presumed to be in the public interest, but this presumption can be rebutted with evidence that the exports would be inconsistent with the public interest. Neither U.S. law nor agency practice establishes binding, objective criteria that DOE must apply when determining whether an export license application meets the public-interest requirement. Moreover, DOE has explained repeatedly that, while it has developed various criteria for evaluating an application, the agency retains complete discretion when deciding whether to grant a license. For example, in a December 2012 letter to U.S. Senator Ron Wyden (D-OR), DOE listed the criteria that it applies: (i) domestic need for the natural gas proposed for export; (ii) adequacy of domestic natural gas supply; (iii) U.S. energy security; (iv) impact on the U.S. economy (GDP), consumers, and industry, including impact on domestic natural gas prices; (v) job creation; (vi) U.S. balance of trade; (vii) international considerations; and (viii) environmental considerations. DOE reiterated, however, that the listed criteria "are not exclusive" and that "other issues" may be considered.6

To date, DOE has granted one long-term application to export domestically produced LNG to non-FTA countries—for Sabine Pass Liquefaction, LLC, in 2011. Sixteen other natural gas export license applications, dating back to 2010, remain pending.7 After the Sabine Pass approval, DOE undertook a two-part study to evaluate the cumulative economic impact of LNG exports. The Energy Information Administration (EIA) conducted the first part of the study, which examined the potential impact of additional natural gas exports on domestic energy consumption, production, and prices under several export scenarios.8 The second part of the study, conducted by the private economic consulting firm NERA and originally due before the November 2012 election, was issued on December 5, 2012.9 The NERA report assessed the potential macroeconomic impact of LNG exports. Neither the EIA report nor the NERA report examines the national security implications of potential gas export transactions.

Both reports have been placed in all 16 pending export license dockets. The DOE solicited, and has received, initial public comments on the study. Reply comments are due by February 25, 2013. The agency stated that it will only begin to make final decisions regarding the pending export applications when it has evaluated both the study and all comments. At that time, applications will be evaluated in the order of priority announced by DOE earlier this year.10

The federal government regulates exports of domestically produced crude oil pursuant to the Energy Policy and Conservation Act of 1975, which instituted an export licensing system intended to address "short supply" conditions in the United States. Under the current system, all U.S. exports of crude oil require a license from the Bureau of Industry and Security (BIS), an agency within the Department of Commerce.

The approval of crude oil export license applications by BIS will depend on whether the transaction meets certain listed criteria. According to the Export Administration Regulations (EAR) on short-supply controls, approval standards are divided among two categories of crude oil exports: (i) presumption of approval, and (ii) approval only in the "national interest."11 For the first category, BIS will approve export applications that satisfy one of several discrete conditions, including "exports to Canada for consumption or use therein."

For the second category, BIS will review applications on a case-by-case basis and "generally will approve such applications if BIS determines that the proposed export is consistent with the national interest and the purposes of the Energy Policy and Conservation Act [EPCA]." The agency retains discretion to approve or reject these applications, although the EAR notes that two types of exports "will be among those that BIS will determine to be in the national interest and consistent with the purposes of EPCA": (i) those with equivalent crude oil or other petroleum product imports, made under contracts that may be terminated if U.S. petroleum supplies are interrupted or seriously threatened, and where the applicant can demonstrate that, for compelling economic or technological reasons beyond his control, the crude oil "cannot reasonably be marketed in the United States"; or (ii) those involving temporary exports or exchanges that are consistent with various statutory exceptions.

According to an April 2012 Congressional Research Service report, few crude oil export license applications have been granted under the "national interest" exception, and none since 2000.12 The Financial Times reported in October 2012 that six companies have applied for export licenses for shipments to Canada and other countries. The BIS has not yet announced its decision on these applications, and the proceedings are confidential.13 Thus, similar to the export licensing system for natural gas, BIS has discretion to consider license applications for most crude oil exports under the "national interest" rule, and several pending applications have been delayed for months.

Policy Concerns Raised by the Current Licensing Systems

U.S. export licensing restrictions on natural gas and crude oil raise significant economic, legal and political concerns.

