Well, that wasn’t fun.

While most of you were, I hope, enjoying your weekends, thousands of journalists and trade dorks like me spent our “free” time Saturday and Sunday glued to our smartphones and frantically tweeting out charts in anticipation of and response to Donald Trump’s latest tariff shenanigans. For those who were (blessedly) checked out, Trump signed three executive orders Saturday declaring a “national emergency” related to fentanyl and illegal immigration and implementing across-the-board tariffs, effective midnight Tuesday, on all imports from Canada, Mexico, and China under the International Emergency Economic Powers Act (IEEPA). Since then, Trump has suspended for 30 days the orders for Mexico and Canada—mostly following the script I laid out in November, by the way—while the China tariffs are in force (for now).

Though the China tariffs remain, the biggest drama—and biggest economic blowback—was avoided with the delay of the Canada/Mexico tariffs, which would have affected about $800 billion in imported goods from our two largest trading partners and wreaked havoc on trilateral food, energy, and manufacturing supply chains that developed over three-plus decades of relatively unfettered trade. Yet, even with that mess paused, there are at least five important things we can learn (or for devout Capitolism readers, relearn) from the Great North American Almost Trade War.

First, U.S. tariffs impose real and significant costs on American businesses and companies—something even the Tariff Man himself has now admitted. One Trump admission was explicit, when he acknowledged over the weekend that there would be “some pain” from his new tariffs (but, of course, that it’d be worth it in the end). More important than this, however, was Trump’s implicit admission of tariffs’ economic costs, which came in the form of a 10 percent tariff on Canadian energy—oil, gas, uranium, etc.—instead of the baseline 25 percent he planned to implement on other goods.

Why is this a big admission? Because such a discount obviously wouldn’t be necessary if Canadians were, as Trump always claims, paying the tariffs.

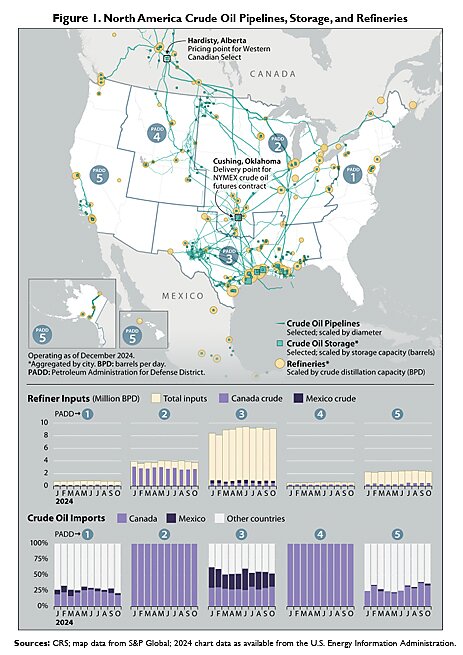

In reality, of course, the energy tariff discount reflects several unavoidable and, for Trump and other protectionists, uncomfortable facts about how imports help the U.S. economy and American consumers—and how protectionism hurts them. In this case, many U.S. refineries in landlocked states—see Petroleum Administration for Defense Districts 2 and 4 in the image below—rely on Canadian heavy crude oil that they can’t cheaply or easily replace with the lighter American version. As a result, U.S. demand for Canadian crude oil (as well as for energy generally) is relatively “inelastic,” meaning we’ll keep buying it even if tariffs increase prices. So, contra the MAGA spin, a full 25 percent tariff on Canadian energy wouldn’t have been paid by Canadians; it’d have been paid by millions of ticked-off American energy consumers, with experts predicting that the full 25 percent tariff on oil could’ve boosted Midwestern U.S. gas prices by as much as 70 cents a gallon.

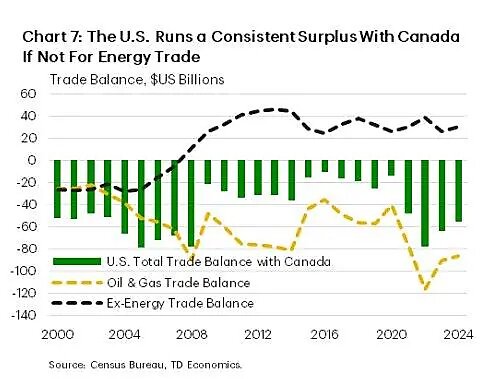

Given the longstanding politics surrounding gas prices in the United States and Trump’s own promises to lower prices (especially for energy) instead of raise them, his Canadian tariff discount bows to the market and economic realities surrounding the win-win nature of international trade (especially in North America), the benefits of imports, and the foolishness of autarky (especially in energy). And it’s especially funny given that Trump cited the U.S. trade deficit with Canada as one of many reasons for his tariffs—a trade deficit owed entirely to the very energy products his tariff discount encourages:

There are other harms to U.S. companies and consumers from these tariffs—see, e.g., these back-of-napkin estimates of how Apple will pay—but this example should prove particularly useful in the weeks ahead since Canada remains on tariff watch.

