Even the most committed free marketer will readily acknowledge an exception for national security. Trade should generally be free, for example, but you’ll rarely see free traders opposing government subsidies to and/or restrictions on defense-related goods like tanks or fighter jets. We’re always quick to add, however, that security exceptions should be limited, transparent, and well-justified, and that policymakers and the public should still scrutinize claims that X or Y is needed on national security grounds. Indeed, that national security is an exception granted by stalwart free marketers also means it’s ripe for abuse by those seeking a government-aided advantage over their competition, customers, or suppliers. And history is littered with politicians, companies, and unions using “national security” as an empty (often comical) excuse for the government to block imports, spend taxpayer dollars, or otherwise intervene in the economy in ways that benefit them alone, economically or politically, at our expense—and often the nation’s expense too.

No recent example more clearly shows said abuse than Nippon Steel’s attempted acquisition of U.S. Steel—a deal that’s good for the companies, their workers, and the nation, yet, thanks entirely to political opposition, could soon be blocked on “national security” grounds.

The ‘National Security’ Hoax

As we discussed a year ago when the news first broke, opposition to Nippon Steel’s acquisition of U.S. Steel—which both Joe Biden and Donald Trump have now voiced—never made much sense on the merits. Economically, the deal was relatively small—involving just the nation’s third-largest steelmaker—and early indications were that its Japanese purchaser would help the long-suffering U.S. Steel regain some of its past mojo. The national security justifications were similarly empty: Japan is one of the United States’ closest military allies, and even if the publicly traded Nippon Steel were to set its billions on fire and shutter all of U.S. Steel’s factories, that impossibly insane move wouldn’t affect the United States’ defense-related steel needs in the slightest. So, while it would be normal for the interagency Committee on Foreign Investment in the United States (CFIUS) to review the deal’s security implications, approval was a no-brainer.

Since then, the vacuity of the opposition has become even clearer. We’ve learned, for example, that Nippon Steel won’t just pay a big premium for U.S. Steel but also invest “no less than $2.7 billion in U.S. Steel’s union-represented facilities and communities,” including a much-needed $1 billion in the Mon Valley Works facilities in Pennsylvania. Large American steel buyers, meanwhile, were also bullish on the deal: Foreign ownership has long been common in the domestic steel industry, they note, and the Nippon deal ensures more competition and better domestic steel supply—especially as compared to a situation in which U.S.-based rival Cleveland-Cliffs’ bid for U.S. Steel had won out. (Cliffs not only offered much less money for U.S. Steel, but also would have had a post-merger monopoly over certain steel products and be more likely to close certain domestic facilities.)

Industry analysts also voiced support, with some predicting that the transaction could “revitalize” U.S. Steel and the broader industry and boost domestic steelmaking capacity:

Nippon Steel’s commitment to heavily investing in modernizing U.S. Steel’s outdated mills could offer the business a crucial technological boost. With these cutting-edge production techniques, U.S. Steel could reduce production costs, improve operational efficiency and compete more effectively with major international players like India’s Tata Steel and China’s Baowu Steel. By contributing financial resources and technological know-how, Nippon Steel might contribute to job security and maintain U.S. Steel’s competitiveness in the worldwide market. For manufacturers and procurement professionals tracking steel prices and supply chains, the deal’s outcome could significantly impact domestic steel pricing. Increased investment from Nippon Steel could mean higher production capacity and a more efficient supply chain, which could ultimately stabilize prices for critical metal products.

Other analysts have “praised Nippon Steel as a potential savior of U.S. Steel,” which has continued to struggle financially. Things are so bad at the company, in fact, that CEO David Burritt has warned that the Nippon deal’s collapse would force U.S. Steel to shutter its most outdated (unionized) U.S. factories—including Mon Valley—and shift its production and workforce to newer, non-unionized facilities in the South.

For these and other reasons, the transaction has been supported by more than 98 percent of U.S. Steel shareholders and an independent arbitration panel, which was chosen by the company and the United Steelworkers (USW) union and which ruled in September that the deal could proceed because Nippon would honor U.S. Steel’s labor commitments, invest billions in union facilities, and not conduct layoffs or plant closings through the term of the current labor agreement. The purchase also has been supported by thousands of U.S. Steel employees, their neighbors, and their local government representatives who have repeatedly rallied on the transaction’s behalf because they see Nippon Steel as the best (only?) possible way to save their jobs and communities. (According to one employee at the latest rally, “90% or more of the steelworkers are for the sale.”) The community benefits were also front and center in a new letter from several Congressional Black Caucus members, asking Biden to let the deal proceed. Former Department of Labor chief economist Ronald Bird summed it all up nicely: “The Nippon offer is clearly better for US Steel stockholders, employees, and union workers, as well as the US businesses that use steel. And the acquisition would improve national security by boosting domestic steel production.”