The current export restrictions create a host of economic problems. First, by depressing domestic prices and subjecting export approval to government discretion, the U.S. licensing systems retard domestic energy production, discourage investment in the oil and gas sectors, and destabilize the domestic energy market. Artificially low prices prevent producers from achieving a sustainable rate of return on the massive up-front costs required to drill and extract oil and gas, and investors lack any assurances under the discretionary licensing systems that domestic prices will not collapse when output increases. In fact, recent low domestic gas prices caused many U.S. energy companies to sell assets and shutter new projects.14 These same concerns affect the domestic crude oil market15 and have led the IEA to warn that the current export restrictions have put the "American oil boom" at risk.16

According to the EIA report commissioned by DOE, increased natural gas exports would lead to higher prices followed by increased domestic production.17 But prices are not expected to skyrocket, and consumers will continue to benefit from hypercompetitive fuel and feedstock supplies. Independent reports from the Brookings Institution and Deloitte project that permitting gas exports would lead to a small and gradual increase in domestic natural gas prices.18 Such predictability and consistency is good for the industry and the overall stability of the U.S. energy market—it would prevent boom and bust cycles of high/low prices and high/low production that hurt the U.S. economy and prevent companies from implementing long-term investment, production, and hiring strategies. The current situation—in which oil and gas export decisions are left the whims of federal regulators—has the opposite effect.

Second, restricting U.S. gas and oil exports could hurt the U.S. economy. Recent studies indicate that U.S. natural gas producers could earn up to $3 billion per year from exports.19 The Sabine Pass liquefaction facility—the lone DOE approval, thus far—is projected to create 30,000 to 50,000 new American jobs.

The export benefits would not be limited to energy producers, however. The NERA report found that LNG exports, even in unlimited quantities, would produce gains in real household income.

Beyond the economic problems, both export licensing systems raise serious concerns under global trade rules. First, the U.S. export licensing regimes for natural gas and crude oil likely violate U.S. obligations under the General Agreement on Tariffs and Trade (GATT). Under GATT Article XI:1, WTO Members are generally prohibited from imposing quantitative restrictions on imports and exports. Under Article XI and related WTO jurisprudence, "discretionary" licensing systems (i.e., those in which the administering authority has the freedom to grant or deny a license) and systems in which applications are delayed for several months constitute impermissible restrictions on export quantities.20 On the other hand, licensing systems in which approval is automatic and relatively quick (e.g., five days) have been found to be lawful.21

Based on these standards, both the U.S. natural gas and crude oil licensing systems appear to violate GATT Article XI:1.22 Each system provides the administering agency (DOE or BIS) with the discretion to grant or deny an export license based on subjective and nonbinding criteria (the "public interest" or "national interest" standards). Moreover, the pending export license applications have been delayed for several months (and, in a few cases, years). Both of these facts support findings of GATT violations.

One or both licensing systems might theoretically be defended under the national security exception of GATT Article XXI, which permits Members to impose WTO-inconsistent measures "which it considers necessary for the protection of its essential security interests ... taken in time of ... emergency in international relations." No panel has ever ruled on the national security exception, but the standard is subjective: the text refers to a measure which the WTO Member considers "essential" for its security interests. Thus, a WTO panel might defer to a Member's definition of what constitutes an "essential" security interest.

Given that crude oil exports are regulated under the same apparatus, and by the same agency (BIS), as other goods regulated for express national security purposes, the U.S. government might be able to successfully invoke GATT Article XXI to defend the system from allegations of WTO-inconsistency. However, it is unclear whether the U.S. government would want to establish international legal precedent on "essential" security measures for a relatively obscure export restriction that has been in place since 1975 (i.e., during periods that were arguably not times of "emergency in international relations").

