38th Annual Monetary Conference — Digital Currency: Risk or Promise?

Featured Speakers

Tobias Adrian

Tobias Adrian

Tobias Adrian is the Financial Counsellor and Director of the Monetary and Capital Markets Department of the International Monetary Fund. Prior to joining the IMF, he was a Senior Vice President of the Federal Reserve Bank of New York and the Associate Director of the Research and Statistics Group. Adrian has published extensively in economics and finance journals, including the American Economic Review and Journal of Finance. He has taught at Princeton University and New York University. He is Associate Editor of the International Journal of Central Banking and the Annual Review of Financial Economics. Adrian holds a PhD from the Massachusetts Institute of Technology in Economics, an MSc from the London School of Economics in Econometrics and Mathematical Economics, a Diplom from Goethe University Frankfurt and a Maîtrise from Dauphine University Paris. He received his Abitur in Literature and Mathematics from Humboldtschule Bad Homburg.

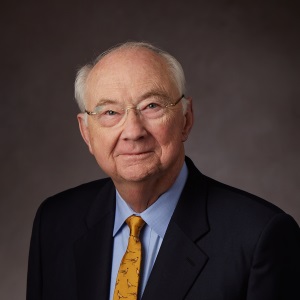

John A. Allison

John A. Allison

John Allison is an Executive in Residence at the Wake Forest School of Business. He is a member of the Cato Institute’s Board of Directors and Chairman of the Executive Advisory Council of the Cato Institute’s Center for Monetary and Financial Alternatives. Allison was President and CEO of the Cato Institute from October 2012 to April 2015. Prior to joining Cato, he was Chairman and CEO of BB&T Corporation, the 10th -largest financial services holding company headquartered in the United States. During his tenure as CEO from 1989 to 2008, BB&T grew from $4.5 billion to $152 billion in assets. He was recognized by the Harvard Business Review as one of the top 100 most successful CEOs in the world over the last decade. Allison has received the Corning Award for Distinguished Leadership and the Lifetime Achievement Award from the American Banker. He is the author of The Financial Crisis and the Free Market Cure: Why Pure Capitalism Is the World Economy’s Only Hope and The Leadership Crisis and the Free Market Cure: Why the Future of Business Depends on the Return to Life, Liberty, and the Pursuit of Happiness. In addition, he is a former Distinguished Professor of Practice at Wake Forest University School of Business and serves on the Board of Visitors at the business schools at Wake Forest, Duke, and the University of North Carolina at Chapel Hill. Allison is a Phi Beta Kappa graduate of the University of North Carolina at Chapel Hill. He received his master’s degree in Management from Duke University and is a graduate of the Stonier Graduate School of Banking; he is the recipient of six honorary doctorate degrees.

David Andolfatto

David Andolfatto

David Andolfatto serves as a Senior Vice President in the Research Division at the Federal Reserve Bank of St. Louis. He was a Professor of Economics at the University of Waterloo and Simon Fraser University before joining the Fed in July 2009. His articles have appeared in leading economic journals, including the American Economic Review, Journal of Political Economy, and Journal of Economic Theory. Andolfatto has been a Visiting Scholar at the Bank of Canada, the Bank of Japan, La Banca de la Republica (Colombia), and De Nederlandsche Bank, along with a number of Federal Reserve banks. In 2009, he was awarded the prestigious Bank of Canada Fellowship Award for his contributions in the area of money, banking, and monetary policy. Andolfatto is a native of Vancouver, Canada, and received his PhD in Economics from the University of Western Ontario in 1994.

