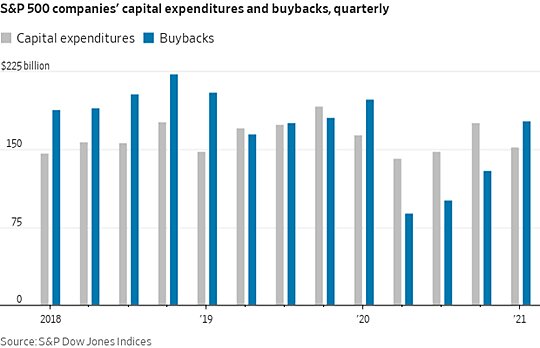

The easy way to think about a buyback and why we see a positive price response when there are buybacks. If I’m a manager of a company, we produce lots of earnings, we’ve got lots of cash in the vault, we’re trying to decide what to do with it. And I look out there and I say, man, this coronavirus is really going to cripple the economy, I don’t see any positive net present value projects that I want to invest in. I can keep this money in the vault, which isn’t really a good investment either. I mean, that is an investment leaving money in your vault, or I can go out and give it back to my shareholders.

An easy way to give it back to my shareholders is to go out and buy stock. So when I see a company buying stock, what I say is, “Oh, this is a manager who’s representing their shareholders well and doing the best thing they can with their shareholder’s resources. And the manager has decided the best thing she can do with it is go out and repurchase shares. And that’s why the market price goes up because people are saying, “Oh, this is a manager that’s respecting the shareholders.” And saying, “I don’t have anything better to do with it, I’m going to buy up these shares.”