Bitcoin policy has been the talk of the town in Washington, D.C. ever since former President Donald Trump, Republican Senator Cynthia Lummis (WY), and presidential candidate Robert F. Kennedy Jr. all announced their support for a strategic Bitcoin reserve at the Bitcoin 2024 conference in Nashville. Yet, the renewed introduction of another proposal in Congress flew under the radar, and it’s long overdue: creating a tax exemption for taxpayers who pay with cryptocurrency.

Cryptocurrency has become many things to many people. But one of the original purposes was to create a new kind of money. Yet, capital gains taxes act as a major obstacle to achieving this end. Just consider how complicated the tax makes something as simple as buying a cup of coffee with Bitcoin.

First, a sales tax is usually a flat percentage added on to the bill by the merchant, but figuring out what you owe for the capital gains tax falls on you. It requires you to report the sale price, cost, timeline, and gain or loss associated with each transaction. All of this information must be recorded on Schedule D of Form 1040 to find the tax owed.

Second, capital gains tax rates are specifically structured to encourage long-term holding. In other words, the tax discourages people from using cryptocurrency as money. It’s as if the government were to tell you that you can’t cash your paycheck for a year, or you’ll be fined.

Between the compliance burden and the incentive structure, the capital gains tax is a major barrier that stops people from using cryptocurrency as money. In fact, just reading this description is likely to discourage people from even considering spending cryptocurrency, no matter how many “Bitcoin Accepted Here” signs they see.

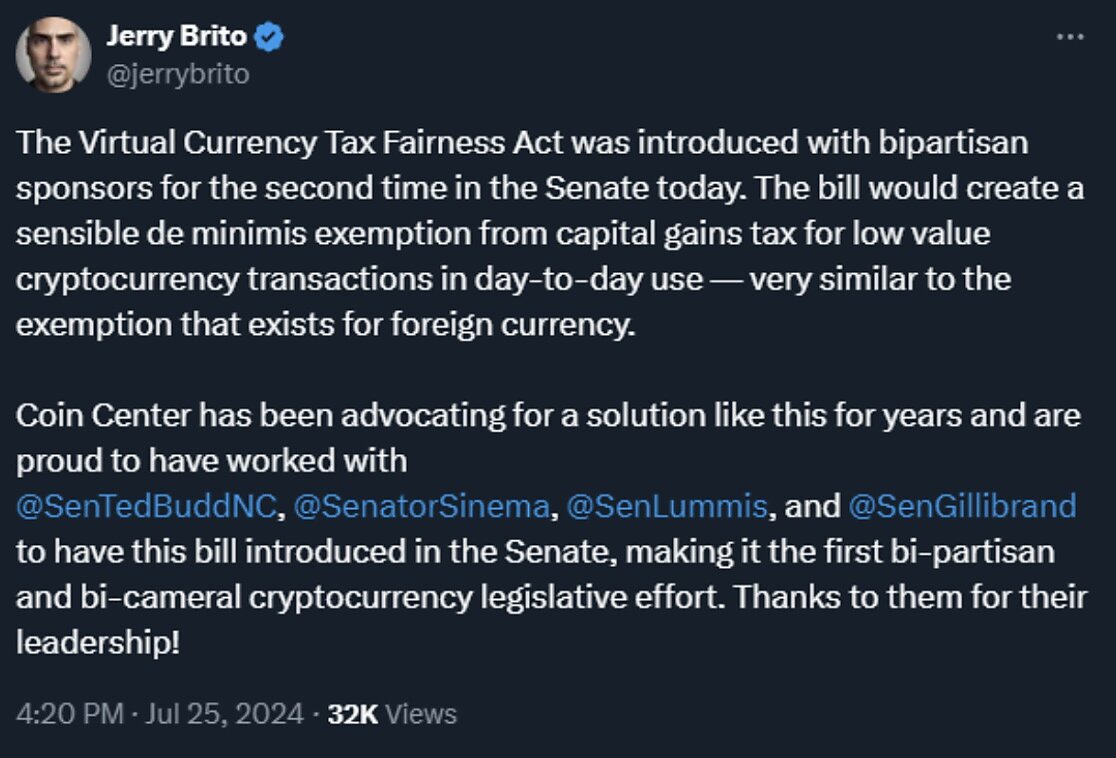

Yet, this problem is exactly what Senators Ted Budd (R‑NC), Kyrsten Sinema (I‑AZ), Cynthia Lummis (R‑WY), and Kirsten Gillibrand (D‑NY) have sought to solve with the Virtual Currency Tax Fairness Act. As Coin Center’s Landon Zinda described it, “The bill creates a sensible de minimis exemption from capital gains tax for low-value cryptocurrency transactions in day-to-day use.”

How would this exemption work in practice? Broadly speaking, if a person uses cryptocurrency to buy something that costs less than $200, then only the sales tax would apply. Zinda further pointed out that the proposal mirrors existing rules where US law provides a similar exemption for foreign currency.

There are a few strings attached, though. First, and most obviously, a transaction must be made for a good or service in order to be eligible for the exemption. Capital gains would still apply if someone were simply cashing out their holdings. In fact, capital gains would also still apply for purchases made with the intent to flip or resell the goods in question.

So, the senators seem to be focused on solely creating a safe harbor for small, consumer purchases made using cryptocurrency.

One small concern with the approach, however, is in the way the bill aggregates related transactions. From a technical perspective, the condition seems like an attempt to prevent people from structuring transactions. In other words, it prevents people from breaking up purchases to avoid crossing the threshold. From a practical perspective, however, it’s not clear what the limits would be to this aggregation.

In any event, clarifying this condition and even raising the $200 threshold are simple amendments that could be made. And what matters most is that the senators clearly recognize that this approach would fix a very real barrier to fostering a more competitive marketplace.

It’s certainly understandable why the idea of the US government stockpiling Bitcoin dominated the headlines, but cutting down the red tape and removing barriers to cryptocurrency use for individual Americans is something people shouldn’t lose sight of. It is long overdue.