Speaking of national security, that case against the transaction has also collapsed—even though it remains the primary obstacle to the deal’s completion. In March, William C. Greenwalt, former deputy undersecretary of defense for industrial policy, explained that the U.S. military needs a tiny amount of domestic steel output and gets none of it from U.S. Steel:

Historically, the Pentagon has bought significantly less than 1 percent of the US steel industry’s output, although the industry believes that number is closer to 3 percent. Even if you take industry’s number as gospel, that’s simply not a massive amount. The steel that is most important to DoD is of high quality and bought at low volumes, primarily from two plants in Pennsylvania that produce the armored plate for Navy ships and Army ground vehicles. These plants are currently owned by Cleveland-Cliffs, a company that, seeing no profitable options to invest in its plants or its workers, recently announced it will engage in high levels of stock buybacks.

Greenwalt added that the two U.S. plants producing defense-grade armor are undoubtedly critical to national security but are at no risk of closure because they receive “Defense Production Act (DPA) subsidies to ensure that they stay in business and support DoD.”

Other national security experts have echoed Greenwalt’s views on the Nippon deal and national security, arguing that it would be crazy for CFIUS to block the transaction. Most notable in this regard is Thomas Feddo—a legit authority who served as assistant treasury secretary for investment security between 2019 and 2021—who wrote in April that a CFIUS ruling against the deal would “clearly be improper.” He then elaborated on why:

Under the committee’s statutory analytical framework, Nippon Steel’s acquisition of U.S. Steel poses no national-security risk to the U.S. The committee primarily considers a foreign investor’s intent and capability to harm U.S. security, together with the character of the work done by the U.S. business that could be exploited. Nothing in this steel-making transaction risks compromising cutting-edge technology, critical infrastructure, sensitive data or the defense industrial base’s supply chain. Nippon Steel’s investment in U.S. Steel promises to enhance American production capacity and strengthen geopolitical ties between the U.S. and Japan in the face of Chinese aggression.

Since then, independent national security and foreign policy experts at the Hudson Institute, Brookings Institution, Heritage Foundation, American Enterprise Institute, CSIS, Council on Foreign Relations, Atlantic Council, and elsewhere have similarly expressed support for the deal, and they’ve been joined by both economists and even several current U.S. government officials (anonymously, of course). To my knowledge, not a single legitimate national security expert has expressed the opposite view. Instead, “expert opinion seems unanimous that there is no real national security interest in the Nippon Steel-US Steel merger” (especially after Nippon’s supposed connections to China were debunked).

Finally, there’s CFIUS itself. As the Financial Times wrote over the weekend, the three departments with the most responsibility for and expertise in national security and foreign investment—Treasury, State, and the Pentagon—have each concluded that the deal poses no security risks. The only agency opposed, meanwhile, is the Office of the United States Trade Representative, which has no direct responsibility for the issues at hand. The FT adds that the committee even drafted a “mitigation agreement” that outlines how Nippon Steel could alleviate various security concerns, but USTR “showed no sign of reversing its opposition.”

If a leaked version of CFIUS’ thinking is accurate, moreover, the novel concerns raised by some committee members are hilariously weak. They’re reportedly worried that Nippon Steel would import large volumes of steel from its affiliates in India and quickly shutter U.S. production capacity that’s needed not for national defense but for infrastructure and commercial manufacturing—productive capacity that might someday be needed in time of war. They’re also worried that the new U.S. Steel would resist U.S. tariffs (antidumping duties, especially) to counter any new surge in imports.

Yet this “risk” not only disregards Nippon Steel’s own written commitments and the open support of downstream steel consumers, but it also bizarrely assumes that a publicly traded Japanese company would pay a large premium (more than $5 billion above U.S. Steel’s market capitalization) to destroy its new U.S. investments; that domestic steelmakers—including Cliffs and domestic titan Nucor—wouldn’t respond to any such actions with additional capacity of their own; and that the U.S. government wouldn’t have tools (subsidies, tariffs, nationalization) to address potential market gaps, especially in time of war. As Bird put it, “Nippon cannot dig up U.S. Steel’s plants and transport them to Japan.”

