Dr. Donald Abrams, professor emeritus of medicine at the University of California San Francisco, has tussled with regulators several times since the 1990s as he sought ways to study the drug’s potential for cancer and HIV/AIDS patients.

“When I used to study marijuana, I used to complain that I have eight different regulatory bodies that needed to approve my protocol,” Dr. Abrams said.

Researchers interested in marijuana must register with the Drug Enforcement Administration, submit their protocols to federal regulators for approval, source the product through an inflexible bureaucracy, and jump through other hoops before beginning a study.

The Biden administration’s anticipated rescheduling of marijuana will likely lift some of those restrictions, but researchers stressed that much is still unknown about how regulators will respond.

“The problem is the FDA’s interpretation of how they review the protocol,” said Rick Doblin, the founder of the Multidisciplinary Association for Psychedelic Studies (MAPS). “I do think the rescheduling will be a helpful signal, but by itself, it’s not sufficient.”

Despite some promising results, federal officials have stymied many studies before they could get off the ground. Researchers at MAPS found preliminary evidence in a 2021 exploratory study that inhaled marijuana can effectively treat post-traumatic stress (PTSD) in military veterans.

These researchers aimed to expand their findings in a phase 2 study with a larger sample size, but the FDA has repeatedly blocked their proposal, arguing that smoking and vaping are not “safe drug delivery” methods.

“The FDA has this extremely unreasonable position, blocking research into the way cannabis is actually consumed, which is smoked or vaporized,” Doblin said of the study, which is one of many studies being funded by a grant program from the state of Michigan. “All of this research trying to study smoked or vaporized cannabis is being blocked by the FDA—it’s not just our study.”

Despite these impediments, countless people have attested to the therapeutic benefits of marijuana. Gary Hess, a Marine veteran who served multiple deployments in Iraq, returned to the United States with PTSD, a traumatic brain injury, chronic pain, insomnia, and other problems.

Raised in a conservative family in Louisiana, Hess steered clear of marijuana and other drugs his entire life, even going so far as to fire his brother from a construction job after finding out he was using the drug.

But after a few fellow Marine veterans suffering from similar ailments told him about the relief they experienced with marijuana, he decided to give it a shot.

“I’d integrate cannabis, and it would bring me back to a point of balance, where I would not turn catastrophic in the way that I would in the past, when I would be triggered to a very hyper-aroused state,” Hess said. “Within three months of integrating cannabis daily, I was off all pharmaceuticals that were prescribed by the VA and private practices, and I was able to live my life in a state of balance that I had not been able to for over a decade.”

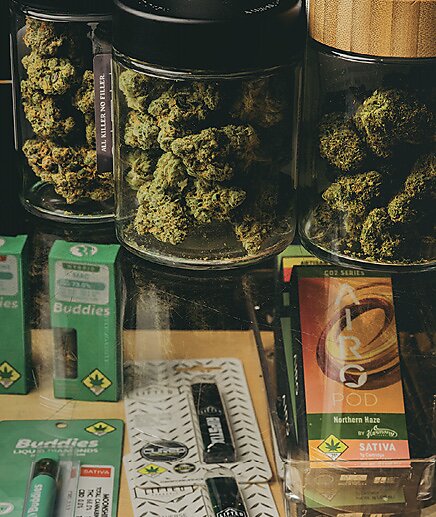

Hess, who founded Veterans Alliance for Holistic Alternatives, testified about his experience before the Louisiana State Legislature and was among the first patients in his state to legally buy medical marijuana in 2019. The drug is now available for medicinal purposes in 38 states and Washington, DC.