These same limitations could apply to the 1930s-origin natural gas licensing system, as could several others. For example, the laws that govern the export of products that could have national security concerns do not appear to apply to natural gas. Gas exports are regulated by DOE, rather than BIS (which, as noted above, typically handles national-security-related export controls). Finally, economic, not security, issues appear to drive the "public interest" standard and DOE's application of it. Only one of the public-interest criteria (U.S. "energy security") could be considered to relate to national security, but the available legislative history of the original 1938 Act and the subsequent amendments do not indicate that the export licensing system was implemented for national security purposes.23 Also, both the reports informing DOE's decisions on the pending LNG export applications address only economic matters. Thus, the U.S. government could be even more hesitant to claim that the natural gas system is "essential" to the country's national security.24

Second, restrictive export licensing systems also raise potential concerns under global anti-subsidy disciplines. There is limited WTO jurisprudence on whether an "export restraint" that lowers domestic input prices for downstream manufacturers constitutes a "subsidy" as defined by the WTO Agreement on Subsidies and Countervailing Measures. The WTO Panel in U.S.—Export Restraints found that certain export measures did not meet the WTO's precise definition.25 However, the panel's ruling was specific to the measures at issue and was not appealed to the WTO Appellate Body, whose rulings have more precedential value. No other disputes have addressed this issue.

Moreover, the Panel ruling has not stopped national governments from imposing anti-subsidy measures (called "countervailing duties" or "CVDs") on downstream exports due to export restrictions on various upstream inputs. Most notably, the Department of Commerce has stated repeatedly that export restrictions are a type of "indirect subsidy."26 And DOC continues to treat them as such in new CVD investigations.27 Furthermore, the European Commission in January 2013 recommended the imposition of anti-subsidy duties on Chinese exports of organic coated steel, finding that the Chinese government provided the subsidies "mainly through export restrictions that artificially lower prices of rolled steel for domestic manufacturers."28

Thus, the crude oil and natural gas licensing systems might not only raise legal problems for the U.S. government, but could subject certain energy-intensive U.S exporters to anti-subsidy duties that negate the competitive price advantages created by the licensing systems.

Current policy is also at odds with other Obama administration policies. First, the restrictive export licensing systems undermine the National Export Initiative (NEI) and its goal of doubling U.S. exports between 2009 and 2014. Second, the administration's reticence with respect to fossil fuel exports stands in stark contrast to its full-throated advocacy of other energy exports, particularly renewables like bio fuels and solar panels. Indeed, the September 2010 White House report setting forth the NEI's priority recommendations calls for increased government support for renewable and nuclear energy exports—but never mentions oil or natural gas.29 A November 2012 follow-up report lauds the U.S. government's efforts to achieve these objectives, yet continues to ignore American fossil fuels, despite the massive increases in production and export potential that occurred between 2010 and 2012.30 Furthermore, increased fossil-fuel exports could actually spur domestic production of renewable energy through higher oil and gas prices. According to the EIA, the role of renewables in electricity generation would be "greater in a higher-gas-price environment."31

Third, the use of export restrictions to benefit downstream industries contradicts longstanding U.S. policy with respect to export restraints and illegal subsidies. The Commerce Department repeatedly has imposed anti-subsidy duties on imports due to countervail subsidies resulting from foreign export restrictions on upstream inputs. The administration's embrace of similar restrictions would not only be hypocritical, but would also expose U.S. exports of energy-intensive products (e.g., fertilizer) to "copycat" duties in key foreign markets.32

Fourth, the U.S. government has long opposed restrictive and opaque export licensing systems in WTO negotiations and dispute settlement. For example, in China—Raw Materials (DS394), the U.S. government challenged China's "non-automatic" export licensing systems for various raw materials as impermissible restrictions on exportation in violation of GATT Article XI.33 In March 2009, the United States and several other countries submitted a proposal to the WTO Negotiating Group on Market Access calling for increased disciplines on Members' use of export licensing.34 The current U.S. export licensing regulations for oil and gas contradict these positions and undermine laudable efforts to rein in such restrictions globally.

Conclusion

If the president really wants to develop America's vast energy resources, grow the U.S. economy, restore some coherence to U.S. trade and energy policy, and avoid potentially embarrassing trade conflicts, he should order the immediate approval of all pending license applications and then pursue, with Congress, an overhaul of our archaic licensing systems. Specifically, the White House and Congress should take the following steps to improve and modernize U.S. energy trade policy:

- First, DOE and BIS should immediately approve the pending export-license applications for natural gas and crude oil, and approve all future applications on a transparent, expedited basis. Such actions would bolster investment, production, and employment in the oil and gas sector, benefit the overall U.S. economy, avoid the myriad policy and legal problems raised by the current system, and gain a rare moment of bipartisan praise from Congress and the general public. Although some people question whether natural gas exports will benefit the U.S. economy in the long-term, clearly the people best situated to make that determination are those risking billions of dollars of their own money, not heavily lobbied government officials in Washington, D.C. Moreover, rejecting or delaying the pending applications could further undermine public support for our political system, as the government would likely be seen as subsidizing certain politically connected producers or coddling environmentalists at the expense of upstream energy producers, their workers, and the U.S. economy more broadly.

