Donald Trump’s constant discussion of tariffs has generated a trove of commentary on their (generally bad) economic and geopolitical implications, including here at Capitolism. Far less discussed, however, is whether a future President Trump—or any other White House occupant with a similar affinity for 19th-century U.S. trade policy—actually could implement a global tariff wall without any input or approval from Congress or any significant pushback from federal courts.

Trump, for his part, confidently claimed last month he has the legal authority to apply the tariffs without congressional consent, and his advisers are reportedly scouring the law books to justify any such actions. However, several educated observers—maybe even more educated than Trump!—have confidently disagreed with his legal analysis. In their view, it’s one thing to unilaterally apply global steel or aluminum tariffs, tariffs on half of all Chinese imports, or other security-related sanctions, but belching out tariffs on everything from everywhere is a totally different animal. And, given U.S. tariff laws’ text and intent, they’re sure that federal courts and Congress would finally put their collective foot down if Trump were to try to fulfill his promises next year.

I was once similarly confident about the institutional checks on the president’s abuse of congressionally delegated tariff powers but, needless to say, have since been humbled by seven solid years of unfettered trade meddling. Thus, my Cato colleague Clark Packard and I set out to explain in a brand new paper why anyone who thinks a 20 percent global baseline tariff is a bad idea should be at least a little concerned about a future president not only trying to implement the policy, but maybe even getting away with it too.

Such an unfortunate outcome certainly isn’t a slam dunk, but its risk is—and will remain—real and significant until Congress fixes the laws at issue.

How We Got Here: A Good Idea Gone Bad

Under the Constitution, it’s Congress—not the president—who has the authority to implement tariffs. Under Article I, Section 8, the legislative branch has the sole power to “lay and collect Taxes, Duties, Imposts and Excises,” and to regulate commerce with foreign countries. And Congress exercised this power—setting tariff rates periodically via legislation—for the first 150-plus years of the republic.

As economic historian Phil Magness details, this period of American tariff history was—contra Trump’s recent love for it—rife with economic and political problems. (See Capitolism’s tariff primer for more.) For today’s purposes, however, it’s sufficient simply to know that the president was largely a bit player in setting international trade policy until the disastrous Trade Act of 1930, aka the uber-protectionist Smoot-Hawley tariffs of economic and cinematic infamy.

Smoot-Hawley not only damaged U.S. international relations and deepened the Great Depression, but also demonstrated the shortcomings (and outright corruption) of congressional tariff-setting. So, Congress in 1934 and through several subsequent laws delegated vast amounts of its international economic authority to the executive branch, each time operating under the assumption that the president, with his national constituency and foreign affairs responsibilities under Article II of the Constitution, was far less likely than Congress to be influenced by local (usually protectionist) interests and rent-seeking lobbyists—and thus far less likely to repeat the Smoot-Hawley debacle.

Oops.

More seriously, this bipartisan approach to U.S. trade policymaking actually did work reasonably well for 80-plus years. Throughout that period, the United States avoided major tariff hikes and trade wars, gradually (though inconsistently) liberalized trade restrictions, entered into several international agreements (that the president negotiated and Congress approved), and generally helped global trade flourish. It wasn’t perfect, but the system worked generally as intended by stabilizing global trade and averting another crisis.

Then came Donald Trump, who exploited the system to implement unilateral tariffs on highly dubious grounds—and ones that, at least in the case of “national security” tariffs on basically all steel and aluminum from even our closest allies, defied longstanding precedent from previous U.S. presidents. The Biden administration then maintained most of those tariffs (in original or modified form) and even increased some of the China tariffs, relying on Trump’s previous abuses to do it.

Documenting the Broadest (and Most Dangerous) U.S. Tariff Laws

Trump and Biden were able to implement these tariffs without Congress—and in many cases in the face of vocal opposition from several influential members of both chambers—because of U.S. law, which through several provisions authorizes the president to impose tariffs on a wide range of imported goods without major procedural or institutional safeguards. First, there are the laws Trump and Biden have already used:

- Section 232 of the Trade Expansion Act of 1962 grants the president wide discretion to initiate an investigation and then impose trade restrictions on a certain category of products that are found to threaten “national security” (which is so broadly defined as to mean almost anything). Given the wording of the law, a global tariff against all imports might require a few separate investigations and reports (one for each broad product category at issue), but, aside from that limitation, Section 232 provides virtually no substantive or procedural checks on the president’s authority to impose security-based trade restrictions. Hence, why Republican Sen. Pat Toomey and Democratic Rep. Ron Kind were so eager to reform it.

