Given my schedule and intense desire to avoid writing about tariffs again, now’s as good a time as any to check in on the Inflation Reduction Act, which has been in the news lately because Republicans are considering whether to trim the law’s subsidies as part of their big tax/spending package. As readers of Capitolism surely know, I am and remain skeptical of the IRA as an industrial policy bill designed to boost American manufacturing and make the United States a clean energy powerhouse (or whatever), and we’ll surely revisit where those efforts stand later this year when more data are in about the factories and jobs at issue. For now, however, it’s worth examining the IRA in terms of simply its budgetary cost and primary objective of reducing carbon emissions to fight climate change. As an excellent new report from the Breakthrough Institute documents, this is not going well. And none of it should be surprising.

The IRA So Far: Higher Costs and Missed Emissions Targets

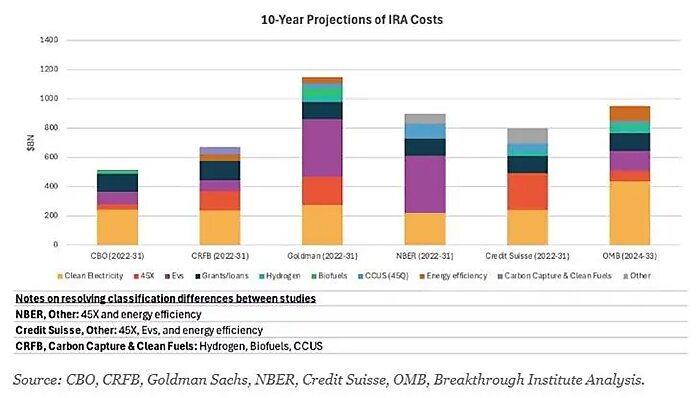

As the Breakthrough report documents, the IRA’s subsidies have already become way more expensive than the already-high $383 billion price tag the Congressional Budget Office originally calculated (which itself was billions more than what Senate Democrats first claimed). “More recent estimates,” the report notes, “project the total cost of these programs to run closer to a trillion dollars, with the cost of wind and solar subsidies alone substantially exceeding the cost of the original estimates not only for the clean energy subsidies but for the entire cost of the package, inclusive of non-climate related spending.”

Even these revised totals, however, substantially undershoot the IRA’s actual costs because they stop counting after the 10-year budget window closes. Thus, as my Cato Institute colleague Travis Fisher discussed in 2023, energy firm Wood Mackenzie has estimated that the IRA’s energy subsidies could hit $3 trillion through 2050, and his own forthcoming estimates push the number even higher—to as much as $4.7 trillion over the same timeframe.

Even in Washington, that’s a lot of money.

As to why the subsidies’ budgetary costs are so high, the Breakthrough report cites two big, fundamental drivers. First, the law subsidized “mature, widely commercialized technologies,” meaning that public uptake (and thus taxpayer cost) would inevitably be substantial:

Solar now accounts for roughly 5% of US electricity generation and almost 25% in California. Wind accounts for over 10% of US generation and almost 30% in Texas. EVs will likely account for around 10% of US vehicle sales this year. With federal tax credits covering a third (or more) of the cost of wind and solar installations and $7500 for every EV that automakers sell, the aggregate costs of this approach to bringing down the unit costs of clean energy gets really expensive really fast.

Put simply, the IRA subsidizes stuff millions of Americans already want and can already access relatively easily. So, of course they’re gonna take advantage, and the taxpayer tab’s gonna climb—a lot.

Second, the law transformed what were originally supposed to be temporary subsidies intended to drive the innovation of new energy technologies into “quasi-permanent” subsidies intended to drive long-term reductions in CO2 (and, for technical reasons that we’ll avoid digging into today, to keep the continuing deployment of wind and solar energy economically viable). So, even though wind and solar technologies are already relatively cheap and available (thus eliminating any need for innovation subsidies), the report notes that IRA’s subsidies are “scheduled to expire only when economy-wide US emissions are 75% below 2022 levels, which translates to almost 80% below 2005 levels, or 40 percentage points lower than the IRA’s 2030 emissions goal.” (Emphasis mine.)

That’s a recipe for never-ending subsidization, especially because the IRA’s emissions goal looks increasingly unlikely (again, emphasis mine):

Despite this significant escalation in the projected cost of the IRA, US emissions appear likely to significantly undershoot the original emissions reduction estimates that proponents of the IRA argued the package would achieve. After passage, Princeton’s Net Zero project estimated US emissions would fall 50% below 2005 levels by 2035. Last year, they softened this projection to 40% below 2005 levels. A 2024 report from Princeton, Rhodium, Energy Innovation LLC, and MIT found that deployment trends in low-carbon electricity were insufficient to achieve the goal of 40% reduction in emissions by 2030 established by the IRA. And as we found last year, taking these revisions into account, IRA investments would likely sustain the existing pace of US emissions reductions, not significantly accelerate them.

