By Romina Boccia

The US national debt is nearing record levels not seen since World War II, driven by politicians on both sides of the aisle abdicating their responsibility to control spending across multiple presidential administrations and Congresses.

Ignoring the threats posed by our ever-increasing debt will only exacerbate problems for future generations, burdening them with slower economic growth, runaway inflation, and higher interest rates.

Despite calls by some independent-minded politicians to balance the budget, most lawmakers and pundits either overlook or downplay these dangers. Others, including former House Budget Committee chair John Yarmuth (D‑KY), dismiss concerns about the debt altogether.

“We are a sovereign currency, we can print all the money we want to serve the people whom we serve,” Yarmuth testified to the House Budget Committee last October, several months after he retired from Congress. “Why are we paying interest on the money we borrow? And why do we borrow money anyway? We can print it and put it in the Treasury.”

The belief that federal deficits and government spending don’t matter because the government can print more money underlies modern monetary theory. This unworkable economic doctrine has gained considerable traction in some circles on the left while downplaying the risks of inflation resulting from fiat money issuance.

But history is replete with examples of runaway inflation caused by out-of-control money printing and government spending. Between 2015 and 2019, average inflation levels in Argentina more than doubled, from 27 to 54 percent, and then hit triple digits last year. This reduction in Argentines’ buying power occurred alongside reckless government spending and rapid growth in the country’s money supply. Argentine president Javier Milei was elected last year on the promise of taming inflation and slashing spending. The early results have been promising, with inflation falling for the fifth straight month in May.

When the government prints more money without the market first creating more resources, the additional money devalues existing money by driving up prices. More money chasing the same number of resources creates inflation. Inflation hits the most vulnerable hardest, eating away at the buying power of wages and savings.

Printing more money is not the answer to growing the economy. Instead, the government should reduce regulation and spending to unleash innovation and improve living standards.

There’s a Milton Friedman quote I keep top of mind when crafting solutions to the federal budget problem: “The important thing is to establish a political climate of opinion which will make it politically profitable for the wrong people to do the right thing.” Few politicians are willing to sign off on the necessary budget cuts to put us back on a path to fiscal sanity; after all, reducing spending at the scale required to balance the budget would mean cutting back on old-age entitlement programs such as Medicare and Social Security—a move so politically unpopular it threatens politicians’ prospects for reelection.

To make entitlement reform feasible, Congress needs political cover to make the tough choices necessary. At the very least, Congress could establish an independent, nonpartisan commission of experts tasked with stabilizing the nation’s debt at a size not exceeding the gross domestic product (also referred to as the economy). An initiative modeled after the Base Realignment and Closure (BRAC) commission would offer a promising path forward. Establishing such a commission would enable members of Congress to set reform discussions in motion while advocating their constituents’ interests.

Following the BRAC model, an independent commission’s recommendations would become law within 45 days unless the House and Senate pass a joint resolution to disapprove of the reform package. As such, the reform package would be enacted by default after presidential approval and without members of Congress being required to vote on it. George Will promoted this idea in a Washington Post column last August, pointing out that the BRAC-like commission would address “fatalism about the political system’s inability” to tackle the debt.

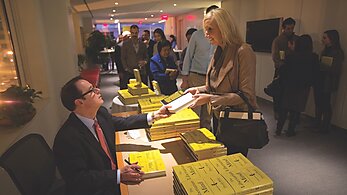

With inflation at an all-time high, there’s been a growing appetite in Congress for fresh ideas on heading off an impending fiscal crisis. I’ve already had dozens of meetings with key members of Congress and their staffers about my proposal for a BRAC-like commission to limit spending and control the national debt.

The attention my proposal is receiving renews hope that national spending can be reformed and that we can avoid the consequences of continuing to kick the budget can down the road: a doom loop of rising interest rates, higher inflation, and shrinking economic growth. The stakes are far higher now than when Congress first set up the original BRAC commission to close obsolete military bases. It’s time for a fiscal BRAC.

An independent commission is the best chance we have of hitting the debt brakes and maybe, just maybe, reversing some of the damage that the government has done to our economy and our everyday lives.