- Second, the White House should work with Congress this year to consolidate and overhaul the U.S. export licensing regime for energy products. All energy exports—fossil fuels, renewables, nuclear, etc.—should be regulated by a single agency and subject to a transparent licensing system whereby applications are automatically approved within a finite period, unless the agency can demonstrate a tangible and immediate national security risk. These changes would create a more stable and secure domestic energy market and get the federal government out of the business of picking winners and losers therein. They also would conform U.S. trade policy to today's energy and economic realities and to global trade and subsidy rules.

Notes

1. AEO2013 Early Release Overview, U.S. Energy Information Administration, December 5, 2012, http://www.eia.gov/forecasts/aeo/er/index.cfm.

2. Mark Perry, "Energy Facts of the Day on America's Energy Bonanza," AEIdeas, January 28, 2013, http://www.aei-ideas.org/2013/01/energy-facts-of-the-day-on-americas-en….

3. Boston Consulting Group, "Rising U.S. Exports—Plus Reshoring—Could Help Create up to 5 Million Jobs by 2020," press release, September 21, 2012, http://www.bcg.com/media/pressre leasedetails.aspx?id=tcm:12-116389.

4. International Energy Agency, "North America Leads Shift in Global Energy Balance, IEA Says in Latest World Energy Outlook," press release, November 12, 2012, http://www.iea.org/newsroomandevents/pressreleases/2012/november/name,3….

5. International Energy Agency, "World Energy Outlook 2012 Executive Summary," November 2012, (http://www.iea.org/publi cations/freepublications/publication/English.pdf.

6. "DOE Lists Criteria Used to Determine 'Public Interest' for LNG Export Applications for Non-FTA Countries," Inside U.S. Trade, January 15, 2013, http://insidetrade.com/201301152421544/WTO-Documents/Text-Document/doe-… (subscription).

7. U.S. Department of Energy, "Applications Received by DOE/FE to Export Domestically Produced LNG from the Lower-48 States (as of January 11, 2013)," http://www.fossil.energy.gov/programs/gasregulation/reports/summary_lng….

8. U.S. Energy Information Administration, "Effect of Increased Natural Gas Exports on Domestic Energy Markets," January 2012, http://www.eia.gov/analysis/requests/fe/pdf/fe_lng.pdf ("EIA Report").9. NERA Economic Consulting, "Macroeconomic Impacts of LNG Exports from the United States," December 3, 2012, http://www.fossil.energy.gov/programs/gasregulation/reports/nera_lng_re….

10. U.S. Department of Energy, "Pending Long-Term Applications to Export LNG to Non-FTA Countries–Listed in Order DOE Will Commence Processing," http://fossil.energy.gov/programs/gasregu lation/publications/export_applications_order_of_precedence.pdf.

11.Bureau of Industry and Security, "Export Administration Regulations," July 11, 2011, http://www.bis.doc.gov/policiesand regulations/ear/754.pdf.

12. Neelesh Nerurkar, "U.S. Oil Imports and Exports," Congressional Research Service, April 4, 2012, http://www.fas.org/sgp/crs/misc/R42465.pdf.

13. Gregory Meyer and Ed Crooks, "Oil groups sent to export U.S. crude," Financial Times, October 11, 2012, http://www.ft.com/intl/cms/s/0/94933124-1322-11e2-ac28-00144feabdc0.htm….

14. Adam Wilmoth, "Natural Gas Price Drops Hurt Oklahoma Companies," Oklahoman, January 4, 2013, http://newsok.com/nat ural-gas-price-drops-hurt-oklahoma-companies/article/3742882.

15. Christopher Swann, "Why Doesn't the United States Export More Oil?" Slate, (October 18, 2012, http://www.slate.com/blogs/breakingviews/2012/10/18/

oil_export_licenses_why_doesn_t_the_united_states_export_more_oil.html.

