Dear Capitolisters,

A few recent headlines have me thinking about one of the least discussed aspects of proposed U.S. economic policies: the old, often bad, policies already in place. These laws and regulations, which govern all sorts of government and private transactions, are particularly relevant right now in the United States, as industrial policy and economic planning are ascendant and fiscal discipline the opposite. Just this month, for example, the Senate passed the U.S. Innovation and Competition Act (which we discussed a couple weeks ago), the Biden administration released a lengthy new report urging all sorts of actions on “supply chain resiliency,” and lawmakers inched closer to a $1.2 trillion infrastructure bill. All come with the promise of revitalizing the economy and key industries in ways that the market won’t, yet these proposals uniformly ignore the pre-existing legal and regulatory hurdles that could turn those beautiful dreams into ugly realities.

Anyway, back to those headlines, which appeared within hours of each other on June 11:

EXCLUSIVE Lithium Americas delays Nevada mine work after environmentalist lawsuit https://t.co/LrwM850pti pic.twitter.com/v5F8nxazg6

— Reuters (@Reuters) June 11, 2021

EXCLUSIVE Biden considers giving refiners relief from U.S. biofuel laws, sources say https://t.co/KfPl3463lH pic.twitter.com/E2nYVgyn9L

— Reuters (@Reuters) June 11, 2021

Here we see the two ways that bad, old policies can breed bad, new ones: First, old policies can become deeply rooted, regardless of their actual benefits, and can thus compel policymakers to paper over their problems with even more bad policy, instead of actually fixing the law or regulation that caused the mess in the first place. Second, old policies can confound the implementation of new proposals that might seem appropriate or justifiable in a vacuum, thus turning a textbook success into a real-world failure.

Bad Policy to ‘Fix’ Bad Policy

U.S. law and regulation are littered with attempts to “fix” problems caused by other government policies—not by reforming or eliminating those policies but through even more subsidies, tariffs, regulations, or waivers. During the Trump years, for example, the administration responded to Chinese retaliation against U.S. tariffs, which harmed export-dependent American farmers, with new (and massive) “emergency” subsidies to those same farmers. Or when Trump’s metals tariffs undermined the competitiveness of metal-consuming U.S. manufacturers of nails and other “derivative” products (who were getting killed by imports from countries without those tariffs), the White House simply tried to expand the tariffs to those derivatives. In neither case, did the Trump administration consider the obvious solution to the tariffs’ totally expected harms: reforming or eliminating the tariffs that were causing them.

Similar band-aids have for decades been applied to the U.S. biofuels policy at issue last week, which centers on corn-based ethanol and the mandate that U.S. refiners blend increasing quantities into gasoline and diesel fuel—aka the “Renewable Fuel Standard.” (Biofuels also benefit from plenty of other support.) As has been widely documented, U.S. biofuels policy has persisted despite numerous studies showing corn-based ethanol to impose substantial economic and environmental damage in the United States, while raising food prices, harming developing countries and undermining U.S. climate goals. For this reason, the RFS is opposed by a long list of business, consumer, and environmental groups. Politicians, on the other hand, love it: Almost every presidential candidate visiting Iowa cheers the RFS; even the pro-deregulation Trump White House expanded it in 2018; and “politicians of both parties are conspiring to keep it alive despite knowing full well what its problems are.”

And it’s not just the politicians—regulators are in on the action, too. For example, one recent study found that the U.S. government has actively resisted assessing ethanol’s environmental impact (emphasis mine):

The only relevant regulation [as of 2020] required that any biofuels produced after 2007 reduce life-cycle greenhouse gas emissions by 20 percent relative to fossil fuels. In practice, … this requirement is essentially meaningless, however. Congress exempted all existing producers of biofuel at the time, and the U.S. Environmental Protection Agency later issued a rule exempting all new corn-based ethanol producers.

