Yesterday, the Senate passed the much-hyped Infrastructure Investment and Jobs Act (aka the “bipartisan infrastructure bill”), which now heads to the House for additional consideration after the August recess. Most of the attention—from the media and the punditocracy—has focused on the bill’s politics, fiscal and economic impact, and spending on classic “infrastructure” like roads and bridges. But also buried in the 2,700-page bill is tens of billions of taxpayer dollars for subsidies to renewable energy companies, with little regard, it seems, for the bad economics and history of this kind of “green industrial policy” in the United States. Since my recent (and very long!) Cato paper on industrial policy covered much of this ground, today’s newsletter will summarize that research—n a (hopefully!) more digestible form.

What’s In the Bill

As is often the case with massive legislation, it’s hard to find a good, concise summary of the infrastructure bill’s renewable energy subsidies (the Senate Republican Policy Committee has a pretty good summary of the entire bill, if you’re interested), but the Wall Street Journal Editorial Board last week highlighted some of the biggest subsidy provisions:

-

The bill allocates $21.5 billion for the Department of Energy’s new “Office of Clean Energy Demonstrations,” which will act as a government venture-capital fund for various green energy startups.

-

DOE also gets $2.4 billion to subsidize advanced nuclear reactor projects; $3.5 billion for carbon capture and storage projects; $8 billion for “clean hydrogen” projects; $5 billion for projects that “demonstrate innovative approaches to transmission, storage, and distribution infrastructure to harden and enhance resilience and reliability”; $9 billion for “grid-balancing technologies”; and $2.5 billion for “capacity contracts” to backstop transmission developers in case of limited market demand for renewable energy.

-

Outside of DOE, the bill allocates $7.5 billion for electric vehicle charging stations; $6 billion for nuclear plants currently scheduled to close; and several billion more for various tax credits and loan guarantees.

A separate breakdown from E&E News reveals numerous other energy subsidies tucked in the bill, much to the delight of the quoted lobbyists’ and trade associations receiving those funds.

As you can imagine, the Journal editors aren’t exactly thrilled with these new programs, but even the bill’s supporters acknowledge (and cheer) what’s going on here—green industrial policy:

The DOE’s ambit is growing again, and now that lawmakers in both parties have embraced industrial policy as the only way to counter China, you can see it gaining its old planning role. So the bill, for instance, beefs up the DOE’s ability to authorize new electricity transmission. It charges the DOE with spending $6 billion to beef up the nascent American battery industry. It frees the DOE to make loans to small businesses. And it also puts the DOE in charge of a program that will keep aging nuclear plants open.

Missing from the cheerleading, however, is any discussion how past U.S. efforts at green industrial policy have fared, especially at the DOE. Perhaps that’s because this history reveals a host of economic and political problems.

Public Choice Theory (Again)

For starters, recent U.S. green industrial policy efforts have been poster children for “public choice theory” (which we detailed in this previous newsletter) and how politics often corrupts the implementation of federal energy programs. For example, a 2018 review by George Mason University’s David Hart of 53 DOE energy technology “demonstration projects” (i.subsidized small-scale projects intended to determine the efficacy of a certain technology) funded by the 2009 American Recovery and Reinvestment Act (ARRA) revealed that coal-related carbon capture projects got special treatment from DOE and “dominate[d] the portfolio from a fiscal perspective… accounting for about five out of every six dollars allocated to energy-demonstration projects during the Obama era.” Meanwhile, technologies with more potential, such as nuclear power, renewables, and gas-fired electricity plants, were ignored, thus putting them at a competitive disadvantage in the U.S. energy market.

At least some of this special treatment, Hart notes, was because of politics—especially when it came to the largest project in DOE’s portfolio (receiving almost one quarter of all DOE demonstration project funding), FutureGen:

This megaproject, which dates back to 2003 and was terminated for the first time in 2008, was revived through ARRA funding earmarked for its Illinois site. President Obama, then a senator from Illinois, had vowed during his 2008 campaign to support clean coal technologies, and the state of Illinois (which had invested its own funds in the project) and its representatives in Congress (and those of surrounding states) pushed to include it among the “shovel-ready” projects eligible for the stimulus. Much like the Clinch River breeder reactor demonstration project…, the local fiscal benefits of FutureGen apparently weighed heavily in its vampire-like rise from the dead.

Another federally funded clean coal demonstration project in Kemper, Mississippi—excluded from Hart’s analysis—has suffered from similar public choice problems: see, for example, “How America’s Clean Coal Dream Unravelled” (the Guardian, 2018) and “Piles of Dirty Secrets behind a Model ‘Clean Coal’ Project” (New York Times, 2016).