Charles W. Calomiris

Charles W. Calomiris

Charles Calomiris is Chief Economist and Senior Deputy Comptroller for Economics at the Office of the Comptroller of the Currency and a member of the Executive Committee. He joined the OCC in July 2020 from Columbia University where he was Henry Kaufman Professor of Financial Institutions at Columbia Business School, Director of the Business School's Program for Financial Studies Initiative on Finance and Growth in Emerging Markets, and a professor at Columbia's School of International and Public Affairs. His research spans banking, corporate finance, financial history, and monetary economics. Calomiris was a Distinguished Visiting Fellow at the Hoover Institution, a Fellow at the Manhattan Institute, a member of the Shadow Open Market Committee and the Financial Economists Roundtable, and a Research Associate of the National Bureau of Economic Research. He is a past president of the International Atlantic Economic Society and has served on numerous committees, including the Advisory Scientific Committee of the European Systemic Risk Board, the U.S. Congress's International Financial Institution Advisory Commission, the Shadow Financial Regulatory Committee, and the Federal Reserve System's Centennial Advisory Committee. In 2015, Calomiris received the American Publishers Award for the best book in business, finance, and management for Fragile By Design: The Political Origins of Banking Crises and Scarce Credit (Princeton 2014). He holds a BA in Economics from Yale University (magna cum laude), a PhD in Economics from Stanford University, and an honorary doctorate from the University of Basel.

Jill Carlson

Jill Carlson

Jill Carlson is Co-founder of the Open Money Initiative, a nonprofit organization that produces research findings and insights on how money is managed in places experiencing hyperinflation, capital controls, and criminalization of free markets. She is also a CoinDesk columnist and a principal at Slow Ventures, where she manages the blockchain portion of the $220 million fund. Carlson is a former Goldman Sachs trader and worked as strategy lead at Chain (sold to Stellar). She earned an undergraduate degree at Harvard (cum laude) and an MSc at Oxford’s Magdalen College, where she wrote a dissertation on “Cryptocurrencies and Capital Controls.” She is an alumni of Harvard/Radcliffe Rowing.

Michael J. Casey

Michael J. Casey

Michael Casey is CoinDesk's Chief Content Officer. Previously, Casey was the CEO of Streambed Media, a company he cofounded to develop provenance data for digital content. He was also a senior advisor at MIT Media Lab's Digital Currency Initiative and a senior lecturer at MIT Sloan School of Management. Prior to joining MIT, Casey spent 18 years at the Wall Street Journal, where his last position was as a senior columnist covering global economic affairs. Casey has authored five books, including The Age of Cryptocurrency: How Bitcoin and Digital Money are Challenging the Global Economic Order and The Truth Machine: The Blockchain and the Future of Everything, both co-authored with Paul Vigna. Upon joining CoinDesk full time, Casey resigned from a variety of paid advisory positions. He maintains unpaid posts as an advisor to not-for-profit organizations, including MIT Media Lab's Digital Currency Initiative and The Deep Trust Alliance. He is a shareholder and non-executive chairman of Streambed Media. Casey owns a small amount of bitcoin.

Martin Chorzempa

Martin Chorzempa

Martin Chorzempa is a Research Fellow at the Peterson Institute for International Economics. He gained expertise in financial innovation while in Germany as a Fulbright Scholar and researcher at the Association of German Banks. He conducted research on financial liberalization in Beijing, first as a Luce Scholar at Peking University’s China Center for Economic Research and then at the China Finance 40 Forum, China’s leading independent think tank. He is working on a forthcoming book on fintech in China. He has been quoted in the Wall Street Journal, New York Times, Washington Post, Financial Times, MIT Technology Review, and Foreign Affairs. He holds a masters in Public Administration in International Development from the Harvard Kennedy School of Government.

James A. Dorn

James A. Dorn

James Dorn is Vice President for Monetary Studies, Editor of the Cato Journal, Senior Fellow, and Director of Cato’s Annual Monetary Conference. He has written widely on Federal Reserve policy and monetary reform and is an expert on China’s economic system. He has edited more than 10 books, including The Search for Stable Money (with Anna J. Schwartz), The Future of Money in the Information Age, and China in the New Millennium. His articles have appeared in the Wall Street Journal, Financial Times, South China Morning Post, and scholarly journals. From 1984 to 1990, he served on the White House Commission on Presidential Scholars. Dorn has been a visiting scholar at the Central European University and Fudan University in Shanghai. He holds a PhD in Economics from the University of Virginia.

