Joe Biden is very upset at the way some companies structure their prices. In September 2022, the President told a White House Competition Council meeting that he’s had enough of “unnecessary hidden fees” – or, as he calls them, “junk fees” – that are eating into families’ budgets. He listed various fees he despised across different sectors: excessive banking overdraft charges, sly termination fees for canceling cellphone and cable internet contracts, frustrating processing fees for hotel bookings, and even airlines making you pay extra to sit next to your kid on a flight. All these pesky charges are “taking money out of the pockets of average Americans,” he moaned.

Fast forward a month, and the White House finally explained why they think meddling with these fairly minor “junk fees” is worth the President’s time. They claimed they weren’t concerned about companies charging more for legitimate add-ons or services. Nope, they’ve only got it in for fees that are “designed either to confuse or deceive consumers or to take advantage of lock-in or other forms of situational market power.” That’s notionally stuff like outright fraud, hiding mandatory fees in headline prices, slapping on “surprise fees” after purchases have been made, or so-called exploitative or predatory fees — in other words, consumer protection policy.

Biden and his team believe these fees nevertheless have meaningful economic costs, harming consumers by increasing search and information collection effort before purchases, making it more difficult to switch to better providers, and extracting more money from vulnerable or ill-informed households.

The administration has thus already thrown its weight around, using its bully pulpit to pressure companies into changing their ways, with the threat of rules and law changes looming. The U.S. Department of Transportation (USDOT) is running a “family seating dashboard” (see below) while plotting “a common-sense rulemaking to ban airlines from charging families junk fees to sit together.” The Consumer Financial Protection Bureau is working on rules and guidance for fees charged by banks and credit card companies. And the Federal Trade Commission is seeking broader authority to slash “junk fees” across the economy – including in event ticketing, hotels, funeral homes, and industries with mandatory fees.

All this fuss raises a few important economic questions: Would using government powers to ban such fees actually save American households a load of cash? Are these pricing structures really a sign of exploitative behavior and uncompetitive markets, or simply rational economics from companies? And what other unintended consequences might come from this meddling and interference?

Over the next couple of The War On Prices newsletters, we’re going to explore this in a bit of detail. Today we’ll make a few big picture observations on the administration’s narrative. Then in the near-future we’ll run through some economics of specific “junk fees” that animate Biden. Specifically: charges for families to sit together during air travel, hotel resort fees, and early termination fees for internet and cell services.

Huge Effects on Households’ Budgets?

The Biden administration lumps many different fees and charges together when talking about “junk fees.” Yet mandatory hotel resort fees, say, are very different from early termination fees in service contracts. It therefore doesn’t make sense to talk about “the economics of junk fees” – you really need to look at each case individually.

Nevertheless, we can make some big picture observations about the economics here.

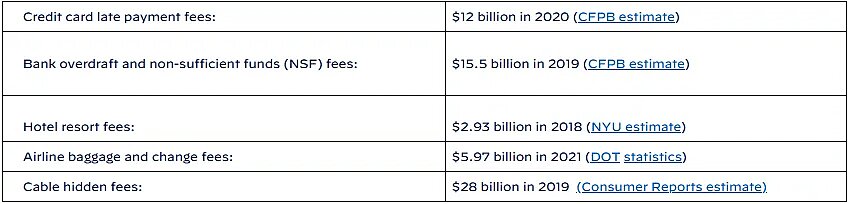

The White House loves to throw around big numbers to stir up outrage over these “junk fees.” They’ve previously cited statistics saying that: credit card late payment fees raked in $12 billion in 2020; hotel resort fees totaled $2.9 billion in 2018; airline baggage and change fees generated $6.0 billion in 2021; and “hidden” cable fees brought in a whopping $28 billion in 2019. The table below is from Biden’s October address.

When they cite these huge figures alongside claims that companies are “taking money out of the pockets of average Americans,” they clearly want you to believe that “junk fees” entail a massive transfer of money from consumers to corporations – money that households could keep if the government would only just step in and ban these sneaky pricing practices.

But that’s obviously not true as a matter of economics. The administration itself admits that banning these fees or charges would, in competitive markets, primarily be offset by an increase in the upfront price or other charges for the product or service. That shifting of the deckchairs might redistribute money between types of customers, but it wouldn’t really change the overall charges faced by consumers as a cohort. There’s no large pot of gold, in other words, to transfer from businesses to American households, however much Biden’s rhetoric suggests otherwise.