And when these policies’ damage gets too acute, politicians don’t consider eliminating the RFS or, at the very least, omitting corn ethanol from its (and other subsidies’) coverage. Instead, they issue a waiver for a struggling refinery; tweak mandated blending levels; exempt small refiners; or demand that regulators crack down on shady speculation in the market for tradable biofuels credits that refiners need to meet the RFS mandate. (And don’t even get me started about their complaints regarding high prices for fuel, cropland, or food more broadly.) Never once is full repeal—or at least serious reform to eliminate corn-based ethanol—considered.

Numerous other examples abound, of course, of politicians seeking to use new government actions to offset not merely failed policies’ unintended harms, but also their intended ones (e.g., higher prices for metals). Why don’t the underlying policies simply get reformed? Cato’s David Boaz explains:

Every tariff, subsidy, regulation, mandate, or other government program creates winners and losers. In most cases, a small number of winners, with the losses spread almost invisibly across the whole society. Economists call it concentrated benefits and diffuse costs. The tariff benefits domestic steel producers and unions, and the costs are spread out over everyone who buys products made with steel or aluminum. Which group is aware and engaged in the debate over the issue? Obviously the steel companies.

It’s not just tariffs. The farm program benefits some farmers and agribusinesses handsomely, with costs spread across all the taxpayers and food buyers. Every new entitlement program has beneficiaries who are well aware of their benefits, while the costs are buried somewhere in the vast federal budget that no taxpayer can comprehend.

For more on these dynamics, see the May 26 edition of Capitolism on public choice theory.

As Boaz goes on to note, these dynamics are a big reason why it pays—literally and figuratively—to be skeptical of new federal economic interventions and conservative in their implementation. Once a policy gets rooted in the U.S. system, it’s incredibly difficult to remove because it inevitably created new and motivated interest groups, as well as PR-focused politicians and “captured” regulators, dedicated to its preservation—regardless of its actual costs. And if the policy’s problems cause the political heat to rise, politicians respond not by fixing the problems’ source but simply paying off the victims or further distorting the market.

And, probably, complaining about a “market failure” while they do it.

How Old Policy Undermines New Policy

Bad old policies can also thwart new ones. As the Brookings Institution’s Shanta Devarajan explained a few years ago, a common problem for industrial policies is that their implementation is undermined by other government policies that have distorted the market at issue (emphasis, again, mine):

The analytical case for industrial policies is based on the idea that there is a market failure that is preventing industrialization and so some form of government intervention, such as a subsidy, is necessary to correct that failure. The case is usually made in the form of elegant economic models that portray the market failure and show how intervention can lead the economy to higher growth. Most of these models assume that the relevant market failure is the only distortion in the economy. In the real world, however, these economies are full of distortions, such as labor market regulations, energy subsidies, and the like. In this setting, correcting the market failure associated with industrial policy may not promote industrialization; in fact, it may make matters worse. Instead of relying on simple models that assume away all other distortions, governments would do better to identify the biggest distortions in the economy (such as energy subsidies) and work on correcting them. And if the biggest distortion cannot be moved, then governments need to take that into account in identifying the next biggest distortion to be addressed.

Devarajan focused on developing countries, but conflicting subsidies are also a common problem in the United States. For example, a big chunk of Department of Energy funding for carbon-capture technology projects—almost all of which ended up failing—went to subsidized, politically powerful ethanol producers, despite the product’s increasingly obvious shortcomings. Without government support for ethanol, other energy projects might have been funded instead, perhaps with better results.

Then there are the U.S. laws and regulations that make projects slower and more costly. The good ol’ Jones Act and other U.S. maritime protectionism slow down offshore wind projects and make them much more expensive than in Europe. Department of Energy loan guarantee applicants must comply with the Davis-Bacon Act (mandating high wages and favoring labor unions) and “Buy American” laws (mandating domestic content and favoring U.S. manufacturers)—both of which increase project costs and paperwork. Buy American restrictions also can limit U.S. companies’ access to needed materials or lead to project delays, and—as I documented last year—they’ve confounded several infrastructure projects funded by the 2009 American Recovery and Reinvestment Act (ARRA).