16. Gregory Meyer and Ajay Makan, "U.S. Shale Boom at Risk, Watchdog Warns," Financial Times, February 6, 2013, http://www.ft.com/intl/cms/s/0/2217180a-70aa-11e2-85d0-00144feab49a.htm….

17. EIA Report, pp. 10–12.

18. Don Boudreaux, "Banning Natural Gas Exports Is Economic Illiteracy in the Extreme," Fairfax Times, January 25, 2013, http://www.fairfaxtimes.com/apps/pbcs.dll/article?AID=/20130125/OPINION… nomic-illiteracy-in-the-extreme&&template=PrinterFriendlyFFX.

19. Ryan Olson, "How to Boost U.S. Exports: Legalize Them," Heritage Foundation, September 26, 2012, http://blog.heritage.org/2012/09/26/how-to-boost-u-s-exports-legalize-t….

20. ATT Panel Report, "India—Quantitative Restrictions," para. 5.130; "Japan—Trade in Semiconductors," para. 118.21. GATT Panel Report, "Japan—Trade in Semiconductors," para. 118.

22. The licensing systems' preferential treatment for Canada (in6the case of crude oil) or all FTA partners (in the case of natural gas) also could violate the Most Favoured Nation (MFN) Principle of GATT Article I:1 because it discriminates against products destined for certain countries. However, this discrimination could be defended under GATT Article XXIV, which permits Members to grant preferential (and otherwise WTO-inconsistent) treatment to FTA partners.

23. See, for example, H.R. Rep. No. 74-2651, at 1 (May 13, 1936); S. Rep. No. 75-1162, at 2 (August 9, 1937).

24. For various reasons, the licensing systems would probably not qualify for the other GATT exceptions listed in Article XX. For example, "conservation" measures under Article XX(g) require comparable domestic restrictions on production and consumption, and "short supply" measures under Article XX(j) must be temporary. Both systems arguably fail to meet either requirement. Moreover, the United States might have difficulty demonstrating, as required by the chapeau of Article XX for all exceptions, that the licensing systems are not "a disguised restriction on international trade."

25. Panel Report, "U.S.–Export Restraints," paras. 8.75–8.76.

26. Department of Commerce, "Countervailing Duties; Final Rule," 63 Fed. Reg. 65351 (November 25, 1998), http://www.gpo.gov/fdsys/pkg/FR-1998-11-25/html/98-30565.htm.

27. See, for example, Department of Commerce, "Certain Coated Paper Suitable for High-Quality Print Graphics Using Sheet-Fed Presses from Indonesia," 75 Fed. Reg. 59209 (September 27, 2010), Issues & Decision Memorandum at 12–14.

28. Joshua Chaffin, "EU Berates China over Steel Subsidies," Financial Times, January 14, 2013, http://www.ft.com/intl/cms/s/0/6d4e6408-5e68-11e2-b3cb-00144feab49a.htm….29. United States Trade Promotion Coordinating Committee, "Report to the President on the National Export Initiative," September 2010, at 31–32 http://www.whitehouse.gov/sites/default/files/nei_report_9-16-10_full.p….

30. United States Trade Promotion Coordinating Committee, "2012 National Export Strategy," December 2012 (at 44), http://ex port.gov/static/2012%20National%20Export%20Strategy-06%2012_19_Latest_eg_main_056128.pdf.

31. EIA Report, p. 12.

32. Scott Lincicome, "Countervailing Calamity: How to Stop the Global Subsidies Race," Cato Institute Policy Analysis no. 710, October 9, 2012, https://www.cato.org/publications/policy-analysis/ countervailing-calamity-how-stop-global-subsidies-race.

33. United States Trade Representative, "China—Measures Related to the Exportation of Various Raw Materials (DS394, DS395, DS398), First Written Submission of the United States of America," (June 1, 2010), at 87, http://www.ustr.gov/webfm_send/1948.

34. Japan Machinery Center for Trade and Investment, "Enhanced Transparency on Export Licensing: Communication from the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu; Japan; Korea and the United States," TN/MA/W/15/Add.4/Rev.3, March 19, 2009, http://www.jmcti.org/2000round/com/doha/tn/ma/tn_ma_w_015_add4_rev3.pdf.