Jesús Fernández-Villaverde

Jesús Fernández-Villaverde

Jesús Fernández-Villaverde is Professor of Economics at the University of Pennsylvania, a Research Associate for the National Bureau of Economic Research and Penn's Population Studies Center, and a Research Affiliate for the Centre for Economic Policy Research. His research agenda is in macroeconomics and econometrics, with a focus on the computation and estimation of dynamic stochastic general equilibrium models, the standard tool of modern quantitative macroeconomics. He has been a visiting professor at Harvard, Yale, Princeton, University of Chicago, and the Universities of Oxford and Cambridge, among others. Currently he is a visiting scholar at the Federal Reserve Bank of Philadelphia, as well as the Chicago Fed and the Bank of Spain. His publications have appeared in many leading journals. He holds a PhD in Economics from the University of Minnesota.

Alex Gladstein

Alex Gladstein

Alex Gladstein is Chief Strategy Officer at the Human Rights Foundation. He has also served as Vice President of Strategy for the Oslo Freedom Forum since its inception in 2009. Gladstein has connected hundreds of dissidents and civil society groups with business leaders, technologists, journalists, philanthropists, policymakers, and artists to promote free and open societies. His writing and views on human rights and technology have appeared in media outlets across the world including The Atlantic, BBC, CNN, The Guardian, New York Times, NPR, Time, Wired, and the Wall Street Journal. He has spoken at universities ranging from MIT to Stanford, briefed the European Parliament and U.S. State Department, and serves as a faculty member at Singularity University and as an advisor to Blockchain Capital, a leading venture firm in the fintech industry.

Phil Gramm

Phil Gramm

Senator Gramm joined Lone Star Global Acquisitions as Vice Chairman in December of 2012. He served as Vice Chairman of UBS Investment Bank from December 2002 to December 2011. At UBS he provided senior leadership for such landmark IPOs as Visa, the Bank of China, the China Merchants Bank, and LGPhillips in Korea. He was instrumental in the follow-on equity offering for the Industrial and Commercial Bank of China, the privatization of Telstra in Australia and the sale of 20 percent of Akbank in Turkey to Citibank. Senator Gramm served six years in the U.S. House of Representatives and 18 years in the U.S. Senate. His legislative record includes the Gramm-Latta Budget, which reduced federal spending, rebuilt national defense and mandated the Reagan tax cut, and the Gramm-Rudman Act, which placed the first binding constraints on the federal deficit. As Chairman of the Banking Committee, Senator Gramm steered through legislation modernizing banking, insurance and securities law, which had been languishing in Congress for 60 years. Dodd-Frank did not repeal Gramm-Leach-Bliley but expanded the law by requiring systemically significant non-banks to become Financial Services Holding Companies under Gramm-Leach-Bliley. Gramm is a Visiting Scholar at the American Enterprise Institute. He has published numerous articles and books on subjects ranging from monetary theory and policy to private property and the economics of mineral extraction. Senator Gramm holds a PhD from the University of Georgia in Economics, the subject he taught at Texas A&M University for 12 years.

Dong He

Dong He

Dong He is Deputy Director of the Monetary and Capital Markets Department of the International Monetary Fund. He has led MCM’s work on digital currencies and fintech, global financial stability analysis, monetary and macroprudential policies, and technical assistance to central banks. He started his career in 1993 when he joined the World Bank through the Young Professionals Program. He was a staff member of the IMF during 1998–2004. Prior to rejoining the IMF in October 2014, he was Executive Director at the Hong Kong Monetary Authority, responsible for directing research and policy advice on issues relating to the maintenance of monetary and financial stability and the development of financial markets. Dong He was also Director of the Hong Kong Institute for Monetary Research. He has been an active member of the global central banking community and a regular participant in international meetings of central banks and regulatory agencies. He has published extensively on macroeconomic and financial market issues. Dong He holds a PhD in Economics from the University of Cambridge.