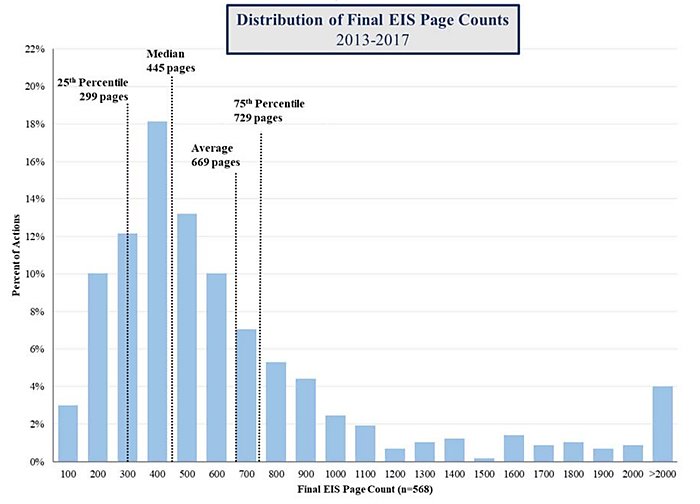

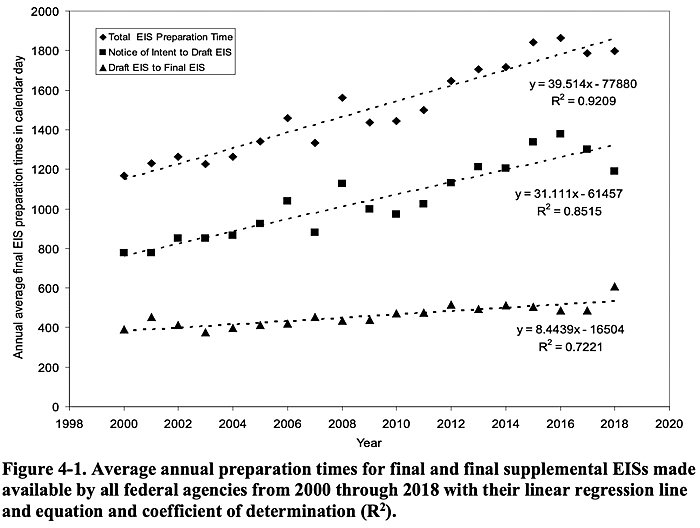

Then there’s the National Environmental Policy Act (NEPA), as well as similar laws at the state level, which requires government review of federal actions—including regulatory approvals of many private projects—“significantly affecting” the environment. A recent assessment of NEPA by Eli Dourado of the Center for Growth and Opportunity found that publication of NEPA-required “environmental impact statements” (EIS) takes an average of 4.5 years, and that ARRA projects were “subject to around 193,000 NEPA reviews including over 7,200 environmental assessments and 850 EISs. During the time the reviews were being performed, no funds for the projects could be disbursed and no work could begin.” To avoid court challenges (more on this in a sec), EISs have kept getting longer in terms of both page count and timeline—thus undermining the economic case for the projects at issue:

NEPA is one of many environmental laws that form what some analysts call the “vetocracy”—a web of U.S. laws and regulations that give “too many factions in our society… the ability to say ‘no’ and stop the progress that others initiate.” That appears to be the case in Nevada, where environmentalists’ lawsuit blocking a new lithium mine project claims that the Trump administration’s quick issuance of the project’s EIS violated NEPA and other federal regulations. Past U.S. permitting delays—which run far longer than other developed countries like Australia and Canada—have also discouraged domestic production of “rare earth” minerals, another longstanding U.S.-China concern.

According to a separate Reuters piece, these very problems pushed the Biden administration’s supply chain report to look to allies abroad for minerals supplied “to ensure the administration’s EV aspirations are not imperilled {sic} as domestic mines face road blocks … both from environmentalists and even some Democrats.” Thus, onerous environmental regulations (and the litigious groups they empower) have forced the Biden administration to embrace certain raw materials imports to boost subsidized EV production in the United States. (Last I checked, EVs also need steel and aluminum too, but—alas—no progress there.)

