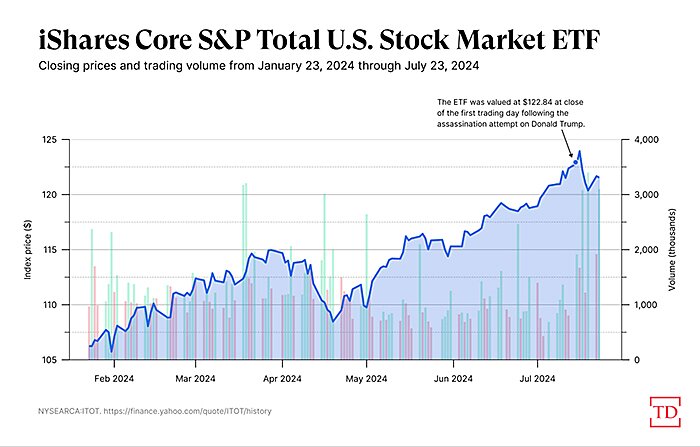

Between the closing bell on June 27 (the date of the now-infamous presidential debate) and the close this Monday, the index is up a little more than 2 percent—part of a mostly steady climb dating back to late 2022. Other broad measures of U.S. financial markets show similar things.

Even indicators of stock market volatility haven’t really moved much over the last month of intense political turmoil. For example, the Chicago Board Options Exchange’s Volatility Index (“VIX,” also known as the “fear index”), which distills the stock market’s volatility expectations based on S&P 500 index options, has increased since late June and ticked up after the Trump assassination attempt, but it’s still nowhere near historical highs (dating back to 2004) and actually ticked down on Monday following the Biden news.

Instead, Bloomberg observed Monday morning, “The market reaction to Biden’s decision to quit the race and endorse Kamala Harris has so far been fairly muted, with the US dollar little changed and Treasuries marginally higher.” As one analyst put it in the article, “This political shake up shouldn’t materially alter the direction of the markets. … The ultimate direction of the S&P 500 will still be determined by economic growth.” Other stock-watchers agreed, with earnings and monetary policy far outweighing the presidential race. The fundamentals, in other words, still matter.

Outside of financial markets, meanwhile, regular folks—at least ones outside the Beltway (but I repeat myself!)—also seem to be fairly calm about it all. I was out shopping when the Biden news broke on Sunday and laughed to Mrs. Capitolism about how blissfully oblivious—or already over it—everyone at the outlet mall seemed to be. They were walking and talking and trying stuff on, with nary an overheard mention of Biden or Trump or Harris among them. My personal “My Sports” list on Twitter, meanwhile, was still (thankfully) focused on sports, with just a few random politics tweets thrown in. (Stay in your lane, sports people!) An old friend emailed me something similar after the Trump shooting—he was struck by how everyone around him ingested the news and, instead of taking up arms or building a bunker, just kept on with their daily lives—despite a major and inarguably upsetting (and possibly even incendiary) political event having taken place just a few hours earlier.

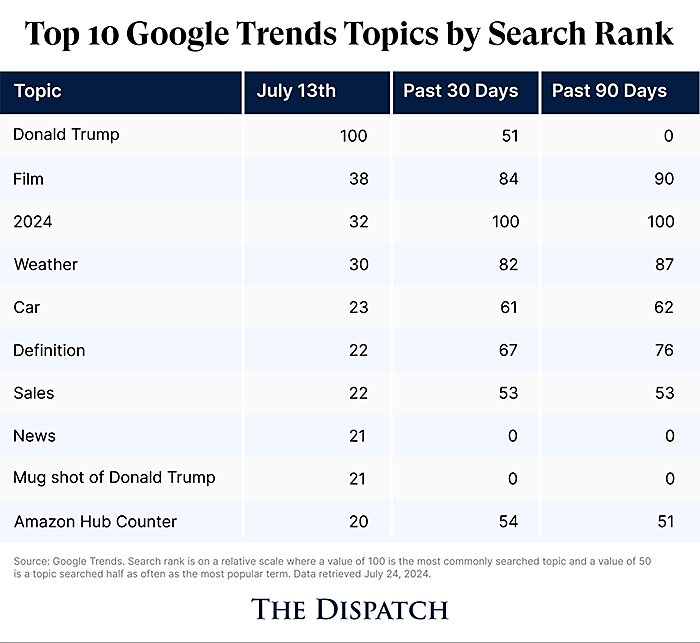

Google search data indicate that these aren’t just cherry-picked anecdotes. On July 13, for example, Trump understandably owned Google’s top search topic and search query. Between June 22 and July 22, however, he came in fifth—beaten by the weather, google, amazon, and youtube, and followed shortly thereafter by Biden and sports, cars, dogs (but not cats!), home depot, target, and other random life-staples that we search for daily. Back it out to the last 90 days, and neither Trump nor Biden crack the top 10. Other data points show people continuing to do what they do or even tuning politics out: Average MLB attendance is basically flat versus 2023; the presidential debate audience (51.3 millions households) was down significantly from 2020 (and more than double the audience of Biden’s big news conference two weeks ago).