Turkey’s President Tayyip Recep Erdogan has done it again. Late last Friday, he ousted the governor of the Central Bank of Turkey, Naci Agbal, replacing him with Islamist Şahap Kavcıoglu. Agbal is the third governor who has been shown the door in the last two years. Just what was Governor Agbal’s sin? To stabilize the Turkish lira, he cautiously raised Turkey’s policy rate by 875 basis points to its present rate of 19 percent during his short tenure of just over three months. Even with these increases, the real, inflation-adjusted interest rate is in deep negative territory (approximately ‑10 percent).

To understand the revolving door that faces Turkey’s central bank governors, we must understand what makes President Erdogan tick. And to do that, we have to understand Islamic finance, which is replete with theories about why interest rates should be avoided. Erdogan has made it clear that he embraces Islamic finance. Indeed, as he once clearly put it, interest rates are the “mother of all evil.” President Erdogan’s economic ideas are fundamentally rooted in charismatic, medieval texts that are far removed from the real world of today, or even yesterday.

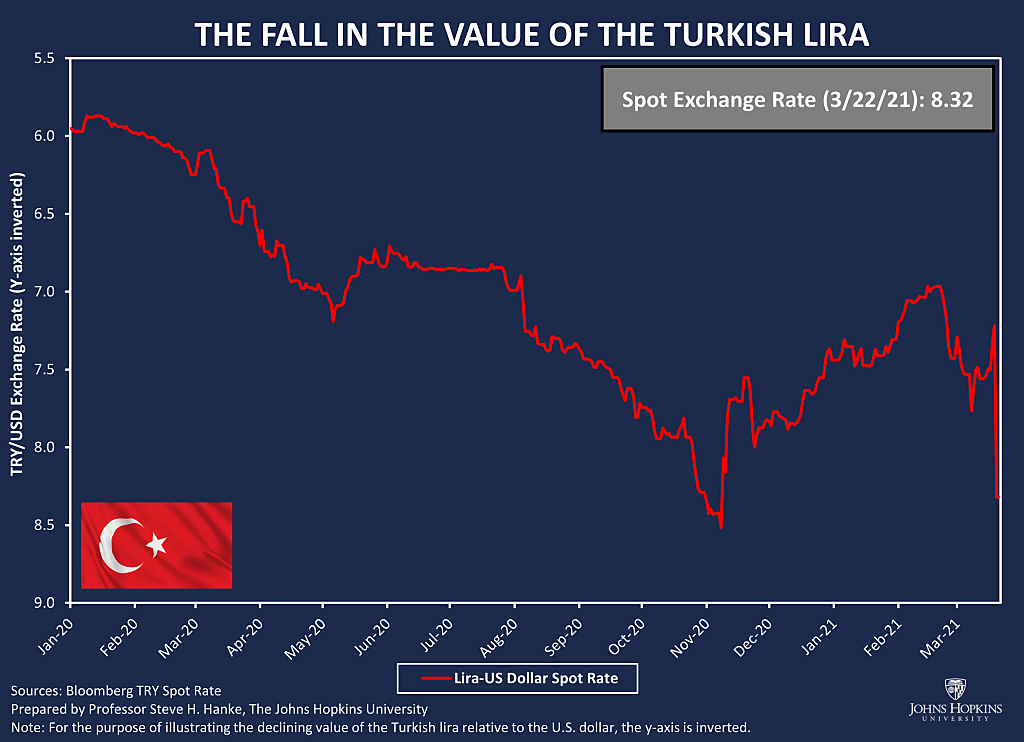

Not surprisingly, on the first hours of trading since Governor Naci Agbal was axed, the lira plunged by 17 percent against the greenback, coming close to its all-time low of 8.52 TRY/USD. Lira instability and weakness and associated elevated inflation are nothing new for Turkey. Indeed, inflation has ravaged Turkey for decades. The average annual inflation rates for the 1970s, 1980s, 1990s, and 2000s were 22.4 percent, 49.6 percent, 76.7 percent, and 22.3 percent, respectively. Those horrendous numbers mask periodic lira routs. In 1994, 2000-01, and most recently since 2018, the lira has been torn to shreds.