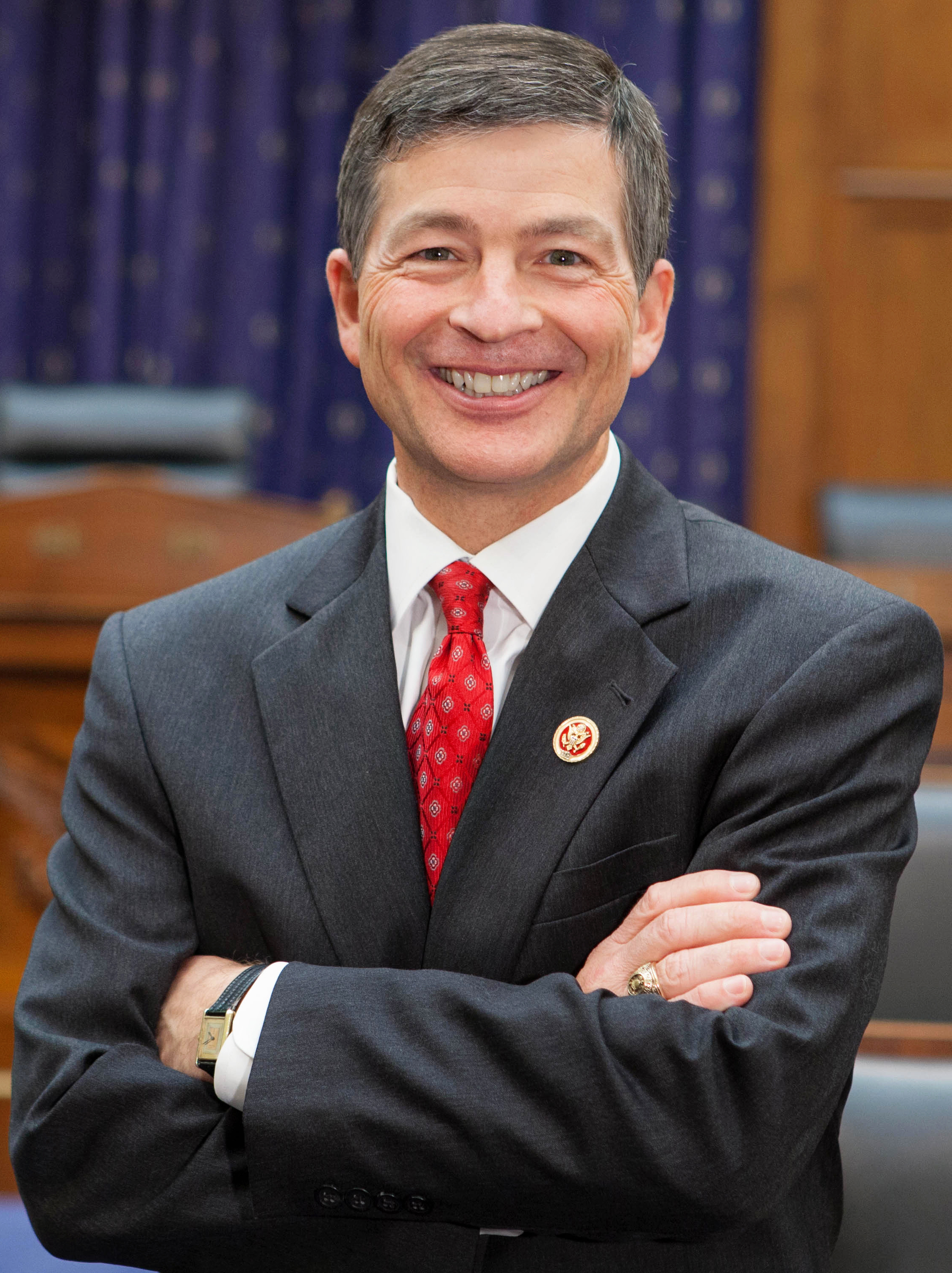

Jeb Hensarling

Jeb Hensarling

Jeb Hensarling is Executive Vice Chairman of UBS Americas, the largest wealth management firm in the world. Prior to joining UBS, he served in the U.S. Congress for eight terms, with three terms as Chairman of the House Financial Services Committee. As chairman, Hensarling shepherded over 80 bills into law including the Economy Growth, Regulatory Relief and Consumer Protection Act, widely recognized as the most pro-growth banking bill in a generation, as well as the JOBS 2.0 legislation, which helps startups and early growth companies access capital. Hensarling was chosen by his colleagues to serve in key leadership positions throughout his congressional career. He was elected House Republican Conference Chairman in the 112th Congress, the 4th highest ranking position in the Republican Leadership, where he was responsible for helping coordinate strategy, policy, messaging, and communications for House Republicans. In the 110th Congress, he led the Republican Study Committee, Congress’ largest caucus and the one dedicated to advancing conservative free market principles. In recognition of his economic policy expertise, Hensarling was appointed to serve on the Congressional Oversight Panel for TARP, the $700 billion troubled asset purchase program set up in the wake of the 2008 financial crisis. Additionally, the Speaker of the House appointed Hensarling to serve on the National Commission on Fiscal Responsibility and Reform and later appointed him co-chair of the Joint Select Committee on Deficit Reduction. Hensarling earned a bachelor’s degree in Economics from Texas A&M University and a law degree from the University of Texas.

Caitlin Long

Caitlin Long

Caitlin Long is the Founder and CEO of Avanti Financial Group. She is a 22-year Wall Street veteran who has been active in bitcoin since 2012, and whose passion is for a fair and stable financial system. She saw inaccuracies in Wall Street’s ledger systems while running Morgan Stanley’s pension solutions business (2007–2016), holding senior roles at Credit Suisse (1997–2007), and starting her career at Salomon Brothers (1994–1997). She jumped to blockchain to try to fix these problems. From 2016 to 2018, Long was Chairman and President of Symbiont, an enterprise blockchain