- Section 301 of the Trade Act of 1974 is what Trump used to apply tariffs on Chinese goods, which Biden subsequently expanded. The law contains some minor substantive and procedural checks on the president’s use, but it still grants the executive branch very wide discretion to address “unfair” foreign economic policies via tariffs on a very wide set of products imported from a targeted country or countries.

Second, other laws might arguably provide the president with even broader tariff powers:

- The International Emergency Economic Powers Act of 1977 confers wide, discretionary authorities to the president to restrict international commerce on ostensible national security grounds or to advance foreign and economic policy goals. Aside from minor reporting and consultations with Congress, the only serious check on IEEPA authority is the requirement that the president declare an emergency via the National Emergencies Act, but he can do that at basically any time and for almost any reason. In May 2019, President Trump threatened to invoke IEEPA to impose tariffs on imports from Mexico to supposedly deal with illegal border crossings; though he later rescinded that threat, various experts opined that the law, while not intended to implement such tariffs, could arguably permit them.

- Section 338 of the Tariff Act of 1930 authorizes the president to impose tariffs of up to 50 percent on imports from countries that have “discriminated” against U.S. commerce as compared to what another foreign nation does. To date, the short and ambiguous law has never been used, but it remains on the books and could therefore be ripe for abuse by a protectionist administration.

- Section 122 of the Trade Act of 1974. Section 122 empowers the president to unilaterally address “large and serious” balance of payments deficits via global tariffs of up to 15 percent for no more than 150 days (after which Congress must act to continue the tariffs). To date, Section 122 hasn’t been invoked to impose trade restrictions, but a president could theoretically try it, at least for 150 days. (What happens after that, however, is anyone’s guess.)

For ease of reference, we even made a handy chart summarizing these five laws and their various (meager) limitations.

Using one or more of the laws to do what Trump now proposes would contradict its spirit and intent, but—thanks to the aforementioned historical assumptions about the president being resistant to impulsive protectionist shenanigans—there’s enough ambiguity and deference in these laws that even a bad lawyer could probably come up with a decent excuse for pursuing them. And silly things like “intent” or “norms” or “precedent” certainly didn’t stop Trump last time, so there’s little reason for us to think they would in the future, either.

Institutional Checks? Wanna Bet?

History shows that Trump might abuse these laws, but surely Congress or the courts would stop him, right? Well, history also indicates that neither branch may be willing or able to check future protectionist abuses—even ones that go far beyond the 232/301 tariffs.

In Congress, both Republican and Democratic lawmakers loudly complained about the Trump/Biden tariffs and even sponsored several pieces of reform legislation. Yet Congress has taken a grand total of zero actions to actually move those or any other bills toward a floor vote. Such inaction might indicate a more protectionist Congress than legislators publicly lead on, but it more likely reflects a simple institutional reality that stymies any effort to limit any presidential power after Congress has delegated it: Even if majorities of both chambers had approved a tariff reform bill, the sitting president—Trump or Biden—almost surely would’ve vetoed it (because they like the tariffs and because the White House jealously guards any delegation of congressional authority). Given this constraint, Congress would likely need a two-thirds majority to override a veto, which is almost impossible in today’s politics. According to one recent report, in fact, congressional Republicans who are today worried about Trump’s global tariff promises believe this institutional issue could limit their ability to stop them next year. The courts, per at least one of the senators recently interviewed in this regard, will thus be the safer bet.