Second, tariff-related U.S. price increases can come very quickly on both imported and domestic products—and can even happen in advance of tariffs being implemented. The speed and magnitude of such price moves depends on lots of factors, such as how much of an item U.S. companies stockpiled in advance, how perishable an item is, and the availability of domestic or imported alternatives. But in general, prices of most tariffed goods are gonna rise, and, for energy and steel at least, the moves were basically instantaneous.

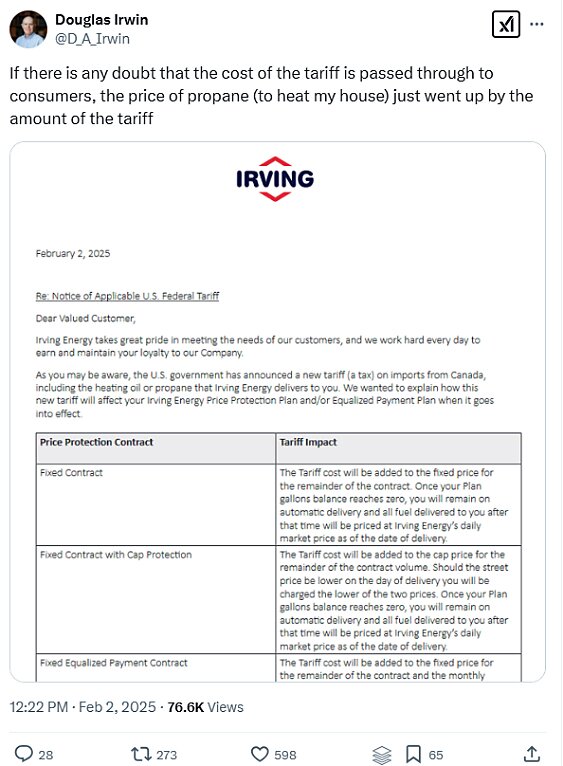

Dartmouth professor Doug Irwin posted a weekend notice from his local energy supplier, Canada-based Irving Oil, informing him of an immediate 10 percent increase in his propane bill, thanks to the new U.S. “tax” on imports from Canada. (Many New Englanders get their energy from Canadian suppliers.)

Gas Buddy’s Patrick De Haan, meanwhile, noted on Sunday that gasoline prices shot up 7 cents in advance of the tariffs. (“Trade wars are BAD NEWS for the economy. … Don’t be fooled- there are no winners here,” he added.) They were up even more on Monday before Trump and Canadian Prime Minister Justin Trudeau announced the temporary truce.

On steel, the Wall Street Journal reported Monday morning—in what may be the least surprising headline ever—that the tariffs, which would have affected almost 40 percent of all imports, had given domestic (yes, domestic) steelmakers and aluminum producers the “green light” to raise prices, too:

Steel prices started rising for some U.S. companies even before President Trump announced tariffs on Canada and Mexico. Executives said they are bracing for more to come. … Higher prices for imported steel are often followed by domestic suppliers raising their own prices, which then get passed through supply chains, manufacturing executives said. … The Trump administration’s tariff on aluminum from Canada and Mexico will get absorbed in the U.S. through a delivery surcharge attached to all aluminum transactions. The higher charge could be a windfall for U.S. aluminum companies that don’t have to pay the tariff but get to collect a higher delivery premium from customers as if they did.

Leaving aside Capitolism’s intense desire to dunk on Big Steel and misguided U.S. tariff-backers (but I repeat myself!), the lessons here extend beyond the commodities at issue. We see how tariffs are paid by American consumers in two ways: a visible tax on imports and an invisible tax on U.S.-made goods, with the latter simply paid directly to producers (via higher prices) instead of to the U.S. Treasury. And simply “buying American”—as so many MAGA fans on Twitter keep telling me to do!—doesn’t avoid immediate tariff pain.

These real-world price increases also show why reported Trump administration plans to slowly ratchet up tariffs to minimize their economic harms won’t work in many (most?) cases. Market participants are paid handsomely to track price-related trends, and they’ll surely anticipate future tariff moves well before they actually happen. This means traders and sellers in the U.S. market will often increase prices if they see additional tariffs coming, and—adding insult to injury—will often reduce prices more slowly (as the classic saying goes) if the tariffs never materialize or are later removed.

For American consumers still reeling from inflation, none of this is good news.