When confronted about this misleading narrative, the Biden administration offers two counterarguments. First, some members claim that many markets aren’t competitive, and in those cases, market power can lead to higher prices for some Americans. Yet where firms have genuine, enduring market power, it’s not clear why they’d need to use deceptive charges to extract their price from consumers.

Some administration officials therefore admit that the goal isn’t really to save Americans a fortune, but to simply encourage transparent pricing. This, they contend, might even make markets marginally more competitive. The idea is that simpler pricing structures will encourage more consumers to switch providers, and firms will thus compete more rigorously on reducing costs and delivering quality, rather than putting their entrepreneurial talents into devising “exploitative” pricing strategies.

That to me seems highly speculative. Either way, it’s obviously not the case that banning fees or charges that businesses consider important would generate a meaningful windfall to customers. Most of the time, there will be offsetting increases in headline prices, or else – if businesses do eat losses – lower profitability and so less incentive for new business entry into the market.

Pricing and Efficiency

Now, the Biden administration may say they’re not interested in cases where fees fund extra products or services. But some of their so-called “junk fees” clearly do include consumers facing charges for services, options, or guarantees (airline seating fees, for example).

So let’s make two basic economic points about this sort of unbundled pricing in which customers are charged more for certain choices.

First, charging separately for services or options is entirely normal and, when freely decided, efficient. If someone’s willing to cough up a few extra bucks to guarantee they’re sitting next to their beloved travel buddy on a flight, why on earth should that be considered harmful?

Over the years, airlines have unbundled loads of non-essential bits and bobs already, like charging for a soggy sandwich on short-haul flights or making you pay for checking your bags rather than providing these services as standard. Not only does this let them enforce the principle of “user pays” more tightly, but the extra wiggle room for managing costs fattened profits and so enticed new low-price carriers into the game.

Now imagine if this unbundling was banned and companies were forced to provide all the services together under a headline price. Not only would airlines hike up base fares for everyone (leaving the cash-strapped traveler high and dry — paying for stuff they don’t want or need), but we’d probably see fewer competitors duking it out on many routes too. So, forcing all-in pricing would almost certainly be highly regressive, as well as inefficient.

Second, sometimes what look like pesky additional fees are actually about giving customers important information about external costs – things like taxes, supplier disputes, or supply hiccups. This can be useful for customers and businesses, sparking demands for much-needed tax policy changes or even just shedding light on temporary quirks in a way that might help encourage customers to use the business again.

In short, there are obvious economic reasons why companies might unbundle their prices or charge separate fees for certain services, choices, or circumstances. Not all of what Biden talks about are really “junk fees” at all.

Ignoring Market Innovation

Customers obviously shouldn’t be charged for products without their consent, and businesses ought to reveal mandatory fees before purchases occur.

But, let’s face it, we have all got annoyed by certain charges at times, even when they’re clearly for additional services. Reading the small print is annoying and costly! So Biden’s intervention will surely be popular with many, who may not perceive of the indirect consequences of banning or limiting such pricing practices.

So it’s worth remembering that the competitive process inherent within a market itself encourages businesses to keep customers happy, which in turn should curb the use of hidden fees which are truly unjustifiable.

Think about it: today when customers buy something, they often leave a review spilling the beans on any hidden fees encountered. This creates an incentive for businesses to be transparent and fair, or risk losing future customers.

And let’s not forget the revolution we’ve seen through third-party institutions already. Price comparison websites now usually lay out any additional fees or charges, giving consumers a clear view of what’s on offer. Intermediaries have strong incentives to be accurate and comprehensive.

If a company’s pricing is seen as unfair, impractical, or is just plain annoying, the business will eventually take a hit for it. Even if they have market power, doing stuff that riles your customers creates a big opportunity for new entrepreneurs to swoop in and shake things up. There’s a reason that many businesses take a short-term profit hit to avoid being accused of price-gouging — consumer sentiment shifts can be brutal for the long-term prospects of a business.

So why on earth would companies engage in pricing structures that some customers loathe? Biden’s team think the conduct is at worst fraudulent and at best nickel-and-diming customers to simply make a quick buck. Yet a lot of businesses do the things he bemoans — and sometimes most players in an industry or geographic location! That should make one stop and think: maybe there are just solid economic reasons for using these pricing practices that Biden’s team hasn’t considered.

In the next newsletter, we’ll begin exploring three of Biden’s pet peeves — airline seat charges, hotel resort fees, and early termination penalties for cell and internet services — to see if that’s the case.