No surprise, then, that when hearing of these excuses, actual CFIUS experts were floored. Lawyer David Plotinsky told Bloomberg, for example, that “it’s hard for the government to say with a straight face that this transaction would in fact weaken the commercial steel market.” He then added (emphasis mine), “In this case it seems that the tail may be wagging the dog, in that Commerce’s trade-related analysis is being used to help CFIUS gin up a very thin national security argument in the absence of genuine national security risk.” Another CFIUS lawyer, Michael Leiter, told Reuters that, “By almost any measure, the issues identified by the committee are not ones that would fall into the national security bucket, but quite clearly into two others: Nationalistic trade protectionism and electoral politics.”

And that, dear readers, gets to what this is all really about—politics. As the FT notes in its writeup, “Several senior US officials told the FT that Biden’s opposition was political. Biden, Kamala Harris and Trump all used their opposition to try to win union votes in Pennsylvania, where US Steel is based, during the presidential election campaign.” The Washington Post and New York Times have written much the same, with each citing the administration’s need to curry political favor with USW leadership, which openly worries about a loss of workers (and influence) at the new U.S. Steel and has close ties to rival bidder Cleveland-Cliffs. Per the WaPo, in fact, administration officials have even told Japanese diplomats that union politics is driving the bus here. And Pennsylvania locals know the score too: “This is nothing but politics,” West Mifflin Mayor Chris Kelly told the Wall Street Journal.

USTR’s opposition appears to be similarly motivated: U.S. Trade Rep Katherine Tai headlined the USW’s convention in 2022 and just two months ago joined Labor Secretary Julie Su and the USW at an “official event” (don’t you dare call it a campaign rally!) hosted by none other than Cleveland-Cliffs. As the FT’s Alan Beattie notes, Tai’s affinity for the USW is a rather open secret:

Tai’s always been obsessed with steel. She told counterparts in other governments that backing the industry was essential to winning Pennsylvania in the election and that they had to join in. It would appear that since the head of the steelworkers’ labour union — though not union officials or workers on the ground — is against the Nippon Steel deal, so is she.

(Never mind, of course, that her and Biden’s “pro-worker” strategy didn’t win Democrats Pennsylvania or the election.)

The Broader Harms of Politicizing Security

The politicization of the Nippon Steel deal and “national security” has potential harms that go way beyond the two companies or even the industry at issue. For starters, there’s the CFIUS process itself, which is imperfect but has generally worked to dispassionately and independently facilitate beneficial investment in the United States while screening out serious national security concerns. For those who follow the committee closely, what’s going on right now with Nippon Steel is “extraordinary” and bodes ill for its future operations:

“The Nippon case reveals a flaw in the Cfius process, where a member like USTR, that does not have national security pedigrees nor represents any specific risk arising from this transaction, is able to make a huge geostrategic mis-step,” said a former Cfius official in the Biden administration.

“Tai is playing a game that exposes the Cfius process to becoming a permanent tool of politicians, unreasonably expands the scope of what is considered national security and will force the US to put in writing that Japan is a national security threat, which is simply untrue and detrimental to American security,” the former official added.

Google around and you’ll find any number of CFIUS practitioners saying much the same thing (albeit in less colorful terms).

The deal’s politicization also throws a wrench into U.S.-Japan relations: “The situation has soured US relations with Japan, its most important ally in Asia. Japanese officials point out that Washington wants Tokyo to work together to counter China but says Japan is a security risk.” And it raises new questions about the United States as an investment destination:

A rejection of the deal could damp Japanese companies’ appetite to consider investing in the US, said Akira Igata, a lecturer at the University of Tokyo who specializes in economic security.

“The damage has been done, Other close allies and partners of the US are closely watching this unfold,” he said. “This also raises a larger question about how the national security exceptions are invoked in investment screening. No one believes that there is a legitimate national security concern in blocking this transaction.”

Indeed, one of the United States’ biggest selling points in its geostrategic competition with Beijing is our nation’s relative openness and hands-off approach to foreigners’ investment and operations in the country. If we’re going to start letting politics drive the bus, on the other hand, then foreign companies—Japanese and others—might be more willing to do business with China, including in ways Washington is trying to prevent.