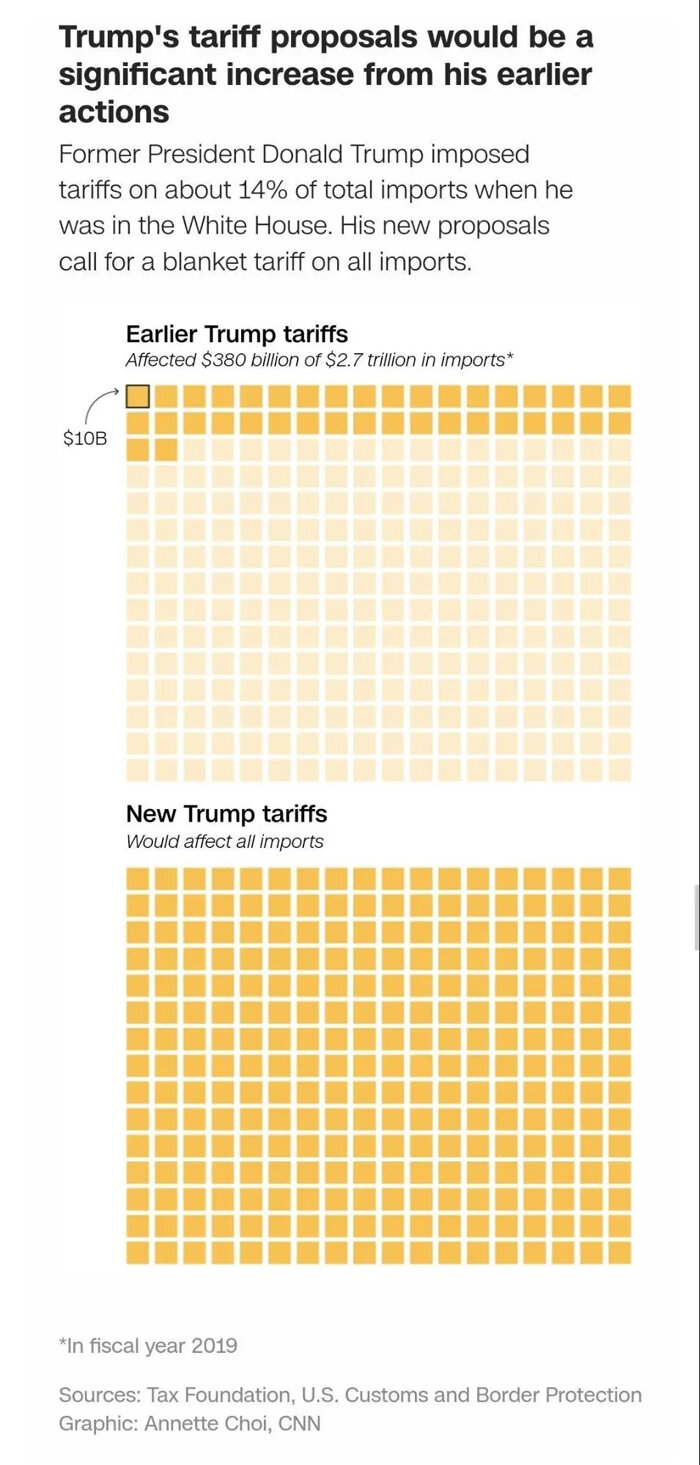

But just how safe is that bet, really? As noted above, some tariff opponents have downplayed the risk of a Trump Tariff Wall (or whatever) by presuming that an activist court would surely check future, broader presidential actions. And on a purely factual level, they have a point. As shown below, Trump’s proposed tariffs are far, far bigger than even the broad (and abusive) ones now in place:

Recent court precedent on those tariffs, however, should at least give us pause—if not cause for real concern. As we discussed last year, U.S. importers have filed several lawsuits challenging the Section 232 and Section 301 tariffs on procedural, substantive, and constitutional grounds, and the Trump and Biden administrations have vigorously defended the tariffs and the president’s broad powers under the laws. In some cases, the facts (e.g., a missed statutory deadline) weren’t in dispute, and, as has been widely documented, the tariffs’ implementation suffered from obvious flaws. Yet, as Packard and I document in the paper, “the courts have ultimately sided with the executive branch in every case thus far” and “have proven especially deferential to tariff cases involving Section 232 and national security.” In case after case, such deference—along with the laws’ broad text and delegations of power plus the president’s legitimate foreign affairs powers under Article II—meant defeat for challengers to both the tariffs and the laws supposedly authorizing them. (Trump and his lieutenants even said/tweeted things that directly contradicted the tariffs’ official justifications, and—for better or worse—the courts simply ignored it.)