Using imports, of course, isn’t a bad thing, but it’s not exactly a good thing when the reasons for doing so have nothing to do with comparative advantage, private decision-making, or even supply chain “resiliency” and everything to do with politics and the “vetocracy.” Yet it’s precisely what Jordan McGillis and Paige Lambermont of the Institute for Energy Research warned might happen when NEPA met the new U.S. push to decouple from China regarding “critical minerals” production:

Another NEPA-centric problem for the Biden plan is that, if we rule out reliance on a supply chain controlled from Beijing, it will necessitate a significant expansion of the mining and processing of rare earths and other minerals. The White House says it will use smart, coordinated infrastructure permitting to expedite federal decisions, but lacks an outline to dredge NEPA’s procedural morass. Under the existing review regime, the plan faces long odds.

Depressingly prescient.

Even more depressing is that bipartisan efforts to overhaul NEPA have thus far failed, and that—far from reforming the other laws that retard various U.S. economic initiatives—Washington policymakers are usually looking to expand them. For example, just last year Congress expressly affirmed that the Jones Act would apply to new offshore wind projects. Biden and his fellow Democrats also want to apply both Buy American and Davis-Bacon to future infrastructure and industrial policy initiatives. As we discussed a few weeks ago, in fact, both of those restrictions were included in the just-passed U.S. Innovation and Competition Act.

These entrenched, policy-driven distortions and others can turn projected potential policy successes into costly failures—exacerbating market failures rather than fixing them. Few in Washington seem to care.

Summing It All Up

So the distortions created by entrenched economic policies can get papered over with new government actions, often making things even worse, and can undermine new economic policies that might in theory have a more legitimate justification. These old policies, moreover, are difficult to reform and—in many cases—actually become more entrenched over time. Yet none of this seems to factor into current discussions about infrastructure or industrial policy or labor markets or health care or a host of other areas in which “market failures” are allegedly prevalent and urgent government action is therefore necessary. This doesn’t mean we should stop making policy altogether, of course, but—as Boaz notes above—it does urge caution about bold new initiatives that might sound great on paper but utterly fail to account for the pre-existing problems that past policies have created. Fix those first, and then we can talk about where the real market failures lie and how government policy might work to address them.

Chart(s) of the Week

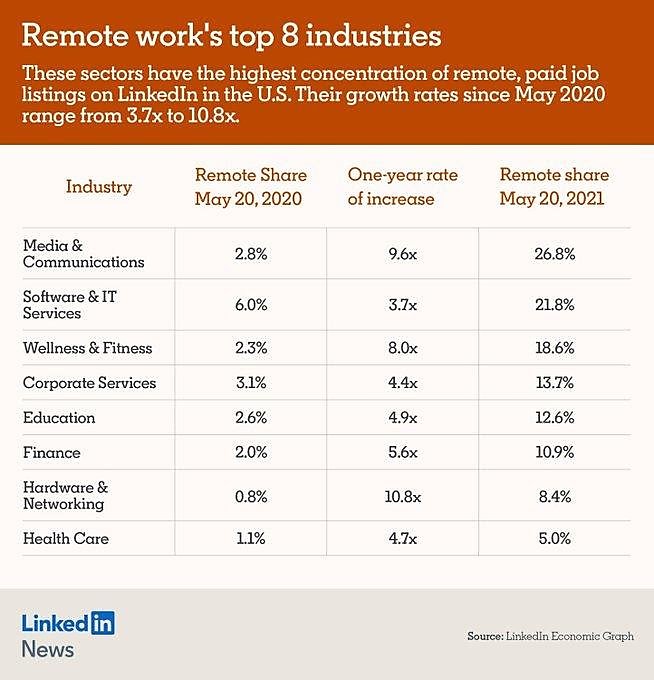

Looks like some employers have gotten the message:

The Links

Inu Manak and I lament Biden’s tacit embrace of the USA’s worst trade law

Will remote work kill rush hour traffic?

A smidge of progress on US-EU tariffs

Europe turns to coal amid gas shortages

Despite the hysteria, the share of U.S. households renting/buying is stable

Dodgy math on taxes paid by the “wealthy”

Chinese government “guidance funds” are struggling

On Florida’s cruise line restrictions

New study on potential minimum wage harms beyond just unemployment

On minimum wages and automation