Then, of course, there’s Solyndra and the Obama administration’s “Section 1705” loan program funded by the American Recovery and Reinvestment Act (ARRA), the 2009 stimulus package. As the Mercatus Center’s Veronique de Rugy explained a few years ago, Solyndra spent almost $1.8 million on lobbyists, employing six firms with ties to Congress and the White House, while DOE reviewed its loan application. Overall, almost $4 billion in DOE grants and financing went to companies with connections to officials in the Obama administration, and “nearly 90 percent of the 1705 loan guarantees went to subsidize projects backed by large, politically connected companies including NRG Energy Inc. and Goldman Sachs.” Two separate analyses—from the Reason Foundation and Georgetown University—found a significant connection between Section 1705 loans’ size and their recipients’ lobbying efforts.

These examples show not only how public choice can undermine, if not actively work against, “green” industrial policy objectives. And far from scrapping this model, the new infrastructure bill doubles down* on it (while also including politically motivated Buy American and “Davis-Bacon” requirements that will raise costs).

No wonder renewable energy lobbyists are “absolutely thrilled” with the outcome.

Lack of Discipline

Another common problem affecting U.S. green industrial policy is an inherent lack of market discipline. The classic tale of these problems is the 1991 Brookings book, The Technology Pork Barrel, which—as I noted back in May—explored how several federal industrial policy programs continued long after their fiscal, technological, and commercial failures had been established. Three of these demonstration projects—the Clinch River breeder reactor, synthetic fuels from cCoal, and the pPhotovoltaics commercialization program—pushed alternative energy and not only cost billions but also diverted federal resources away from better R&D projects. And they survived because of politics and captured regulators, including (and especially) DOE. The authors concluded that the case studies “justify skepticism about the wisdom of government programs that seek to bring new technologies to commercial practice,” because “American political institutions introduce predictable, systematic biases into R&D programs so that, on balance, government projects will be susceptible to performance underruns and cost overruns.”

There are, of course, numerous other examples of these systemic problems: U.S. support for economically and environmentally damaging corn ethanol has—as we’ve also discussed—persisted because of its political importance. And then there are those carbon-capture megaprojects: FutureGen was actually revived from the dead because of its importance to Illinois and President Obama; for Kemper, “[t]he system of checks and balances that are supposed to keep such projects on track was outweighed by a shared and powerful incentive: The company and regulators were eager to qualify for hundreds of millions of dollars in federal subsidies for the plant, which was also aggressively promoted by Haley Barbour, who was Southern’s chief lobbyist before becoming the governor of Mississippi.”

GMU’s Hart notes that many of the ARRA’s failed demonstration projects were ultimately canceled, but only because of a unique confluence of “temporary” events: the ARRA’s 2015 expiration date for fund disbursement, a bipartisan push for fiscal austerity, and partisan Republican opposition to Obama-era industrial policy projects.

Only the first item exists today (sigh).

Costs, Seen and Unseen

Finally, there are the substantial costs—seen and unseen—associated with green industrial policies. Those projects cited in the Technology Pork Barrel, for example, uniformly exhibited “cost overruns” that far exceeded their budgets. Years later, DOE got busted for using—ahem—creative accounting to claim that its ARRA green energy lending programs were “making money” (they ignored borrowing costs, which—per Brookings’ Donald Marron—turned an alleged $810 million “profit” into a $780 million loss). In fact, DOE often loses money on a portfolio-wide or long-term basis. Today, for example, only one of the 10 carbon capture demonstration projects—a relatively small one in Texas—is still active, resulting in billions of losses overall. And cellulosic biofuels projects that DOE once celebrated are today on the ropes (or worse).

And then there are the unseen costs, including:

-

Opportunity costs. Given that both time and federal budgets are finite, industrial policies replace efforts and money that could have been spent on other priorities, potentially imposing significant “opportunity costs” (i.e., the cost of those foreone alternatives) in the process. As economist Michelle Clark Neely explained, any legitimate evaluation of an industrial policy must include “not only what you’re getting, but also what you’re giving up.” Yet governments rarely, if ever, consider these costs, which can be significant. In The Technology Pork Barrel, for example, the Clinch River Breeder reactor “absorbed so much of the R&D budget for nuclear technology that it probably retarded overall technological progress.” And, as noted above, DOE funds for politically-motivated carbon capture projects probably diverted government resources away from other, better environmental technologies.

-

Misallocation of resources. Government subsidies can also lead to a substantial misallocation of non-governmental resources. First, subsidies can discourage private investment in industries that the government is actually trying to promote. As Harvard’s Josh Lerner explained with respect to the Obama-era DOE’s green energy subsidies, “The enormous scale of the public investment appears to have crowded out and replaced most private spending in this area, as [venture capitalists] waited on the sideline to see where the public funds would go…. Rather than being stimulated, clean tech has fallen from 14.9 percent of venture investments in 2009 to 1.5 percent of capital deployed in the first nine months of 2019.” For the $25 billion Advanced Technology Vehicles Manufacturing (ATVM) Loan Program in particular, Wired magazine found in 2009 that “this massive government intervention in private capital markets may have the unintended consequence of stifling innovation by reducing the flow of private capital into ventures that are not anointed by the DOE,” and then provided examples of this very thing.