Would the Supreme Court’s decision in Loper Bright Enterprises v. Raimondo, which overruled the Chevron Doctrine urging court deference to federal agency decisions, change these results? Well, it’s too early to confidently say either way, but—given the breadth of the delegations at issue and how they often task the president himself (not an agency) with decision-making authority—we probably shouldn’t count on it. (For what it’s worth, some legal scholars don’t see much of a Loper angle, and Chevron didn’t come up much in the previous 232/301 litigation.)

So, Are We Screwed?

To summarize, the key issue here isn’t whether the law truly does permit a unilateral tariff action like the ones Trump is proposing, but whether the courts (mainly) would step in quickly to stop him.

I surely wish they would step in, mostly because these laws are simply too broad and ambiguous a delegation of congressional power for any president or any Article I power. But it’s risky to assume they actually will. That’s not because, as some have argued, Trump’s court picks are all in the bag for him, but instead because of the laws themselves and recent court inaction—including the Supreme Court’s recent refusal to reconsider prior precedent finding that the obscenely vague Section 232 was a permissible delegation. Perhaps federal courts are reluctant to second-guess laws related to trade, foreign affairs, and national security. Or perhaps the Supreme Court doesn’t want any big change to the “nondelegation doctrine” to touch those murky (and today highly political) issues.

Whatever the reason, it strikes me as unwise to assume the courts will be eager to strike down broad unilateral tariffs or the laws under which they’ve been applied, especially where “national security” is invoked. Doing so would in effect be betting that the courts will find that, while it’s okay for the president to impose a 25 percent “national security” tariff on all steel imports from close U.S. allies (contra his own secretary of defense!) or a 25 percent blanket tariff on most Chinese goods, a 10 or 20 percent global tariff is simply a bridge too far under whatever law—IEEPA, 232, 301, etc.—Trump’s legal team chooses to get the job done.

Maybe the courts do say this, and maybe that result isn’t even a coin toss. But that still wouldn’t mean the risk isn’t real. And, given the dire economic and geopolitical consequences at play, even a 20 percent chance of the tariffs surviving a legal challenge is serious business.

Summing It All Up

For more than 80 years, presidents largely avoided abusing the enormous unilateral tariff powers that Congress had delegated to the executive branch under several different laws and under the assumption that such abuse was highly unlikely. This all changed in the last decade, as both presidents Trump and Biden implemented broad tariffs on dubious grounds, and as Congress and the courts proved unable or unwilling to limit such actions.

In this regard, the problem of presidential tariff power is really a small part of the even bigger problem of executive power run amok: Once Congress cedes important constitutional authorities to the president, it’s darn near impossible to get them back—especially today, when partisanship is high, vanishingly few members of Congress appear interested in a pesky, time-consuming, and responsibility-creating thing called legislation, and White House inhabitants of both parties are eager to not merely protect the power their predecessors have left them but expand it even further while in office.

Maybe the courts—perhaps empowered by Loper to check executive branch power—finally push back on a president’s even-more-expansive use of unilateral tariff authority in the future. But this outcome is highly uncertain, especially if tariffs are invoked in the name of “national security” or “national emergencies.” Thus, while nobody knows whether Trump really will follow through with his tariff threats, the only sure way to eliminate that risk rests with Congress reclaiming a modicum of its constitutional trade powers via new legislation. Doing this, of course, is a huge lift (to put it nicely). And yet, regardless of who wins in November, there might be a small window to act when a “lame duck” President Biden is more willing to eschew a veto and sign a law that enacts a legacy-building reform that would never apply to him personally.

Should Congress fail to act, U.S. trade law will continue to be ripe for abuse—abuse that almost all serious economists agree would cause substantial economic and geopolitical damage. And regardless of whether Trump acts to fulfill his promises, the uncertainty alone is sure to weigh on investment and the economy more broadly. Indeed, it probably already is.

Chart(s) of the Week