President Trump and his trade team remain clueless about the economics of trade. Their recent imposition of tariffs on the imports of Chinese solar panels and South Korean washing machines is but the latest evidence of a wrongheaded and dangerous U.S. trade policy. Wrongheaded because it is based on incorrect economic analysis. Dangerous because it will inevitably result in a trade war in which there are no winners.

Let’s turn to the president’s trade team and its view of trade. The key players are: Wilbur Ross, U.S. Secretary of Commerce; Professor Peter Navarro, Director of the White House National Trade Council; and Washington trade lawyer Robert Lighthizer, U.S. Trade Representative.

To a man, the members of Trump’s trade team, and the president himself, all embrace the notion that the U.S. trade deficit, something the U.S. has registered every year since 1976, is a “bad” thing, something that should be dramatically reduced (or eliminated) if America is to be First. They also believe that the culprits for this “bad” state of affairs are unfair trade deals and unfair trade practices employed by foreign countries. Their elixir to eliminate the trade deficit is a strong dose of tariffs and other anti-trade policies imposed on foreign exports.

Now here is where the simple analytics of the trade deficit can be used to prove the cluelessness of the Trump trade team on “trade,” of all things, and the utter futility of its policy prescriptions having any impact on America’s aggregate trade deficit. In economics, identities play an important role. These identities are obtained by equating two different breakdowns of a single aggregate. Identities are interesting, and usually important, by definition. In national income accounting, the following identity can be derived. Indeed, it is the key to understanding the trade deficit.

(Imports - Exports ) ≡ (Investment - Savings) + (Government Spending - Taxes)

Given this identify, which must hold, the trade deficit is equal to the excess of private sector investment over savings, plus the excess of government spending over tax revenue. So the counterpart of the trade deficit is the sum of the private sector deficit and the government deficit (federal + state and local). The U.S. trade deficit, therefore, is just the mirror image of what is happening in the U.S. domestic economy. If expenditures in the U.S. exceed the incomes produced in the U.S., which they do, the excess expenditures will be met by an excess of imports over exports (read: a trade deficit).

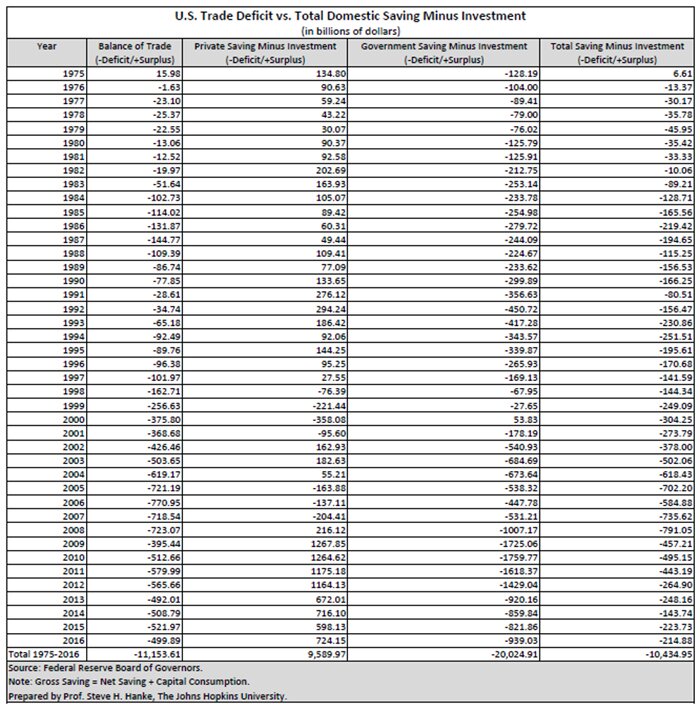

The table below shows that U.S. data support the important trade identity. The cumulative trade deficit the U.S. has racked up since 1975 is about $11.154 trillion, and the total investment minus savings deficit is about $10.435 trillion.

U.S. trade deficits are not caused by so-called unfair trade practices. They are made in the good old U.S.A.

President Trump can bully countries he identifies as unfair traders, he can impose all the restrictions on trading partners that his heart desires, but it won’t change the trade balance. It will only alter the composition of those exporting to the U.S. And by affecting this composition, the president’s interventions will hurt the U.S. consumer.

For someone who is so obsessed by the size of the trade deficit, it is astounding that Trump’s advisers failed to inform him that his fiscal policy of expanding the government deficit will, as night follows day (remember the trade identity), balloon the U.S. trade deficit.