Congress’ ongoing failure to repeal Obamacare means ordinary citizens will continue to suffer that law’s rising penalties, wage cuts, reduced choice, rising premiums, eroding coverage, administrative burdens, and collapsing markets, even as members of Congress enjoy special exemptions and illegal subsidies that spare them from the burdens of that law.

Back when President Obama was implementing Obamacare, his spokesman promised, “Members of Congress will not receive anything that is not available to the public.” Indeed, Obamacare explicitly requires Congress to live under the same rules as everyone else, by kicking members and staff out of the Federal Employees’ Health Benefits Program and leaving them to enroll in health insurance through the law’s exchanges. Since Obamacare prohibits large employers from using small-business exchanges, that left only its individual-market exchanges. And since federal law prohibits tax-free employer contributions toward individual-market coverage, Obamacare ended Congress’ eligibility for premium contributions the federal government makes on behalf of federal workers with FEHBP coverage.

Contrary to assurances and in violation of federal law, the Obama administration shielded lawmakers from an effective pay cut of up to $12,000 each by granting Congress several types of special treatment unavailable to the public. It deemed Congress eligible to participate in D.C.‘s small-business exchange, though both federal and D.C. law prohibit it. That form of special treatment gave rise to another: It made Congress the only large employer in the country that can make tax-free contributions toward its employees’ exchange-plan premiums. The act of issuing those payments conflicts with other federal laws, and bestows yet another form of special treatment on Congress: Members of Congress and their staff are the only group of federal workers who receive FEHBP premium contributions for non-FEHBP coverage.

Obama took these steps because he knew Congress would have quickly revamped or even repealed Obamacare if lawmakers had to live under its terms. President Trump seems to agree, and has threatened to end the exemptions and subsidies. "If a new HealthCare Bill is not approved quickly," he tweeted recently, "BAILOUTS for Members of Congress will end very soon!"

Not only should Trump immediately revoke that exemption, the Justice Department should investigate whether government employees broke any laws in creating it.

For Better or Worse, Congress Cut Its Own Pay

Prior to Obamacare, federal law treated members of Congress and their staffs like other federal workers. They received health benefits through the Federal Employees Health Benefits Program (FEHBP) and a tax-free federal contribution of up to $12,000 toward their premiums.

When Congress passed Obamacare, it shut members of Congress and their staffs out of the FEHBP and ended those premium contributions. "Notwithstanding any other provision of law," the text of the law says, "after the effective date of this subtitle, the only health plans that the Federal Government may make available to Members of Congress and congressional staff" as an employee benefit "shall be health plans that are created under this Act," such as those "offered through an Exchange."

That provision bars premium contributions for Congress in several ways. Federal law authorizes those premium contributions only for health plans the Office of Personnel Management has "approved" to participate in the FEHBP. OPM officials admit the agency has "no role in ‘contracting for' or ‘approving' health benefit plans that are offered through the Exchanges." The agency thus has no legal authority to pay part of the premiums for members and staff who purchase exchange plans.

In case there was any lingering uncertainty, additional provisions of federal law also bar Congress from receiving employer contributions to exchange plans. Federal law prohibitsemployer contributions in Obamacare's individual-market exchanges, while Obamacare itself prohibits any employer with more than 100 employees—such as Congress—from participating in the law's small-business or "SHOP" exchanges. For better or worse, when Congress passed Obamacare, it cut congressional pay by leaving members and staff to buy health insurance without a federal contribution to their premiums.

Nothing in Obamacare or federal law exempts members and staff from that pay cut. Indeed, not exempting Congress was the entire point. Obamacare forces lawmakers into the exchanges for the purpose of making lawmakers live under the same rules they were imposing on everyone else. Any sort of exemption would defeat this express purpose of the statute.

Since Obamacare provides no other effective date, Congress' banishment from the FEHBP and the accompanying pay cut should have taken effect immediately upon Obama signing the law on March 23, 2010.