company, where she jointly spearheaded blockchain delivery of index data to Vanguard. Since January 2018, she has volunteered in her native state of Wyoming to enact a series of enabling blockchain laws and is a gubernatorial appointee to the Wyoming Blockchain Task Force. Long holds degrees from Harvard Law School (JD, 1994), the Kennedy School of Government (MPP, 1994), and the University of Wyoming (BA, 1990).

Neha Narula

Neha Narula

Neha Narula is the Director of the Digital Currency Initiative, a part of the MIT Media Lab focusing on cryptocurrencies and blockchain technology. While completing a PhD in Computer Science at MIT, she built fast, scalable distributed systems and databases. She is a member of the World Economic Forum's Global Futures Council on Blockchain and has given a TED talk on the Future of Money. In a previous life, Neha helped relaunch the news aggregator Digg and was a senior software engineer at Google. There, she designed Blobstore, a system for storing and serving petabytes of immutable data, and worked on Native Client, a way to run native code securely through a browser.

Eswar Prasad

Eswar Prasad

Eswar Prasad is the Tolani Senior Professor of Trade Policy and Professor of Economics at Cornell University. He is also a Senior Fellow at the Brookings Institution, where he holds the New Century Chair in International Trade and Economics, and a Research Associate at the National Bureau of Economic Research. He is a former head of the IMF’s China Division. Prasad is the author of Gaining Currency: The Rise of the Renminbi and The Dollar Trap: How the Dollar Tightened Its Grip on Global Finance. He has testified before numerous U.S. Congressional committees, including the Senate Finance Committee, the House of Representatives Committee on Financial Services, and the U.S.-China Economic and Security Review Commission. He is the creator of the Brookings-Financial Times world index (TIGER: Tracking Indices for the Global Economic Recovery; www.brookings.edu/tiger). His op-eds have appeared in the Financial Times, Harvard Business Review, International Herald Tribune, New York Times, Wall Street Journal, and Washington Post. Prasad is also a Research Fellow at IZA (Institute for the Study of Labor, Bonn). Prasad holds a PhD in Economics from the University of Chicago.