Given that reducing carbon emissions is supposedly the IRA’s No. 1 goal, missing this target is a rather serious problem—especially when the subsidies will continue until the target is reached!

As to why the law has proven less effective at curbing emissions than was advertised, Breakthrough zeroes in on something we’ve discussed here repeatedly: the IRA’s total failure to tackle supply-side impediments to the dissemination of renewable energy, particularly permitting, transmission, and interconnection regulations:

Wind and solar are not economically viable without subsidies not because solar panels and wind turbines aren’t cheap but because it has become increasingly difficult to site them in many places and to get the power they generate to the places where it is needed when it is needed. Democratic leaders in the last Congress ultimately abandoned the opportunity to pass a legislative package inclusive of permitting and transmission reform, at the behest of an unholy alliance of environmental groups adamantly opposed to any meaningful reform of the National Environmental Policy Act and investor-owned utilities wary of competition that grid interconnection would bring.

These supply-side reforms, they add, were probably more important for U.S. renewable energy deployment and carbon emissions than the IRA’s demand-side subsidies, and the policies’ omission has contributed greatly to the law’s failures (and cost):

In the absence of forever subsidies for wind and solar, permitting reform and interstate transmission are essential if those industries are going to thrive. No one appears to have done any modeling directly comparing the emissions benefits of solar and wind with subsidies and without permitting reform and transmission versus with permitting reform and interstate transmission and without subsidies. But given that Jenkins’ modeling at Princeton’s Net Zero project, conducted shortly after passage of the IRA, found that 80% of the estimated total emissions reductions through 2035 vanished without major expansion of transmission, we suspect that transmission, interconnection, and cheap battery storage are much more critical to the future of wind and solar, and the emissions benefits that additional wind and solar deployment might bring, than are the IRA tax credits.

In short, an IRA focused on supply-side reforms alone may have done more for the environment than the subsidy-focused law we got, while saving American taxpayers trillions in the process. And the fact that, as noted above, no one in power in 2021–2022 even considered modeling this alternative approach is a policy failure of epic proportions.

But Wait, There’s More

Adding insult to injury are all the other things unmentioned by Breakthrough that are further inflating costs and slowing deployment of renewable technologies in the United States—some of them baked into the IRA itself. As we’ve discussed, for example, tariffs and “Buy American” restrictions have dramatically inflated solar panel prices in the United States and have increased the cost of solar energy generation, too. Per the latest Energy Department report, in fact, U.S. solar modules at the end of last year were selling at a 190 percent premium over world market prices—driven, the agency notes, by U.S. tariffs and domestic production costs that are more than double those in Southeast Asia (where most solar imports come from these days):

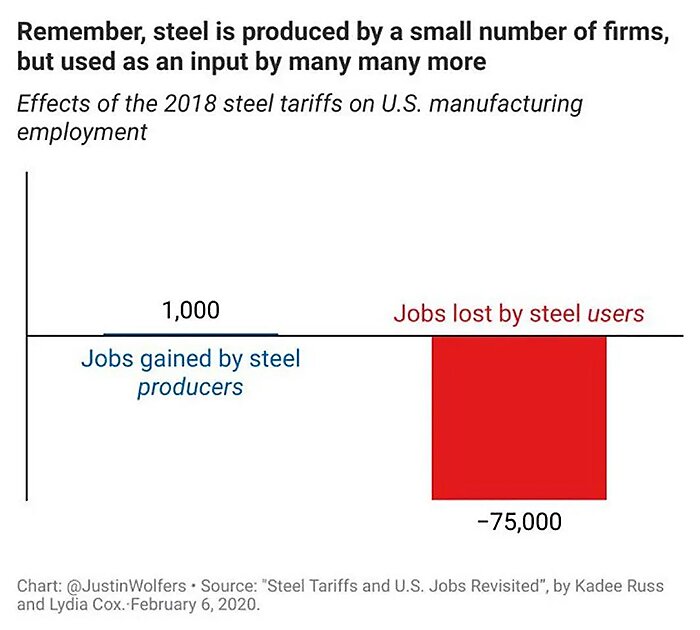

Protectionism—tariffs, the Jones Act, Buy America rules, etc.—and regulatory hurdles also have burdened the offshore wind industry and related U.S. manufacturers, whose struggles have only intensified since we examined the problems in late 2023. And, as Jeff Luse notes over at Reason, U.S. tariffs—both old ones and the brand new taxes Trump has proposed—hobble advanced nuclear power and transmission lines, too. As one energy expert said about the new tariffs, “This really is one of the dumbest things we could be doing.”

Indeed.