Obamacare for Thee, But Not for Me

Instead, the Obama administration immediately ignored that provision and continued to do so for nearly four years. Contrary to Obamacare, and citing no legal authority, the administration allowed Congress to keep enrolling in FEHBP coverage, and to keep receiving the FEHBP premium contribution, until 2014.

The congressional pay cut should have become unavoidable when the Obama administration finally got around to ousting members and staff from the FEHBP in 2014. Indeed, as Politico reported, "OPM initially ruled that lawmakers and staffers couldn't receive the subsidies once they went into the exchanges."

But as Politico also reported, "This caused an uproar in Congress."

Responding to pleading from both parties in Congress, Obama personally intervened and pressured OPM to reverse its initial (and correct) interpretation of the law. The agency acquiesced. Contrary to OPM's initial ruling, to the letter and spirit of Obamacare, and even to the agency's own authorizing statute, OPM ruled Congress could both enroll in the District of Columbia's small-business exchange and keep receiving the FEHBP premium contribution. D.C. officials played along by ignoring a D.C. law prohibiting participation in its small-business exchange by all but "employers with 50 or fewer…employees."

Thanks to those illegal exemptions, members of Congress and congressional staff are receiving an also-illegal subsidy of up to $12,000 toward their health insurance premiums. Those exemptions even give Congress privileged status among federal employees: Members and staff are the only group of federal workers who receive FEHBP premium contributions toward non-FEHBP coverage.

At no point have the Obama administration, OPM, Congress, or any other defenders of this exemption cited any statutory authority either for the OPM to contribute to the premiums of health plans the agency has not "approved" to participate in the FEHBP, or for allowing just this one large employer to participate in a small-business exchange. In its rule announcing the policy, the OPM made no mention at all of the employer-size restrictions in federal and D.C. law that bar large employers from participating in D.C.'s small-business exchange, and offered only blandishments such as"we believe that it is appropriate" to offer the disputed contributions.

That's just not good enough. There is an entire constitutional amendment devoted solely to limiting congressional pay. The 27th Amendment forbids any congressional pay increase from taking effect until after the next federal election. Here, a president personally intervened to produce an agency rule that just happened to increase congressional pay up to $12,000 per member more than federal law allows. It also kept each member's staff from falling apart, a benefit most members likely value even more.

A Tangled Web We Weave

The officials who implemented this scheme betrayed its illegality, and likely violated criminal laws, when they knowingly and repeatedly made false statements to skirt the legal barriers in their way.

Obamacare prohibits employers with more than 100 employees from participating in its small-business exchanges. For calendar year 2014, however, both federal and D.C. law prohibited employers with more than 50 employees from participating in D.C.'s small-business exchange. Obviously, neither the House of Representatives nor the Senate qualifies. The House has 435 voting members. The Senate has 100 senators. Each chamber employs thousands upon thousands of staff.

