Turkey’s president Tayyip Recep Erdogan has hit the panic button. On Saturday, he fired Murat Uysal, the governor of the Central Bank of Turkey. Uysal is the second top monetary official Erdogan has axed in the past 16 months. To add insult to injury, Turkish finance minister Berat Albayrak, Erdogan’s son-in-law, resigned from his post Sunday due to “health problems.”

All of this follows the Turkish lira’s most recent collapse, something I have foreseen and regularly written about. Instability is nothing new for the lira. Indeed, inflation has ravaged Turkey for decades. The average annual inflation rates for the 1970s, 1980s, 1990s, and 2000s were 22.4 percent, 49.6 percent, 76.7 percent, and 22.3 percent, respectively. Those horrendous numbers mask periodic lira routs. In 1994, 2000-01, and most recently since 2018, the lira has been torn to shreds.

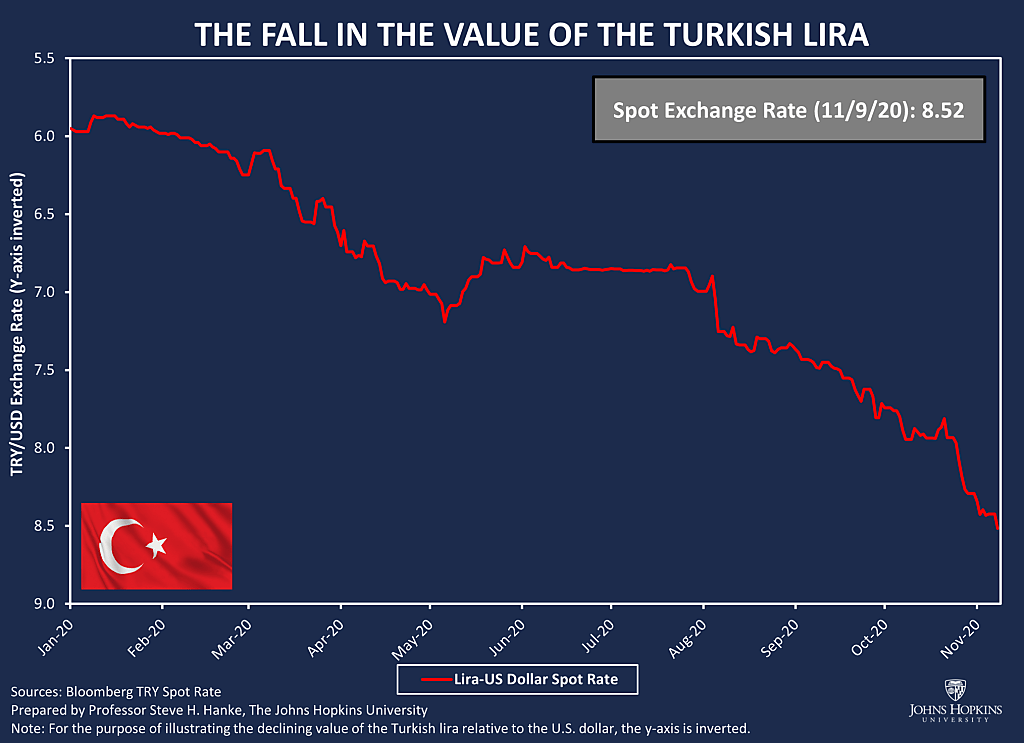

Since Erdogan took over Turkey’s presidential reins in August 2014, the lira has shed 75 percent of its value against the U.S. dollar. And, since the first of this year, the lira has depreciated by 30 percent against the greenback. Today, inflation in Turkey is soaring at 49.60 percent per year by my measure. My measurement, which employs high-frequency data and the use of Purchasing Power Parity theory, is more than four times Turkey’s official annual inflation rate of 11.89 percent per year. The charts below depict the collapse of the lira and Turkey’s annual inflation rate since January 1, 2020, respectively.

Whenever Erdogan feels the heat, he looks for a Turkish bureaucrat to deep-six, but this won’t change the course of the lira or rein in surging inflation. To save the lira and Turkey’s economy, Erdogan must make a change to Turkey’s exchange-rate regime, not its bureaucratic personnel.

All Erdogan has to do is follow the instructions for establishing a gold-backed currency board that are contained in my book Gelişmekte Olan Ülkeler İçin Para Kurullari, which was published in Ankara in December 2019.

A currency board is a monetary institution (or a set of laws that govern a central bank) that issues a domestic currency that is freely convertible at an absolutely fixed exchange rate with a foreign anchor currency. Under a currency-board arrangement, there are no capital controls. The domestic currency, which is issued by a currency board, is backed 100 percent with anchor currency reserves, so the local currency is simply a clone of its anchor currency.

For over 170 years, currency boards have had a perfect record. In total, there have been over 70 — none have failed. Even the North Russian currency board, which was designed by John Maynard Keynes in 1918 during the Russian Civil War, never faltered.

To make the Turkish lira as good as gold, Erdogan should announce that Turkey will install a gold-backed currency board. With a Turkish currency board, the lira would be tied to gold at a fixed exchange rate, and the lira would be fully backed by gold reserves. Gold is particularly attractive for countries such as Turkey because it is not issued by a sovereign and is highly revered by Turks. So, like gold, the lira would become an international currency that holds its purchasing power over time. Indeed, the lira would be as good as gold.

If Erdogan wants to save the Turkish lira and economy, he must go for gold.