George Selgin

George Selgin

George Selgin is a Senior Fellow and Director of the Center for Monetary and Financial Alternatives at the Cato Institute, Editor of Alt-M, and Professor Emeritus of Economics at the University of Georgia. His research covers a broad range of topics within the field of monetary economics, including monetary history, macroeconomic theory, and the history of monetary thought. He is the author of several books, including The Theory of Free Banking (Rowman & Littlefield, 1988); Money: Free & Unfree (Cato Institute, 2017); Less Than Zero: The Case for a Falling Price Level in a Growing Economy (Cato Institute, 2018); Floored! How a Misguided Fed Experiment Deepened and Prolonged the Great Recession (Cato Institute, 2018); and The Menace of Fiscal QE (Cato Institute, 2020). Selgin is one of the founders, with Kevin Dowd and Lawrence H. White, of the Modern Free Banking School, which draws its inspiration from the writings of F. A. Hayek on denationalization of money and choice in currency. He has written for numerous scholarly journals, including the British Numismatic Journal, Economic Journal, Economic History Review, Journal of Economic Literature, and Journal of Money, Credit, and Banking; and for popular outlets such as the Christian Science Monitor, Financial Times, and Wall Street Journal. Selgin holds a BA in Economics and Zoology from Drew University, and a PhD in Economics from New York University.

Rachel Siegel

Rachel Siegel

Rachel Siegel is the Federal Reserve and Economics Reporter for the Washington Post. She previously covered breaking news for the Post’s financial section and local politics for the Post’s Metro desk. Before joining the Post in June 2017, Rachel contributed to The Marshall Project and the Dallas Morning News. Her current columns have covered the Federal Reserve’s response to the pandemic, the stock market, and the latest in economic indicators. She earned her BA in History from Yale University.

Jeanna Smialek

Jeanna Smialek

Jeanna Smialek writes about the Federal Reserve and the economy for the New York Times. She previously covered economics at Bloomberg News, where she also wrote feature stories for Businessweek. Her column has included coverage on the Federal Reserve’s attempt to reach smaller borrowers in the pandemic, the $4 trillion lifeline from the Fed and Treasury that never materialized, and developing discussions on central bank digital currencies. Smialek holds a BA in Journalism and International Relations from the University of North Carolina at Chapel Hill and is currently studying for her MBA at New York University’s Stern School.

John B. Taylor

John B. Taylor

John B. Taylor is the Mary and Robert Raymond Professor of Economics at Stanford University and the George P. Shultz Senior Fellow in Economics at the Hoover Institution. He is Director of the Stanford Introductory Economics Center. He formerly served as Director of the Stanford Institute for Economic Policy Research, where he is now a Senior Fellow. Before joining the faculty at Stanford, Taylor was a Professor of Economics at Princeton and Columbia University. He is best known for his formulation of the Taylor Rule, which has been applied by central banks and financial market analysts around the world. He is a former president of the Mont Pelerin Society and recently served on the Eminent Persons Group on Global Financial Governance created by the G20. He served as Senior Economist on the President’s Council of Economic Advisers from 1976 to 1977, and as a member of the President’s Council of Economic Advisers from 1989 to 1991. He was also a member of the Congressional Budget Office’s Panel of Economic Advisers from 1995 to 2001. From 2001 to 2005, Taylor served as Under Secretary of Treasury for International Affairs where he was responsible for currency markets, trade in financial services, foreign investment, international debt and development, and oversight of the International Monetary Fund and the World Bank. He was also responsible for coordinating financial policy with the G7 countries, was chair of the OECD working party on international macroeconomics, and was a Member of the Board of the Overseas Private Investment Corporation. Taylor holds a BA in Economics (summa cum laude) from Princeton University and a PhD in Economics from Stanford University.