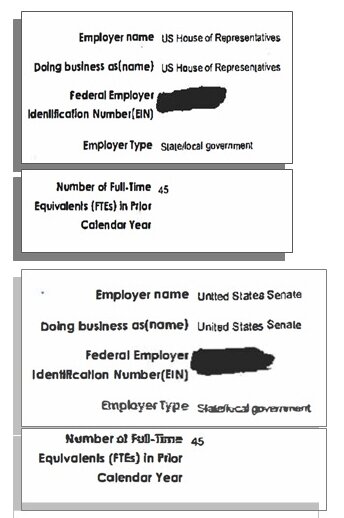

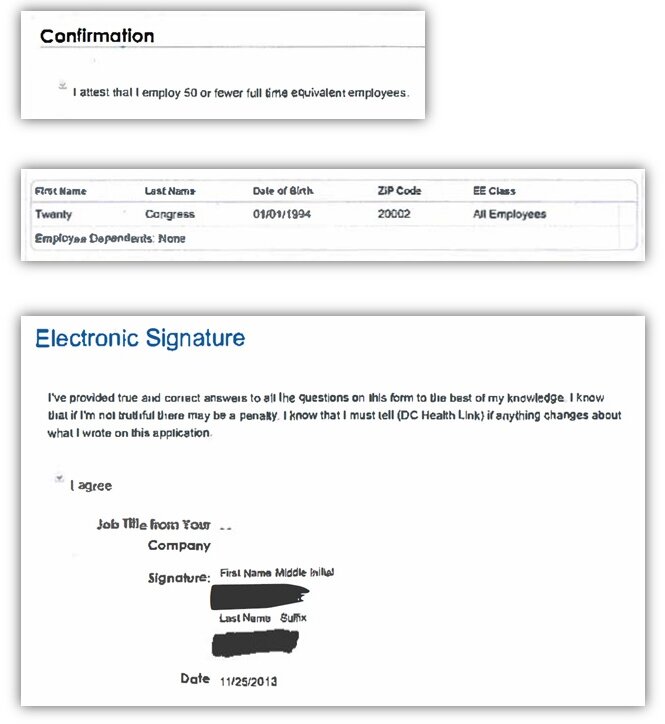

Yet a Freedom of Information Act request filed by the watchdog group Judicial Watch revealed that in Nov. 2013, unknown House and Senate officials filed applications with D.C.'s small-business exchange in which they falsely attested the House has only 45 members, and the Senate only 45 employees total—each just under the statutory limit.

The officials didn't stop with just two obvious falsehoods, either. They further attested: "I employ 50 or fewer full time equivalent employees"; Congress's "employer type" is "State/Local Government"; false names and dates of birth for House and Senate employees; and that no House or Senate employees have any dependents. (Someone should inform Speaker of the House Paul Ryan, R-Wis., that the kids he goes home to see every weekend apparently don't exist.) Finally, after making numerous statements they knew to be false, the officials attested, "I've provided true and correct answers to the questions on this form to the best of my knowledge. I know that if I'm not truthful there may be a penalty."

One cannot credibly argue these were honest mistakes, or a good-faith effort to apply the law. Nor can one claim these unknown congressional officials mistakenly thought each member of Congress runs their own small business. The officials attested that the entire House and the entire Senate are small businesses. Without question, those officials had to have known: (1) They were making false statements to a federal agency that were material to Congress' eligibility for a federal program, and (2) they were doing so as part of a scheme to draw money from the U.S. Treasury for the benefit of members of Congress.

Further records obtained through the Freedom of Information Act suggest these officials began to cover their tracks. After the above-mentioned documents became public in Sept. 2014, D.C. officials dropped the employer-size questions from the city's SHOP exchange applications, which spared congressional officials from having to repeat those particular falsehoods. Even so, when congressional officials re-applied in November 2014, they repeated all of the other false statements. By late 2015, D.C. officials simply stopped asking House and Senate officials to fill out those forms at all.

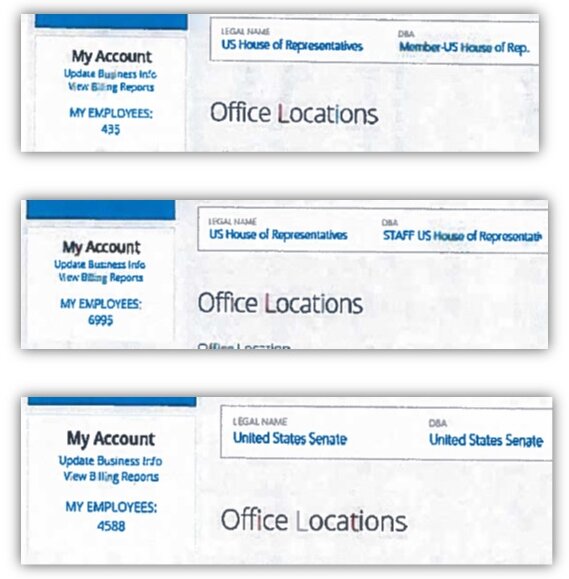

Additional documentation obtained through the Freedom of Information Act show those officials have since admitted Congress is in fact not a small business. Congressional officials reported to the D.C. SHOP exchange that the House has 435 members and 6,995 other employees, while the Senate has 4,588 total employees. These obvious yet long-overdue admissions highlight the ongoing illegality of Congress' participation in D.C.'s small-business exchange.