Bureaucracy is also slowing things down. For example, various reports indicate that U.S. EV uptake would accelerate if charging stations were more widely available, but the rollout of a national EV charging station network has been smothered in red tape. As of November of last year, in fact, National Electric Vehicle Infrastructure program had only 214 operational chargers of the 500,000 that were promised when the initiative launched two years earlier. Bureaucracy is a big reason why:

Under that program, states apply for funding and then private companies make bids to install chargers. However, the charging companies who receive NEVI funds must comply with a complex web of local regulations, work with utility companies and get required permits—a process that can vary wildly from community to community.

The charging station rollout has been further slowed by a Federal Highway Administration rule “requiring that workers for most projects be certified by the electricians union, or another government-approved training program”; federal guidance dictating silly things like the distance between charging stations in a state and the number of charging ports at each station; cumbersome Buy America requirements for certain iron and steel components; and a federal requirement that half of all grant money be set aside for “disadvantaged communities that are marginalized by underinvestment,” instead of places with actual high EV usage rates.

Industry players, meanwhile, have expressed confusion about various IRA tax credit conditions. In one particularly egregious example, “billions of dollars” of potential investments were stalled because, “Two years after President Joe Biden’s landmark climate law promised to kick-start green hydrogen production with generous tax credits, companies still don’t know who will qualify.” Most recently, American EV drivers have struggled to provide the paperwork needed to receive EV tax credits as part of their 2024 tax returns—struggles created by a midstream change to rules on how dealers report EV sales to the IRS.

Finally, political uncertainty regarding the Trump administration’s and congressional Republicans’ plans for the IRA continues to weigh on the renewables sector and the law’s implementation. As we discussed in October, investment in the U.S. clean energy sector had slowed because companies were waiting to see who won the 2024 presidential election, and, as economist Brian Albrecht reminds us in a new piece, policy uncertainty has a long and ignominious history of sapping U.S. business investment, industrial production, and employment. Now that Trump’s in office, the Financial Times reports, uncertainty about the IRA’s future has slowed things down even further:

Dealmaking in the renewables sector has been hit particularly hard, according to one banker who specialises in energy deals. “Green energy investments have been decimated because you’ve got a guy who’s saying he doesn’t like windmills and is pulling permits for wind energy. It’s impossible for the big infrastructure funds, in particular, to get comfortable committing to multiyear projects,” said the person, who did not want to be named.

These doubts should persist for much of 2025 (if not longer), as the Trump administration and Congress mull spending and tax cuts that could take a chunk out of the IRA or consider regulatory changes to various subsidy conditions they don’t like. And, of course, this kind of uncertainty is all but inevitable in an energy market driven by government, not private, actions.

Summing It All Up

So, the IRA costs much more than advertised and, in terms of its main goal of “tackling climate change” (in the Biden White House’s own words), delivers much less. These disappointing outcomes are owed to what’s in the law (endless subsidies to common technologies and more protectionism), what isn’t in the law (supply side reforms on permitting, transmission, interconnection), and other needless rules and regulations that further impede the rollout of supposedly critical goods and services.

And none of it is the least bit surprising. As the Breakthrough report notes, for example, many energy experts in the late 2000s warned against trying “to use public clean energy subsidies as a reverse carbon tax” because it would be “an inefficient and expensive way to cut emissions,” and they’re being proven right today. Meanwhile, as I detailed in a 2021 paper, U.S. industrial subsidies like those in the IRA have routinely fallen victim to budgetary overruns and failed objectives, thanks to poor (often politicized) design and implementation, political uncertainty, and pre-existing laws and regulations that contradict or thwart the subsidies’ goals. Sounds familiar!

But this is more than just a case of I‑told-you-sos; it matters greatly for assessing the IRA’s merits and future. At a piddly $400 billion (ha!), for example, the factories and jobs supposedly spurred by the law might be worth its cost, even if U.S. emissions reductions are meager. At a total price tag more than 10 times that original amount, such results—even assuming they materialize and are owed to the IRA—make far less economic sense, while repealing the IRA subsidies makes much more. According to one recent estimate, for example, “Each new Inflation Reduction Act job ‘created’ costs taxpayers between $2 million and $7 million.” That is objectively not good deal, no matter how you slice it—but especially when you consider that, as the Breakthrough authors calculate, as much as three-quarters of all projected IRA spending over the next 10 years will go toward subsidizing just three mature technologies that don’t need any more subsidization (wind, solar, and EVs).

Cutting those subsidies could alone save American taxpayers between $300 billion and $650 billion over the same timeframe—a nice chunk of change in an era of trillion-dollar deficits—and could in the process put federal energy policy on a better, more sustainable path going forward. Or, we can just keep handing out billions to companies and people who don’t need the money, while distorting U.S. energy markets and waiting for emissions reductions that never actually come about.

Seems like an easy call to me.

Chart(s) of the Week