Second, potential industrial policy beneficiaries often divert resources away from their actual business to the process of obtaining federal benefits (lobbying, grant-writing, etc.). As noted, for example, Solyndra and other “Section 1705” loan guarantee recipients spent millions on lobbyists, and that Wired article provides an on-the-ground example for the ATVM program: “Aptera Motors has struggled this year to raise money to fund production of the Aptera 2e, its innovative aerodynamic electric 3‑wheeler, recently laying off 25 percent of its staff to focus on pursuing a DOE loan. According to a source close to the company, ‘all of the engineers are working on documentation for the DOE loan. Not on the vehicle itself.’”

-

Moral hazard and adverse selection. Industrial policies implemented by DOE also have generated moral hazard (i.e., encouraging actors to engage in overly risky behavior by protecting them from the consequences) and adverse selection (i.e., the tendency to attract the riskiest or least-responsible actors). A 2015 inspector general report, for example, found that DOE should never have approved Solyndra’s application, which was plagued with deficiencies and misrepresentations about a company with publicly-known problems. But it’s not just Solyndra: A comprehensive assessment of all DOE loans and loan programs implemented between 2009 and 2016 found numerous examples of “[f]ailed companies that could not survive even with the federal government’s help,” and that “[b]oth Government Accountability Office (GAO) and DOE Office of Inspector General reports identify that the loan programs were fraught with inefficiencies, lack of due diligence, and inadequate oversight and management.”

Backing One ‘Winner’ Isn’t Enough

Supporters of green industrial policy often claim that rampant cronyism and high costs (seen and unseen) are unfortunate but expected, necessary(to get political support for ventures that are too risky for private capital), and ultimately worth the expense if the government picks one big winner. This argument, however, doesn’t pass the smell test. For starters, it must have limits: Would government-backing of, say, Tesla be worth, say, $2 trillion in waste, failure, and cronyism? Surely, some amount of “losses” would be too much. Yet the overall gains and losses of industrial policy programs are rarely, if ever, ever quantified: instead, we’re usually told about direct benefits for “winner” companies and workers (a low and obvious standard), plus a bunch of unproven cheerleading about positive externalities, market-beating R&D spillovers, and faster economic growth. (Indeed, numerous academics have noted that the industrial policy debate routinely lacks rigorous and systematic empirical analyses of the overall efficacy of a nation’s industrial policy.) Given the long history of industrial policy failures (and that government actions involve taxpayer funds), the burden should rest on supporters to prove that a single winner was worth it—not the other way around.

Indeed, discrete “successes” might—as documented above—actually retard overall energy investment and innovation by misallocating federal dollars that could’ve been better spent in other sectors or by crowding out private investment in the same sector. Costly public failures, moreover, might undermine public confidence in the government and support for future federal policies, industrial or otherwise— jeopardizing the next Tesla (or more worthwhile targets) rather than nurturing it. Solyndra did this very thing.

Finally, one must consider whether the “success” at issue would have occurred in a market without government intervention (the primary reason for “market-beating” subsidies in the first place). Economist Ryan Yonk’s 2020 assessment of DOE loan guarantee programs, for example, found “few loans … extended that would not otherwise be attained” because most of the funding went to large corporations who already had access to capital and could afford DOE’s onerous, costly application process. The Mercatus Center’s de Rugy found the same. Separately, a 2020 analysis of 25 clean tech startups funded by the U.S. Advanced Research Projects Agency-Energy (ARPA‑E) at DOE found “no clear evidence that [awardees] perform differently from similar cleantech startups as a whole in terms of acquisition/IPO, survival or VC funding post-award within 10–15 yr of founding.” And this was, the authors concluded, actually the best result that DOE funding achieved (i.e., other subsidy programs did even worse).

Summing It All Up

Not everything in the IIJA is bad. It includes, for example, prizes for battery recycling and direct air capture (to remove CO2 from the atmosphere) that would better avoid the problems outlined above while still encouraging private competition and innovation. Yet most of the bill just re-ups the same industrial policy model*—top-down subsidies doled out by federal bureaucrats—that has repeatedly proven a failure in the United States, imposing high costs and often undermining, rather than advancing, the government’s very own objectives. (And, judging by the $3.5 trillion “reconciliation package” framework just released by the Senate, they’re just getting warmed up.)