Potential Criminal Violations

Transmitting false statements to a government agency as part of a scheme to draw money from the U.S. Treasury is a serious crime, particularly if done in order to use that money to purchase items of value for members of Congress and congressional staff. Federal prosecutors could charge private citizens engaged in such activity with a wide array of crimes, including: making false statements to federal officials (maximum penalty: 5 years in prison per violation); triggering false claims against the federal treasury (triple damages); conspiracy to defraud the United States (10 years); healthcare fraud (10 years); wire fraud (20 years); violating the Sarbanes-Oxley ban on falsifying documents (20 years); conspiracy to commit the above offenses (5 years); and other crimes under both federal and D.C. law.

The Justice Department has prosecuted designer Martha Stewart, former Speaker of the House Dennis Hastert, R-Ill., and countless other private citizens for making false statements to federal officials, even when the citizens voluntarily tried to correct the false statements. In this case, the false statements were clearly material because statements about eligibility criteria would certainly have "a natural tendency to influence" eligibility determinations.

So what happens when current government employees are caught both engaging in such behavior and covering it up?

Nothing.

Obama's attorney general Loretta Lynch proudly investigated corporate executives and other private citizens who committed similar acts. Yet she took no discernible steps to investigate this obvious fraud. Congress routinely investigates private citizens who defraud taxpayers, yet has refused to investigate this fraud benefiting members of Congress. Watchdog groups filed a complaint with the Senate Select Committee on Ethics, only to have congressional staff summarily close the matter after finding "no violation of Senate Rules."

In the hope of getting some answers, former senator and Senate Small Business Committee Chairman David Vitter, R-La., sought to subpoena the names of the House and Senate officials who submitted the falsified documents. Five Republican senators joined every Democrat on that committee to quash that investigation into potential federal crimes.

The stonewalling comes as little surprise. This is a fraud from which both the Obama administration and Congress benefited. Reports indicate some members of Congress even colluded with Obama to devise these illegal exemptions.

Citizens, moreover, appear to have no access to a judicial remedy. Sen. Ron Johnson, R-Wis., filed suit to block the exemption, but federal courts dismissed the challenge for lack of standing. Judicial Watch has sued on behalf of a D.C. taxpayer, though success there seems unlikely as well.

Are Government Officials Above The Law?

Though Congress has an obvious conflict of interest, in this case Trump's political interests happen to coincide with what is right.

The most important thing Trump can do to pressure Congress to overhaul Obamacare is what he should be doing anyway: directing OPM to end these illegal exemptions and subsidies, and directing the Justice Department to investigate whether government officials violated criminal laws when implementing these exemptions and subsidies.

Forcing lawmakers to experience Obamacare like ordinary people would guarantee that Congress would revamp the law. Members and staff would have to enroll in coverage through the individual-market exchanges, where premiums for ordinary people have doubled since 2013. Ending the illegal premium contributions would subject members and staff to pay cuts similar to those Obamacare routinely inflicts on adjunct professors and other workers.

A criminal investigation might also spur members of Congress to act on Obamacare in order to distance themselves from the corruption involved in the law's implementation. DOJ will face enormous pressure from Congress not to launch an investigation, but it should, and the statutes of limitations for the crimes listed above won't begin to expire until late next year.

If Trump takes these steps, it is conceivable the resulting healthcare bill would enjoy bipartisan support. Democratic members and staffers don't like seeing their premiums rise, having their pay cut, or appearing corrupt any more than Republicans do.

Washington's most powerful special interest group is Congress itself, and its members are more than happy to reach across the aisle when their personal interests are on the line. Nothing will get Congress to act faster than forcing it to swallow its own medicine.