Third, many foreign governments will retaliate against U.S. tariffs, but not always and not necessarily in direct, dollar-for-dollar ways. Mexico seems to have followed the playbook I set out in November, warning of sticks—a carousel of TBD tariffs—but also offering up some superficial, easily-digestible carrots (ones offered months ago, in fact) that let Trump declare momentous victory and turn his focus elsewhere. Canadian officials eventually got to the same place on Monday with similarly minor concessions but were more direct in the meantime: Ottawa published a plan for immediate retaliation against a relatively small number of politically sensitive products and promised even bigger tariffs to come in a few weeks, and various Canadian provinces targeted similarly sensitive American goods and services too. This approach sought to minimize their immediate economic pain, maximize ours (just as occurred in 2018), and show to rightfully pissed-off Canadians, as well as to Donald Trump, that they won’t simply cave to American pressure:

Take Canada, which despite being knee-deep in a political crisis has responded to the threat of tariffs with newfound unity across the political spectrum, from Trudeau’s center-left party to those on the right formerly seen as close to Trump’s positions, such as Ontario Premier Doug Ford. He has pledged to pull U.S.-made alcohol from shelves in his province, and scrapped a high-speed internet contract he had signed with Elon Musk’s Starlink.

Canadian MP Charlie Angus put it even more bluntly on CNN: “We’ll make concessions on something he can write a press release about, but Canadians would hunt our leaders down if they bowed and kissed the ring.” (Canadians were literally booing the U.S. national anthem at an NBA game in Toronto and NHL game in Ottawa.)

Just as Trade Policy 101 predicts.

China, meanwhile, initially vowed a vague response and offered up meaningless concessions or things Beijing was already doing. When the tariffs finally hit Tuesday night, however, Beijing responded with tariffs on U.S. coal, liquefied natural gas, crude oil, agricultural machinery, cars, and pickup trucks—about $20 billion in total imports—as well as asymmetric retaliation: new export controls on “critical minerals” used in various electronics; new restrictions on the in-China operations of U.S. fashion company PVH Corp. and biotech firm Illumina; and antitrust investigations into Google and Nvidia (with one also threatened against Intel). Chinese regulators may now be targeting Apple too. Experts speculate that the Chinese government will quietly discriminate against U.S. commercial interests in other ways as well, but for now Beijing seems to be signaling that it, too, can inflict pain on various U.S. commercial interests while also trying to avoid a major confrontation.

Fourth, we quickly learned the emptiness of Trump’s latest tariff justifications—fentanyl streaming across porous U.S. borders—and the risks that an open-ended IEEPA presents. Granted, the “emergency” declaration’s foundations were never solid to begin with. The drug war has gone on for decades; U.S. drug overdoses and illegal border crossings have been dropping for a while now; and fentanyl use and smuggling concerns are subsiding too (or, in the case of Canada, never really existed). There also are far better, more effective, and less damaging—economically and politically—ways to address drug and border issues than tariffs (which would actually make fentanyl cheaper!); and, as my Cato Institute colleague Colin Grabow helpfully reminded me, it’s rich for Washington to pretend Canada and Mexico can effectively keep dime-sized pills carried mainly by American citizens from crossing multi-thousand-mile borders when it can’t even keep drugs out of our own federal prisons.

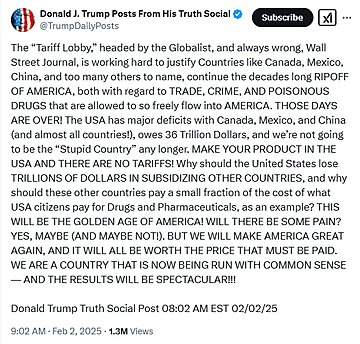

But you don’t even need such facts and logic to understand the emptiness of this new “emergency”, because—while White House aides were on TV Sunday making this all about fentanyl—Trump himself had already pivoted to just throwing mercantilist junk at the wall to justify his tariff actions:

The charade continued on Monday when Trump—clearly laser-focused on solving our northern border crisis—brought up U.S. banking and dairy market access in his first call with Trudeau and, when asked later that day about what Canada could do to escape the tariffs, fired off a 70-second response—covering lumber, autos, Canadian statehood (of course), and other topics—that never mentioned the border or fentanyl even once. And he topped it all off by writing on Truth Social that the Canada tariffs “will be paused for a 30 day period” not to see if Canada follows through on fentanyl but instead “to see whether or not a final Economic deal with Canada can be structured.”