Nick Timiraos

Nick Timiraos

Nick Timiraos is Chief Economics Correspondent for the Wall Street Journal and is based in Washington. He is responsible for covering the Federal Reserve and other major developments in U.S. economic policy. Prior to his current position, he covered the Treasury Department, fiscal policy, and broader economic and labor market issues. Before that, he wrote about U.S. housing and mortgage markets as a reporter based in New York. His coverage included the government's response to the foreclosure crisis and the takeover of finance companies Fannie Mae and Freddie Mac. In 2008, Timiraos contributed to the Wall Street Journal's presidential election coverage and travelled with the campaign of then-Sen. Barack Obama. He joined the Journal in 2006. He is a graduate of Georgetown University.

Lawrence H. White

Lawrence H. White

Lawrence H. White is Professor of Economics at George Mason University and a Senior Fellow at the Cato Institute’s Center for Monetary and Financial Alternatives (CMFA). An expert on banking and monetary policy, he is the author of The Theory of Monetary Institutions (Basil Blackwell, 1999), Free Banking in Britain (2nd ed., Institute of Economic Affairs, 1995), and Competition and Currency (New York University Press, 1989). He is co-editor of Renewing the Search for a Monetary Constitution (Cato Institute, 2015), and editor of The History of Gold and Silver (3 vols., Pickering and Chatto, 2000), Free Banking (3 vols., Edward Elgar, 1993), and The Crisis in American Banking (NYU Press, 1993). His articles on monetary theory and banking history have appeared in the American Economic Review; Journal of Money, Credit, and Banking; and other leading professional journals. White received the 2008 Distinguished Scholar Award of the Association for Private Enterprise Education. He has been a visiting research fellow at the American Institute for Economic Research, a visiting lecturer at the Swiss National Bank, and a visiting scholar at the Federal Reserve Bank of Atlanta. He is a co-editor of the online journal Econ Journal Watch and hosts bimonthly podcasts for EJW Audio. He is a member of the Financial Markets Working Group of the Mercatus Center at George Mason University and writes regularly for CMFA’s publication Alt-M. White holds a BA in Economics from Harvard and a PhD in Economics from the University of California, Los Angeles.

Jen Wieczner

Jen Wieczner

Jen Wieczner is a Senior Writer at Fortune Magazine. Her last name is pronounced vee-ETCH-ner. She covers Wall Street and finance, business, and cryptocurrency. Her recent stories include a profile of hedge fund billionaire Steve Cohen—including his first interview since a record-breaking insider trading scandal; an investigation into an alarming pattern of hacks at leading bitcoin exchange Coinbase; and an award-winning feature about Paul Singer's hedge fund Elliott Management, and the controversial tactics that have helped make it today's most successful activist investor. She is a winner of a SABEW Best in Business award and also of the 2017 American Society of Magazine Editors “Next” Award honoring journalists under 30. Wieczner has previously written for the Wall Street Journal, MarketWatch, SmartMoney, and The Atlantic, among others. Originally from Boston, she graduated from Northwestern University with a BS in Journalism. She currently lives in New York.

Diego Zuluaga

Diego Zuluaga

Diego Zuluaga is Associate Director of Financial Regulation Studies at the Cato Institute’s Center for Monetary and Financial Alternatives, where he covers financial technology and consumer credit. Zuluaga is the author of “Should Cryptocurrencies Be Regulated like Securities?” and “The Community Reinvestment Act in the Age of Fintech and Bank Competition.” He has previously testified on the impact of restrictions on short-term lending before the House Subcommittee on Consumer Protection and Financial Institutions. Before joining Cato, Zuluaga was head of Financial Services and Tech Policy at the Institute of Economic Affairs in London. While there, he wrote on a range of financial regulatory issues, such as the social value of finance, the taxation of capital income, and the importance of free capital mobility around the world. His work has been featured in print and broadcast media, such as Politico, Washington Post, Wall Street Journal, Newsweek, American Banker, and London Times. Zuluaga is a prolific public speaker as well as a former lecturer in economics at the University of Buckingham. Originally from Bilbao in northern Spain, Zuluaga holds a BA in Economics and History from McGill University, and an MSc in Financial Economics from the University of Oxford.