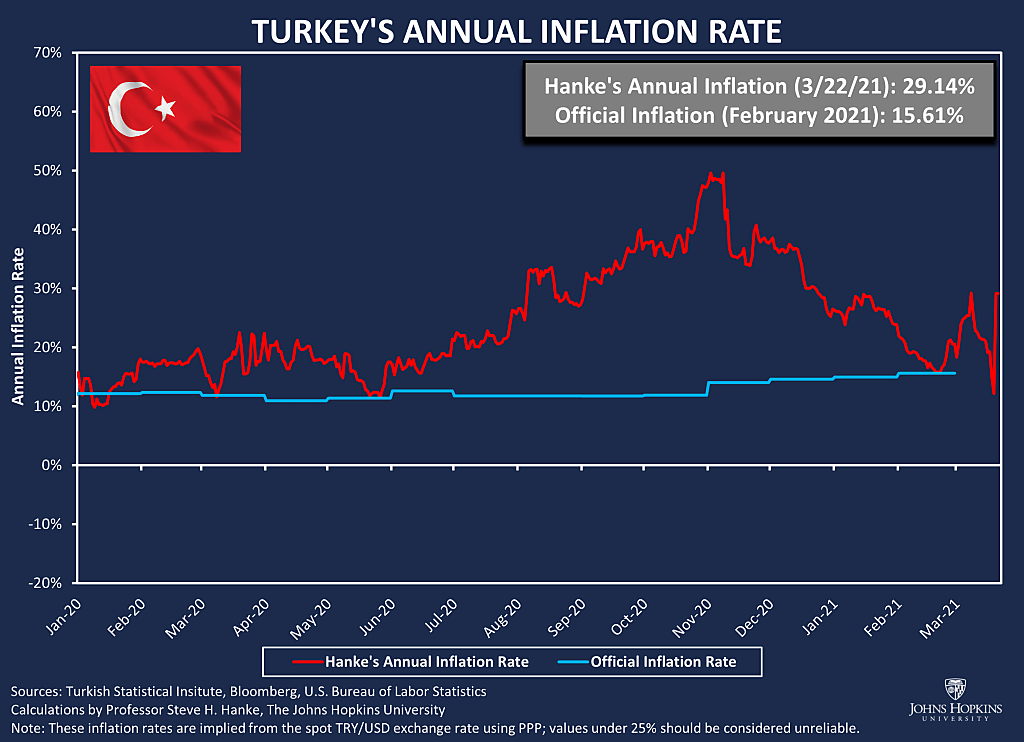

Since Erdogan took over Turkey’s presidential reins in August 2014, the lira has shed 74 percent of its value against the U.S. dollar. And, since the first of this year, the lira has depreciated by 28.5 percent against the greenback. Today, inflation in Turkey is soaring at 29.14 percent per year by my measure. My measurement, which employs high-frequency data and the use of Purchasing Power Parity theory, is nearly double Turkey’s official annual inflation rate of 15.61 percent per year. The charts below depict the collapse of the lira and Turkey’s annual inflation rate since January 1, 2020, respectively.

Erdogan’s frequent changing of the guard at the Central Bank of Turkey won’t change the course of the lira or rein in surging inflation. To save the lira and Turkey’s economy, Erdogan must make a change to Turkey’s exchange-rate regime, not its bureaucratic personnel.

All Erdogan has to do is follow the instructions for establishing a gold-backed currency board that are contained in my book Gelişmekte Olan Ülkeler İçin Para Kurullari, which was published in Ankara in December 2019.

A currency board is a monetary institution (or a set of laws that govern a central bank) that issues a domestic currency that is freely convertible at an absolutely fixed exchange rate with a foreign anchor currency. Under a currency-board arrangement, there are no capital controls. The domestic currency, which is issued by a currency board, is backed 100 percent with anchor currency reserves, so the local currency is simply a clone of its anchor currency.

For over 170 years, currency boards have had a perfect record. In total, there have been over 70 — none have failed. Even the North Russian currency board, which was designed by John Maynard Keynes in 1918 during the Russian Civil War, never faltered.

To make the Turkish lira as good as gold, Erdogan should announce that Turkey will install a gold-backed currency board. With a Turkish currency board, the lira would be tied to gold at a fixed exchange rate, and the lira would be fully backed by gold reserves. Gold is particularly attractive for countries such as Turkey because it is not issued by a sovereign and is highly revered by Turks. So, like gold, the lira would become an international currency that holds its purchasing power over time. Indeed, the lira would be as good as gold.

If Erdogan wants to save the Turkish lira and economy, he must dump Islamic finance and go for gold.