Given this stuff and the “wins” that secured the Mexico and Canada tariff pauses, the “fentanyl” emergency is pretty clearly a sham—a pretext to invoke a vague, constitutionally suspect law that, until neutered by a court or Congress, lets the president threaten sweeping tariffs against close allies and trading partners, dominate the headlines, and demonstrate his great power over foreign governments to an adoring (and gloating) fan base.

Whether this reality has actual legal ramifications is an open question. There’s no precedent for using IEEPA to impose tariffs, especially not ones against an ally like Canada, and, along with big constitutional (separation of powers) questions, courts may look at whether there’s any “causal connection between the emergency—fentanyl and migrants—and the remedy: universal tariffs.” Maybe courts won’t consider Trump’s statements severing this connection, and maybe they will. As a practical matter, however, the issue is clearer: This ain’t about fentanyl and never was; Trump will continue to abuse IEEPA in similar ways until the courts or Congress stop him; and the U.S. economy will suffer—from tariffs or just uncertainty—as a result.

Fifth and finally, we learned that—as long as Trump is president and IEEPA and similar U.S. trade laws are on the books—the United States government is simply not a trustworthy trading partner. Canada and Mexico are the United States’ two largest trading partners, with deeply integrated economies thanks to geographic proximity and 30-plus years of relatively free and friendly trade under the North American Free Trade Agreement and its successor, the U.S.-Mexico-Canada Agreement. The latter deal, of course, was negotiated and signed by none other than Donald J. Trump (who praised it as “the best and most important trade deal ever made by the USA”), and was—certain problematic provisions aside—agreed to by Canada and Mexico and overwhelmingly approved by Congress in large part because of the security and predictability it offered to more than $1 trillion in annual trilateral commerce. The deal even had a novel provision for negotiating, amending, or terminating the deal, via negotiations scheduled to start next year (not this one).

With two quick signatures on Saturday, Trump blew up all of this for basically nothing, in the process signaling—not just to Canada and Mexico but every government in the world—that trade deals Washington signs aren’t worth the paper on which they’re written.

Given how important policy certainty is to markets (and to Federal Reserve decision-making), Trump’s behavior will have real-world economic harms, regardless of whether we see more tariffs in 30 days. But, by devaluing current or future trade agreements, it’ll also have serious implications for future U.S. trade policy. As I told the New York Times earlier this week, Trump’s tariff shenanigans are sure to “dissuade other countries from negotiating trade pacts with the United States out of fear that the president could arbitrarily scrap them by using his emergency powers.” That’s particularly the case because, by opening up domestic farmers, companies, and workers to new foreign competition, trade agreements usually impose real political costs on democratically elected officials. (See, e.g., the insane protests in Seoul when the U.S.-Korea free trade agreement was signed, or the recent ones in Paris for the new EU deal with South American trading bloc MERCOSUR.) After last weekend, every leader in the world’s gotta ask: If Trump can, with the stroke of a pen and for no good reason, completely upend a North American supply chain that has been in place for more than 30 years and involves one of the nation’s closest military allies, why should I expend the political capital needed to enter into a U.S. trade agreement?

Spoiler: They shouldn’t.

That’s a loss for American farmers, companies, and consumers seeking better access to foreign markets, goods, and services, with U.S. economic growth taking a small hit along the way, too. And it’s all but certain to accelerate governments’ moves away from the U.S. market (and toward each others’). But, as trade economist and new Cato adjunct Kyle Handley explains, it’s also a loss for the resiliency of the U.S. economy during times of global economic turmoil:

There was an international economic emergency in 2008 called the global financial crisis. World trade collapsed, almost as if there was a global trade war. US exports also collapsed, but the collapse was much smaller toward destinations where the US had trade agreements like NAFTA.

With [economists] Carballo and Limao, I showed these trade agreements were valuable because they provided insurance against protectionism during a crisis. That meant US trade declined less and recovered faster where policy commitments were already in place.

You see, often times when there is a real economic downturn, countries turn toward protectionism. … Trade agreements are reciprocal commitments to keep tariffs low that reduce the correlation between tariffs and downturns. If you expect low trade barriers, you keep trading, which US firms did where trade agreements existed. Otherwise, firms exited markets with a history of volatile economic shocks and took longer to re-enter those markets.

So now what? The US declares an economic emergency when unemployment is low and growth is high as a pretext for 25% tariffs on Canada & Mexico, after they renegotiated USMCA. I would argue the “good faith” underpinning the insurance against protectionism that kept US supply chains robust during the last economic crisis have vaporized. We’ll be worse off when the next downturn arrives. And…we won’t rebuild that credibility {for} some time even if Trump backs off tomorrow morning.

Trump indeed backed off—at least on Canada and Mexico. But (much to Beijing’s delight, by the way) we’ll be paying the price for years to come.

Chart(s) of the Week