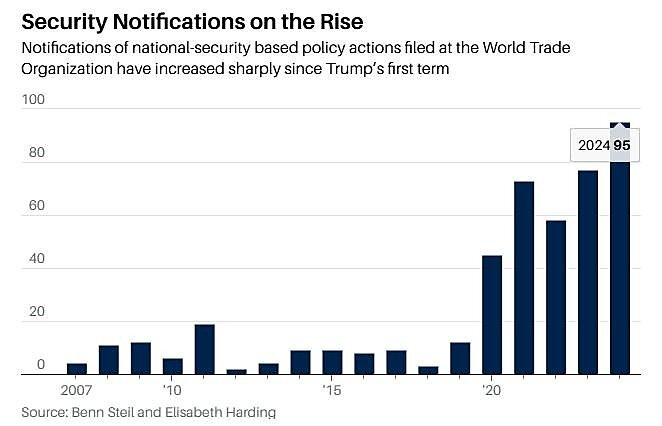

Then there’s the risk that scuttling the Nippon deal further encourages other nations to adopt the United States’ flimsy approach to using “national security” as a guise for economic protectionism —harming American exports and investment along the way. As the Council on Foreign Relations’ Benn Steil just documented, this has already started happening. Since the Trump administration first declared that “economic security is national security” in 2017 and then slapped “national security” tariffs on steel and aluminum, World Trade Organization notifications invoking “national security” to excuse derogations from the WTO Agreements’ general trade liberalization rules have increased significantly, reaching an all-time high this year. Are more on the way?

Finally, there are implications for the U.S. economy itself as the government’s regulation of international commerce becomes increasingly politicized. Fareed Zakaria lays this out well in a recent interview, drawing unfortunate comparisons to how things are done in India:

We have politicized the economy in America. All this industrial policy, these tariffs, these bans. What that does is it suddenly makes Washington a very crucial arbiter to the success of business. You add to it Trump, who personally loves the idea of fining Caterpillar for doing this and Harley Davidson for doing that and Chase for doing — he views it as his job as president to literally dole out rewards and punishments to companies, depending on whether they do what he regards as the right thing or the wrong thing. It’s deeply saddening to me as somebody who grew up in India, where this is business as usual. Every business had to slavishly pander to whoever the prime minister at the time was. And you see it in Musk. Tesla stock, in the two days after Trump won, was up 20 percent or something like that, adding tens of billions of dollars to Elon Musk’s net worth. Nothing fundamental in the economics had changed for Tesla. There was just an expectation, now that he was a friend of Trump’s, that he was going to somehow be showered with federal largesse. You know, there’s a guy in India called Adani who’s Modi’s best friend, and his stocks trade at multiples 10 times that of every other Indian company. Because everyone assumes that at the end of the day, being Modi’s best friend is worth $100 billion or something like that.

Evidence of politicization permeates U.S. international economic policy today. As has been widely reported, for example, “Companies are quietly hiring well-connected firms to make sure their [tariff] perspectives are heard both in Congress and at Mar-a-Lago.” Nippon itself has spent millions on lobbying, and the only clear winners so far have been “Washington lawyers and accountants preparing to rake in a fee bonanza.” The Nippon debacle certainly isn’t alone in driving these bad trends, but it’s perhaps the biggest and most egregious example of the problem.

Summing It All Up

So, to recap, a publicly traded corporation headquartered in one of the United States’ closest allies wants to spend almost $15 billion to acquire—and then another few billion to upgrade—an ailing American steel company that desperately needs the investment. The deal is supported by the target company, its shareholders, many (if not most) of its workers, their local representatives and many federal ones too, most (if not all?) independent national security experts, and the three U.S. agencies with actual responsibility for the relevant economic and security issues raised by the deal. Its main opposition, meanwhile, is just some politicians, union leaders, a handful of nationalist pundits, a domestic competitor that stands to make a mint on the deal’s collapse (when it can swoop in with a lowball offer), and a U.S. agency with no directly relevant expertise or responsibility (but run by an apparent fan of said union and said competitor).

Yet it could all get scuttled on “national security” grounds.

It’s long been said that false patriotism is the “last refuge of the scoundrel.” In the Nippon Steel case, however, that might be unfair to scoundrels.