*Yes, the IIJA would require DOE in certain circumstances to consider whether a loan recipient has “a reasonable prospect of repaying the principal and interest on the loan,” but this requirement is vague and, given that such a low bar is apparently brand new, doesn’t exactly inspire confidence.

Chart(s) of the Week

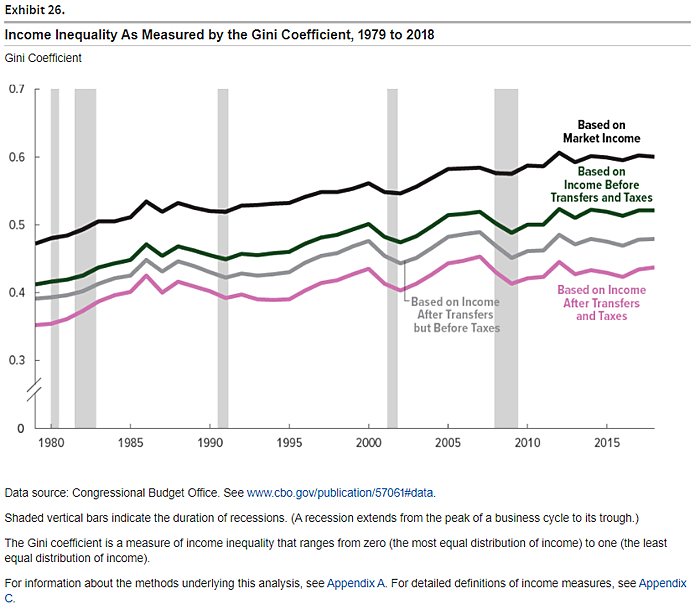

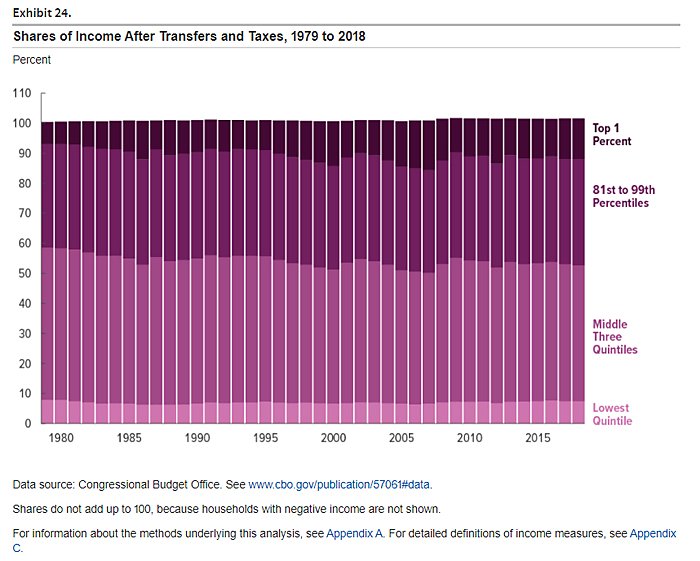

New CBO data on U.S. inequality (for the calendar year 2018) shows more of the same:

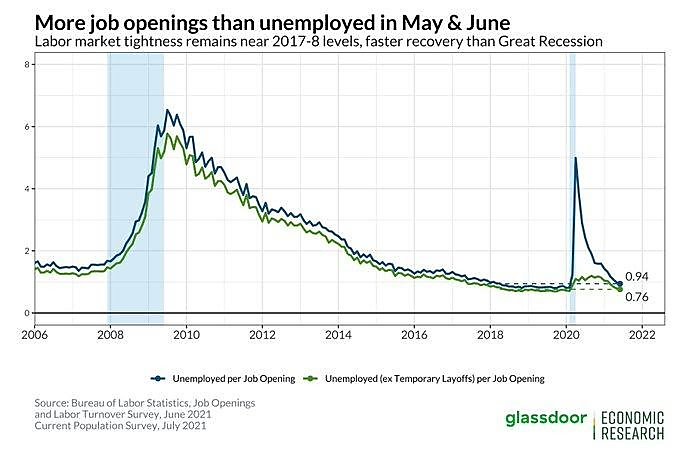

Bonus Chart of the Week

(source)

The Links

Utilities looking into mini-nukes

Biden’s extension of the CDC eviction moratorium, explained

Many Americans are willing to take a pay cut to work from home

Early evidence on the effects of enhanced unemployment benefits

Coastal senators lobbying for more flood insurance subsidies

“China’s techlash explained (and lessons for America)”

Unvaccinated people should pay their own hospital costs

In praise of “short-term” libertarianism

Krugman on vaccines and globalization

“Infrastructure package includes bevy of Buy America provisions”

Americans on automation and jobs

Trump/Biden ban on Chinese students could be hurting the U.S.

More South Park content coming

$72 fried rice is a runaway hit

The most beautiful strike of the 2021 baseball season (so far)